The TFlab Trading Journal in MetaTrader 5 is designed as an integrated analytical tool that receives trade information directly from the trading account. This feature enables the process of recording, reviewing, and analyzing trades to be done without manual data entry and within the same trading environment.

In MetaTrader 5, this journal uses real trade history to provide more accurate performance analysis. The trader can review all trading decisions in the same environment where the trades were executed.

What is the TFlab Trading Journal?

The TFlab Trading Journal is a professional trading journal designed to record, organize, and analyze trading performance, and it runs directly inside MetaTrader 5. Using real account data, this tool evaluates the trader’s performance across different analytical levels.

Unlike manual journals or external software, TFlab extracts all information directly from the trading account. This increases data accuracy and eliminates human errors in trade logging.

The main goal of using a trading journal is to create an organized structure to analyze trading behavior, execution quality, and the efficiency of the trading system. The structure of the TFlab journal in MetaTrader 5 includes a statistical dashboard, a trading calendar, a

trades list, and a section for recording tags and notes. These components are designed so that the trader can review performance from the perspective of time, statistics, and trading behavior.

Specifications and Categorization of the TFlab Trading Journal

The table below contains general information and specifications for downloading the TradingFinder trading journal indicator:

Indicator Categories: | Money Management MT5 Indicators Trading Assist MT5 Indicators Risk Management MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Intermediate |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators Commodity MT5 Indicators Indices MT5 Indicators Share Stock MT5 Indicators |

Key Features and Benefits of the Trading Journal App

The key features of the TFlab trading journal show that this tool works beyond a simple journal and focuses on analytical accuracy, data security, and operational compatibility. Here are it’s main features:

Feature | Description |

Data Security | Local data storage and processing within the MetaTrader 5 environment |

Experience-Based Development | Tool design based on the real needs of traders |

Prop Firm Compatibility | Compliance with prop firm rules, risk control, and drawdown management |

Real-Time Synchronization | Recording and analyzing trades without delay |

Live Balance and Equity Display | Continuous monitoring of account status |

Multi-Market Support | Integrated analysis of trades across diverse markets |

Use Cases of the TFlab Trading Journal

A trading journal is an efficient tool for recording information and evaluating trade results in various financial markets and is not limited to a specific domain.

Since each market has different structure, volatility level, and regulations, the way the journal is used is adjusted according to that market’s characteristics.

Use cases of the TFlab trading journal in MetaTrader 5 include the following:

- Stock journal: In the stock market, a stock journal is used to record trades, review symbol performance, and analyze returns across different time periods;

- Prop journal: In prop firms, a prop journal plays an important role in risk control and reviewing compliance with trading rules such as drawdown and trade volume. Using a prop journal increases the trader’s trading discipline;

- Forex journal: In the Forex market, due to the high number of trades and fast volatility, a Forex journal is used for accurate logging of entries and exits and analyzing performance across different sessions;

- Cryptocurrency journal: In the crypto market, a crypto journal is used to manage high volatility and review performance across different assets. Recording spot and futures trades and calculating profit and loss makes behavioral trade analysis more accurate.

Which Brokers and Prop Firms Does the TFlab Trading Journal Connect to?

The TFlab trading journal in MetaTrader 5 can connect simultaneously to multiple trading accounts and is not dependent on any specific broker or prop firm. This allows the trader to record and review trade information from various sources in a centralized space.

By collecting data from different platforms and accounts, a more accurate picture of the trader’s real performance is formed. This coordination between accounts simplifies the comparison and management process and prevents information fragmentation.

Examples of connectable brokers:

- FTMO

- FxBroker

- Exness

- AvaTrade

Sections of the TFlab Trading Journal

To truly evaluate trade quality, focusing only on profit or loss is not enough. A professional evaluation is formed when factors such as trade timing, execution method, and decision-making logic are also reviewed.

For this reason, a trading journal has the most value when it can provide information in diverse, organized, and processable formats. The TFlab trading journal in MetaTrader 5 is designed with a multi-layer structure to enable performance analysis from different perspectives.

The main sections of the TradingFinder trading journal include:

- Dashboard

- Calendar

- Trades List

- Tags & Notes

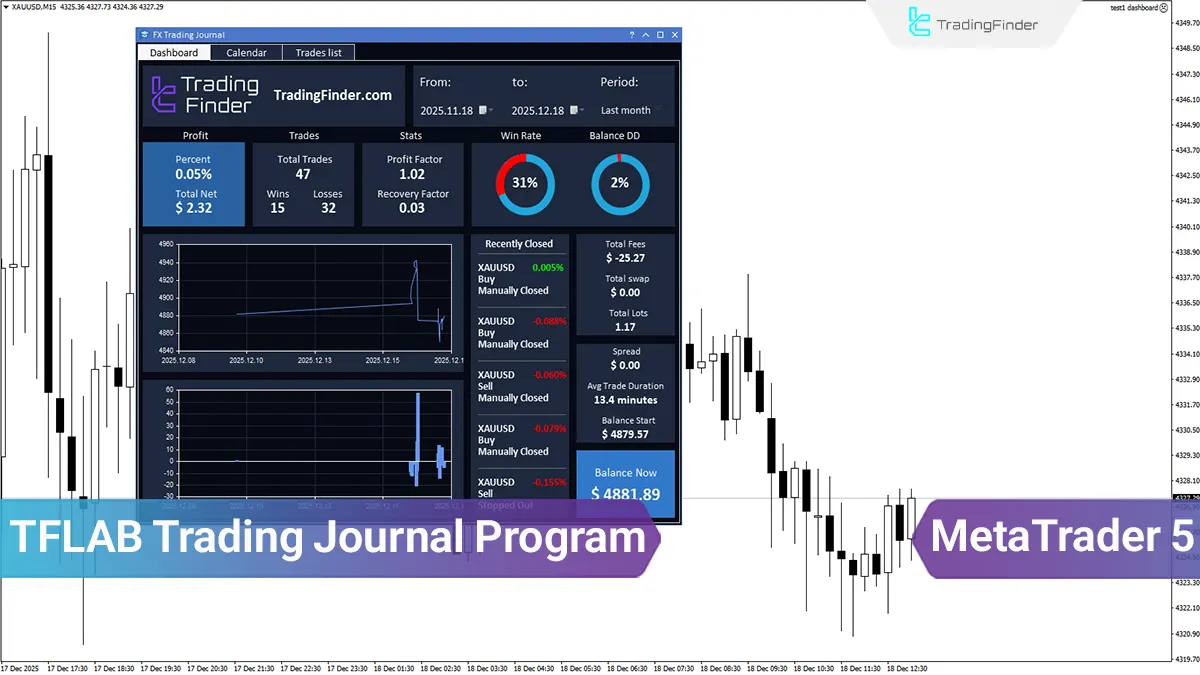

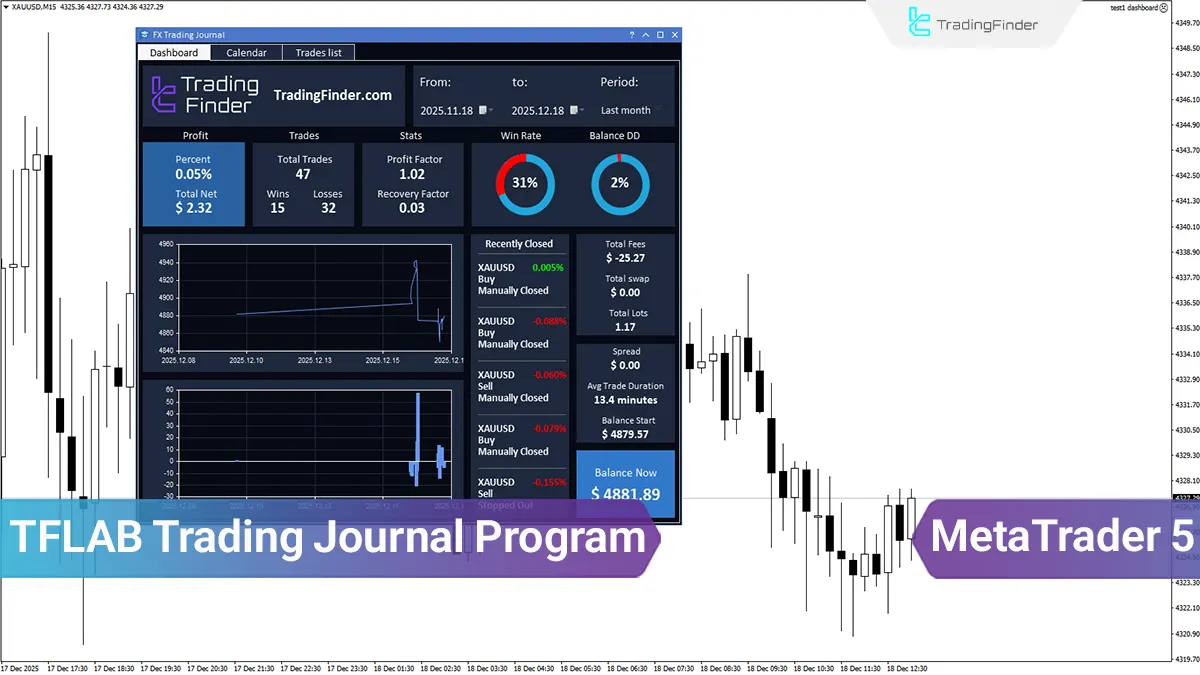

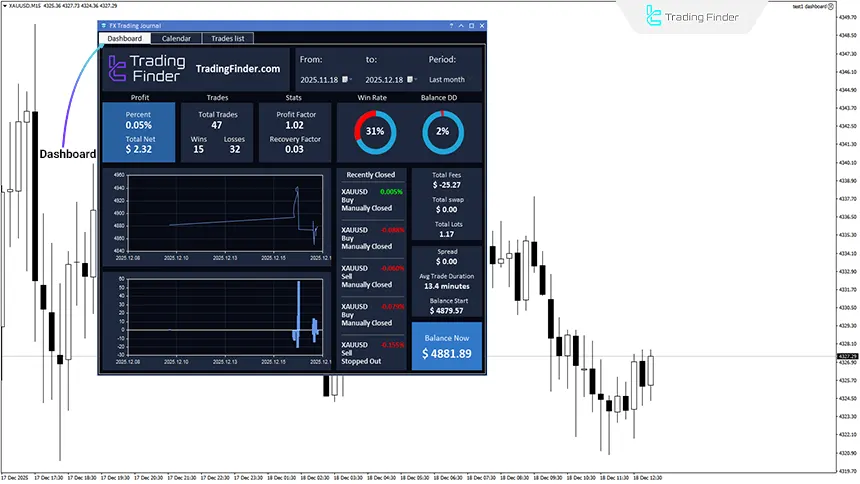

Dashboard

The TradingFinder trading journal dashboard, as the account control center, provides a complete picture of the trader’s performance.

In this section, key data such as the final trade result, trading activity volume, winning percentage, drawdown, and other analytical indicators are displayed in an integrated way.

The main function of the dashboard is to simplify the performance evaluation process so that the trader can check strategy health and account status in the shortest possible time, without needing to analyze each trade separately.

Adjustable Time Range in the Dashboard

One of the key dashboard capabilities in the trading journal is filtering and reviewing performance based on different time ranges. This feature allows the trader to review trading data in specific selectable periods and view reports appropriate to each range.

Using this capability, evaluating and comparing results across different time points is done more accurately, and the trend of improvement or decline in trading performance can be clearly identified.

This section focuses on analyzing performance progression and helps identify strengths and weaknesses of the trading strategy over time.

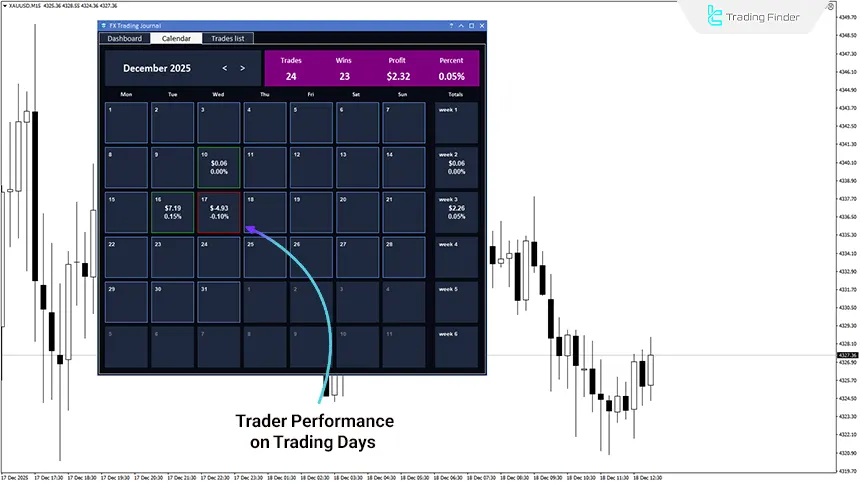

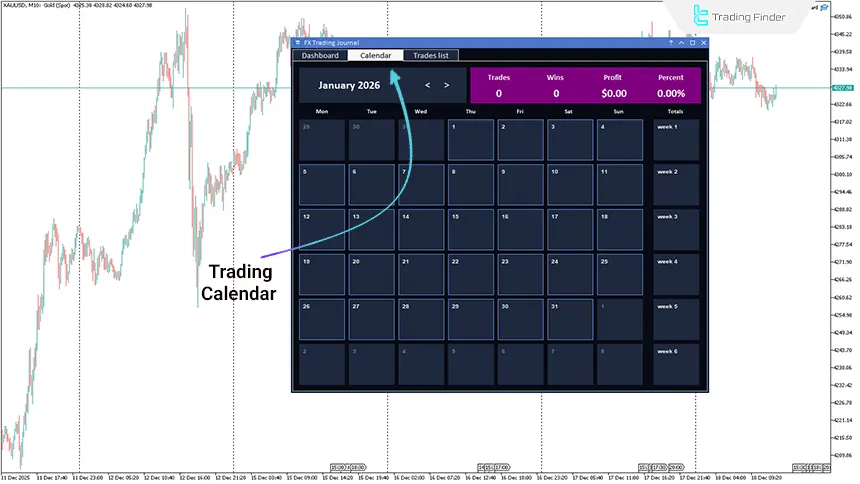

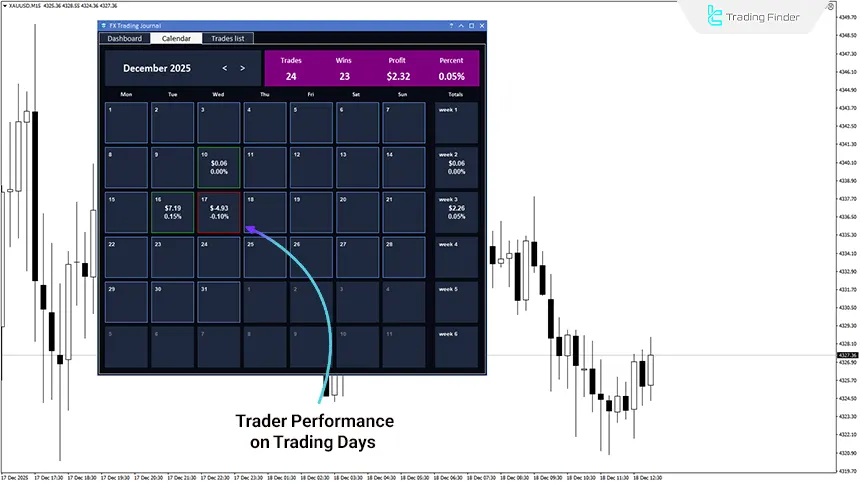

Calendar

The calendar module in the TradingFinder trading journal is a section for reviewing trader performance based on activity timing. In this section, trades are organized into daily and weekly periods so that the distribution pattern of trades over time can be observed.

This time-based view allows the trader to better evaluate discipline in executing the trading plan, identify high risk days, low-return periods, and intervals with weak performance.

Without going into the details of each position, the trading calendar provides an overall picture of time trends.

Daily Reports in the Trading Calendar

In the calendar section of the trading journal, the results of the trader’s activities are presented separately in daily and weekly periods. In this structure, each trading day is evaluated as an independent cycle and the overall result of that day’s trades is recorded in an integrated manner.

In addition, summarized weekly reports are also available to the user, enabling review and comparison of performance in short time periods. This display method is an effective tool for discovering time patterns, reduced focus in some periods, and behavioral changes of the trader over time.

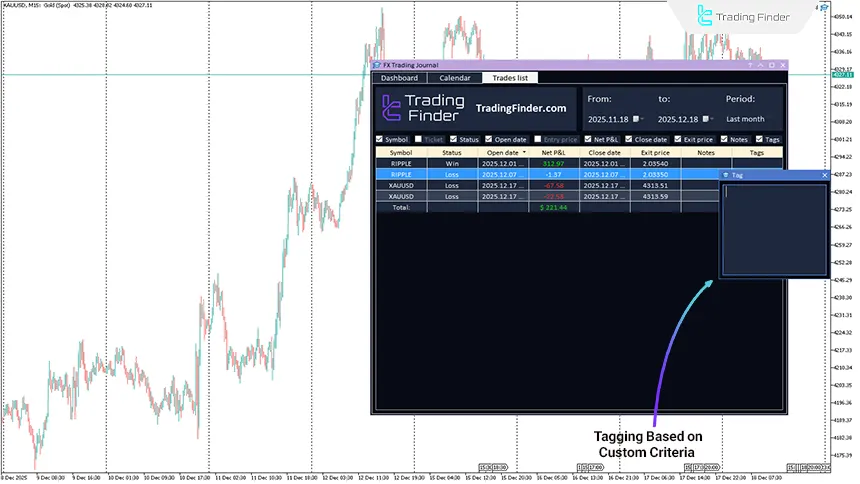

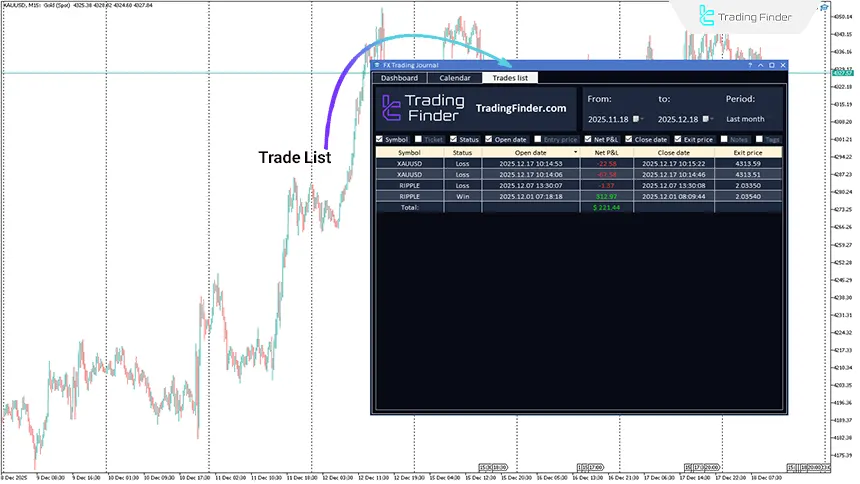

Trades List

The trades list section in the TradingFinder trading journal serves as the main reference for analytical information.

In this part, the full details of each trade are provided in an organized and categorizable format, enabling precise review of the trade execution process and analysis of each position’s outcome.

Analyzing Each Trader’s Trade Details in the Trades List

In the trades display section, each trading position is recorded separately with full details. This section provides a set of practical data to the trader. Types of important information about the trades list:

- The traded asset or currency pair

- Unique trade ID

- The exact time the position opened and closed

- Entry and exit price

- The final result of each trade in terms of return

Having this information enables the trader to compare execution with the predefined strategy and identify potential differences between the plan and actual performance.

In addition, the ability to apply time filters and quickly review a large volume of trades makes it easier to identify behavioral patterns and recurring mistakes.

This section is one of the main tools for precise performance analysis, optimization, and fixing structural weaknesses in the trading system.

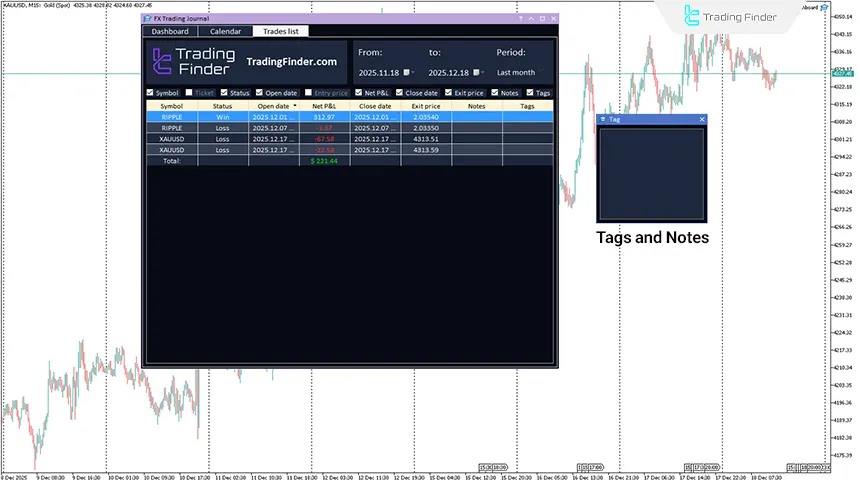

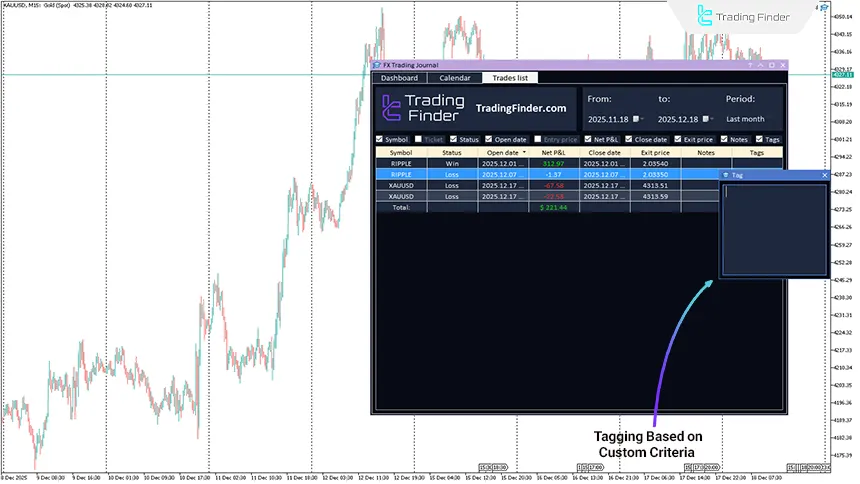

Tags & Notes

The notes and tags section in the trading journal is designed to evaluate non-numerical aspects of trades and plays a complementary role alongside statistical analysis.

In this section, the trader can record personal explanations for each trade or use definable tags to group trades based on preferred criteria.

Adding descriptive information alongside numbers and financial results takes the trading journal beyond a simple statistical report and turns it into a performance analysis tool.

This capability helps the trader more accurately identify and review trading behaviors, adherence to strategy, and mental or decision making errors.

Qualitative Trade Analysis with Tags and Notes

In the TFlab trading journal, adding tags and descriptions for each trade is available separately, and this information is directly linked to that trading position.

This logging method allows the trader to record personal impressions, market conditions, or the reasons for entering and exiting a trade without being limited to a specific time range.

In this section, tags act as a tool for targeted categorization of trades based on defined criteria, while notes are responsible for recording and documenting decision logic and the trade execution process.

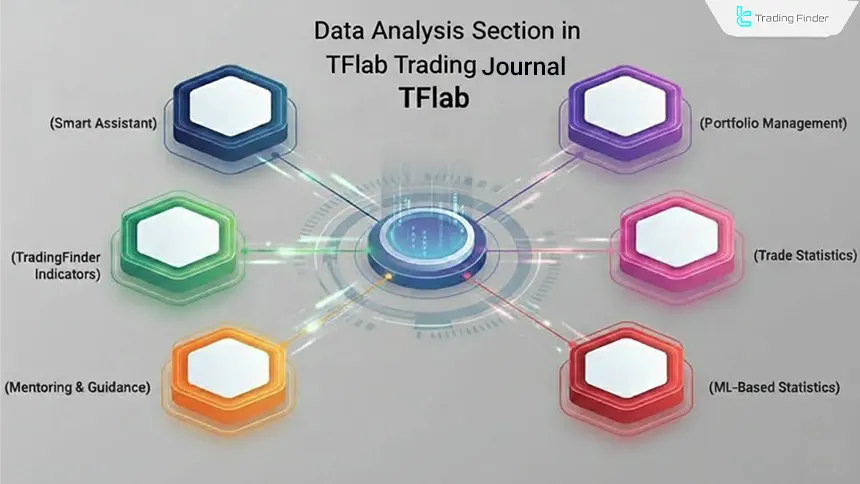

Data Analysis in the TFlab Trading Journal

The data analysis section in the trading journal includes a collection of specialized tools developed to more precisely review trade results and improve account management.

Each of these tools has a specific role in processing data, measuring performance, and evaluating the efficiency of the trading strategy. The analytical modules available in the TFlab journal include:

- AI Assist

- Portfolio Tracker

- Trading Statistics

- ML Statistics

- Mentorship

- Indicators

Smart Assistant (AI Assist)

The smart assistant module in the TradingFinder trading journal is developed as an analytical tool for deep processing of trading information.

By analyzing trade records, trading behavior, and recorded results, this section extracts effective patterns, execution weaknesses, and strengths in the trader’s decision-making.

The main function of AI Assist is to provide an accurate, data based evaluation of trading performance so that frequent errors are identified and controlled.

Portfolio Tracker

The portfolio management module in the TFlab trading journal is developed to monitor multiple accounts simultaneously or a set of different assets.

This section provides an overall picture of capital management and allocation, the risk level of each component, and the final outcome of portfolio performance.

With Portfolio Tracker, comparing the performance of accounts or assets based on metrics such as profitability, drawdown, and result stability becomes possible.

Trading Statistics

The trading statistics section in the trading journal presents trade results as a set of quantitative and analyzable indicators. In this part, parameters such as win rate, average positive and negative return, profit-to-risk ratio, and trading activity volume are evaluated.

The main goal of the module is to extract a more accurate picture of the real performance of the trading system through statistical analysis. Reviewing multiple numerical metrics simultaneously clearly reveals inconsistencies and hidden weaknesses in the trading pattern.

Machine Learning-Based Statistics (ML Statistics)

The ML Statistics section in the trading journal uses advanced analytical algorithms to analyze trading data beyond conventional reviews. This module is developed with a focus on extracting repeatable patterns and complex structures of profitability or loss-making.

Using machine learning-based methods provides a clearer picture of the real efficiency of the trading system.

Mentoring and Guidance (Mentorship)

The mentorship module in the trading journal is developed with an educational and analytical approach and is used to guide the trader on the path of continuous performance improvement.

By providing targeted feedback and step by step analyses, this section provides a clear framework for improving trading level.

The main function of Mentorship is to help strengthen decision-making skills over time. This module is suitable for traders who are learning, refining their strategy, or aiming to achieve consistency in their results.

Indicators

The indicators section in the trading journal provides a set of practical tools that the trader can use to analyze market conditions, control risk, and review trade results. These tools are designed to support more accurate decision-making and better trade management.

Integrating indicators with the trading journal structure turns MetaTrader 5 into an integrated platform for analyzing and evaluating performance.

As a result, reliance on external tools is reduced and the trader can perform analysis with greater speed and focus, which ultimately leads to improved overall efficiency.

Profitability Analysis and Trading Performance Evaluation with a Trading Journal

Many traders measure their performance by a few successful trades, but such a view usually does not provide an accurate picture of real profitability. Sustainable profit becomes meaningful when trading results are measurable and repeatable over a long time period.

Continuous recording of trades and targeted analysis enables the trader to determine whether the achieved profitability is the result of an efficient trading structure or merely caused by short-term market fluctuations.

Improving the Performance of Existing Trading Strategies

After achieving a profitable strategy, the next step is improving the quality of its execution in real market conditions. The TradingFinder trading journal highlights effective parts of the past strategy structure and identifies inconsistencies or execution flaws.

Analyzing factors such asentry and exit method, trade success rate, and the fit between risk and return enables precise and targeted adjustments. As a result of this process, result consistency increases and the trader can use their trading edge more effectively.

Designing and Developing a Personal Trading Strategy

For traders who have not yet achieved consistent performance, a trading journal can act as a development framework.

By enabling comparison of different trading methods’ results across various time periods, this tool helps identify the style that best matches the trader’s personality and capabilities.

Ongoing review of trading data helps detect potential mismatches between strategy, market conditions, and execution in time.

Then, this analytical insight provides the basis for step-by-step refinement of trading rules and moving toward consistency and cohesion in performance.

Artificial Intelligence (AI) Assistant for Analysis in the Trade Journal

The AI assistant in the trading journal is designed to increase trading discipline and improve decision making quality.

By reviewing performance data, it identifies behavioral patterns and areas for improvement and provides more accurate analytical insight to the trader.

One of the important features of this assistant is compatibility with brokers’ and prop firms’ rules. This capability helps the trader operate within trading limitations and prevents high-risk errors.

Backtesting Trades Based on Real Account Data via the Trading Journal

The backtesting process after downloading the trading journal is performed based on real trade data and does not rely on simulated scenarios. With this approach, the trader evaluates strategy performance within real market conditions.

By applying time filters, reviewing statistical indicators, and analyzing each trade’s details, the durability and efficiency of the strategy across different periods and market conditions can be measured.

The results of these reviews lead to more accurate revision of entry and exit rules, improvement of risk management structure, and increased reliability of the trading system.

Support for Diverse Trading Symbols and Markets in the Trade Journal

The trading journal app is not limited to a specific market and enables review of trades across a wide range of symbols.

The ability to analyze trades simultaneously in markets such as Forex, cryptocurrencies, stocks, commodities, and indices allows all trading activity to be evaluated within a single integrated analytical structure.

This feature makes the trading journal a suitable option for traders active in multiple markets who are looking for a coherent tool to monitor and analyze their performance.

Conclusion

The TFlab trading journal in the MetaTrader 5 environment functions as an integrated analytical system that, through direct connection to the trading account, provides an accurate picture of the trader’s performance.

By bringing together statistical reports, a calendar view of trades, trade details, and qualitative analysis sections, this tool enables performance evaluation from different numerical, time-based, and behavioral perspectives.

The trading journal app is considered an analytical platform for traders whose goal is to improve decision-making quality and optimize trading structure based on real and reliable data.

Free Download of TFlab Trading Journal pdf

Free Download of TFlab Trading Journal pdf

Click to download Free Download of TFlab Trading Journal pdfDoes the TFlab Trading Journal automatically record trades?

Yes, after connecting to the trading account, all trades are recorded automatically and no manual data entry is needed.

Is it possible to analyze multiple trading accounts simultaneously in the journal app?

Yes, this journal provides the ability to review and compare multiple trading accounts, and the results of each account can be analyzed separately.

Is the TFlab Trading Journal suitable for short-term and scalping trades?

The analytical structure of this journal is designed so that it can be used for both short-term trades and mid- to long-term strategies.

Can losing trades be analyzed separately?

Yes, using filters and analytical tools, it is possible to specifically review losing trades and identify their reasons.

Are the TradingFinder journal data customizable?

Different sections of the journal such as columns, filters, tags, and reports can be adjusted based on the trader’s needs.

Does using the journal require programming knowledge?

No, all journal features are available through the graphical interface in MetaTrader 5 and no coding knowledge is required.

Can the TFlab journal be used to review trading psychology?

Yes, recording notes and analyzing trading behavior makes it possible to review the trader’s mental and decision-making patterns.

Is advanced statistical reporting available for trading performance?

Yes, the TFlab journal provides precise statistical reports such as Win Rate, Expectancy, Drawdown, Profit Factor, and average R:R, helping the trader evaluate overall performance and strategy weaknesses numerically.

Can trades be categorized based on a specific strategy or setup?

Yes, using tags and custom labeling, trades can be categorized by strategy (for example, ICT, scalp, swing), timeframe, or setup type, and each category can be analyzed separately.

Is the TFlab journal useful for beginner traders as well?

Yes, the simple user interface and visual reports of this journal make it possible even for beginner traders to record and review their trades without complexity and gradually identify their common mistakes.

It doesn't work. It needs a license code. Where can I get a license code?

To receive a free license, please contact our support team via Telegram or WhatsApp.