![Triple Stochastic Oscillator for MT4 Download – Free – [TradingFinder]](https://cdn.tradingfinder.com/image/484358/13-183-en-triple-stochastic-mt4-01.webp)

![Triple Stochastic Oscillator for MT4 Download – Free – [TradingFinder] 0](https://cdn.tradingfinder.com/image/484358/13-183-en-triple-stochastic-mt4-01.webp)

![Triple Stochastic Oscillator for MT4 Download – Free – [TradingFinder] 1](https://cdn.tradingfinder.com/image/484357/13-183-en-triple-stochastic-mt4-02.webp)

![Triple Stochastic Oscillator for MT4 Download – Free – [TradingFinder] 2](https://cdn.tradingfinder.com/image/484360/13-183-en-triple-stochastic-mt4-03.webp)

![Triple Stochastic Oscillator for MT4 Download – Free – [TradingFinder] 3](https://cdn.tradingfinder.com/image/484359/13-183-en-triple-stochastic-mt4-04.webp)

The Triple Stochastic Indicator, through three sequential smoothing steps, eliminates market noise and reveals the actual price movement.

Moreover, this trading tool also detects trend strength and displays overbought and oversold zones.

Specifications Table of the Triple Stochastic Indicator

The table below includes the specifications of the Triple Stochastic Oscillator.

Indicator Categories: | Oscillators MT4 Indicators Currency Strength MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Overbought and Oversold MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Scalper MT4 Indicators Swing Trading MT4 Indicators |

Trading Instruments: | Binary Options MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Triple Stochastic Indicator at a Glance

Buy and sell conditions in the Triple Stochastic Oscillator are based on the lines crossing the overbought and oversold zones, as well as their crossovers. An upward crossover of the lines confirms a buy signal, while a downward crossover validates a sell signal.

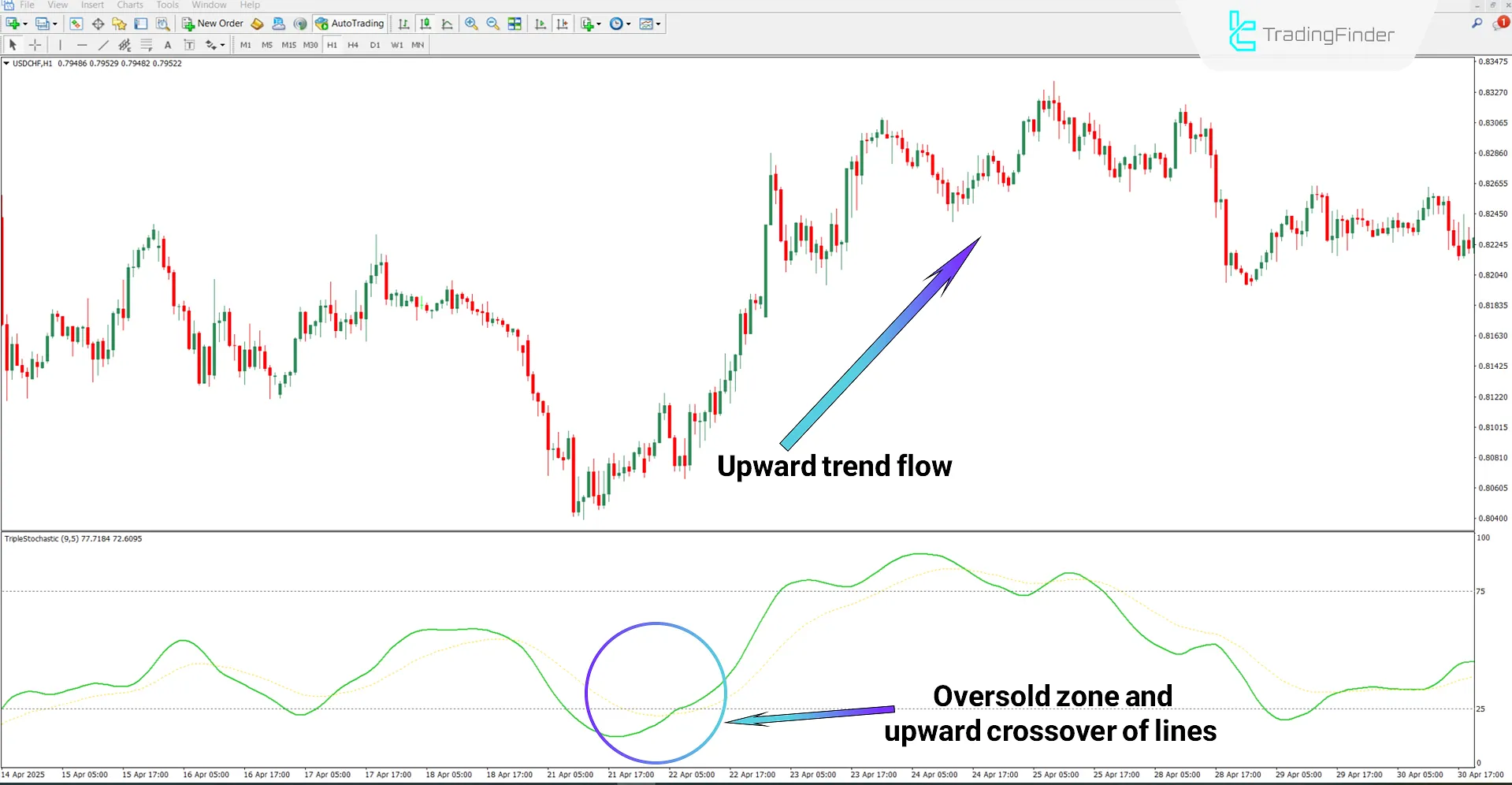

Buy Setup

According to the USD/CHF currency pair chart on the 1-hour timeframe, the indicator lines indicate that the price has entered the oversold zone. Following this, the upward crossover of the lines confirms the beginning of an uptrend.

Sell Setup

Based on the 30-minute chart of the cryptocurrency Chainlink, the position of the oscillator lines indicates that the price is entering the overbought zone. According to the chart, after entering the overbought area, the price declines, and a downward crossover signals the start of a downtrend.

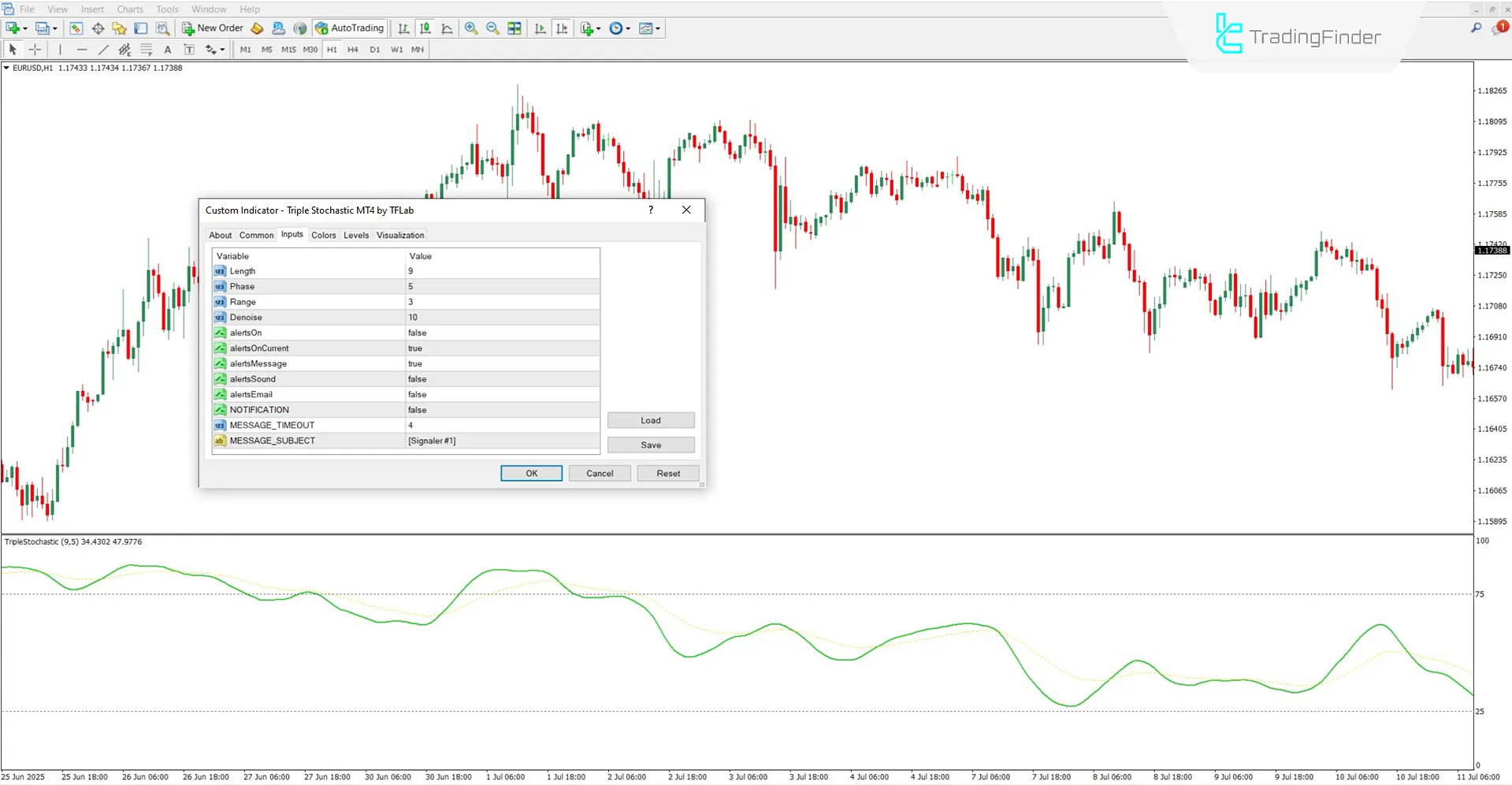

Triple Stochastic Indicator Settings

The configurable parameters of the Triple Stochastic Oscillator are as follows:

- Length: Initial calculation period for the stochastic;

- Phase: First smoothing stage;

- Range: Number of periods used for the second stochastic range calculation;

- Denoise: Level of noise filtering;

- AlertsOn: Enable alerts;

- AlertsOnCurrent: Enable alert on the current candle close;

- AlertsMessage: Alert as a message;

- AlertsSound: Enable sound alert;

- AlertsEmail: Send alert via email;

- Notification: Enable on-screen notification;

- Message_TimeOut: Time interval between alerts;

- Message_Subject: Set the title for the alert display.

Conclusion

The Triple Stochastic Oscillator is a precise tool for identifying momentum and overbought/oversold zones. By utilizing multiple smoothing steps, this indicator minimizes false signals and provides a clearer view of market trends.

The multi-layered structure of the Triple Stochastic makes it adaptable to various market conditions; therefore, it can be effectively applied across all markets, including forex market, stocks, cryptocurrencies, and more.

Triple Stochastic Oscillator MT4 PDF

Triple Stochastic Oscillator MT4 PDF

Click to download Triple Stochastic Oscillator MT4 PDFHow is this indicator different from the regular stochastic?

The Triple Stochastic Oscillator features stronger noise filtering, multi-level smoothing, and more accurate signals.

When is a sell signal generated?

When the lines of the Triple Stochastic Indicator enter the overbought zone, a downward crossover occurs.