![Prop Firm Capital Protection Expert MT4 – Download - [TFlab]](https://cdn.tradingfinder.com/image/445913/13-158-en-prop-firm-capital-protection-expert-mt4-01.webp)

![Prop Firm Capital Protection Expert MT4 – Download - [TFlab] 0](https://cdn.tradingfinder.com/image/445913/13-158-en-prop-firm-capital-protection-expert-mt4-01.webp)

![Prop Firm Capital Protection Expert MT4 – Download - [TFlab] 1](https://cdn.tradingfinder.com/image/445924/13-158-en-prop-firm-capital-protection-expert-mt4-02.webp)

![Prop Firm Capital Protection Expert MT4 – Download - [TFlab] 2](https://cdn.tradingfinder.com/image/445935/13-158-en-prop-firm-capital-protection-expert-mt4-06.webp)

![Prop Firm Capital Protection Expert MT4 – Download - [TFlab] 3](https://cdn.tradingfinder.com/image/445946/13-158-en-prop-firm-capital-protection-expert-mt4-19.webp)

On September 1, 2025, the latest version of this indicator was released. To obtain a free license, click on Online Support and connect with us via Telegram or WhatsApp through the section “Connect with an Expert.

The Prop Firm Capital Protection Expert is one of TradingFinder's specialized products for the MetaTrader 4 platform, designed for advanced capital management, smart risk control, and precise, rapid trade execution.

This tool, with its professional panel, offers features like Break Even, dynamic Trailing Stop, and advanced order management in a Multi-Symbol environment.

Additionally, equipped with 7 practical settings tabs, it can be used to optimize trading psychology and improve trading strategy performance.

By sending smart alerts, it enables Forex traders to implement prop trading rules in a more advanced environment for greater success and profitability.

Who Is the Prop Firm Capital Protection Expert Designed For?

The Prop Firm Capital Protection Expert is a specialized tool for professional trading, capital management, and risk mitigation tailored to meet the needs of a wide range of traders.

From professional prop firm traders to independent retail traders seeking more discipline and control in their strategy execution, this tool offers valuable features for all. Below are the main target user groups:

Prop Firm Traders

This Expert is specifically developed with the rules and limitations of prop firm accounts in mind. Key features include:

- Setting daily/weekly profit and loss limits

- Drawdown limitation

- Defining allowed trade volume

- Time and symbol control tabs

Scalpers

This group of traders requires speed, precision, and rapid decision-making. The Expert provides:

- Instant order execution

- Partial Close capability

- Candle timer

- Dynamic trailing stop

These tools offer a professional environment for executing scalp strategies with controlled risk.

Traders with Personal Strategies

If you follow a defined trading plan or styles like ICT, Smart Money, or Price Action, this Expert allows you to customize all key parameters exactly according to your strategy.

High-Risk Traders

For those struggling with challenges such as overtrading, FOMO, or emotional entries, this tool provides effective safeguards.

It enforces:

- Limits on the number and size of trades

- Profit/loss thresholds

- Auto-disable trading after hitting predefined boundaries

This acts as a psychological barrier, helping to enforce trading discipline.

Table of Specifications for the Prop Firm Capital Protection Expert

The following table displays the information and specifications of theProp Firm Capital Protection Expert:

Indicator Categories: | Money Management MT4 Indicators Trading Assist MT4 Indicators Risk Management MT4 Indicators Drawdown Indicators in MetaTrader 4 |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Advanced |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Intraday MT4 Indicators Scalper MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Indices Market MT4 Indicators Stock Market MT4 Indicators Forex MT4 Indicators |

Prop Firm Capital Protection Expert at a Glance

The Prop Firm Capital Protection Expert, offering features such as determining entry volume, take profit and stop loss in three modes, controlling entry and exit times, and selecting allowed symbols, is a comprehensive tool for the rule-based execution of trades.

This tool, focusing on emotion management and adherence to the trading plan, provides the ability to define personal and structured rules for prop traders.

Furthermore, the Prop Firm Capital Protection Expert, with its simple management panel, offers features like Break Even, Trailing Stop, Partial Close, and Pyramiding for optimal risk and capital management.

Key Features of the Prop Firm Capital Protection Expert

This section presents a set of expert functionalities, each contributing to improved trade accuracy, reduced risk, and enhanced trader discipline. These features are designed to support fast execution, intentional decision-making, and commitment to a trading plan.

Compliance with Prop Firm Account Rules

The expert is designed with strict attention to prop firm account requirements, where even minor rule violations may result in account termination. While it does not execute trades automatically, it acts as a protective framework through precise control settings, preventing common execution errors.

Key capabilities include:

- Drawdown management with daily and overall limits: You can define max loss thresholds per day or account-wide. Once breached, the system disables new trades

- Trade volume and count control over set periods: Helps prevent overtrading and limits emotional decision-making

- Blocking trades during news events: With its news alert system, the expert automatically restricts entries around high-impact economic events

- Halting trades upon hitting profit/loss caps: When defined profit or loss thresholds are reached, the expert suspends trading to protect gains or prevent further losses

Position Sizing Based on Capital, Risk %, or Pip Distance

The expert enables traders to calculate position size precisely based on their risk per trade, eliminating the need for manual calculations.

By selecting one of the inputs (e.g., percentage of account balance, fixed dollar amount, or stop loss distance in pips), the expert calculates the ideal lot size automatically.

This not only saves time but also minimizes risk-related errors.

Partial Close & Break Even Options

By enabling these options, traders can lock in partial profits or automatically move the stop loss to breakeven.

This is especially useful in volatile market conditions to secure profits and eliminate downside risk.

Trade Time Management

With custom active hours per day of the week, traders can restrict market participation to predefined windows.

This prevents off-plan trades and supports a consistent daily trading routine.

Daily & Weekly Profit/Loss Limits

By defining daily or weekly profit/loss ceilings, the expert will halt all trading once thresholds are met.

This helps avoid emotional re entry after losses or overconfidence after gains supporting psychological balance.

Emotion Control & Trading Discipline

The expert constructs a structured framework that enables traders to avoid common psychological pitfalls and adhere to predefined rules.

Key tools include:

- Daily profit/loss caps

- Trade count limits

- Drawdown control

- Auto-disable trading after consecutive losses

- Smart alerts

These features effectively prevent impulsive entries and unplanned decisions.

Candle Timer

In many trading strategies, the remaining timebefore the candle closes is critical for entry or exit decisions.

The expert displays a real-time candle countdown, allowing traders to time their decisions based on the close of a price structure.

Installation and Activation Guide for the Expert

To learn how to install and run the Expert Advisor, refer to the step by step guide on installing an Expert in MetaTrader 4.

This tutorial covers everything from file placement to initial settings and essential tips before activation using visual aids to ensure a smooth, error-free setup process.

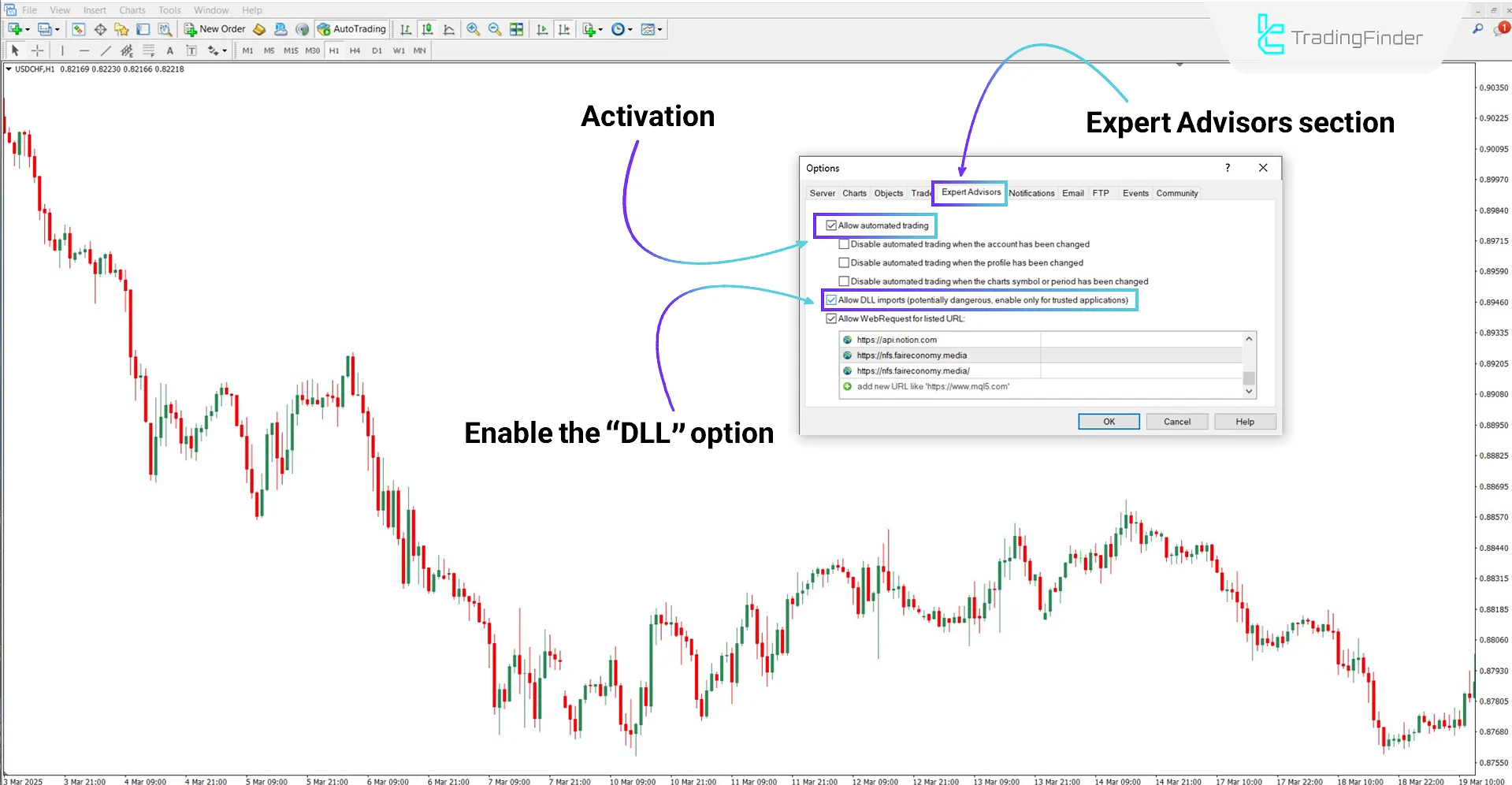

Enable the "Allow DLL" Option in MetaTrader 4 Settings

- For the Expert to function correctly, several key settings in MetaTrader 4 must be enabled. Follow the steps below:

- From the top menu in MetaTrader 4, click on "Tools," then select "Options";

- In the new window, go to the "Expert Advisors" tab;

- In this section, check the following options:

- Allow DLL imports

- Allow automated trading

How to Obtain a License Code

To activate the Expert and receive your license, contact the support team after the first launch of the tool.

You can request your license code via live chat on the website or through messaging apps like Telegram or Whats App. The license code will be issued to you.

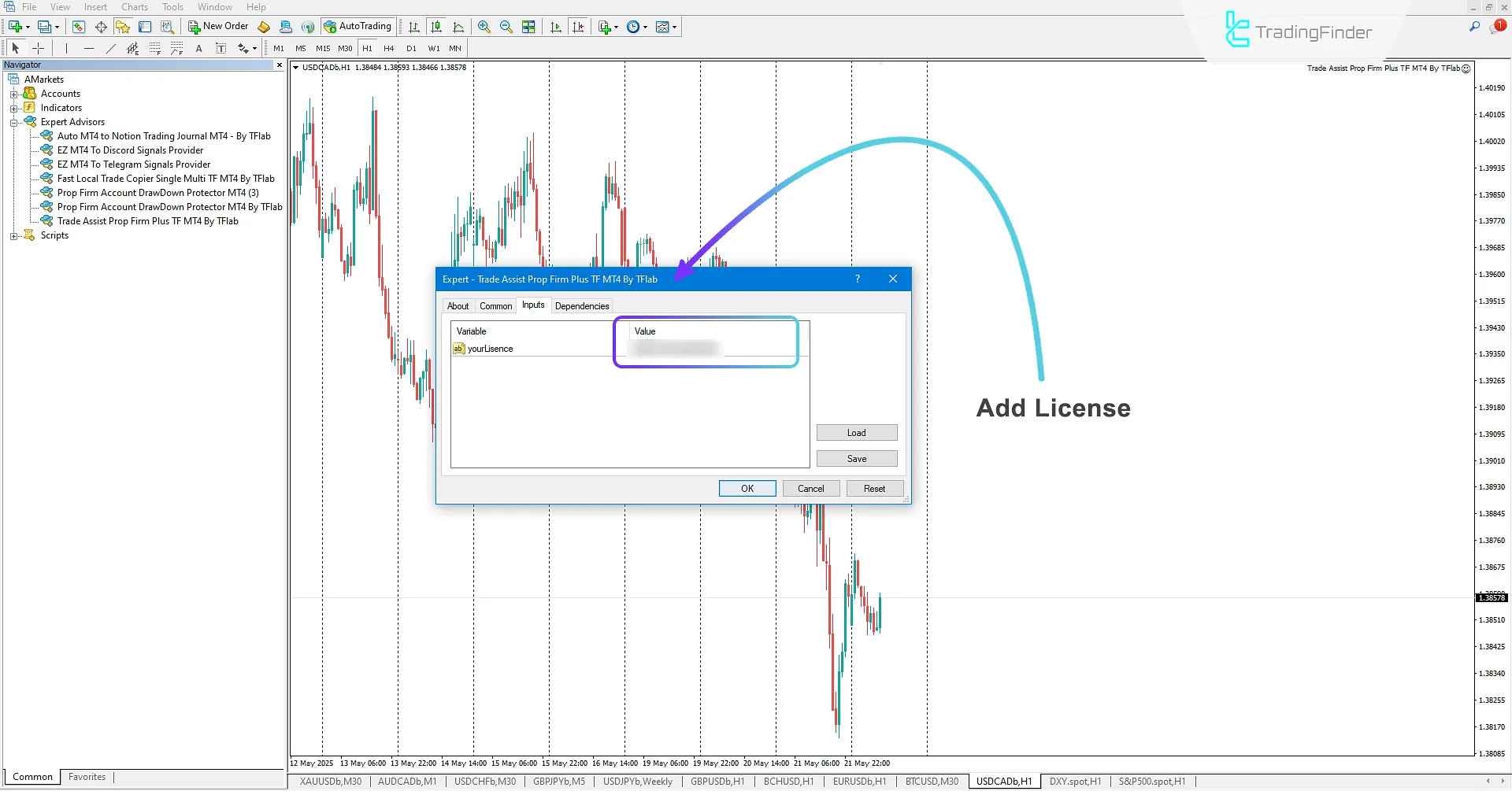

How to Enter the License Code in the Expert Settings

To complete the activation process, enter the license code in the Expert's panel:

- Launch the Expert on the chart

- The main panel will appear on the left side of the screen

- Locate the field labeled "Your License"

- Enter the license code in this field

Panel Structure and Configurable Sections in the Expert Advisor

The Prop Firm Capital Protection Expert includes a variety of functional and modular components, each independently covering a key part of the trading process.

Trade Tab

Traders can have more complete control over their trades using the Trade tab in the Prop Firm Capital Protection Expert. In this tab, a variety of features are provided for better management of trading positions, including:

- Determining position type: Buy, Sell, Buy Pending (Buy Limit/Stop), and Sell Pending (Sell Limit/Stop)

- Determining trade volume: appropriate to the capital management strategy

- Determining Stop Loss (SL): adjustable in three configurable modes

- Based on points

- Based on a percentage of the balance

- Based on a dollar amount

- Determining Take Profit (TP): with the ability to set in four modes

- Based on points

- Based on percentage

- Based on a dollar amount

- Based on the Reward-to-Risk Ratio

This section of the expert allows traders to enter trades more precisely, fully execute their trading plan, and manage trade risk systematically.

- Buy&Sell: Instant buy and sell option

- Buy.P & Sell.p: Option to place pending orders

- Lot size: Determining the trade volume

- SL: Determining the stop-loss calculation method along with setting the amount

- TP: Determining the take-profit calculation method along with setting the amount

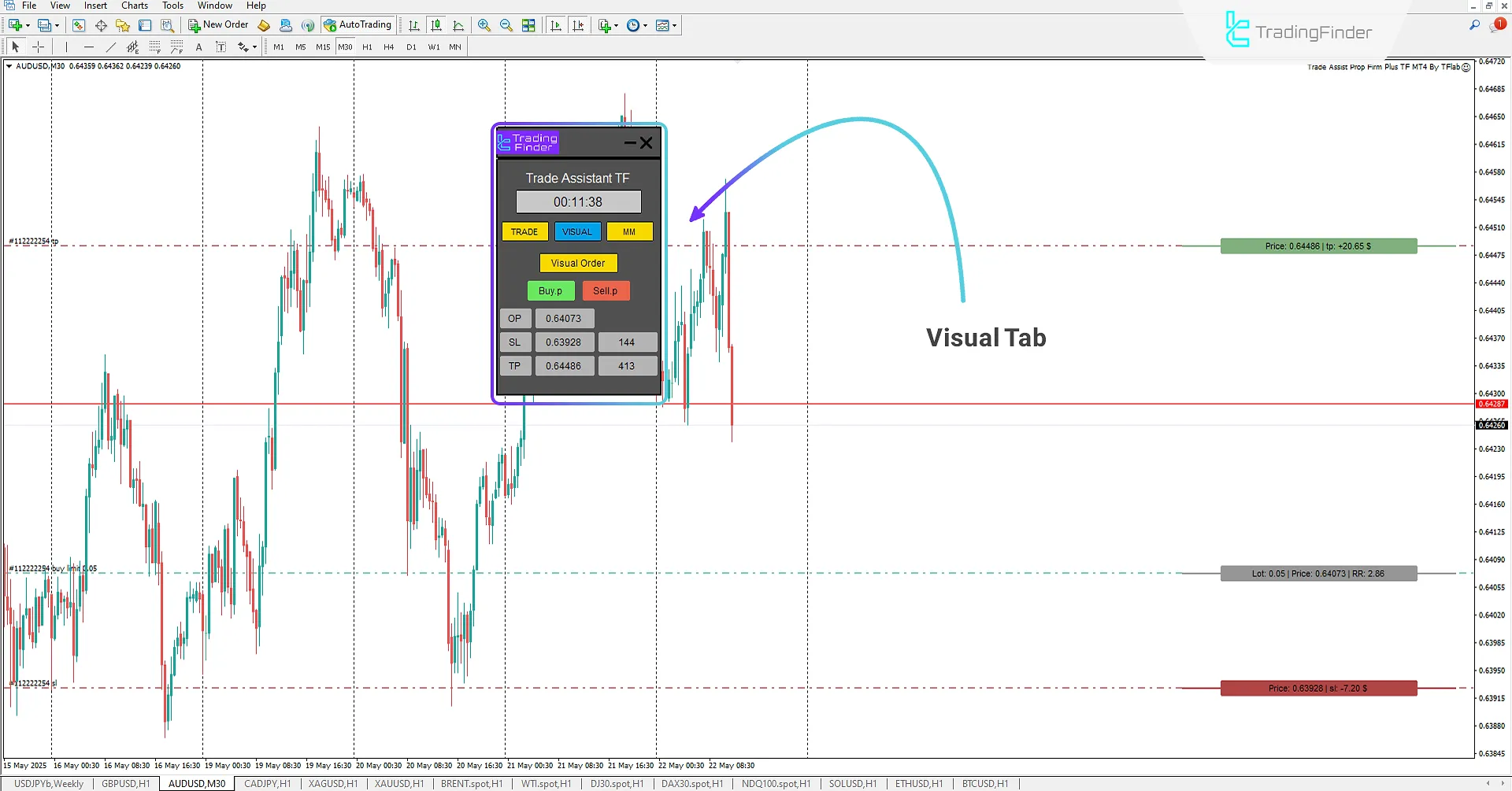

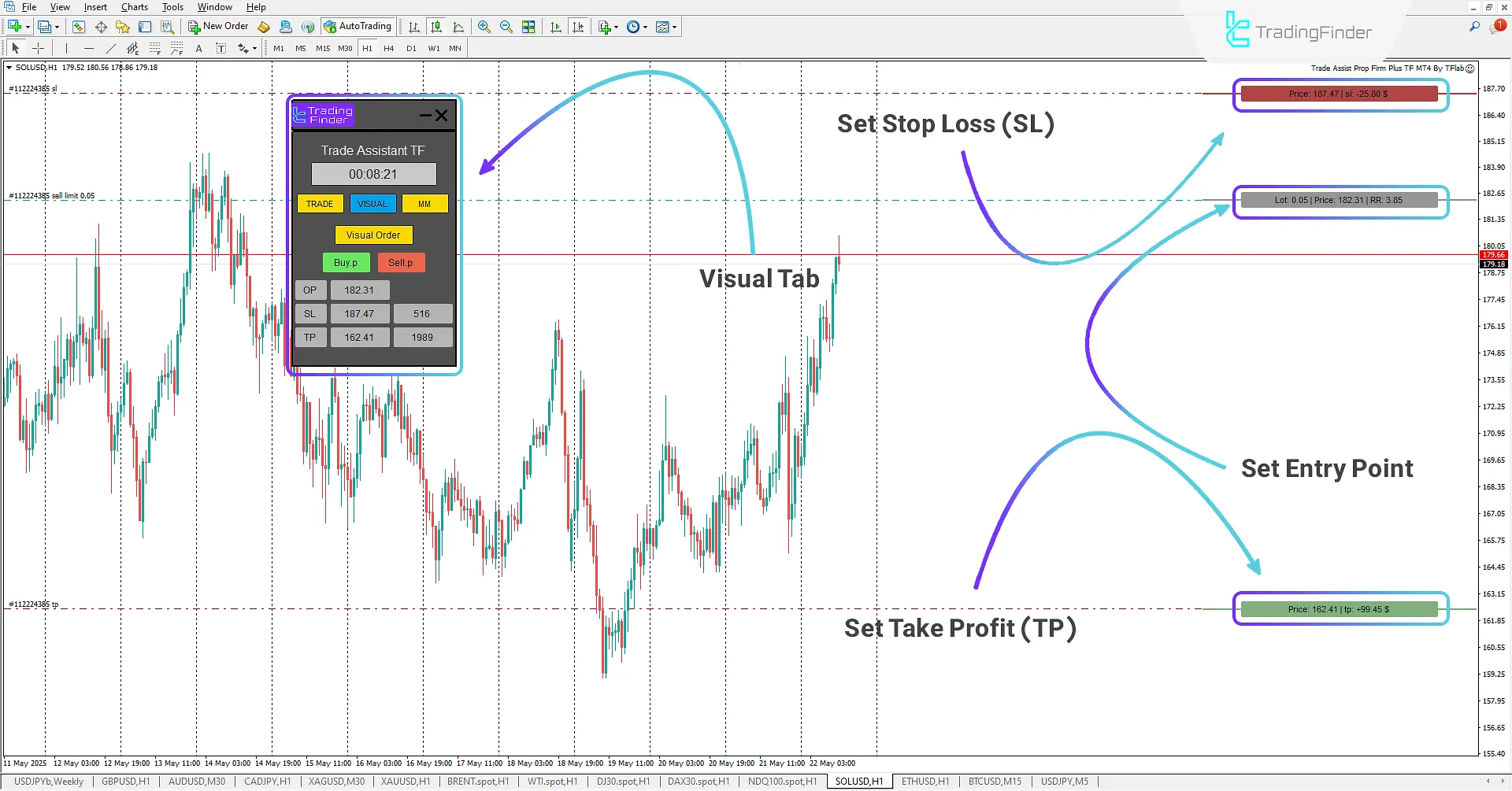

Visual Tab

In this tab of the Prop Firm Capital Protection Expert, traders can set their pending positions visually.

This feature not only makes the user experience more professional but also allows the trader to make more logical and informed decisions by reviewing the Risk to Reward Ratio and displaying the potential profit or loss amount.

In this tab, key information about trading levels is displayed:

- OP (Open Price): Pending open level

- SL (Stop Loss): Stop loss level

- TP (Take Profit): Take profit level

After setting these levels on the chart, the user can place their pending trade with the appropriate type (limit or stop) by clicking on the options:

- Buy Pending (Buy.p)

- Sell Pending (Sell.p)

This functionality increases the trader's accuracy and efficiency in managing pending trades and plays an effective role in better executing trading strategies.

- Visual Order: Enable/disable the status of take profit and stop loss amounts

- Buy.p & Sell.p: Place pending orders based on the mode set in Visual Order

Money Management Tab (MM)

In this tab, options for money management and risk control are embedded, allowing traders to manage their trades professionally and protect their earned profits.

This section includes the following features:

- Break Even: Adjustable based on points, percentage, or dollars, allowing the trader to shift the entry level to stop loss at the right time, so the trade continues risk-free;

- Trailing Stop: A feature to protect trade profits by dynamically adjusting the stop loss as the price moves;

- Utility Buttons: Includes options such asClose All Trades, BreakEven All Trades, Close Pending Orders, and quick access to the Account Protection Panel.

These tools are highly practical for traders seeking to professionalize their trade management, significantly reducing risk and increasing stability in trading performance.

- Breakeven: Determines the activation amount for moving the stop loss of profitable trades to the entry point

- Trail Start: Determines the activation amount for moving the stop loss of profitable trades to a specified profit point

- Trail Step: Determines the activation amount for incrementally moving the stop loss of profitable trades towards the specified amount

- Close All: Closes all executed trades

- Break All: Sets all profitable trades to breakeven

- Close Pending: Closes all pending trades

- AP: Opens the Account Protectionfor managing the trading strategy and trading plan

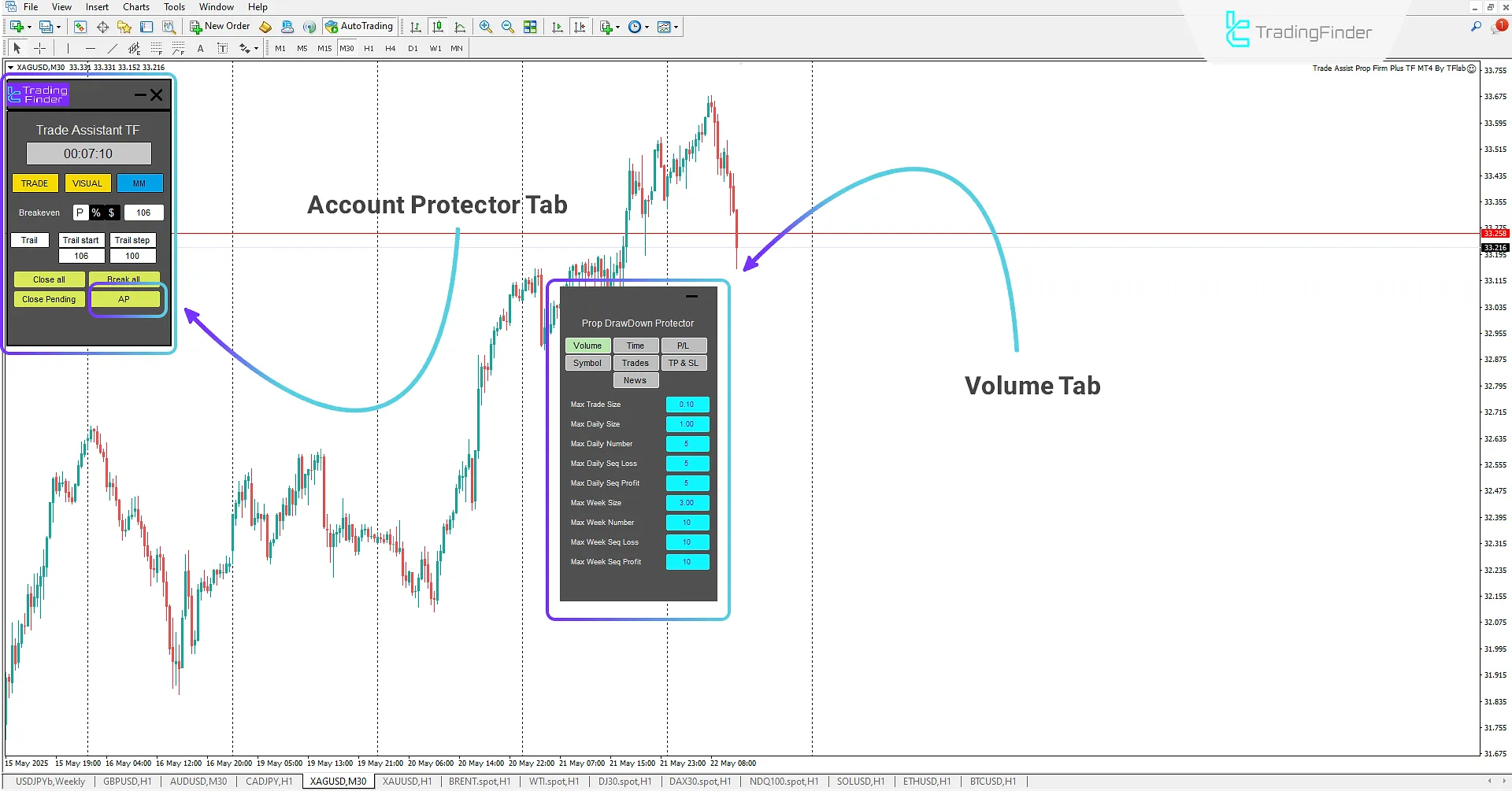

Account Protector Panel

The Account Protector panel is a specialized module with seven separateand customizable tabs, enabling traders to personalize their risk management settings precisely in line with their trading strategy.

Its main objective is to control losses, limit trade volume, prevent risky behaviors like overtrading or consecutive losses, and ultimately enforce trading discipline.

Users can access this panel by clicking the “AP” button located at the bottom of the main panel in the “MM” section.

Volume Tab

The Prop Firm Capital Protection Expert, by providing a dedicated "Trade Volume" tab in the settings section, allows traders to have professional oversight and control over their trading process by determining the maximum allowed volume for each position, the total number of allowed trades, and the maximum allowed daily and weekly volume.

This feature plays an effective role in reducing emotional trading and commits the trader to adhering to the principles of capital management and trading discipline.

Using this feature is an effective step towards increasing performance stability and enhancing the trader's professional level in real market conditions.

- Max Trade Size: Maximum size of each trade

- Max Daily Size: Setting the maximum daily trade size

- Max Daily Number: Setting the maximum number of daily trades

- Max Daily Seq Loss: Setting the maximum daily consecutive losses

- Max Daily Seq Profit: Setting the maximum daily consecutive profits

- Max Week Size: Setting the maximum weekly trade size

- Max Week Number: Setting the maximum number of weekly trades

- Max Week Seq Loss: Setting the maximum weekly consecutive losses

- Max Week Seq Profit: Setting the maximum weekly consecutive profits

Time Tab

The Time tab, as the second settings section in the Prop Firm Capital Protection Expert , allows users to set permitted trading hours.

By setting the start and end times of trading activity, traders can only enter the market during predefined timeframes and avoid trading during low-volatility, high-risk, or off-plan hours.

This feature is useful for creating regular trading routines in a multi-timeframe and multi-symbol environment, guiding traders towards increased personal discipline and purposeful decision-making.

Using this tool is a key step in structuring trading behavior and moving towards greater professionalism in financial markets.

- Start Time: Setting the trade start time

- End Time: Setting the trade end time

- MON: Selecting Monday as a trading day and setting the start and end times

- TUE: Selecting Tuesday as a trading day and setting the start and end times

- WED: Selecting Wednesday as a trading day and setting the start and end times

- THU: Selecting Thursday as a trading day and setting the start and end times

- FRI: Selecting Friday as a trading day and setting the start and end times

- SAT: Selecting Saturday as a trading day and setting the start and end times

- SUN: Selecting Sunday as a trading day and setting the start and end times

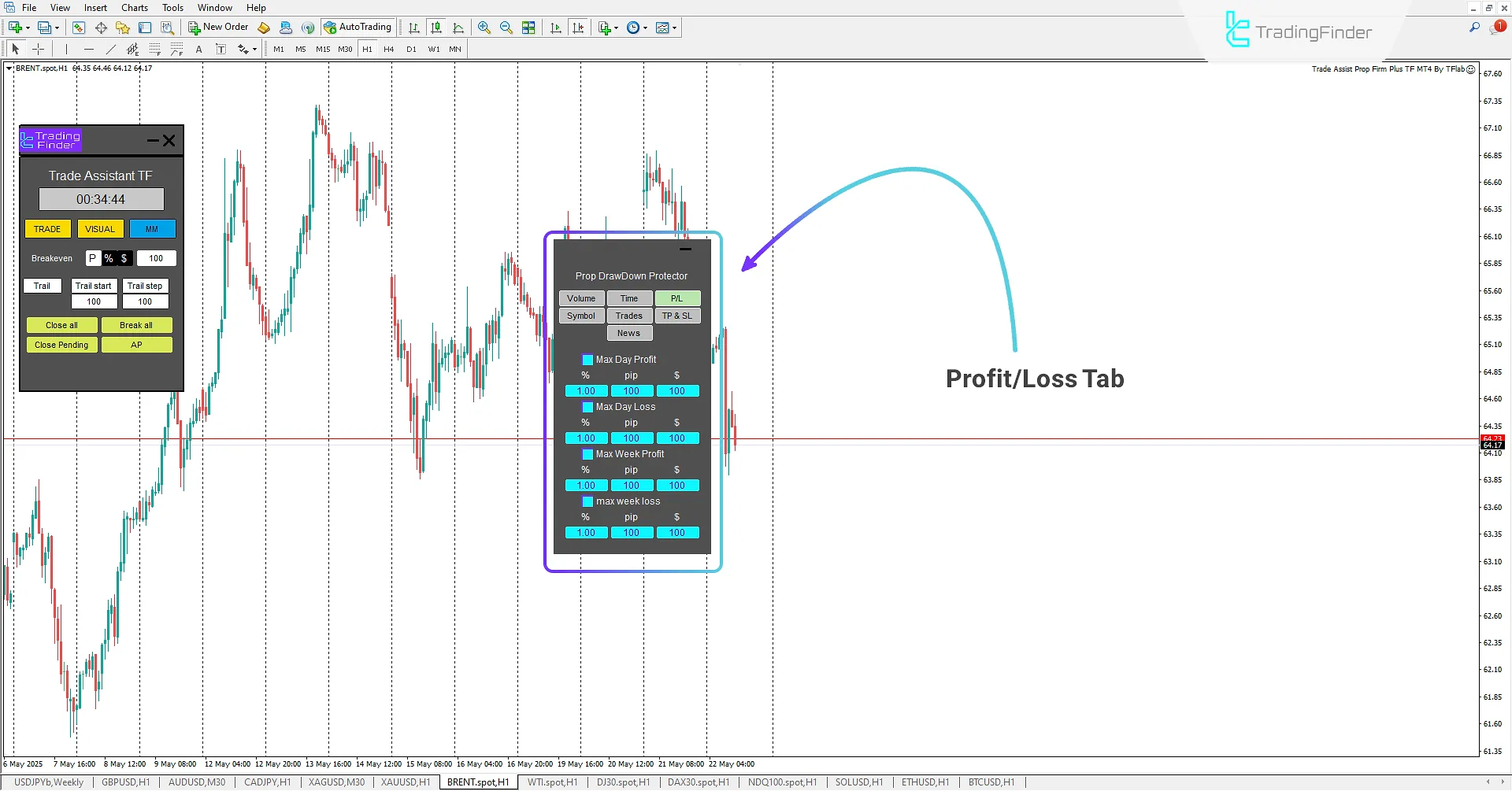

Profit/Loss Limits Tab

The Profit/Loss (P/L) tab in the settings of the Prop Firm Capital Protection Expert allows traders to define maximum daily and weekly profit and loss as a percentage, dollar amount, or based on pips in a completely personalized manner.

Using this feature, if the defined thresholds are reached, the expert automatically stops new trades and prevents further activity in unfavorable psychological or financial conditions.

This feature, which is particularly important in multi-symbol and multi-account environments, enables traders to make decisions within a framework of professional and purposeful risk management, paving the way for performance stability and capital protection.

- Max Day Profit: Setting the maximum daily profit based on three modes: percentage, pips, and dollars

- Max Day Loss: Setting the maximum daily loss based on three modes: percentage, pips, and dollars

- Max Week Profit: Setting the maximum weekly profit based on three modes: percentage, pips, and dollars

- Max Week Loss: Setting the maximum weekly loss based on three modes: percentage, pips, and dollars

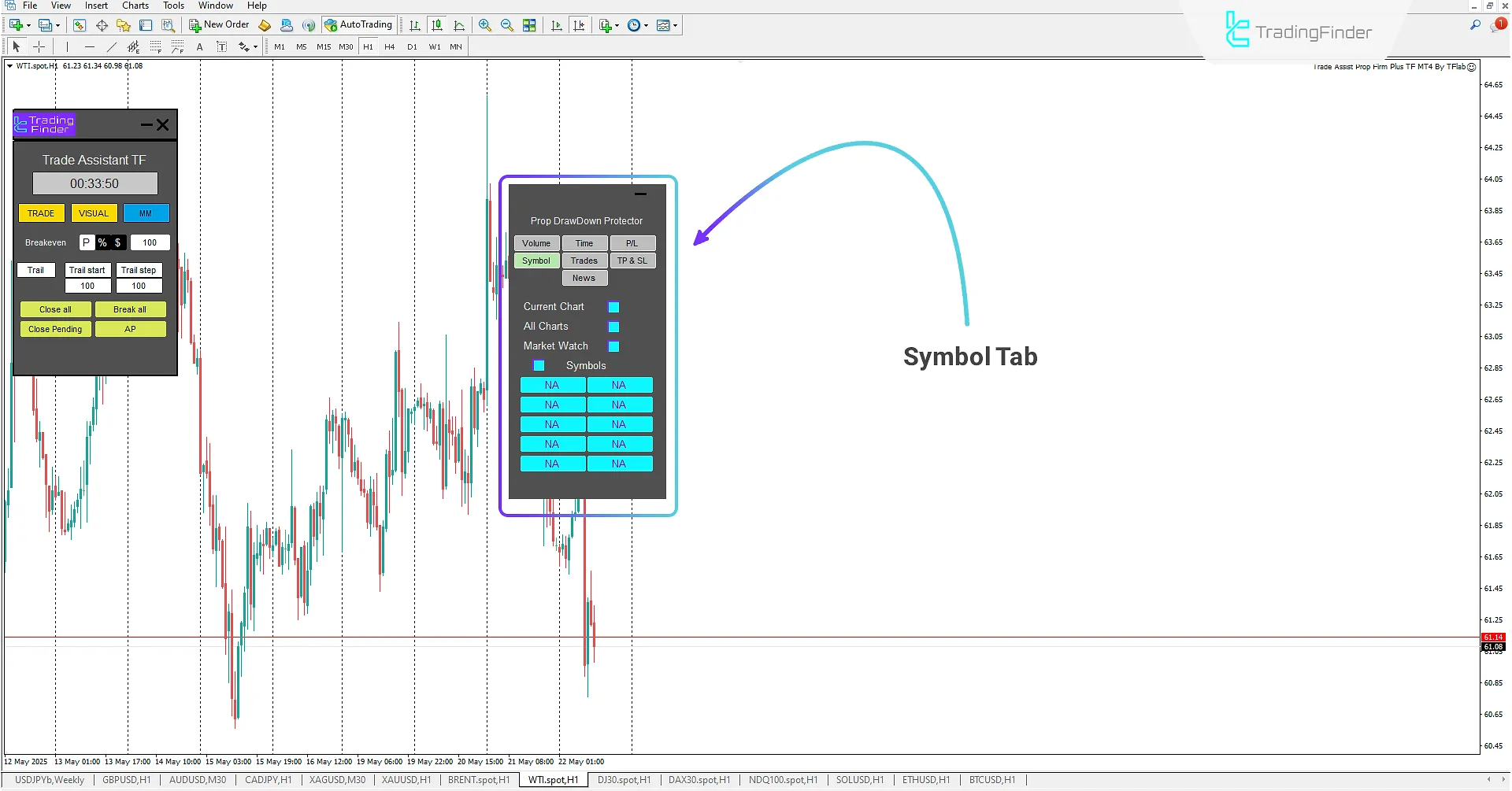

Symbol Tab

The Symbols tab allows traders to predefine a list of permitted trading symbols and only allow activity on these assets.

In an advanced and multi-symbol environment where traders have access to dozens or even hundreds of trading instruments, this feature prevents accidental entry into irrelevant or off-strategy markets by limiting activity to approved symbols.

The result of this purposeful control is increased focus, analytical accuracy, and trading discipline; factors that play a decisive role in long-term performance stability and the prevention of strategic errors.

- Current Chart: Selecting the current chart

- All Charts: Selecting all charts

- Market Watch: Selecting symbols from the Market Watch

- Symbols: Selecting desired symbols

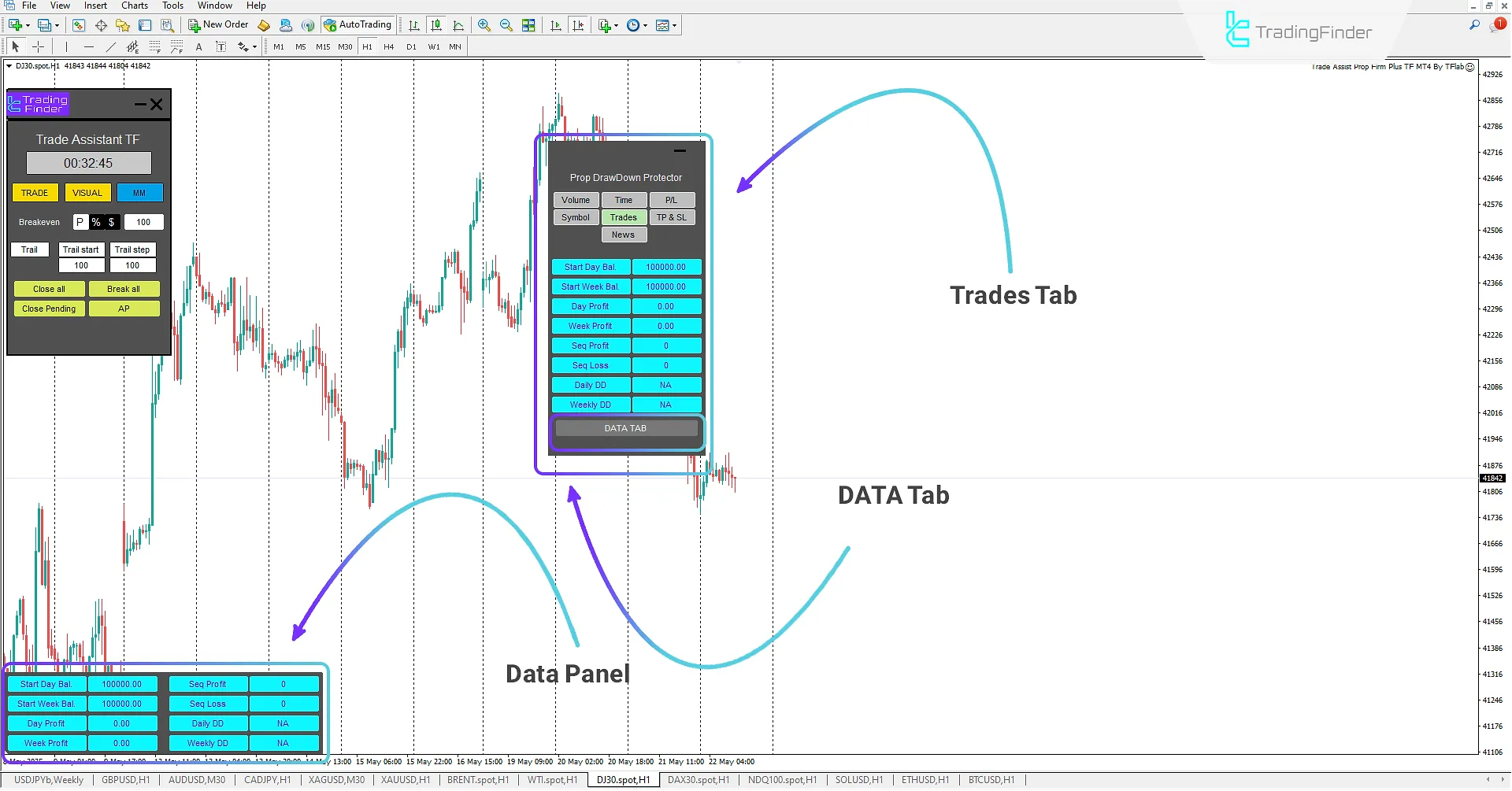

Trades Tab

The Trades tab provides analytical information, enabling users to monitor the status of their trading account.

In this section, data such as floating profit/loss (Floating P/L), total balance, and profit/loss sequence are displayed in Real-Time, allowing traders to have a better understanding of performance trends and current risk.

This information is presented in an analyzable format, enabling users to make informed decisions based on real statistical data and trading logic.

Additionally, by activating the DATA TAB option, a minimal panel appears on the left side of the chart, displaying the overall account status in a concise and practical manner without interfering with the main chart area.

- Start Day Bal: Displaying the starting balance of the day

- Start Week Bal: Displaying the starting balance of the week

- Day Profit: Displaying daily profit

- Week Profit: Displaying weekly profit

- Seq Profit: Displaying consecutive profits

- Seq Loss: Displaying consecutive losses

- Daily DD: Displaying daily drawdown

- Weekly DD: Displaying weekly drawdown

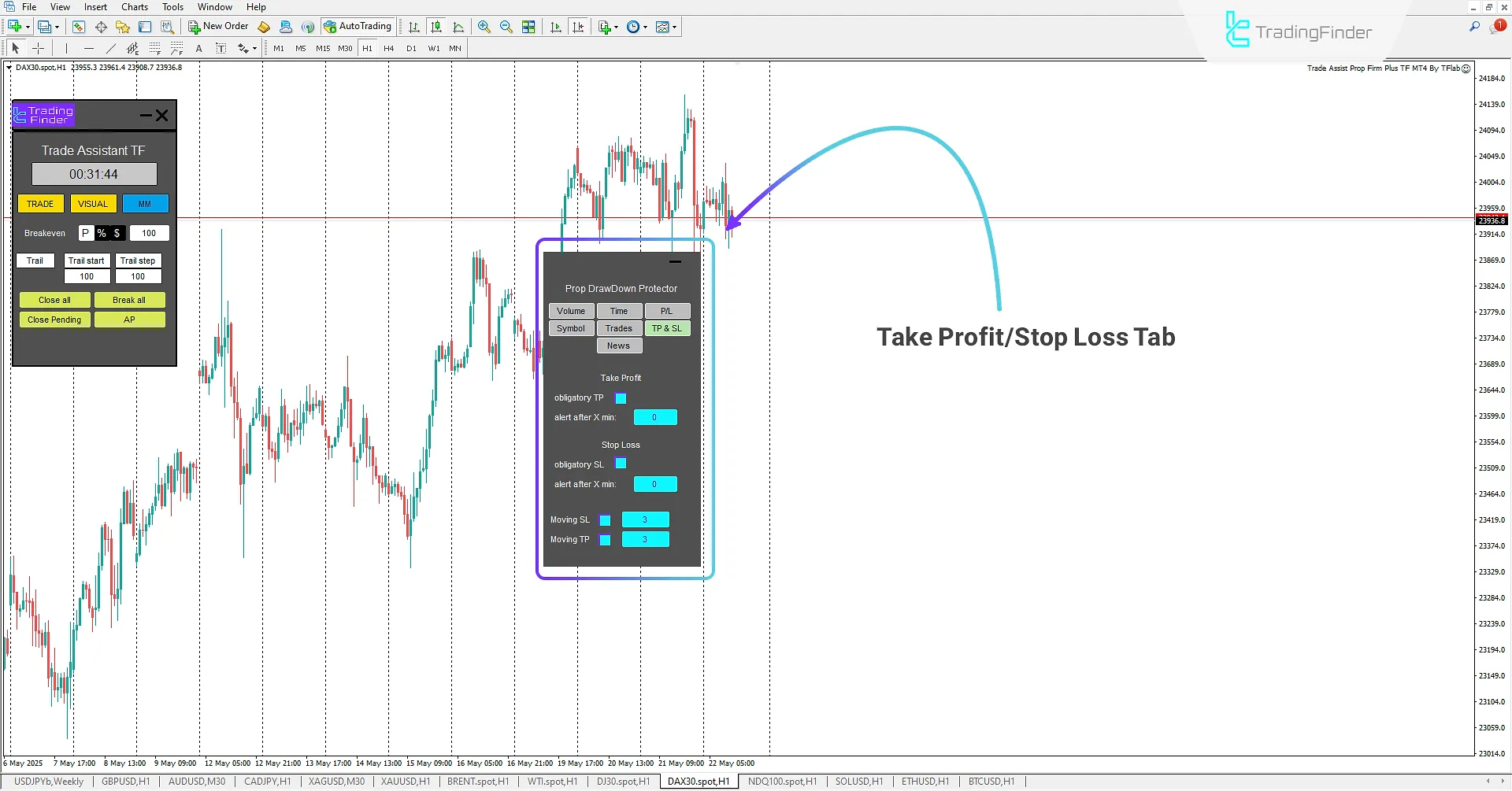

Take Profit & Stop Loss Tab (TP & SL)

The sixth tab, titled Take Profit/Stop Loss Control, allows traders to define a framework for controlling their trade risk.

In this section, users can enable the requirement to set TP and SL levels and also configure the alert interval for not specifying these levels; this is a necessary action to prevent entering trades without a defined risk framework.

Furthermore, the trader will be able to specify the allowed amount of changes in TP/SL levels. This feature prevents emotional manipulations and unprofessional adjustments during trading, leading to increased trading discipline and adherence to the predefined trading strategy.

By using this tab in the analytical environment, traders can leverage the dynamic order placement system of this platform to implement more advanced risk management and create a secure and stable structure for their trades.

Take Profit

- obligatory TP: Enable/disable mandatory take profit setting

- alert after X min: Set the alert time after not setting take profit

Stop Loss

- obligatory SL: Enable/disable mandatory stop loss setting

- alert after X min: Set the alert time after not setting stop loss

- Moving SL: Determine the maximum amount of stop loss movement

- Moving TP: Determine the maximum amount of take profit movement

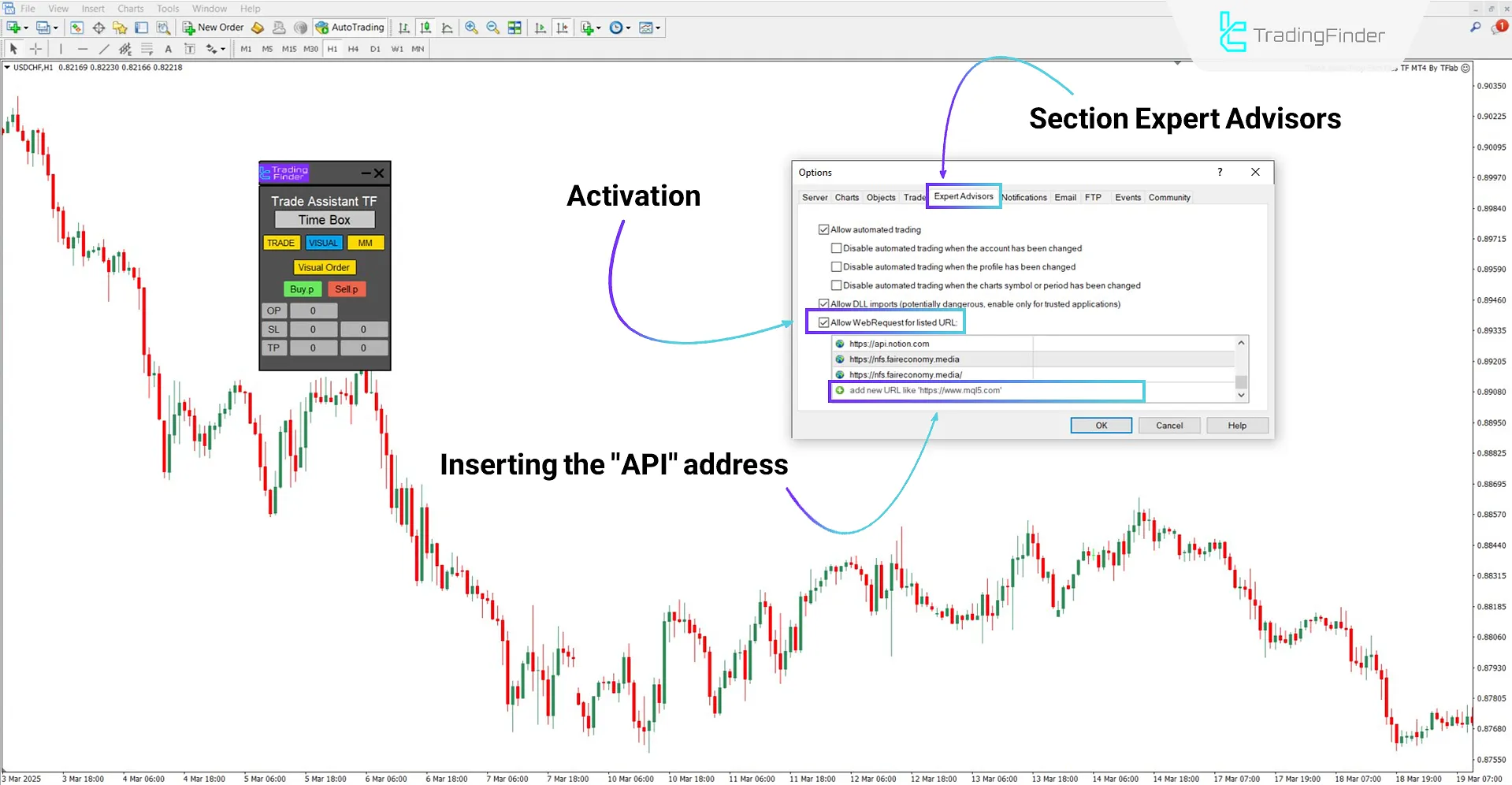

News Tab

The final tab in the Expert Advisor relates to crucial economic news events. This section helps traders avoid entering trades right before high-impact news releases.

To use this feature, you must first enable the "WebRequest" option in MetaTrader 4.

Steps to activate:

- From the top menu in MetaTrader 4, go to Tools > Options

- In the new window, navigate to the Expert Advisors tab

- Enable the checkbox for"Allow WebRequest for listed URL."

- In the designated input field, enter the following URL:

- https://nfs.faireconomy.media/

This News section is particularly useful for prop firm traders, as it enhances their awareness of upcoming economic events and offers options to control the visibility of news alerts before and after their release.

- Limit Before: Determine whether to display news before reaching the news event

- Limit After: Determine whether to display news after reaching the news event

- Check Time (min): Determine the display time for news

- Symbol: Select trading symbols for news display

- All News: Select the status (enable/disable) for displaying all news

- Last News: Select the status (enable/disable) for displaying the latest news

Executing Sample Trades Within the Expert’s Structure

The Prop Firm Capital Protection Expert is designed to provide traders with complete control over all aspects of a trade without requiring technical complexity.

Combining ease of use with precision in execution, it enables structured decision-making in alignment with professional capital management principles.

Below are two real-world scenarios one for a buy trade and one for a sell trade demonstrating how the expert functions in actual market conditions.

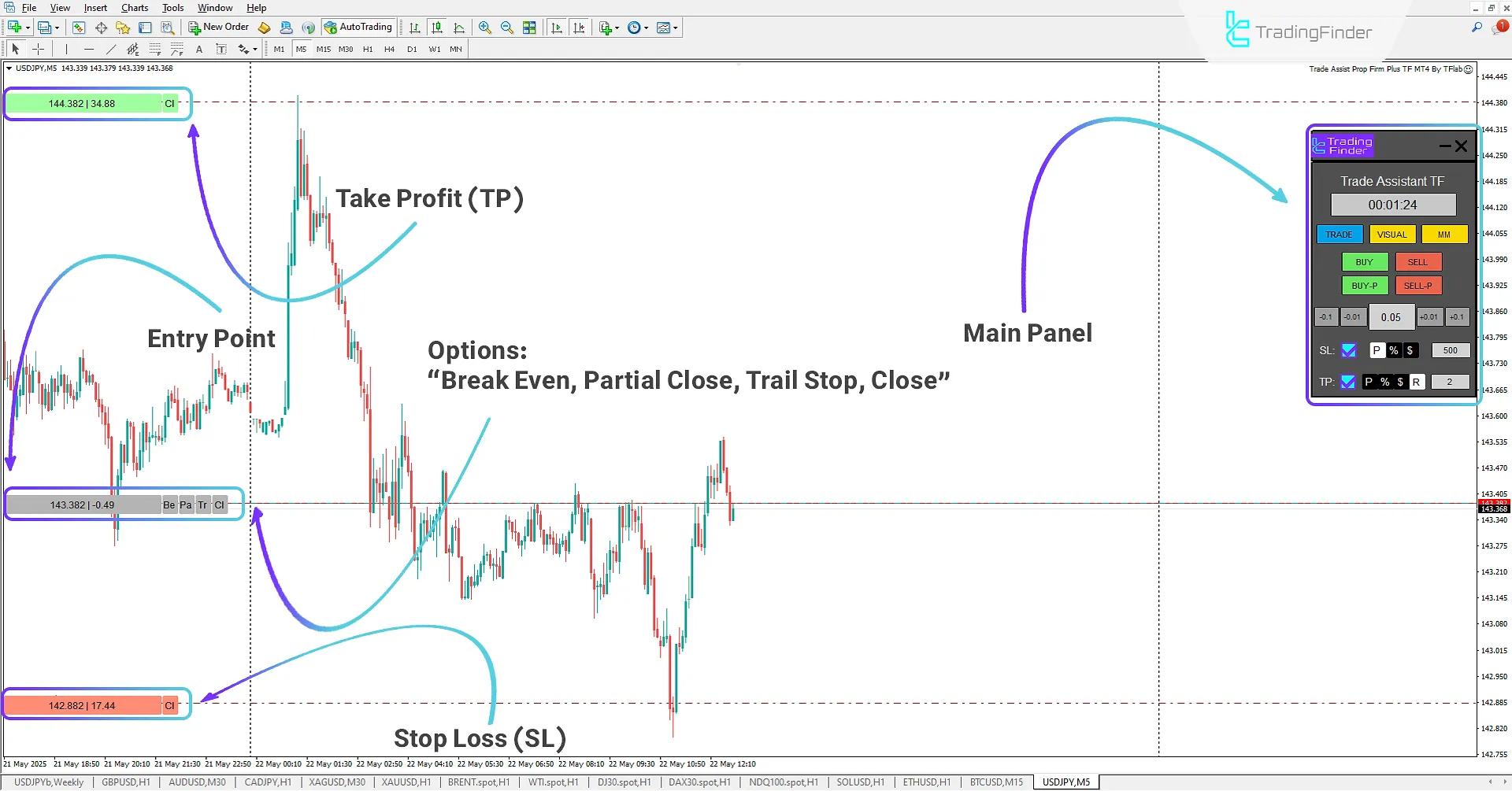

Buy Trade Using the Prop Firm Capital Protection Expert

On the 5-minute chart of the USDJPY currency pair, a buy trade has been executed.

Traders can use the Prop Firm Capital Protection Expert to set the entry volume and stop loss based on Points, Percent Balance, or a specific Dollar amount (Fixed Money Risk).

This tool also allows for setting the Risk to Reward Ratio in various ways, enabling users to make decisions using predefined values that align with their strategy and to have more professional control over risk and capital management.

Sell Trade Using the Prop Firm Capital Protection Expert

On the 1-hour chart of Solana (SOL), traders can visually specify entry points, stop loss, and take profit, and set their desired pending orders using the Visual tab in the Prop Firm Capital Protection Expert .

After setting these levels, the corresponding values are displayed in the expert's main panel, and by selecting the buy or sell pending options, the expert automatically determines the order type as either limit or stop and adjusts the position accordingly.

This process significantly enhances accuracy, speed, and control in trading.

Conclusion

The Prop Firm Capital Protection Expert is considered a specialized and practical tool for prop traders.

This expert, by offering diverse settings and customization capabilities in line with popular trading styles and strategies such asICT (Inner Circle Trader) and Smart Money, plays a significant role in maintaining the trader's psychological control when facing market fluctuations and sentiment.

Using this tool, traders will be able to optimally manage their trades and follow trading psychology in a completely systematic way, without being affected by sudden market emotions and feelings.

Ultimately, this expert, by facilitating adherence to trading plan rules, paves the way for achieving sustainable profitability and effectively prevents unnecessary losses and margin callrisk.

Additionally, this practical tool provides traders with the ability to manage instant trades and pending orders on charts.

Using this expert, traders will be able to adjust entry volume, risk amount, and reward amount, thereby having complete control over their capital management and trade risk.

As an advanced expert in capital management and trading, this tool offers up-to-date and special features to enhance trading performance.

Trade Assist Prop Firm MT4 PDF

Trade Assist Prop Firm MT4 PDF

Click to download Trade Assist Prop Firm MT4 PDFWhat is the Prop Firm Capital Protection Expert?

This expert is one of Trading Finder's specialized products for the MetaTrader 4 platform, designed for advanced capital management, smart risk control, and precise and rapid trade execution for prop traders.

Who is the Prop Firm Capital Protection Expert suitable for?

This tool is specifically suitable for prop firm traders and also for Forex traders who are looking for advanced capital and risk management.

What key features does the Prop Firm Capital Protection Expert offer?

The key features of this expert include Break Even, dynamic Trailing Stop, advanced order management in a multi-symbol environment, determining entry volume, take profit and stop loss in three modes (points, percentage, dollars), controlling entry and exit times, selecting allowed symbols, and optimal risk and capital management through Partial Close and pyramiding.

Does this Expert open or close trades automatically?

No, it is strictly a trade management tool and does not execute trades automatically.

Is this Expert allowed on prop firm accounts?

Yes, it is designed specifically to comply with prop firm rules and helps prevent unintentional violations.

Hello, I need some modifications in this Expert Advisor for MetaTrader 4. What is the best way to contact the developer of this Expert Advisor?

Hello, you can share your suggestion with our team on Telegram.

Hello, you can share your suggestion with our team on Telegram.