TradingView

MetaTrader4

MetaTrader5

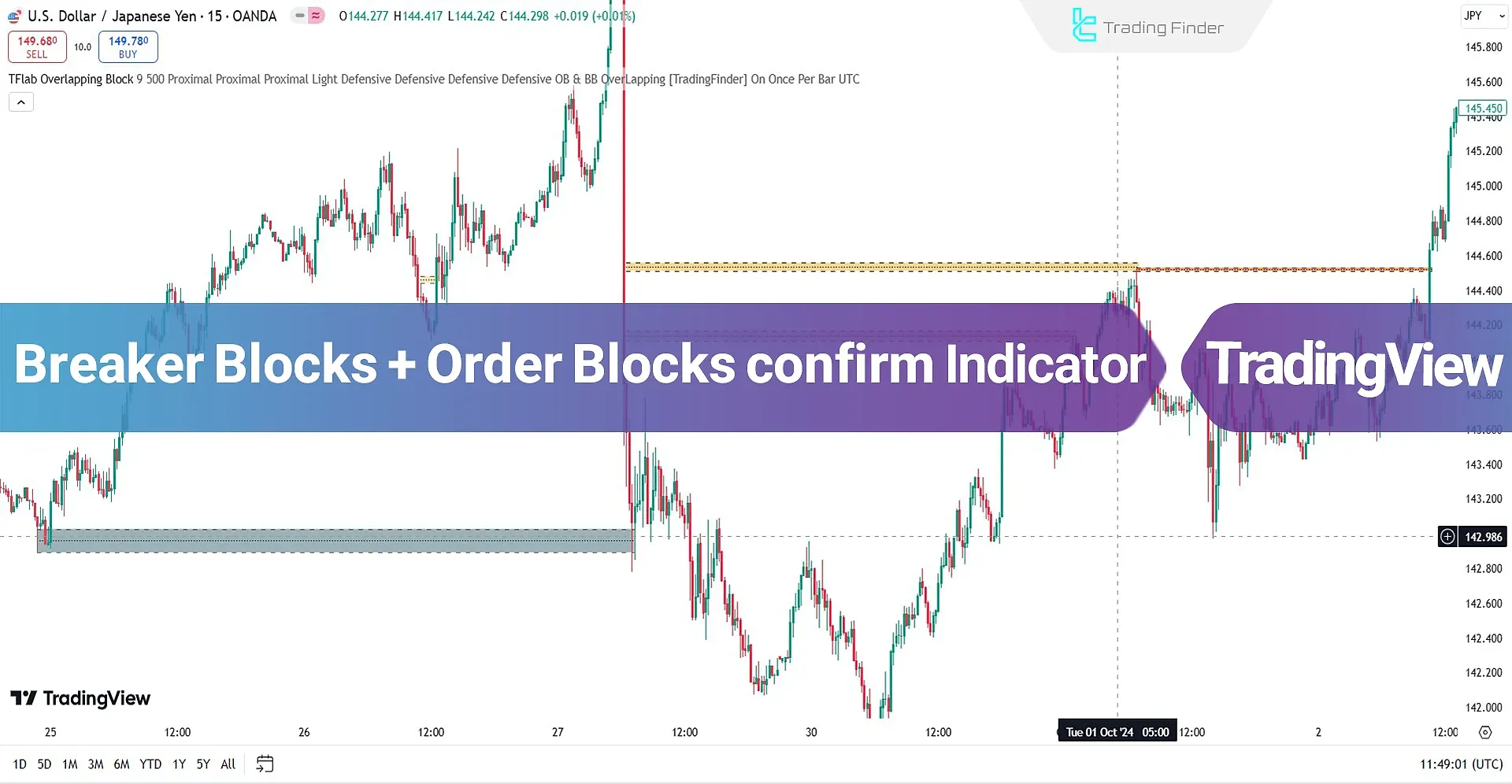

The Breaker Block + Order Block (BBOB) Indicator identifies the overlap between Order Blocks and Breaker Blocks, highlighting potential price reaction zones. These overlaps, within the framework of the ICT trading style, act as support and resistance levels.

Order blocks are areas on the chart where large financial institutions and high-volume traders place their orders. Due to the high volume of buy (Buy) or sell (Sell) orders, these zones are critical for price reversals or temporary trend pauses.

BBOB Indicator Specifications

The table below displays the specifications of the indicator in a summarized format.

Indicator Categories: | ICT Tradingview Indicators Support & Resistance Tradingview Indicators Liquidity Tradingview Indicators |

Platforms: | Trading View Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal Tradingview Indicators |

Timeframe: | Multi-Timeframe Tradingview Indicators |

Trading Style: | Intraday Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Cryptocurrency Tradingview Indicators Stock Tradingview Indicators Commodity Tradingview Indicators |

Overview of the Indicator

Demand-overlapping Blocks, displayed in blue, represent zones representing strong buying pressure and the likelihood of price reversal upward. Conversely, supply-overlapping blocks, displayed in orange, indicate strong selling pressure and potential price decline.

The combination of these two concepts (Order Block and Breaker Block) highlights key trading areas, identifying entry (Entry) and exit (Exit) points.

Indicator Bullish Trend

In the crude oil price chart (WTI), a Demand-Overlapping Block forms, initiating an upward trend. Due to the high volume of orders and liquidity, this zone acts as a strong support level.

After returning to this zone, the price absorbs the available liquidity and continues its upward movement.

Indicator Bearish Trend

In the GBP/USD currency pair chart, after forming a Supply Overlapping Block, the price initially gathers liquidity from this zone and then declines sharply.

Upon revisiting this zone, the selling power diminishes, and the price moves downward with less intensity. However, this zone remains a valid resistance level.

BBOB Indicator Settings

The image below shows the complete settings of the Breaker Block and Order Block indicator:

SettingDescription

- Pivot Period of Order Blocks Detector: Pivot period for detecting order blocks (9);

- Order Block Validity Period (Bar): Validity period for order blocks (500 candles);

- Mitigation Level OB: For Order Blocks (OB);

- Mitigation Level BB: For Breaker Blocks (BB);

- Mitigation Level OLB: For Overlapping Blocks (OLB);

- Switching Colors Theme Mode: Color theme display mode (Light);

- Show All OB: Display all order blocks;

- Demand Overlapping Block: Display demand overlapping blocks;

- Supply Overlapping Block: Display supply overlapping blocks;

- Demand Main Order Block: Disabled (Do not show main demand blocks);

- Demand Sub Order Block: Enabled (Show sub-demand blocks in green);

- Supply Main Order Block: Disabled (Do not show main supply blocks);

- Supply Sub Order Block: Disabled (Do not show sub-supply blocks);

- Show All BB: Display all breaker blocks;

- Demand Main Breaker Block: Enabled (Show main demand breaker blocks in blue);

- Demand Sub Breaker Block: Enabled (Show sub-demand breaker blocks in green);

- Supply Main Breaker Block: Enabled (Show main supply breaker blocks in pink);

- Supply Sub Breaker Block: Enabled (Show sub-supply breaker blocks in yellow);

- Refine Demand Main: Enabled (Defensive mode for main demand blocks);

- Refine Demand Sub: Enabled (Defensive mode for sub-demand blocks);

- Refine Supply Main: Enabled (Defensive mode for main supply blocks);

- Refine Supply Sub: Enabled (Defensive mode for sub-supply blocks);

- Alerts Name: Alert name;

- Alert OB & BB Overlapping Mitigation: Enabled for alerts on overlapping order and breaker blocks;

- Message Frequency: Content of the message;

- Show Alert Time by Time Zone: Display alert time based on UTC timezone.

Conclusion

The BBOB Indicator is an advanced ICT analysis tool designed to identify Order Blocks and Breaker Blocks automatically.

This indicator is built to detect critical market levels, including supply and demand zones, and evaluate price behavior in overlapping block areas (Overlapping Blocks).

Breaker Blocks Order Blocks TradingView PDF

Breaker Blocks Order Blocks TradingView PDF

Click to download Breaker Blocks Order Blocks TradingView PDFWhat is the BBOB Indicator?

The BBOB Indicator identifies Order Blocks and Breaker Blocks, pinpointing key entry and exit zones for trades.

Is it suitable for all timeframes?

Yes, the BBOB Indicator can be used for analysis across all timeframes.