Raw spread brokers are among the best available options for Scalpers, Intraday traders, and HFT traders who prefer low spreads (from 0.0 pips) to execute their fast-paced strategies.

These brokers often charge a set commission for 1 standard lot to connect traders orders straight to the interbank liquidity network.

| fpmarkets | |||

| eightcap | |||

| pepperstone | |||

| 4 |  | vantage | ||

| 5 |  | BlackBull Markets | ||

| 6 |  | GLOBAL PRIME | ||

| 7 |  | FUSION MARKETS | ||

| 8 |  | HFM | ||

| 9 |  | TICKMILL | ||

| 10 |  | ACTIVTRADES |

Trustpilot Ratings of Raw Spread Forex Brokers

The table below shows how trustworthy the best raw spread brokers are in the eyes of their customers.

Broker | Trustpilot Rating | Number of Reviews |

FP Markets | 4.8/5 ⭐ | 9500+ |

4.8/5 ⭐ | 3000+ | |

4.7/5 ⭐ | 6000+ | |

Global Prime | 4.6/5 ⭐ | 400+ |

HFM | 4.6/5 ⭐ | 3000+ |

Vantage | 4.4/5 ⭐ | 11500+ |

Pepperstone | 4.2/5 ⭐ | 3000+ |

EightCap | 4.0/5 ⭐ | 3000+ |

ActivTrades | 3.8/5 ⭐ | 1000+ |

3.5/5 ⭐ | 1000+ |

Minimum Spreads of Forex Brokers

When trading with fast execution trading strategies, traders must choose a Forex broker that offers low spreads on various accounts allowing them to set the stop-loss at very close levels. Here are the minimum spreads of the best zero-spread Forex brokers.

Brokers | Minimum Spreads |

VT Markets | 0.0 Pips |

CMC Markets | 0.0 Pips |

0.0 Pips | |

Pepperstone | 0.0 Pips |

XM Group | 0.0 Pips |

FP Markets | 0.0 Pips |

IC Markets | 0.1 Pips |

Admirals | 0.5 Pips |

0.5 Pips | |

Forex.com | 1.0 Pips |

Account Types and Leverage in Raw Spread Forex Brokers

Having access to various account types and high leverage is a key factor when choosing a Forex brokerage. Traders must consider them before opening an account in a raw spread broker.

Broker | Account Types | Maximum Leverage |

Alpari | Standard, ECN, Micro, Pro ECN | 1:3000 |

Cent, Zero, Pro, Premium | 1:2000 | |

OctaFX | MT4, MT5, OctaTrader | 1:1000 |

XM Group | Ultra-low, Zero | 1:1000 |

Admirals | Zero, Invest, Trade | 1:1000 |

Tickmill | Classic, Raw | 1:1000 |

Windsor | Prime, Zero, VIP | 1:500 |

Standard, Raw | 1:500 | |

Eightcap | Standard, Raw, TradingView | 1:500 |

Standard, Raw | 1:200 |

Number of Tradable Instruments in Raw Spread Forex Brokers Regulated by ASIC

Having access to a wide range of instruments allows traders to diversify their trading capital and minimize risk in raw spread Forex brokers.

Broker | Number of Tradable Assets |

FxPro | 2100+ |

1400+ | |

FXTM | 1000+ |

Pu Prime | 1000+ |

Moneta Markets | 1000+ |

Vantage | 1000+ |

800+ | |

OctaFX | 300+ |

Fusion Markets | 250+ |

FXGlory | 50+ |

Top 8 Raw Spread Forex Brokers

The following sections is dedicated to have overview of the best Forex brokers with raw spreads which allows traders to compare them for themselves and choose the best one based on their preferences.

EightCap

Eightcap is a Forex and CFD broker established in 2009 in Melbourne, providing access to multiple tradable markets such as Forex, commodities, metals, cryptocurrencies, indices, and share CFDs.

The broker offers leveraged trading with ratios of up to 1:500, depending on the regulatory entity under which the trading account is registered. Its trading environment is built around three main account types: Standard, Raw, and TradingView.

The Standard account features spreads starting from 1.0 pip with no commission applied to most instruments, while the Raw account provides spreads from 0.0 pips alongside a fixed commission per lot.

Traders can lower costs of trading with this Forex broker by using the Eightcap rebate program provided by TradingFinder IB.

All live accounts require a minimum deposit of $100 after finalizing the Eightcap registration and operate using a market execution model, with margin call and stop-out levels typically set at 80% and 50%.

From a regulatory perspective, Eightcap operates under multiple licensed entities authorized by ASIC, FCA, CySEC, and SCB.

Client protection mechanisms such as segregated funds and negative balance protection are implemented across these jurisdictions, with eligibility for regional compensation schemes varying based on the registered entity.

Platform support includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView, enabling access to over 800 CFD instruments.

Additional integrations such as Capitalise.ai, FlashTrader, and an AI-based economic calendar provide tools for automation, macroeconomic event tracking, and trade-level execution management within a multi-asset trading environment.

Account Types | Standard, Raw, TradingView, Demo |

Regulating Authorities | ASIC, FCA, CySEC, SCB |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfer, Credit/Debit Cards (Visa, Mastercard), PayPal, Skrill, Neteller, Cryptocurrencies (BTC, ETH, USDT), Online Payment Systems |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, Cryptocurrencies |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView |

Eightcap Pros and Cons

Traders must know the following benefits and drawbacks of trading with Eightcap before opening an account.

Pros | Cons |

Regulation by multiple authorities including ASIC, FCA, CySEC, and SCB | Crypto CFDs are not accessible to UK retail traders due to regulatory restrictions |

Support for MetaTrader 4, MetaTrader 5, and TradingView platforms | No passive investment options such as copy trading or PAMM accounts |

Competitive spreads on Raw account with market execution | Educational resources lack advanced structuring such as level-based learning paths |

Access to trading tools like Capitalise.ai and FlashTrader | - |

ActivTrades

ActivTrades is a London-based Forex and CFD broker that has been operating in the financial markets since 2001, offering trading services to users across more than 170 countries.

The company provides access to a multi-asset environment that includes Forex, shares, indices, commodities, ETFs, bonds, and, in certain jurisdictions, cryptocurrency CFDs through a unified account structure.

The broker operates under several regulatory entities, including FCA, SCB, CMVM, BACEN, CVM, and FSC, with client protection measures such as segregated funds and negative balance protection applied across supported regions.

Eligible clients under specific jurisdictions may also benefit from compensation schemes such as FSCS coverage, with additional insurance policies extending protection up to £1,000,000 per client.

ActivTrades supports a range of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), ActivTrader, and TradingView.

Its proprietary ActivTrader platform incorporates TradingView-powered charting and features such as Progressive Trailing Stops, one-click execution, and real-time market monitoring.

Across platforms, traders can utilize over 100 technical indicators, multiple chart types, and automated trading through Expert Advisors (EAs).

Trading conditions after finalizing ActivTrades registration include floating spreads from 0.5 pips, a minimum trade size of 0.01 lots, and leverage of up to 1:30 for retail clients or up to 1:400 for professional accounts.

ActivTrades follows a No Dealing Desk (NDD) execution model and does not provide copy trading, PAMM accounts, or social trading services, maintaining a structure focused on self-directed trading strategies within a regulated CFD framework.

Account Types | Professional, Individual, Demo, Islamic |

Regulating Authorities | FCA, SCB, CMVM, BACEN, CVM, FSC |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Visa, Mastercard, Skrill, Neteller, PayPal, BitPay (regional) |

Withdrawal Methods | Bank Wire, Visa, Mastercard, Skrill, Neteller, PayPal |

Maximum Leverage | Up to 1:400 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), ActivTrader, TradingView |

Pros and Cons of ActivTrades

Here are the advantages and disadvantages of trading with the ActivTrades broker.

Pros | Cons |

Regulated by multiple authorities (FCA, CMVM, SCB, BACEN, CVM, FSC) | Cryptocurrency CFDs are not available under FCA-regulated accounts |

No minimum deposit requirement (except Brazil & China) | Copy trading, social trading, and PAMM services are not supported |

Access to MT4, MT5, ActivTrader, and TradingView | Certain countries (e.g., USA, Iran, Japan) are restricted from opening accounts |

Negative balance protection and segregated client funds | A €10 monthly inactivity fee applies after 12 months of no trading activity |

Pepperstone

Pepperstone is a Melbourne-based Forex and CFD broker established in 2010, providing trading services to more than 400,000 clients worldwide.

The company reports an average daily trading volume exceeding $9.2 billion and supports account funding in 10 base currencies, including USD, EUR, GBP, AUD, JPY, CAD, CHF, NZD, SGD, and HKD.

The broker operates under multiple regulatory entities, including ASIC, FCA, CySEC, DFSA, CMA, BaFin, and SCB, implementing client fund segregation and negative balance protection across supported jurisdictions.

Maximum leverage varies by regulatory framework, reaching up to 1:500 in certain offshore entities, while retail leverage in tier-1 regulated regions is typically limited to 1:30.

After completing Pepperstone registration, two primary account types are accessible including Standard and Razor; both allowing order sizes from 0.01 to 100 lots and supporting trading strategies such as scalping, hedging, and Expert Advisors (EAs).

The Razor account features spreads from 0.0 pips with a commission-based pricing model, whereas the Standard account integrates trading costs within the spread. Traders can lower costs on both account types by leveraging Pepperstone rebates.

Platform availability includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and the broker’s proprietary web and mobile interface.

Traders can access over 1,200 CFD instruments across Forex, commodities, indices, cryptocurrencies, shares, and ETFs. Copy trading functionality is available through third-party integrations such as DupliTrade, MetaTrader Signals, and Signal Start.

Pepperstone does not apply inactivity or account maintenance fees and provides 24/7 client support through email, live chat, and phone channels.

Account Types | ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB |

Regulating Authorities | $1 |

Minimum Deposit | Apple Pay, Google Pay, Visa, Mastercard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Deposit Methods | Apple Pay, Google Pay, Visa, mastercard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, USDT, ZotaPay |

Withdrawal Methods | Up to 1:500 (entity dependent) |

Maximum Leverage | MetaTrader 4, MetaTrader 5, cTrader, TradingView, Pepperstone proprietary platform |

Trading Platforms & Apps | ASIC, FCA, CySEC, BaFin, DFSA, CMA, SCB |

Pepperstone Pros and Cons

The table below outlines the benefits and drawbacks of trading with the Pepperstone broker.

Pros | Cons |

Broad regulation coverage across ASIC, FCA, CySEC, BaFin, DFSA, CMA, and SCB | Leverage is materially restricted under FCA, CySEC, and BaFin entities, commonly capped at 1:30 for retail clients |

Platform choice includes MT4, MT5, cTrader, TradingView, and a proprietary platform | No PAMM account offering for managed allocation style investing |

Wide market coverage across Forex, indices, commodities, shares, crypto CFDs, and ETFs | Service availability is country dependent, with restrictions reported for regions such as the United States, Canada, Iran, and Japan |

Copy trading access via services like Signal Start, DupliTrade, and MetaTrader Signals | - |

Vantage

Vantage Markets is an online brokerage founded in 2009 with headquarters in Sydney and an operational footprint that includes more than 30 offices.

Public-facing review signals include a 4.3/5 rating on Google, while the broker positions itself as a multi-asset venue offering Forex and CFDs across indices, commodities, stocks, and selected cryptocurrency products, depending on jurisdiction.

Regulatory coverage is structured through several entities, with licenses tied to ASIC and FCA for tier-1 oversight, alongside FSCA, VFSC, and CIMA for additional regional frameworks.

Core protection features referenced across branches include segregated client funds and negative balance protection, although availability can differ by entity; for example, negative balance protection is not listed for the Cayman-based arm.

Leverage is also entity-dependent, ranging from 1:30 under certain tier-1 setups to up to 1:1000 through offshore or regional entities.

Account access after completing the Vantage registration process is organized around Standard STP, Standard Cent, Raw ECN, Pro ECN, and Swap Free structures.

Minimum deposit is generally stated at $20, while Pro ECN carries a materially higher funding threshold in the provided specifications.

Trading costs vary by account type: Standard-style accounts typically price via spreads, whereas ECN models pair raw spreads from 0.0 pips with commissions, including $6 per lot round turn on Raw ECN and $1.5 per lot round turn on Pro ECN.

Platform availability spans MetaTrader 4 (MT4), MetaTrader 5 (MT5), ProTrader, TradingView, and a proprietary application. For passive or signal-based participation, Vantage Markets references third-party integrations such as ZuluTrade, DupliTrade, and Myfxbook AutoTrade.

Payment rails include bank transfer, cards, e-wallets, Perfect Money, and local methods, with support offered via live chat, phone, ticket, and email on a 24/7 schedule.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FCA, FSCA, VFSC, CIMA |

Minimum Deposit | From $20 |

Deposit Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Perfect Money, Local Methods |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Perfect Money |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), ProTrader, TradingView, Proprietary App |

Vantage Pros and Cons

Traders must consider the benefits and drawbacks of trading with Vantage Markets before opening and verifying their accounts.

Pros | Cons |

Supports MT4, MT5, ProTrader, TradingView, and proprietary platform | Pro ECN account requires a significantly higher minimum deposit ($10,000) |

Offers copy trading via ZuluTrade, DupliTrade, and Myfxbook AutoTrade | Negative balance protection is not available under the CIMA-regulated entity |

Maximum leverage up to 1:1000 (entity-dependent) | Services are not available in certain countries (e.g., US, Canada) |

No inactivity fees on trading accounts | - |

Tickmill

Tickmill is a global Forex and CFD brokerage founded in 2014, currently serving more than 785,000 registered users across over 180 countries.

The company reports an average monthly trading volume exceeding $129 billion and supports account funding in six base currencies, including USD, EUR, GBP, ZAR, PLN, and CHF.

The broker operates under multiple regulatory entities, including FCA, CySEC, FSA, LFSA, and FSCA, applying client fund segregation and negative balance protection across its supported jurisdictions.

Depending on the regulatory framework, leverage may vary from 1:30 in tier-1 environments to as high as 1:1000 in offshore or region-specific entities.

Tickmill follows a No Dealing Desk (NDD) execution model, routing client orders directly to liquidity providers without internal dealing desk intervention.

Completing Tickmill registration provides two primary live account types, Classic and Raw, both allowing minimum trade sizes of 0.01 lots with a starting deposit requirement of $100.

The Classic account integrates trading costs into spreads, while the Raw account offers spreads from 0.0 pips alongside a commission-based pricing structure. Islamic (swap-free) versions are available for eligible clients.

The trading costs can be lowered by joining this broker via TradingFinder’s Tickmill rebate program.

Platform support includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), MetaTrader Web, and a proprietary mobile application. Traders can access a range of CFD instruments across Forex, stock indices, commodities, stocks, bonds, and cryptocurrencies.

Tickmill also offers Social Trading functionality, enabling users to follow or provide trading strategies within supported regions.

Deposits and withdrawals are available via bank transfer, credit or debit cards, cryptocurrencies, and electronic payment systems such as Skrill and Neteller.

Account Types | Classic, Raw |

Regulating Authorities | FCA, CySEC, FSA, LFSA, FSCA |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Cryptocurrency, UnionPay |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, Skrill, Neteller, Cryptocurrency, UnionPay |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), MetaTrader Web, Mobile App |

Pros and Cons of Tickmill

Here are the advantages and disadvantages of trading with Tickmill.

Pros | Cons |

Supports NDD execution with direct liquidity provider access | Limited number of live account types compared to some multi-tier brokers |

Offers spreads from 0.0 pips on Raw account | Quarterly inactivity fee applies after 12 months of dormancy |

Regulated by FCA and CySEC entities | PAMM account functionality is not available |

Provides MT4 and MT5 with VPS support for algorithmic trading | - |

BlackBull Markets

BlackBull Markets is a New Zealand-based multi-asset brokerage established in 2014 under the legal entity Black Bull Group Limited.

The firm operates across more than 180 countries and provides access to over 26,000 tradable instruments spanning Forex, equities, indices, commodities, cryptocurrencies, and energies.

The broker is regulated under both the FMA and FSA frameworks, applying client fund segregation and negative balance protection across its supported entities.

Leverage availability extends up to 1:500 depending on the jurisdiction traders complete their BlackBull Markets registration in.

BlackBull Markets offers three primary ECN-based account types, including ECN Standard, ECN Prime, and ECN Institutional, all supporting a minimum trade size of 0.01 lots.

While ECN Standard and ECN Prime can be opened without a fixed minimum deposit, the ECN Institutional account requires higher capital allocation.

Platform support includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and cTrader, alongside proprietary services such as BlackBull CopyTrader for social trading and BlackBull Invest for direct stock market access.

The trading environment supports API connectivity and market execution through order types such as Market, Limit, Stop, and Trailing Stop. Spreads may start from 0.0 pips depending on the account structure, with commission levels varying across ECN tiers.

Deposit options after completing BlackBull Markets verification include Visa, Mastercard, Apple Pay, Google Pay, SEPA transfers, Neteller, Skrill, FasaPay, and multiple cryptocurrency networks.

Withdrawal requests are typically processed within business-day timelines and may incur a flat processing fee. Islamic (swap-free) accounts are available for eligible clients, and PAMM functionality is also supported within the brokerage ecosystem.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FMA, FSA |

Minimum Deposit | From $0 (ECN Standard / ECN Prime), $20,000 (ECN Institutional) |

Deposit Methods | Bank Transfer, Visa, Mastercard, Apple Pay, Google Pay, Skrill, Neteller, SEPA, FasaPay, Cryptocurrency |

Withdrawal Methods | Bank Transfer, Visa, Mastercard, Apple Pay, Google Pay, Skrill, Neteller, SEPA, FasaPay, Cryptocurrency |

Maximum Leverage | Up to 1:500 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

The table below outlines the pros and cons of trading with the BlackBull Markets broker.

Pros | Cons |

Access to 26,000+ tradable instruments across multiple asset classes | ECN Institutional account requires a high minimum deposit ($20,000) |

Supports MT4, MT5, cTrader, and TradingView | Services are not available in several regions (e.g., US) |

Offers ECN-based accounts with spreads from 0.0 pips | Withdrawal requests incur a fixed $5 processing fee |

Provides API trading and CopyTrader functionality | Investor protection scheme is not specified under the FSA-regulated entity |

HFM

HFM, also known as HF Markets, is a multi-asset Forex and CFD broker established in 2010 that currently supports more than 2.5 million live trading accounts worldwide.

The brokerage operates under several regulatory frameworks, including CySEC, FCA, DFSA, FSCA, and FSA, applying client fund segregation and negative balance protection across its licensed entities.

All entities require traders to complete the HFM verification process to comply with AML and CFT laws.

The broker provides access to a wide range of CFD instruments across Forex, metals, commodities, indices, cryptocurrencies, stocks, ETFs, bonds, and energy markets after completing HFM registration.

Trading accounts are available in Cent, Zero, Pro, and Premium formats, with minimum trade sizes starting from 0.01 lots and base currencies such as USD, EUR, and USC supported across account types.

Depending on the jurisdiction, maximum leverage can reach up to 1:2000, particularly under international entities, while tier-1 regulated environments offer more restricted leverage levels.

HFM offers floating spreads from 0.0 pips on the Zero account, where commission-based pricing may apply, whereas other account types integrate trading costs into spreads for commission-free Forex execution.

Platform compatibility includes MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary mobile trading application. Additional services such as Autochartist integration, SMS market notifications, VPS hosting, and economic calendar tools are also supported.

Funding options include bank wire transfer, credit or debit cards, electronic payment systems, and cryptocurrency networks. Investment solutions such as PAMM accounts and HFM Copy Trading functionality are available for users seeking managed or strategy-based exposure within the broker’s infrastructure.

Account Types | Cent / Zero / Pro / Premium |

Regulating Authorities | CySEC / FCA / DFSA / FSCA / FSA (Seychelles) |

Minimum Deposit | From $0 |

Deposit Methods | Bank Wire / Visa / MasterCard / Skrill / Neteller / FasaPay / PayRedeem / Crypto |

Withdrawal Methods | Bank Wire / Visa / MasterCard / Skrill / Neteller / WebMoney / FasaPay / PayRedeem / Crypto |

Maximum Leverage | Up to 1:2000 |

Trading Platforms & Apps | MetaTrader 4 (MT4) / MetaTrader 5 (MT5) / HFM Trading App |

HFM Pros and Cons

The table below contains the advantage and disadvantages of trading with the HFM broker.

Pros | Cons |

Multi-jurisdictional regulation under CySEC, FCA, DFSA, FSCA, and FSA | Geo-restrictions in several countries including the USA |

Access to 1,000+ CFD instruments across Forex, Metals, Indices, Stocks, ETFs, Bonds, and Crypto | Inactivity fees charged after 6 months of dormant accounts |

Flexible account types (Cent, Premium, Pro, Zero) with minimum deposit from $0 | - |

Support for MT4 and MT5 platforms with Copy Trading and PAMM services | - |

Global Prime

Global Prime is an Australia-based brokerage firm established in 2010 by Jeremy Kinstlinger, operating under FMGP Trading Group Pty Ltd and Gleneagle Securities Pty Ltd.

The broker is regulated by ASIC and VFSC, offering differentiated trading conditions across its domestic and international entities.

Client funds are maintained in segregated accounts with HSBC and National Australia Bank (NAB), while Negative Balance Protection is available under the ASIC-regulated branch.

The company provides access to more than 150 tradable CFD instruments across Forex, Indices, Commodities, Crypto, Bonds, and US Share CFDs after Global Prime registration.

Trading is facilitated primarily through MetaTrader 4 (MT4), with integrations for Autochartist and social trading via ZuluTrade.

Order execution supports Market, Limit, Stop Loss, and Take Profit functionalities, with an average execution latency of approximately 10 milliseconds.

Global Prime offers two main account types (Standard and Raw) both supporting a minimum trade size of 0.01 lots and leverage up to 1:500 for VFSC clients (1:30 under ASIC).

Raw accounts feature spreads from 0.0 pips with a commission of $3.5 per side, while Standard accounts apply spreads from 0.9 pips with no commission.

Traders can use Global Prime rebates to lower trading costs in this broker. Swap charges apply to overnight positions, and Islamic (Swap-Free) or PAMM accounts are not currently supported.

Funding options include Credit/Debit Cards, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, and Crypto transfers, with no broker-side deposit or withdrawal fees after completing Global Prime verification.

Inactivity charges are not imposed, though currency conversion or intermediary bank costs may apply depending on the payment provider. The broker also offers VPS access and signal-based tools for strategy development.

Account Types | ASIC, VFSC |

Regulating Authorities | No minimum deposit requirement |

Minimum Deposit | Credit/Debit Cards, Bank Wire, PayPal, Skrill, Neteller, FasaPay, Perfect Money, Crypto, POLi, PayID, DragonPay, VNPay |

Deposit Methods | Credit/Debit Cards, Bank Wire, PayPal, Skrill, Neteller, AstroPay, Perfect Money, Crypto, Interac, Jetonbank |

Withdrawal Methods | Up to 1:500 (VFSC) / Up to 1:30 (ASIC) |

Maximum Leverage | MetaTrader 4 (MT4) |

Trading Platforms & Apps | ASIC, VFSC |

Global Prime Pros and Cons

Here are the pros and cons of trading with the Global Prime broker.

Pros | Cons |

Regulated by ASIC with segregated client funds held at NAB and HSBC | Only MetaTrader 4 (MT4) is currently supported as the trading platform |

Raw spreads from 0.0 pips with fast execution speeds (~10ms) | No Islamic (Swap-Free) account option available |

No minimum deposit requirement for Standard and Raw accounts | Negative balance protection not available under VFSC entity |

Supports Social Trading via ZuluTrade and Autochartist signals | Restricted access for clients from several jurisdictions including the USA |

What is a Raw Spread Forex Broker?

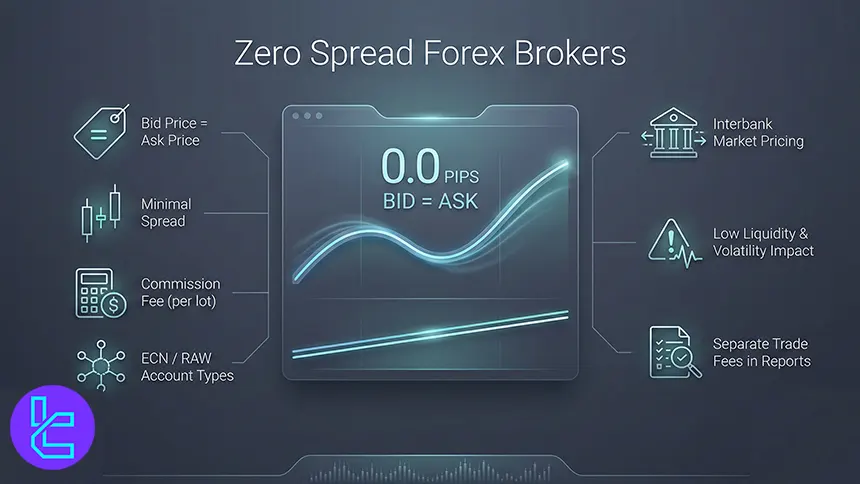

A Zero Spread Forex broker provides trading accounts in which the Bid Price and Ask Price are either identical or maintain an extremely narrow difference under normal market conditions.

In such setups, the traditional spread (which represents the primary transaction cost in most Forex trading accounts) is minimized or effectively removed from the pricing structure.

However, the absence of a visible spread does not necessarily eliminate trading costs.

Many brokers offering Zero Spread accounts apply alternative fee models, such as fixed or volume-based commissions, depending on the selected account type (e.g., ECN or RAW accounts).

Additionally, during periods of low liquidity or elevated market volatility, spreads may temporarily deviate from zero due to real-time price fluctuations in the interbank market.

From a cost-analysis perspective, commission-based pricing can simplify trade performance tracking.

Since the spread component is excluded from the execution price, transaction fees are often itemized separately in brokerage account statements, enabling clearer assessment of entry and exit costs.

Overall, Zero Spread account models restructure transaction expenses rather than removing them entirely, typically shifting cost transparency from spread-based pricing to commission-based execution.

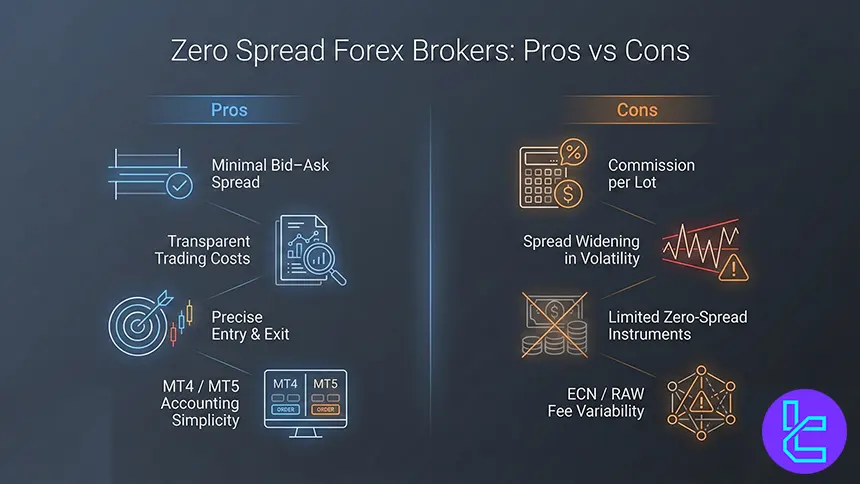

Pros and Cons of Zero Spread Forex Brokers

Here are the benefits and drawbacks of choosing a Zero spread Forex broker.

Pros | Cons |

Eliminates or minimizes Bid-Ask spread during normal market conditions | Commission-based pricing may increase overall trading costs |

Greater pricing transparency for cost calculation and performance tracking | Spreads can still widen during high volatility or low liquidity |

More precise entry and exit levels for scalping and short-term strategies | Not all instruments are consistently offered with zero spread |

Simplifies trade accounting in platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) | Commission structures may vary across ECN or RAW accounts |

Reduces slippage impact in stable market environments | Zero spread conditions may not be maintained during major news events |

Traders who use face-pased trading strategies can get the most benefit from these brokers.

What Are the Differences in Standard and Raw Spread Accounts?

A Standard account in Forex trading typically operates with predefined contract specifications, where one standard lot equals 100,000 units of the base currency.

In this account structure, the trading cost is usually embedded within the Bid-Ask spread, as brokers apply a markup to the pricing they receive from their liquidity providers.

This pricing model simplifies execution but may obscure the actual cost components associated with each transaction.

In contrast, a Raw Spread account reflects institutional-style pricing, where quotes are transmitted directly from external liquidity providers without any additional spread markup by the broker.

Under this execution model, the Bid and Ask prices more accurately represent real-time interbank market conditions, often resulting in spreads that approach 0.0 pips during stable liquidity periods.

Instead of adjusting the spread, brokers operating with ECN or STP infrastructure typically apply a fixed commission per trade to compensate for execution services.

This distinction influences cost transparency and strategy deployment, particularly for scalping or high-frequency trading environments where spread sensitivity is critical.

While Raw accounts may offer tighter spreads in platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), traders should account for commission-based pricing when evaluating total trading expenses.

Ultimately, the choice between Standard and Raw account types depends on execution preferences, cost visibility, and the intended trading methodology within the Forex market ecosystem.

Can I Trust Raw Spread Brokers?

Raw Spread brokers can offer a level of reliability comparable to Standard account providers, as differences between these account types are primarily related to pricing structure rather than operational legitimacy.

In Raw Spread models, trading costs are typically separated into low Bid-Ask spreads and fixed commissions, which may enhance transparency when evaluating total execution expenses.

It remains important to assess the full fee composition associated with Raw Spread accounts, since commissions, swap rates on leveraged positions, or execution-related costs may offset the benefit of tighter spreads.

Promotional claims around low or near-zero spreads should therefore be considered alongside the broker’s overall pricing framework.

Another relevant factor is the broker’s execution model. Firms operating as ECN or STP intermediaries route client orders directly to external liquidity providers, whereas market maker brokers may internalize order flow by taking the opposite side of trades.

Understanding whether this introduces a potential conflict of interest is essential when evaluating trustworthiness.

As a result, the credibility of Raw Spread brokers should be determined based on regulatory oversight, execution methodology, and disclosed trading conditions within platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), rather than on spread size alone within the Forex market environment.

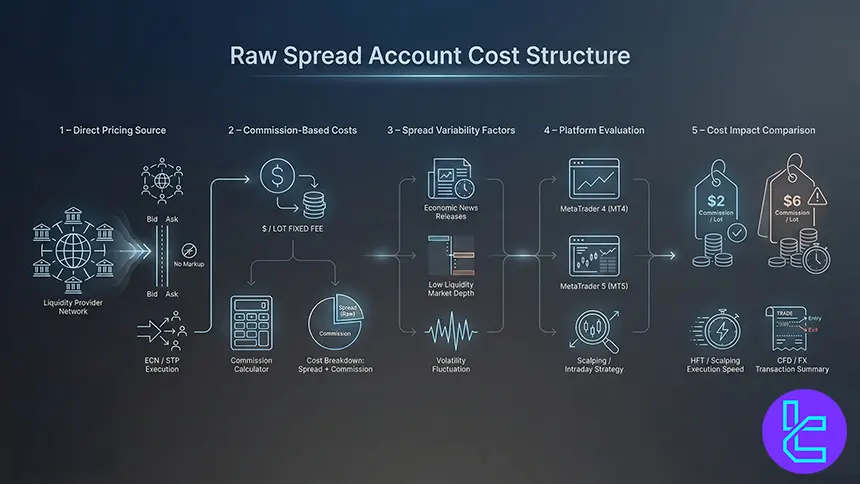

Trading Costs in Raw Spread Brokers

Raw Spread accounts in the Forex market typically present pricing directly from liquidity providers without an added broker markup on the Bid-Ask spread.

Instead, trading costs are structured through a fixed per-lot commission, which can vary depending on the broker’s fee model and account type.

It is also important to recognize that interbank spreads are not static. During macroeconomic news releases, reduced market depth, or low-liquidity trading sessions, Raw Spread values may temporarily expand.

As a result, a quoted 0.0-pip spread does not consistently reflect real-time execution conditions across all market environments.

When evaluating Raw Spread accounts on platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), traders should avoid relying solely on minimum spread figures.

Commission per lot, average spreads during active trading hours, and the broker’s regulatory framework collectively influence the effective transaction cost.

Even marginal differences in commission rates (such as $2 versus $6 per standard lot) can significantly impact total trading expenses, particularly for high-frequency models like scalping strategy or intraday trading.

Therefore, assessing the combined cost structure rather than any single pricing metric provides a more accurate representation of overall trade execution in CFD and FX markets.

How to Open a Raw Spread Account in Forex Brokers

Setting up a Raw Spread trading account with a Forex broker involves more than selecting a pricing model; it requires configuring several structural and compliance-related parameters that directly affect trading conditions within the Forex (FX) market.

The process typically begins with creating access credentials through the broker’s client portal. Many brokerage firms provide a personal dashboard where account types and infrastructure settings can be managed.

Within this interface, traders may initiate the creation of a new account and select a Raw Spread or Professional pricing environment, depending on the broker’s execution framework.

Subsequently, account-level configurations must be defined. This includes selecting a compatible trading platform such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), determining the base account currency, and specifying leverage parameters.

Before account activation, brokers are required to implement Know Your Customer (KYC) procedures under global compliance standards. This identity verification stage generally involves submitting government-issued documentation to meet anti-money laundering (AML) obligations.

Once verification is completed, an initial capital allocation commonly ranging between $50 and $200 is required to enable trading functionality. Funding methods may vary based on the broker’s supported payment infrastructure.

Additionally, traders should review margin requirements and stop-out levels, as these parameters govern position sustainability during volatile market movements.

Evaluating server location or VPS compatibility may also be beneficial for latency-sensitive strategies operating on MT4 or MT5 environments.

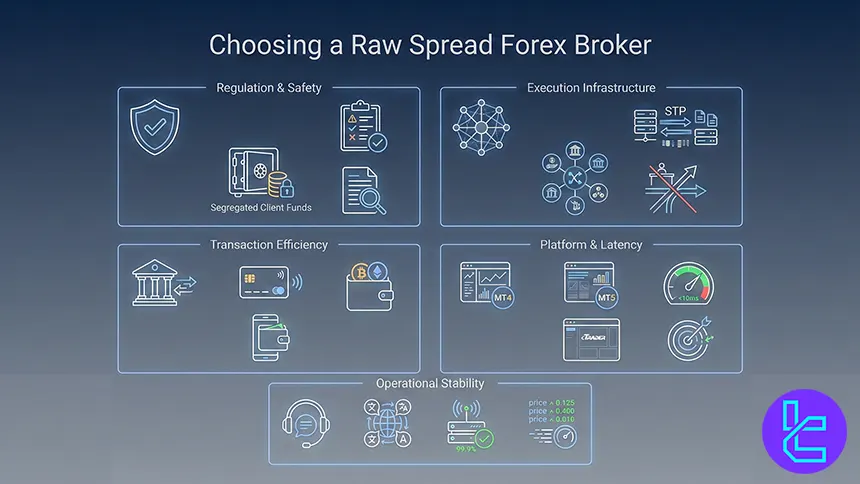

Factors to Consider when Choosing the Best Raw Spread Forex Broker

When evaluating a Raw Spread Forex Broker, pricing alone does not determine execution quality or capital safety. A broker’s operational framework, infrastructure, and regulatory standing directly affect order routing, transaction costs, and platform stability.

Regulatory oversight remains a primary filter. Brokers operating under recognized financial authorities are typically required to implement client fund segregation, risk management protocols, and transparent reporting standards.

In contrast, unregulated entities may expose traders to counterparty and custodial risks regardless of their quoted spreads. The availability of diverse payment methods including bank transfers, debit/credit cards, cryptocurrencies, and e-wallets supports transactional flexibility.

However, settlement speed and withdrawal processing times should be reviewed to assess liquidity accessibility and operational efficiency. Equally important is latency, which directly impacts slippage and fill accuracy. Even when spreads are near zero, delayed execution may distort trade entries and exits.

Testing execution speed through a demo account on platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5) can provide measurable insight into server performance.

Reliable customer support across live chat, ticketing systems, or multilingual channels also contributes to issue resolution during high-volatility trading sessions.

In addition, execution model transparency such as whether the broker operates under ECN or STP infrastructure helps clarify how orders interact with liquidity providers and whether dealing desk intervention is involved.

Finally, platform compatibility and infrastructure stability should be verified. Integration with trading environments like MT4, MT5, or cTrader, alongside uptime consistency, plays a critical role in maintaining uninterrupted access to market data.

Raw Spread Brokers vs ECN Brokers vs STP Brokers

The table below helps you understand the differences in pricing models and execution methods in popular Forex brokers account types.

Parameter | Raw Spread | ECN | STP |

Order Routing | Direct to interbank liquidity; orders matched on network | Direct to interbank liquidity; orders matched on network | Routed to liquidity providers (banks, brokers) |

Spread Type | Raw Spreads | Variable spreads | Variable spreads (aggregated) |

Commission | Yes (per trade) | Yes (per trade) | Sometimes none; markup in spreads |

Conflict of Interest | Minimal | Minimal | Minimal |

Transparency | High (real market pricing) | High (real market pricing) | Moderate |

Execution Speed | Fast (direct matching) | Fast (direct matching) | Fast |

Market Access | Full interbank access | Full interbank access | Access via LPs |

Conclusion

Based on our review of the best raw spread Forex brokers, Eightcap, ActivTrades, Vantage, Tickmill, and BlackBull Markets offer the top trading services for professionals.

Now, traders must compare funding options, customer support quality, minimum spreads, trading commission and regulation to choose the broker that is suitable for their trading needs.

All brokers have been assessed based on various factors mentioned in the TradingFinder Forex methodology.