![Choppiness Index Indicator in MT4 Download - Free - [TradingFinder]](https://cdn.tradingfinder.com/image/124311/13-38-en-choppiness-index-mt4-1.webp)

![Choppiness Index Indicator in MT4 Download - Free - [TradingFinder] 0](https://cdn.tradingfinder.com/image/124311/13-38-en-choppiness-index-mt4-1.webp)

![Choppiness Index Indicator in MT4 Download - Free - [TradingFinder] 1](https://cdn.tradingfinder.com/image/124312/13-38-en-choppiness-index-mt4-2.webp)

![Choppiness Index Indicator in MT4 Download - Free - [TradingFinder] 2](https://cdn.tradingfinder.com/image/124307/13-38-en-choppiness-index-mt4-3.webp)

![Choppiness Index Indicator in MT4 Download - Free - [TradingFinder] 3](https://cdn.tradingfinder.com/image/124306/13-38-en-choppiness-index-mt4-4.webp)

The Choppiness Index indicator is one of the technical analysis tools in MetaTrader 4, designed to measure the level of choppiness or instability in the market over specific time intervals.

This MT4 Volatility indicator for identifying market conditions in Forex market and other markets over short timeframes and recognizes periods of instability and range bound trends.

Indicator Specifications Table

Indicator Categories: | Oscillators MT4 Indicators Volatility MT4 Indicators Currency Strength MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Range MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Indices Market MT4 Indicators Commodity Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Choppiness Index Indicator at a Glance

The "Choppiness Index" Oscillator measures choppiness values from 0 to 100. If the price is above 61.8, the market will be unstable and range bound.

The price is stable and trending if the oscillator's line starts oscillating below 28.2.

Bullish Trend Conditions

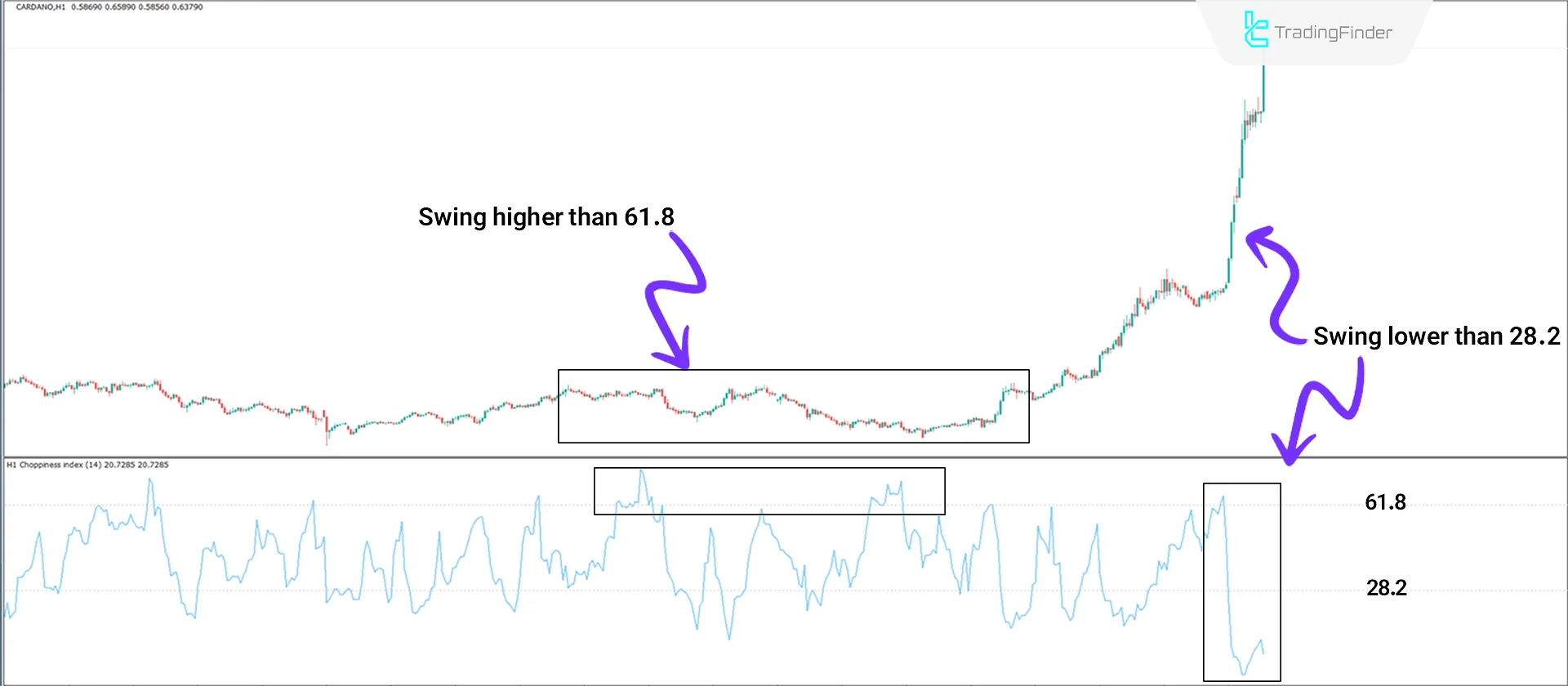

Based on the hourly price chart of Cardano (ADA), when the oscillator line of the indicator fluctuates in positive areas above 61.8, the price is unstable and range-bound.

Conversely, when the oscillator line (in blue) fluctuates below 28.2, the price exits instability and trends.

Bearish Trend Conditions

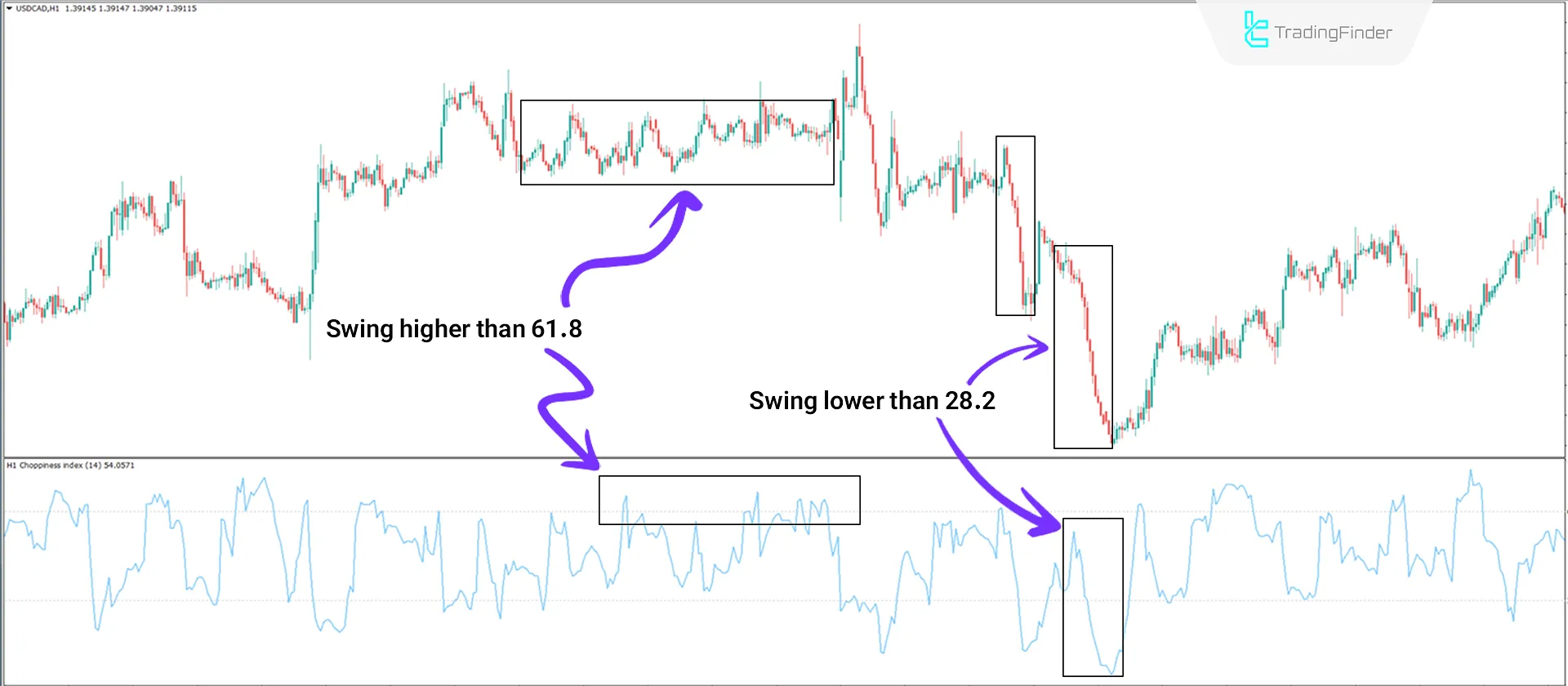

Based on the hourly price chart of the USD/CAD currency pair, when the oscillator line of the indicator fluctuates in positive areas above 61.8, the price is unstable and range-bound.

Conversely, when the oscillator line (in blue) fluctuates below 28.2, the price exits instability and trends.

Indicator Settings

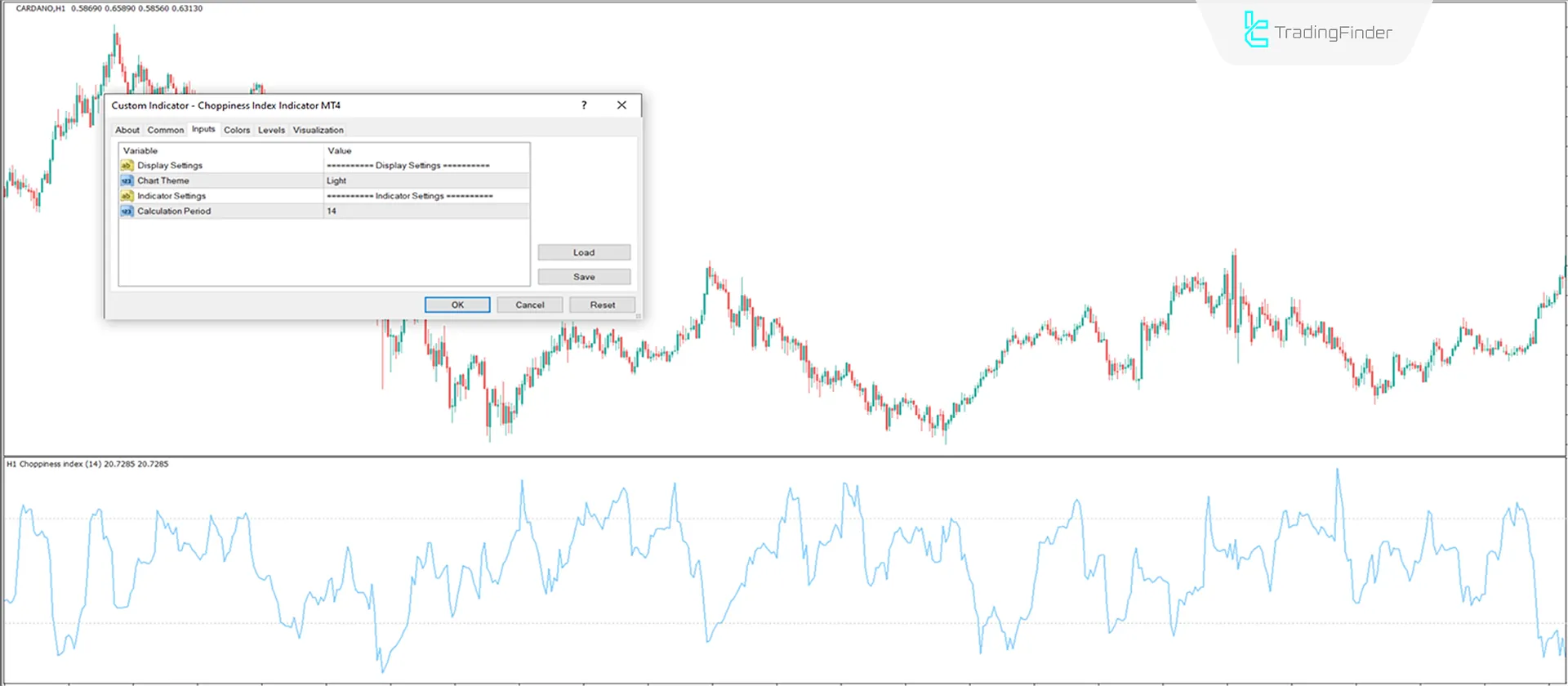

- Chart Theme: Settings Theme;

- Calculation Period: The indicator calculation period is set to 14.

Conclusion

The Choppiness Index Oscillator is a valuable tool for technical analysts using MetaTrader 4 who want to identify choppiness or trend conditions in the market.

This MT4 oscillator allows unstable markets to be easily distinguished from strong trending markets, allowing for appropriate trading strategies in any condition.

Choppiness Index MT4 PDF

Choppiness Index MT4 PDF

Click to download Choppiness Index MT4 PDFWhich trading market is this indicator suitable for?

The Choppiness Index is suitable for use in all trading markets.

Which timeframe is this indicator suitable for?

This indicator is multi-timeframe and works well in all timeframes.