![Balanced Price Range Indicator in MetaTrader 5 Download - [TFlab]](https://cdn.tradingfinder.com/image/249904/11-64-en-bpr-ict-mt5-01.webp)

![Balanced Price Range Indicator in MetaTrader 5 Download - [TFlab] 0](https://cdn.tradingfinder.com/image/249904/11-64-en-bpr-ict-mt5-01.webp)

![Balanced Price Range Indicator in MetaTrader 5 Download - [TFlab] 1](https://cdn.tradingfinder.com/image/249905/11-64-en-bpr-ict-mt5-02.webp)

![Balanced Price Range Indicator in MetaTrader 5 Download - [TFlab] 2](https://cdn.tradingfinder.com/image/249907/11-64-en-bpr-ict-mt5-03.webp)

![Balanced Price Range Indicator in MetaTrader 5 Download - [TFlab] 3](https://cdn.tradingfinder.com/image/249903/11-64-en-bpr-ict-mt5-04.webp)

The Balanced Price Range (BPR) indicator is one of the MetaTrader 5 ICT indicators . Using the concepts of the ICT style, this indicator identifies the intersection zone between two Fair Value Gaps (FVG).

By drawing a bearish BPR in brown and displaying a bullish BPR in green, it highlights important price reaction zones for traders.

Balanced Price Range Indicator Table

The specifications of the Balanced Price Range (BPR) indicator are listed in the table below.

Indicator Categories: | Smart Money MT5 Indicators Supply & Demand MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Breakout MT5 Indicators Entry & Exit MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Stock MT5 Indicators Indices MT5 Indicators |

Balanced Price Range Indicator at a Glance

The Balanced Price Range (BPR) indicator is a tool based on the ICT style, used by traders seeking to identify the intersection of two opposing FV Gs. This indicator helps traders identify supply and demand zones, which can then be used in market analysis.

By identifying these zones, traders can predict suitable entry and exit points, as well as anticipate potential price reactions in these regions.

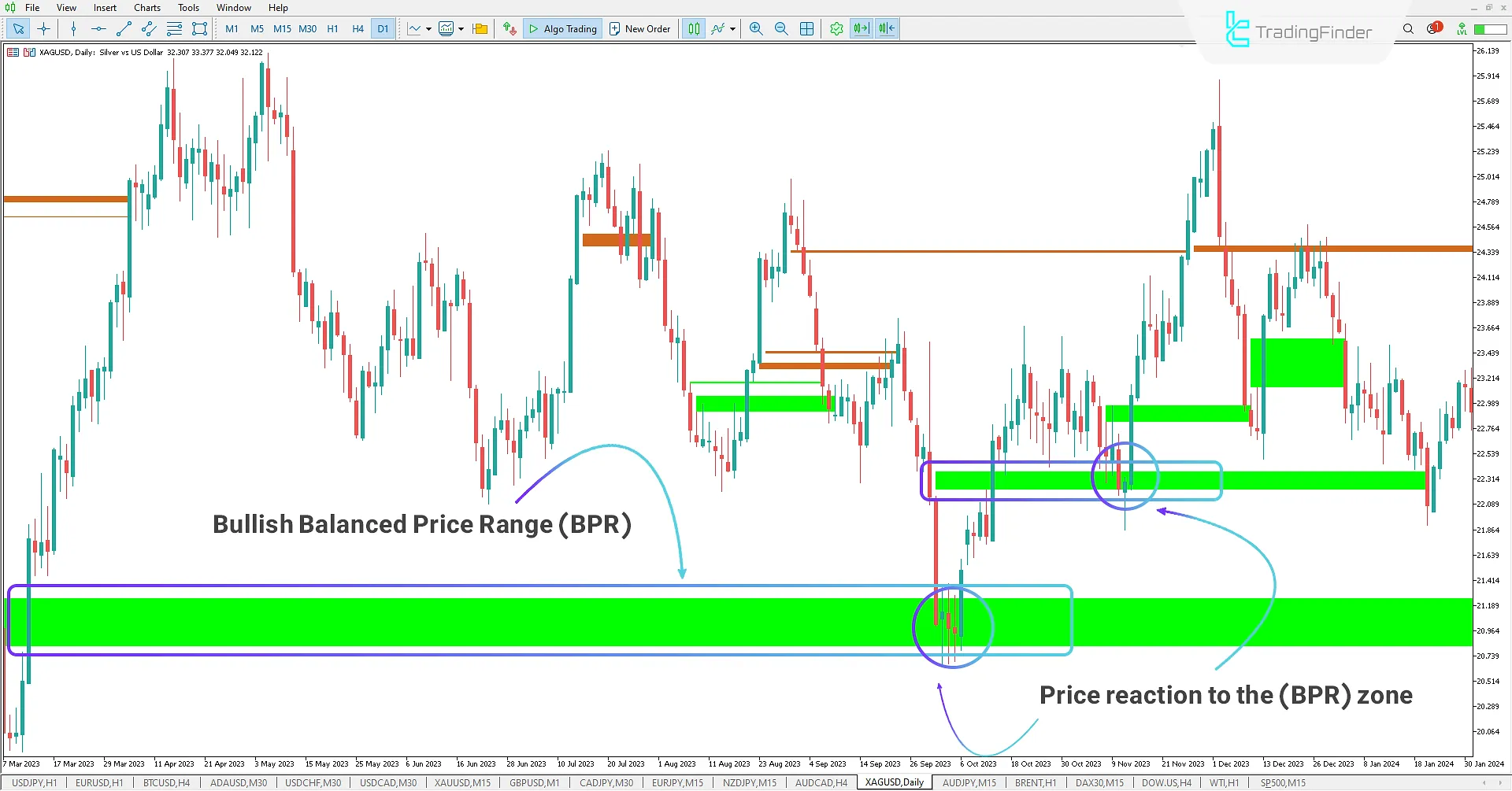

Bullish Trend

On the daily chart of silver (XAGUSD), the Balanced Price Range (BPR) indicator identifies bullish BPR areas on the chart, which are displayed in a green box.

In the chart below, after a correction, the price moves towards the BPR range, and upon reaching this area, the correction ends, and the market trend changes to bullish.

Following this trend change, the price sharply rises, initiating a new market trend. This pattern highlights the importance of BPR zones as reliable points for trend reversal identification, which can provide good trading opportunities for traders.

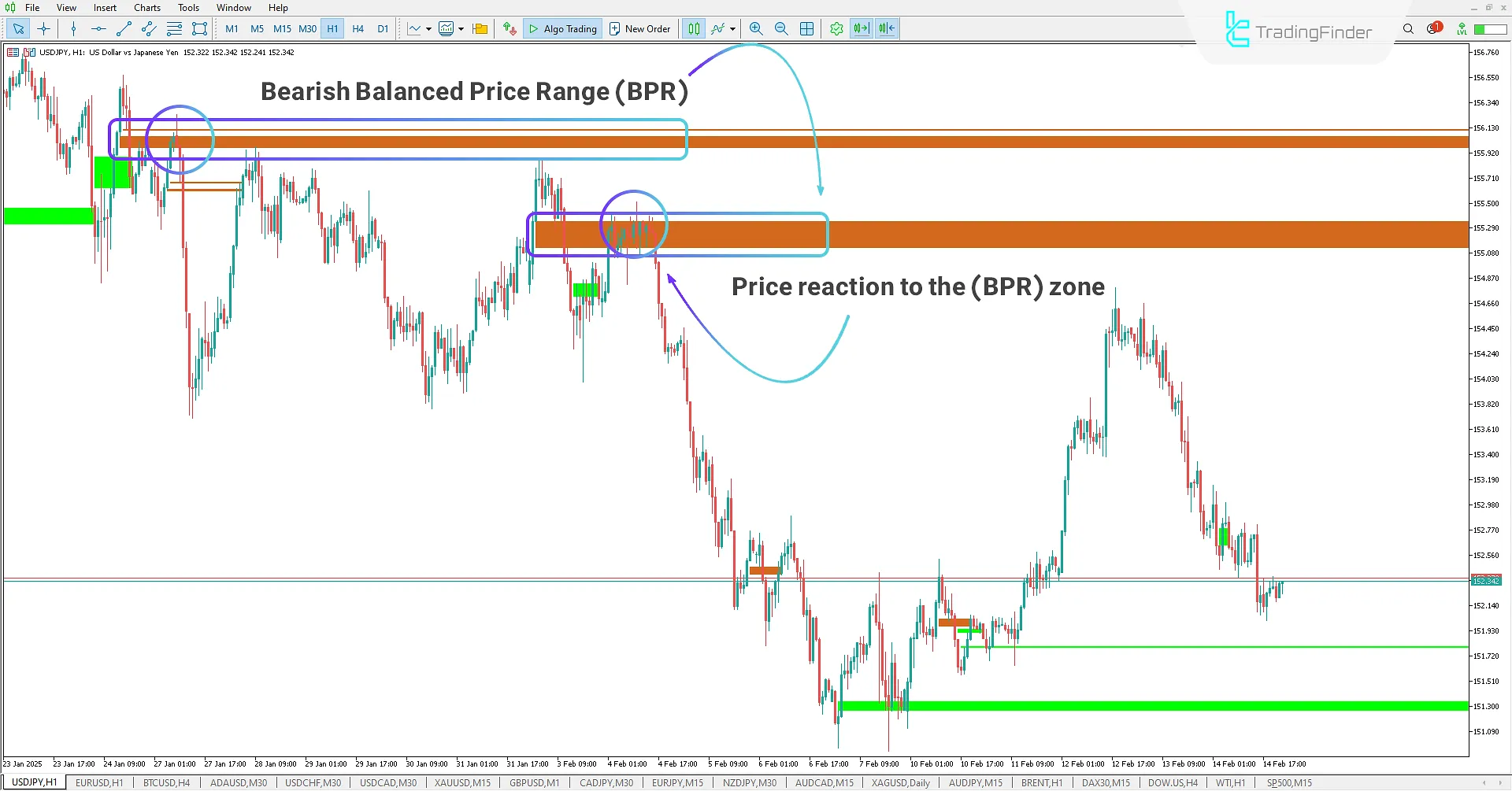

Bearish Trend

On the 1-hour chart (USD/JPY), the Balanced Price Range (BPR) indicator identifies bearish BPR zones and displays them as a brown box on the chart. This indicator identifies supply and demand zones using the intersection of FVGs.

Traders can use these supply and demand zones as key points for decision-making in their trades. This feature is especially useful for ICT traders seeking entry zones into the market.

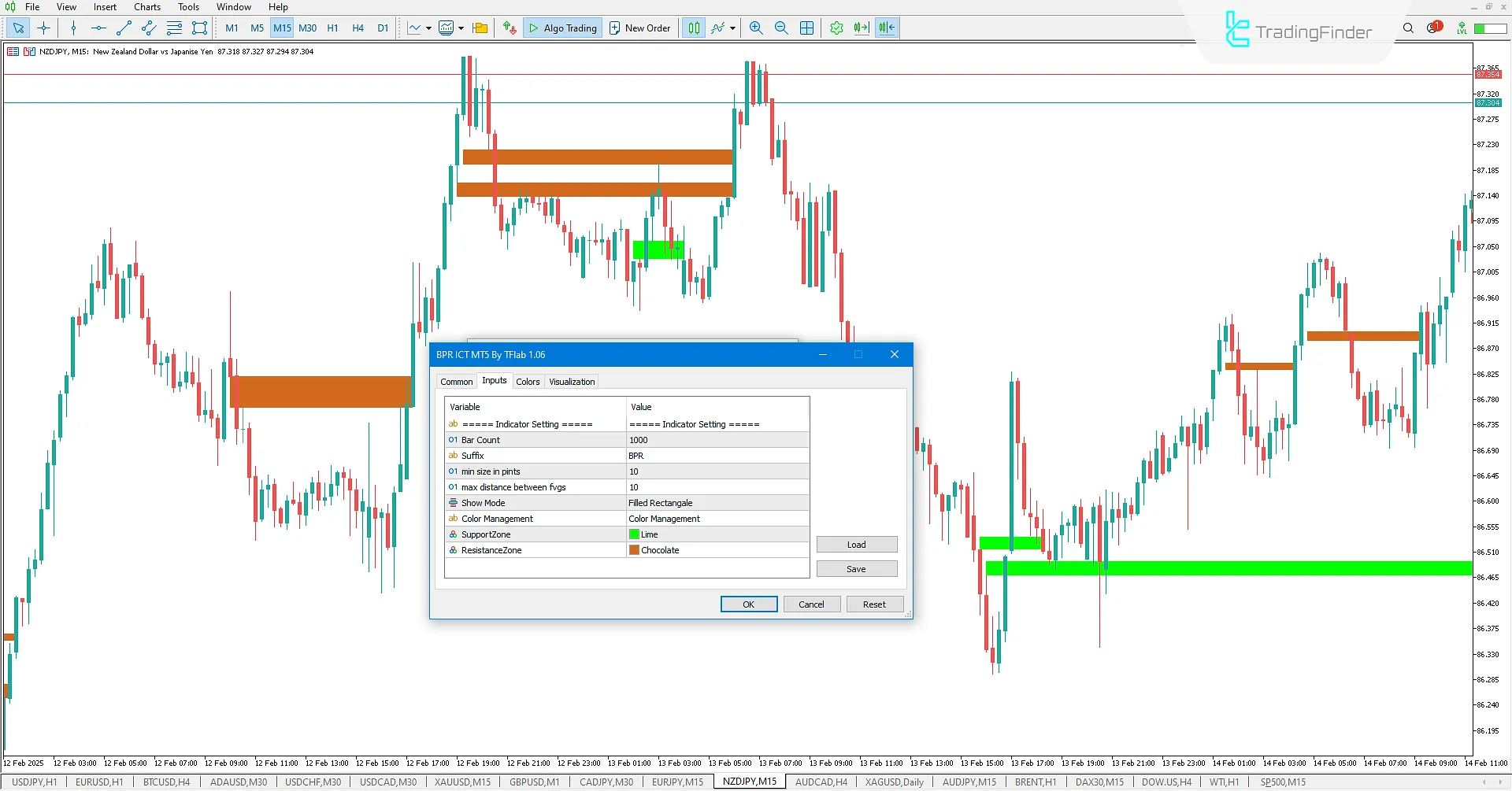

Balanced Price Range Indicator Settings

Below are the settings for the Balanced Price Range indicator:

Indicator Setting

- Bar Count: Select the number of candles to display on the chart

- Min Size in Points: Select the minimum size of the range in points

- Max Distance Between FVGs: Select the maximum distance between two FVGs

- Show Mode: Select display mode for the box

Color Management

- Support Zone: Select the color for the support zone

- Resistance Zone: Select the color for the resistance zone

Conclusion

The Balanced Price Range (BPR) indicator is a tool in MetaTrader 5, designed for traders following the ICT style. With this MetaTrader5 indicator, traders can identify BPR zones and spot trading opportunities based on the intersection areas of two opposing FVGs.

This feature allows traders to detect crucial price zones for decision-making and entry points, enhancing their ability to conduct specialized market analysis.

Balanced Price Range BPR MT5 PDF

Balanced Price Range BPR MT5 PDF

Click to download Balanced Price Range BPR MT5 PDFHow does the BPR indicator help identify supply and demand zones?

This indicator identifies the intersection of two opposing FVGs and plots the BPR zones on the chart, allowing traders to pinpoint supply and demand zones for market analysis.

Why are BPR zones important for traders?

BPR zones are considered important due to the price reactions in these areas. They are known as significant supply and demand levels that can serve as optimal entry or exit points in the market. These zones often have high liquidity and can trigger substantial price movements.