Forex trading in the Philippines continues expanding, supported by a floating exchange rate system supervised by Bangko Sentral ng Pilipinas and market infrastructure such as PDEx and the Philippine Dealing System.

Although SEC Philippines does not require broker authorization, international regulation and strong compliance remain essential selection criteria. Here’s a list of the best Forex brokers in the Philippines.

| Fusion Markets | |||

| FP Markets | |||

| Go Markets | |||

| 4 |  | Moneta Markets | ||

| 5 |  | TMGM | ||

| 6 |  | Eightcap | ||

| 7 |  | Octa | ||

| 8 |  | InstaForex |

Philippines Forex Brokers Ranked by Trustpilot Ratings

Independent Trustpilot data from more than 30,000 verified trader reviews highlights the most reliable forex brokers serving the Philippine market. Top-tier platforms achieve trust scores up to 4.8/5, reflecting strong execution quality, competitive trading costs, stable platforms, and consistent customer satisfaction.

Broker | Trustpilot Score | Number of Reviews |

4.8/5 ⭐️ | 9,734 | |

Fusion Markets | 4.8/5 ⭐️ | 5,562 |

Go Markets | 4.5/5 ⭐️ | 702 |

Moneta Markets | 4.4/5 ⭐️ | 456 |

4.1/5 ⭐️ | 3,359 | |

Octa | 4.0/5 ⭐️ | 8,809 |

TMGM | 3.9/5 ⭐️ | 833 |

InstaForex | 2.7/5 ⭐️ | 455 |

Lowest Spreads Among the Philippines' Forex Brokers

For cost-sensitive traders in the Philippines, spread performance remains a decisive factor. Current market data shows multiple leading forex brokers offering minimum spreads starting from 0.0 pips, delivering institutional-grade pricing.

Broker | Minimum Spread |

0.0 pips | |

TMGM | 0.0 pips |

Go Markets | 0.0 pips |

0.0 pips | |

Octa | 0.0 pips |

AvaTrade | 0.0 pips |

ATFX | 0.0 pips |

FXTrading | 0.0 pips |

Forex Brokers in the Philippines Ranked by Non-Trading Fees

Non-trading costs significantly affect long-term profitability for Filipino traders. Current fee comparisons show multiple international brokers offering zero deposit and withdrawal charges with no inactivity fees, while others apply limited monthly inactivity costs from $10.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

No | No | No | |

Fusion Markets | No | No | No |

No | No | No | |

Interactive Brokers | No | 1 free withdrawal/month | No |

FP Markets | No | Up to 1% | No |

XTB | No | No | €10/month |

TMGM | No | No | $10/month |

IG | Up to 1% | No | $18/month |

Philippines Forex Brokers’ Trading Instruments

Trading instrument diversity remains a key advantage for Filipino traders seeking multi-market exposure. Current platform comparisons show top brokers providing access to over 17,000 tradable assets, including forex pairs, commodities, indices, stocks, ETFs, and CFD contracts.

Broker | Number of Trading Instruments |

IG | 17,000+ |

12,000+ | |

FP Markets | 10,000+ |

FXTrading | 1,000+ |

Eightcap | 800+ |

Go Markets | 500+ |

Fusion Markets | 250+ |

340+ |

Top 6 Forex Brokers in the Philippines

The Philippine forex market continues expanding, driven by international brokers offering institutional-grade execution, spreads from 0.0 pips, leverage up to 1:1000, access to more than 10,000+ instruments, and multi-platform trading via MT4, MT5, cTrader, and TradingView.

These six brokers combine global regulation, competitive pricing, advanced platforms, and strong client protection to deliver the most reliable trading environments for Filipino traders.

FP Markets

FP Markets is an Australian multi-asset broker established in 2005, offering access to more than 10,000 trading instruments across Forex, CFDs, stocks, indices, commodities, ETFs, and cryptocurrencies. The broker operates under multiple global regulators, including ASIC, CySEC, FSCA, FSA, FSC, and CMA.

The company maintains strong regulatory coverage with top-tier licenses from ASIC (Australia) and CySEC (Cyprus), including CySEC license number 371/18. These regulatory frameworks enforce strict financial standards, segregation of client funds, negative balance protection, and ongoing audits.

FP Markets registration provides access to two main trading accounts, Standard and RAW, both requiring a minimum deposit of $50. Traders benefit from spreads starting at 0.0 pips on RAW accounts, commission of $3 per lot, and access to MetaTrader 4, MetaTrader 5, and cTrader platforms with instant order execution.

Clients can trade with leverage up to 1:500, use investment services such as copy trading, PAMM, and MAMM accounts, and access 24/7 multilingual customer support via live chat, phone, and email.

The broker also supports Islamic accounts, and FP Markets deposits and withdrawals are fee-free.

Account Types | Standard, RAW |

Regulating Authorities | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Deposit | $50 |

Deposit Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Withdrawal Methods | Visa and Master card, Skrill, PayPal, Neteller, Bank Transfer |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

FP Markets Pros & Cons

Before choosing a broker, evaluating both strengths and limitations is essential. The following pros and cons highlight FP Markets’ trading conditions, regulatory profile, platform offering, and client experience.

Pros | Cons |

Regulated by multiple top-tier authorities (ASIC, CySEC) | No proprietary trading platform |

Spreads from 0.0 pips with institutional pricing | Limited in-house educational depth |

Over 10,000 tradable instruments | Some third-party withdrawal fees may apply |

Strong copy trading, PAMM, and algorithmic trading support | - |

Fusion Markets

Fusion Markets is a multi-regulated forex and CFD broker founded by Phil Horner, operating under ASIC and VFSC supervision.

By completing the Fusion Markets registration process, traders get access to ultra-low trading costs, average spreads from 0.0 pips, institutional execution, and access to seven global financial markets.

Registered in Vanuatu and Australia, the broker manages client funds through segregated accounts held with HSBC and National Australia Bank. The offshore regulation leads to a smooth Fusion Markets verification procedure.

The parent group, Glen Eagle Securities, oversees more than $400 million in client assets, reinforcing strong financial stability and operational credibility.

Traders can start with $0 minimum deposit, choose from Zero, Classic, or Swap-Free accounts, and trade via MetaTrader 4, MetaTrader 5, cTrader, and TradingView. Maximum leverage reaches 1:500, with ultra-fast execution averaging 0.02 milliseconds.

Fusion Markets dashboard provides copy trading through Fusion+, MAM and PAMM solutions, and 24/7 multilingual customer support. Funding includes more than 30 deposit and withdrawal methods, all processed with zero broker fees.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros & Cons

Before reviewing Fusion Markets’ full feature set, the following summary highlights its key advantages and limitations for active and professional traders.

Pros | Cons |

Ultra-low spreads from 0.0 pips | Limited educational content |

$0 minimum deposit requirement | No proprietary trading platform |

Fast execution at ~0.02 ms | No investor compensation fund |

Regulated by ASIC and VFSC | Limited instrument selection versus mega-brokers |

Go Markets

GO Markets is a globally regulated CFD and forex broker founded in 2006 and headquartered in Melbourne, Australia. The broker operates under ASIC, CySEC, FSC, and FSA supervision, delivering institutional-grade trading services.

Go Markets registration provides access to two core trading accounts, Standard and GO Plus+, alongside PAMM solutions. Traders can access spreads from 0.0 pips with competitive commission structures, execute trades instantly, and benefit from maximum leverage up to 1:500 depending on regulatory jurisdiction.

GO Markets supports a broad range of assets, including Forex, stocks, indices, commodities, cryptocurrencies, metals, ETFs, and treasury instruments. Trading is available through MT4, MT5, cTrader, and WebTrader, offering advanced tools for manual, algorithmic, and high-frequency strategies.

With 24/7 customer support, Go Markets rebate program (up to 15% cashback), negative balance protection, segregated client funds, and extensive educational resources, the broker has established a strong reputation for stability, performance, and trader-focused infrastructure.

Account Types | Standard, GO Plus+ |

Regulating Authorities | CySEC, FSC, ASIC, FSA |

Minimum Deposit | €100 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, cTrader |

GO Markets Pros & Cons

Before evaluating the full trading environment, the following pros and cons summarize GO Markets’ key strengths and potential limitations for global traders.

Pros | Cons |

Regulated by multiple tier-1 authorities | Higher minimum deposit than some competitors |

Spreads from 0.0 pips with fast execution | Limited proprietary research tools |

Wide range of tradable instruments | No promotional bonuses |

Strong educational and platform ecosystem | Some country restrictions |

Moneta Markets

Moneta Markets is a global Forex and CFD broker founded in 2020 and headquartered in Johannesburg, South Africa.

Regulated by the FSCA and registered internationally, the broker delivers multi-asset trading access to over 1,000 instruments with competitive conditions and modern infrastructure.

The broker offers three primary account types: Direct, Prime, and Ultra, all with a low minimum deposit of $50 and maximum leverage up to 1:1000. Trading is available via MT4, MT5, Pro Trader, and App Trader, supporting both discretionary and automated strategies.

By completing the Moneta Markets registration process, traders get access to Forex, shares, indices, commodities, cryptocurrencies, bonds, and ETFs, with spreads starting from 0.0 pips and commissions from $0.

Execution models include both STP and ECN, ensuring pricing transparency and deep liquidity access.

Moneta Markets dashboard provides features like copy trading, PAMM solutions, Islamic accounts, strong fund security, and negative balance protection.

Moneta Markets deposit and withdrawal methods include cards, bank transfers, e-wallets, and crypto. Customer support is available 24/5 via live chat, email, and phone.

Account Types | Direct, Prime, Ultra |

Regulating Authorities | FSCA, FSRA |

Minimum Deposit | $50 |

Deposit Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Withdrawal Methods | Wire transfer, Visa/MasterCard, Fasapay, Stickpay, JCB |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, Pro Trader, App Trader |

Moneta Markets Pros & Cons

Before examining Moneta Markets in detail, the following table highlights the broker’s primary strengths and potential limitations for global traders.

Pros | Cons |

Over 1,000 tradable instruments | Limited top-tier regulatory coverage |

Leverage up to 1:1000 | Restricted in several major regions |

Spreads from 0.0 pips | Relatively new market presence |

Multiple advanced trading platforms | Some withdrawal methods incur third-party fees |

Eightcap

Eightcap is a global Forex and CFD broker founded in 2009 in Melbourne, Australia, delivering access to more than 800 tradable instruments across six markets, including Forex, shares, indices, commodities, metals, and cryptocurrencies. The broker offers leverage up to 1:500 with fast market execution.

Eightcap operates under strong multi-jurisdictional regulation by ASIC, FCA, CySEC, and SCB, providing client fund segregation, negative balance protection, and investor compensation schemes in the UK and EU. This regulatory framework supports a high level of operational transparency and trader security.

The Eightcap registration provides access to three primary account types: Standard, Raw, and TradingView, each with a $100 minimum deposit, spreads from 0.0 pips, and access to MT4, MT5, and TradingView platforms.

Traders benefit from flexible execution, scalping permission, competitive pricing structures, and the Eightcap rebate program with cashbacks of up to $3.6 per lot.

Eightcap enhances trading performance with advanced tools, including Capitalise.ai, FlashTrader, and an AI-powered economic calendar, while maintaining a Trustpilot score of 4.3/5 from over 2,300 reviews. The platform supports global clients with multilingual 24/5 customer service.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Withdrawal Methods | Crypto, e-wallets, credit/debit card, bank transfer, Online Payment Systems |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView |

Eightcap Pros & Cons

Before evaluating Eightcap’s complete trading environment, the following summary highlights its primary strengths and limitations for professional and retail traders.

Pros | Cons |

Regulated by top-tier authorities (ASIC, FCA, CySEC) | High minimum deposit compared to competitors |

Advanced trading tools, including Capitalise.ai and FlashTrader | No copy trading or PAMM services |

Access to 800+ instruments, including 200+ crypto CFDs | Basic educational structure for advanced traders |

Strong TradingView integration | Weekend customer support unavailable |

Octa

Octa is a global Forex and CFD broker established in 2011, serving more than 12 million clients across 180+ countries, with over 40 million accounts created. The broker operates on an ECN/STP execution model, delivering fast market execution and competitive trading conditions for retail and professional traders.

Regulated by FSCA, MISA, and CySEC, Octa provides strong operational oversight across multiple jurisdictions. Client protection features include negative balance protection, segregated funds under key entities, and investor compensation coverage in EU-regulated structures up to €20,000.

Traders can start with a minimum deposit of just $25, access leverage up to 1:1000, and trade on MT4, MT5, OctaTrader, and Octa Copy platforms by completing the Octa registration process. Spreads begin from 0.6 pips, with zero commission and swap-free trading across all accounts.

Octa supports multi-asset trading across Forex, indices, commodities, metals, cryptocurrencies, and stocks, while offering powerful proprietary tools such as OctaVision, Space, and AI-driven market analytics.

Customer support operates 24/7 in 13 languages, reinforcing global accessibility. OctaFX deposit and withdrawal methods include Skrill, Neteller, Bitcoin, USDT, Visa, and MasterCard.

Account Types | MT4, MT5, OctaTrader |

Regulating Authorities | FSCA, MISA |

Minimum Deposit | $25 |

Deposit Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Withdrawal Methods | E-wallets, credit/debit cards, bank transfer, crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, proprietary OctaTrader, and Copy trading app |

Octa Pros & Cons

Before exploring Octa’s full trading environment, the following summary highlights its core advantages and limitations for international traders.

Pros | Cons |

Very low minimum deposit ($25) | Limited top-tier regulation coverage |

Zero commissions and swap-free trading | Smaller instrument selection than mega brokers |

High leverage up to 1:1000 | Payment methods change periodically |

Advanced proprietary trading tools | Restricted in some major jurisdictions |

Is Forex Trading Legal in the Philippines?

Forex trading is not locally licensed in the Philippines, but Filipino residents are legally allowed to trade through international brokers. The Securities and Exchange Commission (SEC) has issued repeated public advisories warning that no local brokers are authorized to offer leveraged forex or CFD services.

Despite this, Filipino individuals actively participate in global forex markets using offshore brokers regulated in jurisdictions such as the UK (FCA), Australia (ASIC), and Cyprus (CySEC). These foreign brokers provide the regulatory protection absent in the local environment.

What Authorities Regulate Forex Trading in the Philippines?

The Bangko Sentral ng Pilipinas (BSP) supervises foreign exchange activities inside the banking system, while the Philippine SEC handles securities oversight and consumer protection. However, no Philippine authority regulates online retail forex brokers.

Because of this regulatory gap, Filipino traders depend on foreign regulators such as FCA (UK), ASIC (Australia), and CySEC (EU) to ensure broker safety, financial transparency, and dispute resolution.

What Client Protection Procedures Do Philippine Forex Brokers Offer?

Because no local protection framework exists, protection for Filipino traders comes from the broker’s foreign regulatory jurisdiction. Tier-1 regulators enforce segregation of funds, negative balance protection, capital requirements, and independent audits.

Top international brokers also provide investor compensation schemes up to €20,000 in the EU and £85,000 in the UK, offering financial recourse unavailable under Philippine law.

Verifying a Broker’s License

The SEC Philippines does not publish a list of authorized forex brokers. Filipino traders must independently verify broker licenses directly with foreign regulators such as FCA, ASIC, or CySEC via their public registries at the links below:

Traders may also contact the SEC’s Enforcement and Investor Protection Department (EIPD) to report suspicious entities or confirm fraudulent activity warnings.

How to Start Forex Trading in the Philippines

Starting forex trading in the Philippines requires choosing a reputable international broker, completing KYC verification, and funding the account using bank transfer or e-wallets such as Skrill or PayPal.

After funding, traders can immediately begin trading while maintaining transaction records for future banking verification and compliance checks.

- Choose a regulated broker;

- Submit ID and proof of address;

- Deposit funds via e-wallet or bank;

- Begin trading with risk management.

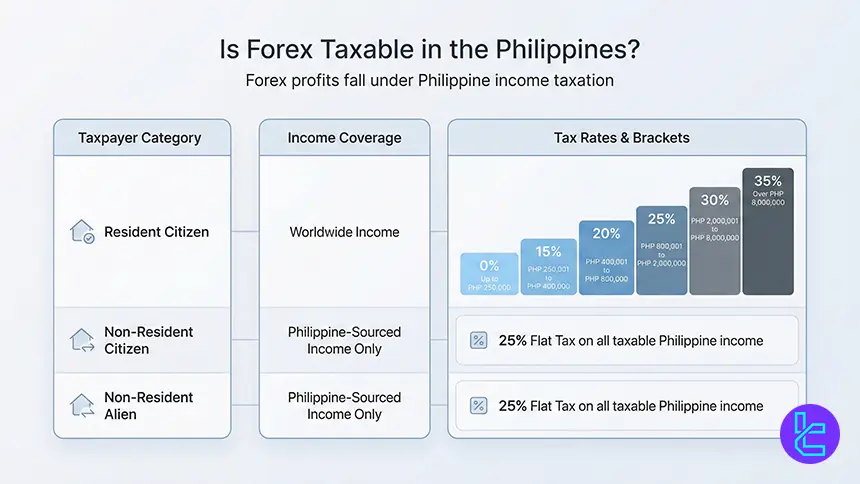

Is Forex Taxable in the Philippines?

Yes. The Bureau of Internal Revenue (BIR) classifies forex profits as ordinary income, taxable under the Philippine progressive tax system from 0% to 35%.

All worldwide income must be declared by Filipino citizens and residents, including profits from offshore forex brokers.

Taxpayer Category | Income Coverage | Tax Bracket or Rate | Income Range |

Resident Citizen | Worldwide Income | 0% | Up to PHP 250,000 |

Resident Citizen | Worldwide Income | 15% | Over PHP 250,000 up to PHP 400,000 |

Resident Citizen | Worldwide Income | 20% | Over PHP 400,000 up to PHP 800,000 |

Resident Citizen | Worldwide Income | 25% | Over PHP 800,000 up to PHP 2,000,000 |

Resident Citizen | Worldwide Income | 30% | Over PHP 2,000,000 up to PHP 8,000,000 |

Resident Citizen | Worldwide Income | 35% | Over PHP 8,000,000 |

Non-Resident Citizen | Philippine-Sourced Income Only | 25% Flat Rate | All taxable Philippine income |

Non-Resident Alien | Philippine-Sourced Income Only | 25% Flat Rate | All taxable Philippine income |

This tax framework reflects the Philippines’ progressive taxation system under the TRAIN Law, where resident citizens face increasing marginal rates based on total global income, while non-residents are subject to a simplified flat tax structure limited strictly to income generated within the Philippine jurisdiction.

Popular Forex & CFD Trading Platforms in the Philippines

The most widely used trading platforms among Filipino traders are MetaTrader 4, MetaTrader 5, cTrader, and TradingView. MT4 remains the dominant choice due to extensive indicators, automation tools, and broker compatibility.

These platforms integrate mobile trading, algorithmic execution, VPS hosting, and copy trading connectivity for Philippine users.

Forex Trading Hours in the Philippines

The Forex market operates continuously from Monday 5:00 AM until Saturday 4:00 AM Philippine Time (PHT), covering all major global trading sessions.

This structure allows Filipino traders to access the market almost 24 hours per day, making Forex one of the most flexible financial markets available locally.

The most liquid and volatile period for Philippine traders occurs during the London–New York session overlap from 8:00 PM to 12:00 AM PHT, when trading volume peaks and spreads tighten. Traders focusing on Asian currencies may prefer the Tokyo session from 8:00 AM to 5:00 PM PHT.

Key Trading Sessions (PHT)

- Sydney Session: 5:00 AM - 2:00 PM

- Tokyo Session: 8:00 AM - 5:00 PM

- London Session: 3:00 PM - 12:00 AM

- New York Session: 8:00 PM - 5:00 AM

- Highest liquidity window: 8:00 PM - 12:00 AM

- Most active trading days: Wednesday and Thursday

What Trading Fees Should Philippines FX Traders Expect?

Forex trading costs in the Philippines consist of spreads, commissions, swap fees, and non-trading charges, all of which directly affect long-term profitability.

Competitive brokers typically offer raw spreads from 0.0–0.3 pips on major pairs with commissions between $3–$7 per lot, or commission-free accounts with spreads starting around 0.6–1.0 pips.

In addition to trading fees, traders should evaluate non-trading charges such as inactivity fees, deposit or withdrawal fees, and currency conversion costs. The best brokers serving Filipino traders maintain zero deposit fees, zero withdrawal fees, and minimal inactivity charges.

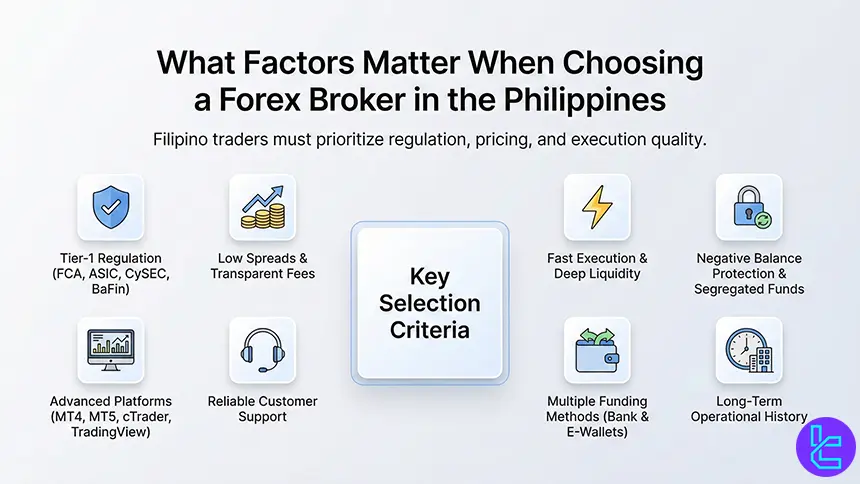

What Factors Are Important for Selecting the Best Forex Broker in the Philippines?

Choosing the right Forex broker is one of the most critical decisions for Filipino traders because no local regulator licenses retail Forex brokers.

As a result, traders must rely on international standards, focusing on regulatory strength, trading costs, execution quality, and long-term reliability to ensure capital protection and fair trading conditions.

A high-quality broker serving the Philippine market should combine top-tier regulation, strong technological infrastructure, transparent pricing, and convenient funding methods that support PHP users.

Key Selection Criteria

- Regulation by Tier-1 authorities such as FCA, ASIC, CySEC, BaFin

- Low spreads and transparent commission structure

- Fast order execution with deep liquidity access

- Negative balance protection and segregated client funds

- Strong platform offering such as MT4, MetaTrader 5, cTrader, TradingView

- Reliable customer support with fast response times

- Multiple funding methods, including local bank transfers and e-wallets

- Long-term operational history with a clean regulatory record

Helpful Links for Forex Traders in the Philippines

Access to accurate regulatory, monetary, and taxation information is essential for every Forex trader in the Philippines.

The following official institutions provide verified guidance on market regulations, foreign exchange policies, taxation rules, investor protection, and fraud reporting, enabling Filipino traders to operate with higher transparency, compliance, and long-term financial security.

- SEC Philippines: Primary authority overseeing securities markets, investor protection, company registration, and public advisories against investment fraud

- Bangko Sentral ng Pilipinas: Central bank regulating currency exchange, monetary policy, banking stability, and foreign exchange market operations

- Bureau of Internal Revenue: Government agency responsible for taxation, income reporting, compliance guidelines, and tax obligations for Filipino traders

- Philippine Stock Exchange: Official exchange platform for Philippine equities, market disclosures, listed companies, and short-selling regulations

- SEC Scam Reporting: Official portal for reporting investment scams, fraudulent brokers, and suspicious financial activities in the Philippines

Forex Trading in the Philippines vs Other Regions

Forex trading conditions in the Philippines differ significantly from other Southeast Asian markets such as Vietnam, Indonesia, and Thailand.

While Filipino traders rely primarily on international brokers and global regulators, neighboring countries apply varying domestic frameworks, leverage limits, and investor protection standards that directly affect trading risk, accessibility, and long-term profitability.

Comparison Factor | Philippines | |||

Primary Regulator | No local regulator | No dedicated Forex regulator; SBV oversees currency controls | BAPPEBTI | Bank of Thailand (BoT) & SEC Thailand |

Regulatory Framework | International regulators | No domestic retail Forex framework | Commodity & futures supervision with limited retail Forex standardization | National oversight; no dedicated retail Forex licensing |

Retail Leverage Cap Forex Majors | No fixed national cap | Not capped locally; broker-dependent | Up to 1:100 (locally); higher via offshore brokers | Not formally capped; broker-dependent |

Investor Protection Level | low | Low to moderate (broker-dependent) | Medium | Moderate |

Negative Balance Protection | Based on the broker’s license | Broker-dependent | Not mandatory | Broker-dependent |

Client Fund Segregation | Based on the broker’s license | Depends on broker regulation | Required by broker policy; varies by structure | Depends on broker regulation |

Broker Transparency Requirements | Market transparency under regulations | Market transparency under regulations | Regulatory disclosures under BAPPEBTI & OJK oversight | Market transparency under regulations |

Broker Availability | International brokers | Offshore international brokers | Predominantly international brokers | International offshore brokers |

Access to International Brokers | Yes | High | High global access | High |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Depends on broker policy and regulatory entity | Broker-dependent | Depends on broker policy | Broker-dependent |

Tax Treatment of Forex Profits | Variable up to 35% | Interpreted as personal income | Progressive income tax under DJP | Taxable as personal income |

Conclusion and Final Words

While SEC Philippines does not license local brokers, Filipino traders actively participate through internationally regulated platforms offering global market access, strong execution, and competitive trading conditions.

Independent evaluations covering regulation, pricing, platforms, trading costs, and client protection identify a core group of international brokers delivering spreads from 0.0 pips, access to more than 17,000 trading instruments, multi-platform support including MT4, and low non-trading fees.

“Final broker rankings are produced using the TradingFinder Forex methodology, a comprehensive evaluation framework that scores brokers across regulation strength, execution quality, trading costs, platform technology, liquidity depth, risk controls, funding efficiency, and long-term reliability.”