![SSMT 4 Quarter Divergence Indicator MT5 – Free Download [TradingFinder]](https://cdn.tradingfinder.com/image/497838/2-122-en-ssmt-4quarter-divergence-mt5-1.webp)

![SSMT 4 Quarter Divergence Indicator MT5 – Free Download [TradingFinder] 0](https://cdn.tradingfinder.com/image/497838/2-122-en-ssmt-4quarter-divergence-mt5-1.webp)

![SSMT 4 Quarter Divergence Indicator MT5 – Free Download [TradingFinder] 1](https://cdn.tradingfinder.com/image/497829/2-122-en-ssmt-4quarter-divergence-mt5-2.webp)

![SSMT 4 Quarter Divergence Indicator MT5 – Free Download [TradingFinder] 2](https://cdn.tradingfinder.com/image/497840/2-122-en-ssmt-4quarter-divergence-mt5-3.webp)

![SSMT 4 Quarter Divergence Indicator MT5 – Free Download [TradingFinder] 3](https://cdn.tradingfinder.com/image/497821/2-122-en-ssmt-4quarter-divergence-mt5-4.webp)

The SSMT 4 Quarter Divergence Smart Money Sequential Divergence Indicator is based on advanced technical analysis concepts and operates within the framework of market structure theory and smart money behavioral analysis.

Using precise time and structural analysis, this tool detects divergence between correlated assets across four quarterly phases (Q1 to Q4).

The operation of this trading tool starts by selecting two correlated assets, such as the NQ100 and JP2000 indices; this correlation is considered an essential prerequisite in the analysis process.

SSMT 4 Quarter Divergence Indicator Table

The specifications of the SSMT 4 Quarter Divergence Indicator are shown in the table below.

Indicator Categories: | Smart Money MT5 Indicators Trading Assist MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators |

SSMT 4 Quarter Divergence at a Glance

The SSMT 4 Quarter Divergence Indicator, by analyzing structural divergence between correlated assets and aligning it with market time cycles, acts as a precise tool for identifying critical phase-shift zones.

The occurrence of such divergence at the transition points between time phases is an indication of smart money entry and a potential trend reversal. Confirmation of these conditions is achieved through a market structure break and the display of pivot points in lower timeframes.

Combining these elements provides a framework for identifying precise entry opportunities with controlled risk in premium (overbought) and discount (oversold) zones.

Indicator in Bullish Trend

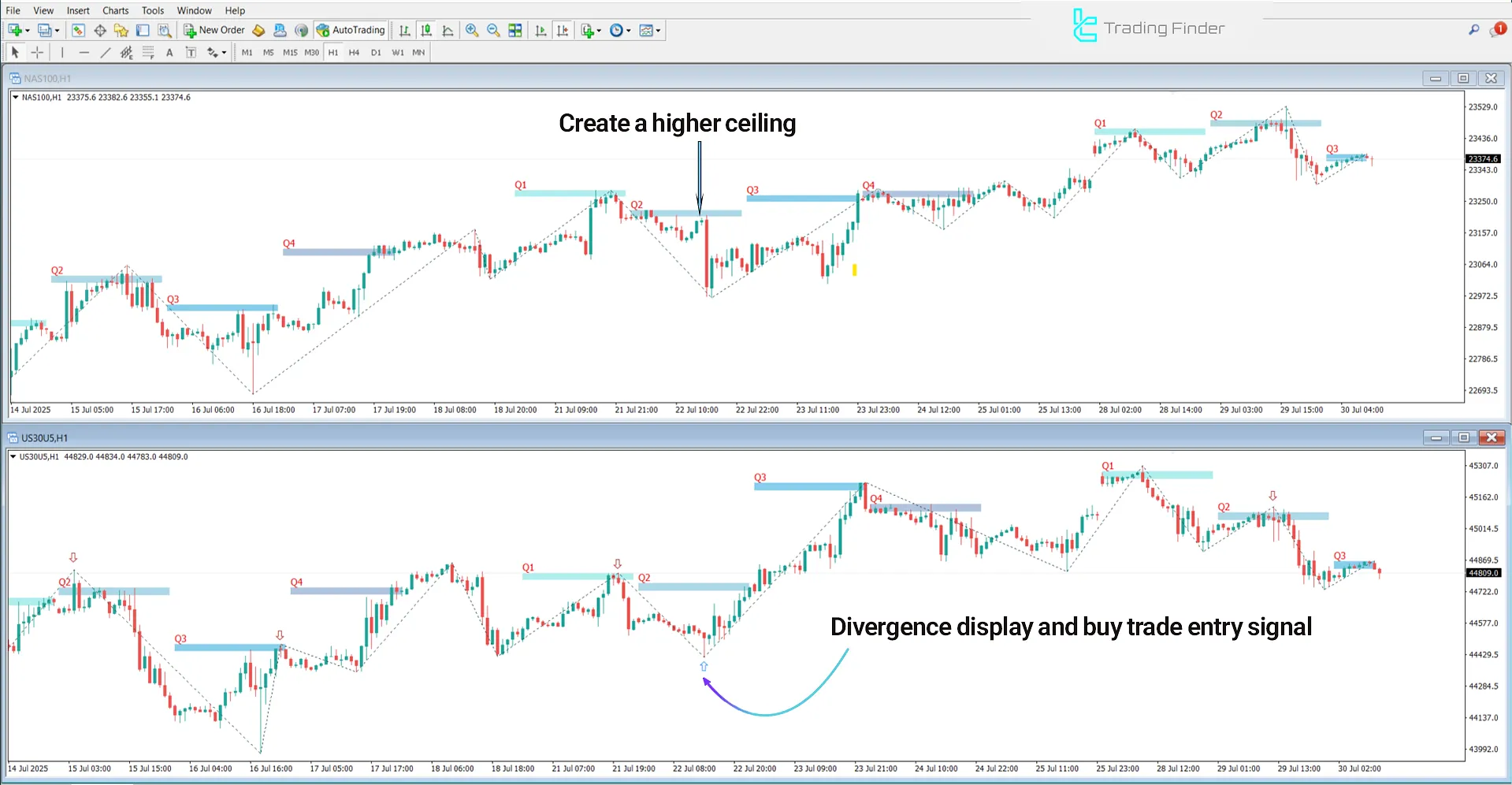

In the bullish scenario, time divergence is observed between the NAS100 and US30U5 indices in the 1-hour timeframe.

The US30U5 index breaks below the previous swing low while the NAS100 index maintains its price structure — a sign that smart money is absorbing selling pressure.

This behavioral difference often indicates liquidity absorption by smart money.

If a bullish candlestick forms alongside a structure break in a lower timeframe, conditions for confirming a buy setup are met.

Indicator in Bearish Trend

In the bearish trend scenario, the US30 index breaks above the previous quarter’s swing high without structural confirmation from the NAS100 index — a sign of time divergence formation.

This divergence indicates weakening buying power and the gradual exit of smart money from the market.

If subsequently, a strong bearish candlestick appears along with a structure break, a high-probability sell setup is formed.

SSMT 4 Quarter Divergence Settings

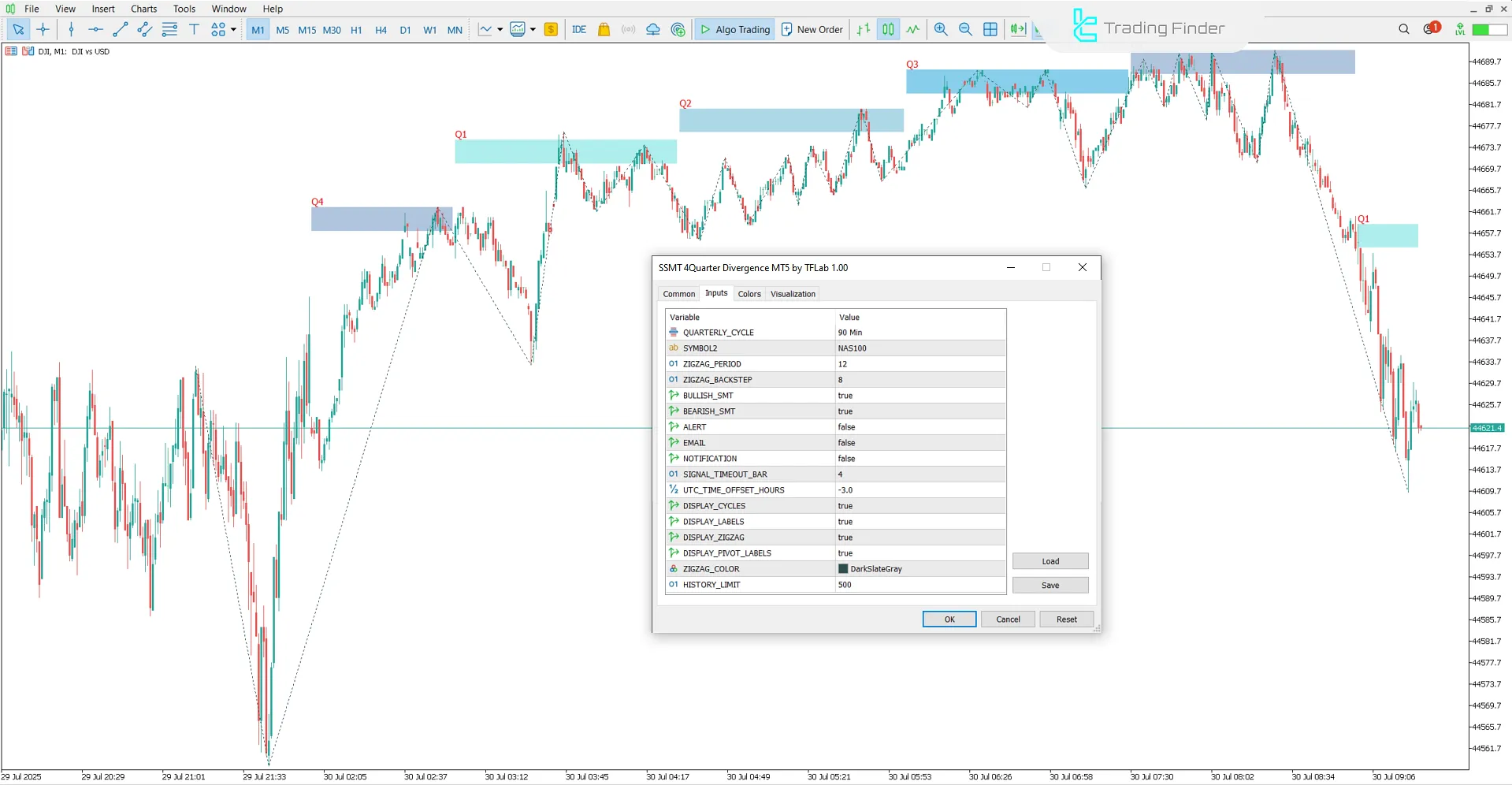

The image below shows the SSMT 4 Quarter Divergence Indicator settings panel in the MetaTrader 5 platform:

- QUARTERLY CYCLE: Type of quarterly time division

- SYMBOL2: Symbol of the second asset

- ZIGZAG PERIOD: Zigzag sensitivity period

- ZIGZAG BACKSTEP: Number of retracement candles required to confirm a pivot in the zigzag algorithm

- BULLISH SMT: Bullish SMT divergence signal

- BEARISH SMT: Bearish SMT divergence signal

- ALERT: Alert setting

- EMAIL: Send email

- NOTIFICATION: Send push notification

- SIGNAL TIMEOUT BAR: Duration of the signal in number of candles

- UTC TIME OFFSET HOURS: Adjust time offset for correct alert timing

- DISPLAY CYCLES: Visual display of quarterly cycles

- DISPLAY LABELS: Display of signal labels

- DISPLAY ZIGZAG: Graphical display of zigzag lines on the chart

- DISPLAY PIVOT LABELS: Display of pivot-related labels

- ZIGZAG COLOR: Select color for zigzag lines

- HISTORY LIMIT: Limit the number of indicator candles for analysis and signal display

Conclusion

The SSMT 4 Quarter Divergence Indicator, by dividing timeframes into four sequential quarters, creates conditions for precise analysis of market behavioral phases.

Divergence between correlated assets in this framework is a sign of phase shifts and liquidity flow changes driven by smart money.

Additionally, this time structure in ICT trading style serves as an effective tool for identifying reversal and turning points in the market.

SSMT 4 Quarter Divergence Indicator MT5 PDF

SSMT 4 Quarter Divergence Indicator MT5 PDF

Click to download SSMT 4 Quarter Divergence Indicator MT5 PDFWhat conditions are essential for using the SSMT 4 Quarter Divergence Indicator?

A strong correlation between the selected assets, precise timeframe configuration, and trader proficiency in market structure concepts is among the key requirements.

What do the blue and red arrows represent in the SSMT 4 Quarter Divergence Indicator?

In this indicator, the blue arrow represents a buy signal, and the red arrow represents a sell signal — both displayed based on structural divergence and confirmed in lower timeframes.