The Financial Services Agency of Japan (JFSA) is a tier-1 regulator in the Forex industry globally with stringent rules and a high level of scrutiny. However, there are only a handful of brokerages regulated by JFSA that are worth mentioning.

Here are the best choices for those interested in the financial authority.

| AvaTrade | |||

| IG | |||

| Interactive | |||

| 4 |  | FOREX.com | ||

| 5 |  | Moomoo |

Trustpilot Ratings and Reviews for JFSA Brokers

In the table below, you can see a ranking of mentioned brands based on given Trustpilot ratings.

Broker Name | Trustpilot Rating | Number of Reviews |

11,798 | ||

FOREX.com | 2,249 | |

IG | 8,668 | |

5,068 | ||

Moomoo | 239 |

Minimum Spread in JFSA-Regulated Brokers

This section ranks abovementioned brokerages according to the minimum spread across various accounts and instruments.

Broker Name | Min. Spread |

AvaTrade | 0 Pips |

0 Pips | |

Interactive Brokers | 0 Pips |

IG | 0.3 Pips |

Moomoo | Not Specified |

JFSA Brokers Non-Trading Costs

Brokerages charge clients for deposits, withdrawals, dormant accounts, and more. The table here demonstrates the non-trading fees for mentioned brands.

Broker Name | Deposit Fee | Withdrawal Fee | Inactivity Fee |

AvaTrade | $0 | $0 | $10 Monthly |

FOREX.com | $0 | $0 | $15 Monthly |

Interactive Brokers | $0 | One Free Withdrawal per Month | $0 |

Moomoo | $0 | $0 for Most Options | $0 |

$0 for Bank Transfers and Debit Cards | $0 | $18 Monthly |

Number of Tradable Instruments in JFSA Brokers

The table in this section demonstrates the number of tradable assets for each of the recommended brokerages. The list is ordered from the highest to the lowest number of instruments.

Broker Name | Number of Instruments |

IG | 17,000+ |

FOREX.com | 5,500+ |

Interactive Brokers | 4,900+ |

AvaTrade | 1,250+ |

Not Specified |

Top 4 JFSA Forex Brokers in Detail

Four of the top choices in the recommended brokers are briefly reviewed in more detail in the following sections.

AvaTrade

AvaTrade is a globally regulated Forex and CFD broker operating under9 financial licenses, including oversight from the Financial Services Agency of Japan. Its multi-entity structure reflects strong compliance across Europe, Asia-Pacific, the Middle East, and Africa.

Under its Japanese entity (Ava Trade Japan K.K.), AvaTrade follows JFSA rules, offering retail traders conservative leverage (up to 1:25), mandatory negative balance protection, and strict client fund segregation. Across entities, margin call and stop-out levels are set at 25% and 10%, respectively.

AvaTrade supports Retail, Professional, Islamic, and Demo accounts with a low $100 minimum deposit. Traders can access MetaTrader 4, MetaTrader 5, WebTrader, a proprietary Mobile App, and AvaOptions, covering Forex, indices, commodities, stocks, metals, and crypto CFDs.

Funding flexibility is another highlight. AvaTrade accepts credit/debit cards, bank wire transfers, Skrill, Neteller, WebMoney, and PayPal, with no deposit or withdrawal commissions charged by the broker. Customer support operates 24/5 via live chat, email, and phone, supporting multiple languages.

Specifics and Details

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, JFSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros & Cons

AvaTrade positions itself as a regulation-first broker with broad platform coverage and structured risk controls. The following pros and cons summarize how its regulatory depth, pricing model, and platform ecosystem compare with other JFSA-regulated Forex brokers. Check these out before going with AvaTrade registration.

Pros | Cons |

Regulated by JFSA and 8 other authorities worldwide | Inactivity fees apply after prolonged dormancy |

Strong risk controls (NBP, 25% margin call, 10% stop-out) | No PAMM or managed account solutions |

Wide platform selection incl. MT4, MT5, and AvaOptions | 24/5 support instead of 24/7 |

Multiple payment methods with no broker-side fees | Leverage tightly capped under JFSA rules |

Interactive Brokers

Interactive Brokers is a global electronic brokerage serving over 2.9 million client accounts across 150+ markets. Founded in 1977 by Thomas Peterffy, the firm provides direct access to Forex, stocks, ETFs, options, futures, bonds, and more through its proprietary trading ecosystem.

Headquartered in Greenwich, Connecticut, Interactive Brokers operates in 34 countries, supports 27 base currencies, and connects traders to 90+ global exchanges. Its scale and infrastructure make it a preferred choice for active traders seeking institutional-grade execution and broad market reach.

From a regulatory standpoint, Interactive Brokers maintains oversight from multiple tier-1 authorities, including the SEC, FINRA, FCA, and regional regulators such as JFSA in Japan. Retail client protections vary by entity, with safeguards like segregated funds and negative balance protection applied where mandated.

The broker’s technology stack is centered on Trader Workstation (TWS), complemented by IBKR Mobile, Client Portal, and API access for algorithmic trading. With 100+ forex pairs, ultra-tight spreads, and transparent pricing, IBKR emphasizes execution quality over promotional incentives. Here’s a table of specifics.

Account Types | Individual, Joint, Trust, Retirement, Institutional, Non-Professional Advisor |

Regulating Authorities | SEC, FINRA, NYSE, FCA, etc. |

Minimum Deposit | $1 |

Deposit Methods | Bank Transfer, Check |

Withdrawal Methods | Bank Transfer, Check |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Proprietary |

Interactive Brokers Pros & Cons

Before going through with the Interactive registration procedure, below is a balanced overview of its key advantages and limitations, helping traders assess whether IBKR aligns with their trading objectives.

Pros | Cons |

Access to 150+ markets and 90+ global exchanges | Limited deposit & withdrawal methods |

Strong multi-tier regulatory oversight (SEC, FCA, JFSA, etc.) | Platform complexity for beginners |

Tight spreads and competitive commissions | No bonuses or promotional programs |

Advanced platforms (TWS, APIs, mobile) | No copy trading or PAMM accounts |

IG

Founded in 1974 in London, IG is one of the longest-standing online brokers worldwide. As a FTSE 250 constituent, the group serves over 381,000 clients across 17 countries, reflecting decades of operational scale, financial transparency, and institutional credibility.

IG provides access to more than 17,000 tradable instruments, including Forex, indices, shares, commodities, bonds, ETFs, IPOs, and crypto CFDs. Features such as 24-hour index trading and extended US share hours position IG as a multi-asset broker designed for both active and long-term traders.

From a regulatory standpoint, IG operates under a multi-jurisdictional Tier-1 framework, including oversight by the Japan Financial Services Agency, FCA, ASIC, MAS, and AMF. This structure ensures localized compliance, strict capital controls, and region-specific investor protections.

For Japanese clients, IG Securities Ltd is regulated by the JFSA, applying conservative leverage limits and robust conduct standards. Combined with segregated client funds and advanced risk controls, IG maintains a strong safety profile within the Japanese regulatory environment.

Note that for a full access to the broker’s features, you must pass the IG verification process.

Table of Specifics

Account Types | CFD |

Regulating Authorities | ASIC, FCA, JFSA, AMF, FMA, MAS, DFSA, FSCA |

Minimum Deposit | Unlimited |

Deposit Methods | Bank Transfer, Credit/Debit Cards |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards |

Maximum Leverage | 1:200 |

Trading Platforms & Apps | MT4, TradingView, L2 Dealer, ProRealTime, Proprietary Platform |

IG Pros & Cons

IG stands out for its regulatory depth, extensive market coverage, and professional-grade platforms. Below is a concise summary of the broker’s main advantages and limitations, helping traders assess its suitability before opening an account through IG registration.

Pros | Cons |

Regulated by multiple Tier-1 authorities including JFSA | No Islamic (swap-free) account |

17,000+ instruments across global markets | Limited cryptocurrency CFD selection |

Advanced platforms (MT4, TradingView, ProRealTime) | No copy-trading or PAMM services |

Strong financial transparency as a FTSE 250 company | Support not available 24/7 |

FOREX.com

FOREX.com is a globally recognized forex and CFD broker serving 1M+ clients with access to 1,000+ instruments. Awarded Most Competitive Broker at the Global Forex Awards 2023, it delivers ultra-fast execution averaging 0.02 seconds across major markets.

Launched in 2001 in New Jersey, the broker expanded into the UK and Japan before joining StoneX Group Inc. in 2020. StoneX reported $19.68B in total assets and $277M pre-tax income (2022), reinforcing FOREX.com’s balance-sheet strength.

FOREX.com operates under multiple tier-1 regulators, including the Financial Services Agency (JFSA) for Japan-based clients. This multi-entity structure ensures region-specific protections, segregated funds, and transparent conduct aligned with local rules.

Traders can access Forex, indices, shares CFDs, commodities, gold, and crypto CFDs via MetaTrader 5, TradingView integration, and a proprietary web platform. Account options (Standard, Raw Spread, MetaTrader) start from a $100 minimum deposit, balancing accessibility with professional tools.

Specifics and Details

Account Types | Standard, Raw Spread, MetaTrader |

Regulating Authorities | CFTC, SEC, FCA, ASIC, MAS, CIRO, FSA, CySEC |

Minimum Deposit | $100 |

Deposit Methods | Local Transfer, Credit/Debit Cards, Wire Transfer, Neteller, Skrill |

Withdrawal Methods | Credit/Debit Cards, Wire Transfer |

Maximum Leverage | 1:50 |

Trading Platforms & Apps | MT5, TradingView, Proprietary Platform |

FOREX.com Pros and Cons

Overall, FOREX.com combines institutional backing, broad regulation, and deep market access. The following pros and cons highlight where the broker excels, and where traders should weigh trade-offs.

Pros | Cons |

Strong multi-jurisdiction regulation incl. JFSA | Higher spreads than some low-cost ECN brokers |

Backed by StoneX Group’s financial strength | Inactivity fees after prolonged dormancy |

Fast execution (~0.02s) and robust platforms | Geo-restrictions by entity/region |

Broad market coverage and TradingView support | No PAMM/managed account offering |

How Was Each JFSA Broker Chosen?

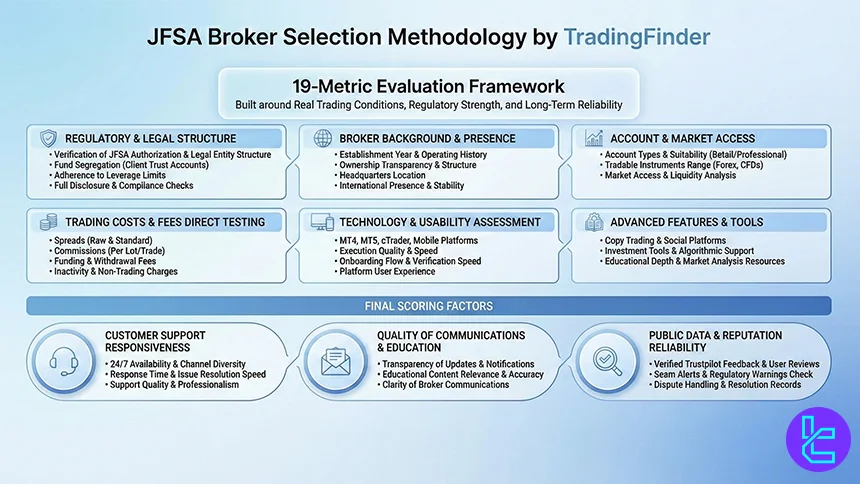

Choosing the Best JFSA-Regulated Forex Brokers requires far more than comparing spreads or leverage limits. At TradingFinder, every broker is assessed using a 19-metric review methodology designed to reflect real trading conditions, regulatory strength, and long-term reliability, especially under the supervision of the Financial Services Agency of Japan (JFSA).

Regulation and licensing form the foundation of our analysis. We verify each broker’s JFSA authorization, legal entity structure, client-fund segregation practices, and compliance with Japan’s strict risk-control rules, including leverage caps and disclosure obligations.

Broker background data, such as year of establishment, headquarters, ownership, and global office presence, is reviewed to assess operational stability and transparency.

Account structure and market access are then examined in depth. Our analysts evaluate the variety of account types (standard, ECN, micro, PAMM, or investment accounts), supported instruments (forex pairs, CFDs, stocks, ETFs, and derivatives), and the overall suitability for different trading styles.

Trading costs are tested directly, covering spreads, commissions, deposit and withdrawal fees, and inactivity charges that directly affect net performance.

Technology and usability are equally important. We assess platform availability, including MetaTrader 4, MetaTrader 5, cTrader, and mobile apps, execution quality, order handling, and the full account-opening and verification process. Features such as copy trading, investment tools, and educational resources are reviewed for depth, transparency, and real value.

Finally, qualitative factors complete the evaluation. Customer support responsiveness, broker communication quality, updates, infographics, verified Trustpilot feedback, scam alerts, and dispute handling are all factored into the final score.

This structured, data-driven approach ensures that every JFSA-regulated broker listed meets both regulatory and trader-focused standards, not just marketing claims.

What is the JFSA?

The Financial Services Agency of Japan (JFSA) is Japan’s primary financial regulatory authority, responsible for supervising banks, securities firms, insurance companies, and forex brokers operating in the country.

Established in 2000, the JFSA operates under the oversight of Japan’s Cabinet Office and plays a central role in maintaining the stability, transparency, and integrity of the Japanese financial system.

In the forex market, the JFSA is widely recognized as a top-tier regulator due to its strict supervisory framework. Forex brokers regulated by the JFSA must comply with rigorous rules covering capital adequacy, client fund segregation, risk disclosure, and operational transparency.

One of its most distinctive features is the enforcement of tight leverage limits, currently capped at 1:25 for retail forex traders, to reduce excessive risk exposure.

The JFSA also conducts continuous monitoring through on-site inspections, periodic reporting, and enforcement actions when violations occur. Brokers failing to meet regulatory standards may face fines, business restrictions, or license revocation.

As a result, JFSA regulation is often associated with a high level of investor protection, making it a key benchmark for safety and compliance in the global forex industry.

The Pros and Cons of JFSA for Forex Brokers

Regulation by the JFSA places forex brokers under one of the world’s most stringent supervisory frameworks. While this enhances transparency, capital protection, and market integrity, it also introduces operational constraints.

Strict leverage caps, intensive reporting, and high compliance costs can limit flexibility for brokers compared with offshore or lighter-regulated jurisdictions.

Pros | Cons |

Tier-1 regulatory oversight with strong enforcement powers | Low retail leverage cap (1:25) reduces trading flexibility |

Mandatory client fund segregation and capital adequacy rules | High compliance and operational costs for brokers |

Continuous monitoring, audits, and on-site inspections | Limited promotional tools and incentives |

High investor trust and domestic market credibility | Slower product innovation due to strict approvals |

What Rules Must JFSA-Regulated Brokers Adhere to?

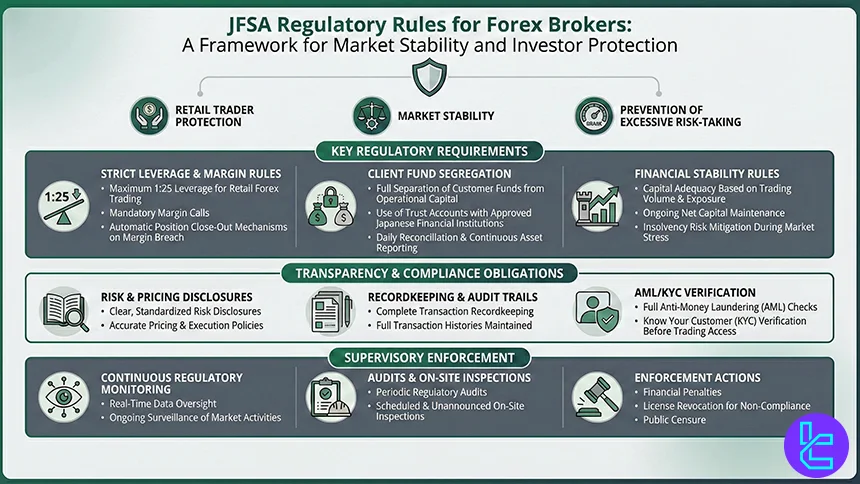

Forex brokers regulated by the JFSA must comply with one of the most comprehensive regulatory frameworks in the global forex industry. These rules are designed to protect retail traders, maintain market stability, and prevent excessive risk-taking.

A core requirement is strict leverage control. JFSA enforces a maximum leverage of 1:25 for retail forex trading, significantly lower than many international regulators, to limit losses during high volatility. Brokers must also apply standardized margin rules and automatic position close-out mechanisms when margin levels fall below regulatory thresholds.

Client fund segregation is mandatory. Brokers are required to keep customer funds fully separated from operational capital, typically held in trust accounts with designated financial institutions in Japan. Daily reconciliation and regular reporting ensure that client assets remain protected at all times.

The JFSA also imposes capital adequacy requirements, obligating brokers to maintain sufficient net capital based on their business volume and client exposure. This reduces insolvency risk and ensures brokers can meet financial obligations during market stress.

In addition, brokers must comply with strict disclosure and transparency rules, including clear risk warnings, accurate pricing information, execution policies, and detailed transaction records. AML and KYC procedures are rigorously enforced, requiring full identity verification before trading.

Ongoing supervision is a defining feature. JFSA-regulated brokers are subject to periodic audits, on-site inspections, and enforcement actions, including fines or license revocation for non-compliance, making JFSA oversight one of the toughest standards in forex regulation worldwide.

Are JFSA-Regulated Forex Brokers Limited in Leverage Offering?

Yes. Forex brokers regulated by the Financial Services Agency of Japan are subject to some of the strictest leverage limits in the global forex industry. Under Japan’s Financial Instruments and Exchange Act, retail forex leverage is capped at 1:25 across all currency pairs, with no flexibility based on account size, trading experience, or client classification.

This leverage restriction is enforced alongside mandatory margin rules and automatic position close-out mechanisms, which require brokers to liquidate positions when margin levels fall below regulatory thresholds.

These measures are designed to prevent excessive losses and reduce the likelihood of negative account balances during periods of high market volatility. Unlike offshore jurisdictions, JFSA regulation does not permit promotional leverage increases or bonus-driven trading incentives.

The conservative leverage framework reflects the JFSA’s broader regulatory philosophy, which prioritizes risk prevention over post-loss compensation. By limiting leverage at the regulatory level, the JFSA minimizes systemic risk and promotes disciplined trading behavior.

For traders, this means lower exposure to sudden market shocks but higher capital requirements. For brokers, it results in a tightly controlled operating environment focused on stability, transparency, and long-term market integrity rather than aggressive growth through high-risk leverage offerings.

What Are JFSA’s Responsibilities?

The Financial Services Agency of Japan is responsible for maintaining the stability, transparency, and integrity of Japan’s financial system across banking, securities, insurance, and forex markets. Operating under the Cabinet Office, the JFSA designs and enforces regulatory policies that protect consumers while ensuring orderly market functioning.

A core responsibility of the JFSA is licensing and supervision. It authorizes financial institutions, including forex brokers, as Financial Instruments Business Operators and continuously monitors their compliance through reporting requirements, audits, and on-site inspections.

This supervision extends to capital adequacy, client fund segregation, risk management, and internal controls.

The JFSA is also tasked with market conduct oversight. It enforces strict rules on disclosure, pricing transparency, advertising, and sales practices to prevent misleading information and unfair treatment of retail investors.

In addition, the agency plays a central role in risk management and systemic stability, implementing measures such as leverage limits and margin rules to reduce excessive speculation and protect the broader financial system.

Another key responsibility is enforcement and corrective action. The JFSA has the authority to issue administrative orders, impose fines, suspend business activities, or revoke licenses when violations occur.

Through these responsibilities, the JFSA functions as one of the world’s most conservative and effective financial regulators, emphasizing prevention, discipline, and long-term market confidence.

What Powers Does JFSA Have?

The JFSA holds extensive statutory powers that allow it to regulate, supervise, and enforce compliance across Japan’s financial markets, including forex brokerage activities. These powers are granted primarily under the Financial Instruments and ExchangeAct (FIEA) and related financial laws.

One of the JFSA’s key powers is licensing authority. It can approve, restrict, or deny applications for Financial Instruments Business Operators and define the scope of activities brokers are legally permitted to offer.

Once licensed, firms remain under continuous supervision, as the JFSA has the power to demand detailed regulatory reporting, financial statements, and risk-exposure data at regular intervals.

The JFSA also possesses strong inspection and investigation powers. It can conduct on-site inspections, examine internal systems and records, and require explanations from management and compliance officers.

When violations are identified, the agency can issue administrative orders, mandate corrective actions, impose financial penalties, suspend part or all of a firm’s operations, or revoke licenses in severe cases.

In addition, the JFSA has authority over market conduct and consumer protection, enabling it to prohibit misleading advertising, restrict high-risk products, enforce leverage and margin rules, and publish public warnings against unlicensed or illegal operators.

Collectively, these powers allow the JFSA to act proactively and decisively, reinforcing its reputation as one of the most stringent and enforcement-driven financial regulators in the global forex industry.

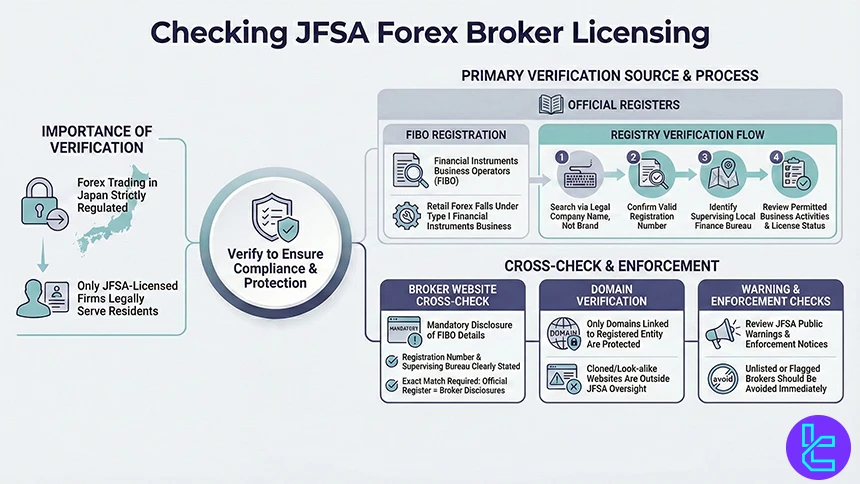

How Can I Check if a Broker Is Licensed by JFSA?

Verifying whether a forex broker is licensed by the Financial Services Agency of Japan is a critical step before opening an account, as Japan strictly controls who can legally offer forex trading services to residents.

The most reliable method is to check the official JFSA and Local Finance Bureau registers. In Japan, licensed forex brokers are supervised through regional Local Finance Bureaus under the JFSA. Each authorized firm must be registered as a Financial Instruments Business Operator (FIBO), typically under Type I Financial Instruments Business.

Start by visiting the official JFSA website or the relevant Local Finance Bureau registry and search for the broker’s legal company name (not just the brand name). A legitimate entry will display the registration number, supervising bureau, permitted business activities, and current license status.

Next, cross-check the broker’s website disclosures. JFSA-regulated brokers are legally required to display their registration details, including the FIBO registration number and supervising Local Finance Bureau, in the website footer or legal documents. The company name and registration number must exactly match the official registry.

It is also important to verify the trading domain. Some fraudulent operations misuse the name of licensed Japanese firms while operating unregistered websites. Only domains explicitly associated with the registered entity fall under JFSA protection.

Finally, review JFSA warning lists and enforcement notices. The JFSA regularly publishes alerts about unlicensed or illegal forex operators targeting Japanese residents. If a broker is not listed in the official register, or appears in a warning, it should be avoided immediately.

Do JFSA Brokers Offer Crypto Trading Services?

Yes, but only within a highly regulated and clearly segmented framework. Under the Financial Services Agency, crypto-related activities are separated into spot crypto trading and crypto derivatives, each governed by different legal regimes and licensing requirements.

Spot cryptocurrency trading (buying, selling, or custody of assets like Bitcoin or Ethereum) is regulated under Japan’s Payment Services Act (PSA). Firms offering spot crypto services must register as Crypto-Asset Exchange Service Providers (CAESPs), meet strict custody, cybersecurity, and segregation rules, and maintain reserves.

Traditional forex brokers regulated only under the Financial Instruments and Exchange Act (FIEA) cannot offer spot crypto unless they hold this additional registration.

Crypto derivatives, such as margin trading on crypto prices, fall under the FIEA. Brokers wishing to offer these products must obtain the appropriate Type I Financial Instruments Business authorization and comply with Japan’s stringent risk controls.

Notably, the JFSA enforces a maximum leverage cap of 2:1 on crypto derivatives, one of the lowest globally, along with enhanced disclosures and suitability checks.

In practice, many JFSA-regulated forex brokers either do not offer crypto products at all or limit access to tightly controlled crypto derivatives due to the compliance burden and low leverage. Traders in Japan typically access spot crypto through specialized, JFSA-registered exchanges, while crypto derivatives, where available, are offered under strict conditions.

Does JFSA Enforce Tax Obligations?

No. The Financial Services Agency of Japan does not enforce tax obligations on traders or forex brokers. Taxation in Japan falls under the authority of the National Tax Agency (NTA), which is responsible for tax assessment, collection, and compliance.

The JFSA’s role is limited to financial supervision and market regulation, licensing brokers, enforcing leverage and margin rules, ensuring client fund segregation, and overseeing conduct and disclosure. It does not calculate taxes, set tax rates, or audit individual trading profits.

For individuals trading forex in Japan, profits are generally classified as miscellaneous income under Japanese tax law and are subject to progressive income tax rates plus local inhabitant tax, depending on total annual income.

Brokers may provide transaction statements and records, but the responsibility to declare and pay taxes rests with the trader, not the broker or the JFSA.

In short, while JFSA regulation ensures a compliant and transparent trading environment, tax compliance is administered separately by the National Tax Agency, and traders must follow NTA rules when reporting forex-related income.

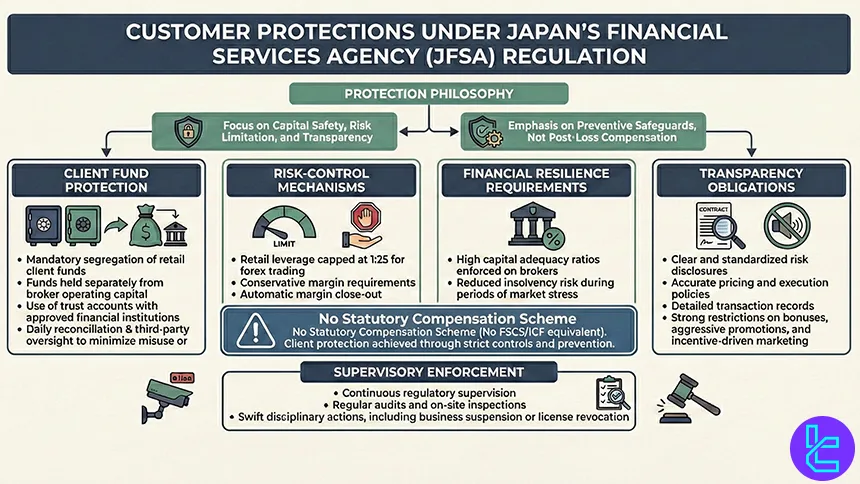

Are Any Customer Protections Offered by the JFSA?

The Financial Services Agency of Japan enforces one of the most robust customer-protection frameworks in the global forex industry, with a strong emphasis on capital safety, risk limitation, and transparency.

A cornerstone of JFSA protection is strict client fund segregation. JFSA-regulated forex brokers must hold retail client funds separately from company operating capital, typically in trust accounts with approved financial institutions.

Daily reconciliation and third-party oversight are required, significantly reducing misuse or shortfall risk.

Unlike many Western regulators, Japan does not rely on a statutory compensation scheme (such as FSCS or ICF). Instead, protection is preventive. The JFSA prioritizes low leverage limits (1:25 for retail FX), conservative margin rules, and mandatory automatic margin close-out mechanisms, limiting the likelihood of catastrophic losses.

Negative balance risk is effectively mitigated through strict margin controls and real-time monitoring, making extreme account deficits rare in practice. Brokers must also maintain high capital adequacy ratios, ensuring financial resilience even during periods of market stress.

Transparency is another key pillar. JFSA-regulated brokers are required to provide clear risk disclosures, accurate pricing, execution policies, and detailed transaction records. Misleading marketing, aggressive promotions, and bonus-driven trading incentives are heavily restricted.

Finally, the JFSA actively protects clients through continuous supervision and enforcement. Regular audits, on-site inspections, and swift disciplinary actions, including business suspension or license revocation, create a high-trust environment.

How Does JFSA Differ from Offshore Regulatory Authorities?

The regulatory gap between the Financial Services Agency of Japan (JFSA) and offshore authorities is substantial, particularly in terms of investor protection, enforcement strength, and risk control. JFSA is widely regarded as a top-tier (Tier-1) regulator, while most offshore regulators operate under lighter supervisory frameworks. Here are the key differences between JFSA and offshore regulators:

Regulatory Strength & Oversight:

- JFSA: Continuous supervision, on-site inspections, mandatory reporting, and strong enforcement powers

- Offshore regulators: Limited ongoing supervision and infrequent audits

Leverage & Risk Controls:

- JFSA: Strict retail leverage cap (1:25 for forex, 2:1 for crypto derivatives), standardized margin rules, automatic close-outs

- Offshore regulators: High leverage allowances (often 1:500 or higher) with minimal risk controls

Client Fund Protection:

- JFSA: Mandatory segregation of client funds, daily reconciliation, and trust account requirements

- Offshore regulators: Segregation rules may be weak, loosely enforced, or absent

Market Conduct & Transparency:

- JFSA: Tight restrictions on bonuses, promotions, and marketing; clear risk disclosures required

- Offshore regulators: Aggressive promotions, trading bonuses, and vague disclosures are common

Legal Accountability & Enforcement:

- JFSA: Clear legal recourse within Japan, with fines, business suspensions, and license revocation

- Offshore regulators: Limited legal remedies; enforcement actions are rare or slow

Target Audience:

- JFSA: Designed primarily for domestic market protection and long-term stability

- Offshore regulators: Often structured to attract international brokers seeking operational flexibility

JFSA in Comparison to Other Regulating Authorities

Japan’s Financial Services Agency applies one of the most conservative regulatory frameworks among major forex regulators, prioritizing systemic stability, strict leverage control, and intensive supervision.

When compared with European and Australian counterparts such as the FCA, BaFin, and ASIC, the JFSA stands out for its low retail risk tolerance and intrusive monitoring model.

The table below highlights how JFSA regulation differs in capital requirements, leverage limits, investor protection mechanisms, and supervisory intensity relative to other well-known authorities.

Parameter | JFSA (Japan) | FCA (UK) | ASIC (Australia) | BaFin (Germany) |

Minimum Capital Requirement | Risk-based; tied to net capital, open exposure, and business scale | £125,000–£730,000+ depending on authorization | No fixed public minimum; capital adequacy assessed case-by-case | €730,000+ under EU investment firm rules |

Client Fund Segregation | Required under strict trust-account rules | Required | Required | Required |

Compensation Scheme | No statutory compensation fund | FSCS up to ~£85,000 | No statutory compensation fund | EdW scheme up to €20,000 |

Leverage Limits (Retail) | Strict cap around 1:25 | Max ~1:30 on major FX pairs | Max ~1:30 under product intervention | Max ~1:30 under ESMA rules |

Negative Balance Protection | Required | Required | Common but not statutory | Required |

Reporting & Supervision | Very frequent reporting and on-site monitoring | Ongoing regulatory reporting | Regular compliance reporting | Continuous supervision and audits |

Conclusion

The Financial Services Agency of Japan is a top-tier financial regulator with a 1:25 limitation on leverage and no investment compensation schemes. There are not many well-known brokerages operating under this financial authority, but AvaTrade, Interactive Brokers, IG, and FOREX.com are some of the best suggestions for average traders.

To learn more details about the way we chose each broker, check out our Forex methodology article.