![Cup and Handle Pattern Indicator for MetaTrader4 Download - Free - [TFLab]](https://cdn.tradingfinder.com/image/106557/10-17-en-cup-and-handle-pattern-mt4.webp)

![Cup and Handle Pattern Indicator for MetaTrader4 Download - Free - [TFLab] 0](https://cdn.tradingfinder.com/image/106557/10-17-en-cup-and-handle-pattern-mt4.webp)

![Cup and Handle Pattern Indicator for MetaTrader4 Download - Free - [TFLab] 1](https://cdn.tradingfinder.com/image/908/10-17-en-Cup-pattern-mt4-04.avif)

![Cup and Handle Pattern Indicator for MetaTrader4 Download - Free - [TFLab] 2](https://cdn.tradingfinder.com/image/907/10-17-en-Cup-pattern-mt4-03.avif)

![Cup and Handle Pattern Indicator for MetaTrader4 Download - Free - [TFLab] 3](https://cdn.tradingfinder.com/image/905/10-17-en-Cup-pattern-mt4-02.avif)

The Cup and Handle Pattern Indicator is inMetaTrader 4 indicator that helps identify one of the most commonly used technical analysis patterns on price charts. This pattern, shaped like a U, can form bullish trends like the Cup and Handle pattern.

Similarly, it forms an inverted U in bearish trends, known as the Reversal Cup and Handle pattern. The indicator typically identifies this pattern in solid trends, indicating that the trend will continue. After the handle is formed, one should wait for a price breakdown. This breakout should be confirmed with an increase in trading volume.

Indicator Table

Indicator Categories: | Price Action MT4 Indicators Chart & Classic MT4 Indicators Candle Sticks MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Breakout MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Forward Market MT4 Indicators Indices Market MT4 Indicators Commodity Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Overview

The Cup and Handle Indicator identifies one of the most widely used and frequent patterns on price charts, providing potential entry and exit points. It is also beneficial for optimizing risk management and trading in line with solid trends in various markets.

To select the best patterns of this indicator, you can trade U-shaped patterns and avoid trading V-shaped patterns due to higher risk.

Buy Signal Conditions

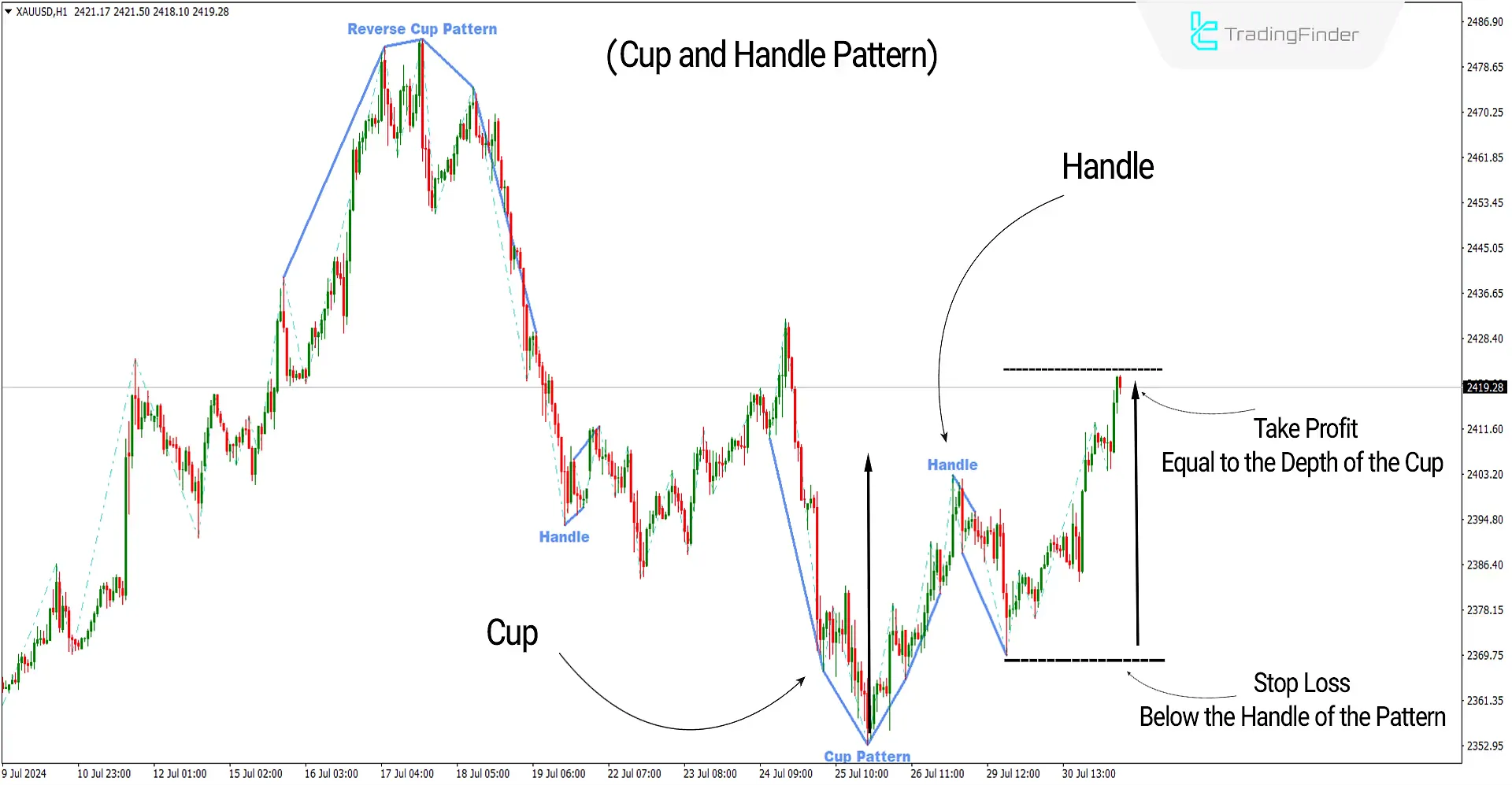

The chart below shows the price of Gold to US Dollar (XAUUSD) in a 1-hour timeframe. The Cup and Handle pattern usually forms an uptrend, indicating the continuation of this trend.

During the cup formation stage, the price declines and then gradually rises, creating a shape similar to a cup. After the cup is formed, the piece undergoes a slight decline to form the handle.

After forming the handle, one should wait for the cost to break the resistance level (the upper line of the handle). For confirmation, this breakout must be accompanied by increased trading volume. Once the breakout is confirmed, you can enter a buy trade. The entry point is usually at the handle's breakout level.

Take Profit and Stop Loss for the Cup and Handle Pattern

To manage risk, you can place your stop loss slightly below the lowest point of the handle. To determine the take profit, you can calculate the distance between the cup's lowest point and the handle's resistance level (the cup's depth) and add this distance to the breakout level.

Sell Signal Conditions

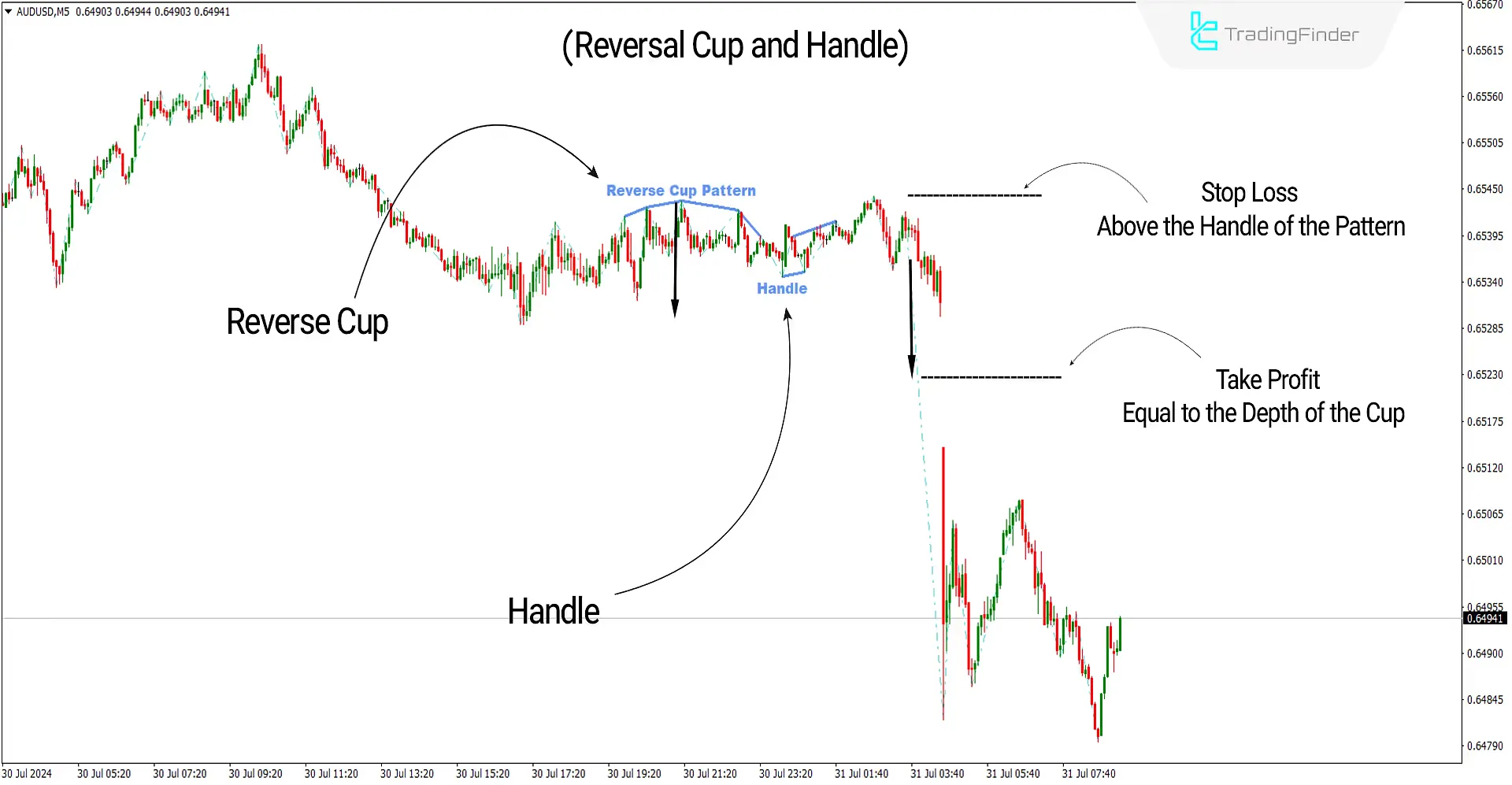

The chart below shows the currency pair of Australian Dollar to US Dollar (AUDUSD) in a 5-minute timeframe. The Reversal Cup and Handle pattern usually form a downtrend, indicating the continuation of this trend.

During the cup formation stage, the price rises and gradually declines, creating a similar shape. After the cup is formed, the price experiences a slight increase that forms the handle.

After forming the handle, one should wait for the cost to break the support level (the lower line of the handle). For confirmation, this breakout must be accompanied by increased trading volume. Once the breakout is confirmed, you can enter a sell trade. The entry point is usually at the handle's breakout level.

Take Profit and Stop Loss for the Reversal Cup and Handle Pattern

To manage risk, you can place your stop loss slightly above the highest point of the handle. To determine the take profit, you can calculate the distance between the cup's highest point and the handle's support level (the cup's depth) and add this distance to the breakout level.

Cup and Handle Indicator Settings

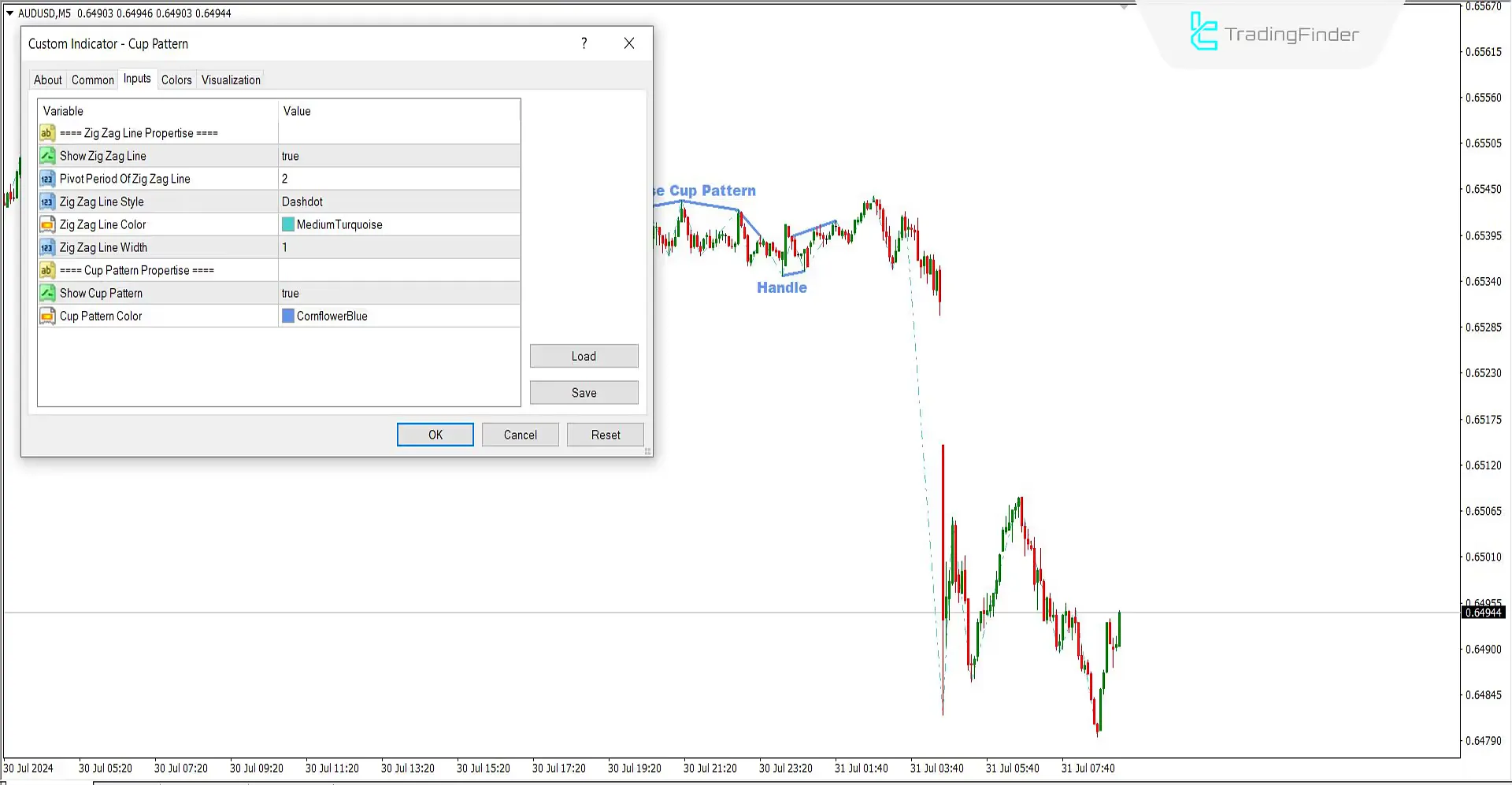

- Zig Zag Line Properties

- Show Zig Zag Line: Set to true to display the Zig Zag line

- Pivot Period Of Zig Zag Line: The Zig Zag line period is set to 2

- Zig Zag Line Style: Displayed as a Dashdot line

- Zig Zag Line Color: Blue, customizable

- Zig Zag Line Width: Set to 1

- Cup Pattern Properties

- Show Cup Pattern: Set to true to display the pattern

- Cup Pattern Color: Dark Blue

Conclusion

The Cup and Handle Pattern Indicator is a Classic Pattern, an effective tool in Technical Analysis that helps traders identify suitable trading opportunities.

For better application and more successful trades, you can determine the trend in higher timeframes and trade when the overall trend aligns with the cup pattern.

Cup Handle Pattern MT4 PDF

Cup Handle Pattern MT4 PDF

Click to download Cup Handle Pattern MT4 PDFDoes the Cup and Handle pattern always work?

Like all technical patterns, the Cup and Handle pattern can sometimes produce false signals. Therefore, it's crucial to always use other technical analysis tools for confirmation, ensuring you're well-prepared and equipped for your trading decisions.

What are the disadvantages of using the Cup and Handle pattern?

This pattern's disadvantages include producing false signals in some instances and the need for confirmation with a high volume.