TradingView

MetaTrader4

MetaTrader5

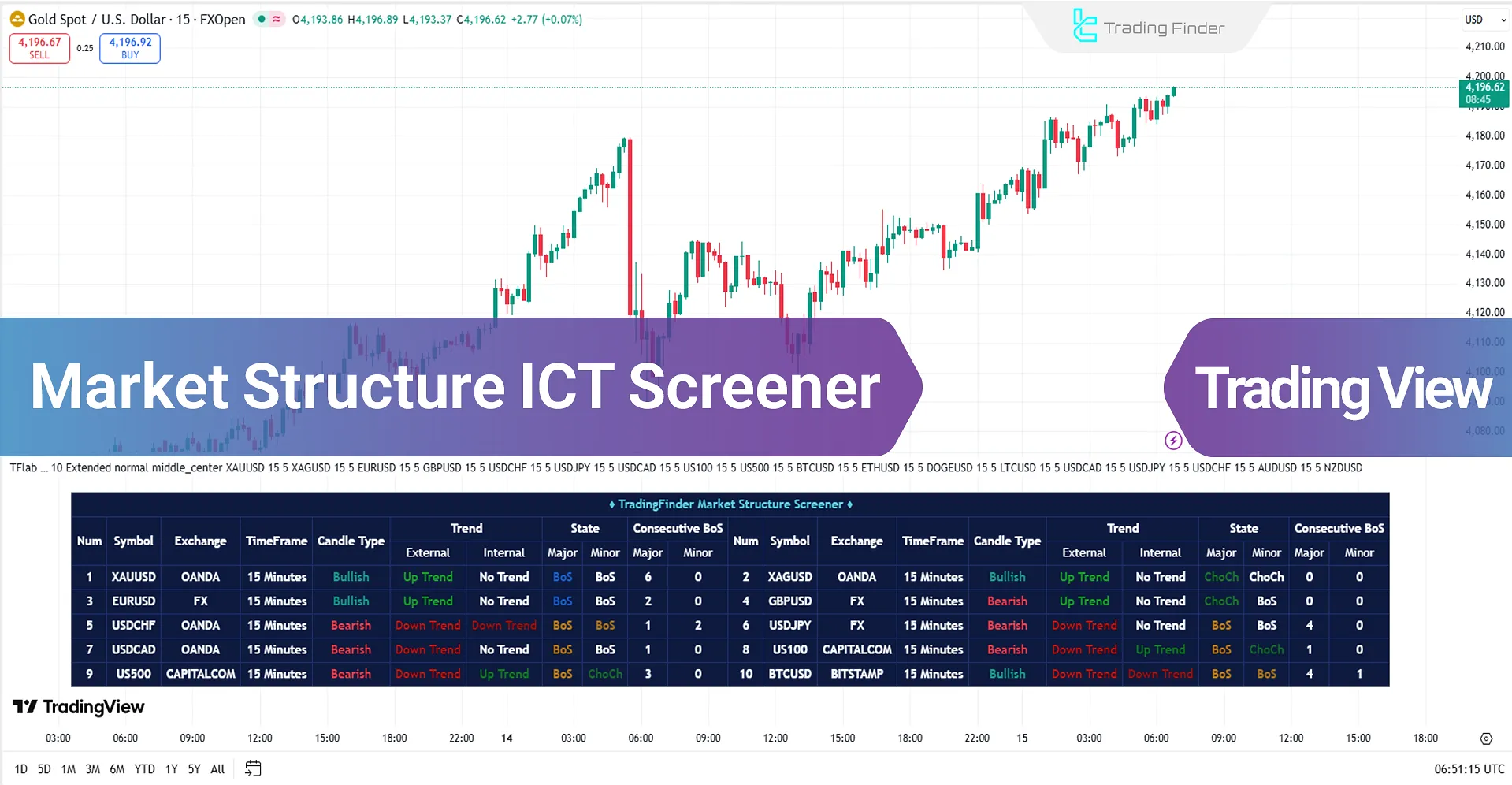

The Market Structure ICT Screener, based on market structure, analyzes price movement as a sequence of highs and lows, classifying each phase of movement into expansion, retracement, and reversal.

This mechanism allows the dominant trends on higher timeframes to be combined with precise details from lower timeframes, creating a multi-layered framework for identifying liquidity movement.

Market Structure ICT Screener Specifications Table

The table below presents the features of the Market Structure ICT Screener:

Indicator Categories: | ICT Tradingview Indicators Smart Money Tradingview Indicators Trading Assist Tradingview Indicators |

Platforms: | Trading View Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal Tradingview Indicators Breakout Tradingview Indicators |

Timeframe: | M1-M5 Time Tradingview Indicators M30-M15 Time Tradingview Indicators |

Trading Style: | Intraday Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Cryptocurrency Tradingview Indicators Stock Tradingview Indicators Commodity Tradingview Indicators Indices Tradingview Indicators |

Market Structure ICT Screener at a Glance

The Market Structure ICT Screener, by identifying a Break of Structure (BOS), shows that liquidity flow continues in the dominant direction and the trend strength is confirmed.

Conversely, a Change of Character (CHOCH), or market structure shift, acts as the first sign of a reversal and signals the beginning of changes in institutional order flow.

This indicator, with its ability to simultaneously display major and internal structures, provides a multi-dimensional layer of the market.

Indicator Performance in an Uptrend

On the EUR/USD pair chart, after a bearish correction, price has managed to break above the previous high with strength.

This movement is registered by the screener as a Break of Structure (BOS) and indicates a shift in liquidity flow toward the upside.

With this confirmation, a buy signal is issued and the best area for buy trade entry is displayed.

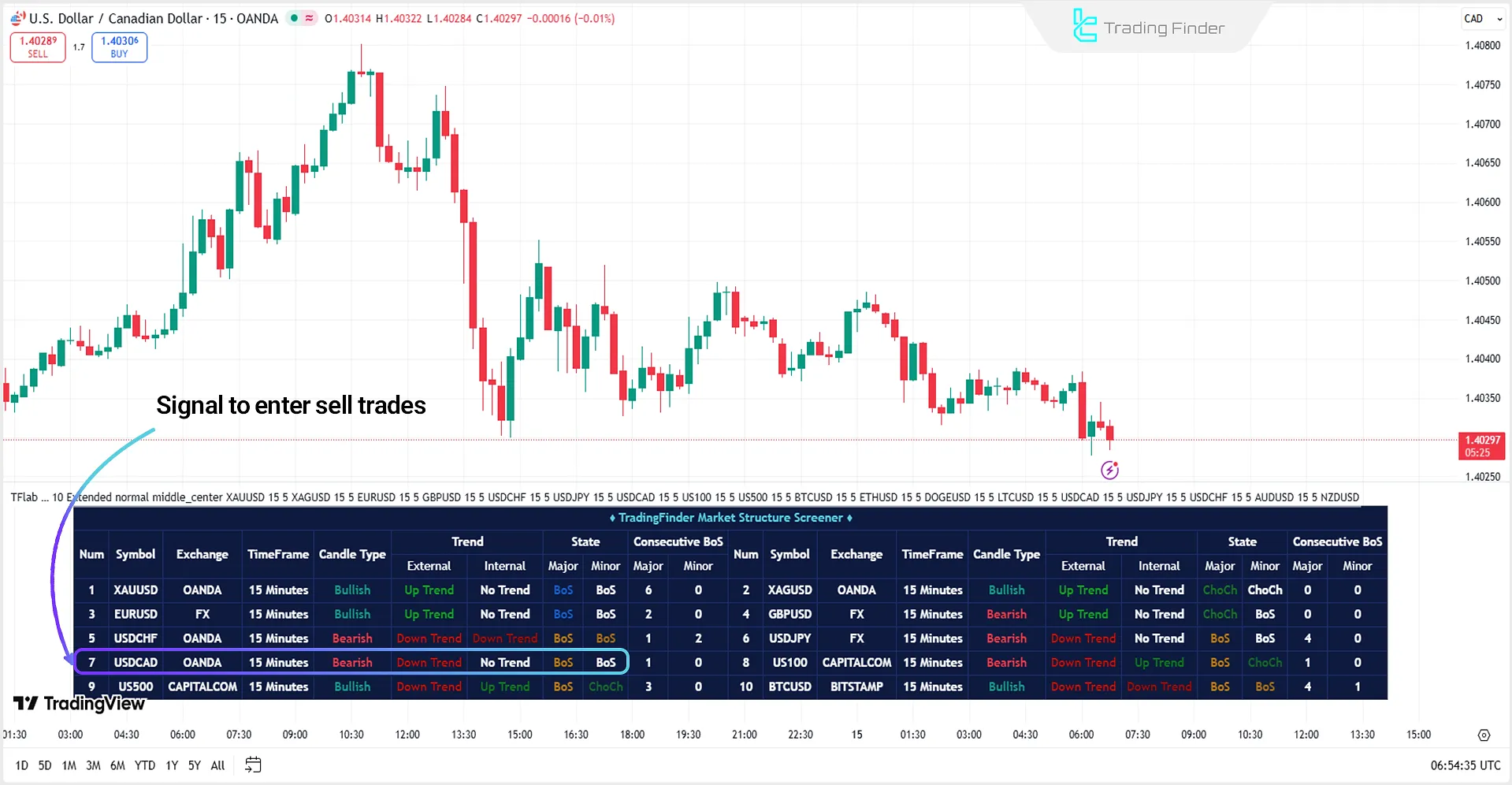

Indicator Performance in a Downtrend

On the USD/CAD pair chart, following a bullish move, price breaks the previous structure with strong bearish candles.

The screener registers this condition as a Break of Structure (BOS), confirming the continuation of liquidity flow to the downside, and with this confirmation, a sell entry signal is issued.

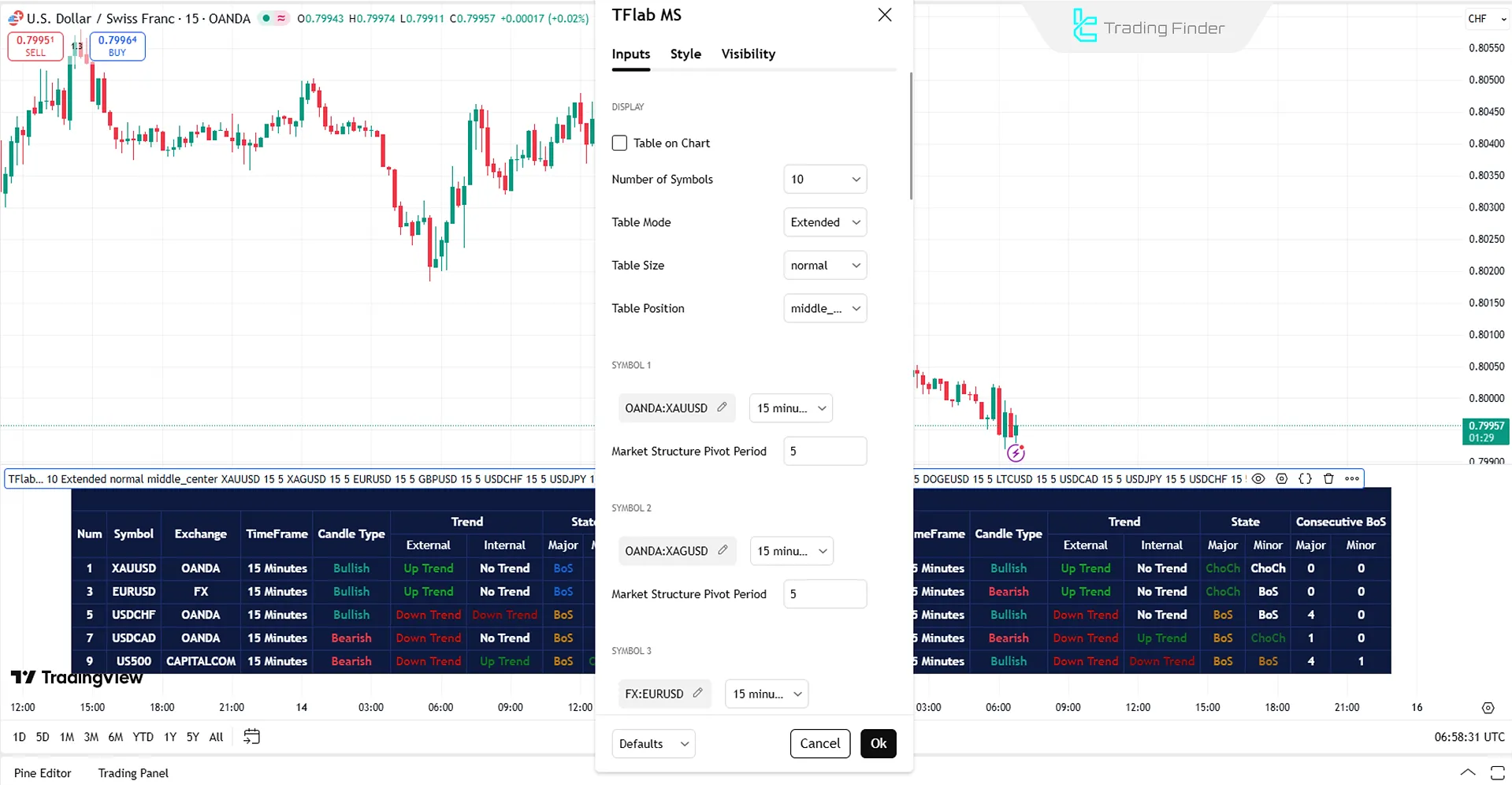

Market Structure ICT Screener Settings

The image below shows the detailed settings of the Market Structure ICT Screener:

Display Settings

- Table on Chart: Show or hide the table on the chart

- Number of Symbols: Number of symbols in the screener table (default 10)

- Table Mode: Display mode of the table in either Basic or Extended style

- Table Size: Table size at different levels

- Table Position: Position of the table on the screen with vertical and horizontal alignment

Symbol Settings

- Symbol: Select asset

- Timeframe: Set desired timeframe for each symbol

- Market Structure Pivot Period: Length of the period used to identify structural highs and lows

Conclusion

The Market Structure ICT Screener, by relying on Break of Structure (BOS) and Change of Character (CHOCH), analyzes price movement in terms of both internal and external structures, identifying liquidity flow across different phases.

Its functionality precisely determines whether a trend will continue or a reversal will begin, and provides buy and sell entry zones based on actual structural changes in the market.

Market Structure ICT Screener to TradingView PDF

Market Structure ICT Screener to TradingView PDF

Click to download Market Structure ICT Screener to TradingView PDFWhat is the principle of the Market Structure ICT Screener?

This screener is designed based on market structure analysis and the identification of Break of Structure (BOS) and Change of Character (CHOCH).

What is the main advantage of the Market Structure ICT Screener?

The main advantage of this screener is the combination of BOS and CHOCH for delivering accurate buy and sell signals alongside simultaneous analysis of both internal and external structures.