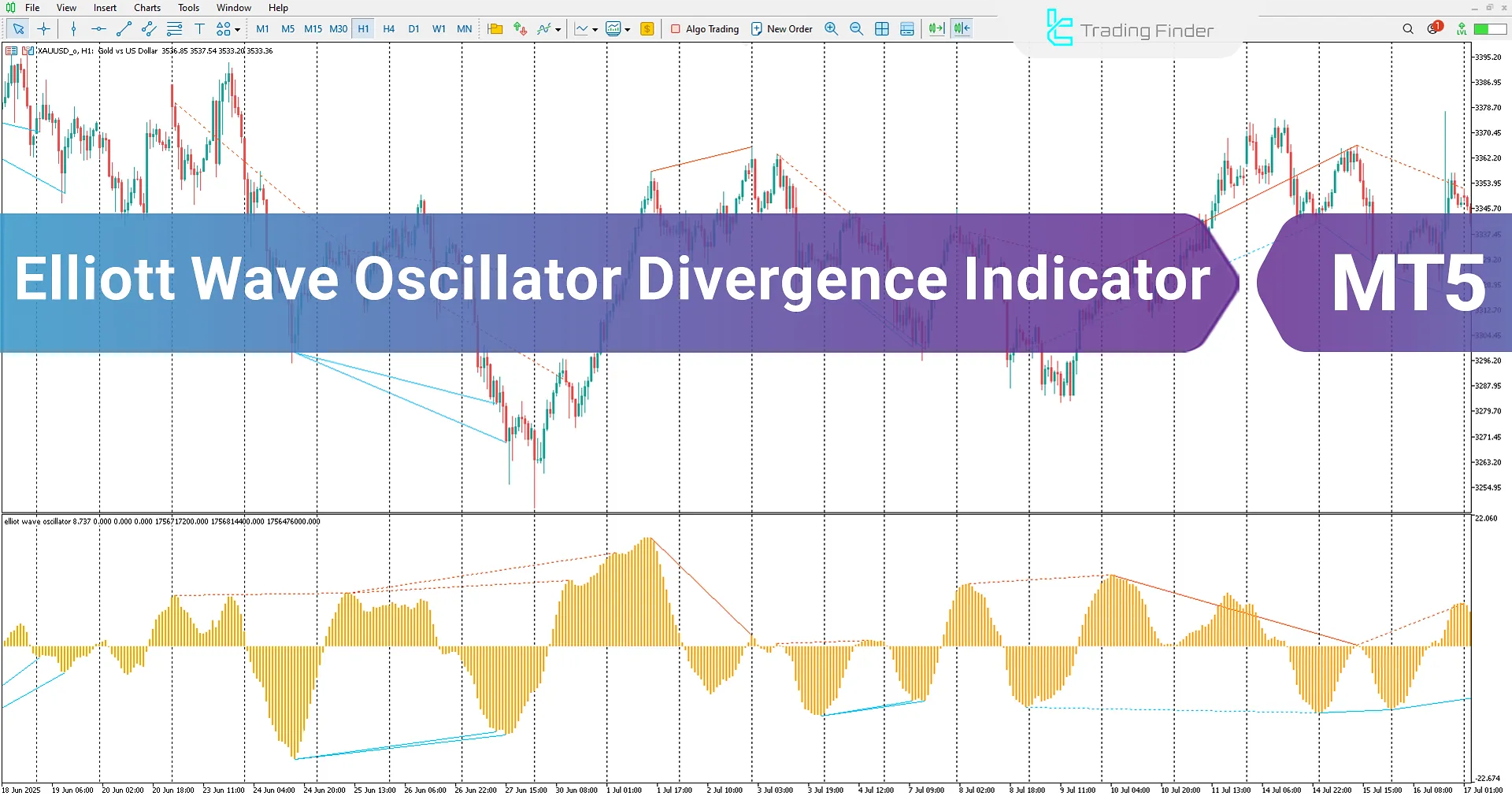

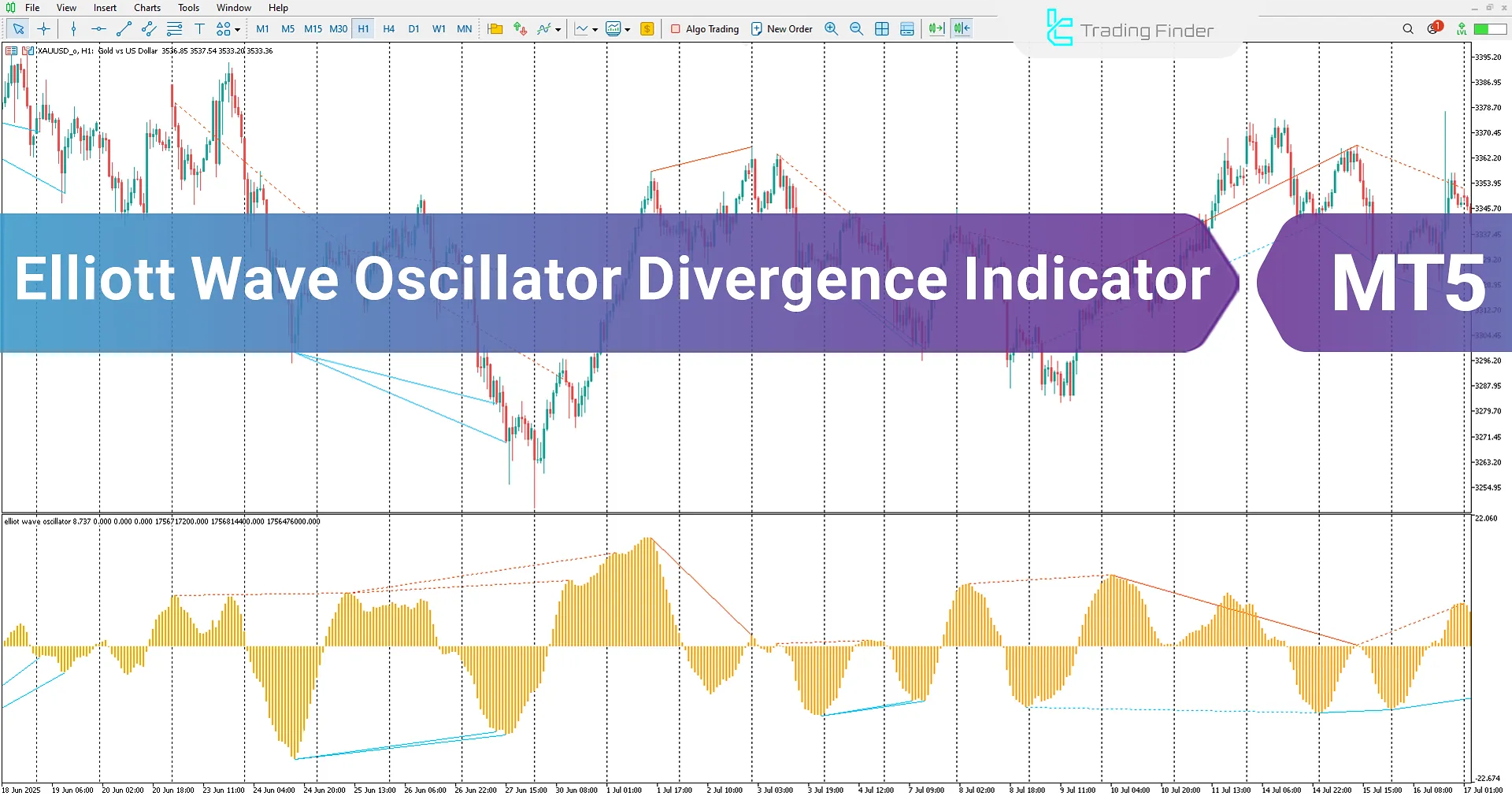

The Elliott Wave Oscillator Divergence Indicator is a specialized tool for technical analysis traders, designed to identify and detect divergences between price and the oscillator in MetaTrader 5.

This indicator detects two types of divergences – regular and hidden – and displays them on the chart through divergence lines, signaling either a trend reversal or continuation.

Elliott Wave Oscillator Divergence Indicator Table

The following section contains information about the Elliott Wave Oscillator Divergence Indicator.

Indicator Categories: | Oscillators MT5 Indicators Trading Assist MT5 Indicators Elliott Wave MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Lagging MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators Indices MT5 Indicators |

Indicator at a Glance

The Elliott Wave Oscillator Divergence Indicator is a specialized oscillator for detecting divergences. By plotting divergence lines on highs and lows, it identifies both regular (positive and negative) and hidden divergences directly on the chart.

Forex traders can apply this indicator to detect potential reversals at the end of a trend or confirm continuation signals, allowing them to enter buy or sell trades according to their strategies.

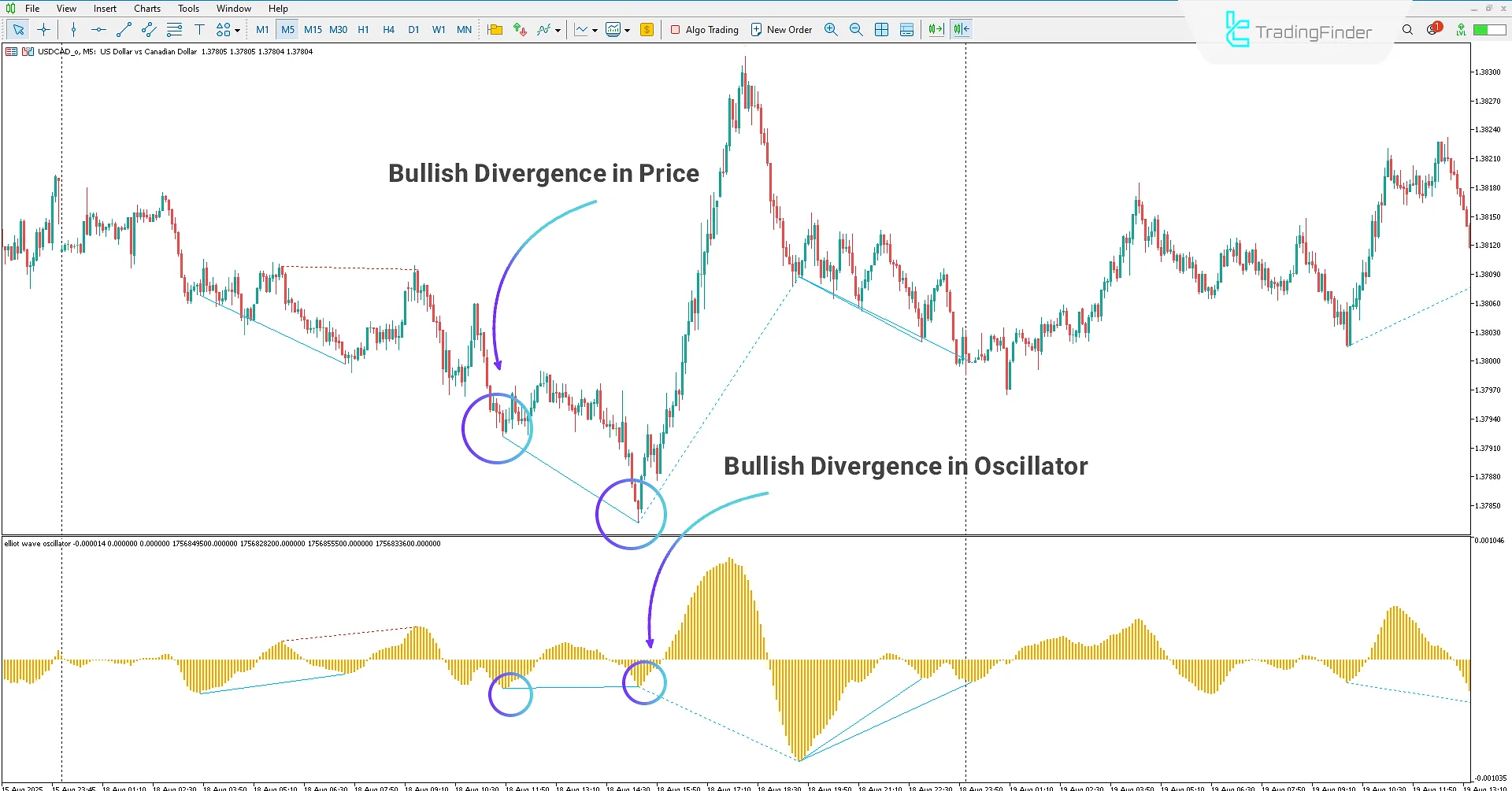

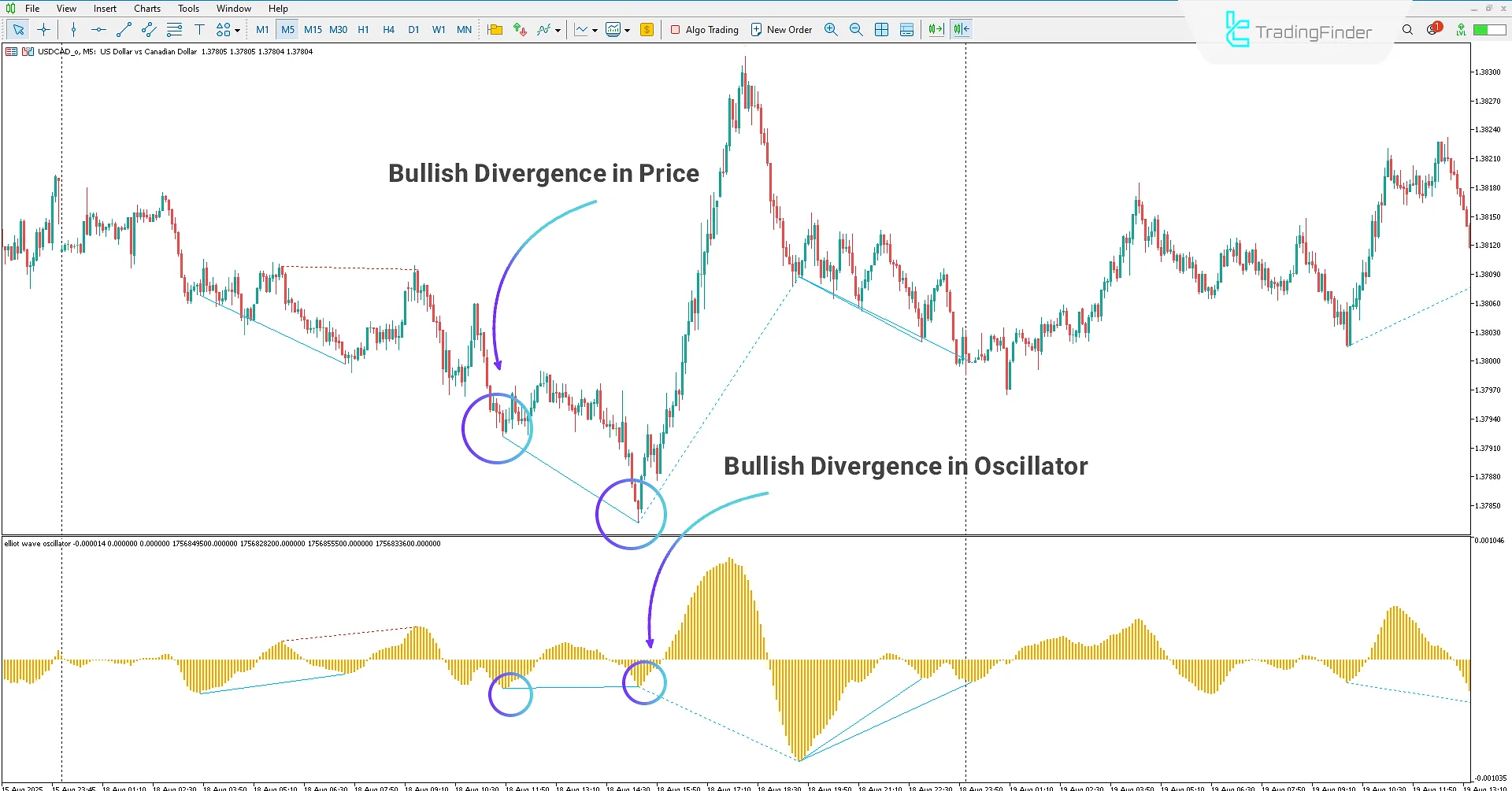

Bullish Trend

On the 5-minute USDCAD chart, the indicator identified bullish divergences at the lows.

While price was forming lower lows, the oscillator was forming higher lows, indicating a potential market reversal.

Traders can use this divergence at the end of a downtrend as a buy signal.

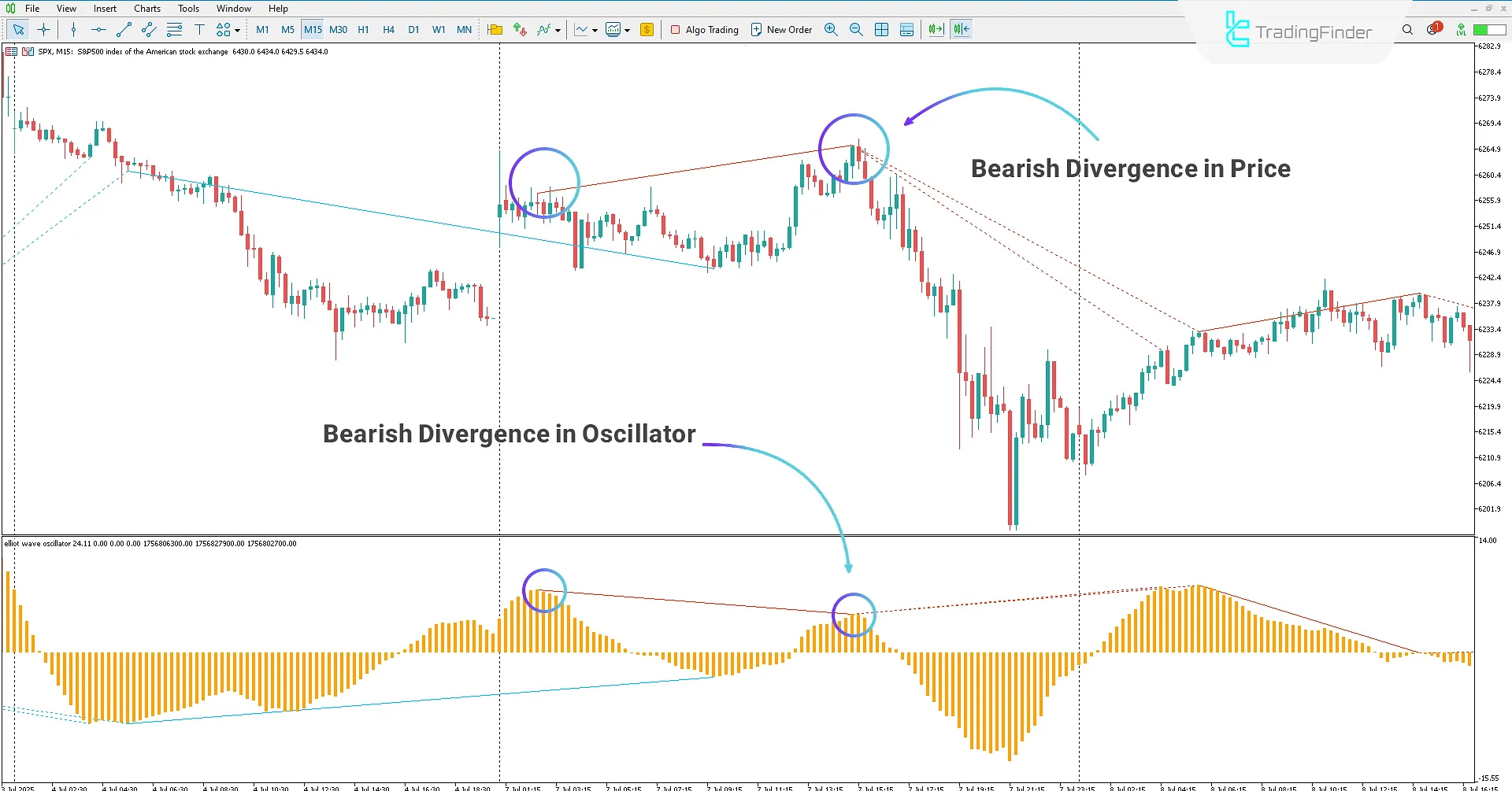

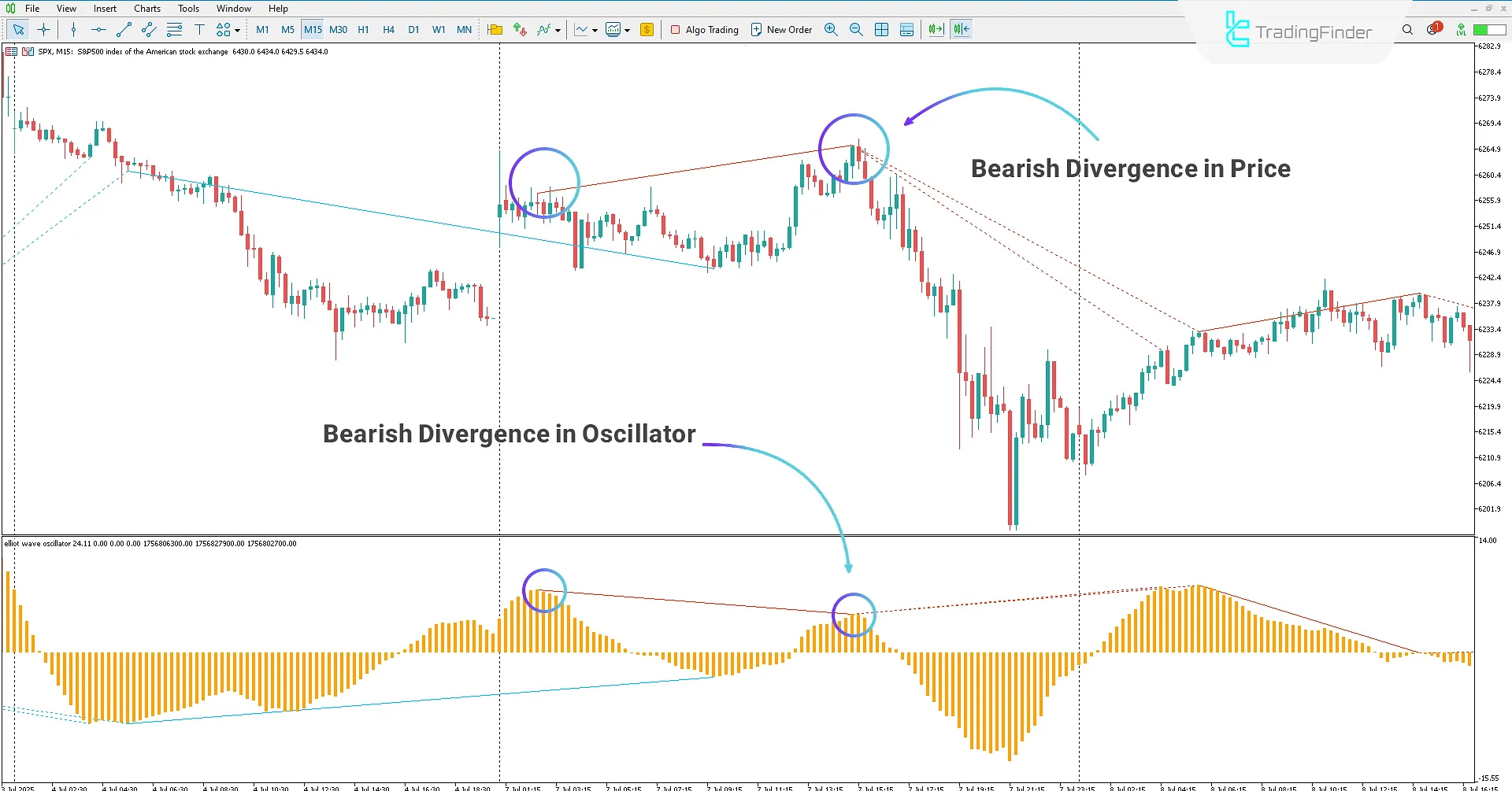

Bearish Trend

On the 15-minute S&P 500 index chart, the price was forming higher highs, while the oscillator showed lower highs.

By applying the indicator, traders can spot divergences between price and oscillator. At the end of an uptrend, this signals a potential reversal, offering a sell opportunity.

Elliott Wave Oscillator Divergence Indicator Settings

The following section contains the settings of the Elliott Wave Oscillator Divergence Indicator:

- Fast Period: Defines the short-term calculation period.

- Slow Period: Defines the long-term calculation period.

- Signal Period: Sensitivity coefficient for divergence detection; higher values make the indicator detect divergences using larger steps.

- Price Source: Defines the basis for price calculation.

- Extr Left Bars: Left-side bar confirmation for divergence.

- Extr Right Bars: Right-side bar confirmation for divergence.

- Plus Sens: Price sensitivity confirmation for bullish divergence.

- Minus Sens: Price sensitivity confirmation for bearish divergence.

Conclusion

The Elliott Wave Oscillator Divergence Indicator is a divergence detection tool that identifies highs and lows of price and oscillator, then draws divergences directly on the chart.

It signals bullish divergences at the end of downtrends, bearish divergences at the end of uptrends, and hidden divergences (dashed lines) to confirm trend continuation.

Elliott Wave Divergence Oscillator Indicator MetaTrader 5 PDF

Elliott Wave Divergence Oscillator Indicator MetaTrader 5 PDF

Click to download Elliott Wave Divergence Oscillator Indicator MetaTrader 5 PDFWhat is the Elliott Wave Oscillator Divergence Indicator?

It is a practical tool for technical traders in MetaTrader 5, designed to detect divergences between price and oscillator.

How can traders use this indicator?

By applying it to the chart, traders can detect divergences during price movement. Depending on whether a reversal or continuation divergence forms, they can enter buy or sell trades in line with their trading strategies.