The One Shot One Kill ICT Indicator is one of the most advanced tools in Smart Money Concepts (SMC) and the ICT trading style.

This strategy focuses on liquidity sweep and the CISDlevel, emphasizing precise price movement analysis and structural market changes.

Specifications Table for the One Shot One Kill ICT Indicator

The table below summarizes the features of this indicator:

Indicator Categories: | ICT Tradingview Indicators Smart Money Tradingview Indicators Liquidity Tradingview Indicators |

Platforms: | Trading View Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal Tradingview Indicators |

Timeframe: | Multi-Timeframe Tradingview Indicators |

Trading Style: | Day Trading Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Cryptocurrency Tradingview Indicators Stock Tradingview Indicators Forward Tradingview Indicators Share Stocks Tradingview Indicators |

Overview of the Indicator

The One Shot One Kill ICT Indicator is designed around the specific strategy of the same name. It initiates its process by targeting liquidity grabs.

It identifies sensitive market zones, including the previous day's highs and lows, to analyze liquidity and price movements.

After liquidity collection and the break of the CISD level, market structure shifts, and the indicator automatically draws Fibonacci levels.

At this stage, traders can enter trades when the price retraces to valid Fibonacci levels, such as the 0.618 level.

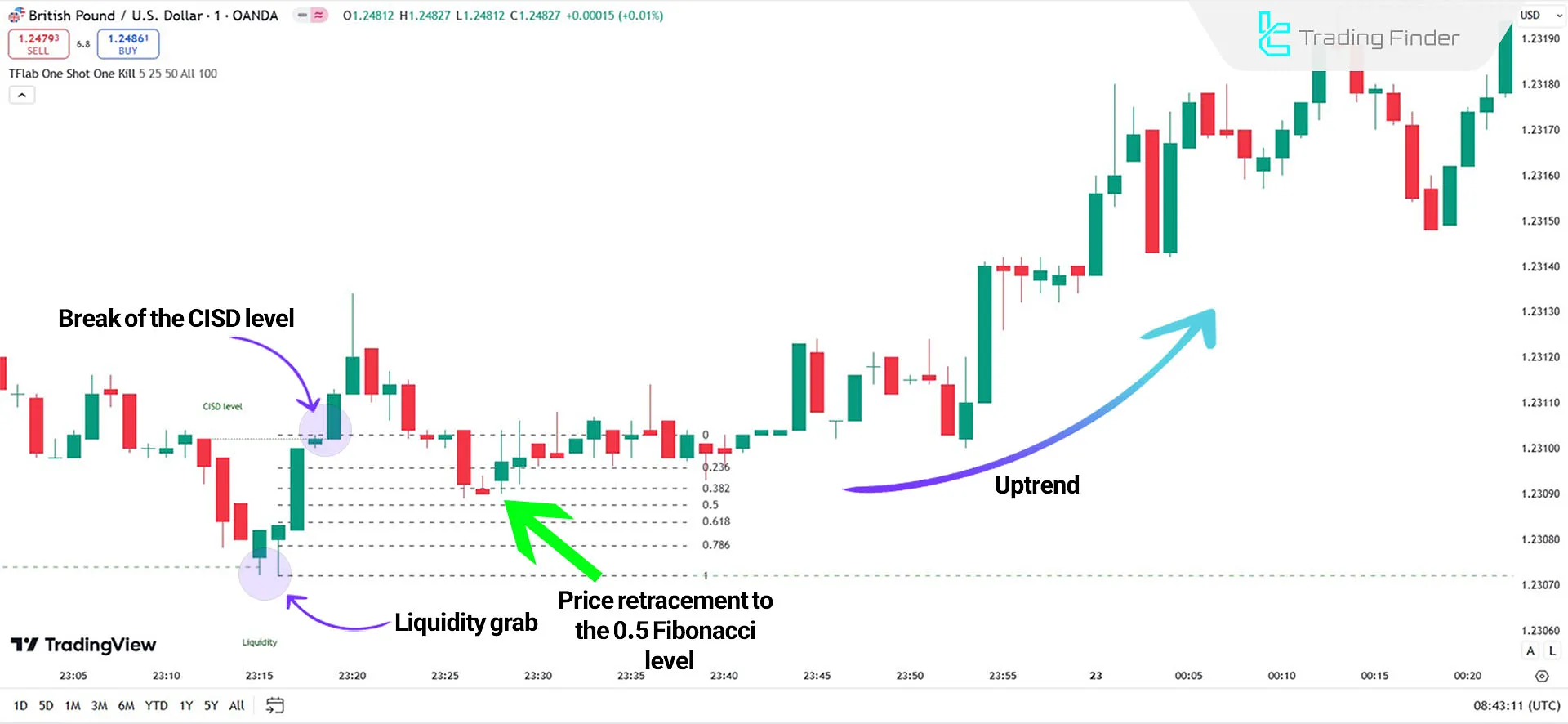

Uptrend Scenario

The One Shot One Kill pattern starts in an uptrend as the price moves toward the previous day's low. Retail traders holding short positions are trapped in lower levels during this phase.

The market reverses after liquidity is absorbed in these zones, initiating an upward movement.

When the CISD level is broken, it confirms the market structure shift toward an uptrend. The indicator uses Fibonacci tools to draw retracement levels from the lowest point to the highest point of the move.

Once the price retraces to the 0.5 Fibonacci level, it creates optimal conditions for entering buy trades.

Downtrend Scenario

In a downtrend, the price initially moves toward the previous day's high to absorb liquidity. After collecting liquidity, the market reverses and starts moving downward.

When the CISD level is broken, it confirms the market structure shift toward a downtrend.

Following this confirmation, traders draw Fibonacci retracement levels from the highest point to the lowest point of the move.

Traders enter sell trades once the price retraces to valid Fibonacci levels, such as 0.5.

These trades' targets could be the previous day's low or other key liquidity zones where major sellers are active.

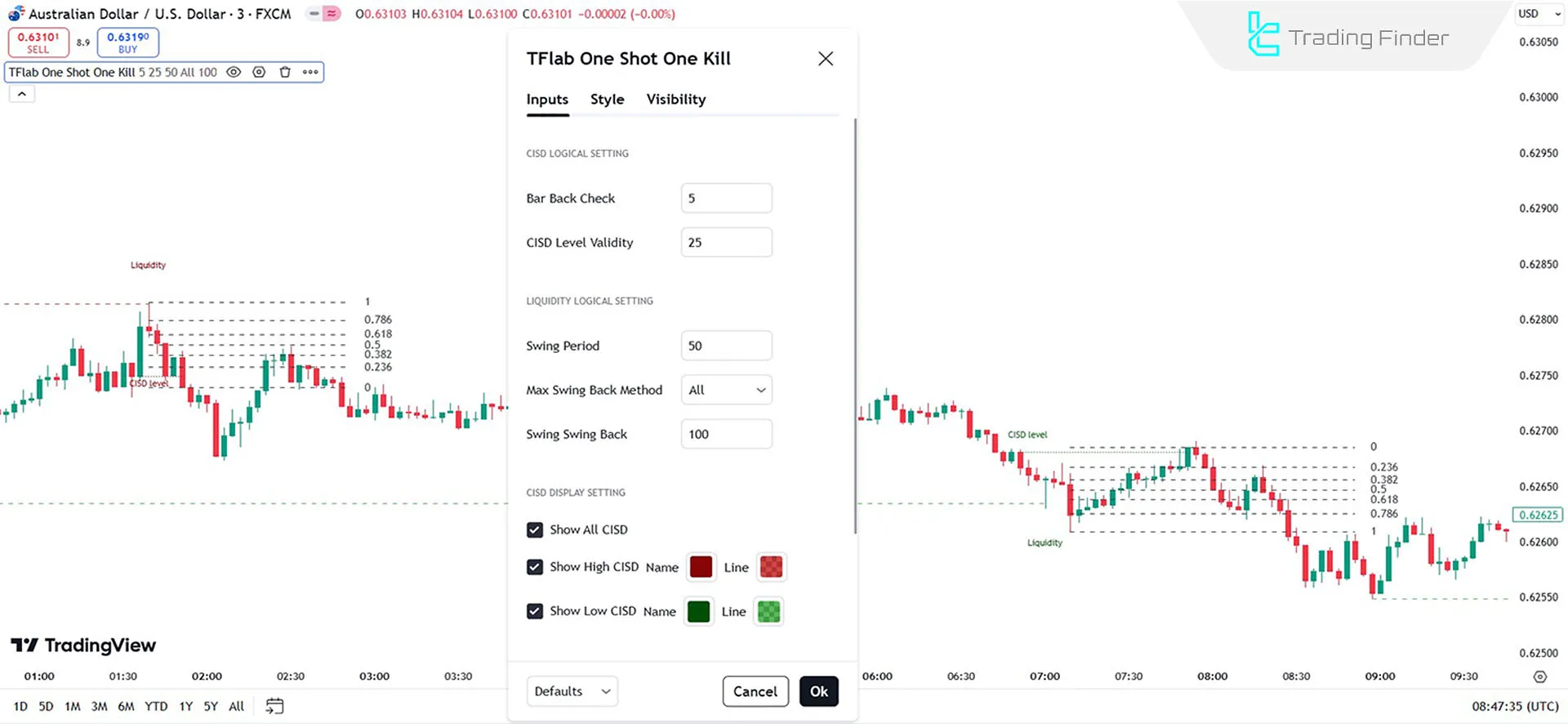

Indicator Settings

Below is the display of the indicator settings section:

CISD Logical Settings

- Bar Back Check: Reviews previous candles for CISD level validation.

- CISD Level Validity: Defines thevalidity period for levels.

Liquidity Logical Settings

- Swing Period: Adjusts the swing period for market analysis.

- Max Swing Back Method: Defines the maximum swing-back method.

- Swing Back: Configures swing-back settings.

CISD Display Settings

- Show All CISD: Displays all CISD levels.

- Show High CISD: Highlightshigher CISD levels.

- Show Low CISD: Highlights lower CISD levels.

Liquidity Display Settings

- Show All Liquidity: Displays all liquidity levels.

- Show High Liquidity: Highlights zones withhigh liquidity.

- Show Low Liquidity: Highlights zones with low liquidity.

Conclusion

The One Shot One Kill ICT Indicator is an advanced tool among TradingView indicators, designed to detect critical market movements.

It leverages key concepts such as liquidity grabs, CISD levels, and Fibonacci retracements for precise market analysis.

This indicator analyzes the previous day's highs and lows, aligns them with the 0.618 Fibonacci level, and helps identify optimal entry points.

Additionally, breaking the CISD level confirms market structure shifts and initiates new trends.

Indicator One Shot One TradingView PDF

Indicator One Shot One TradingView PDF

Click to download Indicator One Shot One TradingView PDFWhat is the One Shot, One Kill ICT Indicator?

The One Shot One Kill ICT Indicator is a specialized tool based on Smart Money Concepts (SMC) and the ICT trading style. It is designed to identify key market movements, liquidity grabs, and market structure changes.

How is the CISD level used in the One Shot One Kill Indicator?

Once broken, the Change in State Delivery (CISD) level indicates a market structure change and the start of a new trend. It acts as a confirmation signal for trade entries in the indicator.