Forex broker is legal and regulated in Nigeria under oversight of the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission of Nigeria (SEC) allowing traders to easily trade Forex.

Since the decline of NGN currency, many people are looking for stable, well-regulated brokers with low trading costs to trade Forex and earn extra income.

Best Forex Brokers for Nigeria

| Exness | |||

| FP Markets | |||

| Blackbull Markets | |||

| 4 |  | HFM | ||

| 5 |  | Multibank Group | ||

| 6 |  | Vantage | ||

| 7 |  | FxPro | ||

| 8 |  | JustMarkets | ||

| 9 |  | Tickmill | ||

| 10 |  | FXTM |

Trustpilot Ratings of Forex Brokers in Nigeria

The table below provides the Trustpilot rating of the top Forex brokers in Nigeria:

Broker | Trustpilot Rating | Number of Reviews |

4.8/5 ⭐ | +25000 | |

FP Markets | 4.8/5 ⭐ | +9500 |

Blackbull Markets | 4.8/5 ⭐ | +2500 |

HFM | 4.6/5 ⭐ | +2500 |

Multibank Group | 4.6/5 ⭐ | +1500 |

Vantage | 4.5/5 ⭐ | +11000 |

FxPro | 3.8/5 ⭐ | +800 |

3.7/5 ⭐ | +3500 | |

Tickmill | 3.6/5 ⭐ | +1000 |

FXTM | 2.6/5 ⭐ | +1000 |

Minimum Spreads of Forex Brokers in Nigeria

Trading with raw spreads from 0.0 pips is available in the top brokers in Nigiria benefiting the traders who use fast-execution trading strategies with tight stoploss.

Brokers | Minimum Spreads |

Fusion Markets | From 0.0 pips |

Blackbull Markets | From 0.0 pips |

From 0.0 pips | |

Admirals | From 0.0 pips |

From 0.0 pips | |

XM Group | From 0.0 pips |

XTB | From 0.1 pips |

SpreadEX | From 0.6 pips |

OctaFX | From 0.6 pips |

Capital.com | From 0.67 Pips |

Non-Trading Fees in Forex Brokers of Nigeria

Non-trading fees include deposit, withdrawal, inactivity and currency conversion fees that traders must consider before choosing a broker in Nigeria.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

IC Markets | $0 | $0 | No |

Pepperstone | $0 | $0 | No |

$0 | $0 | No | |

Exness | $0 | $0 | No |

FP Markets | $0 | No (Except for Skrill and Paysafe: 1%) | No |

Fusion Markets | $0 | Varies | No |

$0 | Varies | $5 | |

FXPro | $0 | $0 | $15 |

XM Group | $0 | $0 | $15 |

$0 | $0 | $60 |

Number of Tradable Instruments in Forex Brokers of Nigeria

Having access to a wide variety of symbols in various markets, including Forex, cryptocurrencies, stocks, indices, commodities, ETFs, allows Nigerian traders to gain the most profits using brokerage services.

Broker | Number of Tradable Assets |

+26000 | |

+10000 | |

Capital.com | +6000 |

IC Markets | +2250 |

+2100 | |

XM Group | +1400 |

Tickmill | +600 |

OctaFX | +300 |

AvaTrade | +250 |

Axi | +200 |

Top 8 Forex Brokers in Nigeria

Based on the current laws set by Central Bank of Nigeria and the Securities and Exchange Commission (the two major regulatory authority in this country) traders can choose both on-shore and offshore brokers.

This allows traders to find a suitable broker based on their trading objectives and risk tolerance.

Exness

Exness is a global forex and CFD broker founded in 2008 by Petr Valov and Igor Lychagov and operating under the EXNESS Group.

The broker reports monthly trading volumes above 4 trillion USD and serves more than 700,000 active clients worldwide. Its regulatory oversight expands by multiple authorities including the FCA, CySEC, FSCA, CMA, FSA, FSC, and CBCS.

Market access covers over 200 tradable instruments across Forex, indices, commodities, cryptocurrencies, and stock CFDs.

Trading is supported through MetaTrader 4, MetaTrader 5, Exness Terminal for web-based execution, and the Exness Trade mobile application.

Account options include Standard, Standard Cent, Pro, Raw Spread, and Zero, with spreads starting from 0.0 pips and commission structures ranging between 0.2 USD and 3.5 USD per lot.

Initial account creation is completed through the Exness registration workflow, while withdrawals and full functionality require successful Exness verification in line with compliance standards.

Ongoing account control, funding methods, leverage settings, and Social Trading services are handled within the Exness dashboard.

Risk management features include segregated client funds, negative balance protection, margin call thresholds between 30% and 60%, and swap free trading on selected instruments.

Account Types | Standard, Standard Cent, Pro, Raw Spread, Zero |

Regulating Authorities | FCA, CySEC, FSCA, CMA, FSA, FSC, CBCS |

Minimum Deposit | 10 USD |

Deposit Methods | Bank Cards, Neteller, Skrill, SticPay, Perfect Money, USDT (TRC20/ERC20), BTC, Binance Pay |

Withdrawal Methods | Bank Cards, Neteller, Skrill, SticPay, Perfect Money, USDT, BTC, Internal Transfer |

Maximum Leverage | Unlimited (subject to account type and equity conditions) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Exness Terminal (Web), Exness Trade App (iOS, Android), Social Trading App |

Exness Pros and Cons

Here are the main benefits and drawbacks of choosing Exness as your broker in Nigeria.

Pros | Cons |

Regulation under FCA, CySEC, FSCA, CMA, FSA, FSC, and CBCS | Stock CFD range is limited compared to equity focused brokers |

Multiple account types including Standard, Pro, Raw Spread, and Zero | Payment method availability depends on region |

Support for MT4, MT5, Exness Terminal, and Exness Trade app | No standalone proprietary desktop platform |

Spreads from 0.0 pips with commissions up to 3.5 USD per lot | - |

BlackBull Markets

BlackBull Markets is a New Zealand based forex and CFD broker founded in 2014 by Michael Walker and Selwyn Loekman and officially registered as Black Bull Group Limited.

The broker operates under regulatory oversight from the New Zealand Financial Markets Authority (FMA) and the Seychelles Financial Services Authority (FSA), offering different compliance frameworks through its Tier 1 and Tier 3 entities.

Client funds are held in segregated accounts, with negative balance protection applied across supported jurisdictions.

The broker provides access to more than 26,000 tradable instruments spanning Forex, equities, indices, commodities, metals, energies, and cryptocurrencies.

Trading is supported through MetaTrader 4, MetaTrader 5, TradingView, cTrader, BlackBull CopyTrader, and BlackBull Invest, enabling both active trading and long-term stock investing.

Account structures include ECN Standard, ECN Prime, and ECN Institutional, with spreads starting from 0.0 pips and commission models varying by account tier. Traders can easily open any of these account types by completing the BlackBull Markets registration.

BlackBull Markets supports copy trading, API trading, and Islamic accounts, alongside leverage up to 1:500.

Deposits are fee free across multiple payment methods, while withdrawals incur a fixed processing fee. All traders must complete the BlackBull Markets verification to cashout profits from this broker.

The broker maintains 24/7 customer support and reports strong user feedback on platforms such as Trustpilot, TradingView, and Forex Peace Army, reflecting its positioning within the multi asset trading ecosystem.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | New Zealand FMA, Seychelles FSA |

Minimum Deposit | 0 USD |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

Pros and Cons of BlackBull Markets

Before choosing BlackBull Markets as your broker, you must consider the benefits and limitations of trading with this broker.

Pros | Cons |

Regulation under New Zealand FMA with FSCL membership for NZ clients | Flat 5 USD withdrawal fee applies to all payout methods |

Access to 26,000+ instruments including Forex, equities, indices, commodities, and crypto CFDs | Stock trading available only via BlackBull Invest |

ECN Standard, ECN Prime, and ECN Institutional accounts with spreads from 0.0 pips | ECN Prime requires a 2,000 USD minimum deposit |

Support for MT4, MT5, TradingView, and cTrader platforms | - |

Multibank Group

MultiBank Group is a global forex and CFD broker established in 2005, with operational headquarters in Dubai and regulated entities across multiple jurisdictions.

The broker operates through licensed companies under ASIC, CySEC, UAE SCA, MAS, BaFin, CIMA, FSC, FMA, AUSTRAC, and other regional authorities. These regulatory authorities require traders to complete MultiBank Group verification.

This multi-jurisdictional framework is complemented by segregated client funds, negative balance protection, and excess loss insurance coverage of up to 1 million USD per client.

MultiBank provides access to more than 20,000 tradable instruments across Forex, commodities, metals, indices, share CFDs, and cryptocurrencies.

Trading is available via MetaTrader 4, MetaTrader 5, and the proprietary MultiBank-Plus platform all accessible via the MultiBank Group dashboard.

Account structures include Standard, Pro, and ECN, with spreads starting from 0.0 pips, zero commission models, and leverage reaching up to 1:500 depending on the regulatory entity.

Additional features include Islamic accounts, PAMM and MAM solutions, copy trading, and automated trading via Expert Advisors.

While deposits are generally fee free, allowing traders to use various methods, including the MultiBank USDT TRC20 deposit method with a minimum amount of $200.

Account Types | Standard, Pro, ECN |

Regulating Authorities | ASIC, CySEC, SCA (UAE), MAS, BaFin, CIMA, FSC, FMA, AUSTRAC |

Minimum Deposit | 50 USD |

Deposit Methods | Credit/Debit Cards (Visa, Mastercard), Bank Wire, SEPA, Cryptocurrencies (BTC, USDT ERC20/TRC20), Skrill, Neteller |

Withdrawal Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, Cryptocurrencies |

Maximum Leverage | Up to 1:500 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, MultiBank-Plus, WebTrader |

Multibank Group Pros and Cons

Choosing MultiBank Group has its own advantages and disadvantages that traders must consider before opening an account.

Pros | Cons |

Regulation under ASIC, CySEC, MAS, SCA (UAE), BaFin, and CIMA | ECN account requires a 10,000 USD minimum deposit |

Access to 20,000+ instruments across Forex, Share CFDs, Indices, Commodities, and Cryptocurrencies | MultiBank-Plus lacks deep institutional analytics compared to TradingView or cTrader |

Standard, Pro, and ECN accounts with zero-commission pricing | - |

Trading via MetaTrader 4, MetaTrader 5, and MultiBank-Plus | - |

FxPro

FxPro is a global Forex and CFD broker established in 2006, providing online trading services. Instruments span across multiple asset classes including Forex, indices, shares, commodities, metals, futures, and cryptocurrency CFDs.

The broker operates through several regulated entities such as FCA CySEC, FSCA, SCB. Client protection mechanisms include segregated accounts and negative balance protection for all traders who finalize FxPro verification.

FxPro supports over 2,100 tradable instruments and offers account structures including Standard, Pro, Raw+, and Elite, each with distinct pricing and execution conditions.

Trading is available via MetaTrader 4, MetaTrader 5, cTrader, WebTrader, and the FxPro mobile app, with support for Expert Advisors, scalping, and copy trading through FxPro CopyTrade accessible after FxPro registration.

Execution models include market and instant execution, with reported order execution speeds below 12 milliseconds.

The broker applies variable spreads, commission-based pricing on selected accounts, and leverage up to 1:500 depending on jurisdiction.

Traders should note that they can reduce the trading costs by using the FxPro rebate service via TradingFinder IB.

Account Types | Standard, Pro, Raw+, Elite |

Regulating Authorities | FCA, CySEC, FSCA, SCB |

Minimum Deposit | 100 USD |

Deposit Methods | Visa, Mastercard, Bank Wire Transfer, Broker-to-Broker Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Wire Transfer, Broker-to-Broker Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:500 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader, WebTrader, FxPro Mobile App |

FxPro Pros and Cons

Here are the most important advantages and disadvantages of using FxPro broker.

Pros | Cons |

Regulation by FCA (UK), CySEC (EU), FSCA (South Africa), and SCB (Bahamas) | Higher minimum deposit for Pro (1,000 USD) and Elite (30,000 USD) accounts |

More than 2,100 tradable instruments across Forex, shares, indices, metals, energies, futures, and crypto CFDs | Customer support operates 24/5, not 24/7 |

Multiple account types including Standard, Pro, Raw+, and Elite | - |

Fast execution speeds with reported latency under 12 milliseconds | - |

Tickmill

Tickmill is a multi-asset Forex and CFD broker founded in 2014, operating globally with more than 785,000 registered users and an average monthly trading volume exceeding 129 billion USD.

The broker follows a no-dealing-desk (NDD) execution model, routing orders directly to external liquidity providers to support fast execution and transparent pricing.

Tickmill operates through several regulated entities, including FCA CySEC, FSCA and FSA allowing users to complete Tickmill registration worldwide.

Client protection mechanisms include segregated funds, negative balance protection, FSCS coverage up to GBP 85,000 for UK clients, ICF protection up to EUR 20,000 for EU clients, and additional fund insurance via Lloyd’s for offshore entities.

The broker offers Classic and Raw account types with minimum deposits starting at 100 USD and leverage reaching up to 1:1000.

Trading is available across Forex, indices, commodities, stocks, bonds, and cryptocurrency CFDs via MetaTrader 4, MetaTrader 5, WebTrader, and mobile applications.

Tickmill also provides Social Trading, Islamic accounts, VPS access, and supports scalping and hedging strategies. TradingFinder IB offers Tickmill rebates allowing traders to lower trading fees up to $7.75 per lot.

Account Types | Classic, Raw |

Regulating Authorities | FCA, CySEC, FSCA, FSA (Seychelles), LFSA |

Minimum Deposit | 100 USD |

Deposit Methods | Bank Transfer, Credit/Debit Cards (Visa, Mastercard), Skrill, Neteller, UnionPay, Cryptocurrencies |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards (Visa, Mastercard), Skrill, Neteller, UnionPay, Cryptocurrencies |

Maximum Leverage | Up to 1:1000 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, MetaTrader Web, Tickmill Mobile App |

Pros and Cons of Tickmill Broker

These are the pros and cons of trading with Tickmill as your Forex broker.

Pros | Cons |

Regulation by FCA, CySEC, FSCA, FSA (Seychelles), and LFSA across multiple jurisdictions | Limited account variety with only Classic and Raw account types |

No Dealing Desk (NDD) execution with direct access to liquidity providers | Forex pair selection is smaller compared to multi-asset brokers |

Tight spreads from 0.0 pips on Raw accounts with competitive commission | Social Trading available mainly under Seychelles-regulated entity |

Support for MetaTrader 4, MetaTrader 5, WebTrader, and Tickmill Mobile App | - |

FP Markets

FP Markets, legally known as First Prudential Markets, is a multi-regulated Forex and CFD broker founded in 2005, with primary operations in Australia and global coverage across multiple jurisdictions.

The broker operates under regulatory oversight from ASIC and CySEC as top-tier authorities, alongside FSCA, FSC, FSA (Seychelles), and SVG FSA through different legal entities.

Client protection mechanisms include segregated funds, negative balance protection, and participation in compensation schemes. The broker also comply with KYC and AML by applying FP Markets verification process.

FP Markets offers Standard and RAW account types with a minimum deposit of 50 USD, floating spreads from 0.0 pips, and commission- based pricing starting at 3 USD per lot on RAW accounts.

Traders can lower trading costs by leveraging FP Markets rebates (up to $3 per lot).

Trading access spans over 10,000 instruments across Forex, share CFDs, indices, commodities, metals, ETFs, and cryptocurrency CFDs.

Platforms supported include MetaTrader 4, MetaTrader 5, and cTrader, enabling manual, algorithmic, and ECN style trading available to download after completing the FP Markets registration.

Additional services include copy trading, PAMM and MAM accounts, Islamic swap-free options, VPS hosting, and integrated risk management tools.

Leverage can reach up to 1:500 depending on the regulatory entity.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSCA, FSC, FSA (Seychelles), SVG FSA |

Minimum Deposit | 50 USD |

Deposit Methods | Visa, Mastercard, Bank Transfer, Skrill, Neteller, PayPal |

Withdrawal Methods | Visa, Mastercard, Bank Transfer, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:500 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, cTrader |

FP Markets Pros and Cons

The table below helps traders outline the key advantages and disadvantages of trading with FP Markets broker.

Pros | Cons |

Regulation under ASIC and CySEC, with additional oversight from FSCA, FSC, and FSA entities | Offshore entities regulated by SVG FSA offer lower-tier protection |

Standard and RAW accounts with spreads from 0.0 pips and low commission pricing | Educational content is less comprehensive than some Tier-1 brokers |

Access to 10,000+ instruments across Forex, share CFDs, indices, commodities, ETFs, and crypto CFDs | - |

Minimum deposit starting from 50 USD | - |

Vantage

Vantage Markets is a multi-asset Forex and CFD broker founded in 2009, with headquarters in Sydney and operational offices across more than 30 global locations.

The broker provides trading access to Forex, indices, commodities, shares, ETFs, bonds, and cryptocurrency CFDs.

Vantage Markets has diversified regulatory structure that includes ASIC, FCA, FSCA, VFSC, and CIMA.

Client protection measures vary by entity and include segregated client funds, negative balance protection, FSCS coverage for UK clients, and additional insurance via Lloyd’s for select jurisdictions.

Vantage Markets offers multiple account structures such as Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap Free, with minimum deposits starting from 20 USD and leverage reaching up to 1:1000 under offshore entities.

Trading is supported across MetaTrader 4, MetaTrader 5, ProTrader, TradingView integration, and a proprietary mobile application, enabling both manual and algorithmic strategies available to all traders who complete the Vantage Markets registration.

Additional services include copy trading and social trading via ZuluTrade, DupliTrade, and Myfxbook AutoTrade, as well as PAMM functionality and VPS hosting.

Pricing models range from commission-free accounts to ECN structures with raw spreads from 0.0 pips.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FCA, FSCA, VFSC, CIMA |

Minimum Deposit | 20 USD |

Deposit Methods | Bank Transfer, Credit/Debit Cards (Visa, Mastercard), E-wallets (Skrill, Neteller, FasaPay), Perfect Money, Local Payment Methods |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, E-wallets (Skrill, Neteller, FasaPay), Local Payment Methods |

Maximum Leverage | Up to 1:1000 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, ProTrader, TradingView, Vantage proprietary mobile app |

Vantage Pros and Cons

Here’s a detailed table of the benefits and drawbacks of Vantage Markets for Nigerian traders.

Pros | Cons |

Support for MetaTrader 4, MetaTrader 5, ProTrader, TradingView, and proprietary mobile app | No proprietary desktop trading platform; desktop trading relies on third-party software |

Raw spreads from 0.0 pips with ECN execution on Raw ECN and Pro ECN accounts | Social trading availability and features vary by regulatory entity |

Copy and social trading via ZuluTrade, DupliTrade, and Myfxbook AutoTrade | - |

High leverage up to 1:1000 under VFSC and CIMA entities | - |

HFM

HFM operates as a globally active Forex and CFD broker, providing trading services under a multi-jurisdictional regulatory framework.

Oversight is maintained by several recognized authorities, including CySEC, FCA, DFSA, FSCA, FSA in offshore jurisdictions. All regulatory authorities require traders to complete the HFM verification to comply with international laws.

Trading access covers a broad range of CFD markets, including Forex, metals, commodities, indices, equities, ETFs, bonds, energies, and cryptocurrencies. Trading costs can be lowered by leveraging HFM rebates.

Account structures such as Cent, Zero, Pro, and Premium accommodate different trading profiles, with minimum deposits starting from 0 USD and leverage extending up to 1:2000.

The broker supports MetaTrader 4, MetaTrader 5, and a proprietary mobile application, enabling manual trading, Expert Advisors, and algorithmic strategies.

Additional infrastructure includes copy trading, PAMM accounts, Autochartist integration, VPS hosting, and market notification tools accessible after HFM registration.

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | FCA, CySEC, DFSA, FSCA, FSA |

Minimum Deposit | From 0 USD |

Deposit Methods | Bank Wire Transfer, Credit/Debit Cards (Visa, Mastercard), E-wallets (Skrill, Neteller, FasaPay), Crypto (BTC, USDT TRC20/ERC20), Perfect Money |

Withdrawal Methods | Bank Wire Transfer, Credit/Debit Cards, E-wallets (Skrill, Neteller, FasaPay), Crypto, Perfect Money |

Maximum Leverage | Up to 1:2000 (varies by regulatory authority) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, HFM Mobile App (Android, iOS) |

Pros and Cons of HFM

Nigerian traders must consider the following benefits and limitations before choosing HFM as their broker:

Pros | Cons |

Minimum deposit starting from 0 USD on Cent and Premium accounts | Leverage capped at 1:30 under FCA and CySEC regulation |

High leverage availability up to 1:2000 under offshore and FSCA entities | No cTrader or TradingView integration |

Support for MetaTrader 4, MetaTrader 5, and HFM Mobile App | Cryptocurrency CFD selection is smaller compared to crypto-focused brokers |

Wide market access including Forex, indices, metals, commodities, stocks, ETFs, bonds, and crypto CFDs | Inactivity fee applies after 6 months of no trading activity |

Is Forex Trading Legal in Nigeria?

Forex trading is legally permitted in Nigeria within a regulatory environment supervised by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission of Nigeria (SEC Nigeria).

Institutions that provide over-the-counter (OTC) foreign exchange products domestically must obtain approval from the CBN, while brokerage and investment activities generally require additional authorization from the SEC.

These bodies define licensing requirements, enforce compliance standards, and oversee financial market operations.

Nigerian residents are not restricted from opening trading accounts with international forex brokers regulated outside Nigeria, provided that any trading income is properly reported for tax purposes under Nigerian law.

The regulatory framework in Nigeria continues to develop, though investor protection mechanisms remain less extensive than those found in jurisdictions such as the United Kingdom, the European Union, or Australia.

This structure permits access to elevated leverage levels, creating both expanded opportunity and increased risk exposure.

Which Financial Authority Regulates Forex Brokers in Nigeria?

Forex trading in Nigeria operates within a regulatory framework anchored by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission of Nigeria (SEC Nigeria).

The CBN functions as the primary authority for monetary policy and currency management, including oversight of the Nigerian Naira (NGN) and supervision of financial institutions.

In parallel, SEC Nigeria governs capital market activities, covering securities, derivatives, and retail participation in instruments such as Forex and Contract for Differences.

Nigeria’s modern regulatory structure is largely shaped by the Investments and Securities Act (ISA) of 2007, which introduced investor protections, market transparency requirements, and compliance obligations for brokers acting as principals.

Although retail CFD regulation remains less formally codified than in jurisdictions such as the UK or EU, Parts X and XI of the ISA define key responsibilities for brokerage operations.

Key institutional functions of the CBN include:

- Currency issuance and monetary policy control

- Supervision of capital markets and derivative products

- Enforcement of investor protection standards

Together, these frameworks define the legal and operational foundation of Nigeria’s forex market.

It’s important to note that SEC in Nigeria is a low-tier financial authority based on TF scores for top financial regulators.

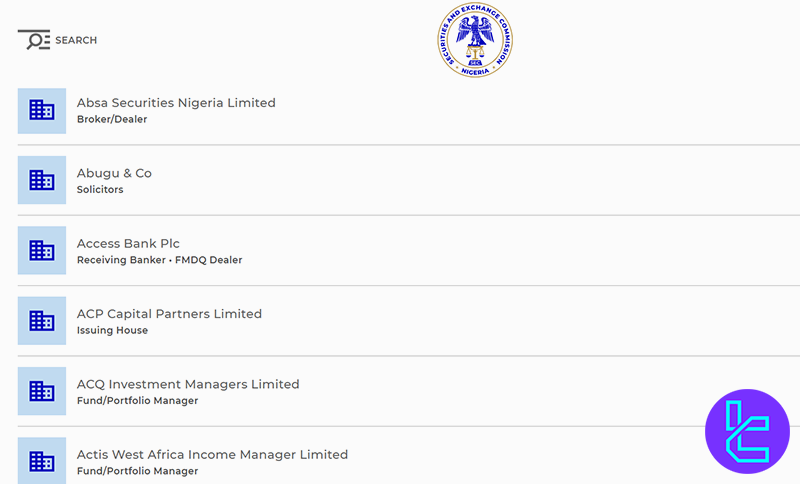

How to Verify SEC Regulation?

In Nigeria, only local banks and Nigerian-based financial institutions are typically licensed by the Central Bank of Nigeria (CBN) and supervised by the Securities and Exchange Commission of Nigeria (SEC Nigeria).

Most international forex brokers serving Nigerian traders operate under foreign regulatory authorities rather than Nigerian registration.

To verify which firms are legally authorized within Nigeria’s capital markets, traders can consult the Capital Markets Operator Search (CMOS) database maintained by SEC Nigeria.

This public registry lists approved market participants and their permitted business activities, including brokerage and dealer services.

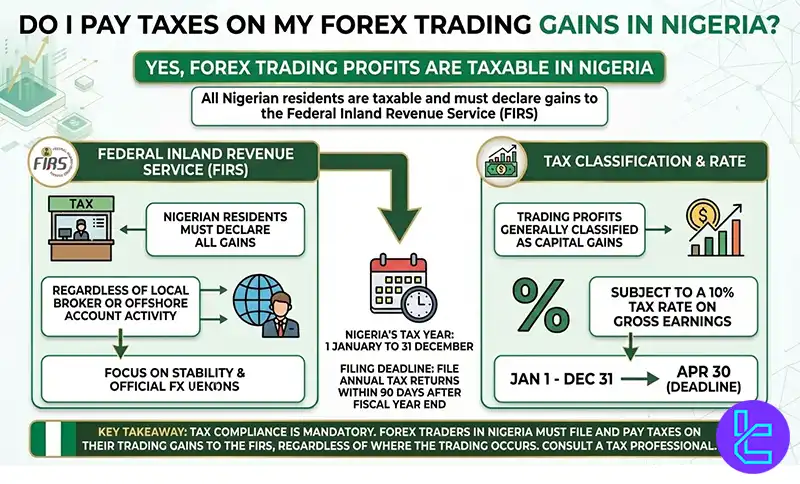

Do I Pay Taxes on My Forex Trading Gains in Nigeria?

Yes; Profits generated from Forex trading by Nigerian residents are taxable and must be declared to the Federal Inland Revenue Service (FIRS), regardless of whether the trading activity takes place with a local broker or through an offshore trading account.

Under Nigeria’s current tax framework, trading profits are generally classified as capital gains and are subject to a 10% tax rate on gross earnings.

Tax liability is determined by residency status, not by the geographic location of the broker.

This means that income earned from international forex platforms remains reportable in Nigeria if the trader resides within Nigerian borders while generating that income.

A common misconception is that offshore trading profits are exempt from Nigerian taxation; however, this assumption is incorrect under Nigerian tax law.

Forex traders are required to file their annual tax returns within 90 days after the end of the fiscal year.

Nigeria’s tax year runs from 1 January to 31 December, and all taxable income derived from currency trading during this period must be disclosed in the relevant filing.

Failure to comply with FIRS reporting obligations may result in financial penalties or regulatory enforcement actions.

What is the Maximum Trading Leverage in Nigeria?

In Nigeria, forex and CFD leverage is determined by broker policy and regulatory structure rather than a single national limit.

Most brokers serving Nigerian traders offer leverage ranging from 1:400 to 1:3000, with offshore-regulated entities providing the highest ratios.

Brokers such as FBS offer leverage up to 1:3000, while HFM provides up to 1:2000. A common mid-range level is 1:500, including brokers supervised by CySEC and FSA, and some firms such as FXTM apply a 1:400 cap in certain regions.

By contrast, brokers regulated by FCA and ASIC often restrict leverage to 1:30 for retail accounts, significantly limiting risk exposure under strict regulatory oversight.

When is the Best Time to Trade Forex in Nigeria?

Forex trading in Nigeria follows the global market cycle, opening with the Sydney session and closing with the New York session, while local participation occurs in the West Africa Time (WAT) zone.

This alignment provides Nigerian traders with strong access to European and North American market activity.

The most effective trading window generally falls between 1:00 pm and 6:00 pm WAT, when the London session overlaps with the New York session.

During this period, market liquidity and price volatility are typically at their highest due to increased institutional participation and cross-border order flow.

This timeframe is particularly suitable for day trading and swing trading, as execution conditions improve and spreads often tighten.

Although the forex market remains accessible 24 hours a day, selecting periods of peak global participation plays a crucial role in effective trade timing and overall market efficiency.

How to Choose a Forex Broker in Nigeria

Selecting the right forex broker in Nigeria requires structured evaluation across several core criteria that directly influence safety, cost efficiency, and trading performance.

- Regulation & Compliance: Verify supervision by recognized authorities such as the Central Bank of Nigeria (CBN) or reputable international regulators.

- Reputation & User Feedback: Analyze trader reviews and platform history to assess execution quality and dispute resolution reliability.

- Trading Costs: Compare spreads, commissions, swap rates, and non-trading fees that affect long-term profitability.

- Trading Platform Quality: Ensure availability of stable, intuitive software with support for technical analysis and risk controls.

- Payment Infrastructure: Confirm access to multiple deposit and withdrawal methods with efficient processing and low friction.

- Education & Market Resources: Look for structured learning materials, research tools, and continuous market analysis support.

- Customer Support: Evaluate response speed, problem-solving efficiency, and availability of multilingual assistance.

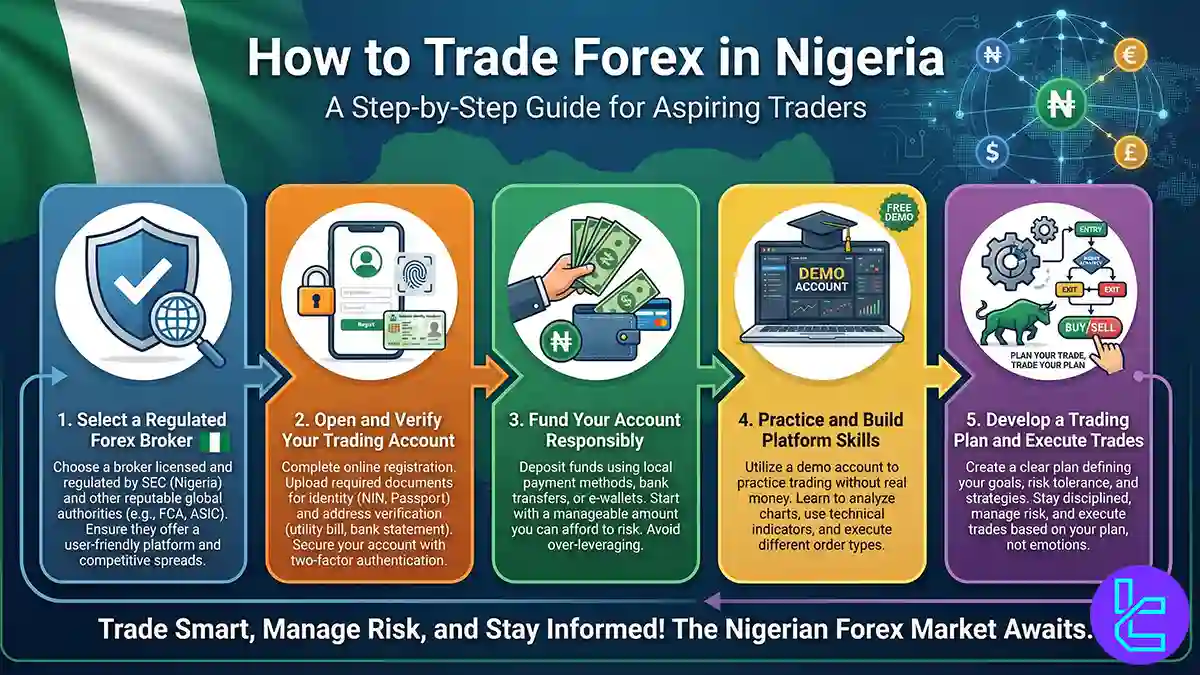

How to Trade Forex in Nigeria

Entering the Nigerian forex market requires a structured approach that balances regulatory awareness, platform familiarity, and disciplined risk management.

Below is a streamlined framework that preserves the core process while remaining practical for new participants.

#1 Select a Regulated Forex Broker

Choose a broker that operates under credible regulators and offers trading access to Nigerian residents. Well-established global brokers illustrate the type of regulatory oversight and operational stability traders should look for.

#2 Open and Verify Your Trading Account

Complete the broker’s application process and submit required identity documents in line with international compliance standards before gaining full account access.

#3 Fund Your Account Responsibly

Deposit capital using supported funding methods and begin with an amount aligned to your risk tolerance and trading experience.

#4 Practice and Build Platform Skills

Use a demo account to understand order execution, position management, and the application of technical indicators within the trading platform.

#5 Develop a Trading Plan and Execute Trades

Construct a strategy that defines entry logic, position size, and risk controls, then place long or short positions based on structured market analysis.

Consistent learning, patience, and risk discipline remain central to long-term trading performance in Nigeria’s forex market.

Forex Trading in Nigeria Compared to Other Countries

Nigeria’s forex market functions under a dual supervisory structure led by the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission of Nigeria (SEC Nigeria).

Unlike the strict leverage controls imposed under MiFID II in the European Union or the regulatory framework of the FCA in the United Kingdom, Nigeria applies a more flexible regulatory model.

At the same time, core standards such as client fund segregation and regulatory compliance remain in place. Here’s a comparison of the Forex trading conditions in Nigeria compared to other countries.

Comparison Factor | Nigeria | |||

Primary Regulator | Central Bank of Nigeria (CBN), Securities and Exchange Commission of Nigeria (SEC Nigeria) | Financial Markets Authority (FMA) | Cyprus Securities and Exchange Commission (CySEC) | Financial Conduct Authority (FCA) |

Regulatory Framework | National regulatory framework under CBN and ISA 2007 | National FMA regime with FSPR registration | EU wide MiFID II and ESMA | National FCA framework (post Brexit) |

Retail Leverage Cap Forex Majors | No fixed national cap; brokers typically offer 1:400 to 1:3000 depending on regulation | No fixed cap under FMA | 1:30 | 1:30 |

Investor Protection Level | Medium | Medium to High | High | Very High |

Negative Balance Protection | Not standardized; depends on broker entity | Not mandatory | Mandatory | Mandatory |

Client Fund Segregation | Required under regulatory standards | Mandatory under FMA rules | Mandatory | Mandatory |

Broker Transparency Requirements | ISA 2007 disclosure and compliance obligations | Disclosure based supervision | Strict EU disclosure rules | Very strict conduct and disclosure standards |

Broker Availability | Local and international brokers | Local and international brokers | Broad EU access via passporting | FCA licensed local and international brokers |

Access to International Brokers | Very high global broker access | High global access | High EU access | High global broker access |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Depends on broker policy and regulatory entity | Depends on broker policy | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Capital gains tax of 10 percent via FIRS | Income tax if trading is a business | Capital gains tax applies | Capital gains or income tax depending on activity |

Conclusion

By comparing the regulation status, trading costs, leverage limits, trading platforms, and investor protection measures, TradingFinder picks Exness, Vantage, HFM, FxPro, and MultiBank Group as the best Forex brokers of Nigeria.

Traders must compare these options and choose the best one according to their trading objectives, risk tolerance, and time limits.

"You can explore the criteria and evaluation process applied in broker selection by reviewing our Forex methodology article".