![RSI Multi Length Indicator for MT5 Download – Free – [TradingFinder]](https://cdn.tradingfinder.com/image/693473/1.webp)

![RSI Multi Length Indicator for MT5 Download – Free – [TradingFinder] 0](https://cdn.tradingfinder.com/image/693473/1.webp)

![RSI Multi Length Indicator for MT5 Download – Free – [TradingFinder] 1](https://cdn.tradingfinder.com/image/480389/13-180-en-rsi-multi-length-mt5-02.webp)

![RSI Multi Length Indicator for MT5 Download – Free – [TradingFinder] 2](https://cdn.tradingfinder.com/image/480388/13-180-en-rsi-multi-length-mt5-03.webp)

![RSI Multi Length Indicator for MT5 Download – Free – [TradingFinder] 3](https://cdn.tradingfinder.com/image/480387/13-180-en-rsi-multi-length-mt5-04.webp)

The RSI Multi Length Indicatorsimultaneously analyzes multiple values of the Relative Strength Index, adapting to different market conditions.

Based on its data analysis, the indicator draws two horizontal levels in green and red to identify overbought and oversold zones.

The position of the RSI curve relative to these levels facilitates the identification of entry and exit points.

Specifications Table for the RSI Multi-Length Indicator

The specifications of theRSI Multi Length Indicatorare listed in the table below:

Indicator Categories: | Oscillators MT5 Indicators Signal & Forecast MT5 Indicators RSI Indicators for MetaTrader 5 |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Overbought & Oversold MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Swing Trading MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators |

RSI Multi Length Indicator at a Glance

Buy and sell signals are triggered when the Relative Strength Index (RSI) curve penetrates the defined levels.

If the “RSI” line crosses above the red level, the indicator issues an overbought warning by displaying a red dot. In contrast, when the “RSI” drops below the green line, it indicates entry into the oversold zone.

Buy Setup

According to the GBP/USD chart on the 1-hour timeframe, the “RSI” index falls below the green level, and the indicator highlights this drop using green dots.

As shown in the image, these green dots signal entry into the oversold area and can be considered potential buy signals.

Sell Setup

Based on the EUR/USD pair chart, the “RSI” line enters the overbought zone, and the indicator marks this with red dots.

In this case, these red dots are considered signals to evaluate potential sales opportunities.

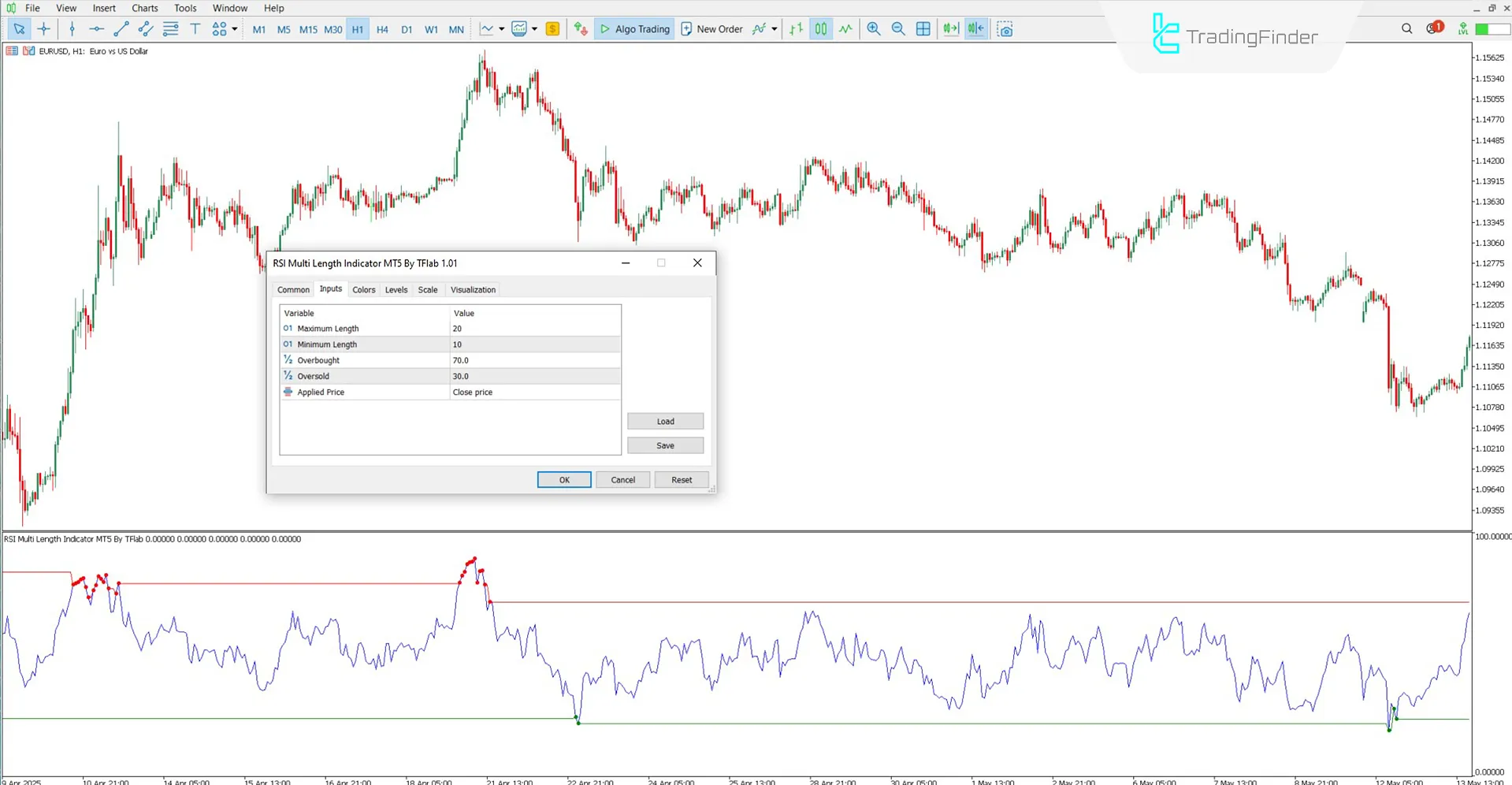

RSI Multi Length Indicator Settings

The configurable options of the Relative Strength Oscillator with multiple lengths are as follows:

- Maximum Length: Longer period for RSI calculation, generates slower signals, and reduces noise

- Minimum Length: Shorter period for RSI calculation, quicker response to price changes

- Overbought: Alert level for overbought condition

- Oversold: Alert level for oversold condition

- Applied Price: Type of price used for RSI calculation

Conclusion

The RSI Multi Length Indicatorcalculates the RSI across various timeframes simultaneously, providing more accurate signals compared to the classic version.

By displaying overbought and oversold areas using colored lines and marking RSI penetration points, this tool facilitates the identification of price reversal zones.

RSI Multi Length Indicator MT5

RSI Multi Length Indicator MT5

Click to download RSI Multi Length Indicator MT5Is this indicator usable in lower timeframes?

Yes, this indicator can be used and applied across all timeframes.

Does this tool generate trading signals?

Yes, the RSI Multi Length Indicator with multiple lengths detects RSI penetration into overbought and oversold zones and marks these areas with colored markers.