![Bollinger Bands RSI Indicator for MT5 Download – Free – [TradingFinder]](https://cdn.tradingfinder.com/image/514938/13-195-en-bollinger-bands-rsi-mt5-01.webp)

![Bollinger Bands RSI Indicator for MT5 Download – Free – [TradingFinder] 0](https://cdn.tradingfinder.com/image/514938/13-195-en-bollinger-bands-rsi-mt5-01.webp)

![Bollinger Bands RSI Indicator for MT5 Download – Free – [TradingFinder] 1](https://cdn.tradingfinder.com/image/514937/13-195-en-bollinger-bands-rsi-mt5-02.webp)

![Bollinger Bands RSI Indicator for MT5 Download – Free – [TradingFinder] 2](https://cdn.tradingfinder.com/image/514936/13-195-en-bollinger-bands-rsi-mt5-03.webp)

![Bollinger Bands RSI Indicator for MT5 Download – Free – [TradingFinder] 3](https://cdn.tradingfinder.com/image/514939/13-195-en-bollinger-bands-rsi-mt5-04.webp)

The Bollinger Bands RSI indicator is developed by combining two analytical tools: Bollinger Bands indicator and the Relative Strength Index (RSI).

This oscillator, by analyzing price volatility and trend momentum, facilitates accurate identification of reversal zones and is used to determine entry and exit points.

Specification Table of Bollinger Bands RSI Oscillator

The specifications of the Bollinger Bands RSI indicator are presented in the table below:

Indicator Categories: | Oscillators MT5 Indicators Bands & Channels MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Swing Trading MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators |

Bollinger Bands RSI Indicator at a Glance

In the Bollinger Bands RSI oscillator, when the “RSI” line touches the lower band, it indicates oversold conditions, and the indicator draws a green arrow to issue a buy signal.

Conversely, when the “RSI” line touches the upper band, overbought conditions are detected and the indicator displays a red arrow as a sell signal.

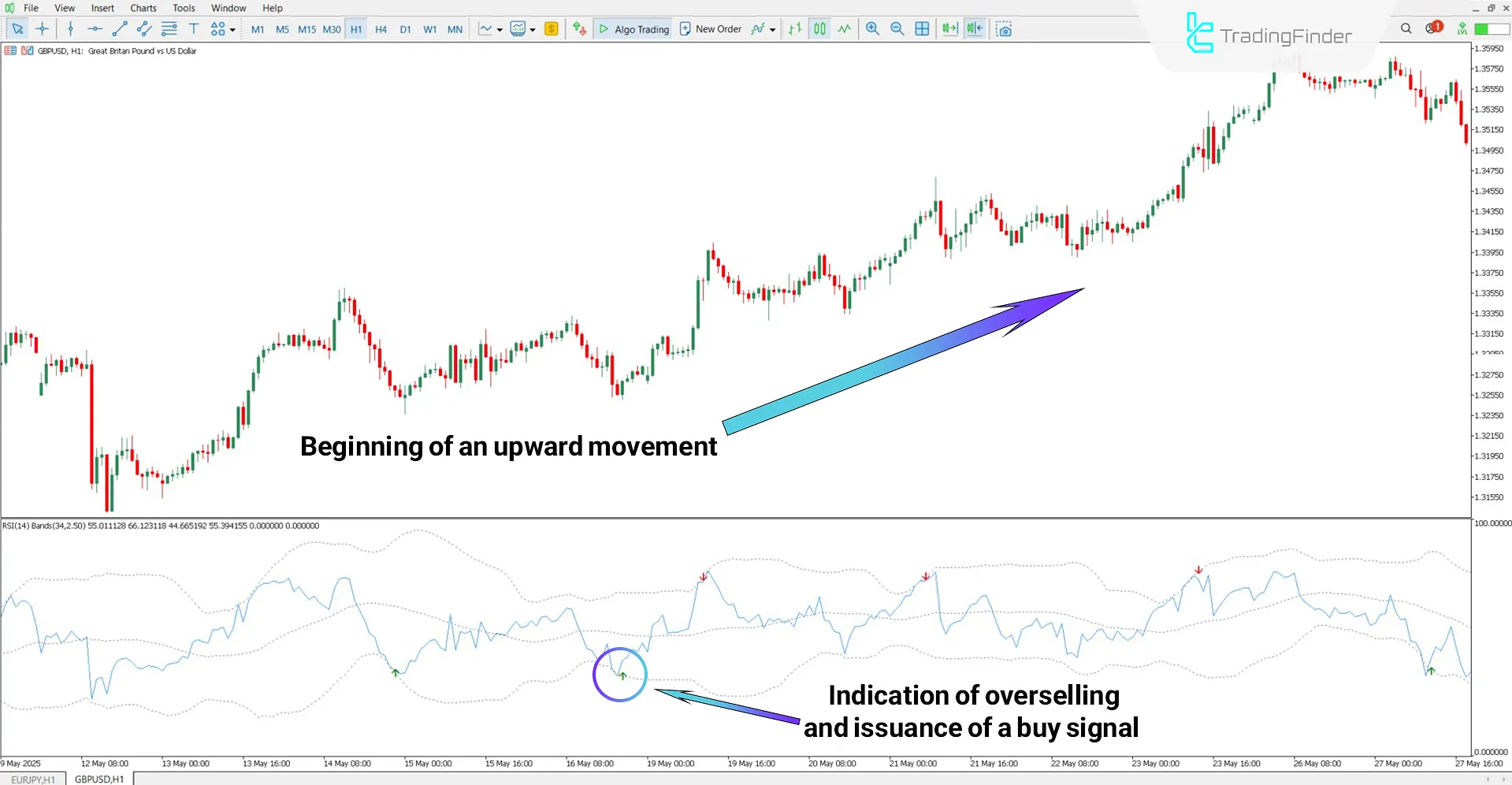

Buy Position

Based on the GBP/USD currency pair chart in the 1-hour timeframe, the RSI line touching the lower band indicates entry into the oversold zone.

Subsequently, the indicator identified a potential reversal and at the same spot issued a buy signal by displaying a green arrow.

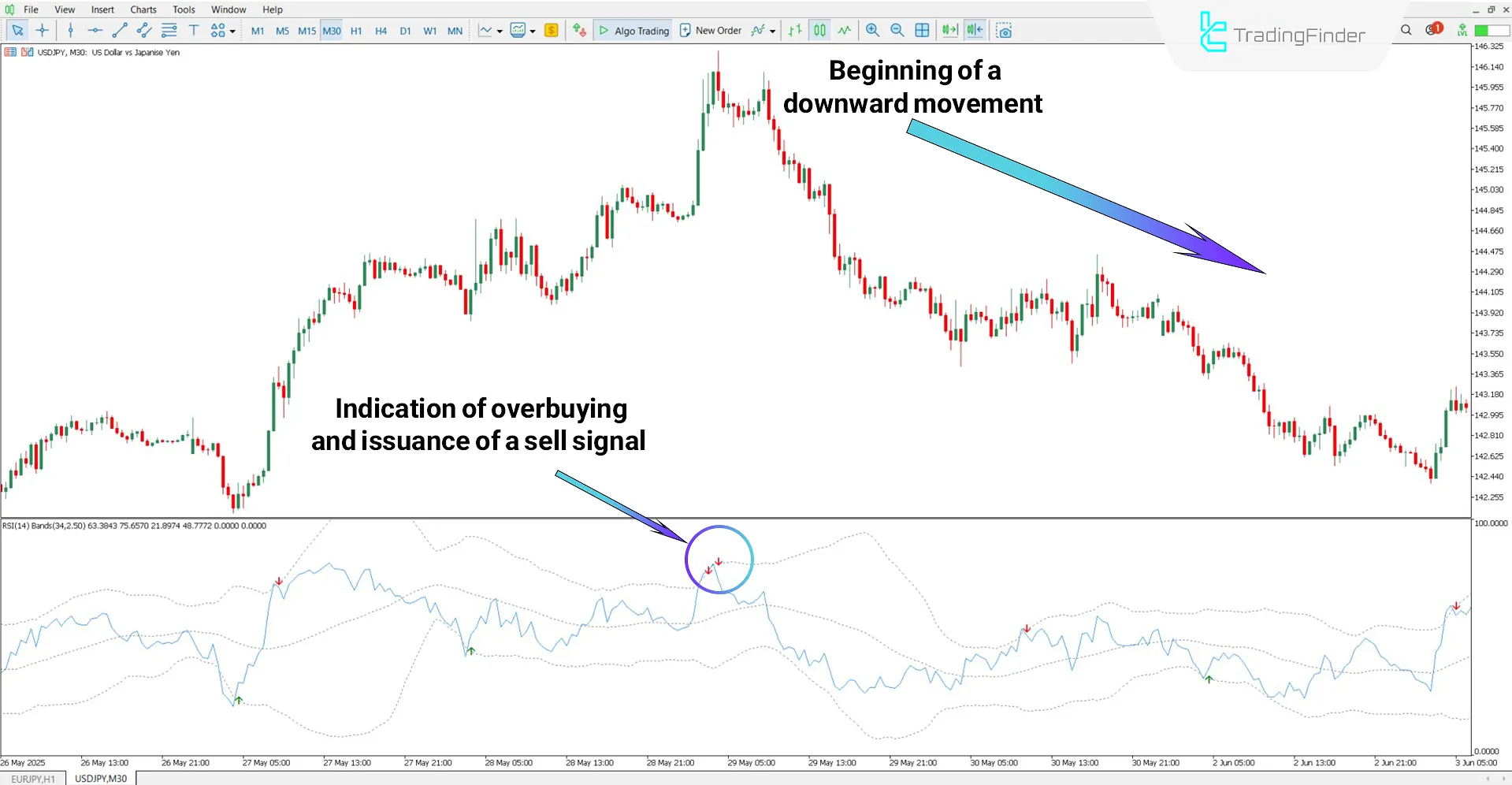

Sell Position

According to the USD/JPY chart in the 30-minute timeframe, the RSI line touching the upper band indicates overbought conditions and potential price reversal.

In this situation, the indicator considers the contact point as a sell signal and marks it with a red arrow.

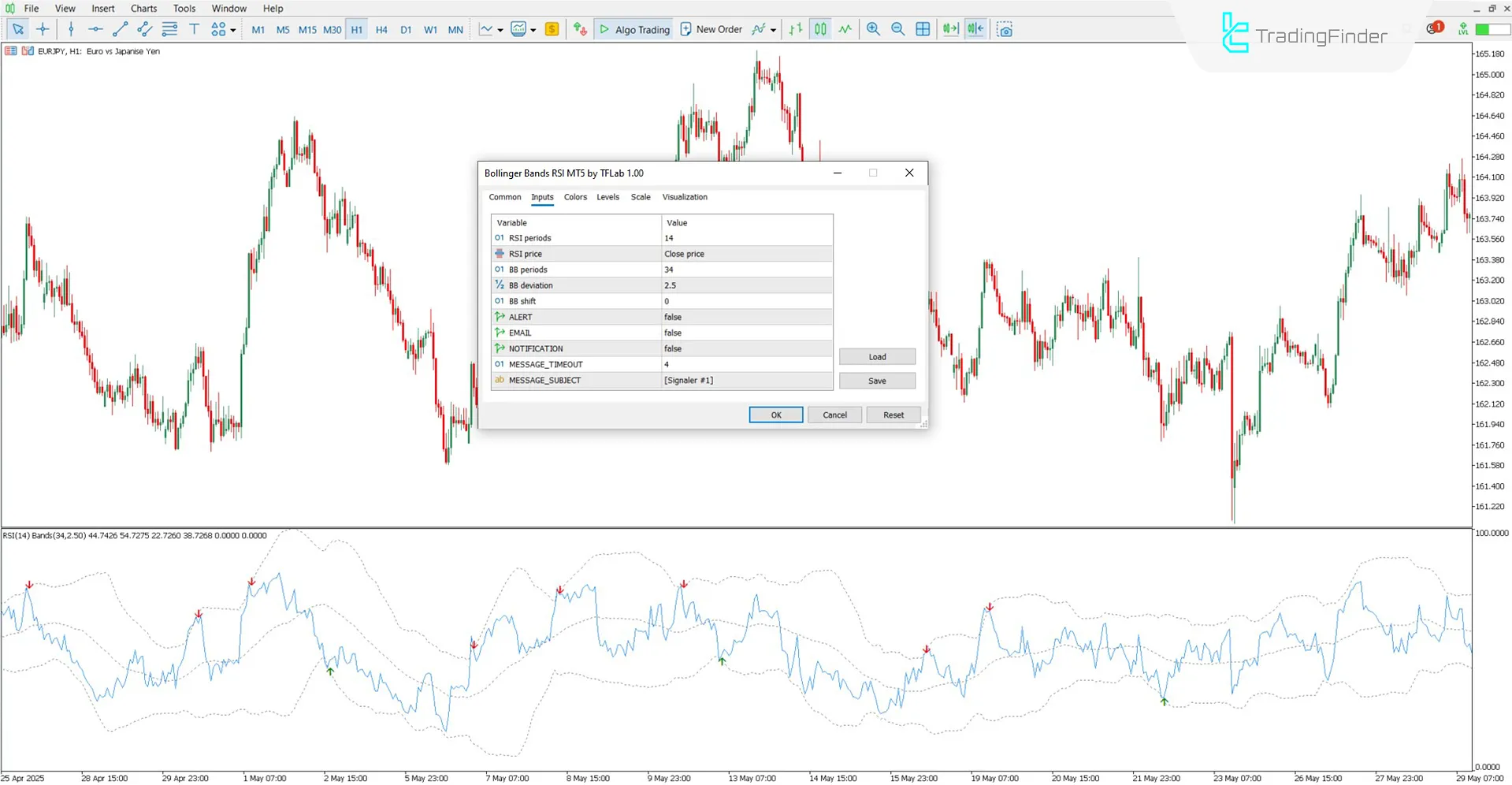

Settings of the Bollinger Bands RSI Indicator

The settings of the Bollinger Bands RSI indicator are as follows:

- RSI period: Relative Strength Index calculation period

- RSI price: Type of price used for RSI calculation

- BB periods: Number of periods used to calculate Bollinger Bands

- BB deviation: Standard deviation value for plotting upper and lower bands

- BB shift: Shift amount of Bollinger Bands relative to the chart

- ALERT: Enable alert

- EMAIL: Send alert via email

- NOTIFICATION: Enable notification

- MESSAGE_TIMEOUT: Display duration of the signal alert message

- MESSAGE_SUBJECT: Title or label of the alert message upon sending

Conclusion

The Bollinger Bands RSI oscillator, by combining Bollinger Bands and RSI, accurately displays overbought and oversold zones.

When the RSI line touches the lower band, the indicator issues a buy signal, and when it touches the upper band, it generates a sell signal.

Integrating volatility analysis with momentum makes this tool an ideal option for analyzing markets such as stocks, forex market and cryptocurrencies.

Bollinger Bands RSI Indicator MT5 PDF

Bollinger Bands RSI Indicator MT5 PDF

Click to download Bollinger Bands RSI Indicator MT5 PDFWhen does this indicator issue a buy signal?

When the RSI line touches the lower band, the oscillator issues a buy signal.

Can this indicator be used in smaller timeframes?

Yes, the Bollinger Bands RSI indicator is multi-timeframe and can be applied in all timeframes.