The Silver Bullet ICT indicator is one of the advanced MetaTrader 5 indicators that initially examines the high and low prices during New York trading sessions and identifies key zones based on ICT concepts.

When the price hits a support or resistance level and returns to its previous range after liquidity absorption, the indicator identifies an Order Block near the CISD level. The indicator issues a trade entry signal if there is a Fair Value Gap (FVG) in this area.

Silver Bullet ICT Indicator Table

The specifications of the Silver Bullet ICT indicator are summarized in the table below.

Indicator Categories: | Signal & Forecast MT5 Indicators Liquidity Indicators MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal MT5 Indicators |

Timeframe: | M1-M5 Timeframe MT5 Indicators M15-M30 Timeframe MT5 Indicators |

Trading Style: | Scalper MT5 Indicators Fast Scalper MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Forward MT5 Indicators |

Indicator at a Glance

The Silver Bullet indicator is set across three key timeframes based on New York local time, during which market liquidity increases, providing more trading opportunities:

- London Open Silver Bullet: Between 03:00 and 04:00 AM, when the London market opens

- AM Session Silver Bullet: Between 10:00 and 11:00 AM, coinciding with increased activity in the New York market

- PM Session Silver Bullet: Between 2:00 and 3:00 PM, overlapping the New York session and the closing of the European market

Indicator in an Uptrend

In the 1-minute chart of CAD/CHF, the price returns to the price channel after breaking the support zone and absorbing liquidity.

After forming the CISD pattern and liquidity absorption from the Order Block zone, the indicator provides a trade entry signal by displaying a green arrow.

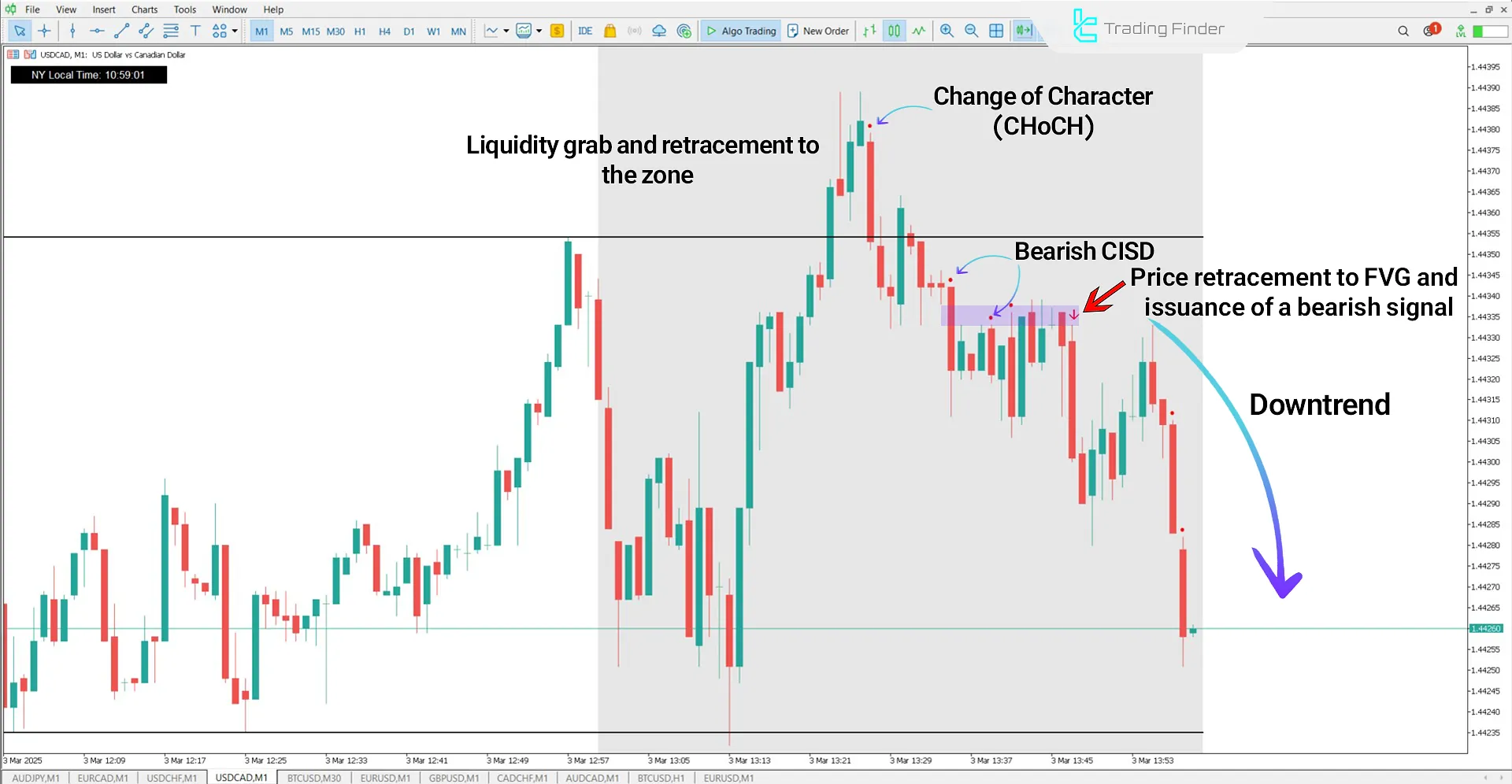

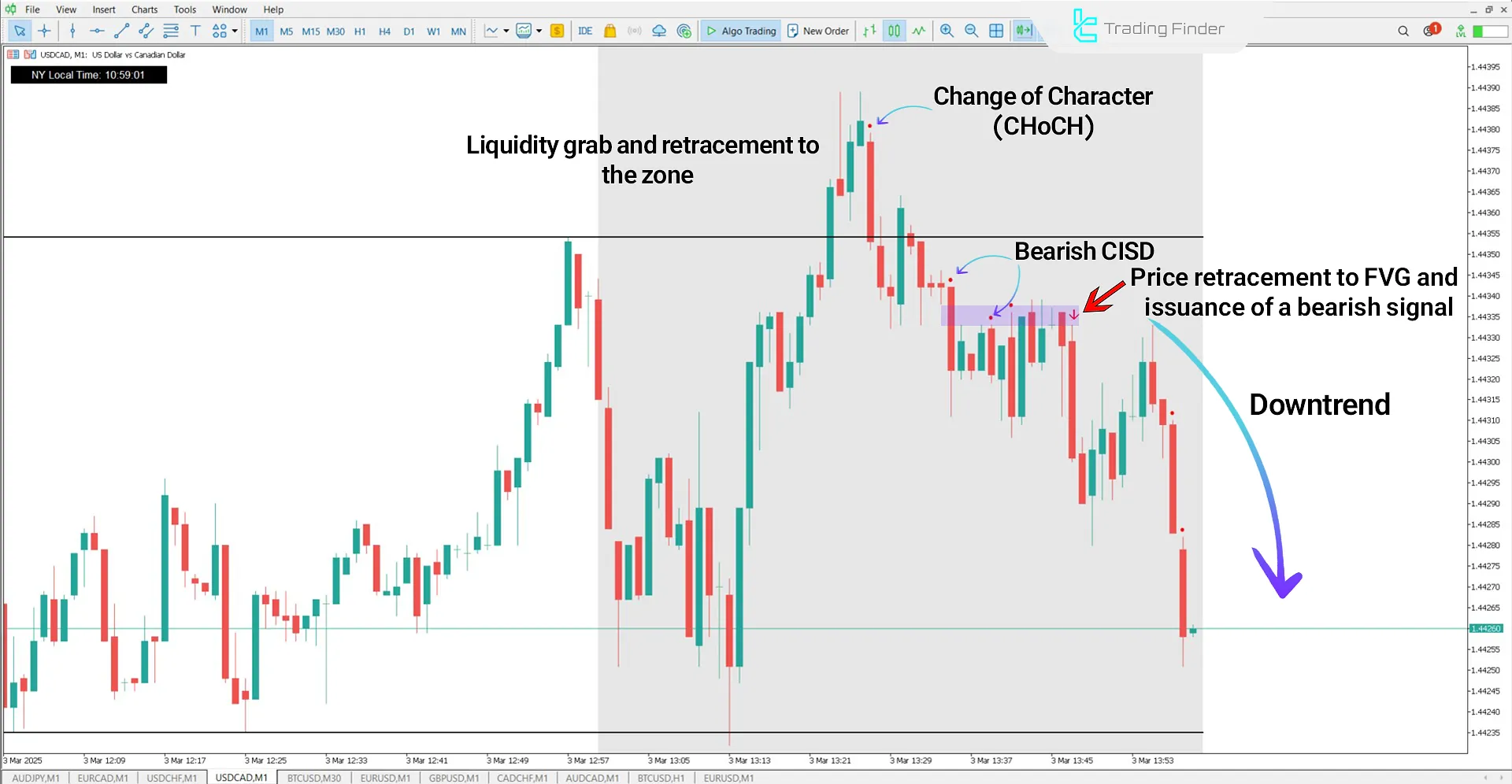

Indicator in a Downtrend

The 1-minute chart of USD/CAD shows that after breaking the resistance zone, the price returns to its range by absorbing liquidity.

Subsequently, when the price reaches the FVG zone along with a change in price delivery (CISD), the indicator issues a trade entry signal via a red arrow.

Silver Bullet ICT Indicator Settings

The details of the Silver Bullet indicator settings are fully displayed in the image below:

- Time1Bool: Activate Time Range 1

- Time Range 1 in New York local time: Time Range 1 in New York time

- Time2Bool: Activate Time Range 2

- Time Range 2 in New York local time: Time Range 2 in New York time

- Time3Bool: Activate Time Range 3

- Time Range 3 in New York local time: Time Range 3 in New York time

- Warning: Just use for backtest GMT minus Server: Backtest trades with GMT settings

- Zigzag level 1 calculation type: Zigzag Level 1 calculation type

- Zigzag Level 1 trend show: Display Zigzag Level 1 trend

- Show CISDs in the range: Display CISD in the range

- Show ChoCH in the range: Display ChoCH in the range

- SameColor: Same color

- OppositColor: Opposite color

- SupportZone: Support zone

- ResistanceZone: Resistance zone

- RangeColor: Range color

- Trend1Color: Trend 1 color

- Trend2Color: Trend 2 color

Conclusion

The Silver Bullet ICT indicator is one of the signal and forecasting indicators for MetaTrader 5. This indicator analyzes market liquidity, false breakouts, and key zones based on ICT concepts to help traders evaluate price movements more accurately.

This tool is specifically designed for scalpers and performs best on 1-minute, 5-minute, and 15-minute timeframes.

Silver Bullet ICT MT5 PDF

Silver Bullet ICT MT5 PDF

Click to download Silver Bullet ICT MT5 PDFWhat is the Silver Bullet ICT indicator used for?

This indicator is designed to identify key liquidity zones, false breakouts, and short-term trading opportunities. Analyzing the market structure and support/resistance levels identifies suitable entry and exit points.

How does this indicator issue entry signals?

First, it identifies the highest and lowest points of the session. If liquidity is absorbed in key zones, it detects a change in market structure. Then, an entry signal is issued by analyzing the CISD level, Order Block, and Fair Value Gap (FVG).