The Breaker Block + Order Block Indicator (BB+OB) is designed explicitly for ICT style traders to identify critical market areas. This indicator uses a proprietary algorithm to detect overlapping Order Blocks and Breaker Blocks.

It displays them on the chart in bullish green and bearish brown zones on the MetaTrader 5 (MT5) platform. Traders can use this tool to pinpoint entry and exit points in the market more accurately and optimize their trading strategies based on these powerful zones.

BB + OB Indicator Table

Indicator Categories: | Smart Money MT5 Indicators Supply & Demand MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Leading MT5 Indicators Breakout MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Indices MT5 Indicators |

Identifying Bullish Breaker Block and Order Block Overlap

In the 15-minute EUR/JPY chart below, the BB + OB Indicator accurately identifies bullish Order Blocks and Breaker Blocks, displaying the overlapping area in green. As the price returns to this critical area, the market quickly reacts, and the upward trend resumes.

The rapid price reaction to these indicator-determined zones highlights the importance of this tool for precise price movement forecasting and improving trading decisions.

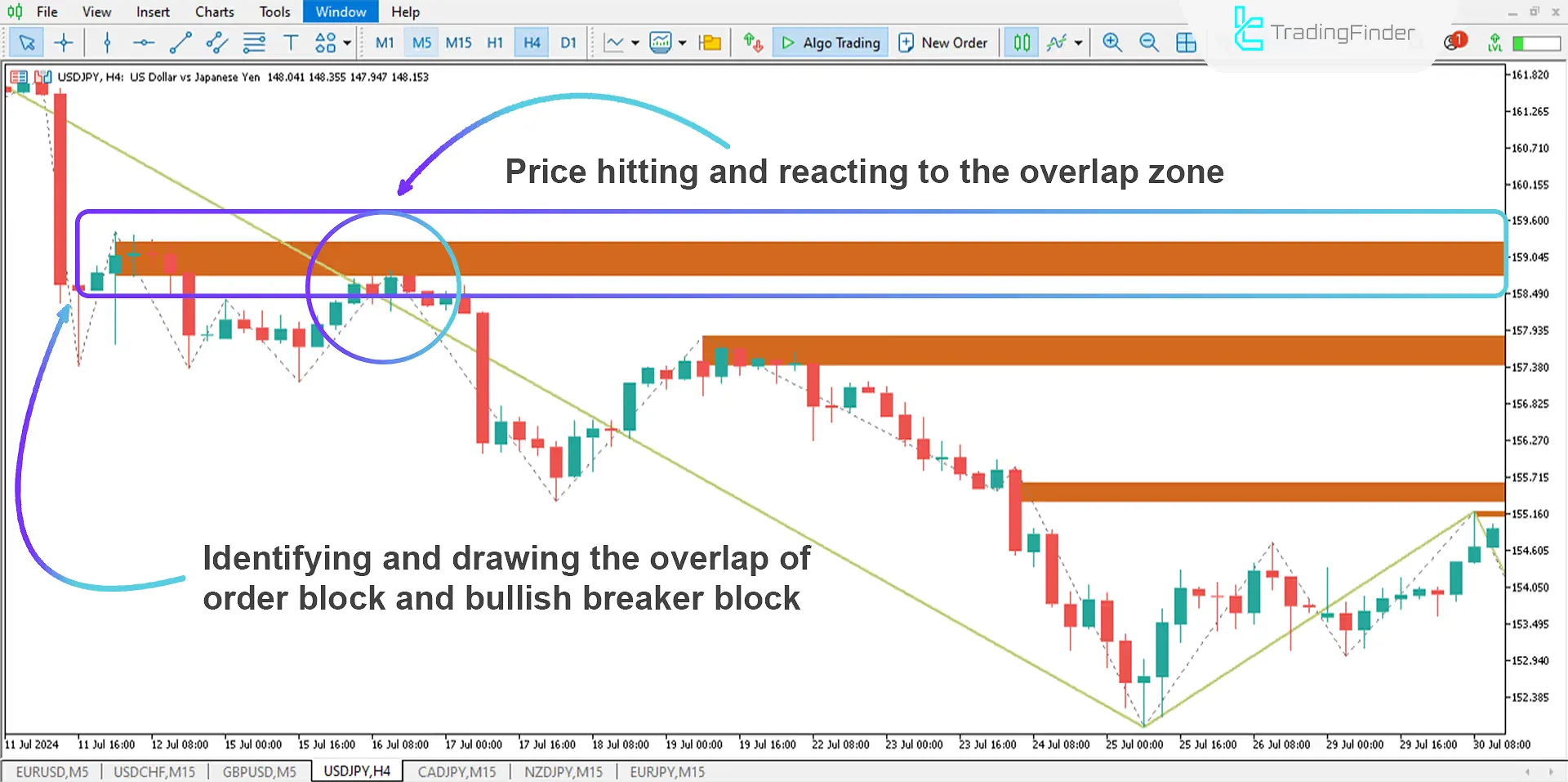

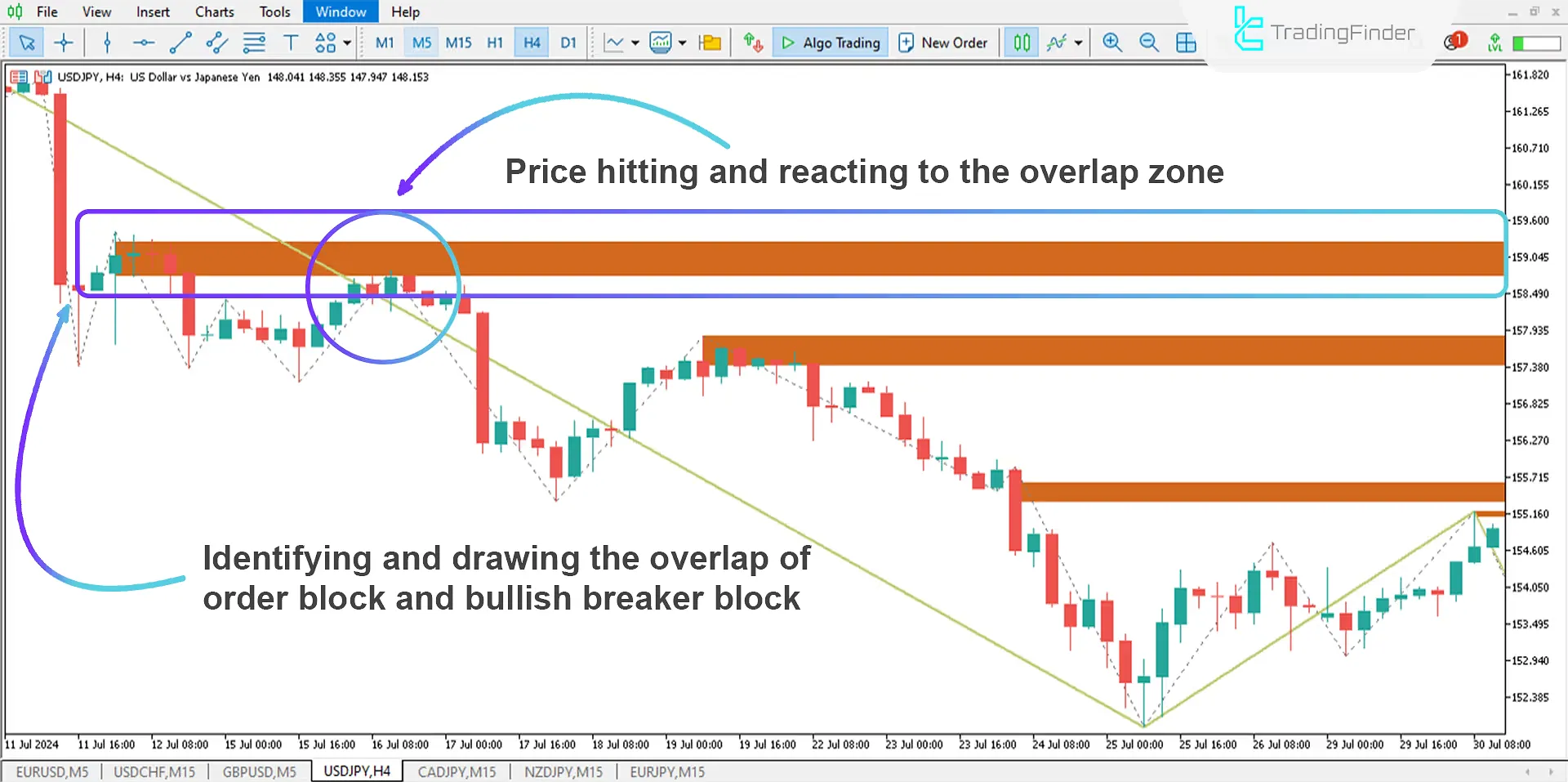

Identifying Bearish Breaker Block and Order Block Overlap

The 4-hour USD/JPY chart below, the price is forming lower lows in a downtrend. The BB + OB Indicator identifies Order Blocks and Breaker Blocks during this downtrend, displaying the overlapping area in brown.

Traders can observe these zones to identify potential price reactions and make better trading decisions. This indicator serves as a valuable tool for deeper market analysis.

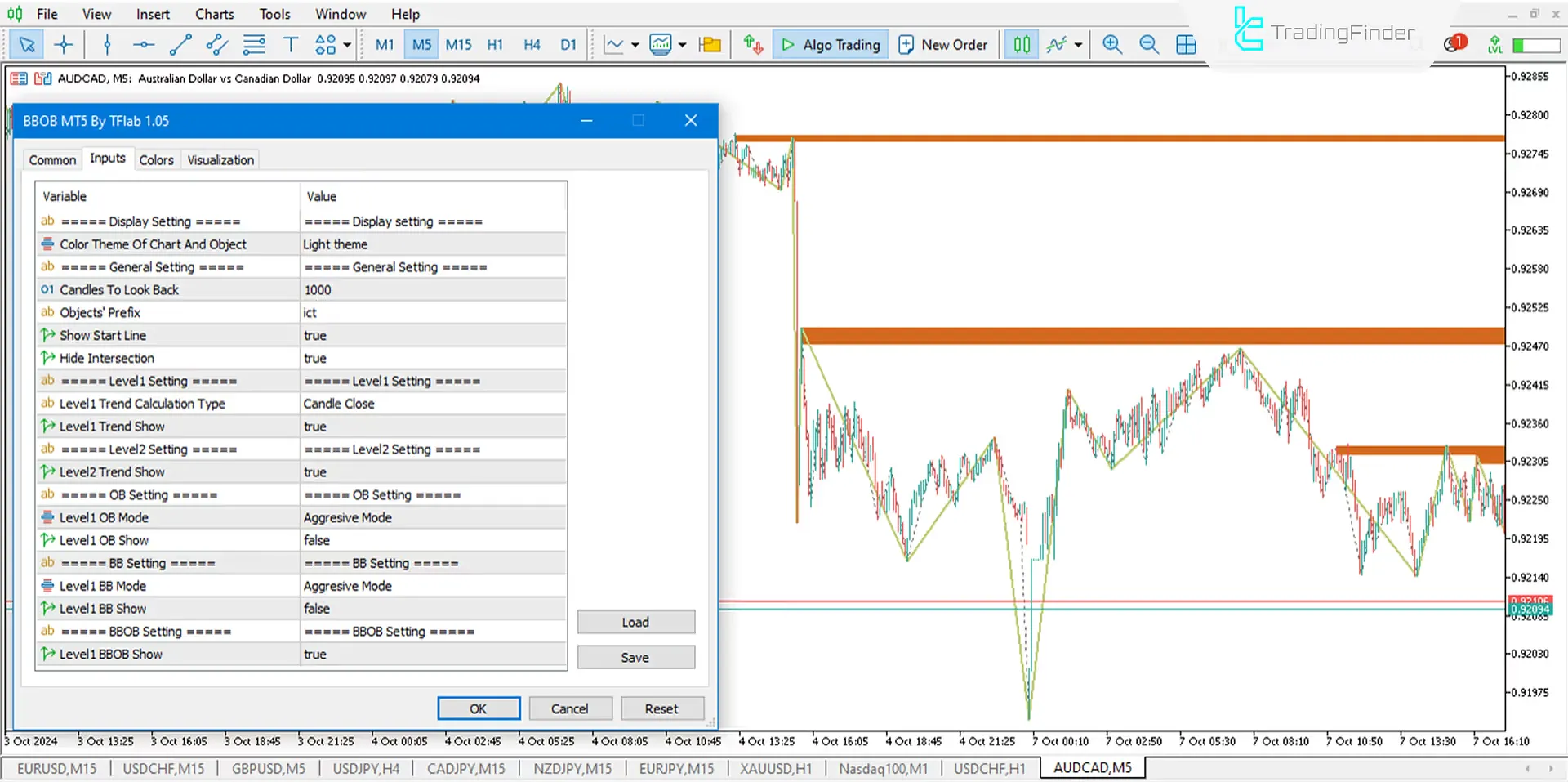

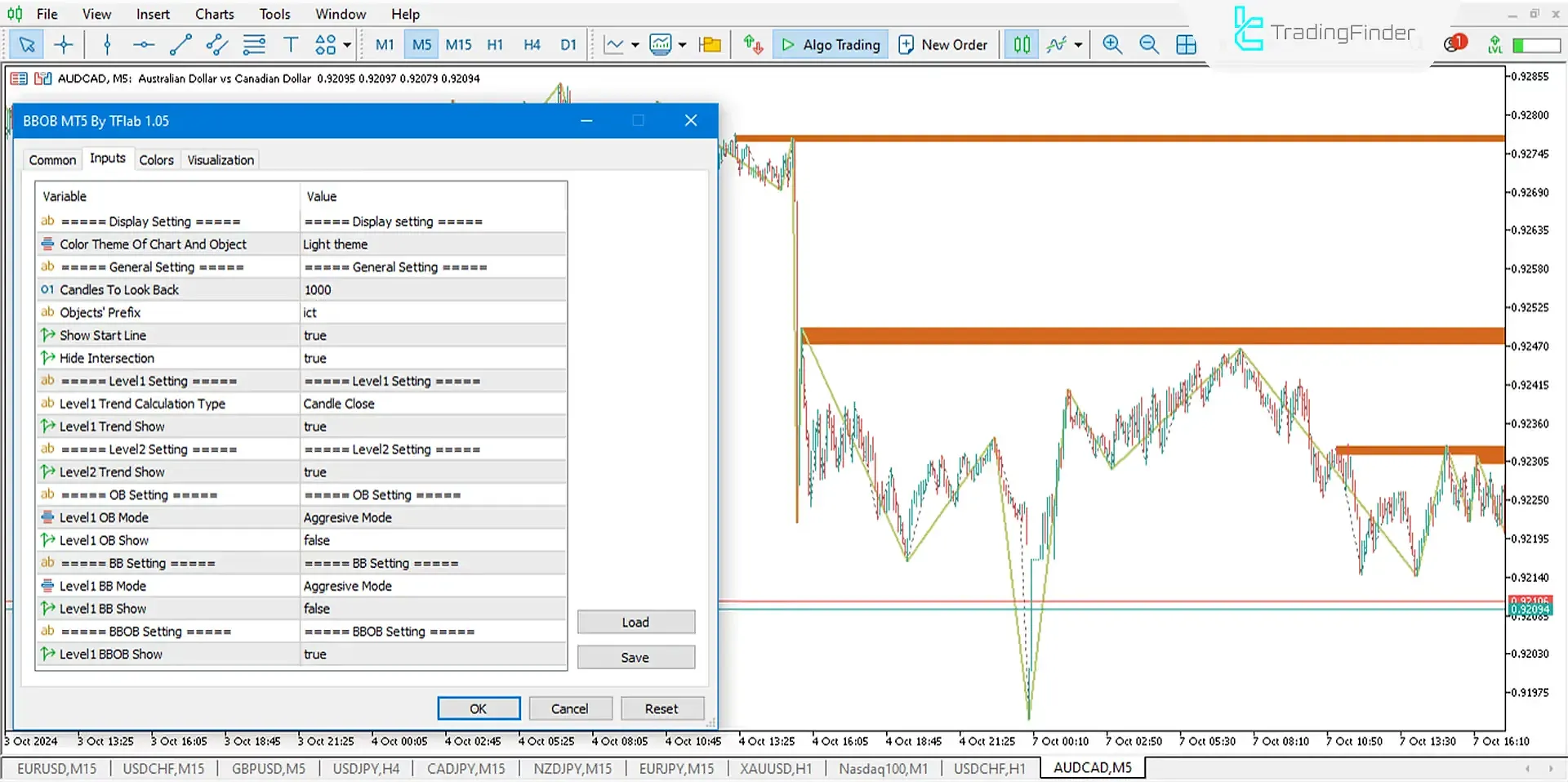

Indicator Settings

Display Setting: Indicator Display Settings

- Color Theme Of Chart And Object: Select the color theme.

General Setting: General Settings for the Indicator

- Candles To Look Back: Select the number of candles to calculate the past data.

- Show Start Line: Choose whether to show or hide the starting calculation line.

- Hide Intersection: Choose whether to show or hide the overlapping Order Blocks.

Level1 Setting: Level 1 Settings for the Indicator

- Level1 Trend Calculation Type: Choose the type of trend line calculation (dashed lines).

- Level1 Trend Show: Choose whether to show or hide the Level 1 trend line.

Level2 Setting: Level 2 Settings for the Indicator

- Level2 Trend Show: Choose whether to show or hide the Level 2 trend line.

OB Setting: Order Block Settings for the Indicator

- Level1 OB Mode: Select the calculation mode for Level 1 Order Blocks: Normal, Aggressive, or Defensive.

- Level1 OB Show: Choose whether to show or hide the Level 1 Order Blocks.

BB Setting: Breaker Block Settings for the Indicator

- Level1 BB Mode: Select the calculation mode for Level 1 Breaker Blocks: Normal, Aggressive, or Defensive.

- Level1 BB Show: Choose whether to show or hide the Level 2 Breaker Blocks.

BBOB Setting: Order Block + Breaker Block Settings for the Indicator

- Level1 BBOB Show: Choose whether to show or hide the combined Order Blocks + Breaker Blocks.

Conclusion

The BB + OB Indicator is a practical and effective tool for traders identifying Order and Breaker Block overlaps. This MT5 ICT indicator displays overlap zones and independently determines and displays Order Blocks and Breaker Blocks on the chart.

This feature allows traders to make more accurate decisions and shape their strategies based on more precise data. Using this indicator can improve trading performance and increase market analysis accuracy.

Breaker Block Order Block MT5 PDF

Breaker Block Order Block MT5 PDF

Click to download Breaker Block Order Block MT5 PDFWhat is the purpose of the BB + OB Indicator?

The BB + OB Indicator is a specialized tool for ICT traders to help identify critical market zones.

Is the BB+OB Indicator suitable for all experience levels?

This indicator is designed explicitly for ICT traders but can also be helpful for traders with varying experience levels.