![Anti-Gartley Harmonic Pattern Indicator in MT5 - [TradingFinder]](https://cdn.tradingfinder.com/image/365456/11-83-en-anti-gartley-harmonic-pattern-mt5-01.webp)

![Anti-Gartley Harmonic Pattern Indicator in MT5 - [TradingFinder] 0](https://cdn.tradingfinder.com/image/365456/11-83-en-anti-gartley-harmonic-pattern-mt5-01.webp)

![Anti-Gartley Harmonic Pattern Indicator in MT5 - [TradingFinder] 1](https://cdn.tradingfinder.com/image/365450/11-83-en-anti-gartley-harmonic-pattern-mt5-02.webp)

![Anti-Gartley Harmonic Pattern Indicator in MT5 - [TradingFinder] 2](https://cdn.tradingfinder.com/image/365460/11-83-en-anti-gartley-harmonic-pattern-mt5-03.webp)

![Anti-Gartley Harmonic Pattern Indicator in MT5 - [TradingFinder] 3](https://cdn.tradingfinder.com/image/365461/11-83-tr-anti-gartley-harmonic-pattern-mt5-04.webp)

On July 2, 2025, in version 2, alert/notification and signal functionality was added to this indicator

The Anti-Gartley Harmonic Pattern indicator is considered a powerful technical analysis tool in MetaTrader 5, designed with the goal of identifying harmonic patterns.

By focusing on five key pivot points, this indicator detects the structure of the Anti-Gartley pattern on the chart and displays it to analysts by drawing specific lines.

Using this indicator alongside various technical analysis methods can enable traders to better understand bullish or bearish market trends and provide more professional analyses based on harmonic structures.

Anti-Gartley Harmonic Pattern Indicator Table

The general specifications of the Anti-Gartley Harmonic Pattern indicator are listed in the section below.

Indicator Categories: | Price Action MT5 Indicators Chart & Classic MT5 Indicators Harmonic MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Leading MT5 Indicators Non-Repaint MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Stock MT5 Indicators Indices MT5 Indicators Share Stock MT5 Indicators |

Indicator at a Glance

The Anti-Gartley Harmonic Pattern indicator is an advanced and efficient tool in technical analysis designed to identify harmonic patterns.

This indicator draws the Anti-Gartley pattern on the chart by detecting five key points X, A, B, C, D and connecting them with lines.

The Anti-Gartley pattern is one of the complex harmonic patterns that appears under specific market conditions and can show signs of potential price reversal.

By using this indicator, traders will be able to identify price reversal areas (PRZ) and thus find more suitable points for entering buy or sell trades.

This tool, which is particularly useful in highly volatile markets like Forex, allows analysts to use more appropriate analyses and implement their trading strategies more professionally.

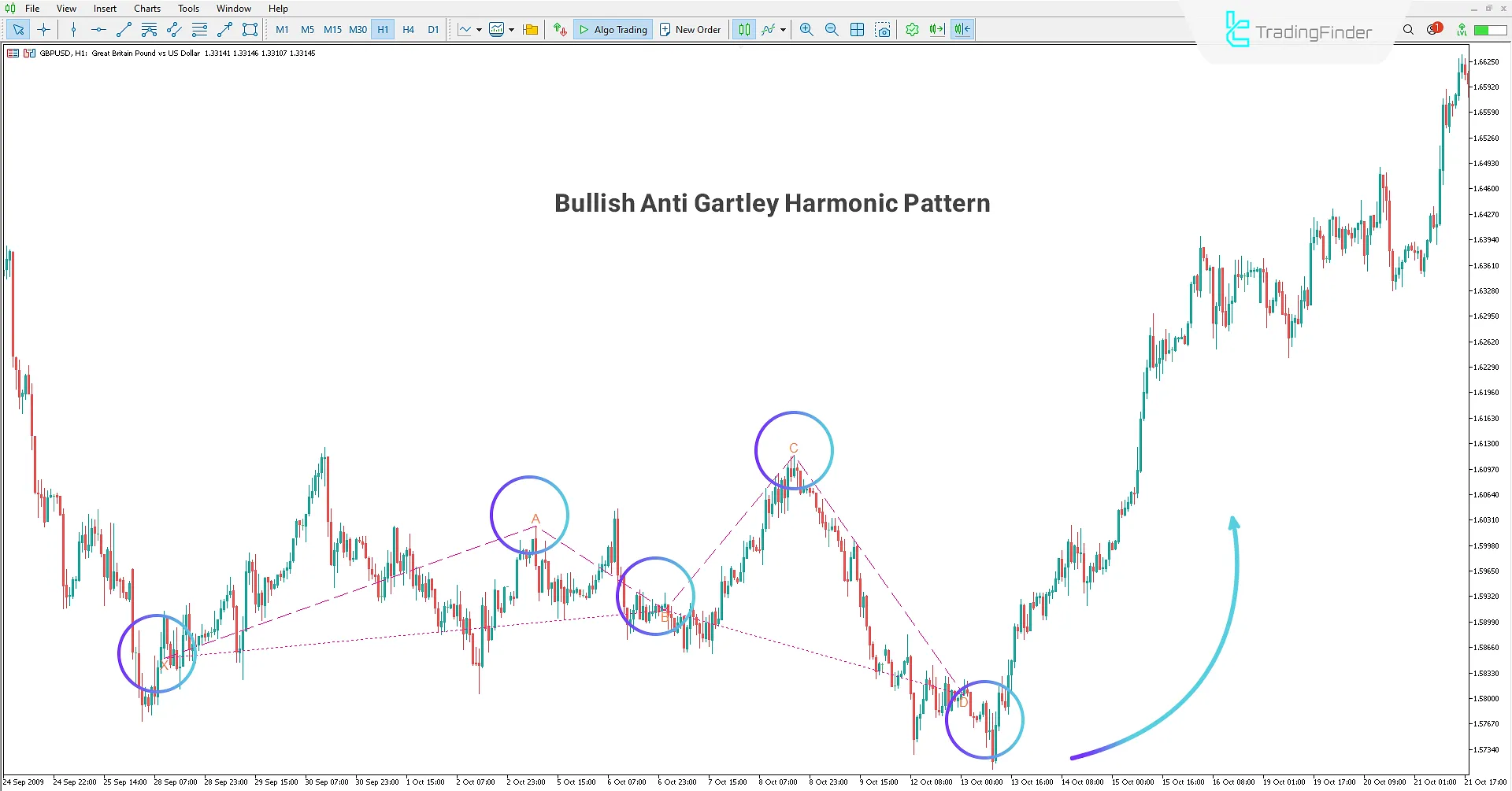

Bullish Pattern

On the 1-hour chart of the GBPUSD currency pair, a bullish Anti-Gartley harmonic pattern has been identified, which can act as a strong signal for a change in price direction.

Using the Anti-Gartley Harmonic Pattern indicator, traders can easily identify this pattern and, by determining point D as the potential price reversal area (PRZ).

enter a buy position. This pattern usually appears under specific market conditions and can provide suitable trading opportunities for entering buy trades.

Using this indicator, especially in shorter time frames, can enable traders to make more timely and specialized decisions.

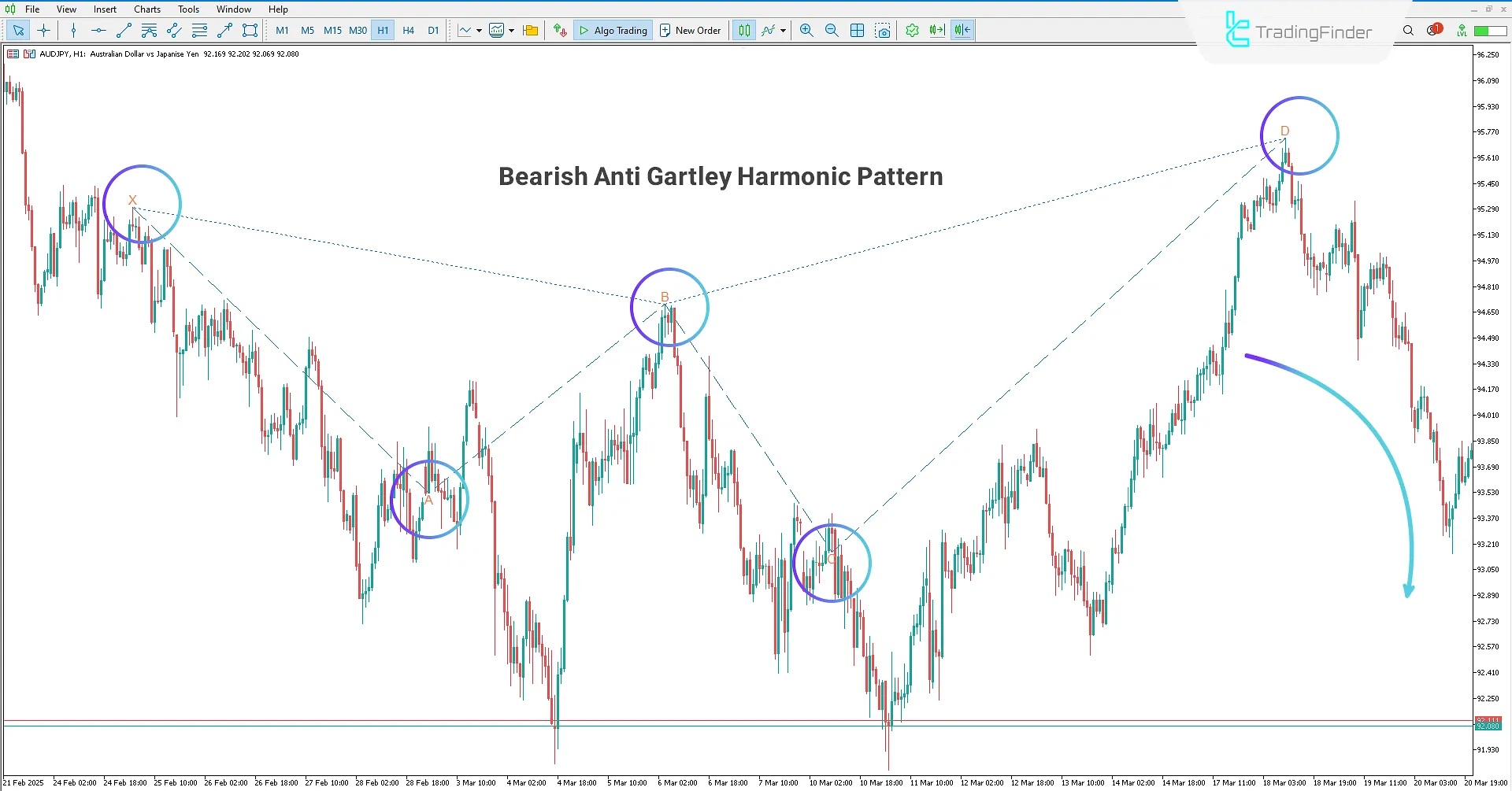

Bearish Pattern

On the 1-hour chart of the AUDJPY currency pair, the Anti-Gartley Harmonic Pattern indicator has identified and drawn a bearish Anti-Gartley pattern on the chart.

This pattern usually appears when the price is changing its trend and can be a sign of a future downtrend. Traders using this indicator will be able to identify entry points for sell positions.

Given the display of point D as the potential price reversal area (PRZ), traders can use this signal as an opportunity to enter sell positions.

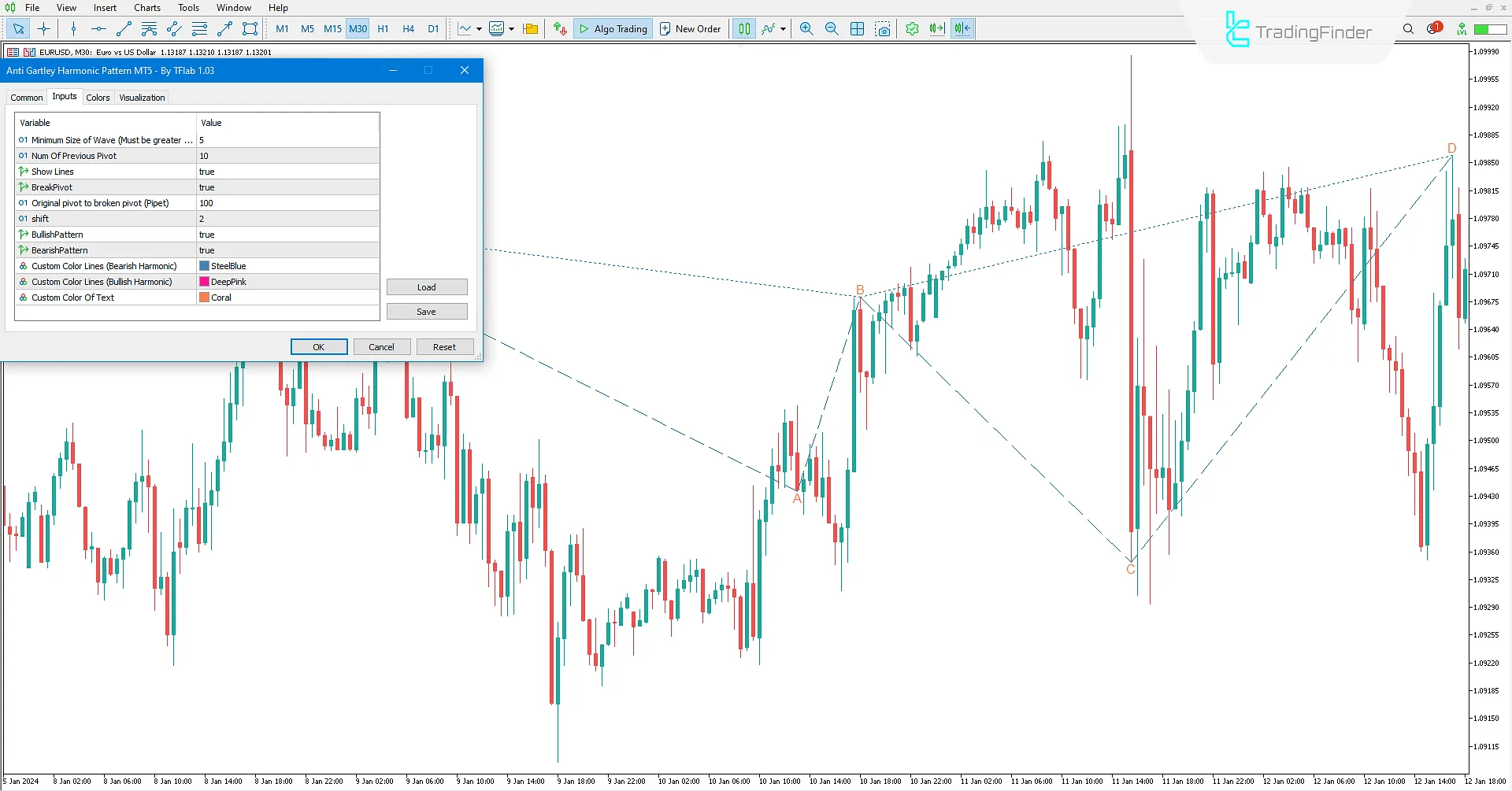

Anti-Gartley Harmonic Pattern Indicator Settings

The settings for the Anti-Gartley Harmonic Pattern indicator are provided in the section below.

- Minimum Lenth Of Wave: Adjust the minimum length of a wave;

- Num Of Previous Pivot: Adjust the number of previous candles to examine the market;

- Show Lines: Adjust whether to display pattern lines;

- Break Pivot: Adjust whether to check for pivot breakouts;

- Original pivot to broken pivot (Pipet): Adjust the distance (in pipettes) between the original pivot and the broken pivot;

- Shift: Adjust the horizontal shift of the lines;

- Bullish Pattern: Adjust whether to display bullish patterns;

- Bearish Pattern: Adjust whether to display bearish patterns;

- Custom Color Lines (Bearish Harmonic): Adjust the color for bearish harmonic pattern lines;

- Custom Color Lines (Bullish Harmonic): Adjust the color for bullish harmonic pattern lines;

- Custom Color Of Text: Adjust the color for the explanatory text on the chart.

Conclusion

The Anti-Gartley Harmonic Pattern indicator is known as a specialized and advanced tool in Forex market trading strategies.

By identifying and drawing the Anti-Gartley pattern on the chart, this indicator enables traders to understand the market structure and the potential price trend.

This tool provides ideal conditions for identifying entry points for buy or sell positions by displaying potential price reversal areas (PRZ).

By using this indicator, traders can perform more specialized analyses regarding price reversal points and consequently improve their trading performance.

Anti-Gartley Harmonic Pattern MT5 PDF

Anti-Gartley Harmonic Pattern MT5 PDF

Click to download Anti-Gartley Harmonic Pattern MT5 PDFWhat is the Anti-Gartley Harmonic Pattern indicator?

This indicator is an advanced tool in technical analysis designed to identify the Anti-Gartley harmonic pattern. By identifying five key pivot points (X, A, B, C, D) and drawing the connecting lines between these points, this indicator shows the Anti-Gartley pattern on the price chart.

How does the Anti-Gartley Harmonic Pattern indicator work?

The Anti-Gartley pattern indicator identifies and displays the Anti-Gartley pattern to analysts by determining five key points (X, A, B, C, D) on the chart and connecting them with lines. This process helps in identifying price reversal areas (PRZ).