![STL & ITL & LTL Indicator for MetaTrader 4 Download (ICT) - Free - [TFlab]](https://cdn.tradingfinder.com/image/154598/4-18-en-stl-itl-ltl-mt4-1.webp)

![STL & ITL & LTL Indicator for MetaTrader 4 Download (ICT) - Free - [TFlab] 0](https://cdn.tradingfinder.com/image/154598/4-18-en-stl-itl-ltl-mt4-1.webp)

![STL & ITL & LTL Indicator for MetaTrader 4 Download (ICT) - Free - [TFlab] 1](https://cdn.tradingfinder.com/image/154569/4-18-fa-stl-itl-ltl-mt4-2.webp)

![STL & ITL & LTL Indicator for MetaTrader 4 Download (ICT) - Free - [TFlab] 2](https://cdn.tradingfinder.com/image/154568/4-18-fa-stl-itl-ltl-mt4-3.webp)

![STL & ITL & LTL Indicator for MetaTrader 4 Download (ICT) - Free - [TFlab] 3](https://cdn.tradingfinder.com/image/154585/4-18-fa-stl-itl-ltl-mt4-4.webp)

The STL, ITL, and LTL Indicator in MetaTrader 4 indicators is a practical tool for traders seeking to identify short-term (STL), mid-term (ITL), and long-term (LTL) price lows.

This indicator is designed based on the ICT trading style and helps traders recognize key market reversal points.

Indicator Table

Indicator Categories: | ICT MT4 Indicators Currency Strength MT4 Indicators Liquidity MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Forward Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Indicator at a Glance

This indicator identifies swing lows in price movements, enabling traders to detect price reversal points. These key points occur at levels where price fluctuates due to changes in supply and demand.

By accurately analyzing price lows, from short-term lows (STL) to long-term lows (LTL), the indicator provides traders with a more comprehensive picture of price trends.

Indicator in an Uptrend

In the uptrend of the CAD/JPY currency pair, the price consistently breaks its short-term and mid-term lows before forming a long-term low (LTL).

This pattern indicates a price reversal, and to sustain this trend, the price must not break the newly formed long-term low. Otherwise, there is a potential for trend reversal.

Traders, upon confirming the price trend, can place their stop-loss before the long-term low (LTL) and enter a Buy trade.

Indicator in a Downtrend

In the USD/CHF 5-minute price chart, the price, after forming a long-term low (LTL), fails to create a new high.

Following this inability to form a high, the price breaks its recent long-term low, and with confirmation of the break, continues its downtrend.

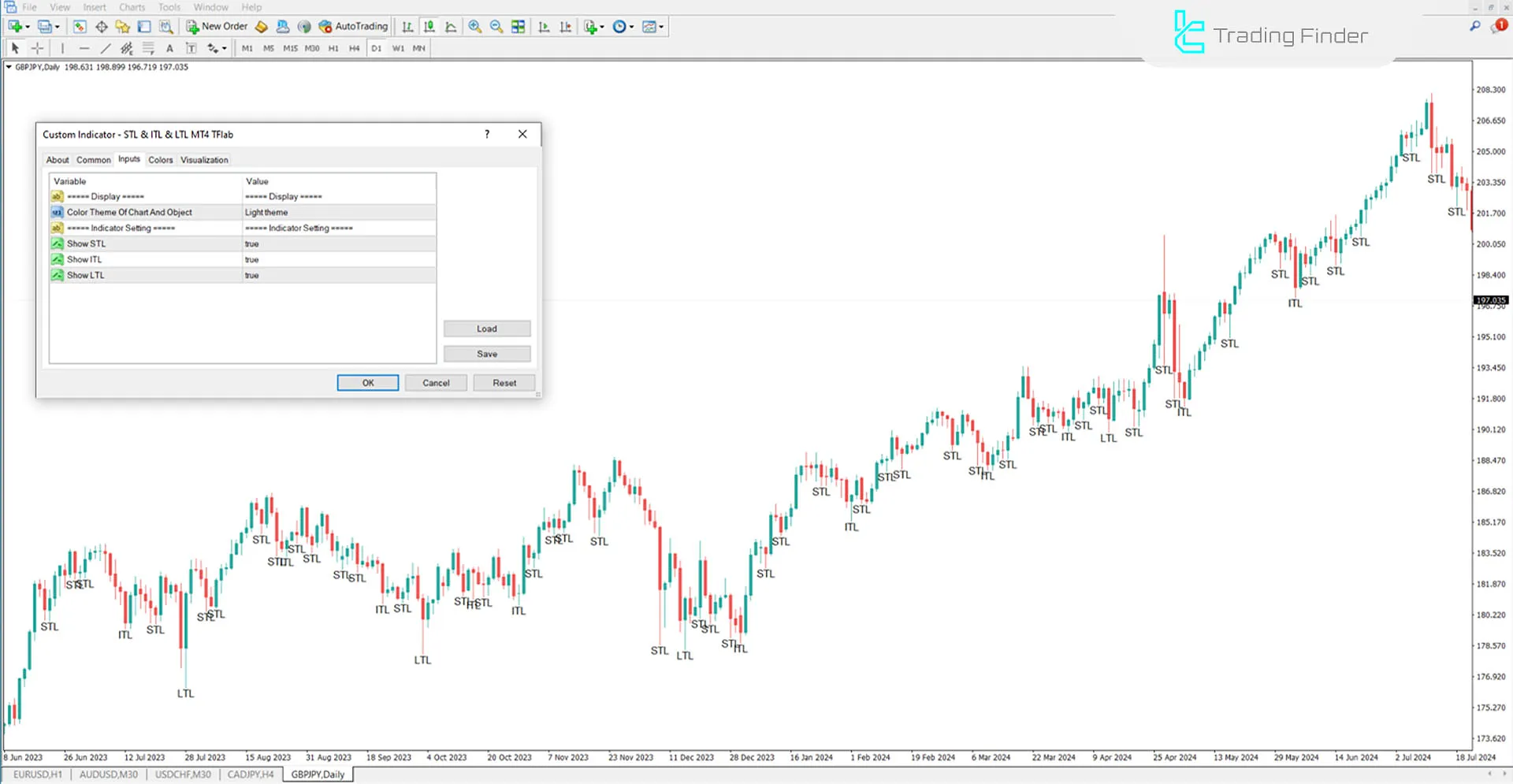

Indicator Settings

- Color Theme of Chart and Object: Background color of the chart;

- Show STL: Displays short-term lows;

- Show ITL: Displays mid-term lows;

- Show LTL: Displays long-term lows.

Conclusion

Traders use STL, ITL, and LTL to identify key support and resistance levels, potential reversal points, and trend confirmations.

By understanding the hierarchy and relationships among these lows, traders can predict market movements, plan trades based on their strategies, and achieve profitability.

STL ITL LTL ICT MT4 PDF

STL ITL LTL ICT MT4 PDF

Click to download STL ITL LTL ICT MT4 PDFWhat is the STL, ITL, and LTL Indicator?

It is a tool for identifying short-term, mid-term, and long-term price lows to determine key market points.

How does the indicator work?

Based on the ICT style, it identifies swing lows and detects key market reversal points.