![Volume Weighted MA with Price Indicator MetaTrader 4 - [TradingFinder]](https://cdn.tradingfinder.com/image/334767/2-28-en-volume-weighted-ma-with-price-mt4-1.webp)

![Volume Weighted MA with Price Indicator MetaTrader 4 - [TradingFinder] 0](https://cdn.tradingfinder.com/image/334767/2-28-en-volume-weighted-ma-with-price-mt4-1.webp)

![Volume Weighted MA with Price Indicator MetaTrader 4 - [TradingFinder] 1](https://cdn.tradingfinder.com/image/334770/2-28-en-volume-weighted-ma-with-price-mt4-2.webp)

![Volume Weighted MA with Price Indicator MetaTrader 4 - [TradingFinder] 2](https://cdn.tradingfinder.com/image/334768/2-28-en-volume-weighted-ma-with-price-mt4-3.webp)

![Volume Weighted MA with Price Indicator MetaTrader 4 - [TradingFinder] 3](https://cdn.tradingfinder.com/image/334769/2-28-en-volume-weighted-ma-with-price-mt4-4.webp)

On July 22, 2025, in version 2, alert/notification and signal functionality was added to this indicator

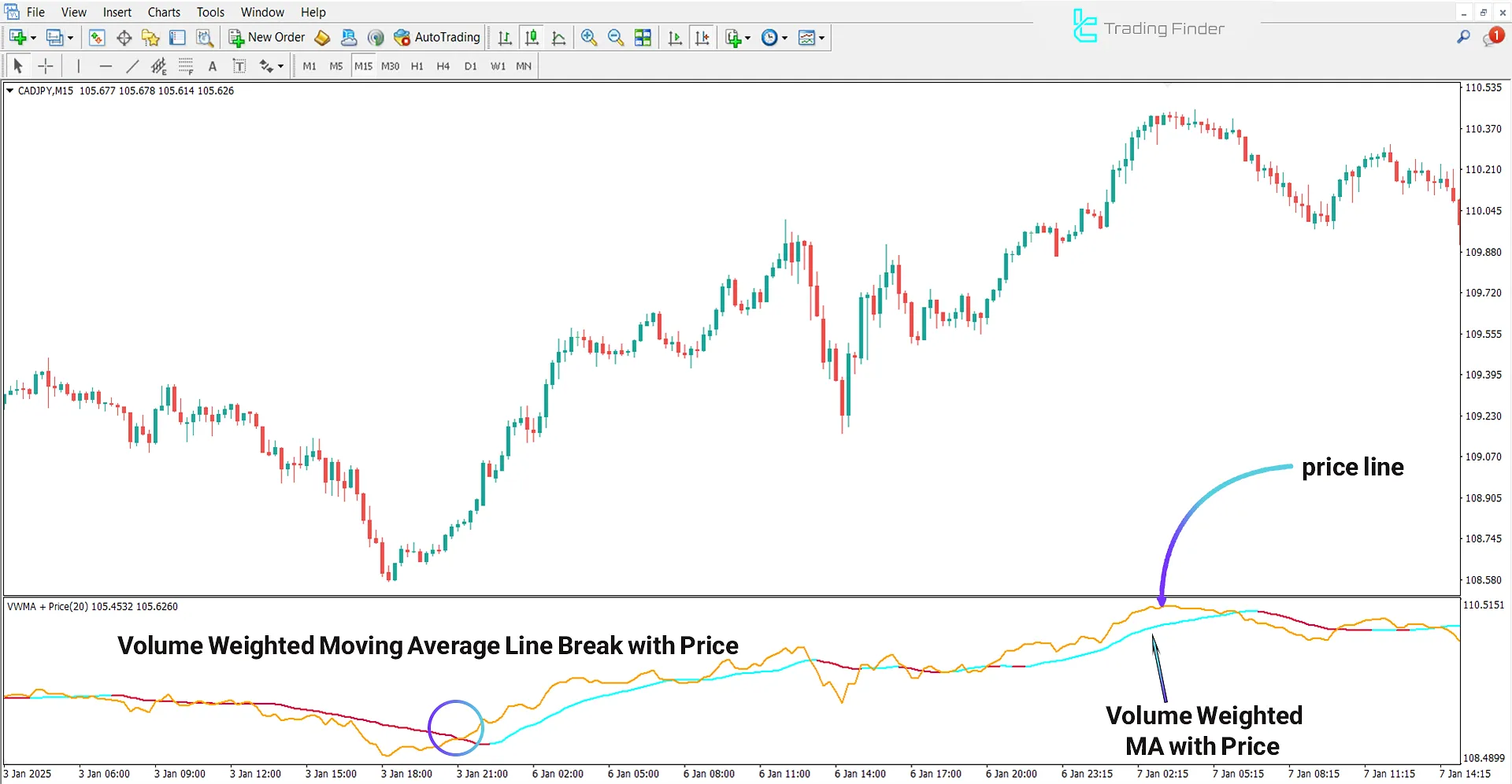

The Volume Weighted Moving Average with Price (VWMA with Price) indicator in MetaTrader 4 displays two moving lines by combining price and volume data.

This indicator consists of a price line (golden line) and a moving average line, which adjusts based on trading volume and candlestick weight.

This feature makes the calculated average more significant in high-volume areas, allowing trends to be analyzed more accurately.

Volume Weighted MA with Price Indicator Specifications Table

The specifications and features of the volume weighted MA with Price indicator are presented in the table below:

Indicator Categories: | Oscillators MT4 Indicators Volatility MT4 Indicators Currency Strength MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Range MT4 Indicators Breakout MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Forex MT4 Indicators |

Indicator Overview

The Volume Weighted Moving Average (VWMA) indicator is designed using trading volume. Its combination with price behavior enhances the accuracy of trend analysis and helps identify optimal entry and exit points.

In MetaTrader 4 oscillator is displayed in red during downtrends and in blue during uptrends. The VWMA oscillator assigns more weight to trades with higher volume.

Uptrend Conditions

In the 15-minute CAD/JPY price chart timeframe, when the price (golden line) crosses the Volume Weighted Moving Average (blue line) from below to above, it indicates increasing buyer strength.

An upward slope in the moving average suggests a strong bullish trend and a potential buy opportunity.

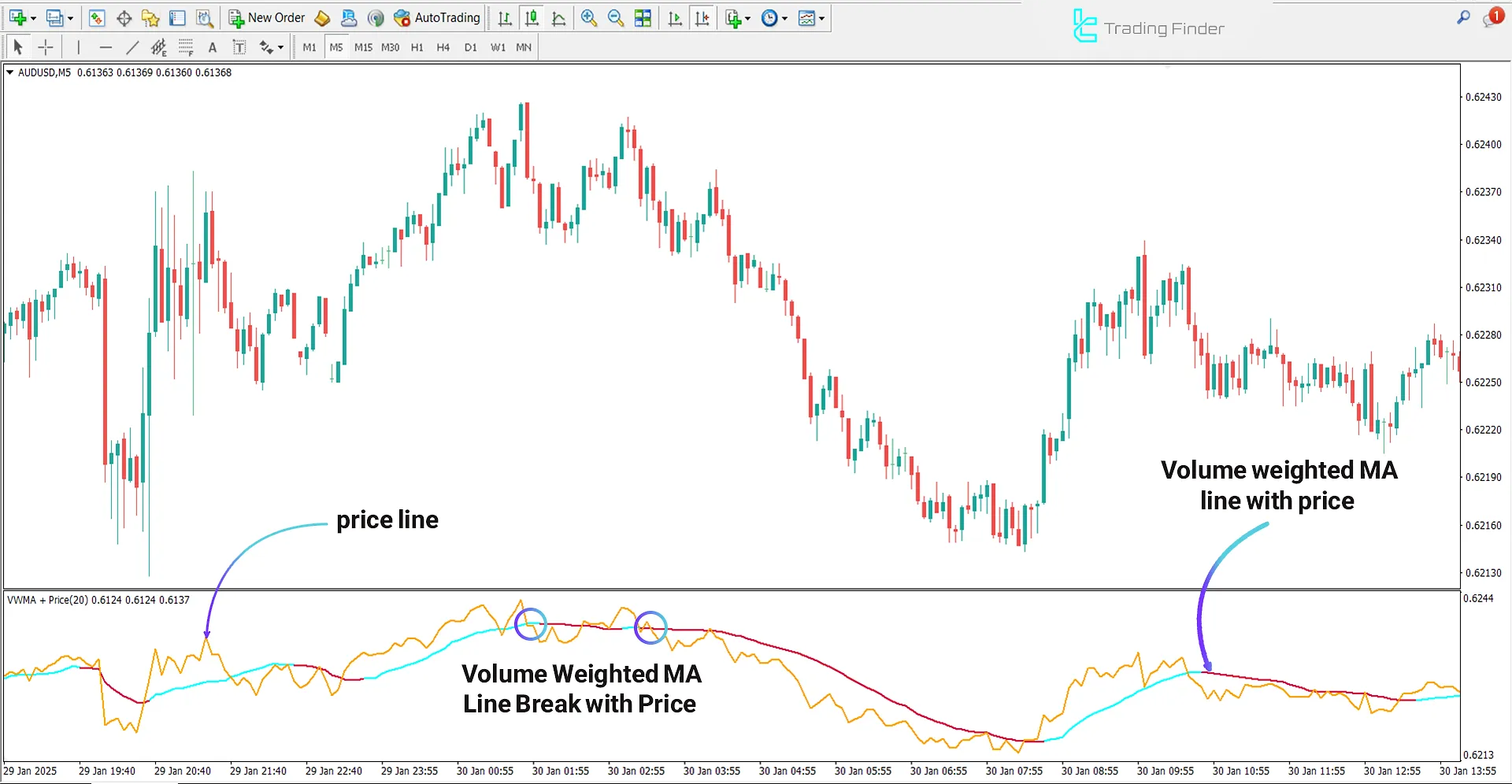

Downtrend Conditions

The following chart illustrates the 5-minute timeframe of the AUD/USD currency pair. A downtrend is established when the price (golden line) crosses below the moving average (red line).

Additionally, an increase in trading volume alongside a price decline signifies strong seller dominance in the market, providing a sell signal.

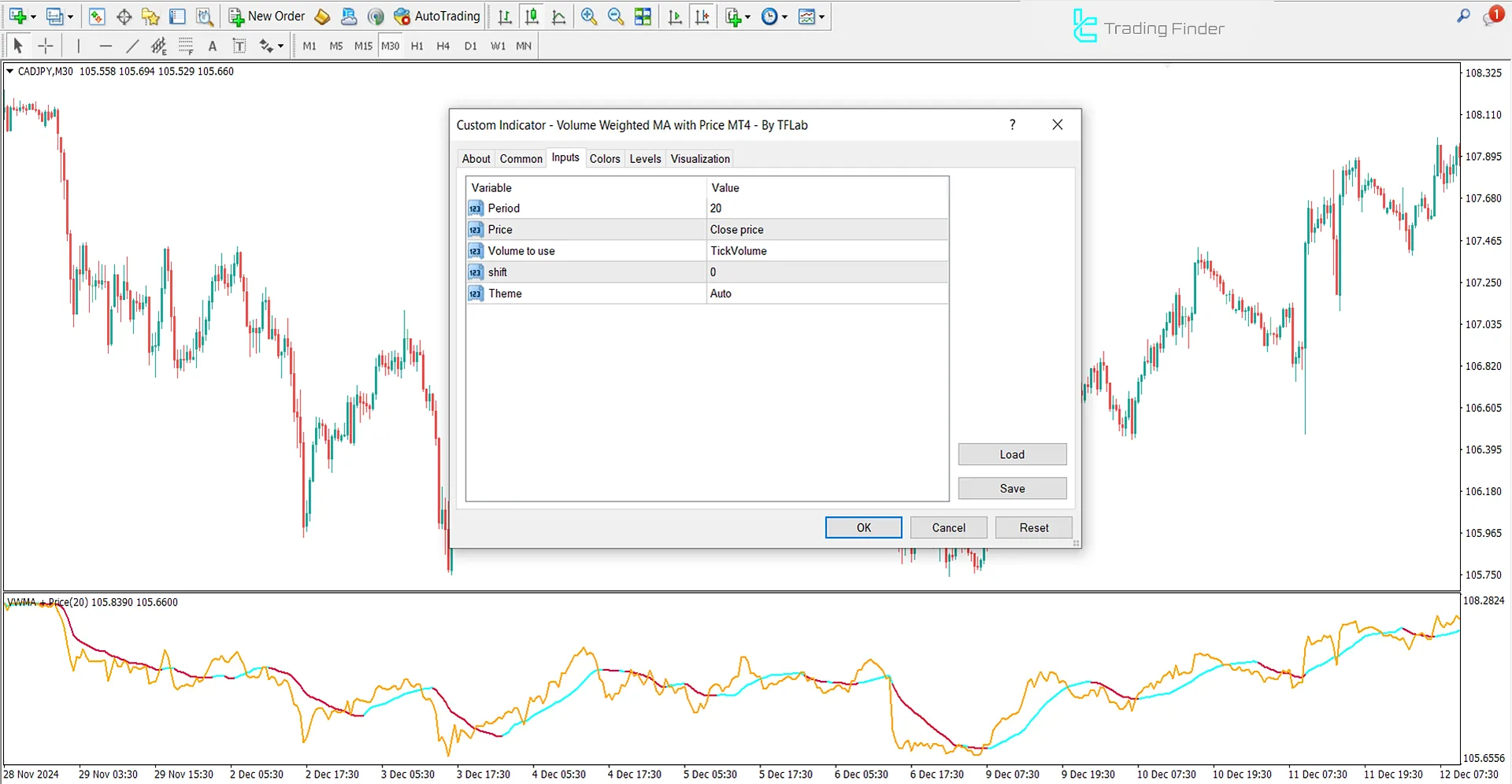

Indicator Settings

The settings of the Volume Weighted MA with Price indicator are as follows:

- Period: Number of courses

- Price: Price selection

- Volume to use: Applied volume

- Shift: Offset

Conclusion

The Volume Weighted Moving Average with Price indicator is a multi-timeframe tool applicable in various markets, especially forex market.

This Volatility MetaTrader 4 indicator is helpful in both ranging and trending markets. Using price lines and volume based moving averages provides effective entry and exit points.

Volume Weighted MA Price MT4 PDF

Volume Weighted MA Price MT4 PDF

Click to download Volume Weighted MA Price MT4 PDFWhat is the ideal timeframe for using the volume-weighted MA with a Price Indicator?

This indicator is multi timeframe and can be used in all timeframes.

Is the Volume weighted MA with Price Indicator only beneficial in ranging markets?

No, this indicator also identifies trend reversals and entry zones, not just in ranging markets.