We reviewed and investigated a high number of Forex brokers to find the best options for Japan, a major financial hub supervised by the Japanese Financial Services Agency (JFSA).

Japan-based traders can register with almost any international broker, but companies headquartered in the country are regulated by JFSA.

Best Forex Brokers for Japan

| TMGM | |||

| Go-markets | |||

| VT-Markets | |||

| 4 |  | Libertex | ||

| 5 |  | Avatrade | ||

| 6 |  | Fxpro | ||

| 7 |  | Global-prime | ||

| 8 |  | XM |

Forex Brokers with High Trustpilot Ratings in Japan

If you want to measure the users’ satisfaction with each of the brokers mentioned above, Trustpilot rating can be a good reference.

Broker | Trustpilot Rating (out of 5) | Number of Reviews |

AvaTrade | 4.7⭐ | 11,470 |

Global Prime | 4.7⭐ | 380 |

4.5⭐ | 704 | |

VT Markets | 4.4⭐ | 1,957 |

3.9⭐ | 833 | |

Libertex | 3.8⭐ | 4,077 |

FxPro | 3.8⭐ | 862 |

XM | 3.5⭐ | 2,825 |

Japan Forex Brokers for Low-Spread Trading

Spread is a number that you should keep low when trading in various markets. If you want to choose a broker with relatively low spreads, here are some of the best ones.

Broker | Min. Spread |

Interactive Brokers | 0 Pips |

FOREX.com | 0 Pips |

0 Pips | |

0 Pips | |

Global Prime | 0 Pips |

TMGM | 0 Pips |

FxPro | 0 Pips |

0.1 Pip |

Non-Trading Fees in Japan Forex Brokers

Deposit/withdrawal costs and inactivity fees are also of utmost importance when choosing a broker. Here’s an outline.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

None | None | None | |

AvaTrade | None | None | $10 Monthly |

TMGM | None | None | $10 Monthly |

ActivTrades | None | None | €10 Monthly |

None | None | $15 Once + $5 Monthly | |

Interactive Brokers | None | One Free Withdrawal per Month Only | None |

Libertex | None | Min. 1 EUR | 10 EUR Monthly |

IG | 0.5% | None | $18 Monthly |

Tradable Instruments in Japan Brokers

Some Forex brokers offer a really long list of symbols and assets for trading. Those are the best choices for diversifying investments.

Broker | Number of Tradable Instruments |

TMGM | 12,000+ |

Plus500 | 2,800+ |

IC Markets | 2,200+ |

FxPro | 2,100+ |

1,400+ | |

AvaTrade | 1,250+ |

850+ | |

Oanda | 70+ |

Top 6 Forex Brokers for Japan: Detailed Introduction

We select and nominate the best Forex brokers based on many factors, including these:

- Regulation and supervision by financial authorities

- Trading costs

- Customer support services

- Trading platform options

- Investment and passive earning programs

- Reputation among traders

In the next sections, each chosen broker for Japan-based traders will be introduced in detail.

GO Markets

GO Markets is headquartered in Melbourne and has been operating since 2006, building its reputation around transparent pricing, fast execution, and multi-platform access.

The broker is regulated by ASIC and CySEC, with additional offshore entities that allow flexible trading conditions for eligible international clients.

GO Markets supports Forex trading across major, minor, and selected exotic pairs, with pricing models designed for both cost-sensitive and high-volume strategies.

For traders in Japan who use international brokers, GO Markets offers Standard and GO Plus+ accounts, featuring spreads from zero and commissions of $5 per round lot on the GO Plus+ option. Leverage can reach up to 1:500 under non-EU entities, alongside negative balance protection and segregated client funds, supporting structured risk management.

Trading is available via MT4, MT5, and cTrader, covering Forex, indices, commodities, metals, and crypto CFDs. With copy trading, PAMM accounts, and a 4.6/5 Trustpilot score, GO Markets presents a well-rounded Forex environment for experienced Japan-based traders seeking offshore access.

Note that you may use a GO Markets rebate program to trade with discount on fees.

Below is a summary of the broker’s specifics.

Account Types | Standard, GO Plus+ |

Regulating Authorities | CySEC, FSC, ASIC, FSA |

Minimum Deposit | 100 EUR |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

GO Markets Pros and Cons

Before heading to the GO Markets registration page, take a look at the broker’s advantages and disadvantages.

Pros | Cons |

Regulated By Reputable Authorities | Higher Minimum Deposit Compared to Some Competitors |

Multiple Advanced Trading Platforms | Limited Investment Options |

Comprehensive Educational Resources | - |

Negative Balance Protection | - |

Wide Range of Tradable Instruments | - |

TMGM

TMGM, also known as TradeMax Global Markets, is headquartered in Australia and operates under a multi-entity regulatory structure led by ASIC.

The broker provides access to a broad CFD offering, covering Forex, indices, commodities, stocks, energies, and cryptocurrencies, with a total instrument list exceeding 12,000 symbols.

Its infrastructure is built around fast market execution, deep liquidity, and institutional-grade pricing models.

TMGM offers two core retail accounts - EDGE and CLASSIC. The EDGE account features spreads from 0.0 pips with a $3.5 commission per lot, while the CLASSIC account combines commission-free trading with spreads from 1.0 pip.

Maximum leverage can reach 1:1000 under offshore entities, alongside segregated funds and negative balance protection depending on jurisdiction. Moreover, TMGM deposit/withdrawal methods include VISA/MasterCard, bank transfers, WISE, Skrill, etc.

Trading is supported via MT4, MT5, IRESS, and a proprietary mobile app, complemented by copy and social trading tools and a rewards-based loyalty program. Check out the TMGM dashboard article for a walkthrough of the broker’s interface.

Japanese traders should note that local residency restrictions apply, making TMGM primarily relevant for those evaluating offshore Forex options.

Here’s an outline of the broker’s parameters.

Account Types | EDGE/ECN, CLASSIC |

Regulating Authorities | ASIC – Australia, VFSC – Vanuatu, CMA -Kenya, FSC-Mauritius, FSA -Seychelles |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, Crypto (USDT, USDC) |

Withdrawal Methods | Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Crypto (USDT, USDC) |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, IRESS, TMGM Mobile App |

TMGM Pros and Cons

Always research about the benefits and drawbacks of a broker before making any commitments and going through the TMGM verification or registration.

Pros | Cons |

Extensive Range of Tradable Symbols (12,000+) | Inactivity Fee |

Multiple Tier-1 Regulatory Licenses | Low Diversity in Account Types |

Copy Trading and Trading Signals Available | - |

Fast Execution Speeds (Average Under 30ms) | - |

Libertex

Libertex is part of the Libertex Group and has been active in global financial markets since 1997. The broker is regulated by CySEC under MiFID II and operates through its Cyprus-based entity, offering a high level of transparency, segregated client funds, and investor compensation coverage up to EUR 20,000.

Libertex focuses on streamlined trading conditions rather than complex account structures, supporting Forex and CFD trading across five core markets.

For traders in Japan who analyze offshore brokers, Libertex provides access to Forex, indices, commodities, stocks, and crypto CFDs via its proprietary platform alongside MT4 and MT5. you can visit the Libertex dashboard to learn more about the broker’s interface.

Retail leverage is capped at 1:30, while professional accounts can access leverage up to 1:600, combined with market and instant execution models and competitive spreads starting from 0.1 pip.

With a minimum deposit of 100 EUR, commission-based pricing, and copy trading functionality, Libertex is positioned for experienced traders who value regulated EU infrastructure and multi-asset exposure over promotional incentives.

Specifications and Details

Account Types | Demo, Real, Invest, MT4, MT5 |

Regulating Authorities | CySEC |

Minimum Deposit | 100 EUR |

Deposit Methods | E-payments, Credit/Debit Card, Bank Wire Transfer |

Withdrawal Methods | E-payments, Credit/Debit Card |

Maximum Leverage | Up To 1:30 For Retail Clients Up To 1:600 For Professional Accounts |

Trading Platforms & Apps | MT4, MT5, Proprietary Platform |

Libertex Pros and Cons

You should be aware of the upsides and downsides of the broker before going through the Libertex registration.

Pros | Cons |

Regulated By a Tier-One Authority | Not Available In Some Countries (e.g., US) |

Tight Spreads From 0.1 Pip | Limited Educational Resources |

Commission-Free Crypto CFD Trading | - |

Popular Trading Platforms Support | - |

VT Markets

VT Markets is headquartered in Australia and operates as a multi-asset CFD broker regulated by ASIC, alongside additional oversight from FSCA and FSC Mauritius.

The broker supports a global trading infrastructure processing tens of millions of trades monthly, with a focus on fast market execution, segregated client funds, and a broad multi-market offering.

For traders in Japan who assess offshore Forex brokers, VT Markets provides access to over 1,000 instruments across Forex, indices, shares, metals, energies, ETFs, bonds, and soft commodities. Account options include Standard STP and RAW ECN, with spreads from zero on ECN accounts and leverage up to 1:500 under non-ASIC entities.

A low minimum deposit starting from $50 supports flexible entry, while negative balance protection applies under specific jurisdictions.

Trading is available via MT4, MT5, Webtrader+, and a proprietary mobile app, complemented by copy trading and PAMM services. VT Markets is suited to active traders prioritizing execution speed, platform familiarity, and diversified CFD access over long-term investor protections.

The table below demonstrates the brokerage’s important specifics.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

Here are some of the important benefits and drawbacks you should consider before visiting the VT Markets registration page.

Pros | Cons |

Low Commissions and Tight Spreads | Customer Service Can Be Hit Or Miss |

Wide Range of Tradable Assets Beyond Forex | Limitations in Payment Methods |

Strong Regulatory Oversight | - |

Access To Global Markets | - |

AvaTrade

AvaTrade is a globally regulated Forex and CFD broker that has built a strong presence in the Japanese market through its locally licensed entity under the JFSA.

This regulation places AvaTrade under strict domestic standards, including mandatory fund segregation, defined leverage limits, and clear margin protection rules, making it a compliant choice for traders based in Japan.

The broker offers access to Forex, indices, commodities, stocks CFDs, and cryptocurrencies through MetaTrader 4, MetaTrader 5, and proprietary web and mobile platforms. Also, there are various AvaTrade deposit and withdrawal options.

For Japanese retail clients, leverage is capped at 1:25 in line with local regulations, while risk controls such as margin call at 25% and stop-out at 10% are clearly defined. Account opening starts with a minimum deposit of $100, supported by multiple payment methods including cards, bank transfers, and e-wallets.

Considering additional features such as Islamic accounts, copy trading via AvaSocial and DupliTrade, and multi-language customer support, AvaTrade suits Japanese traders looking for regulated access combined with flexible trading tools.

Features and Parameters

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | JFSA, ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:25 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

Before AvaTrade registration, it is essential to be familiar with the broker’s advantages and disadvantages.

Pros | Cons |

Well-regulated by multiple authorities | Limited account types compared to some competitors |

Wide Selection of tradable instruments | - |

Multiple trading platforms, including MT4/MT5 | - |

Decent educational resources | - |

FxPro

FxPro is a technology-driven Forex and CFD broker that has been active since 2006, with a strong reputation for execution quality and platform diversity. For traders in Japan, FxPro operates through its global entities, applying clear risk controls, segregated client funds, and negative balance protection.

Order execution speeds averaging below 12 milliseconds position FxPro as a performance-focused broker rather than a marketing-driven one.

Traders gain access to more than 2,100 instruments across Forex, indices, metals, energies, shares CFDs, and cryptocurrencies. One of FxPro’s defining strengths is platform choice, offering MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and a proprietary mobile app. Also, you can learn about the FxPro dashboard through our detailed guide.

Account structures range from spread-based to raw pricing models, allowing flexibility for different trading styles, including scalping and algorithmic trading.

For a quick look at the broker’s services and features, here’s a specifics summary.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, FSCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker to Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader, Web Trader, Mobile Appz |

FxPro Pros and Cons

You shouldn’t go through with the FxPro registration if you are not aware of the broker’s pros and cons.

Pros | Cons |

Multiple regulated entities | restrictions in some countries |

Wide range of trading platforms | High minimum deposit |

Competitive spreads and fast execution | Doesn’t offer various bonuses |

Client funds insurance | Doesn’t offer 24/7 customer support |

Mor than 100 million € company capital | - |

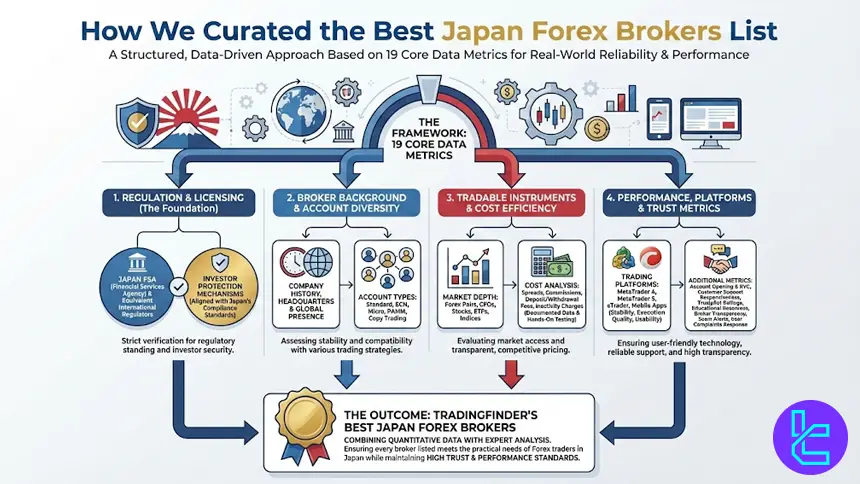

How We Curated the Best Japan Forex Brokers List

Selecting the Best Forex Brokers in Japan requires a structured, data-driven approach that reflects both global standards and the strict local regulatory environment.

Our analysis framework is based on 19 core data metrics that collectively determine a broker’s real-world reliability and performance. Regulation and licensing sit at the foundation of this process.

We verify that brokers operate under reputable authorities such as the Japan Financial Services Agency or equivalent international regulators, and that they implement investor protection mechanisms aligned with Japan’s compliance standards.

Beyond regulation, our experts assess the broker’s background, including company history, headquarters, and global office presence. Account type diversity is carefully reviewed, covering Standard, ECN, Micro, PAMM, and Copy Trading accounts to ensure compatibility with different trading strategies.

We also evaluate the range of tradable instruments, including Forex pairs, CFDs, stocks, ETFs, and indices, as market depth directly impacts trading flexibility.

Cost efficiency is another critical factor. TradingFinder examines spreads, commissions, deposit and withdrawal fees, and inactivity charges through documented data and hands-on testing. Trading platforms such as MetaTrader 4, MetaTrader 5, cTrader, and mobile apps are reviewed for stability, execution quality, and usability.

Additional metrics include account opening and KYC verification, customer support responsiveness, Trustpilot ratings, educational resources, broker transparency, scam alerts, and response to user complaints.

By combining quantitative data with expert analysis, TradingFinder ensures that every broker listed meets the practical needs of Forex traders in Japan while maintaining high trust and performance standards.

How Can I Verify if a Broker is JFSA-Regulated?

Verifying whether a Forex broker is regulated by the JFSA is a critical step before opening a trading account. In Japan, only brokers registered as Financial Instruments Business Operators (FIBOs) are legally allowed to offer Forex margin trading to retail clients.

#1 Identify the Broker’s Legal Entity Name

Before checking any official database, determine the broker’s legal company name, not just its commercial brand. In Japan, Forex regulation applies to specific legal entities registered as FIBOs. Many global brokers operate multiple subsidiaries, and only the Japan-registered entity falls under JFSA supervision.

#2 Access the JFSA Financial Instruments Business Register

Visit the JFSA website or the relevant Local Finance Bureau database. Use the official register of Financial Instruments Business Operators to search for the broker’s legal name. A regulated broker will appear with a registration number, business category (usually Type I Financial Instruments Business) and the supervising finance bureau.

#3 Verify Registration Details and Business Scope

Confirm that the broker is authorized to provide Forex margin trading services. The registration record should clearly state permitted activities, office location, and compliance status. If Forex trading is not listed within the approved business scope, the broker is not legally allowed to serve retail traders in Japan.

#4 Cross-Check Regulatory Disclosures on the Broker’s Website

JFSA-regulated brokers must display their registration number, legal entity name, and mandatory risk disclosures.

Compare this information with the official JFSA records. Any inconsistency or vague regulatory wording is a strong red flag.

#5 Confirm Compliance with Japan-Specific Trading Rules

Finally, ensure the broker follows Japan’s strict Forex regulations, including leverage caps, client fund segregation, and transparency requirements. These rules are enforced only on JFSA-authorized brokers and are a reliable indicator of regulatory legitimacy.

Is Forex Trading Legal in Japan?

Forex trading is legal in Japan, but it is one of the most strictly regulated Forex markets in the world. The legal framework governing Forex trading is enforced by the Japan Financial Services Agency under the Financial Instruments and Exchange Act (FIEA).

In Japan, retail Forex trading is permitted only through brokers registered as Financial Instruments Business Operators.

These brokers must obtain authorization from the JFSA and comply with ongoing supervisory requirements, including capital adequacy, reporting obligations, and consumer protection standards.

Any broker offering Forex margin trading to Japanese residents without this registration is considered illegal, regardless of its licensing status in other countries.

One of the defining features of Japan’s Forex regulation is the strict leverage cap. Retail traders are limited to a maximum leverage of 1:25 on major currency pairs, a rule designed to reduce excessive risk and protect individual investors.

Additionally, JFSA-regulated brokers are required to implement client fund segregation, ensuring that customer deposits are held separately from the broker’s operational funds.

Forex trading is legal for both individuals and businesses, provided that trading activity complies with Japanese laws related to disclosure, taxation, and anti-money laundering (AML) requirements. Traders are also expected to report profits appropriately under Japan’s tax system.

In practice, Japan’s legal environment prioritizes market integrity, transparency, and investor protection. While this limits access to high leverage and offshore platforms, it creates a highly regulated ecosystem where Forex trading operates within clear legal boundaries and strong regulatory oversight.

Is There a Leverage Cap for Forex Trading in Japan?

Yes, Forex trading in Japan is subject to a strict leverage cap, making it one of the most tightly regulated leverage environments globally. The leverage rules are enforced by the JFSA under the FIEA and apply to all retail Forex traders residing in Japan.

For retail clients, the maximum allowable leverage is 1:25 on major, minor, and exotic currency pairs

This leverage limit is mandatory for all brokers registered as Financial Instruments Business Operators (FIBOs) and applies uniformly across the Japanese Forex market. Unlike some jurisdictions where leverage varies by asset class or volatility, Japan enforces a fixed leverage ceiling to limit excessive risk exposure.

The rationale behind this cap is investor protection. High leverage can amplify losses rapidly, especially in volatile currency markets. By limiting leverage to 1:25, the JFSA aims to reduce the likelihood of retail traders incurring losses beyond their risk tolerance and to maintain overall market stability.

Key points to understand about leverage regulation in Japan include:

- JFSA-regulated brokers cannot offer higher leverage, even upon request;

- Promotional claims of leverage above 1:25 indicate non-compliance or offshore solicitation;

- Leverage limits are enforced alongside margin maintenance rules and close-out thresholds;

- Client fund segregation and strict reporting obligations complement leverage restrictions.

Some Japanese traders choose to use offshore Forex brokers to access higher leverage. However, doing so places them outside Japan’s regulatory protection framework, exposing them to legal, financial, and dispute-resolution risks.

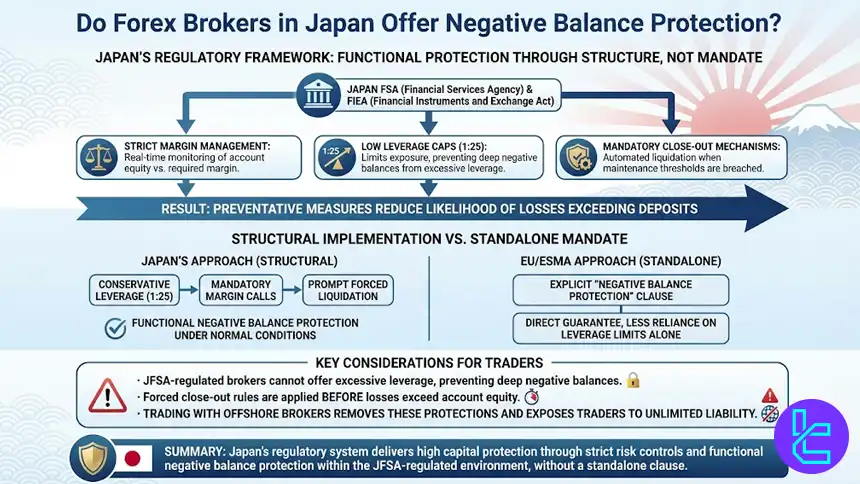

Do Forex Brokers in Japan Offer Negative Balance Protection?

Negative balance protection is not effectively enforced in Japan’s Forex market; it is implemented through regulatory margin rules and risk controls, rather than a standalone negative balance protection mandate as seen in some other jurisdictions.

Under the supervision of the Japan Financial Services Agency (JFSA) and the Financial Instruments and Exchange Act (FIEA), JFSA-regulated brokers must apply strict margin management, low leverage caps (1:25), and mandatory close-out mechanisms.

These measures are designed to prevent retail traders from falling into a negative account balance during periods of high volatility.

In practice, Japanese Forex brokers are required to monitor margin levels in real time and automatically liquidate positions when maintenance margin thresholds are breached. This early and enforced liquidation significantly reduces the likelihood of losses exceeding deposited funds.

As a result, most retail traders trading with JFSA-licensed brokers do not experience negative balances under normal market conditions.

However, it is important to understand the regulatory nuance. Japan’s framework does not explicitly label this protection as “negative balance protection” in the same way as ESMA rules in the EU. Instead, protection is achieved structurally through conservative leverage limits, mandatory margin calls, and prompt forced liquidation.

Key considerations for traders:

- JFSA-regulated brokers are not permitted to allow excessive leverage that could trigger deep negative balances;

- Forced close-out rules are applied before losses exceed account equity;

- Trading with offshore brokers removes these protections and may expose traders to unlimited liability.

In summary, while Japan does not rely on a standalone negative balance protection clause, its regulatory system delivers functional negative balance protection through strict risk controls, ensuring a high level of capital protection for retail Forex traders operating within the JFSA-regulated environment.

Do Brokers in Japan Have Investor Compensation Schemes?

Forex brokers in Japan are covered by an investor compensation framework, but it operates differently from the deposit guarantee or compensation schemes seen in some other jurisdictions.

The system is overseen under the regulatory authority of the JFSA and implemented through a specialized protection body.

In Japan, licensed Forex brokers that are registered as FIBOs are generally required to participate in the Japan Investor Protection Fund (JIPF). This fund is designed to protect client assets in specific failure scenarios.

Unlike some European schemes, Japan’s compensation system is not marketed as a fixed “deposit guarantee”. Instead, it works as a backstop mechanism, reinforcing Japan’s strict rules on client fund segregation, capital adequacy, and ongoing supervision. In practice, segregation requirements significantly reduce the likelihood that compensation claims are needed at all.

Traders should note that using offshore Forex brokers removes access to Japan’s investor protection framework entirely. Even if an offshore broker claims compensation coverage elsewhere, those protections do not apply under Japanese law.

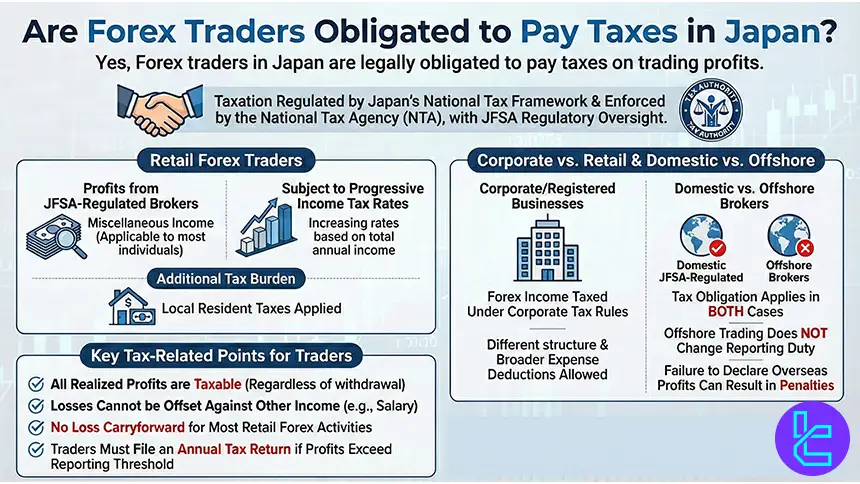

Are Forex Traders Obligated to Pay Taxes in Japan?

Forex traders in Japan are legally obligated to pay taxes on their trading profits. Taxation of Forex income is regulated under Japan’s national tax framework and enforced by the National Tax Agency (NTA), with regulatory oversight of trading activity provided by the JFSA.

For retail Forex traders, profits earned from margin trading with JFSA-regulated brokers are generally classified as “miscellaneous income”. This category applies to most individual traders and is subject to progressive income tax rates, which increase based on total annual income.

In addition to national income tax, local resident taxes are also applied, increasing the overall tax burden.

Key tax-related points Forex traders in Japan should be aware of include:

- All realized profits are taxable, regardless of withdrawal;

- Losses from Forex trading cannot be offset against other income types such as salary income;

- Loss carryforward is not allowed for most retail Forex activities;

- Traders must file an annual tax return if trading profits exceed the reporting threshold.

For corporate traders or registered trading businesses, Forex income may be taxed under corporate income tax rules instead, which follow a different structure and allow broader expense deductions.

It is also important to distinguish between domestic JFSA-regulated brokers and offshore brokers. While the tax obligation applies in both cases, offshore trading does not change the trader’s duty to report income, and failure to declare overseas trading profits can result in penalties.

In summary, Forex trading profits are fully taxable in Japan. Accurate record-keeping, proper classification of income, and compliance with NTA filing requirements are essential for operating legally and avoiding tax-related risks in the Japanese Forex market.

Forex Trading in Japan Compared to Other Countries

Japan’s Forex market stands out for its highly structured regulation, strong investor protection, and strict leverage controls, making it one of the safest environments for retail traders. Compared to offshore-friendly jurisdictions, Japan prioritizes stability and transparency over flexibility.

When placed alongside markets such as the UAE, India, and New Zealand, Japan offers lower leverage but clearer rules, mandatory protections, and tighter supervision by domestic authorities.

The table below highlights how Japan compares to other major Forex regions across regulation, leverage, broker access, and trader protections, helping traders understand where Japan fits within the global Forex landscape.

Comparison Factor | Japan | |||

Primary Regulator | Japan Financial Services Agency (JFSA) | SEBI & RBI | Financial Markets Authority (FMA) | DFSA, SCA (plus global regulators) |

Regulatory Framework | National regulation under FIEA | Highly restricted; exchange-traded FX only | Open national framework under FMCA | Multi-authority, zone-based regulation |

Retail Leverage Cap (Forex) | 1:25 | ~1:50 (derivatives only) | Up to 1:500 | 1:50 (DFSA); higher offshore |

Investor Protection Level | Very high | High (limited scope) | High | Moderate to high (entity-dependent) |

Negative Balance Protection | Structurally enforced | Not standardized | Commonly applied | Entity-dependent |

Client Fund Segregation | Mandatory | Mandatory | Mandatory | Mandatory |

Broker Availability | JFSA-licensed domestic brokers | Limited domestic access | Broad global access | Broad global & regional access |

Access to International Brokers | Limited (local entities required) | Restricted | Very high | High |

Typical Trading Platforms | MT4, MT5, proprietary | Exchange platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView |

Maximum Loss Protection | Cannot exceed deposit | Product-dependent | Cannot exceed deposit | Broker/entity-dependent |

Tax Treatment of Profits | Taxable as miscellaneous income | Taxable | Taxable as income | No personal income tax |

Conclusion

Japan traders have access to Forex trading under the supervision of the JFSA, one of the top-tier financial authorities in the globe, with a 1:25 leverage cap and JIPF investor compensation scheme.

TMGM, GO Markets, VT Markets, and AvaTrade are some of the best choices for Forex trading in the country with good and excellent Trustpilot ratings in addition to spreads from 0 and fair non-trading fees.

““At TradingFinder, our broker evaluation process is built around a proprietary Forex methodology designed to deliver transparent, unbiased, and actionable insights for traders operating in the Japanese Forex market.””