The "Turtle Soup Strategy" indicator is designed based on the ICT trading style.

ThisTradingView liquidity indicator points toliquidity hunting through false breakouts and failed breakouts in key liquidity zones (highs, lows, or major support and resistance levels).

Table of Turtle Soup Strategy Indicator Specifications

Below is a table that includes the specifications of the Turtle Soup Strategy indicator:

Indicator Categories: | ICT Tradingview Indicators Smart Money Tradingview Indicators Liquidity Tradingview Indicators |

Platforms: | Trading View Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal Tradingview Indicators |

Timeframe: | Multi-Timeframe Tradingview Indicators |

Trading Style: | Day Trading Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Cryptocurrency Tradingview Indicators Stock Tradingview Indicators Commodity Tradingview Indicators Share Stocks Tradingview Indicators |

Indicator Overview

By the Turtle Soup Strategy, when the price moves through liquidity zones, it triggers Stop Loss orders, then reverses direction as quickly as possible. The price reversal is typically confirmed by one of the following three structures:

- Market Structure Shift (MSS)

- Change of Character (CHoCH)

- Change in State of Delivery (CSD)

Uptrend Conditions

As seen in the 1-hour USD/JPY chart, the Market Structure Shift (MSS) occurs after liquidity hunting.

After thebreak of structure, the price immediately reverses and hits the nearest FVG in line with the trend, causing the price to move uptrend.

Downtrend Conditions

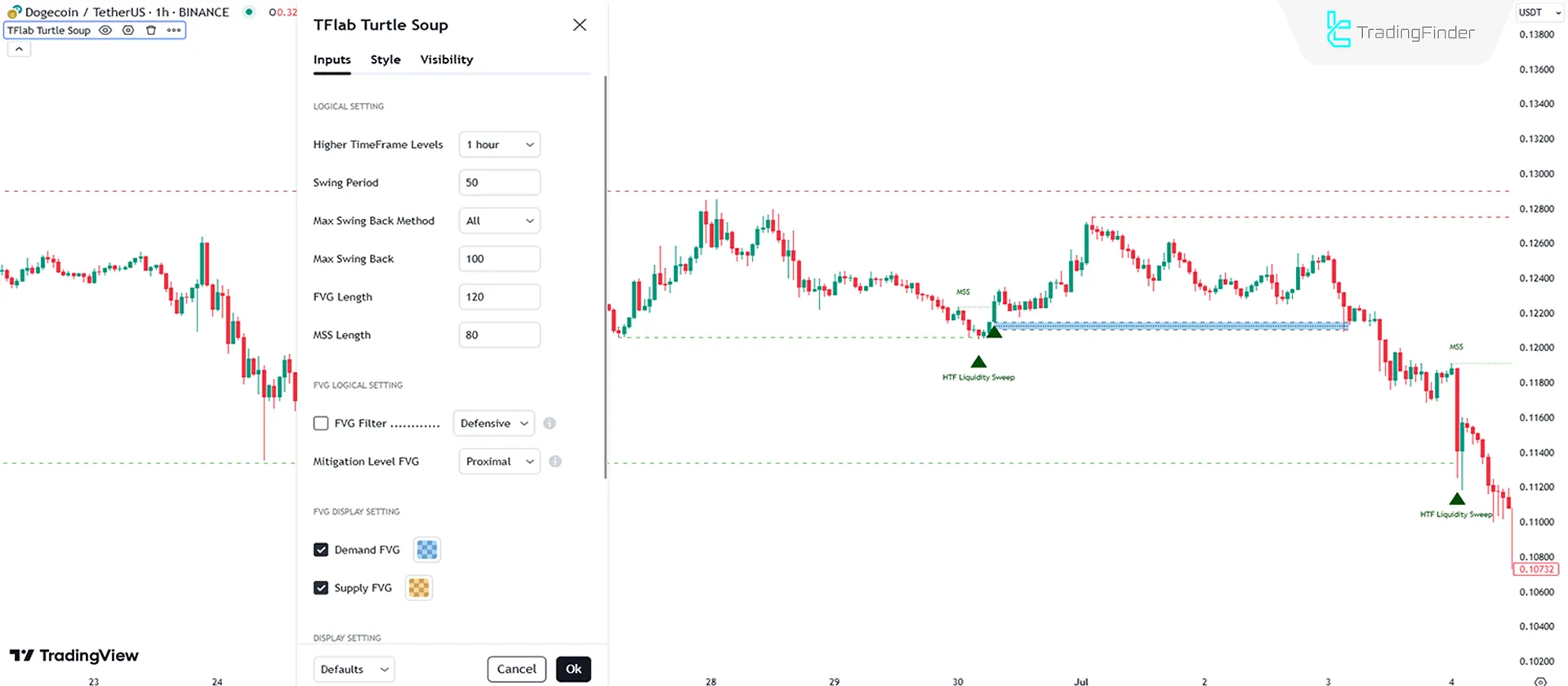

As seen in the 1-hour Dogecoin (DOGE) chart, the price triggers the Stop Loss at the highest high, reverses, and then, after a Market Structure Shift (MSS), returns to the FVG, moving downward.

Indicator Settings

The Turtle Soup Strategy indicator settings are customizable as follows:

Logical Setting

- Higher TimeFrame Levels: Select higher timeframes;

- Swing Period: Set to 50 for swing detection;

- Max Swing Back Method: Check trend swings;

- Max Swing Back: Checks previous swings, set to 100;

- FVG Length: Set to 120 for FVGs;

- MSS Length: Set to 80 for MSS.

DVG Logical Setting

- FVG Filter: Set filters for FVGs;

- Mitigation Level FVG: Set the mitigation level for FVGs.

FVG Display Setting

- Demand FVG: Display demand FVGs;

- Supply FVG: Display supply FVGs.

Display Setting

- Show All HTF LvL: Show all higher timeframe liquidity levels;

- Show High HTF LvL Name: Show high-level liquidity names in higher timeframes;

- Show Low HTF LvL Name: Show low-level liquidity names in higher timeframes;

- Show All MSS: Show all MSS;

- Show High MSS Name: Show high MSS;

- Show Low MSS Name: Show lowMSS.

Conclusion

The Turtle Soup Strategy indicator combines concepts such as Market Structure Shift (MSS), Change of Character (CHoCH), and Change in State of Delivery (CSD) to create an effective tool for identifying false breakouts and entering trades.

This TradingView ICT indicator is specifically suited for traders with liquidity based strategies such as ICT and Smart Money (SMT).

Turtle Soup Strategy TradingView PDF

Turtle Soup Strategy TradingView PDF

Click to download Turtle Soup Strategy TradingView PDFDo the Turtle Soup Strategy arrow indicators mark trade entry points?

No, the arrows indicate liquidity hunting at significant levels.

Can this indicator be used in cryptocurrency markets?

Yes, this indicator can be used in all markets without any restrictions.