![Judas Swing ICT Forex With Confirmation Indicator MT5 - [TradingFinder]](https://cdn.tradingfinder.com/image/260792/2-34-en-judas-ict-forex-with-confirmation-mt5-1.webp)

![Judas Swing ICT Forex With Confirmation Indicator MT5 - [TradingFinder] 0](https://cdn.tradingfinder.com/image/260792/2-34-en-judas-ict-forex-with-confirmation-mt5-1.webp)

![Judas Swing ICT Forex With Confirmation Indicator MT5 - [TradingFinder] 1](https://cdn.tradingfinder.com/image/260789/2-34-en-judas-ict-forex-with-confirmation-mt5-2.webp)

![Judas Swing ICT Forex With Confirmation Indicator MT5 - [TradingFinder] 2](https://cdn.tradingfinder.com/image/260791/2-34-en-judas-ict-forex-with-confirmation-mt5-3.webp)

![Judas Swing ICT Forex With Confirmation Indicator MT5 - [TradingFinder] 3](https://cdn.tradingfinder.com/image/260788/2-34-en-judas-ict-forex-with-confirmation-mt5-4.webp)

The Judas Swing ICT Forex With Confirmation Indicator operates within one minute, detecting the primary market trend.

This MetaTrader 5 indicator identifies areas of liquidity accumulation where deceptive price movements (Judas Swing) are likely to occur. These zones are marked with gray arrows (CISD - FVG).

Judas Swing ICT Forex With Confirmation Indicator Specifications Table

The table below evaluates the features of the Judas Swing ICT Forex With Confirmation Indicator .

Indicator Categories: | Smart Money MT5 Indicators Liquidity Indicators MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Breakout MT5 Indicators Reversal MT5 Indicators |

Timeframe: | M1-M5 Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Fast Scalper MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators |

Indicator Overview

In the Judas Swing ICT Forex With Confirmation Indicator, when the price breaks one of the red levels, it initially moves in the breakout direction. This short term move is recognized as a Judas Swing, a deceptive market trap in the ICT style.

After breaking the red level and forming CISD, the price retraces to the Fair Value Gap (FVG), accumulating liquidity within the order block before the next significant movement.

Uptrend Conditions

The chart below displays the EUR/CAD currency pair in one minute. The price breaks below the previous low (red line) in this scenario, leading to CISD formation.

Once the price returns to the Fair Value Gap (FVG) and bullish order blocks, it indicates weakening bearish momentum and creates an optimal buy entry zone.

Downtrend Conditions

The image below shows the GBP/USD currency pair in a one minute timeframe. When the price breaks the highlighted high (red line) in this indicator, CISD formation occurs.

As the price retraces to the Fair Value Gap (FVG) to accumulate liquidity, it presents a suitable sell entry opportunity.

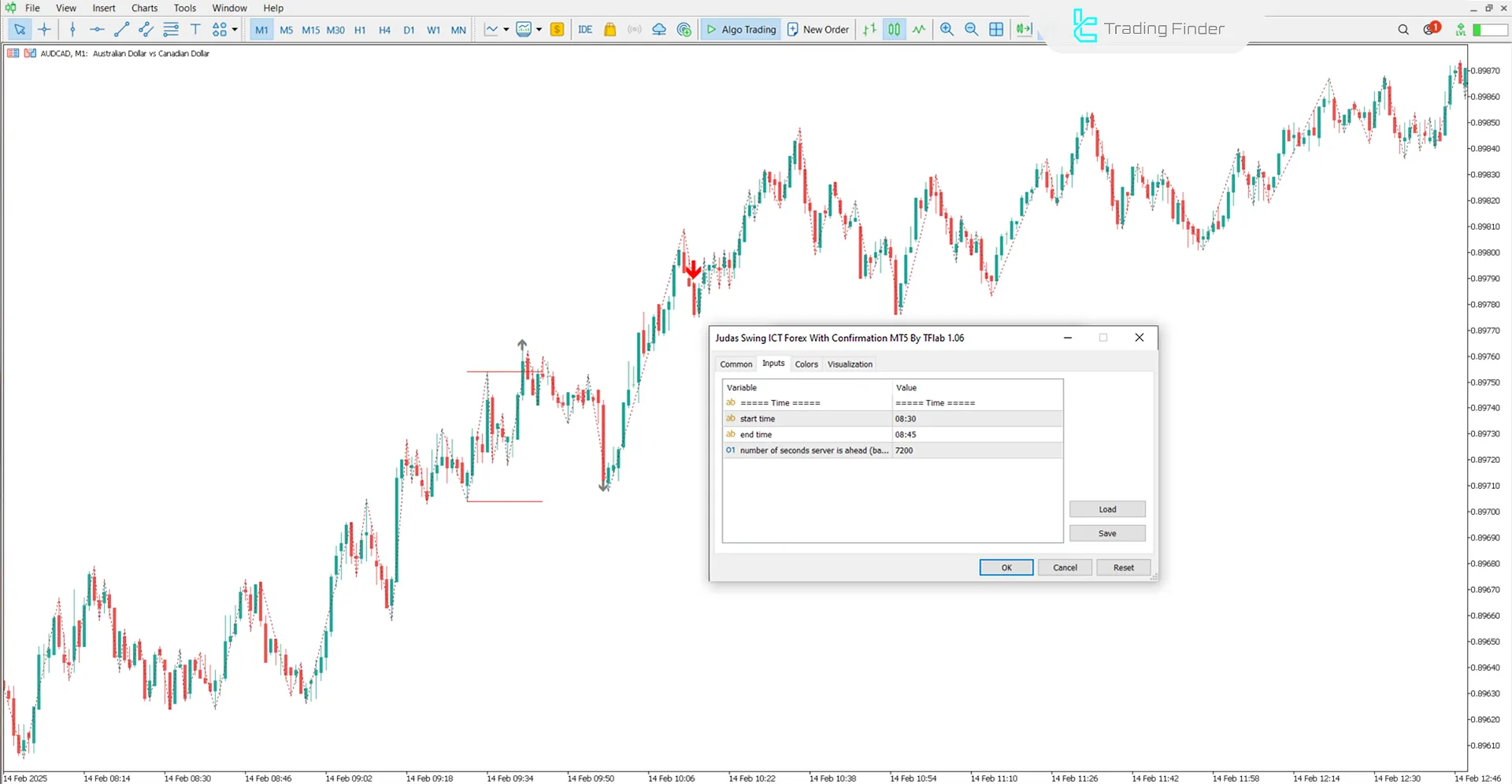

Indicator Settings

The following image showcases the adjustable parameters of the Judas Swing ICT Forex With Confirmation Indicator :

- Start time: Defines the trading session start time

- End time: Specifies the trading session end time

- Number of seconds the server is ahead (backtest): Adjusts the time difference between the server and market data for backtesting

Conclusion

The Judas Swing ICT Forex With Confirmation Indicator effectively avoids entries based on false breakouts (Judas Swing) in the market.

This MetaTrader 5 ICT Indicator utilizes green and red arrows to highlight optimal entry and exit points after liquidity accumulation.

Judas Swing ICT Forex MT5 PDF

Judas Swing ICT Forex MT5 PDF

Click to download Judas Swing ICT Forex MT5 PDFIs the Judas Swing ICT Forex Indicator exclusively for the Forex market?

Yes, this MetaTrader 5 trading tool is specifically designed for Forex trading.

Does the Judas Swing ICT Forex Indicator generate trade signals?

Yes, after a CISD breakout and liquidity accumulation, the indicator provides entry signals using green and red arrows.