![MA Gideon Oscillator for MT4 Download – Free – [TradingFinder]](https://cdn.tradingfinder.com/image/693813/13-239-en-ma-gideon-mt4-01.webp)

![MA Gideon Oscillator for MT4 Download – Free – [TradingFinder] 0](https://cdn.tradingfinder.com/image/693813/13-239-en-ma-gideon-mt4-01.webp)

![MA Gideon Oscillator for MT4 Download – Free – [TradingFinder] 1](https://cdn.tradingfinder.com/image/693815/13-239-en-ma-gideon-mt4-02.webp)

![MA Gideon Oscillator for MT4 Download – Free – [TradingFinder] 2](https://cdn.tradingfinder.com/image/693817/13-239-en-ma-gideon-mt4-03.webp)

![MA Gideon Oscillator for MT4 Download – Free – [TradingFinder] 3](https://cdn.tradingfinder.com/image/693803/13-239-en-ma-gideon-mt4-04.webp)

The MA Gideon Indicator is designed to identify market trends and generate trading signals. This indicator combines several types of moving averages displayed as separate lines to determine the dominant market direction (bullish or bearish).

Furthermore, based on the intersection of these lines, traders can identify suitable points for buy and sell entries.

Specification Table of MA Gideon Oscillator

The specifications of the MA Gideon Indicator are as follows:

Indicator Categories: | Oscillators MT4 Indicators Signal & Forecast MT4 Indicators Moving Average MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Scalper MT4 Indicators Swing Trading MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Indices Market MT4 Indicators Commodity Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

MA Gideon Indicator at a Glance

The MA Gideon Indicator uses four types of moving average lines to display market direction and potential trade setups.

These four lines are:

- Pink Line: Mainline

- Dark Blue Line: Fast Moving Average

- Light Blue Line: Slow Moving Average

- Light Green Line: End-Trend Line

Buy Signal

Based on the 4-hour chart of GBP/USD, the crossover between the fast and slow moving averages is considered a suitable point for buy entries.

Additionally, when all three moving averages move above the mainline, it indicates the continuation of a bullish trend.

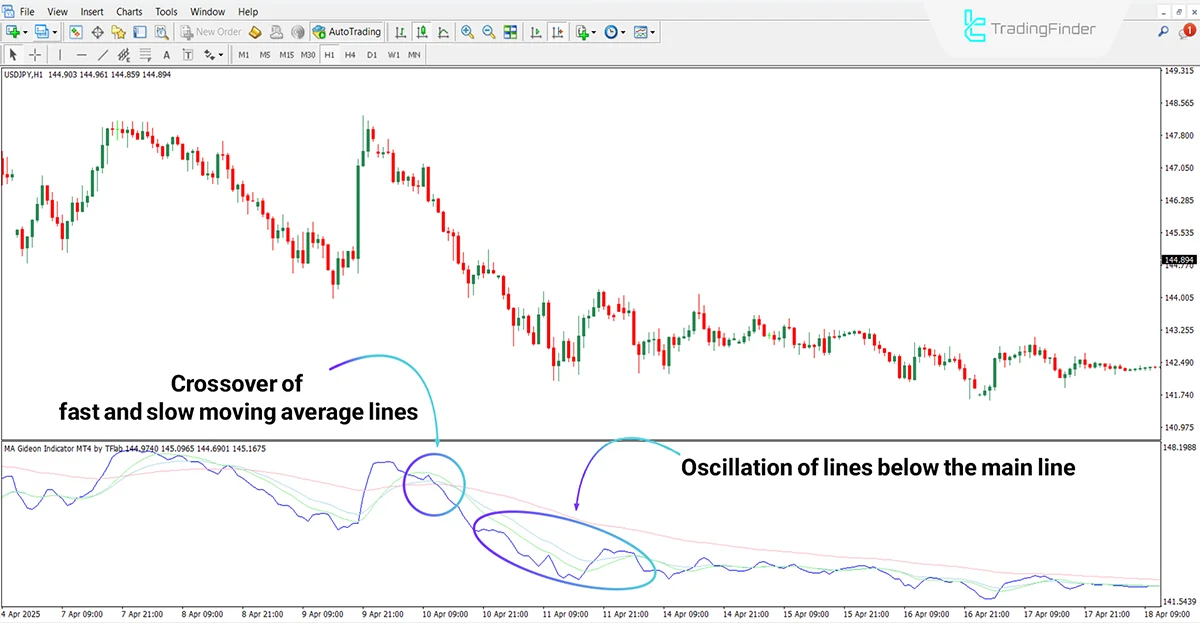

Sell Signal

According to the 1-hour USD/JPY chart, a downward crossover between the fast and slow moving averages indicates a suitable sell position.

In such conditions, when all three moving averages are positioned above the mainline, it demonstrates the buyers’ strength and the continuation of an upward trend.

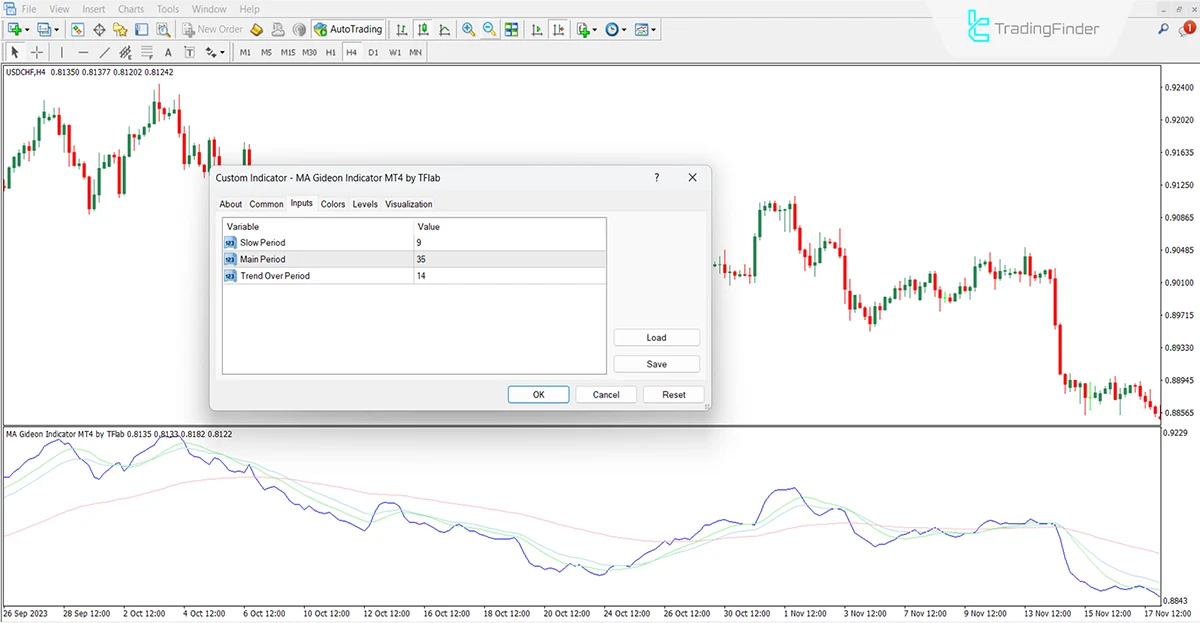

MA Gideon Oscillator Settings

The settings of the MA Gideon Indicator are shown below:

- Slow Period: Slow moving average period

- Main Period: Mainline period

- Trend Over Period: End-trend line period

Conclusion

The MA Gideon Oscillator is based on MA structures and uses four distinctive lines to represent the market trend.

The relative position of these lines reveals whether the market is in a bullish or bearish state, while the crossover between the fast and slow lines acts as a buy or sell signal.

MA Gideon Oscillator for MT4 PDF

MA Gideon Oscillator for MT4 PDF

Click to download MA Gideon Oscillator for MT4 PDFWhat is the purpose of the End-Trend Line?

It defines the final direction and confirms the dominant market trend.

How is a bullish trend detected in the MA Gideon Indicator?

When the three lines (fast, slow, and end-trend) are positioned above the mainline.