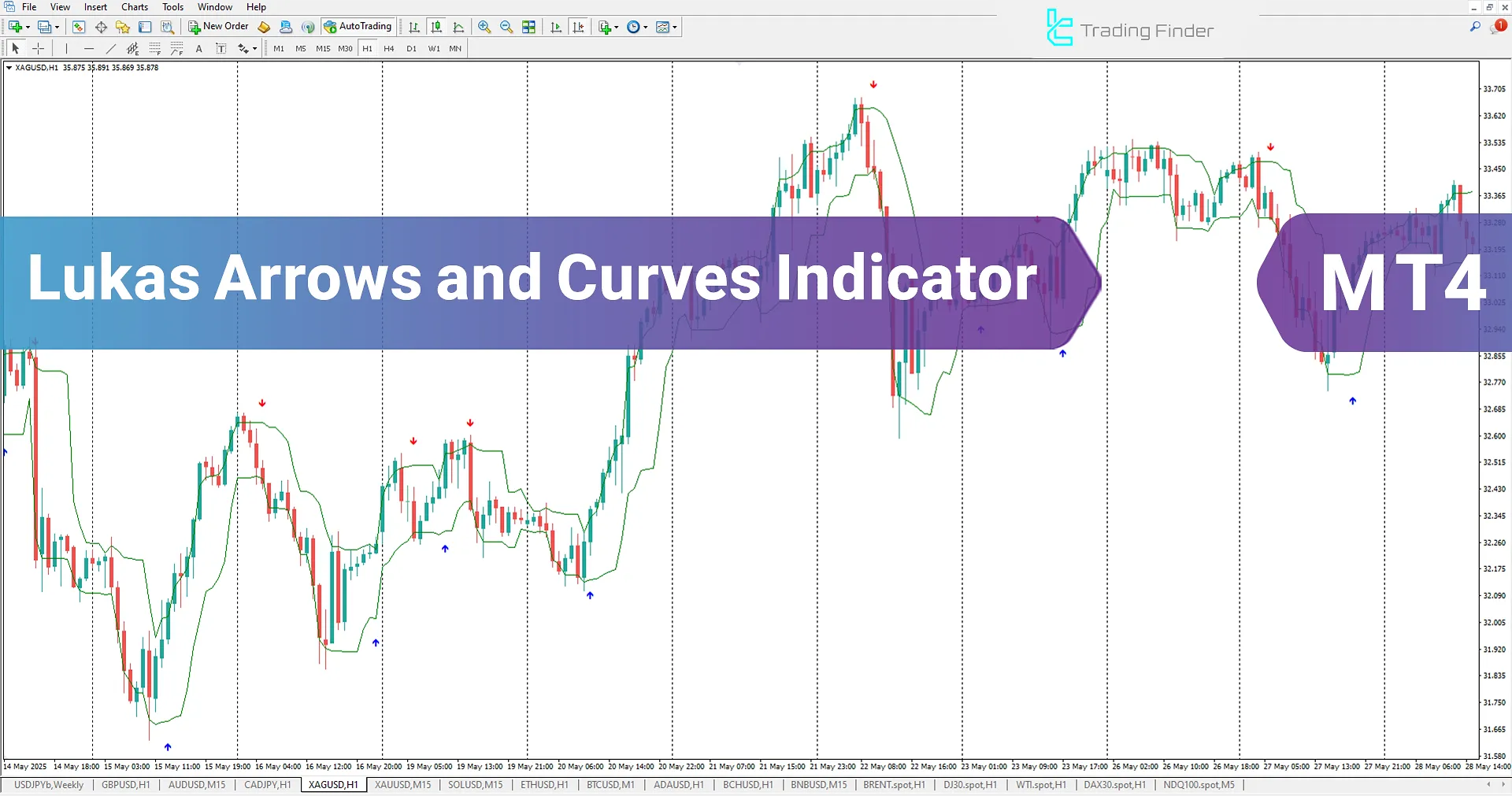

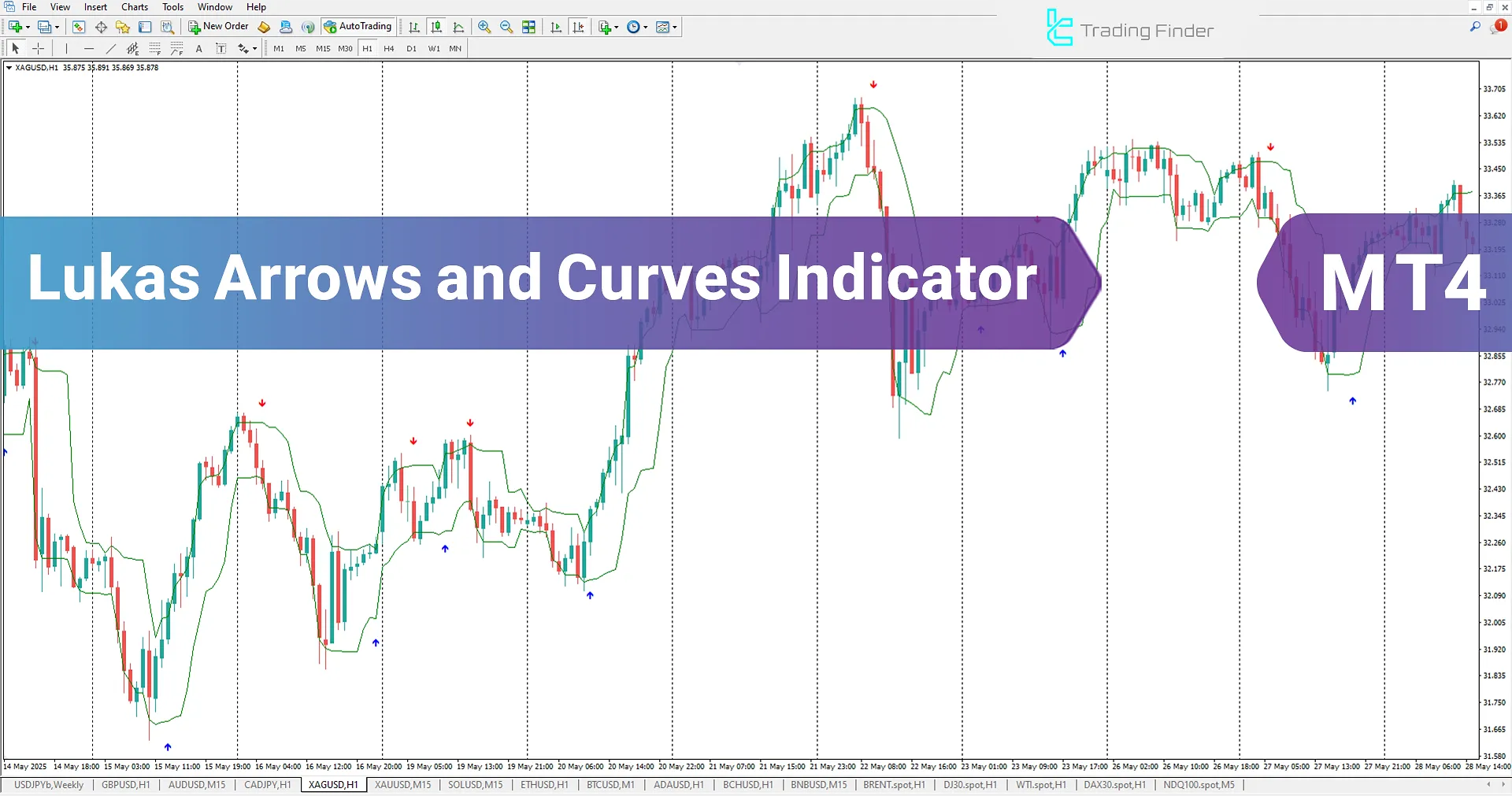

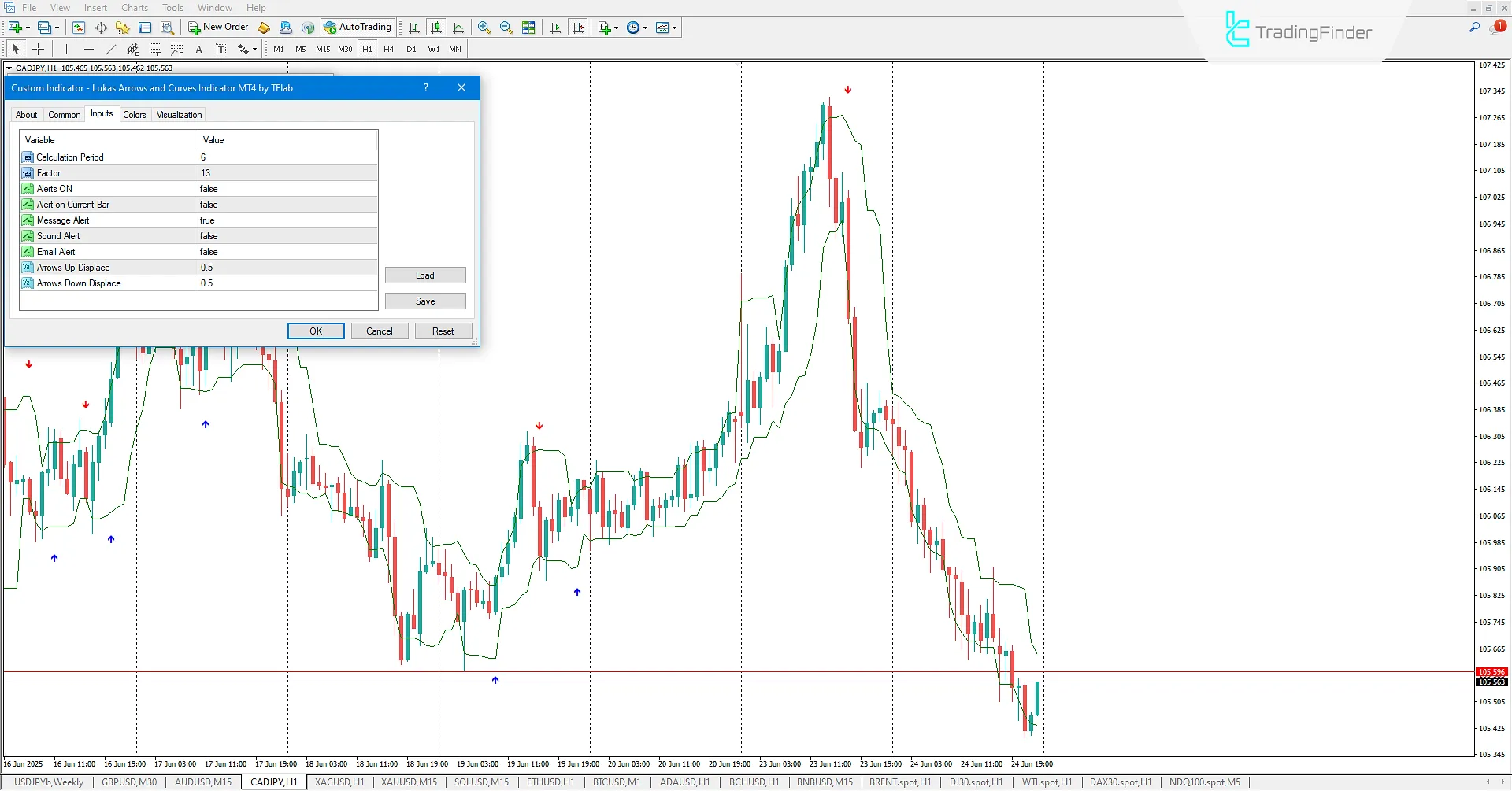

The Lukas Arrows and Curves Indicator in MetaTrader 4 platform displays trading positions by drawing a dynamic channel as support and resistance levels.

Traders can use this channel as dynamic support and resistance levels to better analyze market trends and use the buy and sell signals provided by the indicator to identify and capitalize on suitable entry points for buying or selling. This tool is useful for improving the efficiency of trading decisions.

Lukas Arrows and Curves Indicator Table

In the general information section, the Lukas Arrows and Curves Indicator is placed.

Indicator Categories: | Signal & Forecast MT4 Indicators Trading Assist MT4 Indicators Bands & Channels MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Entry and Exit MT4 Indicators Reversal MT4 Indicators |

Timeframe: | M15-M30 Time MT4 Indicators H4-H1 Time MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Intraday MT4 Indicators Scalper MT4 Indicators |

Trading Instruments: | Binary Options MT4 Indicators Indices Market MT4 Indicators Stock Market MT4 Indicators Forex MT4 Indicators |

Indicator at a Glance

The Lukas Arrows and Curves Indicator is a specialized and practical tool that, by drawing a price channel, allows traders to use the channel bands as support and resistance levels.

This Binary indicator calculates trading signals, which serve as buy or sell signals for traders to enter trades. Using this tool for more specialized market analysis and better decision-making in trades is highly beneficial.

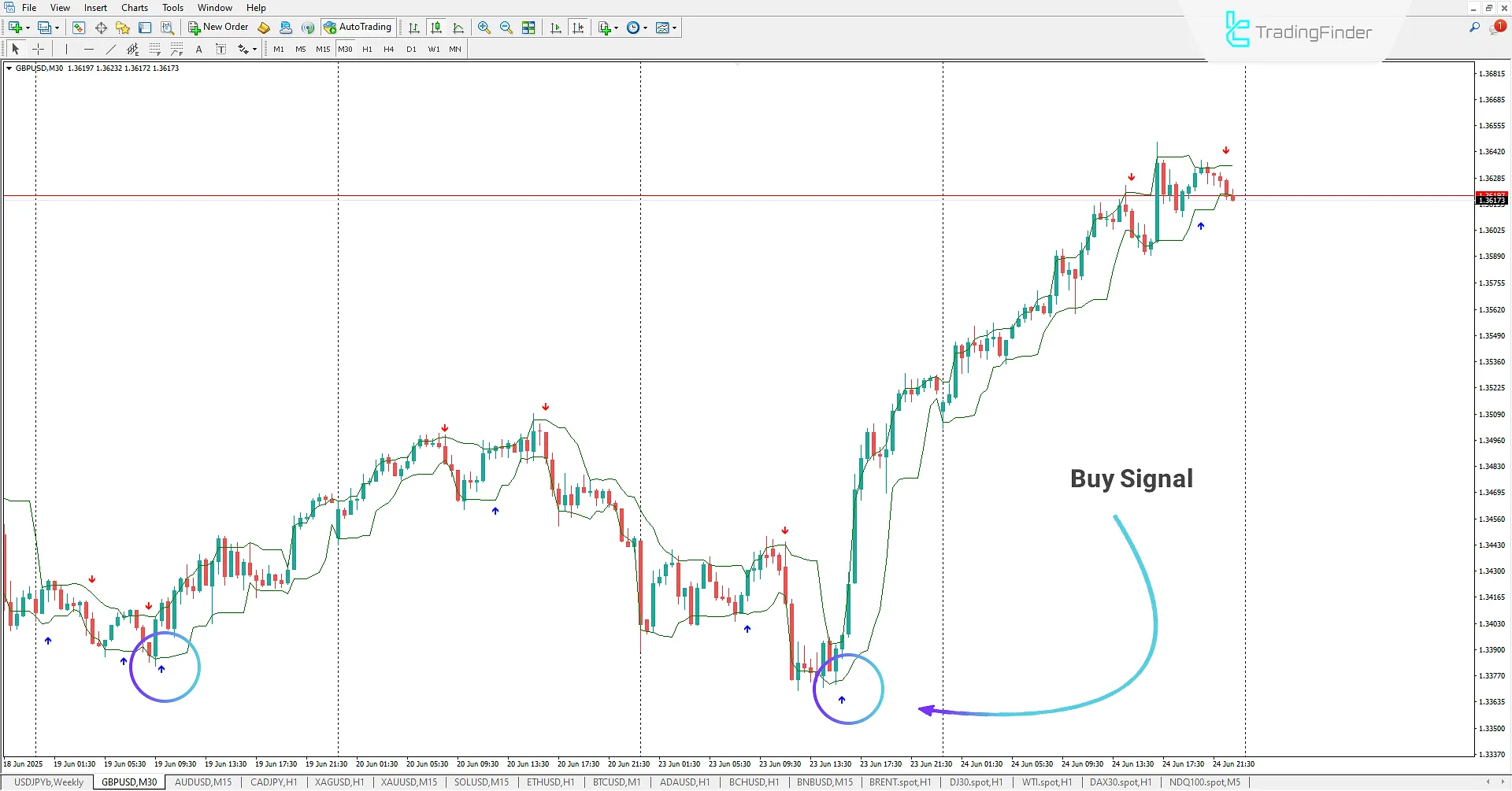

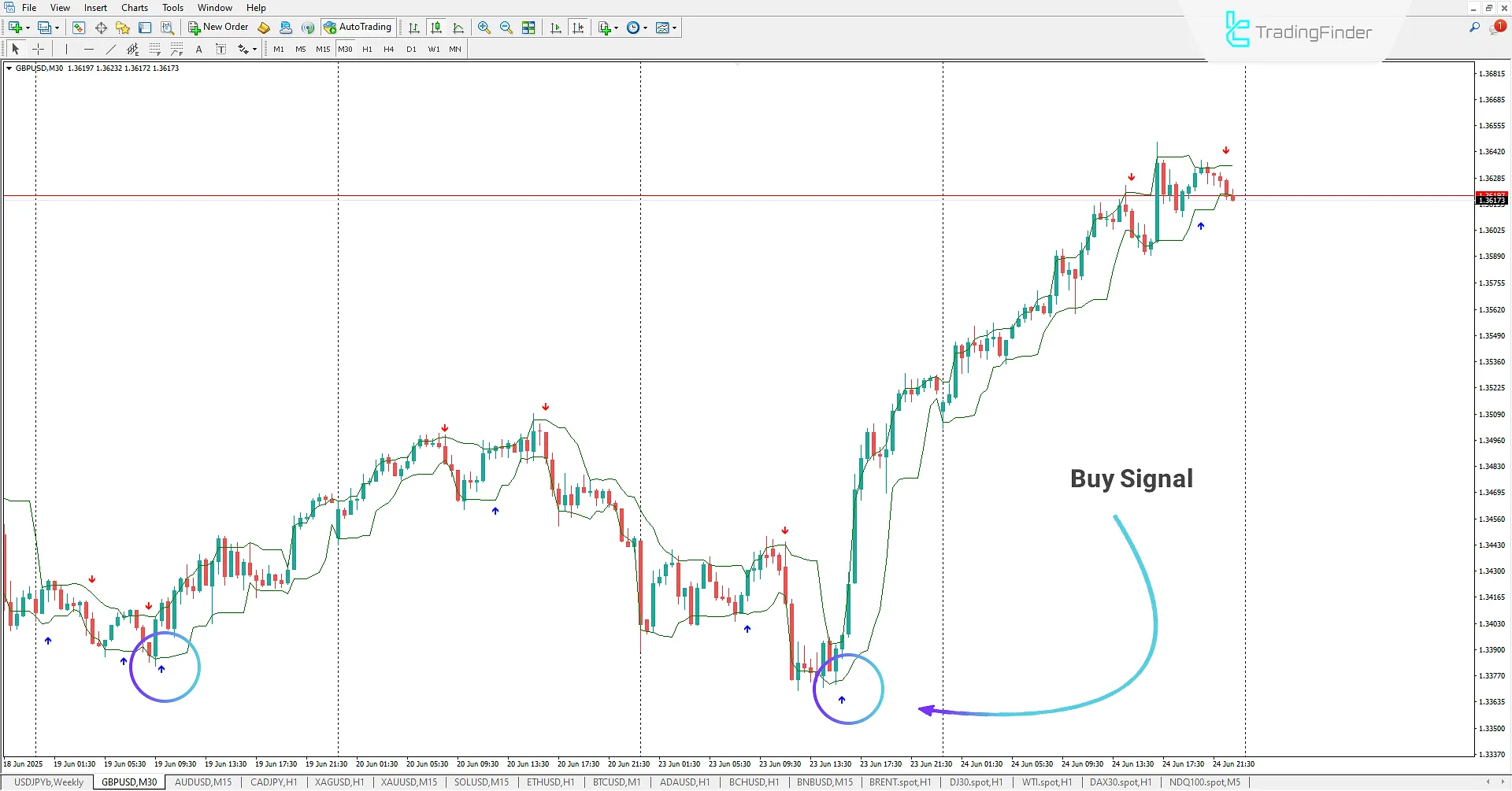

Upward Trend

In the 30-minute chart of the GBP/USD pair, when the price reaches the lower band of the Lukas Arrows and Curves Indicator's channel and simultaneously shows a buy signal, a buy trading opportunity arises.

Traders can enter a buy trade by observing this upward signal and use the channel bands as dynamic support and resistance levels for better trade management. This tool helps identify entry and exit points and enhances the accuracy of market analysis.

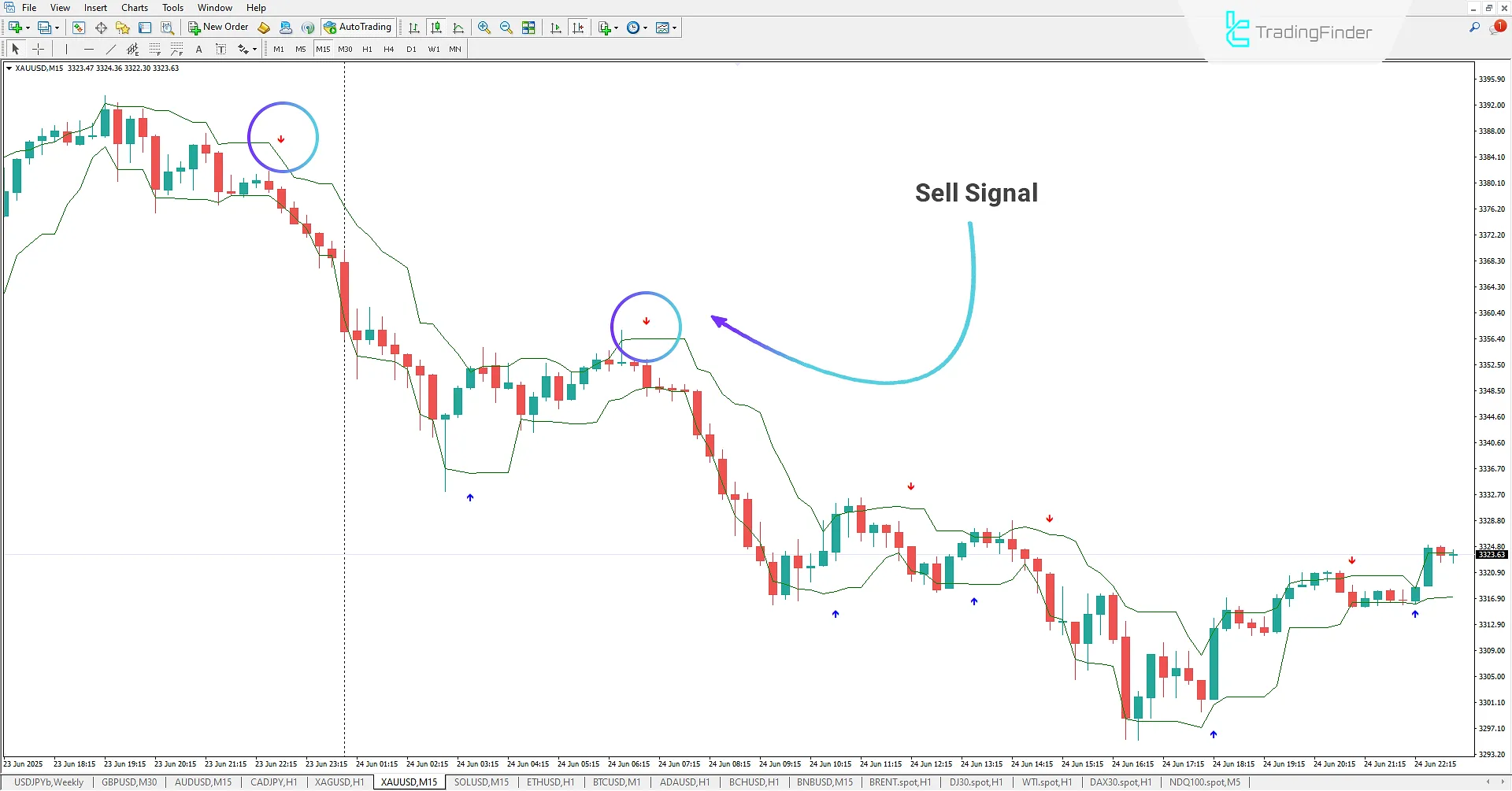

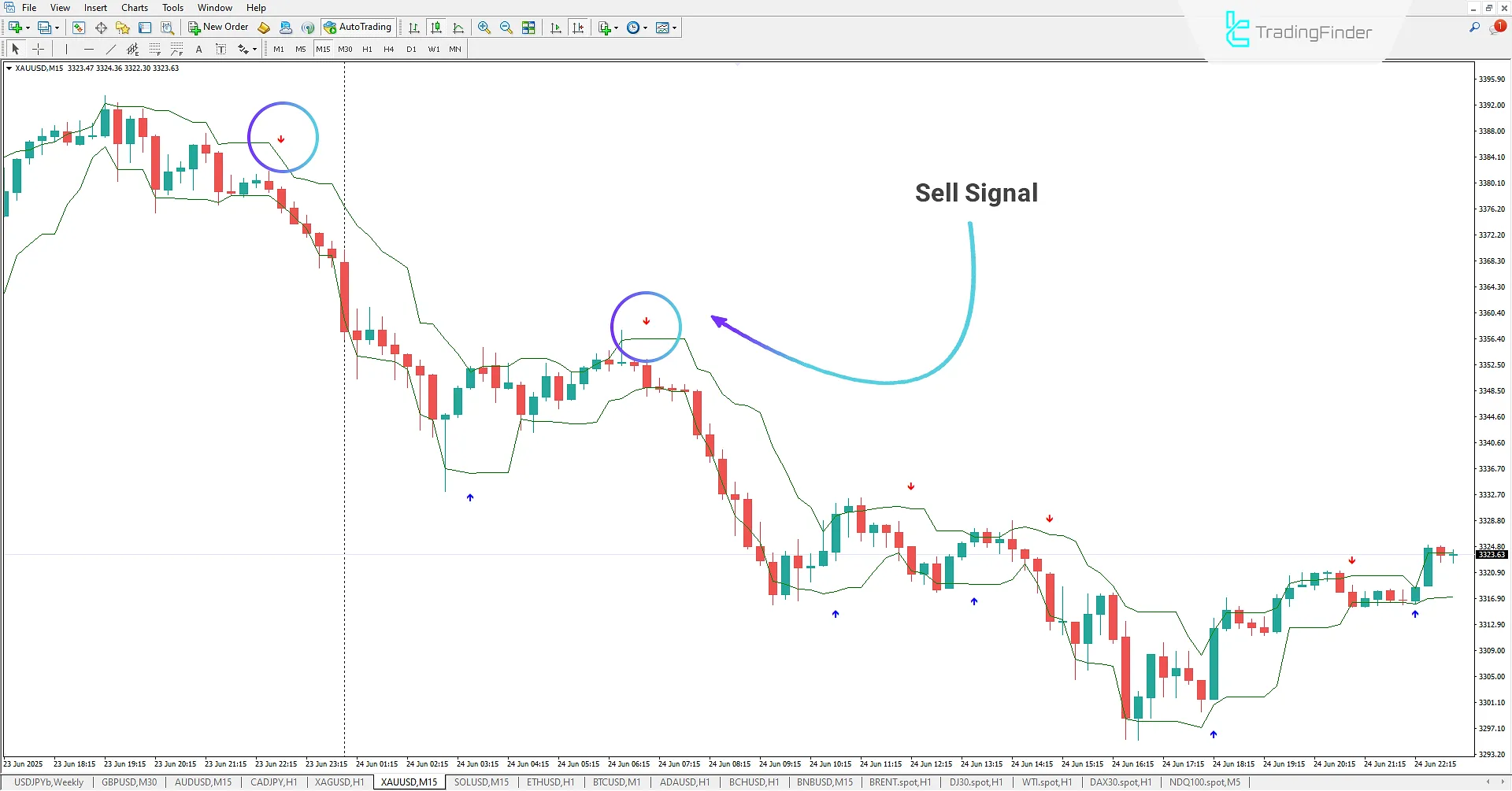

Downward Trend

In the 15-minute chart of the XAU/USD symbol, traders can enter a sell trade by observing the downward signal.

The Lukas Arrows and Curves Indicator enables traders to identify dynamic support and resistance levels using the channel and enter a sell position when the sell signal is generated.

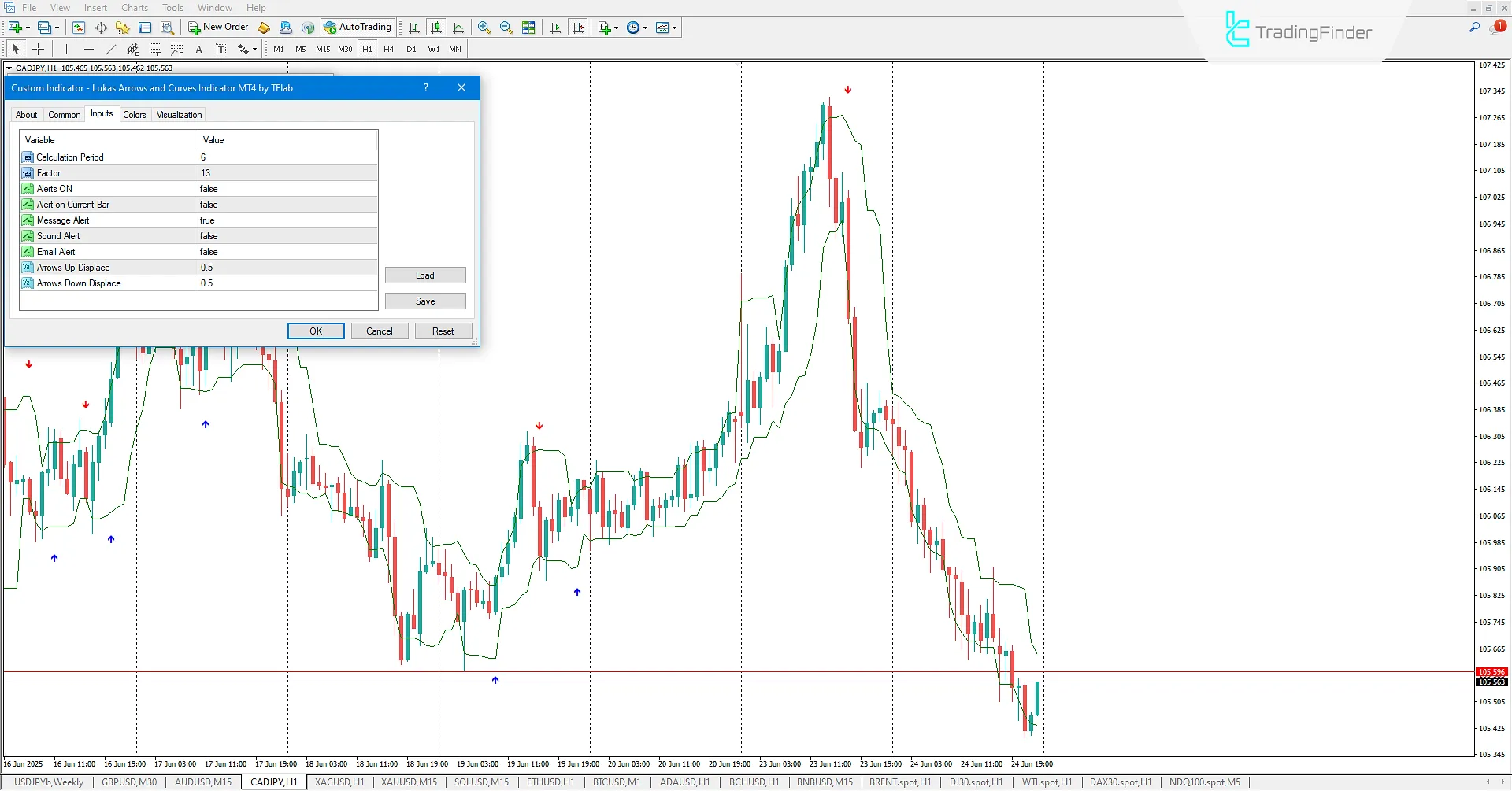

Lukas Arrows and Curves Indicator Settings

Below are the settings for the Lukas Arrows and Curves Indicator:

- Calculation Period: Set the calculation period for the indicator.

- Factor: Set the factor value for the calculation coefficient.

- Alerts ON: Activate/deactivate alert sending.

- Alert on Current Bar: Set the alert sending for the current candle or after the current candle closes.

- Message Alert: Enable/disable message alert.

- Sound Alert: Enable/disable sound alert.

- Email Alert: Enable/disable email alert.

- Arrows Up Displace: Set the distance of upward signals from the candle.

- Arrows Down Displace: Set the distance of downward signals from the candle.

Conclusion

The Lukas Arrows and Curves Indicator is a practical and effective tool for technical analysis traders. This indicator, by drawing a dynamic channel, allows for the identification of moving support and resistance levels.

Traders can use this channel to better understand market structure and enter trades at optimal points through buy and sell signals issued by the indicator. These features make this indicator a crucial tool in improving entry and exit strategies.

Lukas Arrows & Curves MT4 PDF

Lukas Arrows & Curves MT4 PDF

Click to download Lukas Arrows & Curves MT4 PDFWhat is the Lukas Arrows and Curves Indicator?

The Lukas Arrows and Curves Indicator is a specialized tool in MetaTrader 4 that draws a dynamic channel, indicating dynamic support and resistance levels on the chart. Additionally, it provides buy and sell signals, helping traders identify suitable entry points.

How does the Lukas Arrows and Curves Indicator draw a dynamic channel?

Using internal calculations, the indicator creates a moving price channel on the chart, with the upper and lower edges serving as dynamic resistance and support levels. These levels are updated with price movement and align with current market conditions.