![Triple Bottom and Triple Top Indicator for MT4 Download - [TradingFinder]](https://cdn.tradingfinder.com/image/346255/2-55-en-triplebottom-tripletop-mt4-1.webp)

![Triple Bottom and Triple Top Indicator for MT4 Download - [TradingFinder] 0](https://cdn.tradingfinder.com/image/346255/2-55-en-triplebottom-tripletop-mt4-1.webp)

![Triple Bottom and Triple Top Indicator for MT4 Download - [TradingFinder] 1](https://cdn.tradingfinder.com/image/346242/2-55-en-triplebottom-tripletop-mt4-2.webp)

![Triple Bottom and Triple Top Indicator for MT4 Download - [TradingFinder] 2](https://cdn.tradingfinder.com/image/346253/2-55-en-triplebottom-tripletop-mt4-3.webp)

![Triple Bottom and Triple Top Indicator for MT4 Download - [TradingFinder] 3](https://cdn.tradingfinder.com/image/346254/2-55-en-triplebottom-tripletop-mt4-4.webp)

The Triple Bottom and Triple Top indicator is a classic structure in technical analysis used to identify potential trend reversal points.

These patterns consist of three consecutive peaks (in the Triple Top pattern, shown in blue) or three straight troughs (in the Triple Bottom pattern, shown in red).

Table of Features for Triple Bottom and Triple Top Specifications Table

The features of the Triple Bottom and Triple Top pattern indicator are presented in the table below.

Indicator Categories: | Price Action MT4 Indicators Chart & Classic MT4 Indicators Candle Sticks MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Intraday MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Forward Market MT4 Indicators Stock Market MT4 Indicators Cryptocurrency MT4 Indicators Forex MT4 Indicators |

Uptrend Conditions

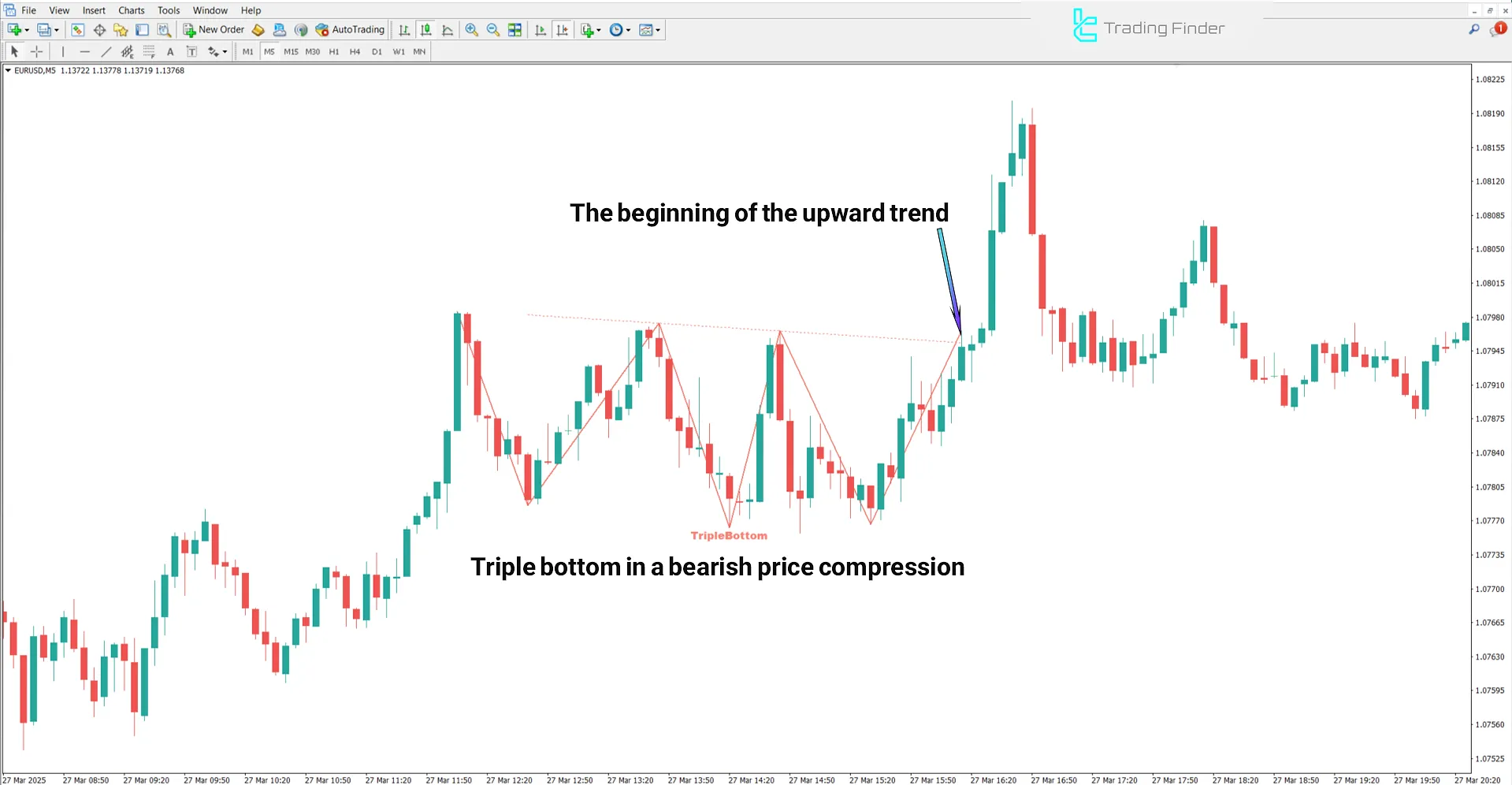

On the EUR/USD chart, the Triple Bottom pattern appears after a short-term downtrend. The market reacts to a support zone with three touches, showing strengthened demand and decreasing selling pressure.

Once this support level holds, the chance for a price reversal and the beginning of an uptrend increases.

Downtrend Conditions

The image below illustrates a downtrend on the CAD/CHF chart.

In this case, the Triple Top pattern gives a sell signal when the price fails to break resistance after forming three relatively equal peaks. A subsequent break of the support area confirms a bearish trend, reflecting weak demand and growing selling pressure.

Indicator Settings

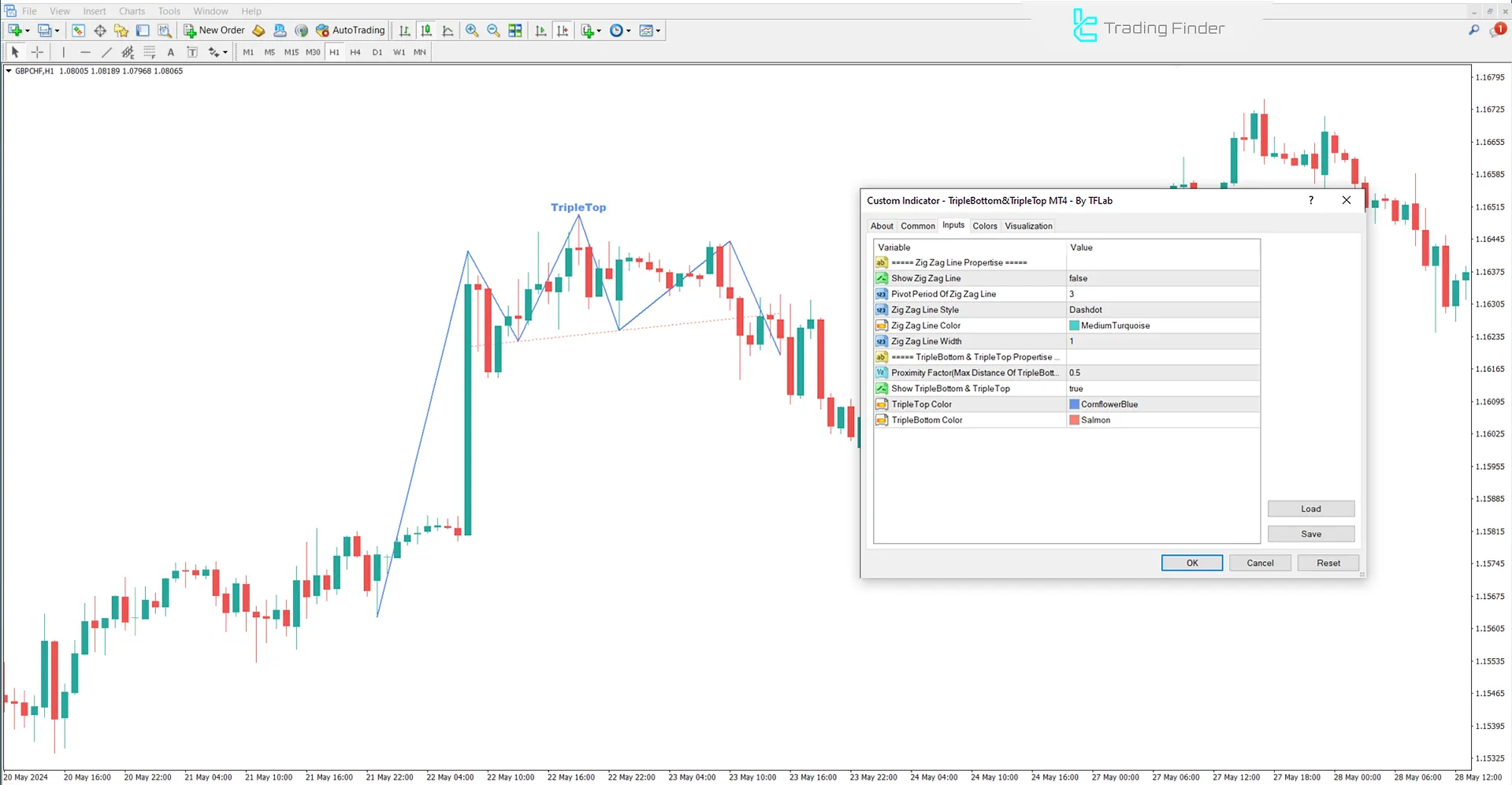

The customizable settings for the Triple Bottom and Triple Top indicator are shown in the image below:

- Display Zig Zag Line: Show the zigzag line

- Pivot Period Of Zig Zag Line: Pivot period of the zigzag line (number of candles required to detect turning points)

- Zig Zag Line Style: Display style of the zigzag line

- Zig Zag Line Color: Zigzag line color

- Zig Zag Line Width: Zigzag line thickness

- Proximity Factor (Max Distance): Maximum allowable distance between peaks or troughs to confirm the pattern

- Display TripleBottom & TripleTop: Show Triple Bottom and Triple Top patterns

- TripleTop Color: The Color of the Triple Top pattern

- TripleBottom Color: The Color of the Triple Bottom pattern

Conclusion

The Triple Bottom and Triple Top indicators detect bullish and bearish reversal patterns. The Triple Top issues a sell signal upon breaking support, while the Triple Bottom gives a buy signal when resistance is breached.

In the MetaTrader 4 version of this tool, the distance between peaks or troughs is calibrated based on 0.5 units of the ATR indicator, enhancing pattern accuracy.

Triple Bottom Triple Top MT4 PDF

Triple Bottom Triple Top MT4 PDF

Click to download Triple Bottom Triple Top MT4 PDFWhat is the visual difference between the Triple Top/Bottom and the Head and Shoulders pattern?

In the Triple Top/Bottom, all three peaks or troughs are approximately level, while the middle peak is taller in the Head and Shoulders.

In what kind of trend does the Triple Top pattern form?

This pattern forms at the end of an uptrend and signals a potential trend reversal.