Brokers are ranked using a weighted scoring approach that measures key criteria including trading costs, regulatory oversight, and account selection, as structured in our Forex methodology framework.

Forex trading in Canada operates within a tightly regulated framework designed to prioritize investor protection and market integrity.

Canada is widely recognized as a Tier-1 regulatory jurisdiction with oversight by the Canadian Investment Regulatory Organization (CIRO), which supervises investment dealers and derivatives providers offering services to Canadian residents.

| Libertex | |||

| IC Markets | |||

| FXCM | |||

| 4 |  | AvaTrade Canada | ||

| 5 |  | Vantage Markets | ||

| 6 |  | FP Markets | ||

| 7 |  | Fusion Markets | ||

| 8 |  | Blackbull Markets | ||

| 9 |  | PU Prime | ||

| 10 |  | Eightcap |

Trustpilot Ratings of Forex Brokers in Canada

The table below shows the Trustpilot ratings of Forex brokers suitable for Canadian traders.

Broker | Trustpilot Rating | Number of Reviews |

4.8/5 ⭐ | +49000 | |

4.8/5 ⭐ | +5000 | |

BlackBull Markets | 4.8/5 ⭐ | +2900 |

FP Markets | 4.8/5 ⭐ | +9500 |

AvaTrade Canada | 4.7/5 ⭐ | +11000 |

FXCM | 4.6/5 ⭐ | +800 |

Vantage | 4.5/5 ⭐ | +11000 |

Eightcap | 4.1/5 ⭐ | +3000 |

Libertex | 3.9/5 ⭐ | +9500 |

PU Prime | 3.8/5 ⭐ | +1500 |

Minimum Spreads of Forex Brokers in Canada

Canadian traders typically evaluate brokers by examining the full cost structure, which includes raw spreads, per-lot commissions, overnight swap rates, currency conversion fees, and non-trading charges such as inactivity or withdrawal fees. Here are the spreads in best Forex brokers.

Brokers | Minimum Spreads |

From 0.0 pips | |

IC Markets | From 0.0 pips |

OANDA | From 0.0 pips |

From 0.0 pips | |

Fusion Markets | From 0.0 pips |

Admirals | From 0.0 pips |

Axi | From 0.0 pips |

Forex.com | From 0.0 pips |

FXCM | From 0.2 pips |

From 0.6 pips |

Non-Trading Fees of Forex Brokers in Canada

Having low deposit and withdrawal fees is key for Forex brokers to attract traders to their platform and allow them to manage funds with minimal fees. Traders must also consider the inactivity fee that some brokers charge for keeping the dormant accounts active.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Vantage | $0 | $0 | No |

$0 | $0 | No | |

FP Markets | $0 | No (Except for Skrill and Paysafe: 1%) | No |

Ava Trade | $0 | Varies | No |

XTB | $0 | Free withdrawal above $50 | €10 |

Admirals | $0 | $0 | €10 |

CMC Markets | $0 | $0 | £10 |

Axi | $0 for up to $50,000 deposited funds | Free withdrawal above $50 | $10 |

$0 | Maximum €10 | $10 | |

FXCM | $0 | Varies | $50 |

Number of Tradable Instruments in Forex Brokers of Canada

Having access to a wide variety of assets allows traders to diversify their portfolio and find trading opportunities in various markets. Best Forex brokers number of tradable instruments

Broker | Number of Tradable Assets |

| +26000 | |

XTB | +10000 |

Forex.com | +7000 |

IC Markets | +2250 |

OANDA | +1700 |

SpreadEX | +1400 |

| +1000 | |

Vantage | +1000 |

+800 | |

Libertex | +300 |

Top 8 Forex Brokers in Canada

Transparent operations, competitive pricing structures, and access to a diverse set of trading platforms generally characterize reliable Forex brokers in the Canadian market.

In the sections that follow, the focus shifts to a detailed review of the top Forex brokers serving Canadian traders, highlighting their core features, trading conditions, and how well they align with different trading approaches and experience levels.

Libertex

Libertex is an international financial broker operating under the regulation of the Cyprus Securities and Exchange Commission (CySEC) as part of the Libertex Group.

Established in 1997, the company has built a long track record in global financial markets and currently serves millions of clients across more than 120 countries, giving them access to a wide variety of services in the Libertex dashboard.

The broker provides access to multiple asset classes, including Forex, cryptocurrencies, commodities, stocks, and indices. Trading is available through MetaTrader 4, MetaTrader 5, and a proprietary web-based platform designed for both desktop and mobile use after completing the Libertex registration.

Libertex offers several account structures, such as Real, Invest, and Demo accounts, allowing traders to engage in leveraged trading or commission-based investing depending on their objectives after finalizing the Libertex verification process.

From a risk management perspective, Libertex applies client fund segregation, negative balance protection, and participation in the Investor Compensation Fund, which covers eligible clients up to 20000 Euros in case of insolvency.

Pricing is based on variable spreads combined with instrument-specific commissions, alongside defined non-trading fees such as inactivity charges.

Account Types | Demo, Real, Invest, MT4, MT5 |

Regulating Authorities | Cyprus Securities and Exchange Commission (CySEC) |

Minimum Deposit | 100 EUR |

Deposit Methods | E-payments, credit and debit cards, bank wire transfer |

Withdrawal Methods | E-payments, credit and debit cards, bank wire transfer |

Maximum Leverage | Up to 1:30 for retail clients, up to 1:600 for professional clients |

Trading Platforms & Apps | Proprietary web platform, MetaTrader 4, MetaTrader 5 |

Libertex Pros and Cons

The following overview highlights the main strengths and limitations of Libertex based strictly on its regulatory status, trading conditions, and platform features.

Pros | Cons |

Regulated by a tier 1 authority (CySEC) | Not available in several major jurisdictions, such as the US and UK |

Segregation of client funds and negative balance protection | No Islamic account option |

Access to multiple platforms including MT4, MT5, and a proprietary platform | Educational materials are relatively limited compared to some competitors |

Wide range of tradable markets including Forex, crypto, CFDs, stocks, and indices | - |

IC Markets

IC Markets operates as a global multi-asset Forex and CFD broker with a strong focus on institutional style execution and broad market coverage.

The broker supports 10 base account currencies, including USD, AUD, EUR, GBP, SGD, NZD, JPY, CHF, HKD, and CAD, and applies a minimum deposit threshold of $200 across its trading accounts.

Trading access is delivered primarily through CFD instruments, spanning Forex pairs, indices, commodities, bonds, cryptocurrencies, and a large universe of more than 2,100 equity CFDs.

Founded in 2007, IC Markets delivers its services through several regulated entities, including oversight by CIRO, CySEC, and the FSA.

Regulatory scope determines leverage caps, client eligibility, and investor protection mechanisms, with EU clients covered by the Investor Compensation Fund up to €20,000.

Across all entities, the broker enforces client fund segregation, external auditing standards, and anti-money laundering compliance.

From a risk management perspective, Libertex applies client fund segregation, negative balance protection, and participation in the Investor Compensation Fund, which covers eligible clients up to 20000 Euros in case of insolvency.

An Islamic swap-free option is also available, supporting traders who require interest-free trading conditions. Traders must note that they could reduce their trading costs by leveraging IC Markets' rebate services provided by well-known IBs such as TradingFinder.

Account Types | Standard, Raw Spread, Islamic |

Regulating Authorities | CIRO, CySEC, SCB, FSA, CMA |

Minimum Deposit | $200 |

Deposit Methods | Bank Cards (Visa, MasterCard), Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal), Local and regional payment solutions |

Withdrawal Methods | Bank Cards, Bank Wire Transfer, E-wallets (Skrill, Neteller, PayPal) |

Maximum Leverage | Up to 1:500 (subject to trading conditions) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, cTrader Web, IC Markets Mobile |

Pros and Cons of IC Markets for Canadian Users

The following table contains the benefits and drawbacks of trading with the IC Markets broker for traders residing in Canada.

Pros | Cons |

Operates via the IC Markets Canada entity, aligning with traders seeking Canada-based brokerage access | The $200 minimum deposit may be restrictive for entry-level or small-balance traders |

Offers access to over 2,100 equity CFDs alongside Forex, indices, commodities, and cryptocurrency markets | PAMM and managed investment account solutions are not supported |

Supports a broad platform lineup, including MetaTrader 4, MetaTrader 5, cTrader, cTrader Web, and the IC Markets mobile application | Raw Spread accounts use a commission per lot pricing structure |

Raw Spread accounts feature institutional-style pricing with spreads from 0.0 pips | - |

BlackBull Markets

BlackBull Markets is a New Zealand-based Forex and CFD broker established in 2014 under the legal entity Black Bull Group Limited.

The broker operates within a multi-regulatory structure, primarily overseen by FMA in New Zealand and FSA in Seychelles, which allows it to provide services to all traders who complete Blackbull Markets registration across different jurisdictions while maintaining segregated client funds and negative balance protection.

The broker offers access to more than 26,000 tradable instruments spanning Forex, equities, indices, commodities, energies, metals, and cryptocurrencies.

Trading is supported through widely adopted platforms such as MetaTrader 4, MetaTrader 5, cTrader, and TradingView, alongside proprietary solutions including BlackBull CopyTrader and BlackBull Invest.

Account offerings are structured around ECN Standard, ECN Prime, and ECN Institutional models, with spreads starting from 0.0 pips and leverage availability reaching up to 1:500 depending on regulatory conditions.

BlackBull Markets provides a broad range of funding methods for traders who have completed BlackBull Markets verification, with no broker-side deposit fees, and applies a fixed withdrawal processing cost.

Additional features include copy trading, API access, Islamic accounts, PAMM solutions, and an extensive educational hub.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | Financial Markets Authority (FMA), Financial Services Authority (FSA Seychelles) |

Minimum Deposit | $0 (ECN Standard), $2,000 (ECN Prime), $20,000 (ECN Institutional) |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | Up to 1:500 (depending on regulatory entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

Blackbull Pros and Cons

Here are the details Canadian traders must consider before choosing BlackBull Markets as their broker.

Pros | Cons |

Multi-regulated structure under FMA (New Zealand) and FSA (Seychelles) | Higher minimum deposit required for ECN Prime and ECN Institutional accounts ($2000) |

Access to over 26,000 tradable instruments across multiple asset classes | Product range and platform variety may be complex for beginner traders |

ECN account models with spreads starting from 0.0 pips | - |

Support for MT4, MT5, cTrader, TradingView, and proprietary platforms | - |

PU Prime

PU Prime operates as a multi-asset Forex and CFD broker with a global client focus and a product range exceeding 800 tradable instruments across six asset classes.

Established in 2016, the broker provides market access through CFD structures covering Forex, indices, commodities, shares, bonds, metals, ETFs, and cryptocurrencies.

Trading is supported on MetaTrader 4, MetaTrader 5, and the proprietary PU Prime mobile application, enabling access across desktop, web, and mobile environments after completing the PU Prime registration.

The broker offers four primary account types: Standard, Prime, ECN, and Cent, designed to accommodate different trading volumes and execution preferences.

Pricing conditions vary by account, with spreads starting from 0.0 pips on Prime and ECN accounts combined with per lot commissions, while Standard and Cent accounts follow a spread-only model.

The minimum deposit starts from $20, positioning PU Prime among brokers with relatively low entry requirements.

From a regulatory and risk management perspective, PU Prime operates through multiple entities under oversight from ASIC, FSCA, and offshore regulators, which all require PU Prime verification for AML and KYC purposes..

Additional features include Islamic accounts, demo trading, copy trading, and social trading, forming a diversified trading environment with a wide variety of PU Prime deposit and withdrawal methods, rather than a purely execution focused brokerage.

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | ASIC, FSCA, SVG FSC, Mwali FSC |

Minimum Deposit | $20 |

Deposit Methods | Credit and debit cards, e-wallets, cryptocurrencies, local bank transfer, and international wire transfer |

Withdrawal Methods | Credit and debit cards, e-wallets, cryptocurrencies, local bank transfer, and international wire transfer |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, PU Prime mobile app |

PU Prime Pros and Cons

Here are some of the pros and cons of trading with PU Prime as a Canadian trader.

Pros | Cons |

Wide range of over 800 tradable instruments across Forex, indices, commodities, shares, and cryptocurrencies | Client protection and compensation schemes vary significantly depending on the regulatory entity |

Multiple account types including Standard, Prime, ECN, and Cent for different trading styles | High leverage offerings are primarily available under offshore entities rather than top tier regulators |

High leverage availability up to 1:1000 for eligible clients | - |

Supports MT4, MT5, and a proprietary mobile app with copy trading features | - |

FXCM

FXCM operates as a multi-regulated Forex and CFD broker with a market presence spanning more than 25 years, having been founded in 1999.

The company delivers its services through several licensed entities overseen by top-tier regulators, including the FCA in the UK, ASIC in Australia, CySEC in the EU, FSCA in South Africa, and ISA in Israel.

Regulatory coverage determines leverage limits and investor protection by region, with safeguards such as client fund segregation, negative balance protection, and regular audits applied across entities.

FXCM offers three primary account categories for traders who finalize the FXCM registration: CFD, Active Trader, and Corporate accounts, with a minimum deposit requirement of $50.

Trading access is provided mainly through CFD instruments across Forex, indices, commodities, shares, and cryptocurrencies. Pricing follows a spread-based structure, with floating spreads starting from 0.2 pips on major Forex pairs and zero commission on standard CFD trades.

Maximum leverage can reach up to 1:1000 under selected entities, while stricter caps apply in regions such as the EU and Australia.

Platform availability includes MetaTrader 4, TradingView, TradeStation, and FXCM’s proprietary Trading Station, supporting manual, algorithmic, and social trading workflows.

Additional features include demo accounts, Islamic swap-free options, ZuluTrade copy trading, and Capitalise AI. Just like many other brokers on our list, traders can use FXCM rebates to minimize their trading costs by joining this broker via TradingFinder IB.

Account Types | CFD Account, Active Trader Account, Corporate Account |

Regulating Authorities | FCA, ASIC, CySEC, FSCA, ISA |

Minimum Deposit | $50 |

Deposit Methods | Credit and debit cards (Visa, MasterCard), bank wire transfer, Skrill, Neteller |

Withdrawal Methods | Credit and debit cards, bank wire transfer, Skrill, Neteller |

Maximum Leverage | Up to 1:1000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 4, TradingView, TradeStation, FXCM Trading Station |

FXCM Pros and Cons

The table below helps traders outline the key advantages and disadvantages of trading with the FXCM broker.

Pros | Cons |

Regulated by multiple top-tier authorities including FCA, ASIC, CySEC, FSCA, and ISA | An inactivity fee of $50 per year applies after 12 months of no trading activity |

Long operating history since 1999 with established global market presence | Bank wire withdrawals are subject to a $40 processing fee |

Access to several professional trading platforms including MetaTrader 4, TradingView, TradeStation, and FXCM Trading Station | Maximum leverage levels vary significantly by entity and are restricted in EU and Australian jurisdictions |

Spread-based pricing with floating spreads starting from 0.2 pips and no standard CFD commissions | Past regulatory actions and historical bankruptcy proceedings may be considered a risk factor by some traders |

AvaTrade Canada

AvaTrade operates as a global Forex and CFD broker structured around a diversified regulatory framework that spans multiple jurisdictions.

The company holds licenses from authorities such as CIRO, CySEC, the Central Bank of Ireland (CBI), FSCA, FSA Japan, ADGM, ISA, and the BVI FSC, placing different operating entities under both Tier 1 and regional regulators. The broker offers services to residents of Canadian region through its AvaTrade Canada entity.

This structure defines leverage limits, client eligibility, and protection standards by region, while core safeguards such as client fund segregation and negative balance protection are applied across accounts.

The broker sets a minimum deposit requirement of $100 and supports a wide range of funding channels, including credit and debit cards, bank wire transfers, Skrill, Neteller, WebMoney, and PayPal, subject to local availability.

Trading conditions include a margin call threshold of 25% and a stop out level of 10%. Maximum leverage varies by entity, reaching higher levels in certain offshore jurisdictions, while EU and Canadian clients are subject to stricter caps aligned with local regulatory rules.

AvaTrade Canada delivers market access through multiple platforms, including MetaTrader 4, MetaTrader 5, WebTrader, a proprietary mobile application, and AvaOptions for options trading. The available markets cover Forex, equities, indices, commodities, metals, and cryptocurrencies.

Account offerings include retail, professional, Islamic swap-free, and demo accounts, complemented by copy trading solutions via DupliTrade and AvaSocial, positioning AvaTrade as a regulation-focused broker with a broad platform and asset coverage rather than a leverage-driven model. Traders should also note that by using the AvaTrade Canada rebate program, they can lower Forex and metals trading costs up to $3.5 per lot.

Account Types | Retail, Professional, Islamic (Swap Free), Demo |

Regulating Authorities | Central Bank of Ireland (CBI), CIRO (Canada), CySEC (Cyprus), FSCA (South Africa), FSA (Japan), ADGM (Abu Dhabi), ISA (Israel), BVI FSC |

Minimum Deposit | $100 |

Deposit Methods | Credit and Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Withdrawal Methods | Credit and Debit Cards, Bank Wire Transfer, Skrill, Neteller, WebMoney, PayPal |

Maximum Leverage | Up to 1:400 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), AvaTrade WebTrader, AvaTrade Mobile App, AvaOptions |

Pros and Cons of AvaTrade Canada Broker

Like any other broker, AvaTrade Canada has its own pros and cons. The table below provides more information on that subject:

Pros | Cons |

Operates under a broad regulatory umbrella, including CBI, CIRO, CySEC, FSCA, FSA Japan, and ADGM, covering both Tier 1 and regional authorities | Retail leverage is capped at relatively conservative levels for EU and Canadian clients due to regulatory restrictions |

Supports a wide range of trading platforms such as MetaTrader 4, MetaTrader 5, WebTrader, the AvaTrade mobile app, and AvaOptions | Does not provide PAMM solutions or traditional managed account structures |

Provides access to multiple asset classes, including Forex, equities, indices, commodities, metals, and cryptocurrencies | - |

Offers Islamic swap-free accounts alongside negative balance protection across regulated entities | - |

Eightcap

Eightcap is a multi-asset Forex and CFD broker that enables leveraged trading across global markets, with maximum leverage reaching up to 1:500 depending on the applicable regulatory entity and client classification.

The broker provides exposure to six primary asset classes, including Forex, commodities, metals, cryptocurrencies, indices, and shares, delivered mainly through CFD instruments for traders who complete the Eightcap registration process.

Founded in Melbourne in 2009, Eightcap operates under a multi-jurisdiction regulatory structure that includes the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), and the Securities Commission of The Bahamas (SCB).

This regulatory coverage positions the broker to serve traders across different regions while aligning trading conditions with local compliance requirements.

Platform support spans MetaTrader 4, MetaTrader 5, and TradingView, while additional tools such as Capitalise.ai, FlashTrader, and an AI-based economic calendar enhance analytical and automation capabilities without introducing proprietary execution layers.

Account offerings include Standard, Raw, and TradingView accounts, alongside a Demo environment, allowing traders to choose between spread-only pricing or raw spreads combined with fixed commissions. Trading costs can be further optimized through the Eightcap rebate program offered via TradingFinder IB, which may reduce expenses by up to $3.6 per traded lot.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC (Australia), FCA (United Kingdom), CySEC (Cyprus), SCB (Bahamas) |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards (Visa, Mastercard), Bank Wire Transfer, E-wallets (Skrill, Neteller), PayPal, Cryptocurrencies (BTC, ETH, USDT) |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfer, E-wallets, PayPal, Cryptocurrencies |

Maximum Leverage | Up to 1:500 (depends on regulatory entity) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView |

Eightcap Pros and Cons

The table below contains the benefits and limitations of using Eightcap as your broker.

Pros | Cons |

Regulated under ASIC, FCA, CySEC, and SCB | No swap-free accounts |

Access to MT4, MT5, and native TradingView integration | No PAMM or copy trading services |

Raw spreads from 0.0 pips | Educational resources are relatively basic |

Broad market coverage across Forex, crypto, indices, commodities, metals, and shares | - |

Vantage Markets

Vantage Markets operates as a multi-asset Forex and CFD broker with a global footprint that has expanded steadily since its establishment in 2009.

Headquartered in Sydney, the broker maintains a network of more than 30 offices worldwide and serves traders across multiple regions through several regulated entities.

Regulatory oversight spans both Tier 1 and regional authorities, including ASIC in Australia, FCA in the United Kingdom, FSCA in South Africa, VFSC in Vanuatu, and CIMA in the Cayman Islands.

This structure results in entity-specific leverage limits, client eligibility rules, and protection standards, while core safeguards such as segregated client funds and negative balance protection apply across most entities.

Vantage Markets provides access to a broad range of tradable instruments, covering Forex pairs, indices, commodities, shares, ETFs, bonds, and cryptocurrencies after Vantage Markets registration.

Account options include Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap-Free accounts, with minimum deposits starting from $20 and leverage reaching up to 1:1000 under certain jurisdictions.

Pricing varies by account type, with ECN accounts offering spreads from 0.0 pips combined with commission-based pricing. Trading is supported through MetaTrader 4, MetaTrader 5, ProTrader, TradingView integration, and a proprietary mobile application.

In addition to self-directed trading, Vantage offers copy and social trading solutions via ZuluTrade, DupliTrade, and Myfxbook AutoTrade.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap-Free |

Regulating Authorities | ASIC, FCA, FSCA, VFSC, CIMA |

Minimum Deposit | $20 |

Deposit Methods | Credit and debit cards, bank transfer, e-wallets (Skrill, Neteller, Fasapay), Perfect Money, local payment methods |

Withdrawal Methods | Credit and debit cards, bank transfer, e-wallets, local payment methods (region dependent) |

Maximum Leverage | Up to 1:1000 (entity dependent) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, ProTrader, TradingView, proprietary mobile application |

Vantage Markets Pros and Cons

Key benefits and drawbacks that traders must consider before choosing Vantage Markets:

Pros | Cons |

Regulated by multiple authorities, including ASIC, FCA, FSCA, VFSC, and CIMA, with segregated client funds across entities | Regulatory protections and investor compensation schemes vary significantly depending on the entity and jurisdiction |

Wide range of account types such as Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap-Free | High minimum deposit requirement for Pro ECN accounts compared to entry-level account options ($10,000) |

Access to multiple trading platforms, including MetaTrader 4, MetaTrader 5, ProTrader, TradingView, and a proprietary mobile app | - |

Competitive pricing on ECN accounts with spreads from 0.0 pips and commission-based execution | - |

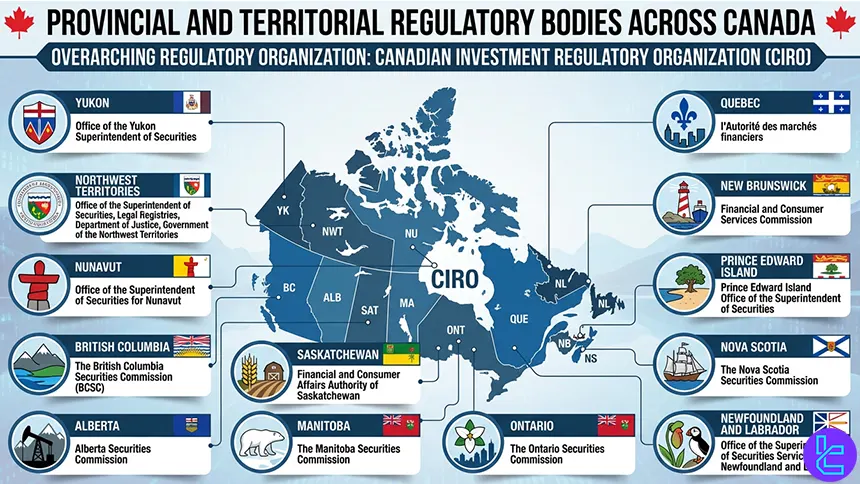

Is Forex Trading Legal in Canada?

Forex trading is legal in Canada and operates within a structured regulatory framework that combines national oversight with provincial supervision.

At the federal level, the Canadian Investment Regulatory Organization (CIRO) acts as the primary self-regulatory body, having assumed the responsibilities of the former IIROC.

CIRO sets rules for investment dealers offering retail over-the-counter Forex and CFD services, including registration requirements, capital adequacy standards, and ongoing compliance obligations.

Alongside CIRO, regulatory authority is shared with the Canadian Securities Administrators (CSA), an umbrella organization coordinating provincial and territorial securities commissions such as the British Columbia Securities Commission and the Ontario Securities Commission.

Canadian residents are permitted to trade a wide range of financial instruments, including spot Forex, Contracts for Difference (CFDs), commodities, metals, indices, global equities, ETFs, and options, provided they use properly registered brokers.

Which Financial Authority Regulates Forex Brokers in Canada?

Forex brokers operating in Canada fall under a layered regulatory model that blends centralized supervision with province-based enforcement.

The cornerstone of this system is the Canadian Investment Regulatory Organization (CIRO), as the successor to IIROC following the consolidation of Canada’s major self-regulatory bodies.

This financial body is a top-tier regulator based on TF score system. Through this transition, CIRO became the primary authority overseeing investment dealers, including firms providing retail Forex and CFD trading services.

CIRO functions within the broader framework of the Canadian Securities Administrators (CSA), a national council that unites all provincial and territorial securities regulators. While CIRO establishes countrywide standards covering dealer registration, minimum capital thresholds, leverage controls, disclosure obligations, and client protection rules, it does not operate in isolation.

Licensing decisions and regulatory enforcement remain the responsibility of provincial regulators acting under CSA.

Each province and territory maintains its own securities authority, such as:

- Ontario Securities Commission

- British Columbia Securities Commission

- Quebec’s Autorité des marchés financiers

These bodies cooperate closely with CIRO to maintain regulatory consistency across Canada, while retaining the discretion to introduce stricter local requirements where deemed necessary.

How to Verify CIRO Regulation?

CIRO provides public tools that allow investors to confirm whether a firm meets Canada’s regulatory requirements for offering retail Forex and CFD services.

One method is to consult the Office of the Investor section on the CIRO website, where registered investment dealers and their regulatory status are listed.

CIRO functions within the broader framework of the Canadian Securities Administrators (CSA), a national council that unites all provincial and territorial securities regulators. CIRO oversees more than 250 investment and mutual fund firms and monitors over 100,000 registered representatives, making this database a primary reference point for verification. Regulatory activity, including enforcement actions and disciplinary outcomes, is also published to support transparency.

In addition to CIRO resources, traders can cross-check a broker’s registration through the CSA National Registration Search, which is maintained by the Canadian Securities Administrators.

This database allows users to review dealer memberships, imposed terms or conditions, and registration history at both the national and provincial levels.

Broker websites can also provide confirmation, as CIRO-regulated firms typically disclose their membership status and license details.

If discrepancies arise, investors can contact their local provincial securities regulator for clarification, ensuring that any broker selected operates within Canada’s regulatory framework.

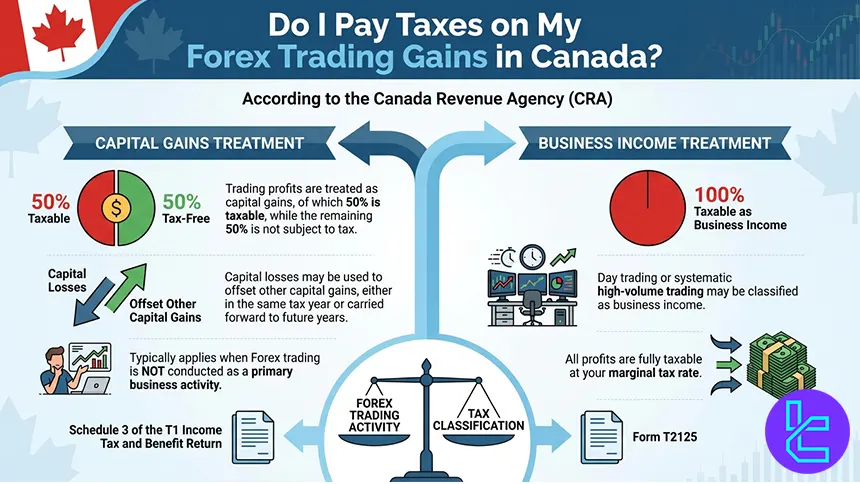

Do I Pay Taxes on My Forex Trading Gains in Canada?

Yes, profits from Forex trading are generally taxable in Canada, and the way they are treated depends on how the trading activity is classified by the Canada Revenue Agency (CRA).

For most individual traders, Forex gains and losses are considered capital in nature rather than business income. In this case, trading profits are treated as capital gains, of which 50% is taxable, while the remaining 50% is not subject to tax.

Capital losses may be used to offset other capital gains, either in the same tax year or carried forward to future years, which can reduce overall tax liability.

This capital gains treatment typically applies when Forex trading is not conducted as a primary business activity. However, more active trading styles, such as frequent day trading or systematic high-volume trading, may be classified as business income. When trading is deemed a business, all net profits are fully taxable at the trader’s applicable marginal tax rate. The CRA determines this classification based on factors such as transaction frequency, holding periods, and the level of time and expertise involved.

Canadian residents are required to report net foreign exchange gains or losses exceeding $200 annually.

Capital gains are reported on Schedule 3 of the T1 Income Tax and Benefit Return, while business income is reported on Form T2125. Tax rates and outcomes can vary by province and personal circumstances, so accurate record keeping is essential.

What is the Maximum Forex Trading Leverage in Canada?

Forex brokers regulated by the Canadian Investment Regulatory Organization (CIRO) are permitted to offer retail leverage of up to 1:50 under specific conditions.

This ceiling applies primarily to certain major currency pairs and is not uniform across the market. For example, the 1:50 ratio typically applies to USD/CAD, while other currency pairs may be subject to lower limits, such as 1:20 for pairs like GBP/CAD.

These restrictions are higher than those imposed in some regions, including the European Union and Australia, where retail leverage is generally capped at 1:30.

Offshore Forex brokers, which operate outside the Canadian regulatory perimeter, often advertise significantly higher leverage levels. However, such offerings fall outside CIRO oversight and do not provide the same investor protection standards.

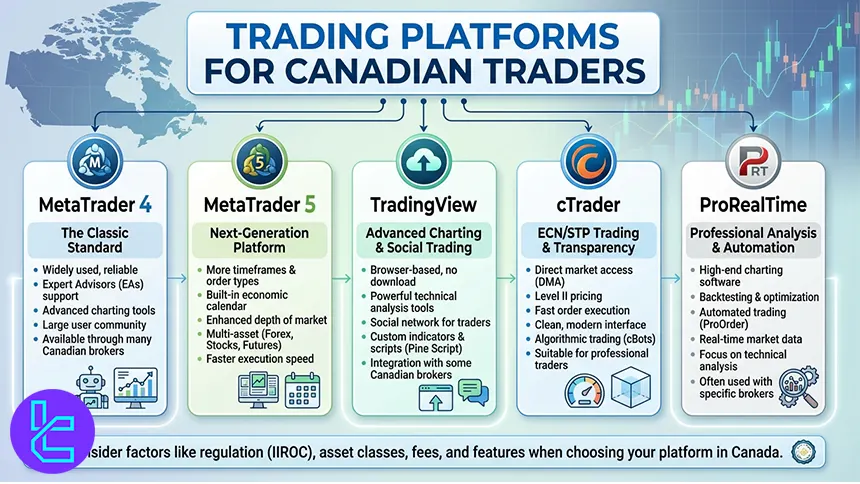

Forex Trading Platforms Available to Canadian Traders

Forex trading platforms available to Canadian traders cover a wide range of trading styles, technical analysis needs, and experience levels.

Most CIRO-regulated and international brokers provide access to the following well-established platforms, each serving a distinct role within the trading ecosystem.

MetaTrader 4

MetaTrader 4 remains one of the most widely used Forex trading platforms globally.

It is primarily designed for spot Forex and CFD trading and is known for its lightweight structure, stable performance, and extensive library of custom indicators and Expert Advisors. MT4 supports algorithmic trading, multiple order types, and detailed charting, making it suitable for discretionary traders as well as automated strategy users.

MetaTrader 5

MetaTrader 5 is the more advanced successor to MT4, offering broader market coverage and enhanced analytical capabilities.

In addition to Forex, MT5 supports trading in indices, commodities, equities, and futures through CFDs.

The platform includes more timeframes, an expanded economic calendar, and improved backtesting features, which appeal to traders seeking multi asset exposure and deeper market analysis.

TradingView

TradingView is primarily a charting and analysis platform rather than a standalone execution terminal.

It is widely used by Canadian traders for technical analysis, idea sharing, and market screening across Forex, stocks, cryptocurrencies, and indices.

Many brokers integrate TradingView directly, allowing users to execute trades while benefiting from advanced visualization tools and a large community-driven indicator ecosystem.

cTrader

cTrader is a professional-grade trading platform focused on transparency and execution quality.

It offers level II pricing, advanced order management, detachable charts, and native support for algorithmic trading through cAlgo. cTrader is often preferred by traders who prioritize ECN execution, scalping strategies, and detailed order flow visibility.

ProRealTime

ProRealTime is an advanced charting and analysis platform known for its high-quality data feeds and decision support tools.

It is commonly used for discretionary trading and technical analysis across Forex and CFD markets, offering customizable indicators, automated strategies, and real time market scanning features.

Together, these platforms provide Canadian traders with flexible options for execution, analysis, and strategy development, allowing them to select tools aligned with their regulatory environment and trading objectives.

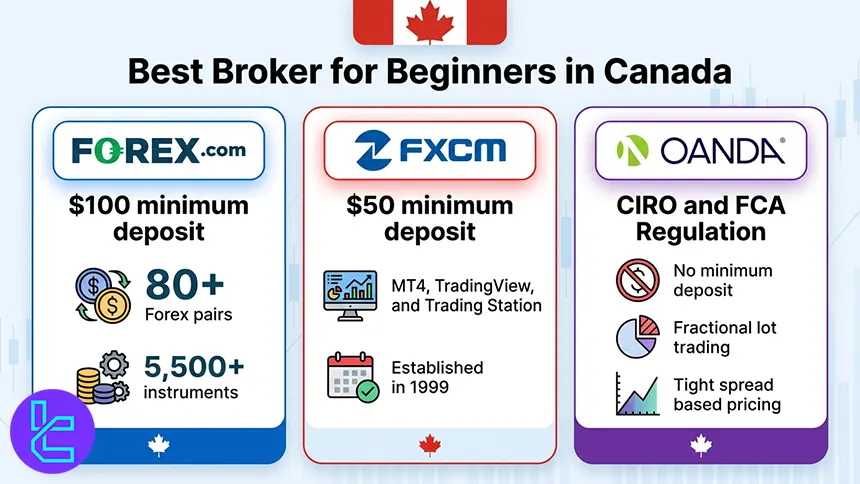

Best Broker for Beginners in Canada

Beginner-focused brokers in Canada are typically defined by CIRO-aligned regulation, low entry thresholds, and platforms that reduce execution complexity.

The brokers below are commonly chosen by new Canadian traders based on measurable features rather than generic claims.

- Forex.com: CIRO regulated broker under StoneX Group Inc. with a $100 minimum deposit, 80+ Forex pairs, 5,500+ instruments, and average execution speed of 0.02 seconds, offering structured access via MT5 and TradingView integration;

- FXCM: Established in 1999 with regulation from FCA, ASIC, CySEC, FSCA, offering a $50 minimum deposit, MT4, TradingView, and Trading Station, plus demo accounts and predefined risk controls for entry-level traders;

- OANDA: Regulated by CIRO and FCA, known for no minimum deposit, fractional lot trading, and tight spread-based pricing, allowing beginners to trade small position sizes while accessing institutional-grade market data.

Forex Trading in Canada Compared to Other Countries

Forex trading in Canada functions under a mature and credibility-driven regulatory structure that places strong emphasis on oversight, transparency, and financial stability. In contrast to less regulated markets and some international jurisdictions, the Canadian framework focuses more on broker licensing standards, capital adequacy, and operational controls rather than broad compensation schemes.

The comparison table below outlines how Canada’s Forex trading environment differs from other regions by examining key factors such as regulatory strength, leverage restrictions, investor safeguards, broker availability, and the tax treatment of trading activity.

Comparison Factor | Canada | |||

Primary Regulator | Canadian Investment Regulatory Organization (CIRO) | Australian Securities and Investments Commission (ASIC) | Capital Markets Authority (CMA) | Financial Sector Conduct Authority (FSCA) |

Regulatory Framework | National Tier 1 framework under CIRO | National framework under ASIC | National regulation under CMA | National regulation under FSCA (non-EU) |

Retail Leverage Cap (Forex Majors) | Up to 1:50 | 1:30 | Up to 1:400 | Not strictly capped; higher leverage common |

Investor Protection Level | High | High | Medium | High |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Commonly applied by brokers |

Client Fund Segregation | Required under CIRO rules | Required under ASIC rules | Required under CMA rules | Required under FSCA rules |

Broker Transparency Requirements | Strict compliance and disclosure standards | Licensing and conduct rules under ASIC | Not strict | Strong conduct and disclosure standards |

Broker Availability | CIRO authorized and international brokers | ASIC licensed brokers | CMA regulated local and international brokers | Mix of FSCA licensed and international brokers |

Access to International Brokers | Yes | Yes | Yes | High (global brokers target ZA market) |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView, ProRealTime | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, cTrader | MT4, MT5, cTrader, proprietary platforms |

Maximum Loss Protection | Cannot lose more than the deposit | Cannot lose more than the deposit | Cannot lose more than the deposit | Often applied but entity dependent |

Tax Treatment of Forex Profits | Gains are treated as capital gains with 50% taxable | Generally treated as assessable income and reported to the Australian Taxation Office | Taxable income by the Kenya Revenue Authority | Taxed as income or capital gains |

Conclusion

Libertex, XTB, PU Prime, FXCM, Vantage Markets, and Forex.com are the best brokers in Canada. Traders must assess the overall trading costs of their preferred assets, trade on a demo account, and start with low capital before finalizing their Forex broker decision.

TradingFinder experts suggest using Forex brokers that have CIRO regulation and are compatible with Canadian laws.