![Synthetic Volatility Index Indicator for MetaTrader 4 Download - Free - [TFlab]](https://cdn.tradingfinder.com/image/276613/4-57-en-synthetic-volatility-index-mt4-1.webp)

![Synthetic Volatility Index Indicator for MetaTrader 4 Download - Free - [TFlab] 0](https://cdn.tradingfinder.com/image/276613/4-57-en-synthetic-volatility-index-mt4-1.webp)

![Synthetic Volatility Index Indicator for MetaTrader 4 Download - Free - [TFlab] 1](https://cdn.tradingfinder.com/image/276614/4-57-en-synthetic-volatility-index-mt4-2.webp)

![Synthetic Volatility Index Indicator for MetaTrader 4 Download - Free - [TFlab] 2](https://cdn.tradingfinder.com/image/276602/4-57-en-synthetic-volatility-index-mt4-3.webp)

![Synthetic Volatility Index Indicator for MetaTrader 4 Download - Free - [TFlab] 3](https://cdn.tradingfinder.com/image/276616/4-57-en-synthetic-volatility-index-mt4-4.webp)

The Synthetic Volatility Index (SVI) Indicator is designed to measure market volatility among MetaTrader 4 indicators. This oscillator monitors price fluctuations and visualizes market volatility.

The SVI oscillator first identifies the highest closing price within a 22-candle period, then subtracts the lowest price of the same period.

The result is then divided by the highest closing price of the same 22-period and multiplied by 100 to adjust the scale.

Indicator Specifications Table

The table below summarizes the key features of the Synthetic Volatility Index Indicator.

Indicator Categories: | Oscillators MT4 Indicators Volatility MT4 Indicators Trading Assist MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Range MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Forward Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Indicator at a Glance

This MetaTrader 4 oscillator does not directly provide buy or sell signals but instead displays the current state of market volatility. If the VIX value is below 1, it indicates a price increase. Conversely, when VIX is above zero, the price tends to decline.

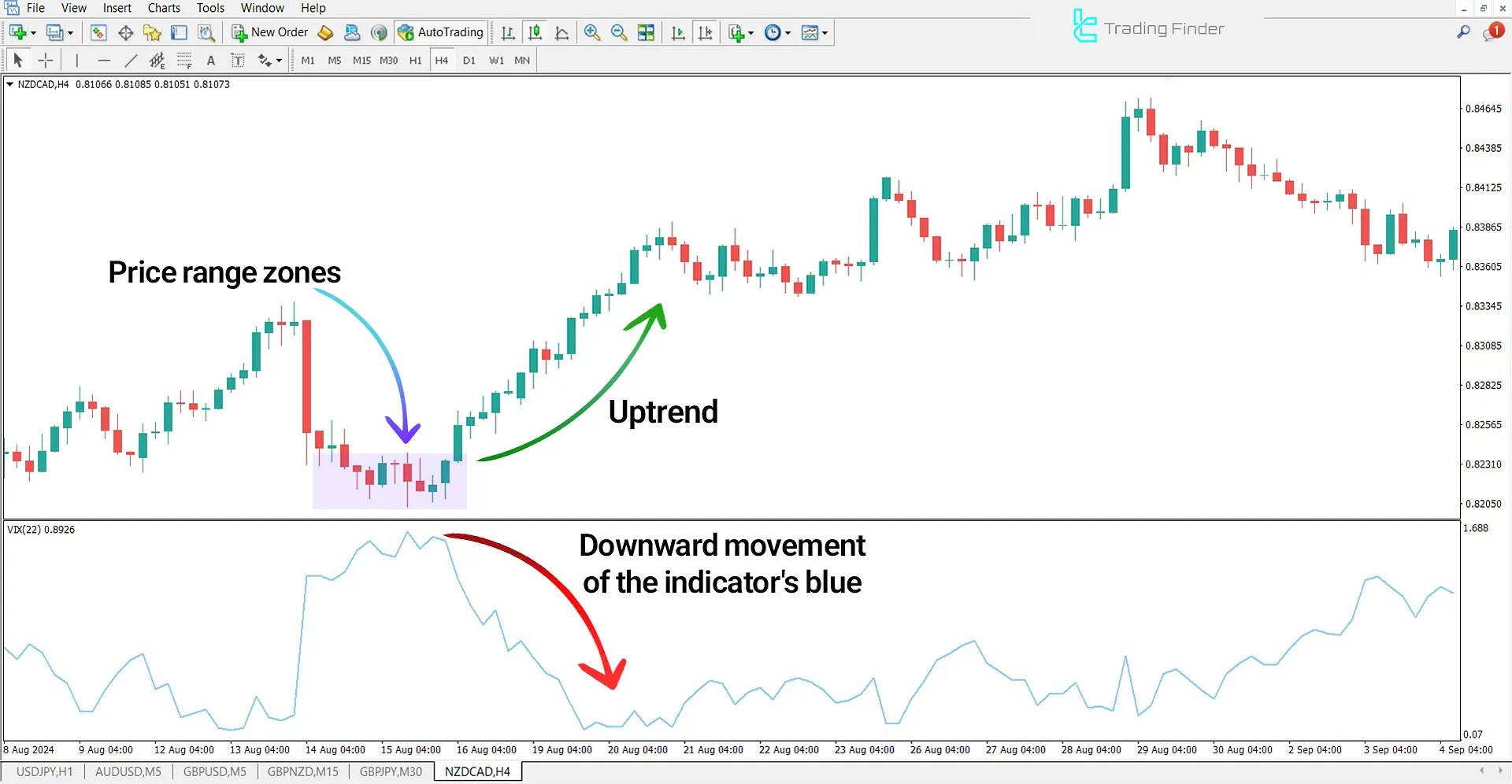

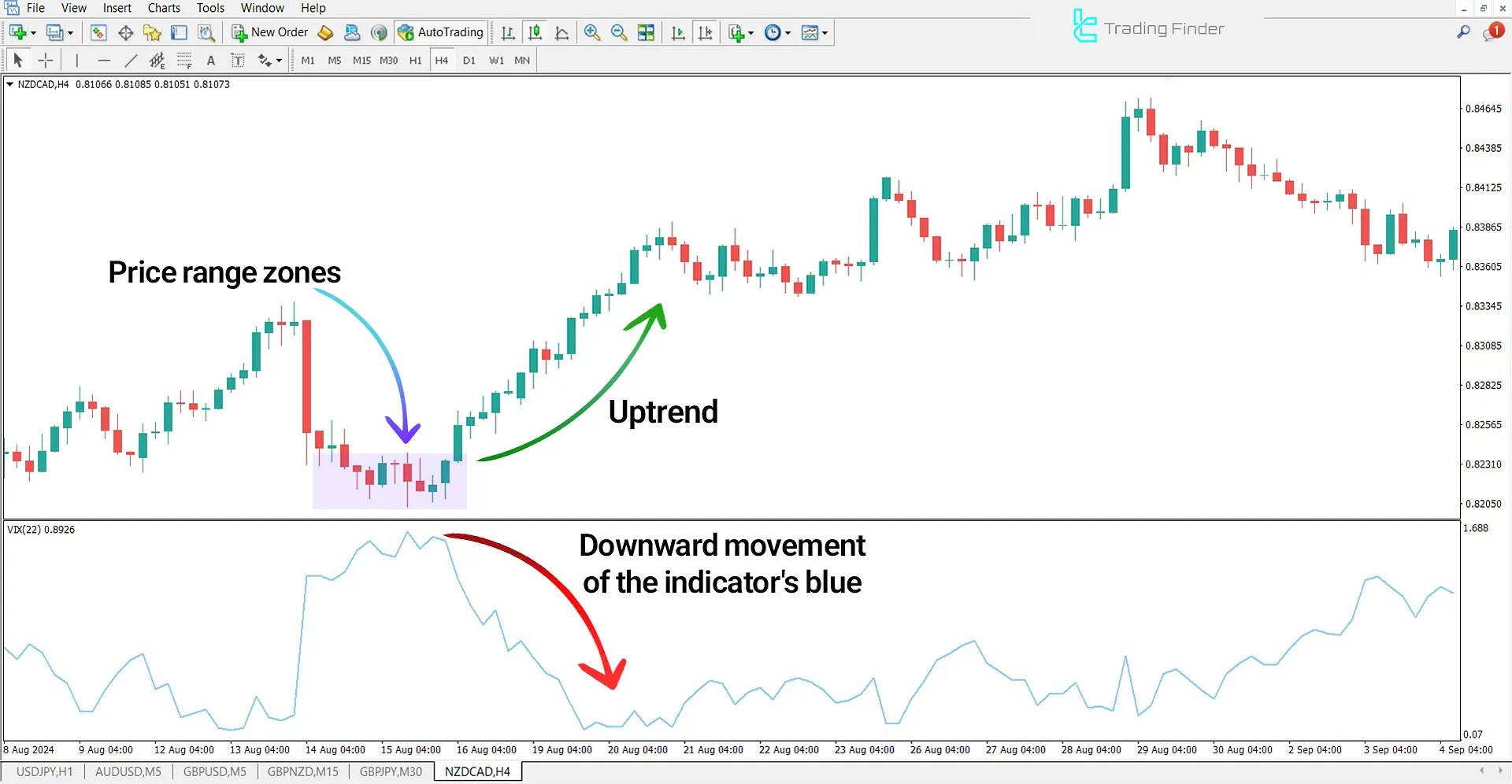

Indicator in an Uptrend

When the blue oscillator line moves downward, the probability of a price increase rises.

Traders can use this indicator in key areas, such as Order Blocks or Breaker Blocks, to identify entry points.

Indicator in a Downtrend

On the 30-minute timeframe, the GBP/JPY currency pair's price ranged within a consolidation zone.

The blue indicator line started rising after a trend formation and price drop. An exit opportunity is created as the blue line reaches low values in the oscillator window.

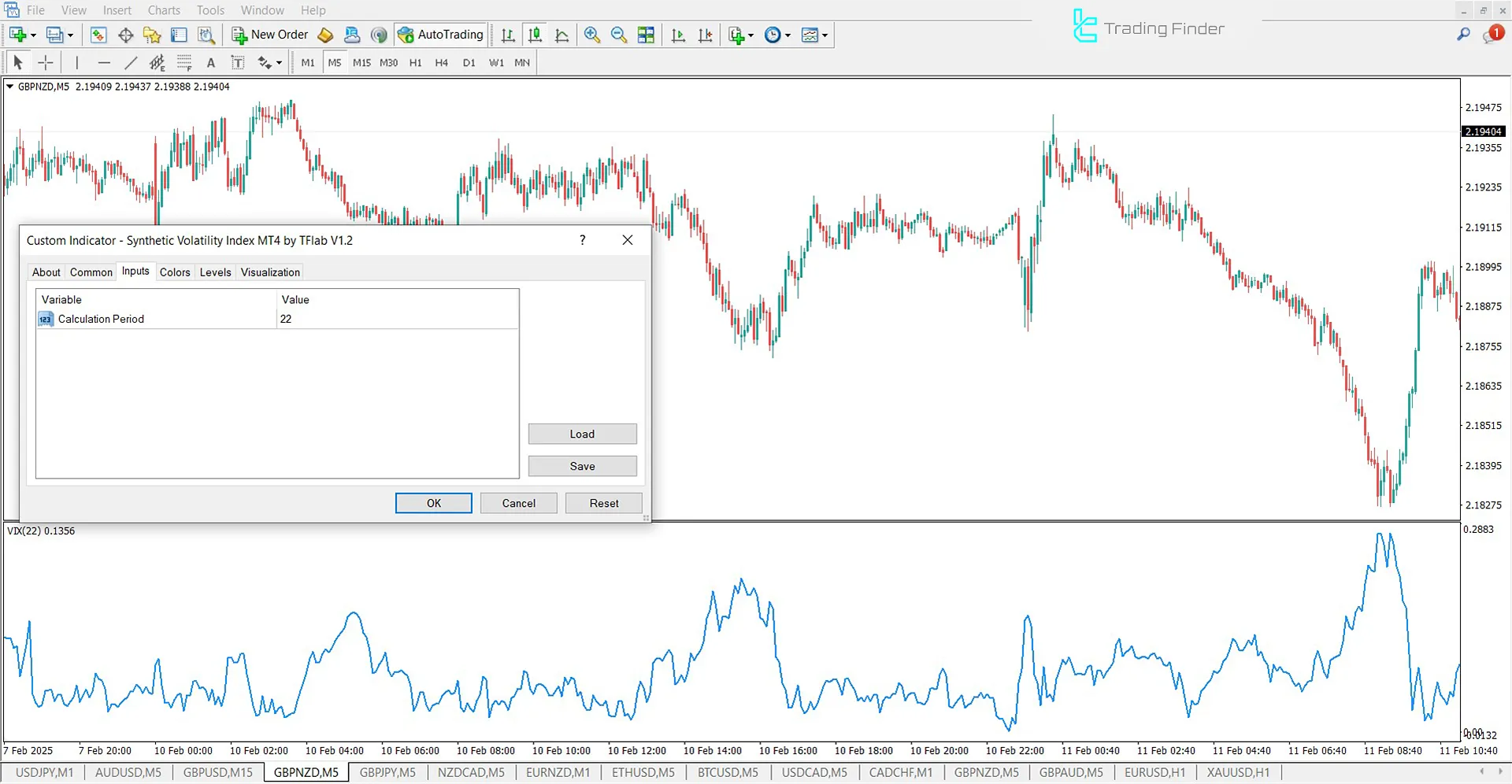

Indicator Settings

The image below displays all sections of the Synthetic Volatility Index Indicator settings:

- Period: Defines the calculation period for candles in the indicator

Conclusion

The Synthetic Volatility Index Oscillator is most effective in range-bound markets or uncertain market conditions.

When prices fluctuate within a narrow range and the probability of a breakout increases, this indicator assesses trend strength and breakout likelihood.

Beyond Forex, this indicator also performs well in cryptocurrency markets and other tradable assets.

Synthetic Volatility Index MT4 PDF

Synthetic Volatility Index MT4 PDF

Click to download Synthetic Volatility Index MT4 PDFWhat is the purpose of the Synthetic Volatility Index Indicator?

This indicator measures market volatility and provides traders with insights into the current volatility conditions.

How can this indicator be used for market analysis?

Traders can use this indicator to evaluate trend strength and potential breakouts in range-bound or uncertain market conditions.