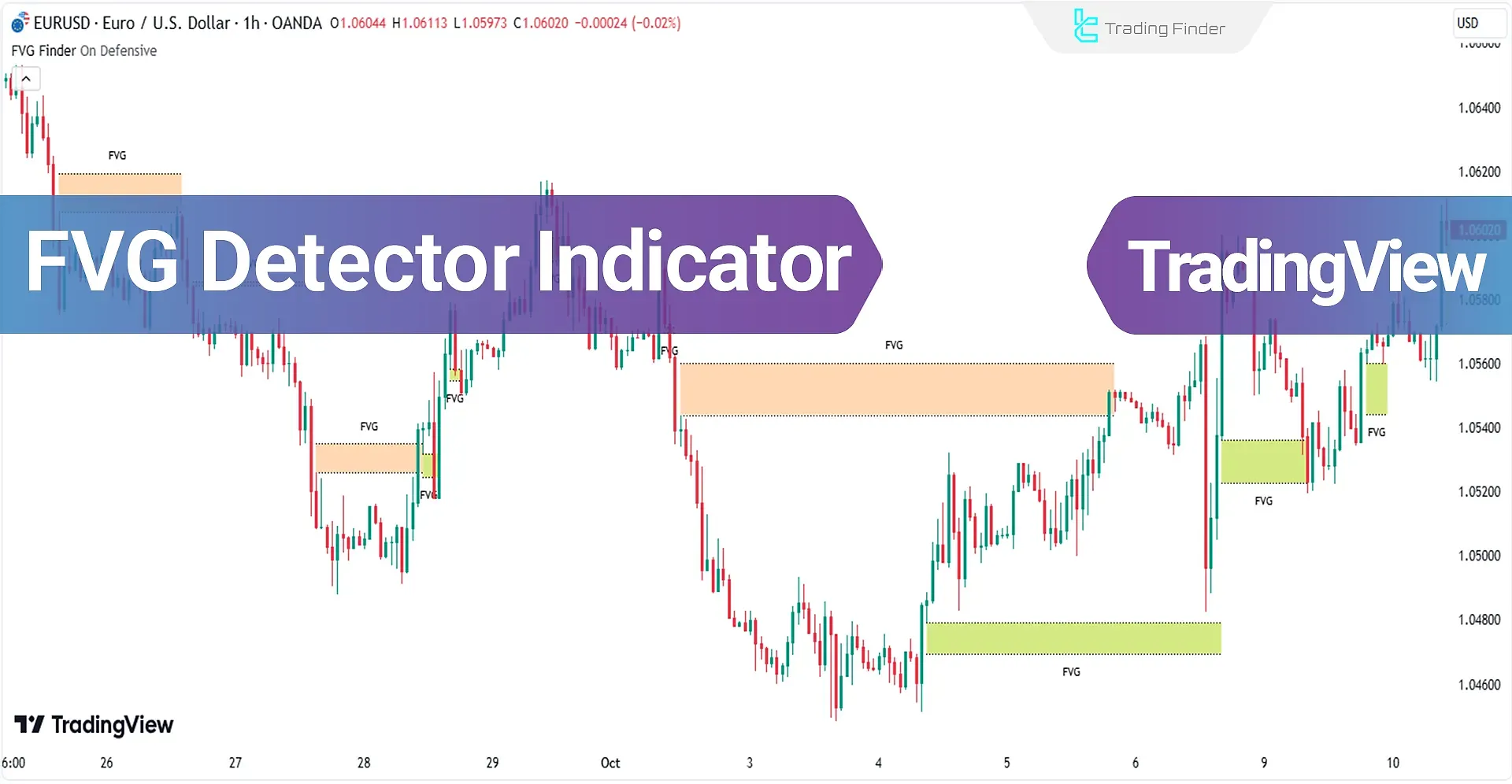

TheFair Value Gap (FVG) Detector indicator on Trading View indicator is an essential technical analysis tool within the ICT sytle (Inner Circle Trader) strategy system, automatically identifying areas of imbalance on price charts.

In strong market movements, a Fair Value Gap is created when a specific candle does not cover the body of the previous and following candles.

Under these conditions, due to the imbalance between buyers and sellers, the market is likely to return to these areas to address the gaps.

The indicator marks bearish gaps with an orange box and bullish gaps with a green box.

Indicator Table

Indicator Categories: | ICT Tradingview Indicators Smart Money Tradingview Indicators Liquidity Tradingview Indicators |

Platforms: | Trading View Indicators |

Trading Skills: | Expert |

Indicator Types: | Reversal Tradingview Indicators Leading Tradingview Indicators Non-Repaint Tradingview Indicators |

Timeframe: | Multi-Timeframe Tradingview Indicators |

Trading Style: | Intraday Tradingview Indicators Day Trading Tradingview Indicators Scalper Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Cryptocurrency Tradingview Indicators Stock Tradingview Indicators |

Overview

The ICT (Inner Circle Trader) trading style developed by Michael Huddleston is one of the advanced strategies in technical analysis.

It is founded on the concepts of liquidity and price imbalance. A key element in ICT is the identification of Fair Value Gaps (FVG).

This indicator can automatically detect both bullish and bearish gaps on the price chart, eliminating the need for manual chart analysis.

Fair Value Gap (FVG) in a Bullish Trend

In the image below, the price chart of Brent Crude Oil in a 5-minute timeframe shows a Bullish Fair Value Gap (FVG) that formed during an upward movement.

Subsequently, the price returned to this gap to rebalance the area of imbalance.

This FVG, highlighted with a green box, has effectively acted as a support level, facilitating the continuation of the uptrend.Bottom of Form.

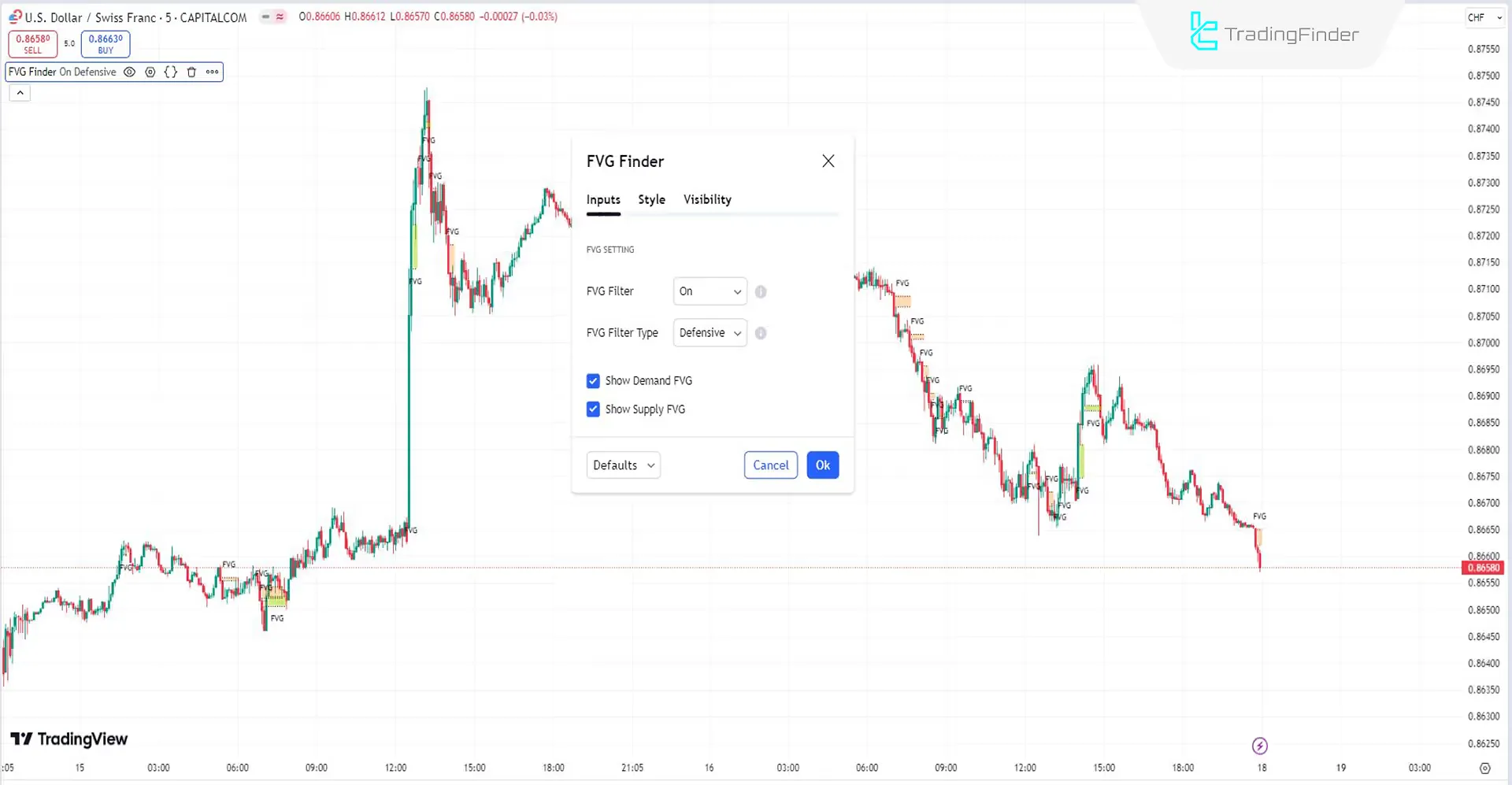

Fair Value Gap (FVG) in a Bearish Trend

In the image below, the price chart of the (USD/CHF) currency pair in a 5-minute timeframe is displayed.

A bearish Fair Value Gap (FVG) has formed during a downward movement. The price has returned to this gap to rebalance the area of imbalance.

This FVG, highlighted with an orange box, has effectively acted as resistance, facilitating the continuation of the downtrend.

Settings of the FVG Detector Indicator

- FVG Filter: Set to (On) to filter out excessive FVGs;

- FVG Filter Type: Set it to Defensive mode to filter gaps;

- Show Demand FVG: Display bullish gaps (demand);

- Show Supply FVG: Display bearish gaps (supply).

Descriptions

- Aggressive: In this mode, the size of the middle candle should not be small. Therefore, a more significant number of gaps are eliminated;

- Defensive: In this mode, the size of the middle candle should be relatively large and primarily composed of the body. Additionally, to identify bullish gaps, the second and third candles should be positive; for bearish gaps, the second and third candles should be negative.

Conclusion

In the ICT (Inner Circle Trader) trading system, detecting gaps (FVGs) is crucial; therefore, traders require high precision and skill.

Consequently, the Fair Value Gap (FVG) detector indicator provides an essential service by automatically identifying gaps in the price chart without manual chart analysis and with a minimal error rate.

This allows traders to focus on strategy and execution rather than the meticulous task of gap identification.

FVG Fair Value Gap TradingView PDF

FVG Fair Value Gap TradingView PDF

Click to download FVG Fair Value Gap TradingView PDFWhat is a Fair Value Gap (FVG)?

A Fair Value Gap is an area on a price chart where there is no balance between buyers and sellers. This gap occurs when a candle forms without overlapping the bodies of the candles before and after it.

In which markets can the FVG Detector indicator be used?

This indicator can be used in all markets as it is based on the concepts of supply and demand.