![Inverse Fisher Transform of RSI Indicator MT5 Download – Free – [TFlab]](https://cdn.tradingfinder.com/image/279583/13-88-en-inverse-fisher-transform-of-rsi-mt5-01.webp)

![Inverse Fisher Transform of RSI Indicator MT5 Download – Free – [TFlab] 0](https://cdn.tradingfinder.com/image/279583/13-88-en-inverse-fisher-transform-of-rsi-mt5-01.webp)

![Inverse Fisher Transform of RSI Indicator MT5 Download – Free – [TFlab] 1](https://cdn.tradingfinder.com/image/279582/13-88-en-inverse-fisher-transform-of-rsi-mt5-02.webp)

![Inverse Fisher Transform of RSI Indicator MT5 Download – Free – [TFlab] 2](https://cdn.tradingfinder.com/image/279580/13-88-en-inverse-fisher-transform-of-rsi-mt5-03.webp)

![Inverse Fisher Transform of RSI Indicator MT5 Download – Free – [TFlab] 3](https://cdn.tradingfinder.com/image/279581/13-88-en-inverse-fisher-transform-of-rsi-mt5-04.webp)

The Inverse Fisher Transform of RSI Indicator determines the appropriate points for entering buy and sell trades based on Overbought and Oversold zones.

This MT5 oscillator is created by combining the Inverse Fisher Transform with the Relative Strength Index (RSI) and is used to identify trend reversal zones.

Buy and sell signals are issued based on the oscillator line’s position relative to +0.5 and -0.5 levels.

Inverse Fisher Transform of RSI Indicator Table

The table below outlines the details and features of the Inverse Fisher Transform of RSI Indicator.

Indicator Categories: | Oscillators MT5 Indicators Signal & Forecast MT5 Indicators Trading Assist MT5 Indicators RSI Indicators for MetaTrader 5 |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Leading MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Indices MT5 Indicators |

Indicator Overview

The Inverse Fisher Transform of the RSI indicator combines the popular RSI and Fisher indicators. A moving average reduces market noise and helps traders identify overbought and oversold zones.

When the price reaches the overbought zone, the indicator changes to orange. Similarly, upon entering the oversold zone, it turns green, alerting traders to these conditions and helping them optimize their trading decisions.

Buy Signal

An analysis of the 15-minute chart of the NZD/USD currency pair shows that the oscillator line fluctuates around -0.5, indicating an Oversold condition.

As a result, the indicator plots the signal line in red. Exiting this area may serve as a buy signal.

Sell Signal

Based on an analysis of the 1-hour Polkadot (DOT) chart, price positioning above +0.5 indicates an Overbought condition.

Under these circumstances, the oscillator line turns light blue. A return of the oscillator line to values below +0.5 may be considered a sell signal.

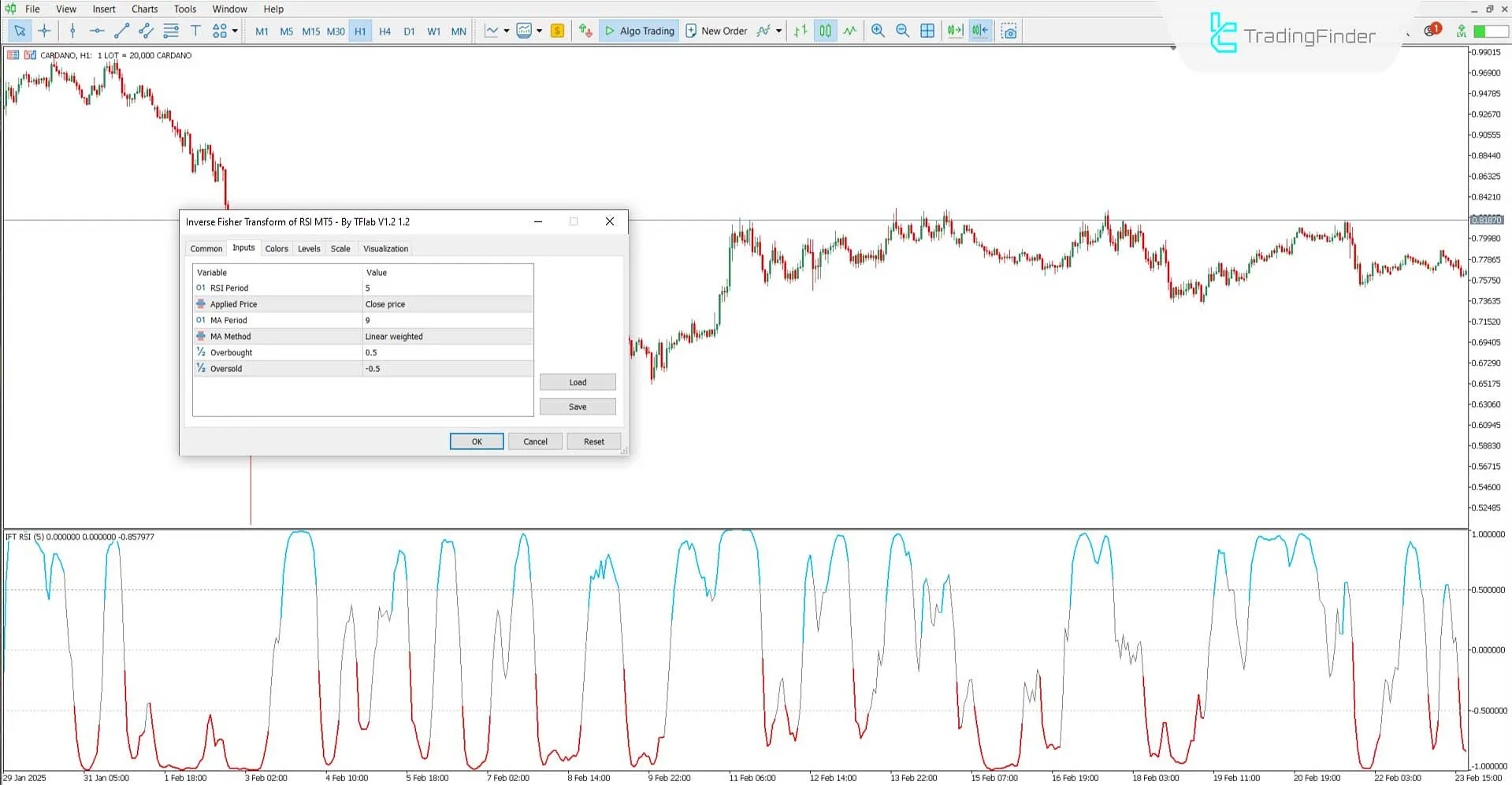

Settings of the Inverse Fisher Transform of RSI Indicator

The image below provides an overview of the customizable settings in the Inverse Fisher Transform of RSI Indicator:

- RSI Period: Setting for calculating the RSI period

- Applied Price: Selection of the RSI calculation method

- MA Period: Setting the moving average period

- MA Method: Choosing the moving average calculation method

- Overbought Level: Setting the overbought threshold

- Oversold Level: Setting the oversold threshold

Conclusion

The Inverse Fisher Transform of RSI Oscillator is a signal and forecast indicator for MT5. This combined tool provides trading signals based on overbought and oversold levels.

By analyzing the position of the indicator line relative to predefined levels, traders can identify trend reversals. Additionally, flexible settings allow for customization to fit various technical analysis styles.

Inverse Fisher Transform RSI MT5 PDF

Inverse Fisher Transform RSI MT5 PDF

Click to download Inverse Fisher Transform RSI MT5 PDFWhich timeframes is this indicator suitable for?

The Inverse Fisher Transform of RSI Oscillator can be used across all timeframes.

Is this indicator only suitable for professional traders?

No. The Inverse Fisher Transform of RSI Indicator is user-friendly and suitable for traders of all skill levels due to its clear and transparent signals.