![Swami Aroon Oscillator for MetaTrader 4 – Free Download [TradingFinder]](https://cdn.tradingfinder.com/image/583367/2-153-en-swami-aroon-oscillator-mt4-1.webp)

![Swami Aroon Oscillator for MetaTrader 4 – Free Download [TradingFinder] 0](https://cdn.tradingfinder.com/image/583367/2-153-en-swami-aroon-oscillator-mt4-1.webp)

![Swami Aroon Oscillator for MetaTrader 4 – Free Download [TradingFinder] 1](https://cdn.tradingfinder.com/image/583371/2-153-en-swami-aroon-oscillator-mt4-2.webp)

![Swami Aroon Oscillator for MetaTrader 4 – Free Download [TradingFinder] 2](https://cdn.tradingfinder.com/image/583375/2-153-en-swami-aroon-oscillator-mt4-3.webp)

![Swami Aroon Oscillator for MetaTrader 4 – Free Download [TradingFinder] 3](https://cdn.tradingfinder.com/image/583400/2-153-en-swami-aroon-oscillator-mt4-4.webp)

The Swami Aroon Oscillator on the MetaTrader 4 platform moves within a range of 0 to 100 and identifies overbought and oversold conditions as well as bullish and bearish trends as follows:

- Indicator value above 80: Indicates overbought condition and potential correction or bearish reversal

- Indicator value below 20: Indicates oversold condition and potential bullish reversal

Swami Aroon Indicator Table

The general specifications of the Swami Aroon Oscillator are presented in the table below.

Indicator Categories: | Signal & Forecast MT4 Indicators Trading Assist MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Overbought and Oversold MT4 Indicators Trend MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Swami Aroon Oscillator at a Glance

The Swami Aroon Oscillator in MetaTrader 4 displays market trends using color codes. Green indicates bullish strength, while dark pink reflects bearish strength.

The gradual change of these colors defines the momentum intensity and strengthens entry or exit signals.

In addition, buy trades are triggered when the indicator falls below 20 (oversold zone) and changes to green, while sell signals occur when the indicator rises above 80 (overbought zone) and changes to pink.

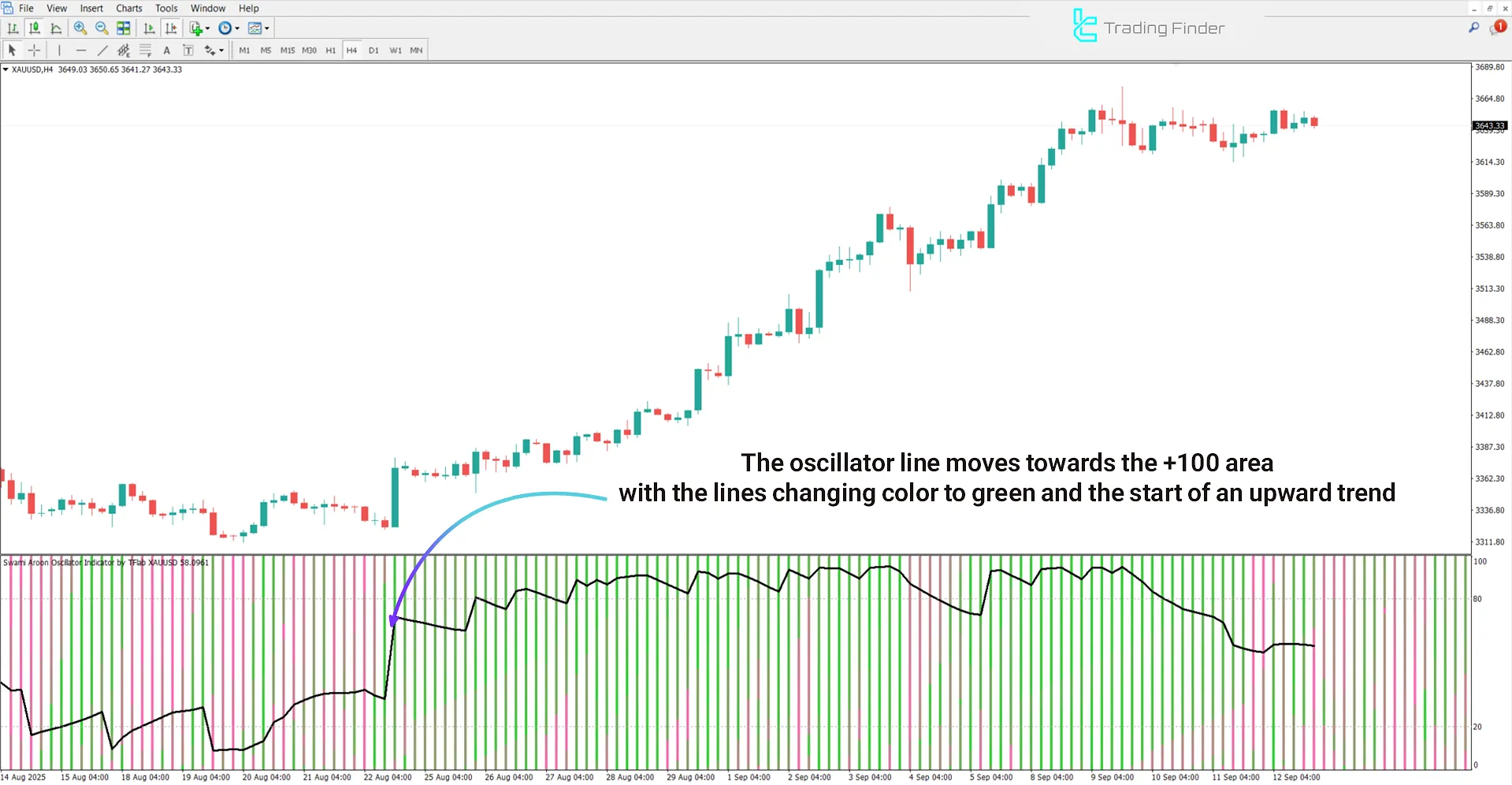

Indicator in a Bullish Trend

The chart below shows the global gold index (XAU/USD) on the 4-hour timeframe. After the oscillator values dropped and approached the 20 level, the bars gradually changed from pink to green. This transition indicates increasing buyer strength and signals the start of a new bullish wave in the market.

Indicator in a Bearish Trend

The image below illustrates the EUR/USD currency pair on the 30-minute timeframe. In the range where the oscillator reached the 80 level and the bars shifted from green to pink, the market entered an overbought state.

Under such conditions, price decline is expected, creating an ideal zone for entering sell trades.

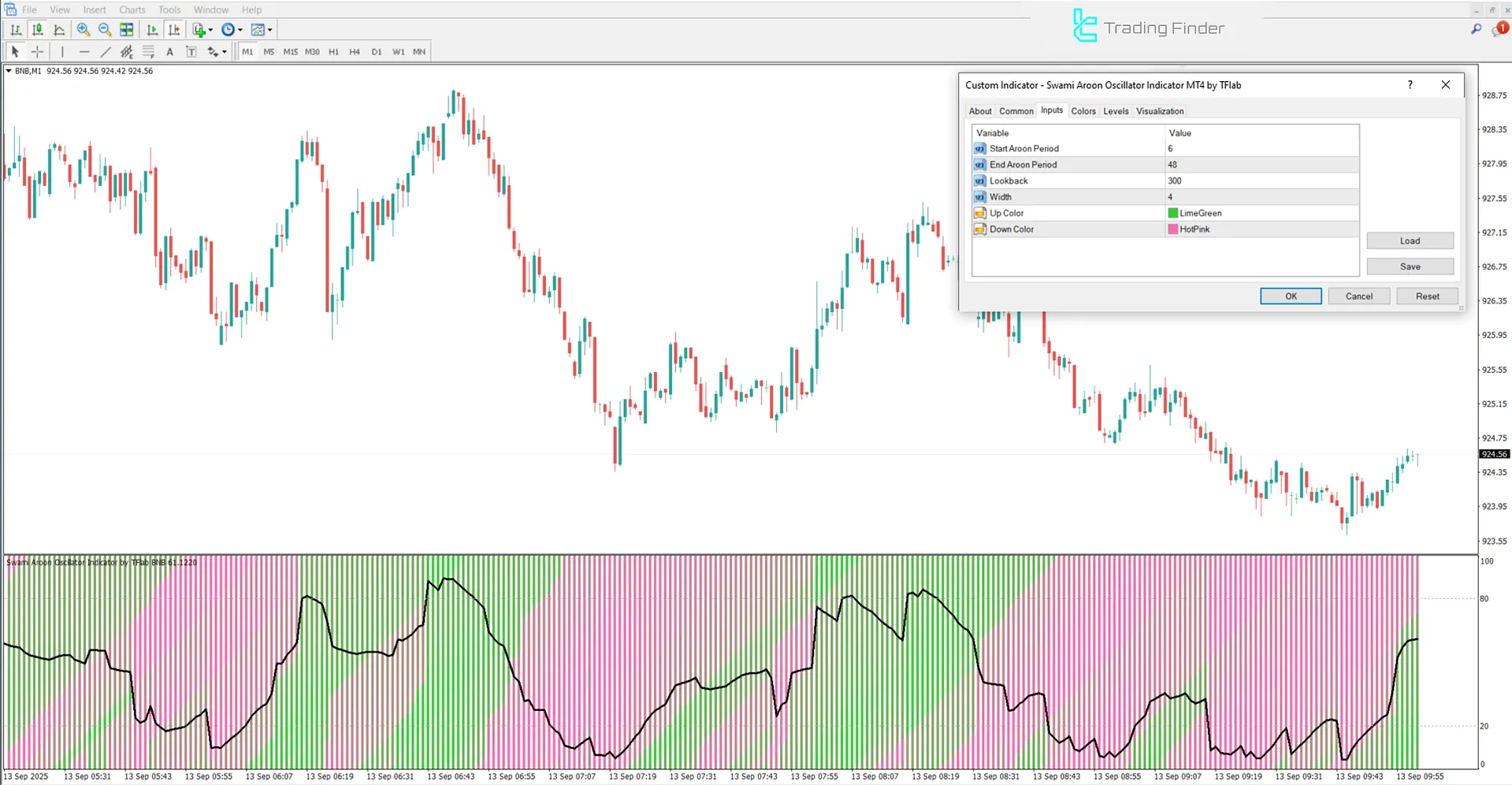

Swami Aroon Oscillator Settings

The image below displays the settings panel of the Swami Aroon Oscillator in MetaTrader 4:

- Start Aroon Period: Initial calculation period for the Aroon Index

- End Aroon Period: Ending period for the Aroon Index

- Lookback: Number of previous candlesticks considered

- Width: Line thickness

- Up Color: Bullish trend color

- Down Color: Bearish trend color

Conclusion

The Swami Aroon Oscillator is a dynamic tool in technical analysis that precisely identifies overbought and oversold conditions.

This trading tool, besides highlighting price ranges, determines market trends through bar color coding: green signals buyer dominance, while dark pink indicates seller dominance.

Swami Aroon Oscillator for MetaTrader 4 PDF

Swami Aroon Oscillator for MetaTrader 4 PDF

Click to download Swami Aroon Oscillator for MetaTrader 4 PDFIn what range does the Swami Aroon Oscillator fluctuate?

This indicator fluctuates between 0 and 100 and identifies overbought and oversold zones.

What is the role of gradual color changes in the Swami Aroon Oscillator?

In this indicator, the transition from pink to green or vice versa reflects the market momentum and strengthens or weakens the current trend.