- TradingFinder

- Products

- Indicators

- MetaTrader 4 Indicators

- Multi-Timeframe MT4 Indicators

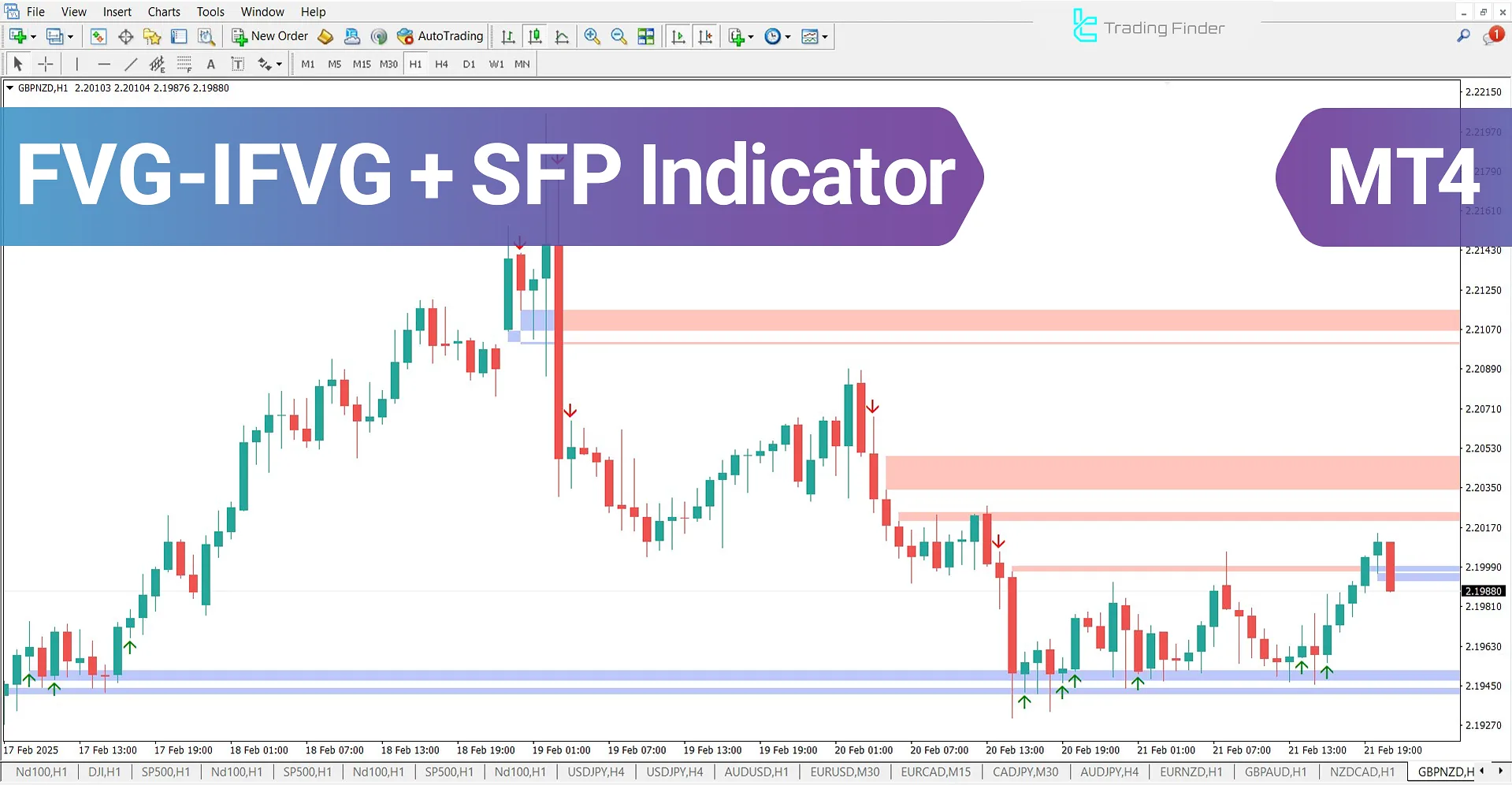

Multi-Timeframe MT4 Indicators

Time frames are used to determine the primary market trend, medium-term time frames help analyze price fluctuations in detail, and short-term time frames allow for more accurate trade entries. For instance, if the Weekly chart indicates an uptrend while the Daily time frame shows a price correction, a trader can utilize Moving Averages (MA) and the Relative Strength Index (RSI) to find optimal entry points. MetaTrader 4 (MT4) provides various tools to facilitate multi-timeframe analysis, including Volume Weighted Average Price (VWAP), Heikin Ashi Candles, and the Directional Movement Index (DMI). This method reduces false signals, improves risk-to-reward ratios, and enhances trading accuracy. By applying multi-timeframe analysis, traders can minimize analytical errors and implement more stable trading strategies effectively.

Sorting:

![Prop Firm Capital Protection Expert MT4 – Download - [TFlab]](https://cdn.tradingfinder.com/image/445902/13-158-en-prop-firm-capital-protection-expert-mt4-01.webp)

![Fast Local Trade Copier Single Multi TF Expert MT4 Download – Free – [TFlab]](https://cdn.tradingfinder.com/image/340226/13-104-en-fast-local-trade-copier-single-multi-mt4-01.webp)

![Trade Manager TF Expert MetaTrader 4 Download - Free - [TradingFinder]](https://cdn.tradingfinder.com/image/269323/11-66-en-trade-manager-tf-mt4-01.webp)

![Forex Factory Calendar Indicator for MetaTrader 4 - Free - [TFlab]](https://cdn.tradingfinder.com/image/260044/13-79-en-ffnews-mt4-01.webp)

![Easy Trade Panel Expert in MetaTrader 4 Download - Free - [TFlab]](https://cdn.tradingfinder.com/image/253984/11-65-en-easy-trade-panel-expert-mt4-01.webp)

![Automatic Premium and Discount Indicator in MT4 Download - Free - [TFlab]](https://cdn.tradingfinder.com/image/248152/13-72-en-automatic-premium-and-discount-ict-mt4-01.webp)

![Market Structure Indicator (BOS-CHOCH) for MT4 Download - Free - [TFlab]](https://cdn.tradingfinder.com/image/242181/11-60-en-market-structure-bos-choch-mt4-01.webp)

![Trade Assist TF Expert for MetaTrader 4 Download - Free - [TFlab]](https://cdn.tradingfinder.com/image/236905/11-59-en-trade-assitent-expert-mt4-01.webp)

![3TP Easy Trade Pad Expert for MT4 Download - [TradingFinder]](https://cdn.tradingfinder.com/image/221433/11-55-en-3tp-easy-trade-pad-expert-mt4-01.webp)

![Easy Trade Manager Expert in MT4 Download - Free - [TradingFinder]](https://cdn.tradingfinder.com/image/214046/13-66-en-easy-trade-manager-mt4-01.webp)