![CCI Divergence Oscillator for MetaTrader 5 – Free Download - [TFlab]](https://cdn.tradingfinder.com/image/298897/4-72-en-cci-divergence-mt5-1.webp)

![CCI Divergence Oscillator for MetaTrader 5 – Free Download - [TFlab] 0](https://cdn.tradingfinder.com/image/298897/4-72-en-cci-divergence-mt5-1.webp)

![CCI Divergence Oscillator for MetaTrader 5 – Free Download - [TFlab] 1](https://cdn.tradingfinder.com/image/298912/4-72-en-cci-divergence-mt5-2.webp)

![CCI Divergence Oscillator for MetaTrader 5 – Free Download - [TFlab] 2](https://cdn.tradingfinder.com/image/298896/4-72-en-cci-divergence-mt5-3.webp)

![CCI Divergence Oscillator for MetaTrader 5 – Free Download - [TFlab] 3](https://cdn.tradingfinder.com/image/298911/4-72-en-cci-divergence-mt5-4.webp)

On June 22, 2025, in version 2, alert/notification functionality was added to this indicator

The CCI Divergence Indicator for MetaTrader 5 is designed to identify price divergences and analyze overbought and oversold conditions.

This MT5 trading assist analyzes Commodity Channel Index (CCI) fluctuations, allowing traders to detect early trend changes and potential price reversal points.

The indicator highlights bullish and bearish divergences, with bullish divergences marked by a pink line and bearish divergences marked by a yellow line.

CCI Divergence Oscillator Specifications

The table below presents a summary of this indicator’s specifications:

Indicator Categories: | Oscillators MT5 Indicators Signal & Forecast MT5 Indicators Trading Assist MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Leading MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators Forward MT5 Indicators Share Stock MT5 Indicators |

Indicator Overview

A key feature of this tool is the combination of divergence lines with overbought and oversold zones, which helps traders quickly identify potential trend reversals:

- CCI above +100: Indicates an overbought condition, suggesting a possible price correction or bearish trend reversal.

- CCI below -100: Indicates an oversold condition, signaling excessive selling pressure and an increased likelihood of a bullish reversal.

Indicator in an Uptrend

The CCI Divergence Indicator detects price divergence on the 1-hour EUR/USD chart, marks it with a pink line, and generates a buy signal.

If CCI drops below -100, the signal strengthens, indicating a higher probability of price reversal.

Indicator in a Downtrend

The price is downtrend in the GBP/USD chart, and entering the overbought zone suggests weakening buyer strength.

Under these conditions, the bearish divergence is detected, and the indicator generates a sell signal, marking it with a yellow line.

CCI Divergence Indicator Settings

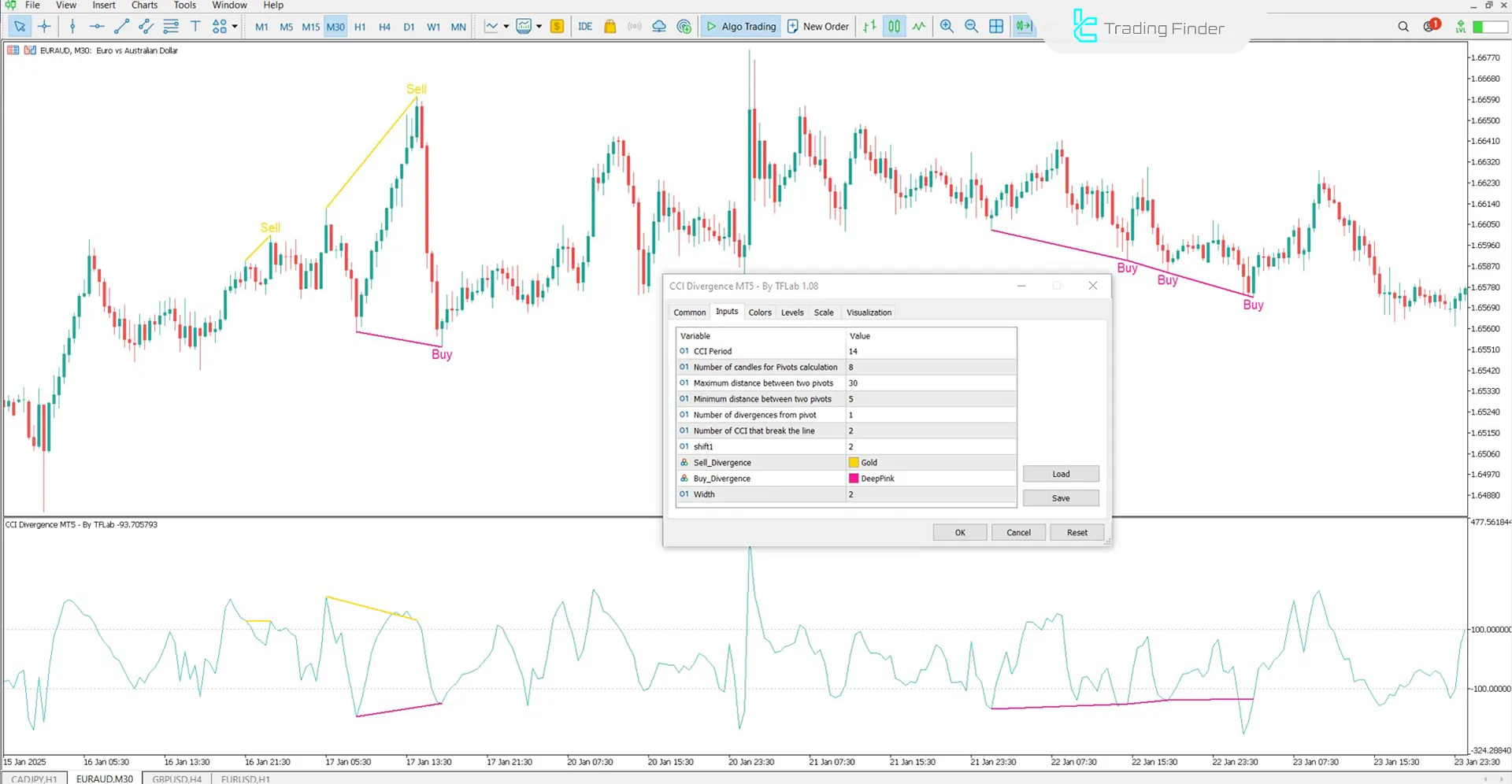

The settings panel for this MetaTrader 5 trading tool is displayed in the image below:

- CCI Period: Defines the calculation period for CCI

- Number of candles for Pivots calculation: Specifies the number used to calculate pivots

- Maximum distance between two pivots: Sets the maximum allowable distance between two pivots

- Minimum distance between two pivots: Defines the minimum distance between pivots

- Number of divergences from pivot: Determines the number of divergences identified from a pivot

- Number of CCI that break the line: Specifies the number of CCI line breaks required to confirm divergence

- Shift: Adjusts the price shift value

- Sell Divergence: Color setting for bearish divergence signals

- Buy Divergence: Color setting for bullish divergence signals

- Width: Adjusts the thickness of divergence lines

Conclusion

The CCI Divergence Indicator for MetaTrader 5 is a specialized tool for analyzing price divergences and detecting overbought and oversold conditions.

This indicator allows traders to examine trend changes and potential price reversal points using CCI levels.

In this MT5 oscillator, critical CCI levels (+100 and -100) indicate volatile price conditions, offering deeper insights into supply and demand imbalances.

CCI Divergence Oscillator MT5 PDF

CCI Divergence Oscillator MT5 PDF

Click to download CCI Divergence Oscillator MT5 PDFWhich markets are best suited for the CCI Divergence Indicator in MetaTrader 5?

This indicator can be used in Forex, stocks, cryptocurrencies, and commodities.

Can the CCI Divergence Indicator in MetaTrader 5 be customized?

Yes, this indicator offers flexible settings, allowing traders to adjust CCI calculation periods, pivot distances, the number of detectable divergences, and signal colors.

Hi, I really would appreciate it if sound alert could be added this indicator for buy and sell signals. 🙏