Forex trading in Lebanon remains active despite economic decline and a 53%+ contraction since 2019. With no strict local Forex regulation from the Capital Market Authority (CMA), Lebanese traders rely on internationally regulated brokers for security, fair pricing, and reliable execution.

The best Forex brokers in Lebanon offer low spreads, flexible deposits, multilingual support, advanced platforms like MetaTrader, and fast execution, supporting popular strategies such as scalping and day trading while providing stable access to global markets.

| PrimeXBT | |||

| TMGM | |||

| D Prime | |||

| 4 |  | easyMarkets | ||

| 5 |  | Global Prime | ||

| 6 |  | Tickmill | ||

| 7 |  | FP Markets | ||

| 8 |  | IUX | ||

| 9 |  | XM Group | ||

| 10 |  | FXTM |

Lebanon Brokers Ranked by Trustpilot Ratings

Trustpilot ratings offer a clear view of broker reliability for Lebanese traders by combining verified user feedback with large review volumes.

The highest performers exceed 4.5 out of 5 with nearly 10,000 total reviews, while mid-tier brokers remain above 4.0. Lower-rated firms still attract thousands of clients, highlighting the importance of comparing both rating scores and review counts when selecting a Forex broker in Lebanon.

Broker | Trustpilot Score | Number of Reviews |

4.8/5 ⭐️ | 9,726 | |

Global Prime | 4.7/5 ⭐️ | 380 |

IUX | 4.3/5 ⭐️ | 875 |

4.2/5 ⭐️ | 1,768 | |

TMGM | 4.0/5 ⭐️ | 832 |

PrimeXBT | 3.8/5 ⭐️ | 362 |

Tickmill | 3.6/5 ⭐️ | 1,058 |

3.5/5 ⭐️ | 2,831 | |

D Prime | 3.1/5 ⭐️ | 459 |

FXTM | 2.6/5 ⭐️ | 1,074 |

Forex Brokers with Lowest Spreads in Lebanon

For Lebanese traders focused on cost efficiency, minimum spreads remain a decisive factor. Several leading Forex brokers offer ultra-tight pricing starting from 0.0 pips on major currency pairs, while others maintain competitive levels below 1 pip.

Comparing spread floors alongside execution quality and regulation allows traders in Lebanon to optimize both short-term strategies and long-term profitability.

Broker | Minimum Spread |

Tickmill | 0.0 pips |

0.0 pips | |

Admirals | 0.0 pips |

D Prime | 0.0 pips |

TMGM | 0.0 pips |

Vantage Markets | 0.0 pips |

0.0 pips | |

PrimeXBT | 0.1 pips |

XTB | 0.5 pips |

easyMarkets | 0.7 pips |

Non-Trading Fees in Lebanon Forex Brokers

Non-trading costs significantly impact long term profitability for Lebanese traders, especially for inactive or long-term investors.

Several leading Forex brokers operating in Lebanon charge no deposit fees and no withdrawal fees, while inactivity fees range from $0 to €10 per month. Comparing these cost structures helps traders preserve capital and improve overall trading efficiency.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Global Prime | No | No | No |

Vantage Markets | No | No | No |

Tickmill | No | No | $10/month |

No | No | $10/month | |

No | From 0.05% | No | |

easyMarkets | No | 10% for withdrawals above $500 | No |

No | $25 for wire transfers | No | |

Admirals | No | 1 free/month (then up to 1%) | €10/month |

FXTM | No | Up to $30 | €10/month |

XTB | No (except 2% for Skrill and 1% for Neteller) | No (except 2% for Skrill and 1% for Neteller) | €10/month |

Forex Brokers’ Trading Instruments for Lebanese Traders

Access to a wide range of markets is essential for Lebanese traders seeking diversification. Leading Forex brokers serving Lebanon now provide from 200 to over 12,000 trading instruments, covering the Forex market, stocks, indices, commodities, and cryptocurrencies.

This broad product depth allows traders to build flexible multi-asset strategies under one trading account.

Broker | Number of Trading Instruments |

TMGM | 12,000+ |

D Prime | 10,000+ |

FP Markets | 10,000+ |

FXTM | 1,000+ |

600+ | |

Axi | 280+ |

easyMarkets | 275+ |

Fusion Markets | 250+ |

250+ | |

Exness | 200+ |

Top 8 Forex Brokers in Lebanon

Lebanese traders now access a powerful global trading ecosystem through 8 leading Forex brokers offering leverage up to 1:3000, spreads from 0.0 pips, more than 12,000 trading instruments, and strong regulatory coverage from entities such as ASIC, FCA, CySEC, and FSCA.

These brokers deliver advanced platforms including MT4, MT5, TradingView, and proprietary systems, with minimum deposits starting from just $0 to $200, making professional-grade trading widely accessible in Lebanon.

D Prime

D Prime, legally operating as D Prime Limited, was founded on December 1, 2014, and is headquartered in Hong Kong, serving over 400,000 active clients with support from 37,000 introducing brokers and 1,000 employees worldwide.

The broker offers Lebanese traders broad access to global markets with strong multi-asset coverage and institutional-grade infrastructure.

The company operates through two regulatory entities: D Prime Vanuatu Limited, regulated by VFSC, and D Prime Mauritius Limited, regulated by FSC, both classified as Tier-3 regulators. While this structure allows high flexibility, including leverage up to 1:1000, investor protection depends on the specific entity and account type selected.

Lebanese traders get access to Cent, STP, and ECN accounts by completing the Doo Prime registration process. The Cent account requires no initial funding, while STP and ECN start from $100, supporting lot sizes up to 100. Trading is available on MT4, MT5, and the proprietary Doo Prime InTrade, with spreads starting from 0.0 pips on ECN accounts.

D Prime supports over 10,000 instruments across Forex, Crypto, Metals, Commodities, Indices, Futures, and Securities, with investment services including PAMM, MAM, FOLLOWME, and Copy Trading available via D Prime dashboard.

Traders benefit from no internal deposit, withdrawal, or inactivity fees, plus optional swap-free Islamic accounts for Sharia-compliant trading.

Account Types | Cent, STP, ECN |

Regulating Authorities | VFSC, FSC |

Minimum Deposit | $0 |

Deposit Methods | Local bank Transfers, E-wallets, International Wire Transfers, Credit/Debit Card |

Withdrawal Methods | Local bank Transfers, E-wallets, International Wire Transfers, Credit/Debit Card |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Doo Prime InTrade |

D Prime Pros and Cons

The following advantages and limitations help Lebanese traders evaluate D Prime’s suitability based on cost efficiency, leverage flexibility, market access, and regulatory coverage.

Pros | Cons |

Very high leverage up to 1:1000 for flexible strategies | No Tier-1 regulatory license |

Over 10,000 tradable instruments for portfolio diversification | Investor protection depends on offshore entity |

Educational content accessible only after registration | |

Islamic swap-free accounts available for Lebanese traders | Restricted availability in some jurisdictions globally |

TMGM

TMGM, short for TradeMax Global Markets, is an Australian Forex and CFD broker founded in 2013 that delivers access to more than 12,000 tradable instruments. Lebanese traders gain exposure to Forex, stocks, indices, commodities, energies, and cryptocurrencies through advanced infrastructure and globally distributed liquidity providers.

The broker’s primary regulatory license is issued by ASIC (Australia), a Tier-1 authority, complemented by offshore regulation from VFSC, FSC, and CMA.

TMGM provides full client fund segregation, negative balance protection, and up to AUD 10 million in Professional Indemnity Insurance coverage across its regulated entities.

Lebanese clients can choose between EDGE/ECN and CLASSIC accounts with a $100 minimum deposit, spreads from 0.0 pips, and leverage up to 1:1000 under offshore entities.

Trading is supported via MT4, MT5, IRESS, and the TMGM mobile app, enabling institutional-grade execution and automation.

TMGM dashboard enhances portfolio diversification with copy trading and social trading, a Rewards Program, and Islamic swap-free accounts.

Additional features include demo trading, fast execution averaging under 30 milliseconds, 24/7 multilingual support, and extensive TMGM deposit and withdrawal methods, including cards, e-wallets, bank wires, and crypto (USDT, USDC).

Account Types | EDGE/ECN, CLASSIC |

Regulating Authorities | ASIC – Australia, VFSC – Vanuatu, CMA -Kenya, FSC-Mauritius, FSA-Seychelles |

Minimum Deposit | $100 |

Deposit Methods | VISA, MasterCard, Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Union Pay, Fasapay, Crypto (USDT, USDC) |

Withdrawal Methods | Bank Transfer, RMB Instant, Revolut, WISE, Neteller, Skrill, Crypto (USDT, USDC) |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, IRESS, TMGM Mobile App |

TMGM Pros and Cons

The following advantages and limitations provide a balanced view of TMGM’s overall suitability, focusing on regulation, trading costs, execution quality, and operational efficiency.

Pros | Cons |

ASIC Tier-1 regulation with strong investor safeguards | An inactivity fee charged after 12 months of dormancy |

12,000+ instruments for wide portfolio diversification | Limited built-in educational depth for beginners |

Ultra-low spreads from 0.0 pips and fast execution under 30ms | Offshore leverage structure depends on the regulatory entity |

TMGM rebate program with forex cashbacks up to $5 per lot | No PAMM investment accounts available |

FXTM

FXTM (ForexTime) is a global Forex and CFD broker established in 2011, serving over 1 million traders across 150+ countries.

The broker offers access to 1,000+ tradable assets with support for Forex, stocks, indices, commodities, metals, and cryptocurrencies, alongside copy trading and proprietary mobile solutions.

The company operates primarily under Exinity Limited, regulated by the Financial Services Commission (FSC) of Mauritius, classified as a Tier-3 regulator, leading to a less stringent FXTM verification process.

While FXTM previously held licenses from FCA, CySEC, and FSCA, those authorizations have expired, leaving its current regulatory framework offshore-based.

Traders can open Advantage, Advantage Plus, and Advantage Stocks accounts with a $200 minimum deposit, benefiting from leverage up to 1:3000, by completing the FXTM registration process.

Trading is available via MetaTrader 4, MT5, and the proprietary FXTM Trader App, supporting flexible strategies and advanced execution tools.

FXTM enhances trader engagement through FXTM Invest copy trading, extensive educational resources under its Knowledge Hub, and a portfolio of 45+ international awards.

Additional features include swap-free Islamic accounts, loyalty programs, FXTM rebate program with cashbacks up to $5 per lot, and multilingual customer support available 24/5 for global clients.

Account Types | Advantage, Stocks Advantage, Advantage Plus |

Regulating Authorities | FSC |

Minimum Deposit | $200 |

Deposit Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Withdrawal Methods | FasaPay, TC Pay, M-Pesa, VISA, MasterCard, Maestro, Google Pay, GlobePay, Skrill, PayRedeem, Perfect Money, Neteller, Bank Wire Transfer |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MT4, MT5, FXTM Trader App |

FXTM Pros and Cons

The following strengths and limitations highlight FXTM’s suitability based on leverage flexibility, market access, regulatory standing, education quality, and overall trading conditions.

Pros | Cons |

Very high leverage up to 1:3000 | Only offshore Tier-3 regulation |

1,000+ assets across six global markets | Higher $200 minimum deposit |

Excellent educational ecosystem and demo trading | Limited cryptocurrency variety |

Strong copy trading via FXTM Invest | No PAMM investment accounts |

IUX

IUX is an international Forex and CFD broker founded in 2016, designed for active traders seeking low-cost execution and flexible access to global markets. With a minimum deposit of only $10, IUX serves both entry-level and professional traders while supporting STP execution for transparent and fast order processing.

The broker operates under multiple regulatory entities, including ASIC (Australia, Tier-1), FSCA (South Africa, Tier-2), and FSC (Mauritius, Tier-3), offering full client fund segregation and negative balance protection across all branches. Transactions are managed by UAB Woxa Corporation Limited in Lithuania.

IUX registration provides access to three account types: Standard, Raw, and Pro, with leverage up to 1:3000, floating spreads from 0.0 pips, and commission from $0.

Lebanese traders can trade currencies, crypto CFDs, indices, stocks, and commodities via MT5, Web Trader, and the IUX Trade App.

The broker delivers robust infrastructure with a 30% margin call / 0% stop-out, swap-free Islamic accounts, no inactivity fees, and 24/7 multilingual support.

IUX has received multiple international awards, including Best Trading Broker 2024 and Best Low Spread Broker 2024, reflecting its strong execution and pricing model.

Account Types | Standard, Raw, Pro |

Regulating Authorities | FSC, FSCA, ASIC |

Minimum Deposit | $10 |

Deposit Methods | Mobile Money, Bank Transfer, Cards (Visa, Master), QR, E-wallet, Crypto, Virtual Bank |

Withdrawal Methods | Mobile Money, Bank Transfer, Cards (Visa, Master), QR, E-wallet, Crypto, Virtual Bank |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | MetaTrader5, Web Trader, Application |

IUX Pros and Cons

The following strengths and limitations summarize IUX’s overall suitability for traders, particularly those focused on low trading costs, execution speed, and flexible leverage structures.

Pros | Cons |

Very low entry barrier with $10 minimum deposit | Limited availability in many regions, including EU and UK |

Tight spreads from 0.0 pips with strong execution | No copy trading or PAMM investment services |

Strong regulatory mix with ASIC, FSCA, FSC | High leverage up to 1:3000 increases risk exposure |

No inactivity fees and extensive funding options | Educational depth may not suit absolute beginners |

Global Prime

Global Prime is an Australian brokerage founded in 2010 by Jeremy Kinstlinger, offering over 150 tradable instruments with raw spreads from 0.0 pips.

With more than 13 years of market experience, the broker focuses on professional-grade execution, competitive pricing, and transparent trading conditions for global clients.

The broker operates primarily under ASIC (Australia, Tier-1) regulation, leading to a stringent Global Prime verification process. It also maintains an offshore entity regulated by VFSC.

Client funds are held in segregated accounts with HSBC and National Australia Bank, and Global Prime provides negative balance protection and institutional-level execution with average trade speeds of 10 milliseconds.

Global Prime registration provides access to Standard and Raw accounts with leverage up to 1:500, no minimum deposit requirement, and trading costs among the lowest in the industry.

The platform supports MT4, with upcoming TradingView and cTrader integration, plus social trading via ZuluTrade and signals from Autochartist.

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros and Cons

The following advantages and limitations summarize Global Prime’s overall suitability for active traders seeking high-speed execution, deep liquidity, and institutional trading conditions.

Pros | Cons |

ASIC Tier-1 regulation with segregated client funds | MT4 is currently the only trading platform |

Raw spreads from 0.0 pips with ultra-fast execution | No Islamic or swap-free account option |

No minimum deposit and fee-free funding | Leverage capped at 1:500 |

Global Prime rebate program offering up to 44.44% discount on spreads | Limited bonus and promotion structure |

PrimeXBT

PrimeXBT is a global multi-asset broker founded in 2018, serving more than 1 million clients worldwide with access to Forex, 100+ CFDs, spot crypto, and advanced Crypto Futures markets.

Lebanese traders can open accounts with just a $15 minimum deposit and benefit from TradingView-powered charting tools.

PrimeXBT operates through a diversified regulatory structure, holding licenses from FSA Seychelles, FSCA South Africa, FSC Mauritius, Lithuania FCIS, and Banco Central de Reserva. This framework enables international service coverage while providing baseline regulatory compliance and a $20,000 compensation fund per client.

The broker offers a unified Standard account with leverage up to 1:1000, spreads from 0.1 pips, and zero commissions on most instruments. PrimeXBT registration provides access markets via the proprietary WebTrader, Mobile App, and MT5 through a regulated partner entity.

The platform supports copy trading, seasonal promotions, and advanced crypto derivatives. Crypto Futures feature maker fees of 0.01% and taker fees from 0.02%, making PrimeXBT attractive for high-frequency and crypto-focused traders seeking low entry barriers and high market flexibility.

Account Types | Standard, Demo |

Regulating Authorities | FSA, FCIS, FSCA, BCR, FSC |

Minimum Deposit | $15 |

Deposit Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer, Crypto |

Withdrawal Methods | Visa/Mastercard, E-Wallet, Bank cards, Crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Proprietary Mobile App, WebTrader, MT5 |

PrimeXBT Pros and Cons

The following strengths and limitations highlight PrimeXBT’s suitability for traders prioritizing crypto exposure, leverage flexibility, and low entry requirements.

Pros | Cons |

Very low entry with $15 minimum deposit | No Tier-1 regulatory license |

Powerful crypto futures platform with TradingView charts | Limited traditional asset depth |

High leverage up to 1:1000 | Fee structure lacks full transparency |

Profitable copy trading ecosystem | Withdrawal fees apply on crypto transactions |

easyMarkets

easyMarkets is a Cyprus-based multi-asset broker founded in 2001 and led by CEO Nikos Antoniades, serving global traders with commission-free trading from just $25 minimum deposit.

The broker delivers access to 200+ instruments, including Forex, indices, commodities, metals, stocks, crypto, and options with both fixed and variable spreads.

The broker operates under multiple regulatory authorities, including CySEC (Tier-1), ASIC (Tier-1), FSCA (Tier-2), FSC BVI (Tier-3), and FSA Seychelles, providing strong regulatory coverage and full client fund segregation with negative balance protection across all entities. Maximum leverage reaches 1:2000 for international clients.

easyMarkets registration provides access to tools such as dealCancellation, Freeze Rate, and Guaranteed Stop Loss, unavailable on most competing platforms.

easyMarkets supports MT4, MT5, TradingView, and its proprietary web and mobile platforms with both fixed and variable spread account structures.

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

easyMarkets Pros and Cons

The following strengths and limitations highlight easyMarkets’ overall suitability for traders prioritizing execution stability, capital protection, and user-friendly risk management tools.

Pros | Cons |

Strong dual Tier-1 regulation with CySEC and ASIC | No copy trading or PAMM investment services |

Innovative risk tools: Guaranteed Stop Loss, dealCancellation, Freeze Rate | Limited crypto deposit and withdrawal options |

Commission-free trading with low $25 minimum deposit | Not all features available on MT4 and MT5 |

High leverage up to 1:2000 for international clients | 24/5 support instead of full 24/7 |

Tickmill

Tickmill is a global multi-asset Forex and CFD broker founded in 2014, serving more than 785,000 registered users across 180+ countries.

The broker records an average monthly trading volume exceeding $129 billion and offers spreads from 0.0 pips with leverage up to 1:300, making it attractive for active and professional traders.

Tickmill operates under a strong multi-jurisdictional regulatory framework, holding licenses from FCA (UK), CySEC (Cyprus), FSCA (South Africa), LFSA (Labuan), and FSA (Seychelles).

Client funds remain fully segregated, with investor protection up to £85,000 under FSCS and up to $1,000,000 via Lloyd’s insurance.

Tickmill registration provides access to Classic and Raw accounts with a $100 minimum deposit, base currencies including USD, EUR, GBP, ZAR, PLN, CHF, leverage up to 1:1000 depending on entity, and $1,000 Tickmill live contest.

Trading platforms include MetaTrader 4, MetaTrader 5, web terminal, and mobile app, supporting scalping, hedging, and automated trading.

Account Types | Classic, Raw |

Regulating Authorities | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Withdrawal Methods | Crypto, Payment Systems, Credit/Debit Cards, Bank Transfers |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, MetaTrader Web, Mobile App |

Tickmill Pros and Cons

The following advantages and limitations help Lebanese traders evaluate Tickmill’s overall suitability based on execution quality, asset diversity, regulatory strength, and trading flexibility.

Pros | Cons |

Strong Tier-1 regulation with FCA and CySEC | Limited number of account types |

Ultra-low spreads from 0.0 pips | Forex pair selection smaller than industry leaders |

Investor protection up to £85,000 and $1M insurance | Trustpilot user rating below some competitors |

High leverage up to 1:1000 via an offshore entity | No PAMM investment accounts available |

Is Forex Trading Legal in Lebanon?

Forex trading in Lebanon is fully legal and accessible to both residents and expatriates.

While the Central Bank of Lebanon (Banque du Liban) supervises financial institutions, retail Forex trading itself operates without a dedicated domestic regulatory framework, allowing Lebanese traders to freely register with internationally regulated Forex brokers.

This open environment has accelerated Forex adoption, especially after Lebanon’s economic contraction of over 53% between 2019 and 2021.

Lebanese traders increasingly rely on offshore brokers regulated by FCA, ASIC, CySEC, and DFSA to access global markets with proper capital protection, secure payments, and competitive trading conditions.

Lebanon Regulatory Bodies for Forex Trading

The Banque du Liban (BDL) serves as Lebanon’s central monetary authority, supervising banking and financial institutions. However, BDL does not impose direct regulation over retail online Forex trading, leaving Lebanese traders dependent on internationally licensed brokers for regulatory protection and compliance.

Because no domestic Forex licensing is required, Lebanese traders must prioritize brokers regulated by globally recognized agencies such as the UK Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and Dubai Financial Services Authority (DFSA).

What Client Protection Protocols Do Forex Brokers Offer in Lebanon?

Due to the absence of detailed domestic regulation, Lebanese traders depend on international Forex brokers for investor protection. Leading brokers offer:

- Client fund segregation

- Negative balance protection

- Automatic stop-out mechanisms

- Participation in compensation schemes

Segregated accounts ensure client funds remain separate from broker operational capital, while negative balance protection prevents traders from losing more than their deposited amount. These protections form the foundation of secure trading for Lebanese Forex investors.

Security shield diagram displaying layers of protection: segregation, NBP, stop-out, compensation.

How Can I Start Forex Trading in Lebanon?

Starting Forex trading in Lebanon begins with education, discipline, and risk management. New traders should understand trading psychology, leverage mechanics, stop-loss usage, and strategy development before opening an account with internationally regulated brokers.

Lebanese traders commonly start with demo accounts, cent accounts, and small deposits. Low trading costs, proper position sizing, and continuous learning significantly increase long-term success rates in the Lebanese Forex market.

- Education is essential;

- Learn leverage and risk management;

- Use demo and cent accounts;

- Focus on trading psychology;

- Develop a personal trading strategy.

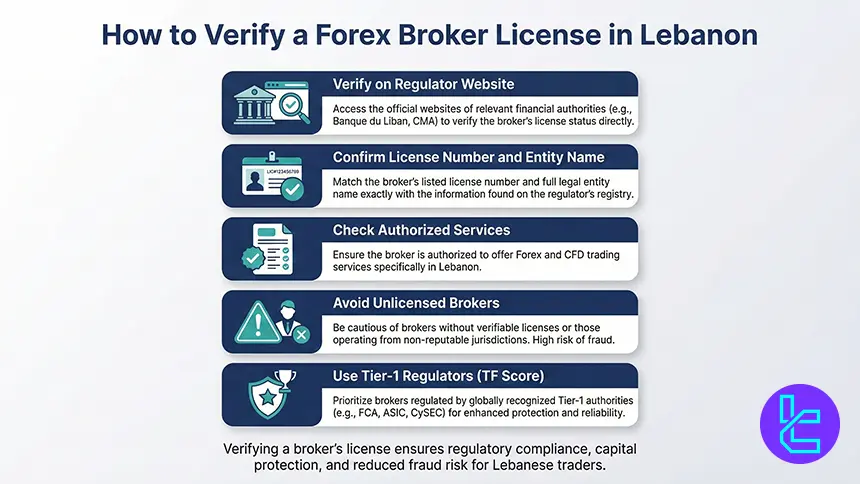

How to Verify A Broker's License

Lebanese traders should always verify a broker’s license directly on the regulator’s official database. This includes checking the registration number, company name, authorized activities, and regulatory status with authorities such as FCA, ASIC, CySEC, and DFSA.

A valid license confirms that the broker complies with capital requirements, reporting standards, and consumer protection policies. Verifying licenses significantly reduces the risk of fraud and ensures traders operate within internationally accepted compliance standards.

- Verify directly on regulator websites;

- Confirm license number and entity name;

- Check authorized services;

- Avoid unlicensed brokers;

- Use Tier-1 regulators, according to TF Score.

Do Lebanon Forex Brokers Offer Negative Balance Protection?

Most internationally regulated Forex brokers serving Lebanese clients provide negative balance protection. This ensures traders cannot lose more than their account balance, even during extreme market volatility.

Combined with automatic stop-out systems, NBP protects Lebanese traders from catastrophic losses, especially when using high leverage levels that may reach up to 1:3000 under some brokers’ trading conditions.

How to Select the Best Forex Broker in Lebanon?

Selecting the best Forex broker in Lebanon requires evaluating regulation, spreads, fees, trading platforms, payment methods, and customer support. Brokers regulated by FCA, ASIC, CySEC, or DFSA provide the strongest protection for Lebanese traders.

Traders should prioritize low spreads, transparent commissions, multiple funding options, including bank cards, Skrill, Neteller, cryptocurrency, and advanced platforms such as MT4, MT5, cTrader, and TradingView with Arabic or bilingual customer support.

- Regulation is critical;

- Compare spreads and fees;

- Evaluate platforms MT4, MT5, or cTrader;

- Check payment methods;

- Ensure multilingual customer support.

Is Forex Trading Halal or Haram?

Forex trading can be halal if conducted in compliance with Islamic finance principles. It must avoid riba (interest), excessive speculation, and uncertainty. Many brokers offer swap-free Islamic accounts to accommodate Muslim traders in Lebanon.

Halal instruments may include Forex pairs, ETFs, and Sharia-compliant stocks. Islamic Forex trading enables participation in global markets while respecting religious principles.

Islamic Forex Accounts for Lebanese Traders

Islamic Forex accounts remove overnight swap interest and operate under Sharia principles. These accounts allow Lebanese Muslim traders to participate in Forex markets without violating religious restrictions.

Leading brokers in Lebanon provide fully compliant Islamic accounts with transparent pricing, no hidden fees, and full access to global markets including currencies, commodities, indices, and stocks.

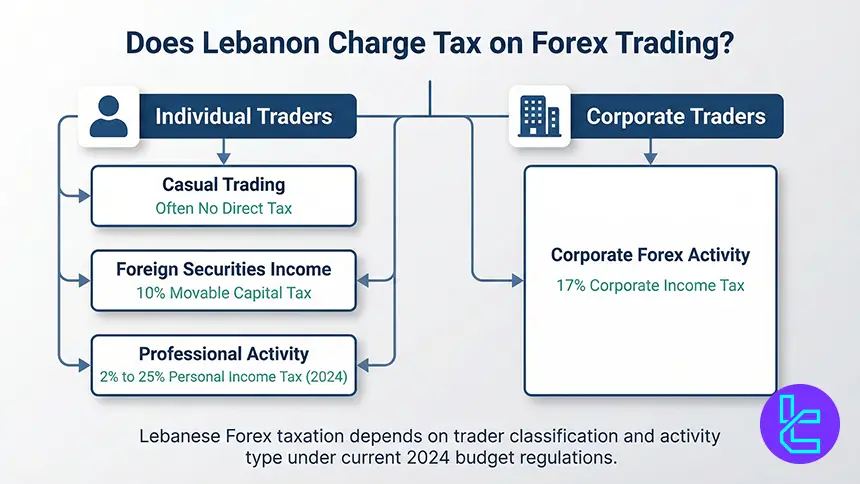

Does Lebanon Charge Tax on Forex Trading?

Lebanon does not impose a direct transaction tax on Forex trades, and no foreign exchange controls restrict retail traders. However, under the 2024 Lebanese budget framework, profits from certain official exchange activities tied to the financial crisis became taxable.

In practice, Forex taxation depends on how the activity is classified and who performs it. For individuals, casual trading gains may escape taxation, while income from foreign securities is subject to a 10% movable capital tax.

If Forex trading becomes a primary business activity, profits fall under progressive personal income tax rates ranging from 2% to 25% as of 2024. Corporate Forex income is typically taxed at 17%.

What Trading Fees Should FX Traders Expect in Lebanon?

Lebanese Forex traders face trading costs including spreads, commissions, swap fees, and non-trading fees. Raw accounts provide tight spreads with commissions, while standard accounts embed costs within spreads.

Non-trading fees may include withdrawal charges, inactivity fees, and conversion fees, depending on broker policy and funding method.

What Are the Popular Forex and CFD Trading Platforms in Lebanon?

MetaTrader 4 remains the dominant platform in Lebanon, supporting over 80% of daily Forex trading volume globally. It offers algorithmic trading, API access, copy trading, and over 25,000 custom indicators and EAs.

MT5 and cTrader follow, providing advanced analytics, multi-asset trading, and improved execution, though MT4 retains unmatched ecosystem support.

- MT4 dominates 80%+ of trading volume

- 25,000+ MT4 tools

- Supports algorithmic and copy trading

- MetaTrader 5 and cTrader alternatives

- Offered by all major brokers

Professional Forex Accounts Requirements for Lebanese Traders

Professional Forex accounts in Lebanon require meeting criteria such as minimum portfolio size, trading frequency, and market experience. These accounts provide higher leverage, lower margin requirements, and priority execution.

However, professional status reduces some regulatory protections, making risk management and financial discipline essential.

- Experience and capital required

- Higher leverage access

- Reduced regulatory protections

- Priority execution

- Institutional conditions

Infographic Idea: Eligibility ladder from retail to professional trader.

Helpful Links for Forex Traders in Lebanon

The following official resources help Lebanese Forex traders verify broker regulation, understand taxation, and access reliable financial governance information from recognized global authorities.

- Banque du Liban: Central Bank of Lebanon, providing monetary policy, banking supervision, and financial stability information

- UK FCA Register: Official database to verify authorization and regulatory status of UK financial firms and brokers

- ASIC Register: Australian government register for checking licensed financial services providers and corporate entities

- CySEC Register: Cyprus regulator platform for verifying investment firms and financial market licenses across Europe

- DFSA Register: Dubai regulator database listing licensed financial institutions operating in the DIFC jurisdiction

- Lebanese Ministry of Finance: Government authority overseeing taxation, fiscal policy, customs, and public financial administration in Lebanon

Lebanon Forex Trading Conditions vs Other Countries

Forex trading conditions in Lebanon differ significantly from regional and global markets. Unlike the UAE, Saudi Arabia, and India, Lebanon operates without a dedicated domestic Forex regulator, leaving traders dependent on internationally regulated brokers.

Retail leverage has no fixed national cap, investor protection remains low, and negative balance protection depends entirely on the broker’s license and regulatory entity.

By comparison, the UAE enforces oversight through DFSA and DIFC with a 1:50 leverage cap and high investor protection, while Saudi Arabia mandates negative balance protection under SAMA and CMA.

Comparison Factor | Lebanon | |||

Primary Regulator | No local Forex regulator | Dubai Financial Services Authority (DFSA), Dubai International Financial Centre (DIFC) | Saudi Central Bank (SAMA), Capital Market Authority (CMA) | Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI) |

Regulatory Framework | International regulators | National framework | National regulatory framework under SAMA and CMA | National regulation under SEBI |

Retail Leverage Cap Forex Majors | No fixed national cap | 1:50 | No fixed national cap | 1:50 |

Investor Protection Level | low | High | Medium | Moderate to high |

Negative Balance Protection | Based on the broker’s license | Not mandatory; applied by many brokers | Mandatory | Mandatory |

Client Fund Segregation | Based on the broker’s license | Mandatory | Mandatory | Required for SEBI-regulated brokers |

Broker Transparency Requirements | market transparency under regulations | Transparent risk disclosures | market transparency under SAMA and CMA | Strict disclosure for SEBI-regulated Firms |

Broker Availability | Local and international brokers | DFSA-regulated and international | Local and international brokers | Limited to SEBI-regulated brokers on NSE and BSE; offshore brokers are widely used |

Access to International Brokers | Yes | Yes | Yes | Moderate to high |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView, cTrader |

Maximum Loss Protection | Depends on broker policy and regulatory entity | Entity-dependent | Depends on broker policy and regulatory entity | Cannot lose more than the deposit |

Tax Treatment of Forex Profits | Up to 25% for retail traders | Tax-free | Capital gains tax of 10 percent via FIRS | Taxed as business income or capital gains under Indian tax law |

Conclusion and Expert Suggestions

Lebanese traders should focus on brokers that demonstrate consistent execution quality, efficient transaction handling, dependable support, and flexible trading environments. These elements strongly influence overall performance and long term stability, making careful broker selection an essential step for sustainable trading success.

The optimal broker choice depends on each trader’s individual goals, preferred strategies, risk tolerance, and future growth plans. Comparing brokers across these dimensions allows traders to structure their accounts in a way that supports both immediate objectives and long term scalability.

“All broker evaluations in this guide are built using the TradingFinder Forex methodology, which applies a structured, multi-layer analysis of regulation, costs, execution performance, platform technology, market coverage, and verified client feedback to deliver objective and reliable recommendations.”