The Forex trading framework in Bangladesh is governed by the Bangladesh Bank, providing traders with legal access to the Forex market without specific domestic restrictions on participation.

Traders may select between onshore and offshore brokers, each offering different cost structures, account models, tradable instruments, and trading conditions for engaging in Forex and CFD markets.

| Eightcap | |||

| XM Group | |||

| OctaFX | |||

| 4 |  | IUX | ||

| 5 |  | FP Markets | ||

| 6 |  | STARTRADER | ||

| 7 |  | Deriv | ||

| 8 |  | FxPro | ||

| 9 |  | eToro | ||

| 10 |  | D Prime |

Trustpilot Ratings of Forex Brokers in Bangladesh

Bangali Traders can check how trustworthy a broker is by reviewing it’s Trustpilot score in the table below.

Broker | Trustpilot Rating | Number of Reviews |

FP Markets | 4.8/5 ⭐ | +9500 |

4.4/5 ⭐ | +69500 | |

IUX | 4.2/5 ⭐ | +800 |

eToro | 4.2/5 ⭐ | +29500 |

Eightcap | 4.1/5 ⭐ | +3000 |

OctaFX | 4.0/5 ⭐ | +8000 |

FxPro | 3.8/5 ⭐ | +500 |

STARTRADER | 3.8/5 ⭐ | +500 |

XM Group | 3.5/5 ⭐ | +2500 |

3.1/5 ⭐ | +500 |

Minimum Spreads of Forex Brokers in Bangladesh

The core trading cost of Forex trading in the top brokers of Bangladesh is the spreads. Here are the minimum spread amounts in these brokers.

Brokers | Minimum Spreads |

Vantage | From 0.0 Pips |

Tickmill | From 0.0 pips |

From 0.0 pips | |

Pepperstone | From 0.0 pips |

Fusion Markets | From 0.0 pips |

FxPro | From 0.0 pips |

HFM | From 0.0 pips |

Capital.com | From 0.6 Pips |

From 0.6 Pips | |

From 1.0 pips |

Non-Trading Fees in Forex Brokers of Bangladesh

Besides spreads, traders must also consider non-trading fees which also affect their overall profitability.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

FBS | $0 | $0 | No |

Global Prime | $0 | $0 | No |

$0 | $0 | No | |

$0 | Varies | No | |

HFM | $0 | $0 | $5 |

Litefinance | $0 | Varies | $10 |

Alpari | $0 | Varies | $10 |

Errante | $0 | Varies | $15 |

Deriv | $0 | $0 | $25 |

TMGM | $0 | $0 | $30 |

Number of Tradable Instruments in Forex Brokers of Bangladesh

Having access to a wide variety of tradable instruments allow traders to diversify their trading portfolio and minimize risk.

Broker | Number of Tradable Assets |

Saxo Bank | +71000 |

D Prime | +10000 |

FP Markets | +10000 |

+2100 | |

XM Group | +1400 |

+1000 | |

PU Prime | +1000 |

+800 | |

Tickmill | +600 |

OctaFX | +300 |

Top 8 Forex Brokers in Bangladesh

To choose the best Forex broker from the available options, traders must check the spreads, commissions, deposit and withdrawal methods, customer support methods and hours, leverage, etc. to ensure they choose the best option.

The following paragraph are dedicated to a complete review of the best Forex brokers in the Bangladesh region.

D Prime

Doo Prime, operating under D Prime Limited, is a multi-asset brokerage established in 2014 and headquartered in Hong Kong, serving more than 400,000 active clients worldwide.

The group operates through regulated entities including D Prime Vanuatu Limited and D Prime Mauritius Limited, overseen by the regulatory authorities VFSC and FSC.

The broker delivers access to more than 10,000 financial instruments across Forex, Cryptocurrencies, Precious Metals, Commodities, Stock Indices, Futures, and Securities. Details of each contract is available in the D Prime dashboard.

Trading infrastructure includes MetaTrader 4, MetaTrader 5, and the proprietary Doo Prime InTrade, alongside TradingView integration and institutional connectivity via FIX API.

Leverage is available up to 1:1000, depending on asset class and account configuration after D Prime registration.

Doo Prime structures its services through Cent, STP, and ECN accounts using a Market Execution framework under a No Dealing Desk (NDD) environment. Traders can open these accounts in the

ECN spreads begin from 0.0 pips, with commissions applied exclusively to ECN accounts. The broker supports Islamic swap-free trading, permits Expert Advisors and hedging, and imposes no internal fees on deposits, withdrawals, or inactivity.

Funding channels include bank transfers, credit and debit cards, e-wallets, and multiple cryptocurrency options, with most transactions processed efficiently for account that have completed the D Prime verification.

Account Types | Cent, STP, ECN |

Regulating Authorities | VFSC (Vanuatu), FSC (Mauritius) |

Minimum Deposit | $0 (Cent Account), $100 (STP & ECN Accounts) |

Deposit Methods | Local Bank Transfer, International Wire Transfer, Credit/Debit Card (Visa, MasterCard, Apple Pay, Google Pay), E-wallets (Epay, FasaPay, HWGC), Cryptocurrencies (BTC, ETH, USDT, TRC20, BEP, ERC) |

Withdrawal Methods | Local Bank Transfer, International Wire Transfer, Credit/Debit Card, E-wallets, Cryptocurrencies |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Doo Prime InTrade, TradingView Integration, FIX API, Web, Android, iOS, Windows, macOS |

D Prime Pros and Cons

Here are the benefits and drawbacks of trading with the D Prime broker.

Pros | Cons |

Maximum leverage up to 1:1000 across supported assets | Investor compensation scheme not available under VFSC entity |

Multiple account types (Cent, STP, ECN) with flexible structures | Educational materials accessible only after registration |

Support for MetaTrader 4, MetaTrader 5, and proprietary Doo Prime InTrade platform | - |

No internal fees for deposits, withdrawals, or account inactivity | - |

FP Markets

FP Markets, operating under the legal name First Prudential Markets, has provided brokerage services since 2005, with its core operations based in Australia and client access extending across multiple international jurisdictions.

Regulatory supervision is maintained through a multi-license framework that includes ASIC and CySEC as primary tier-1 authorities, supported by FSCA, FSC, FSA (Seychelles), and SVG FSA under separate legal entities.

Client safety is reinforced through segregated account structures, negative balance protection, formal compensation participation, and strict adherence to KYC and AML compliance procedures by making FP Markets verification mandatory.

The trading environment supports Standard and RAW account models, requiring a minimum capital entry of 50 USD.

Pricing conditions feature floating spreads from 0.0 pips and commission schedules beginning at 3 USD per lot on RAW accounts, with additional cost efficiency available through FP Markets rebates of up to 3 USD per lot.

Market coverage exceeds 10,000 instruments, including Forex, share CFDs, indices, commodities, precious metals, ETFs, and cryptocurrency CFDs.

Execution and strategy deployment are facilitated via MetaTrader 4, MetaTrader 5, and cTrader, enabling discretionary trading, algorithmic systems, and ECN-style execution following completion of the FP Markets registration.

Supplementary infrastructure includes copy trading, PAMM, MAM, Islamic swap-free accounts, VPS hosting, and integrated risk management tools. Leverage capacity extends up to 1:500, subject to regulatory jurisdiction.

Various FP Markets deposit and withdrawal methods are available to traders, including bank wire, credit/debit cards, cryptocurrencies, Neteller, Skrill, and many more.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSCA, FSC, FSA (Seychelles), SVG FSA |

Minimum Deposit | 50 USD |

Deposit Methods | Visa, Mastercard, Bank Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:500 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader |

Pros and Cons of FP Markets

FP Markets advantages and disadvantages for Bangali traders.

Pros | Cons |

Supervision by ASIC and CySEC, supported by regulatory coverage from FSCA, FSC, and FSA entities | Offshore regulatory bodies governed by SVG FSA provide comparatively lower regulatory protection |

Availability of Standard and RAW accounts featuring spreads from 0.0 pips and competitive commission models | Educational resources are not as extensive as those offered by some Tier-1 regulated brokers |

Trading access to more than 10,000 instruments including Forex, share CFDs, indices, commodities, ETFs, and crypto CFDs | – |

Entry-level funding requirement starting at 50 USD | – |

STARTRADER

STARTRADER is a global multi-asset brokerage founded in 2012 and headquartered in Seychelles under registration number 8427362-1.

The company provides trading access to more than 1000 instruments, including over 50 Forex pairs, global equities, indices, commodities, metals, ETFs, and cryptocurrency CFDs.

Its regulatory structure spans several jurisdictions, with oversight from ASIC, FCA, FSCA, SCA, FSC, and FSA through separate legal entities, creating a diversified compliance framework with varying protection levels.

Client funds are held in segregated accounts and negative balance protection is applied under major operating entities. All traders are required to complete the STARTRADER verification.

In addition, certain offshore branches participate in third-party compensation schemes with coverage up to EUR 20000, alongside separate insurance protection reaching 1 million USD.

The broker operates STP and ECN execution models with market execution, floating spreads from 0.0 pips, micro-lot trading from 0.01 lots, and leverage capacity ranging from 1:500 to 1:1000 depending on jurisdiction.

Trading platforms include MetaTrader 4, MetaTrader 5, WebTrader, and the proprietary STARTRADER mobile application.

The service infrastructure extends to copy trading, PAMM and MAM investment structures, Islamic swap-free accounts, VPS hosting, integrated risk management tools available to use on the STARTRADER dashboard.

STARTRADER deposit and withdrawal methods also offer a comprehensive payment network supporting bank transfers, cards, e-wallets, and selected cryptocurrencies.Top of FormBottom of Form

Account Types | STP, ECN |

Regulating Authorities | ASIC, FCA, FSCA, SCA, FSC, FSA |

Minimum Deposit | 50 USD |

Deposit Methods | Visa, Mastercard, International Bank Wire Transfer, E-Wallets (SticPay, Perfect Money, Wise), Cryptocurrency |

Withdrawal Methods | Visa, Mastercard, International Bank Wire Transfer, E-Wallets, Cryptocurrency |

Maximum Leverage | Up to 1:1000 (depends on jurisdiction) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, WebTrader, STARTRADER Mobile App |

STARTRADER Group Pros and Cons

Traders must consider the following benefits and limitations of STARTRADER broker before choosing it as their Forex trading brokerage.

Pros | Cons |

Multiple regulatory licenses across several jurisdictions including ASIC, FCA, FSCA, SCA, FSC, and FSA | Compensation eligibility differs between offshore and onshore entities |

STP and ECN account models with spreads from 0.0 pips and flexible execution | Customer support availability is 24/6 rather than full 24/7 |

Access to more than 1000 tradable instruments across major asset classes | Educational and research materials are limited compared with some large Tier-1 brokers |

Wide platform support including MT4, MT5, WebTrader, and proprietary mobile app |

IUX

IUX operates as an international derivatives brokerage established in 2016, delivering trading services across multiple jurisdictions through regulatory supervision from FSC, FSCA, and ASIC.

Its operational infrastructure is supported by UAB Woxa Corporation Limited in Lithuania, forming the backbone of its cross-border execution framework.

Trade processing follows a Straight Through Processing (STP) architecture, ensuring direct order routing, reduced execution latency, and transparent market access.

The broker’s product coverage focuses on active participation in the Forex and CFD segments, offering exposure to currency pairs, cryptocurrency CFDs, global indices, equities, commodities, and thematic investment instruments.

Client onboarding provides access to three account configurations: Standard, Raw, and Pro. Capital entry requirements begin at 10 USD, while leverage availability extends to 1:3000 depending on the regulatory entity governing the account. Pricing conditions incorporate floating spreads from 0 pips and commission structures starting at 0 USD.

Risk controls are structured around a 30 percent margin call level and a 0 percent stop-out threshold.

After completing IUX registration, users trade through MetaTrader 5, a browser-based Web Trader, and the IUX Trade App on mobile devices.

Transaction processing supports bank transfers, cards, electronic wallets, QR-based payments, mobile money services, and cryptocurrency funding channels.

Account Types | Standard, Raw, Pro, Demo, Islamic |

Regulating Authorities | Financial Services Commission (FSC Mauritius), Financial Sector Conduct Authority (FSCA South Africa), Australian Securities and Investments Commission (ASIC) |

Minimum Deposit | $10 |

Deposit Methods | Bank Transfer, Credit & Debit Cards (Visa, MasterCard), E-wallets, Mobile Money, QR Payment, Virtual Bank, Cryptocurrency |

Withdrawal Methods | Bank Transfer, Credit & Debit Cards, E-wallets, Cryptocurrency |

Maximum Leverage | Up to 1:3000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 5 (MT5), Web Trader, IUX Trade App (iOS, Android) |

IUX Pros and Cons

Traders residing in Bangladesh most consider these pros and cons before opening an account with IUX broker.

Pros | Cons |

Multi-jurisdiction oversight from FSC, FSCA, and ASIC combined with an STP execution framework | No formal investor compensation or guarantee schemes in place |

Leverage flexibility reaching 1:3000 with entry-level funding from 10 USD | Educational materials are relatively limited for new market participants |

Cost structure featuring floating spreads from 0 pips and commission rates starting at 0 USD | Absence of PAMM, social trading, and copy trading investment programs |

Cross-platform access via MetaTrader 5, Web Trader, and IUX Trade App on mobile devices | – |

eToro

eToro is a multi-asset brokerage group founded in 2007 and operating under the legal entity eToro Ltd, with headquarters in Tel Aviv, Israel.

The company functions through a network of regulated subsidiaries including eToro (UK) Ltd, eToro (Europe) Ltd, eToro AUS Capital Ltd, eToro USA Securities Inc., eToro X Ltd (Gibraltar), eToro (Seychelles) Ltd, and eToro (ME) Limited in ADGM.

Regulatory supervision is provided by FCA, CySEC, MFSA, FSRA, ASIC, FSA Seychelles, and the Gibraltar Financial Services Commission, creating a diversified compliance framework with jurisdiction-specific client protections.

The broker offers Personal, Professional, Corporate, and Islamic account structures with minimum entry from 10 USD.

Trading access spans more than 6,000 assets across stocks, ETFs, Forex, commodities, indices, and cryptocurrencies, with retail leverage capped at 1:30 and professional leverage up to 1:400.

All activity is conducted through eToro’s proprietary trading platform, available via web and mobile applications, as the broker does not support MetaTrader 4 or MetaTrader 5.

Investment services include CopyTrader, Smart Portfolios, and Crypto Staking for assets such as ETH, SOL, ADA, and TRX. Funding and withdrawals are supported through bank transfers, cards, PayPal, Skrill, Neteller, Trustly, iDEAL, Sofort, and Przelewy24.

Non-trading fees include a $5 withdrawal charge and a $10 monthly inactivity fee after 12 months of inactivity. Traders must consider this before completing the eToro registration.

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA (Seychelles), Gibraltar FSC |

Minimum Deposit | 10 USD |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Maximum Leverage | Retail: up to 1:30, Professional: up to 1:400 |

Trading Platforms & Apps | Proprietary eToro Platform (Web, Android, iOS) |

Pros and Cons of eToro

The table below offers insights on the eToro advantages and disadvantages.

Pros | Cons |

Broad market coverage across stocks, ETFs, Forex, commodities, indices, and cryptocurrencies | Monthly inactivity fee applied after 12 months with no trading activity ($10) |

Multiple account types including Personal, Professional, Corporate, and Islamic | Crypto trading fees are higher compared to some competing brokers |

Strong investor protection mechanisms including segregated funds and compensation schemes | Leverage limits for retail clients are relatively low compared to offshore brokers |

Wide range of funding and withdrawal methods across global regions | Withdrawal fee of 5 USD applies on most transactions |

FxPro

FxPro operates as an international brokerage group specializing in Forex and CFD trading, active in global markets since 2006.

The company manages millions of client accounts through a network of licensed entities regulated by FCA (UK), CySEC (Cyprus), FSCA (South Africa), and SCB (Bahamas), establishing a multi-jurisdiction compliance framework that governs client onboarding and trading operations.

Market access covers more than 2,100 financial instruments, including currency pairs, equities, stock indices, commodities, precious metals, futures, and cryptocurrency CFDs.

The trading infrastructure supports both discretionary and automated execution via MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and the proprietary FxPro Mobile App, allowing traders to deploy diverse strategy models across desktop and mobile environments.

Client accounts are structured into Standard, Pro, Raw+, and Elite categories, with an entry requirement of 100 USD. Leverage parameters extend up to 1:500, subject to regulatory jurisdiction and client classification. Trader can use the FxPro rebate to lower trading costs in this broker.

Capital tra are processed through multiple channels, including Visa, MasterCard, bank wire transfer, broker-to-broker transfer, Skrill, Neteller, and PayPal available in the FxPro dashboard.

One of the best methods to fund your account in this broker is the FxPro USDT TRC20 deposit method.

Additional operational features include Islamic (swap-free) accounts and customer assistance via live chat, email, phone support, and a dedicated FAQ system.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA (UK), CySEC (Cyprus), FSCA (South Africa), SCB (Bahamas) |

Minimum Deposit | $100 |

Deposit Methods | Visa, MasterCard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, MasterCard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:500 (entity and client classification dependent) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, WebTrader, FxPro Mobile App |

FxPro Pros and Cons

These are the advantages and disadvantages of trading with the FxPro broker.

Pros | Cons |

Broad selection of over 2,100 tradable instruments across multiple asset classes | Leverage conditions vary depending on regulatory entity and client classification |

Multiple professional trading platforms including MT4, MT5, cTrader, WebTrader, and mobile app | No fixed-spread account offering |

Support for both manual and algorithmic trading strategies | - |

Availability of Islamic (swap-free) accounts | - |

Deriv

Deriv operates as a global derivatives brokerage founded in 1999 and formerly known as Binary.com, now functioning as part of the Regent Markets Group.

Following its rebranding in 2020, the company expanded its offering to include leveraged trading and CFD instruments, serving over 2.5 million registered users across 16 countries and executing more than 187 million trades monthly.

Its operational footprint spans 20 international locations, including Berlin, Paris, Cyprus, Hong Kong, Singapore, and Dubai, supported by a workforce exceeding 1,300 employees from over 70 nationalities.

Regulatory supervision is provided through multiple licensed entities under MFSA, FSA, VFSC, and BVI FSC, with jurisdiction-specific client safeguards such as segregated funds, negative balance protection, and participation in compensation mechanisms.

Deriv registration provides access to Forex, stocks, indices, commodities, ETFs, cryptocurrencies, and proprietary Derived Indices, alongside Options and Multipliers.

Trading infrastructure includes MetaTrader 5, cTrader, Deriv X, and Deriv Trader, enabling CFD, options, and copy trading functionality accessible via Deriv dashboard.

Account structures include Standard, Financial, and Swap-Free, with entry thresholds starting at 5 USD, floating spreads from 0.24 pips, and zero-commission pricing.

Deriv deposit and withdrawal methods operate on a 24/7 basis, with transaction support across cards, e-wallets, online banking, crypto, and P2P channels.

Account Types | Standard, Financial, Swap-Free |

Regulating Authorities | MFSA (Malta), Labuan FSA, VFSC, BVI FSC |

Minimum Deposit | 5 USD |

Deposit Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Cryptocurrencies, Voucher, Deriv P2P |

Withdrawal Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Cryptocurrencies, Voucher, Deriv P2P |

Maximum Leverage | Up to 1:1000 (depends on entity and jurisdiction) |

Trading Platforms & Apps | MetaTrader 5, cTrader, Deriv X, Deriv Trader |

Deriv Pros and Cons

Traders must consider the following benefits and drawbacks of using Deriv before opening an account.

Pros | Cons |

Broad product range including Forex, stocks, indices, commodities, ETFs, cryptocurrencies, Options, and Derived Indices | No top-tier regulation such as FCA or ASIC |

Multiple regulatory licenses across MFSA, Labuan FSA, VFSC, and BVI FSC | No PAMM or MAM account structures |

Low entry threshold with minimum deposit from 5 USD | - |

Commission-free pricing with floating spreads from 0.24 pips | - |

XM Group

XM Group has operated as a global online brokerage since 2009, building a client base exceeding 15 million traders and processing nearly 14 million transactions per day across international offices in Cyprus, South Africa, Dubai, and Belize.

The broker functions through multiple licensed entities regulated by FSC (Belize), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSC (Mauritius), and FSA (Seychelles), creating a broad regulatory framework with region-specific oversight and investor protections.

Trading access extends to more than 1,400 CFD instruments, covering Forex with over 55 currency pairs, shares, indices, commodities, cryptocurrencies, and precious metals.

Execution is supported through MetaTrader 4, MetaTrader 5, and the XM Mobile App, enabling discretionary and algorithmic trading across desktop and mobile environments available for download in the XM Group dashboard.

Traders can also use the XM Group copy trading system to copy other successful traders to gain passive income.

Account structures include Micro, Standard, Ultra Low, and Shares, with entry requirements starting from 5 USD for most account types.

Leverage reaches up to 1:1000, while cost conditions feature spreads from 0.6 pips, commission-free trading on most accounts, and 50 percent margin call with 20 percent stop-out thresholds.

Additional operational features include negative balance protection, Islamic (swap-free) accounts, MQL5 signal integration, and continuous 24/7 multilingual customer support for all traders who complete the XM Group verification.

Account Types | Micro, Standard, Ultra Low, Shares, Demo |

Regulating Authorities | FSC (Belize), CySEC (Cyprus), FSCA (South Africa), DFSA (Dubai), FSC (Mauritius), FSA (Seychelles) |

Minimum Deposit | 5 USD |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfers, E-Wallets, Mobile Payments (Google Pay, Apple Pay), Local Payment Methods |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfers, E-Wallets |

Maximum Leverage | Up to 1:1000 (depends on regulatory entity and client classification) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, XM Mobile App |

Pros and Cons of XM Group

Traders must consider the following drawbacks and advantages before choosing XM Group as their broker.

Pros | Cons |

Strong regulatory coverage across multiple jurisdictions including CySEC, FSCA, DFSA, FSC, and FSA | $10 per month inactivity fee |

Low minimum deposit of 5 USD suitable for entry-level traders | Investment options such as PAMM accounts are not available |

Wide range of over 1,400 tradable instruments across major asset classes | Limited proprietary trading tools compared to some competitors |

Multiple account types including Micro, Standard, Ultra Low, and Shares | - |

Is Forex Trading Legal in Bangladesh?

Yes, Forex is legal in Bangladesh. The Forex trading operates under structured legal framework administered by the Bangladesh Bank, the country’s central financial authority.

Participation in the Forex market is permitted primarily through licensed banks and approved financial institutions that are officially registered with this regulatory body.

These institutions are required to maintain regulatory compliance through capital adequacy controls, transaction monitoring, and periodic reporting.

In addition, several international Forex brokers provide access to Bangladeshi traders, as long as their services align with both international regulatory practices and local legal requirements.

Traders and investors may also conduct foreign exchange operations using Foreign Currency Accounts (FCA) and authorized remittance-linked accounts, which facilitate legal currency transactions for investment, business activities, travel expenditures, and international payments.

Professional traders use top-tier brokers to trade Forex in this country.

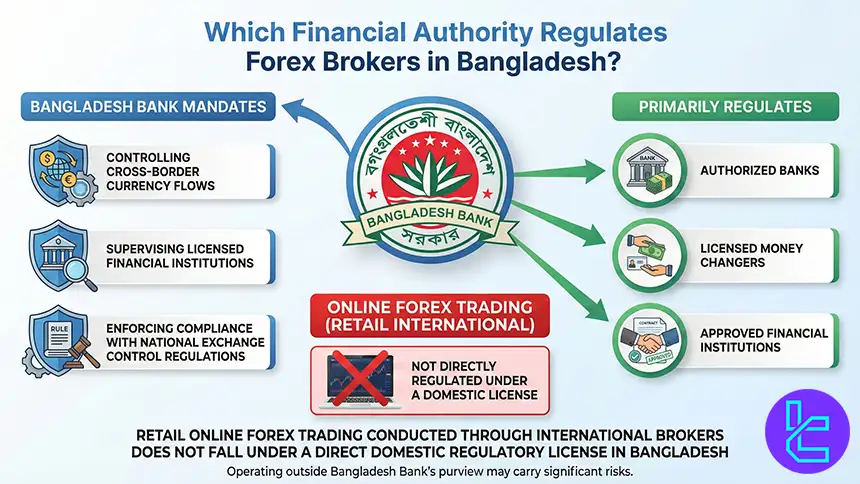

Which Financial Authority Regulates Forex Brokers in Bangladesh?

The regulatory structure governing Forex trading in Bangladesh is centered on the Bangladesh Bank (a low-tier authority based on TF score), which functions as the country’s primary monetary authority and oversees the foreign exchange market.

Its mandate includes controlling cross-border currency flows, supervising licensed financial institutions, and enforcing compliance with national exchange control regulations.

Within this framework, the Bangladesh Bank primarily regulates authorized banks, licensed money changers, and approved financial institutions that participate in currency exchange operations.

These entities are subject to reporting requirements, transaction monitoring, and capital controls designed to preserve financial stability and limit systemic risk.

However, retail online Forex trading conducted through international brokers does not fall under a direct domestic regulatory license, as such platforms operate outside the formal supervisory perimeter of Bangladesh’s financial system.

As a result, investor protection for Bangladeshi Forex traders depends largely on the regulatory jurisdiction of the foreign broker they choose.

While the Bangladesh Bank establishes the legal boundaries for currency transactions within the country, the absence of local regulation for offshore retail brokers means that legal safeguards and compensation mechanisms are determined by the broker’s home regulator.

Do I Pay Taxes on My Forex Trading Gains in Bangladesh?

Profits generated from Forex trading in Bangladesh fall under the country’s taxable income framework set by the National Board of Revenue Bangladesh and are therefore subject to national taxation rules.

Earnings derived from currency trading are generally assessed as personal income, with tax obligations determined according to the trader’s applicable income bracket.

Bangladesh applies a progressive income tax structure, with rates typically ranging between 10% and 25%, depending on the individual’s total annual earnings.

In addition, certain trading gains may also be evaluated under capital gains tax, which is commonly applied at a rate of 15%, depending on the classification of income and the specific circumstances of the taxpayer.

Compliance requires maintaining accurate transaction records, including trading statements, deposit and withdrawal confirmations, and profit documentation, as tax filings must be supported by verifiable financial evidence.

What is the Maximum Trading Leverage in Bangladesh?

In the Bangladeshi Forex trading environment, access to high trading leverage is commonly provided by international brokers, with levels reaching up to 1:500 on major currency pairs.

This leverage structure enables traders to control larger market positions using comparatively smaller capital commitments.

Although higher leverage increases market exposure, it also amplifies potential risk, making risk management a critical component of any trading strategy.

Lower leverage settings do not eliminate risk, but they can influence portfolio efficiency and position flexibility.

As a result, Bangladeshi Forex participants are encouraged to develop a clear understanding of how leverage interacts with market volatility, margin requirements, and capital preservation before applying leverage within live trading conditions.

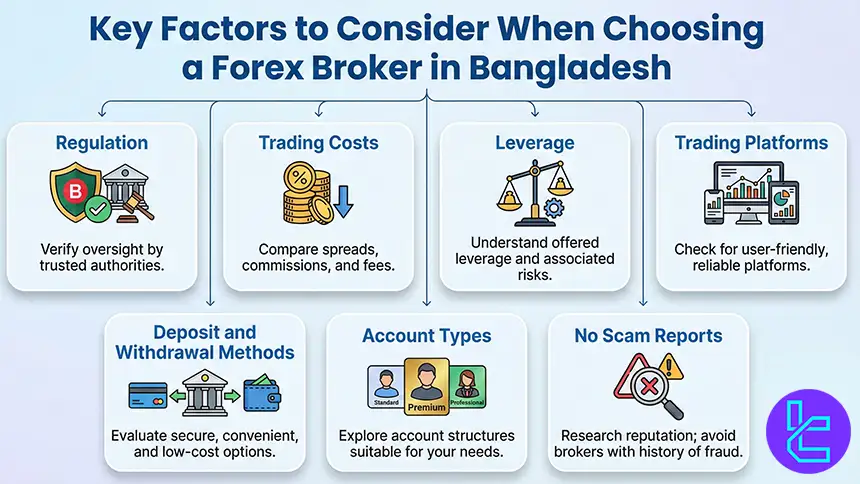

What Are Key Factors to Consider When Choosing a Broker in Bangladesh?

Selecting a suitable Forex broker in Bangladesh requires evaluating several structural and operational elements that directly affect trading performance, cost efficiency, and risk exposure.

Regulation

A broker’s regulatory profile remains a primary consideration. Preference is generally given to brokers supervised by recognized authorities such as FSCA, BVI FSC, FSC, IFSC, DFSA, and CIMA, particularly those with long-standing regulatory records and consistent compliance histories.

Trading Costs

Pricing conditions significantly influence profitability.

Many traders assess commission-based models with raw spreads between 0.0 and 0.01 pips on major currency pairs and round-turn commissions below 7 USD per lot, while spread-only accounts are typically expected to maintain minimum spreads near 0.7 pips.

Swap rates on leveraged overnight positions should remain transparent and commercially reasonable.

Leverage

Access to high leverage, combined with negative balance protection and automatic stop-out mechanisms, forms a core part of risk governance.

Trading Platforms

Platform availability also plays a central role.

MetaTrader 4 (MT4) remains the dominant trading platform for algorithmic and copy trading, supported by over 25,000 Expert Advisors, plugins, and custom indicators, while MetaTrader 5 (MT5) and cTrader serve as alternative solutions.

Other Critical Factors

Additional evaluation criteria include efficient deposit and withdrawal systems, competitive account structures, reliable demo accounts, and a disciplined approach to fraud avoidance by prioritizing properly regulated brokers and ignoring unverifiable profit claims.

How to Start Trading Forex in Bangladesh

Traders in Bangladesh begin by learning core market concepts such as currency pairs (EUR/USD, GBP/JPY, USD/BDT), pips, spreads, leverage, technical analysis, fundamental analysis, and trading psychology.

The following steps are necessary after learning about Forex terminology.

#1 Select a Regulated Broker

The next step involves choosing a Forex broker that offers transparent pricing, stable execution, and accessible deposit and withdrawal methods for Bangladeshi clients.

#2 Complete Account Registration

After selecting a broker, traders open an account by submitting personal details, verifying identity using documents such as a passport, NID, or driving license, and confirming residential information through official records.

#3 Fund the Trading Account

Accounts are funded through channels including bKash, Nagad, Rocket, local bank transfers, payment cards, and sometimes cryptocurrency, with minimum deposits typically between 5 USD and 25 USD.

#4 Install Trading Platforms

Trading operations are conducted through MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on Windows, macOS, Android, and iOS.

#5 Practice on a Demo Account

Before trading live capital, traders use demo accounts to test strategies, analyze market behavior, and gain operational confidence without financial risk.

#6 Execute the First Trade

Live trading begins by selecting a currency pair, defining lot size, and setting stop-loss and take-profit levels to control risk exposure.

#7 Apply Risk Management

Sustainable trading requires limiting exposure to 1 to 2 percent per trade, controlling leverage, keeping a trading journal, and maintaining consistent discipline.

#8 Withdraw Trading Profits

Profits are withdrawn through the same payment systems used for deposits, with most brokers completing transactions within several hours to one business day after verification.

Forex Trading in Bangladesh Compared to Other Countries

Trading Forex in Bangladesh isn’t as secure as other countries due to lower level of supervision, by the Bank of Bangladesh. Most traders prefer to trade with off-shore brokers that have better regulatory oversight, higher leverage and overall better trading conditions.

The table below offers a deep comparison of the Forex regulations and frameworks in Bangladesh in comparison to the UK, Australia, and Canada.

Comparison Factor | Bangladesh | |||

Primary Regulator | Bangladesh Bank | Canadian Investment Regulatory Organization (CIRO) | Australian Securities and Investments Commission (ASIC) | Financial Conduct Authority (FCA) |

Regulatory Framework | Central bank supervision of FX operations; offshore retail brokers not locally licensed | National investor protection framework under CIRO | ASIC national regulatory framework | National FCA framework (post Brexit) |

Retail Leverage Cap Forex Majors | 1:500 | 1:50 | 1:30 | 1:30 |

Investor Protection Level | Low | High | High | Very High |

Negative Balance Protection | Low | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Required | Required under CIRO | Required under ASIC | Mandatory |

Broker Transparency Requirements | Low | Strict compliance and disclosure standards | Strict disclosure and reporting standards | Very strict conduct and disclosure standards |

Broker Availability | Local banks and approved institutions; wide access to international brokers | CIRO-authorized brokers | ASIC-licensed brokers | FCA licensed local and international brokers |

Access to International Brokers | Yes | Yes | Yes | High global broker access |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Income tax 10 to 25 percent; possible 15 percent capital gains tax | Capital gains or income tax | Capital gains tax | Capital gains or income tax depending on activity |

Conclusion

Based on our review of the best Forex brokers in Bangladesh, FxPro, eToro, FP Markets, STARTRADER, Deriv, and XM are the top available options. Now traders must consider their risk tolerance and trading objects and choose the broker that aligns with their current trading strategy.

“All brokers have been carefully evaluated based on TradingFinder Forex methodology. This framework allows TF experts to analyze regulatory strength, trading conditions, platform quality, cost structure, risk management features, and overall reliability in a consistent and objective manner.”