On aug 1, 2025, in version 2, alert/notification functionality was added to this indicator

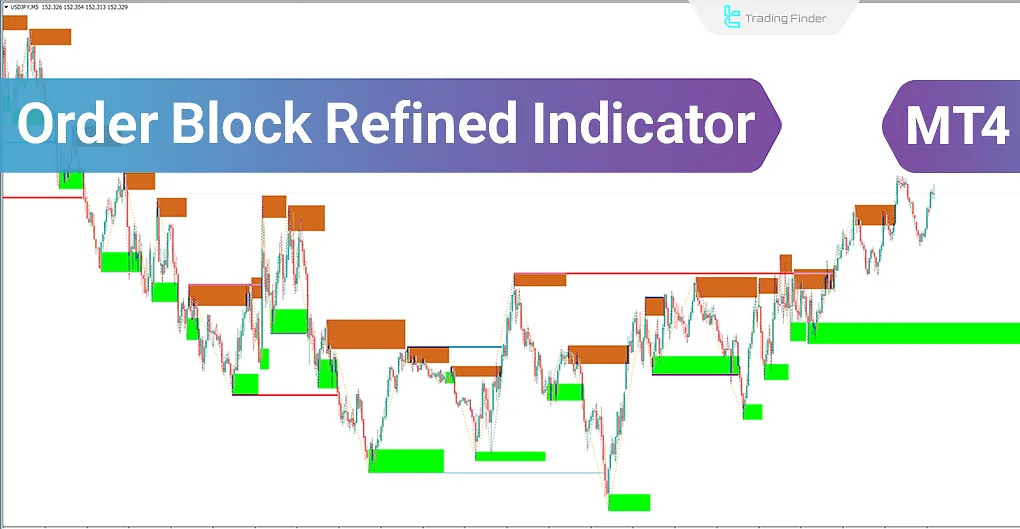

The Order Block Refined (OBR) indicator is a unique tool for traders using ICT and Smart Money (SMC) trading styles, designed for the MetaTrader 4 (MT4) platform. This indicator identifies bullish order blocks in green and bearish order blocks in brown, alerting traders to key areas in the market.

Order block zones are considered crucial price areas, as large influential orders increase the likelihood of price reversals or changes in trend direction. This indicator helps analysts make more informed decisions based on price behavior in these zones.

Order Block Indicator Table

Indicator Categories: | ICT MT4 Indicators Smart Money MT4 Indicators Supply & Demand MT4 Indicators Currency Strength MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Leading MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Intraday MT4 Indicators Scalper MT4 Indicators |

Trading Instruments: | Indices Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Indicator at a Glance

The Order Block Refined Indicator highlights bullish order blocks in green and bearish order blocks in brown on the chart, making these zones easily identifiable for traders.

This indicator is a practical tool for traders who pinpoint high-value order blocks to conduct more precise analyses and make better trading decisions based on these trading zones.

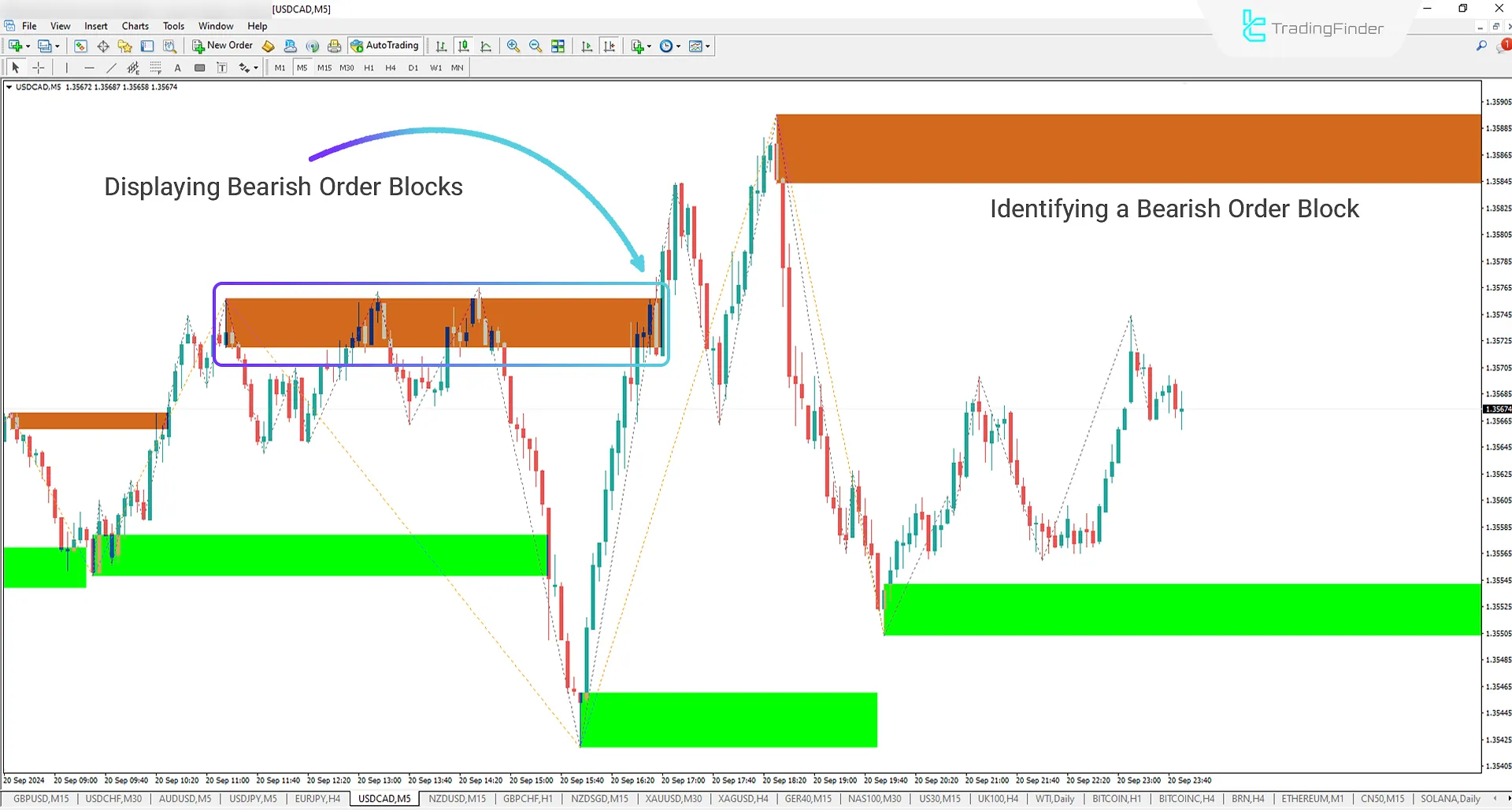

Bullish Order Block (OBR)

On the 15-minute GER40 Index chart, the Order Block Refined (OBR) indicator identifies bullish order blocks and displays them in green, informing traders of key price zones. In this chart, an order block is determined at the price level of 18207.4 and marked with a rectangle.

After the price returns to this zone, a strong upward reaction occurs, indicating the importance of this zone in guiding price movements and trend changes. Traders can use this information to make more precise trading decisions.

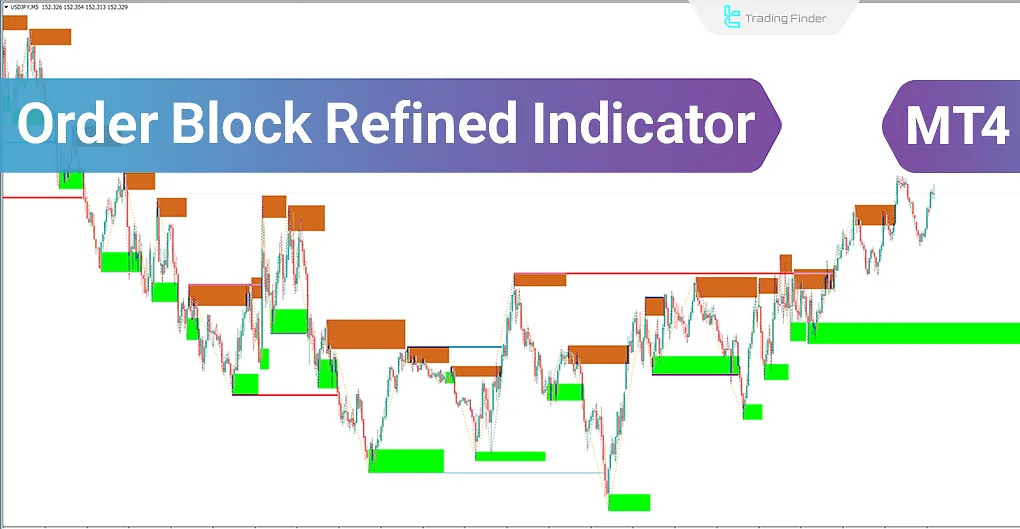

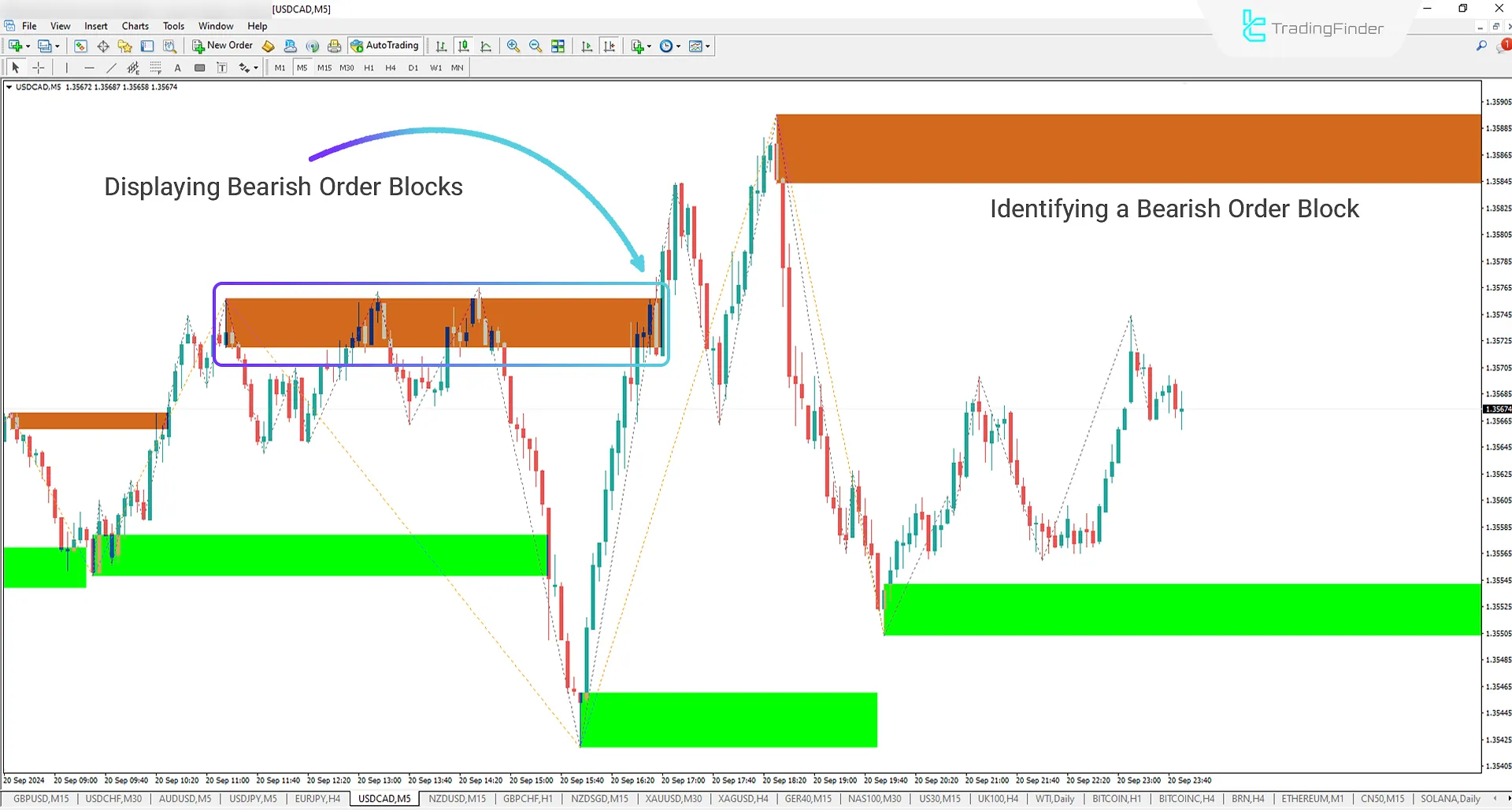

Bearish Order Block (OBR)

In the 5-minute USD/CAD chart, a bearish order block is identified at the price of 1.35720, displayed in brown. When the price returns to this key price zone, it reacts, testing the order block again, but fails to break through this important zone. After this, a sharp downward trend follows.

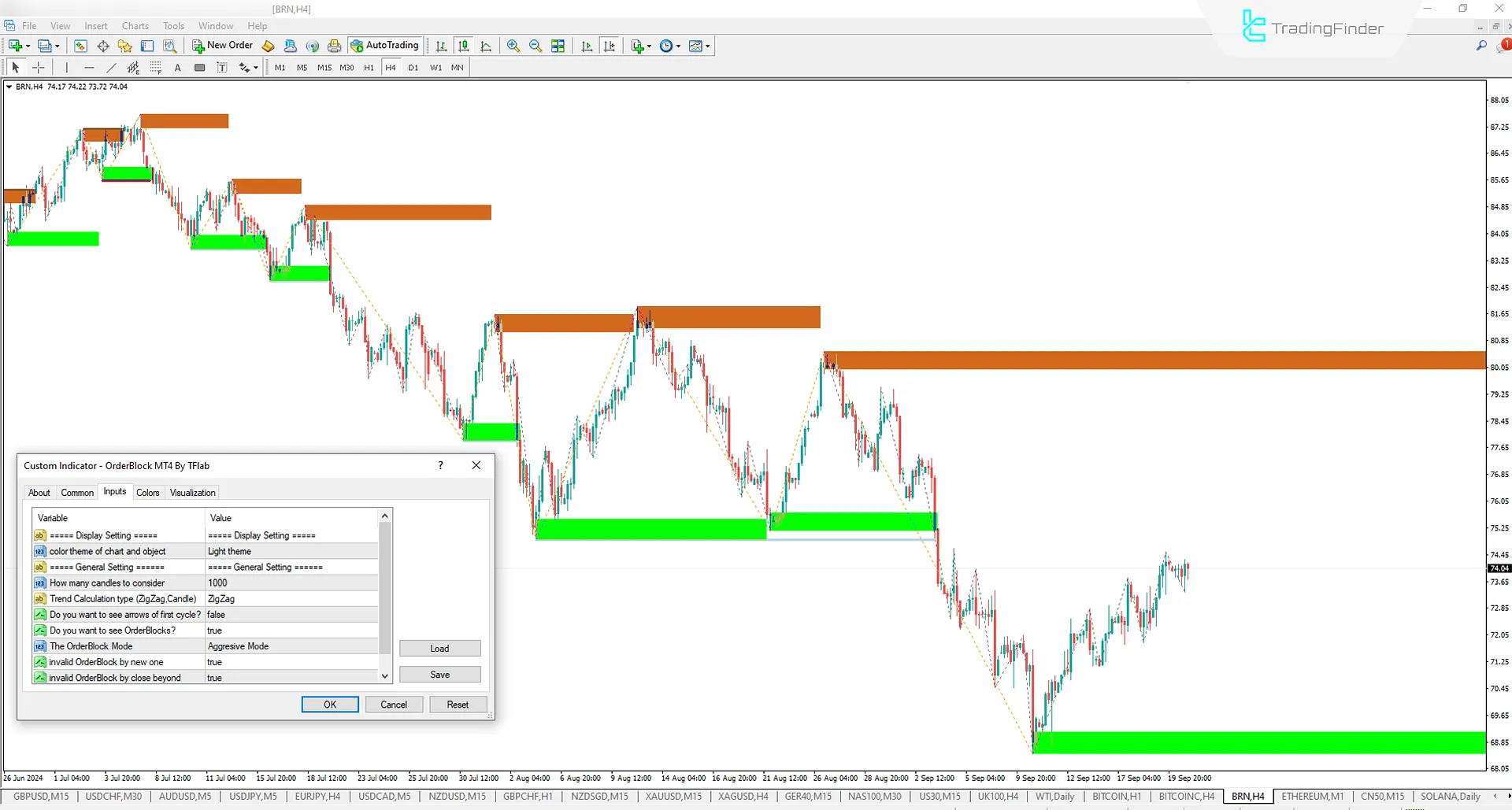

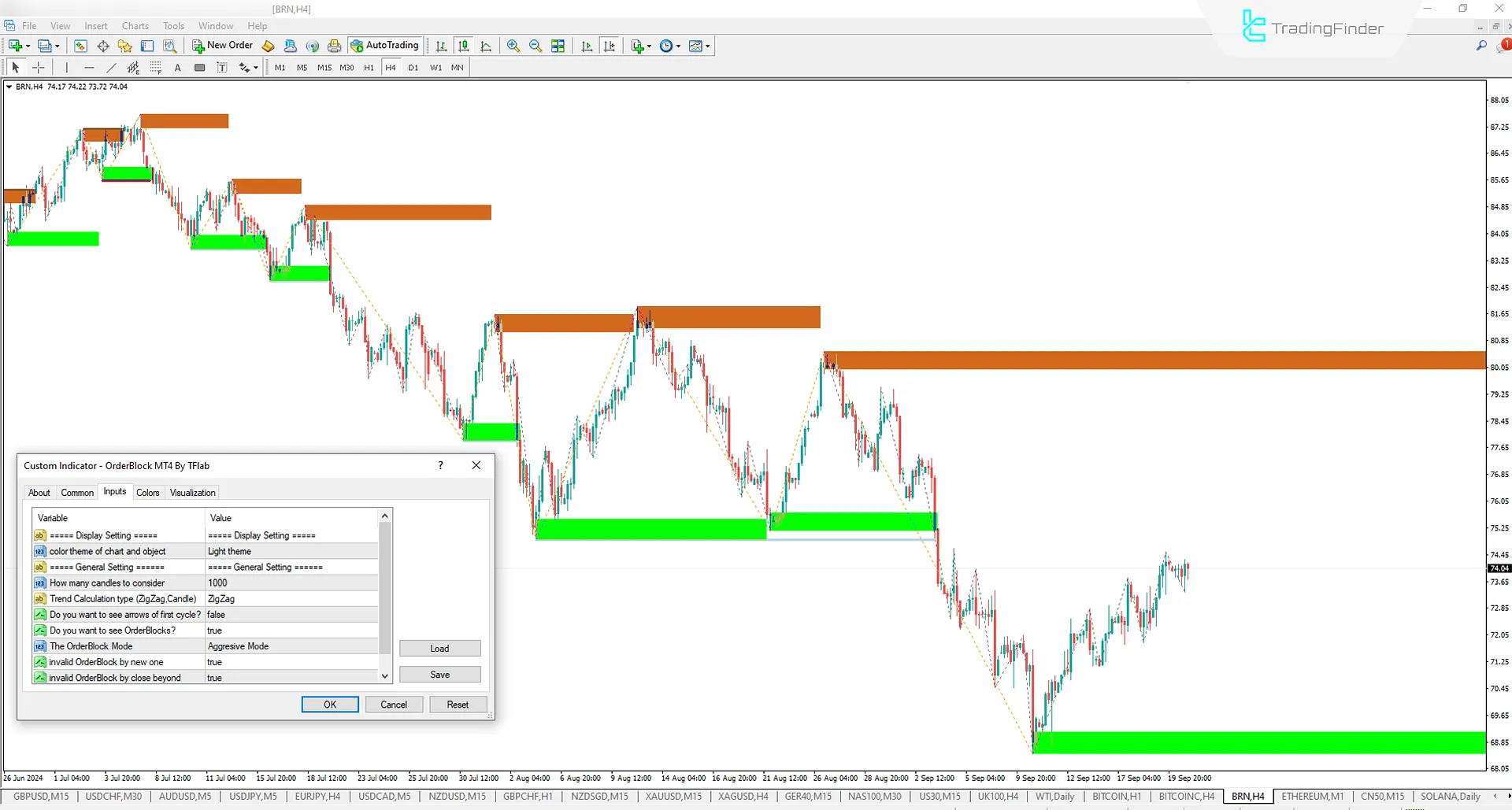

Refined Order Block Indicator Settings

- Color theme of chart and object: Set the chart theme to one of three options: Light, Dark, or Auto;

- How many candles to consider: Number of candles from the past to include in the calculation;

- Trend Calculation type (ZigZag.Candle): Choose the trend calculation type based on ZigZag or Candles;

- Do you want to see the arrows for the first cycle?: Enable/turn off the display of arrows for the first cycle;

- Do you want to see Order Blocks? Turn on/off the display of order blocks;

- The Order Block Mode: Set the order block mode to one of three options Normal, Aggressive;

- Invalid Order Block by new one: Continue/discontinue the previous order block zone;

- Invalid Order Block by close beyond: Complete the zone until a new zone opens.

Conclusion

The Refined Order Block (OBR) indicator is a suitable Trading tool for traders seeking strong potential order blocks. It is helpful for traders looking for order blocks on price charts. Identifying and drawing bullish blocks in green and bearish blocks in brown highlights the large orders of banks and financial institutions.

Order Block Refined indicator MT4 PDF

Order Block Refined indicator MT4 PDF

Click to download Order Block Refined indicator MT4 PDFWhat is the Refined Order Block (OBR) Indicator?

The OBR indicator is a tool for identifying supply and demand zones in the market. It works based on the analysis of large orders and refined points. This indicator helps traders identify suitable entry and exit points

Is the OBR suitable for all markets?

The OBR can be used in various markets, including Forex, stocks, and cryptocurrencies. However, results may vary depending on market conditions and financial instruments