![Forex Overbought/Oversold Indicator on MetaTrader 5 Download - [TFlab]](https://cdn.tradingfinder.com/image/571576/11-108-en-forex-overbought-oversold-mt5-01.webp)

![Forex Overbought/Oversold Indicator on MetaTrader 5 Download - [TFlab] 0](https://cdn.tradingfinder.com/image/571576/11-108-en-forex-overbought-oversold-mt5-01.webp)

![Forex Overbought/Oversold Indicator on MetaTrader 5 Download - [TFlab] 1](https://cdn.tradingfinder.com/image/571583/11-108-en-forex-overbought-oversold-mt5-02.webp)

![Forex Overbought/Oversold Indicator on MetaTrader 5 Download - [TFlab] 2](https://cdn.tradingfinder.com/image/571581/11-108-en-forex-overbought-oversold-mt5-03.webp)

![Forex Overbought/Oversold Indicator on MetaTrader 5 Download - [TFlab] 3](https://cdn.tradingfinder.com/image/571579/11-108-en-forex-overbought-oversold-mt5-04.webp)

The Forex Overbought and Oversold Indicator is a practical tool for traders that enables them to identify overbought and oversold zones.

This indicator is designed for MetaTrader 5, and forex traders can apply it to charts and, using technical analysis, recognize trading opportunities when the price reaches overbought or oversold levels, entering buy or sell positions accordingly.

Forex Overbought and Oversold Indicator Table of Specifics

The following section provides information about the Forex Overbought and Oversold Indicator:

Indicator Categories: | Oscillators MT5 Indicators Volatility MT5 Indicators Trading Assist MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Trend MT5 Indicators Overbought & Oversold MT5 Indicators Reversal MT5 Indicators |

Timeframe: | M15-M30 Timeframe MT5 Indicators H1-H4 Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators Indices MT5 Indicators Share Stock MT5 Indicators |

Forex Overbought/Oversold Indicator at a Glance

The Forex Overbought and Oversold Indicator is an oscillator that identifies overbought and oversold zones. By analyzing oscillator lines, traders can detect these areas.

Technical analysis traders can use trading strategies based on these zones to identify price reversals and enter buy or sell trades at the right time.

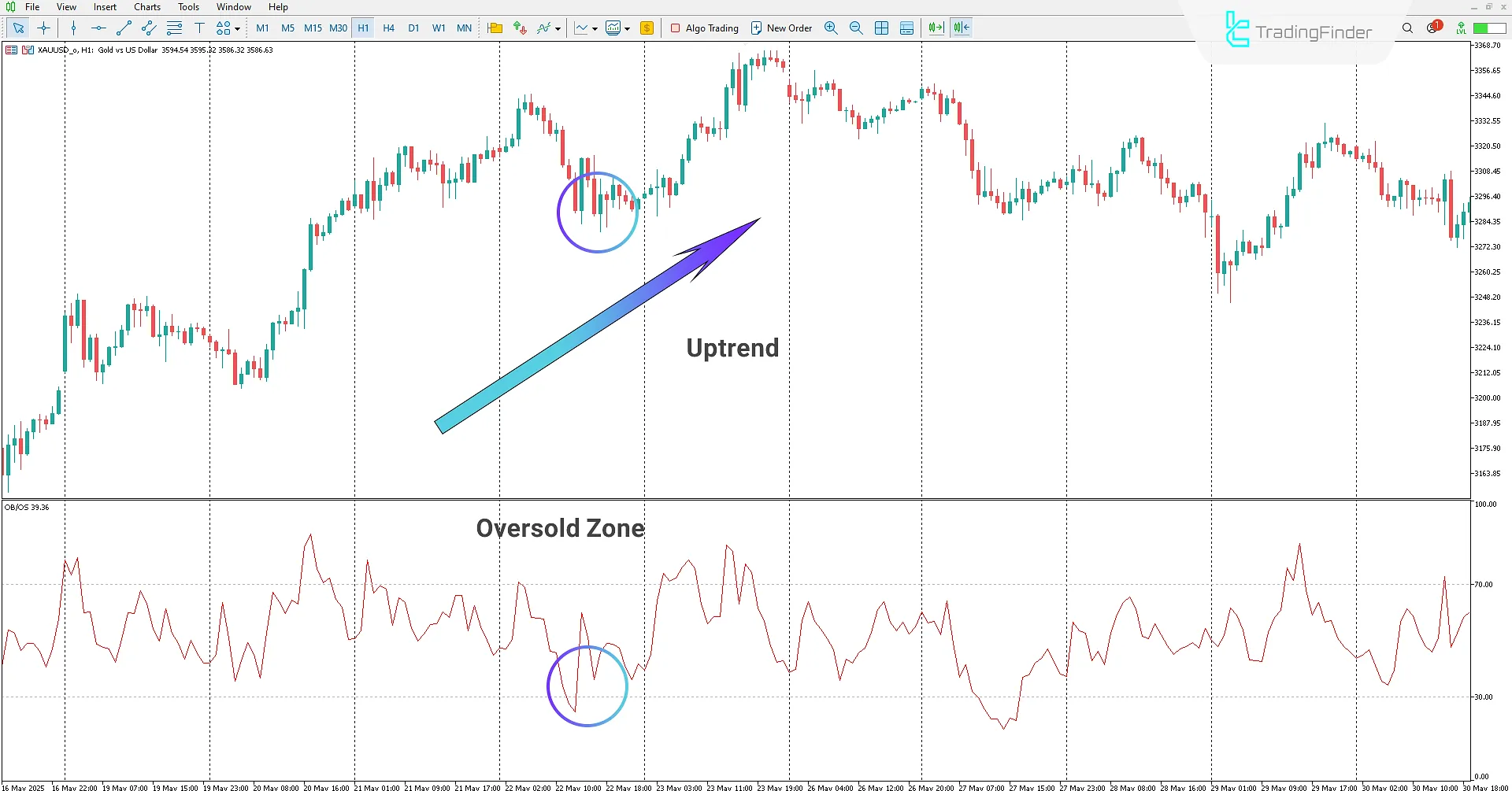

Uptrend in the Forex Overbought/Oversold Indicator

On the 1-hour gold chart, the Forex Overbought and Oversold Indicator entered the oversold zone.

Traders can analyze the market trend, and during a downward correction, consider the oscillator reaching the oversold zone as the end of the correction.

After the oscillator exits the 30 level, they may enter a buy position in the market.

Downtrend in the Forex Overbought/Oversold Indicator

On the 30-minute USD/CHF chart, traders can use the Forex Overbought and Oversold Indicator to detect the overbought zone.

In this chart, the price is in a downtrend, and during an upward correction, the oscillator entered the overbought zone.

After the oscillator exits the 70 level, traders can consider this as a sell signal and enter the market.

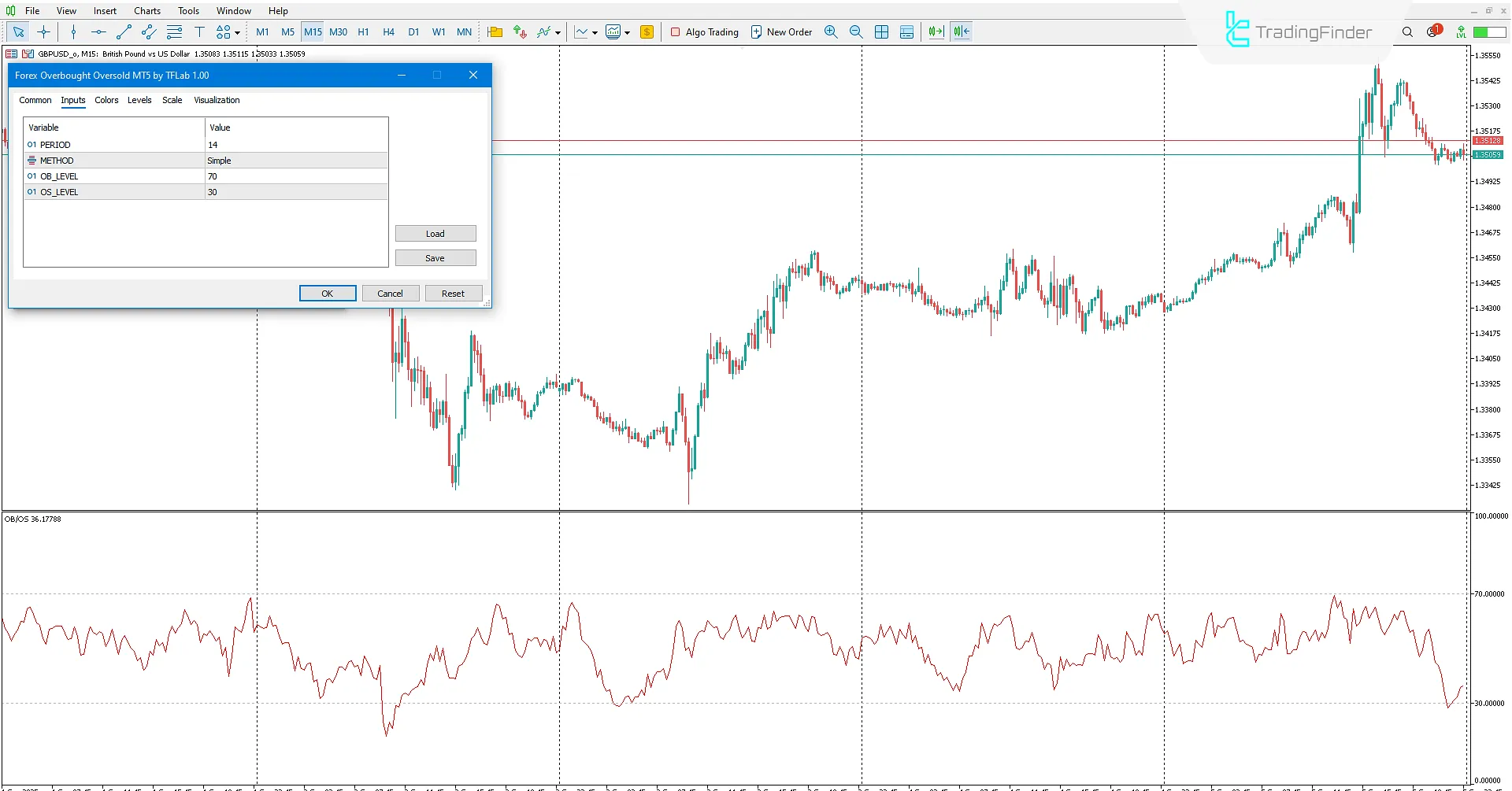

Settings of the Forex Overbought and Oversold Indicator

The following section shows the settings of the Forex Overbought and Oversold Indicator:

- PERIOD: Defines the calculation period of the indicator;

- METHOD: Defines the calculation method;

- OB_LEVEL: Defines the overbought level;

- OS_LEVEL: Defines the oversold level.

Conclusion

The Forex Overbought and Oversold Indicator is a practical tool for traders who use oscillators to identify these zones on price charts.

By applying this indicator and analyzing the oscillator line, traders can consider the 70 level as the overbought zone and the 30 level as the oversold zone.

These levels indicate the potential for trend reversals in the market.

Forex Overbought/Oversold Indicator on MetaTrader 5 PDF

Forex Overbought/Oversold Indicator on MetaTrader 5 PDF

Click to download Forex Overbought/Oversold Indicator on MetaTrader 5 PDFWhat is the Forex Overbought and Oversold Indicator?

This indicator is a practical tool for forex traders that uses an oscillator to identify overbought and oversold zones on charts.

What is the main application of the Forex Overbought and Oversold Indicator?

By analyzing oscillator lines, traders can detect price reversals and find suitable entry or exit points for buy and sell trades.