Copy trading is an intuitive feature that allows beginner traders to copy experts’ strategies and trading styles. This allows new traders to learn advanced trading strategies and earn a passive income using this feature.

The table below has list of the 8 best Forex brokers that offer top-tier copy trading platforms.

| eToro | |||

| FXTM | |||

| PrimeXBT | |||

| 4 |  | IFC Markets | ||

| 5 |  | NAGA | ||

| 6 |  | FXCM | ||

| 7 |  | Vantage | ||

| 8 |  | PU Prime |

Trustpilot Rating of the Brokers with the Copy Trading Platform Feature

Choosing a well-known and reputable broker allows you to safely invest in high-performing strategies and earn rewards from other traders’ expertise.

Broker | Trustpilot Rating | Number of Reviews |

FXCM | 4.6/5⭐️ | +800 |

Vantage | 4.5/5⭐️ | +11000 |

4.2/5⭐️ | +29500 | |

NAGA | 4.1/5⭐️ | +4000 |

PrimeXBT | 3.8/5⭐️ | +300 |

3.8/5⭐️ | +1500 | |

IFC Markets | 3.6/5⭐️ | +500 |

FXTM | 2.6/5⭐️ | +1000 |

Minimum Spreads in Brokers with Copy Trading Platforms

Considering the minimum spreads is an essential factor when evaluating the best brokers that offer copy trading software due to the fact the traders don’t have full control over their trades.

Broker | Minimum Spreads |

Pepperstone | 0.0 Pips |

0.0 Pips | |

0.0 Pips | |

IC Markets | 0.0 Pips |

Tickmill | 0.0 Pips |

AvaTrade | 0.6 Pips |

FXCM | 0.8 Pips |

eToro | 1.0 Pip |

Non-Trading Fees in Brokers with Copy Trading Platforms

Traders must consider the non-trading fees since they add-up to the overall cost of trading with a Forex broker.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Exness | $0 | $0 | $0 |

FBS | $0 | $0 | $0 |

$0 | Varies | $0 | |

BlackBull | $0 | $5 | $0 |

PU Prime | $0 | Varies (Maximum $20) | $0 |

$0 | Varies (Maximum $20) | $0 | |

FXCM | $0 | Varies (Maximum $30) | $5 |

RoboForex | $0 | Varies (Up to 3%) | $0 |

Number of Tradable Instruments in Brokers with Copy Trading Feature

The table below allows you to see how diverse are the tradable instruments of the best brokers with copy trading feature.

Broker | Minimum Spreads |

FP Markets | 10000+ |

eToro | 5000+ |

3000+ | |

2200+ | |

Darwinex | 1500+ |

Vantage | 1000+ |

OctaFX | 300+ |

JustMarkets | 250+ |

Top 6 Copy Trading Platforms

In the following paragraphs we have gathered some of the best brokers that offer copy trading services allowing traders to earn passive income while participating and learning various trading strategies.

eToro

eToro, founded in 2007 and operating as eToro Ltd from Tel Aviv, has built its platform primarily around its CopyTrader system, which serves as the core of its social investing model.

CopyTrader allows users to automatically replicate the trading activity of experienced investors with a minimum copy amount of 1 USD, providing real-time exposure to diversified portfolios across more than 6,000 financial instruments.

This copy trading framework operates under the supervision of major regulatory authorities such as the FCA, CySEC, ASIC, MFSA, and FSRA, ensuring that all replicated trading activity follows jurisdictional compliance standards and investor protection rules.

In addition to direct copy trading, eToro extends its social investment structure through Smart Portfolios, which group multiple strategies and assets into theme-based portfolios managed by eToro’s analysts, as well as Crypto Staking services.

All copy trading activity is executed exclusively through eToro’s proprietary web and mobile platform (Android and iOS).

This broker also segregates client funds and provides negative balance protection, creating an infrastructure specifically designed for large-scale automated portfolio replication.

To use these services, traders must first complete the eToro registration process.

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA (Abu Dhabi), ASIC, FSA (Seychelles), Gibraltar FSC |

Minimum Deposit | 10 USD |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Maximum Leverage | Up to 1:400 (Professional clients; Retail up to 1:30) |

Trading Platforms & Apps | eToro Proprietary Platform, Web Platform, Android App, iOS App |

eToro Pros and Cons

Here’s what traders must consider before opening an account with this Forex broker.

Pros | Cons |

Industry-leading CopyTrader system enabling automated replication of top investors’ strategies | No support for MetaTrader 4 or MetaTrader 5 |

Strong multi-jurisdiction regulation under FCA, CySEC, ASIC, MFSA, FSRA, and others | No phone-based customer support |

Broad market coverage with 6,000+ tradable instruments across Forex, stocks, ETFs, indices, commodities, and crypto | Proprietary platform only; limited third-party platform compatibility |

Integrated social investing tools including Smart Portfolios and Crypto Staking | - |

FXCM

FXCM (Forex Capital Markets), founded in 1999, structures a significant part of its trading ecosystem around copy trading and algorithmic investment services, positioning automated portfolio participation as a central feature.

Through ZuluTrade Copy Trading and Capitalize AI Algo Trading, FXCM enables traders to replicate experienced strategies or deploy AI-generated models with automated execution, backtesting, and real-time optimization across various assets.

These copy trading and AI systems operate directly on MetaTrader 4 (MT4), TradingView, and TradeStation, creating seamless integration between social investing and professional-grade trading platforms.

Operating under regulatory oversight from major authorities including the FCA, CySEC, ASIC, FSCA, and ISA, FXCM applies strict client-protection standards such as segregated accounts, negative balance protection, and investor compensation of up to £85,000.

The broker supports CFD, Active Trader, and Corporate account structures, with entry requirements starting from 50 USD, floating spreads from 0.2 pips, and leverage reaching 1:1000 under specific jurisdictions for all traders who complete FXCM registration.

Traders can also benefit from reduced costs by joining this broker via the TradingFinder FXCM rebate program.

Account Types | CFD Account, Active Trader Account, Corporate Account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | 50 USD |

Deposit Methods | Credit/Debit Cards (Visa, MasterCard), Bank Transfer, Skrill, Neteller |

Withdrawal Methods | Credit/Debit Cards (Visa, MasterCard), Bank Transfer, Skrill, Neteller |

Maximum Leverage | Up to 1:1000 (jurisdiction dependent) |

Trading Platforms & Apps | MetaTrader 4 (MT4), TradingView, TradeStation, FXCM Trading Station (Web, Android, iOS) |

FXCM Pros and Cons

FXCM has its own advantages and disadvantages for traders who are looking for a broker with copy trading options.

Pros | Cons |

Advanced copy trading and algorithmic investment via ZuluTrade and Capitalize AI | Historical regulatory penalties and bankruptcy record (2017) |

Strong multi-regulation under FCA, ASIC, CySEC, FSCA, ISA | 50 USD annual inactivity fee |

Professional-grade platforms: MT4, TradingView, TradeStation, Trading Station | 40 USD fee on bank wire withdrawals |

Competitive pricing with floating spreads from 0.2 pips and zero CFD commission | Limited Forex symbol count compared to some competitors |

IFC Markets

IFC Markets, founded in 2006, positions copy trading and managed investment services as a core component of its brokerage model through IFCM Invest and its integrated PAMM (Percentage Allocation Management Module) system.

This framework allows investors to allocate funds to verified portfolio managers, monitor performance in real time, and distribute profits and losses proportionally.

Portfolio diversification is supported through simultaneous allocation to three to five PAMM strategies, providing structured exposure to professional trading across global markets.

This investment infrastructure operates across more than 650 tradable instruments, including Forex, indices, commodities, ETFs, stocks, cryptocurrencies, and synthetic instruments, delivered through MT4, MT5, and the NetTradeX platform.

All platforms are ready for download via the IFC Markets dashboard.

IFC Markets is regulated by the Labuan Financial Services Authority and the BVI Financial Services Commission, and applies essential safeguards such as segregated client funds, negative balance protection.

Completing IFC Markets verification is required for all traders in this broker.

Account access for traders who complete IFC Markets registration begins from a 1 USD minimum deposit, with leverage up to 1:400, ECN spreads from 0.0 pips, and transaction commissions of 0.005% on ECN accounts.

By combining advanced copy trading infrastructure with multi-asset coverage and proprietary technologies such as the GeWorko Method and Portfolio Quoting Method, IFC Markets delivers a robust environment for both passive and active portfolio participation.

Account Types | Standard, Micro, ECN |

Regulating Authorities | Labuan FSA, BVI FSC |

Minimum Deposit | 1 USD |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Cryptocurrency, Mobile Money |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Cryptocurrency |

Maximum Leverage | Up to 1:400 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), NetTradeX, Web Platform, Android App, iOS App |

IFC Markets Pros and Cons

Before opening an account to copy trade in the IFC Markets broker, ensure you are fully aware of these benefits and limitations

Pros | Cons |

Integrated copy trading and PAMM investment system (IFCM Invest) with real-time performance tracking | No top-tier Tier-1 regulation such as FCA or ASIC |

Very low minimum deposit from 1 USD, suitable for small-capital investors | Some popular Forex pairs have higher average spreads |

Access to 650+ instruments across Forex, CFDs, Crypto Futures, stocks, ETFs, and synthetic instruments | Limited number of cryptocurrency pairs compared to major brokers |

Advanced trading platforms: MT4, MT5, NetTradeX with proprietary technologies like GeWorko Method | - |

PrimeXBT

PrimeXBT, established in 2018, structures its trading ecosystem around an advanced Copy Trading framework designed for both active and passive market participants.

Through its integrated PrimeXBT Copy Trade system, users can automatically replicate the strategies of experienced traders while retaining full control over risk parameters using built-in tools such as stop loss, take profit, and capital allocation limits.

The platform allows followers to earn up to 75% profit share, while strategy providers can generate returns of up to 20%, creating a performance-driven marketplace for strategy deployment across Forex, indices, commodities, cryptocurrencies, and Crypto Futures.

This copy trading infrastructure operates alongside access to 100+ CFD instruments, supported by TradingView charting, a proprietary WebTrader, mobile trading applications, and optional MetaTrader 5 (MT5) integration through PrimeXBT’s regulated partner.

PrimeXBT is regulated by multiple authorities, including the FSA (Seychelles), FSCA (South Africa), FCIS (Lithuania), BCR, and the Mauritius FSC, providing baseline regulatory oversight across jurisdictions. Traders who complete the PrimeXBT registration are fully protected by law in the mentioned jurdistictions.

Account entry begins from a 15 USD minimum deposit, with leverage up to 1:1000, spreads from 0.1 pips, zero trading commissions on most products, and transparent Crypto Futures fees of 0.01% maker and 0.02% taker.

Combined with institutional-grade copy trading, diversified market access, and global user coverage exceeding 1 million clients, PrimeXBT delivers a technologically mature environment for systematic and social investing.

Account Types | Standard, Demo |

Regulating Authorities | FSA (Seychelles), FCIS (Lithuania), FSCA (South Africa), BCR, FSC (Mauritius) |

Minimum Deposit | 15 USD |

Deposit Methods | Visa/Mastercard, E-Wallets, International Bank Transfer, Cryptocurrency |

Withdrawal Methods | Visa/Mastercard, E-Wallets, Bank Cards, Cryptocurrency |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | PrimeXBT WebTrader, Proprietary Mobile App (Android, iOS), MT5 (via partner PXBT Trading Ltd) |

PrimeXBT Pros and Cons

Traders must consider the following pros and cons of trading with the PrimeXBT broker.

Pros | Cons |

Advanced Copy Trading system with up to 75% profit share for followers and 20% for strategy providers | Lack of Tier-1 regulation such as FCA or ASIC |

Access to Forex, CFDs, Crypto, and Crypto Futures from a single integrated platform | Limited number of tradable assets compared to multi-asset brokers |

Low entry barrier with 15 USD minimum deposit and leverage up to 1:1000 | - |

Proprietary WebTrader, mobile apps, TradingView charts, and optional MT5 integration | - |

NAGA

NAGA operates as a multi-asset brokerage and social trading platform where copy trading, delivered through NAGA Autocopy, functions as the central pillar of its investment ecosystem in the NAGA dashboard.

The NAGA Copy Trading framework enables traders to replicate strategies from verified investors in real time, monitor performance metrics, and exit copying relationships at any moment, creating a flexible environment for both portfolio diversification and risk control.

This social trading infrastructure is supported by access to more than 4,000 tradable instruments across Forex, CFD stocks, indices, ETFs, commodities, crypto, and futures, with trading executed via MT4, MT5, WebTrader, and mobile app.

Headquartered in Germany and operating under NAGA Group AG, a publicly listed company on the Frankfurt Stock Exchange, the broker is regulated by CySEC (License 204/13) and adheres to MiFID standards.

Client protections include segregated funds, negative balance protection, and participation in the Investor Compensation Fund (ICF) covering up to EUR 20,000 for eligible clients.

NAGA has 1.5 million users, variable spreads from 0.2 pips, commissions from 2.5 EUR on stocks, and tiered accounts ranging from Iron to Crystal and traders must complete the NAGA verification process to access all features.

Account Types | Iron, Bronze, Silver, Gold, Diamond, Crystal |

Regulating Authorities | CySEC (License No. 204/13), MiFID |

Minimum Deposit | 250 USD |

Deposit Methods | Credit/Debit Cards, Bank Wire, Skrill, Neteller, PayPal, NAGA Pay, Cryptocurrency |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, Skrill, Neteller, Cryptocurrency |

Maximum Leverage | Up to 1:30 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), NAGA WebTrader, NAGA Mobile App (iOS, Android) |

NAGA Pros and Cons

The following table contains the advantages and disadvantages of trading with the NAGA broker.

Pros | Cons |

Advanced copy trading via NAGA Autocopy with real-time strategy replication and performance analytics | High minimum deposit for premium accounts (up to 100,000 USD for Crystal) |

Strong regulatory framework under CySEC and MiFID, with ICF protection up to 20,000 EUR | Maximum leverage limited to 1:30, restricting high-risk strategies |

Broad market coverage with 4,000+ instruments across Forex, CFDs, stocks, indices, ETFs, crypto, futures, and real shares | Inactivity fee of 50 USD per month after 60 days |

Multi-platform support: MT4, MT5, NAGA WebTrader, Mobile App | - |

Vantage

Vantage Markets, founded in 2009 and headquartered in Sydney, has developed its trading ecosystem with a strong emphasis on copy trading and social investment services as a core participation model.

Through integrated access to ZuluTrade, DupliTrade, and Myfxbook AutoTrade, traders can replicate strategies from thousands of experienced signal providers while applying independent risk controls and performance monitoring.

This framework is supported by a broad multi-asset environment offering Forex, indices, commodities, shares, ETFs, and bonds, with execution delivered across MetaTrader 4, MetaTrader 5, ProTrader, TradingView, and Vantage’s proprietary mobile platform.

The broker operates under a diversified regulatory structure including ASIC, FCA, FSCA, CIMA, and VFSC, with client protections such as segregated funds, negative balance protection, and insurance coverage of up to 1,000,000 USD via Lloyd’s of London.

Entry requirements for new Vantage Markets registrations start from a 20 USD minimum deposit, spreads from 0.0 pips on ECN accounts, and leverage reaching 1:1000 under selected jurisdictions.

By combining institutional-grade copy trading infrastructure, advanced execution technology, and global regulatory oversight, Vantage Markets provides a structured environment for both active and passive portfolio participation.

Account Types | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Regulating Authorities | ASIC, FCA, FSCA, CIMA, VFSC |

Minimum Deposit | 20 USD |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Wallets (Skrill, Neteller, FasaPay), PayPal, Apple Pay, Google Pay, Perfect Money, Local Payment Options |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Wallets, Local Payment Options, Cryptocurrency (region-dependent) |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), ProTrader, TradingView, Vantage Mobile App, Proprietary Web Platform |

Vantage Pros and Cons

Here are the main benefits and drawbacks of choosing Vantage Markets as your Forex broker.

Pros | Cons |

Advanced copy trading and social investment via ZuluTrade, DupliTrade, and Myfxbook AutoTrade | Some countries restricted including the US, Canada, China, and Australia |

Strong multi-regulation under ASIC, FCA, FSCA, CIMA, VFSC with Lloyd’s of London insurance up to 1,000,000 USD | High minimum deposit for Pro ECN account |

Very low entry barrier with 20 USD minimum deposit and leverage up to 1:1000 | - |

Wide platform support: MT4, MT5, ProTrader, TradingView, Vantage App | - |

What is Copy Trading?

Copy trading is a structured investment method that allows investors to automatically replicate the trading activity of professional signal providers in real time.

Commonly categorized as social trading or mirror trading, this model plays a central role in modern Forex trading by combining automated execution with personalized risk and capital management.

Instead of manually placing orders, traders configure allocation parameters and allow their accounts to synchronize with selected strategies, creating a rules-based portfolio framework driven by external expertise.

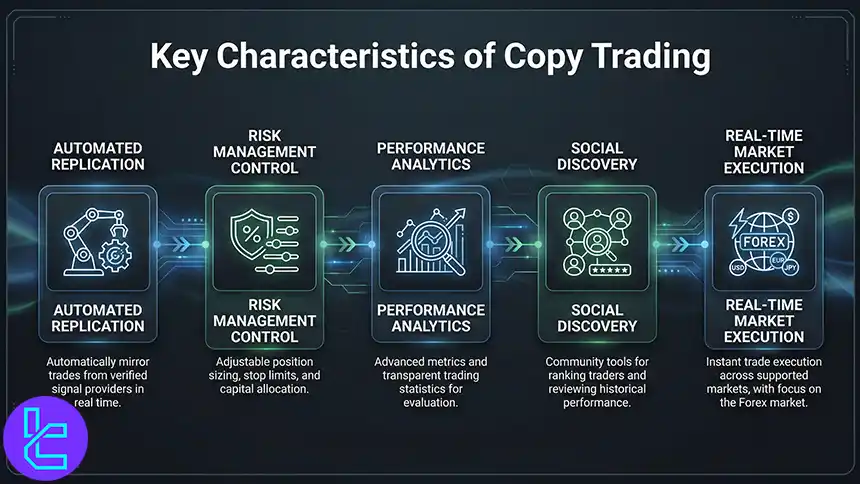

Key characteristics of copy trading include:

- Automated replication of trades executed by verified signal providers;

- Customizable risk management through position sizing, stop limits, and capital allocation;

- Integration with advanced performance analytics and transparent trading statistics;

- Social discovery tools for evaluating trader rankings and historical consistency;

- Real-time execution across supported markets, particularly the Forex market.

This model remains highly accessible for new participants who may lack advanced experience with technical indicators, chart analysis, or strategy construction.

However, long-term effectiveness depends on the quality of the copy trading platform, regulatory safeguards, transparency of performance data, and the strategic discipline of the selected signal providers.

What Are the Pros and Cons of Copy Trading?

The following table outlines the benefits and drawbacks of using copy trading:

Pros | Cons |

Trade execution is fully automated, making it suitable for beginners and time-constrained investors | Portfolio performance is directly affected by the copied trader’s decisions |

Enables real-time observation of professional trading behavior and strategy development | Excessive reliance on external traders may slow independent skill development |

Copying multiple traders distributes risk across assets and methodologies | Performance and management fees may reduce net returns |

Reduces impulsive trading behavior by removing emotional decision-making | Investors relinquish direct trade-level control |

Provides exposure to strategies and asset classes otherwise difficult to approach | Historical performance does not ensure future profitability under changing market conditions |

What is the Difference Between Copy Trading and Social Trading?

While the core concept of copy trading and social trading are the same, there is still a difference in how they work.

Feature | Copy Trading | Social Trading |

Core Function | Automatically mirrors the trades of selected signal providers in real time | Provides a community-driven environment for observing, discussing, and evaluating trader activity |

Execution Method | Fully automated trade replication after parameters are configured | Primarily manual decision-making, with optional transition to copy trading |

User Involvement | Minimal after setup; trades execute without further user action | High involvement through interaction, analysis, and selective copying |

Primary Objective | Portfolio automation and systematic strategy deployment | Knowledge sharing, idea generation, and trader evaluation |

Decision Control | Controlled through predefined risk and capital allocation settings | Controlled through continuous user judgment and social insights |

Typical Tools | Signal provider selection, performance analytics, risk management modules | Social feed, trader profiles, performance statistics, communication tools |

Learning Curve | Lower, as execution is automated | Higher, as interpretation and judgment play larger roles |

Relationship Between Models | Operates as a specialized execution layer | Functions as the discovery and evaluation ecosystem |

Current Market Structure | Core service in modern multi-asset and Forex trading platforms | Commonly integrated alongside copy trading systems |

Traders must consider who a brokers copy trading system works before joining it.

Is Copy Trading Legal?

The legal status of copy trading depends primarily on the regulatory standing of the broker and the jurisdiction in which the investor resides.

In most regions, copy trading is permitted when conducted through a properly licensed brokerage firm, with regulatory safeguards applied during the account verification and onboarding process to ensure compliance with local financial laws.

In the United States, copy trading is lawful when forex activity is supervised by the Commodity Futures Trading Commission (CFTC) and equity trading falls under the authority of the Securities and Exchange Commission (SEC).

For cryptocurrency-related copy trading, brokers must operate as registered Money Services Businesses (MSB) and maintain licensing with FinCEN.

From a legal standpoint, copy trading is generally treated as a self-directed investment service, meaning that trading decisions remain the responsibility of the individual investor.

A key legal mechanism supporting this structure is the Letter of Direction (LoD), a contractual authorization allowing brokers to replicate the trades of selected traders automatically based on the client’s explicit instructions.

This framework replaced older power-of-attorney arrangements and was instrumental in formalizing copy trading within U.S. financial regulation.

While many jurisdictions follow similar principles, regulatory requirements may differ.

For example, in the United Kingdom, additional money management licensing is required for certain forms of copy trading, highlighting the importance of selecting brokers that operate under appropriate regulatory oversight such as the Financial Conduct Authority.

Best Multi-Broker Copy Trading Service Providers

Many brokers don’t provide their own custom-built copy trading softwares; instead, they rely on other companies’ services and offer them to their users. Here are well-known copy trading options available in many brokers:

- ZuluTrade: This is a multi-asset copy trading platform that enables investors to automatically mirror the strategies of experienced signal providers (Leaders) across Forex, commodities, cryptocurrencies, and stocks, with direct execution into connected broker accounts, commonly via MetaTrader 4/5;

- DupliTrade: This social copy trading platform enables automated replication of strategies from vetted professional traders directly into linked brokerage accounts, including brokers such as AvaTrade and Pepperstone, primarily via MetaTrader 4 (MT4). The system combines real-time execution with structured risk management, trade multipliers, and transparent performance reporting, supported by a built-in simulator for risk-free strategy testing;

- MyFXBook Auto Trade: This is an automated copy trading service that mirrors the strategies of verified Forex traders directly into linked MetaTrader 4 (MT4) and MetaTrader 5 (MT5) accounts, enabling portfolio diversification without manual trade management. The platform relies on Myfxbook’s independently verified performance statistics, curated trader selection, and customizable risk controls, allowing investors to manage exposure through flexible allocation and trade-sizing settings.

Can I Copy Trades in Mobile Phone?

Modern copy trading platforms enable investors to manage and replicate professional strategies directly from a mobile (Android or iOS) device through dedicated applications provided by brokers such as Axi, Pepperstone, and HFM.

These mobile systems integrate automated execution, real-time performance tracking, and configurable risk management tools including position sizing and drawdown controls.

By linking mobile interfaces with established trading infrastructures such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), users gain full portfolio oversight without reliance on desktop platforms.

How mobile copy trading works:

- Download the broker’s copy trading application;

- Link your trading account, including MT4 or MT5;

- Review trader rankings based on performance, risk, and strategy;

- Configure capital allocation and risk parameters;

- Activate automatic copying and monitor results in real time.

How to Choose the Best Forex Copy Trading Broker

Traders must conduct in-depth research based on the following topics to choose the best Forex broker for copy trading.

Commissions and Trading Costs

The total cost structure of a copy trading broker directly impacts portfolio performance and long-term capital growth.

Brokers may apply wider Forex spreads, additional CFD commissions, or platform-specific copy trading fees to compensate signal providers and liquidity partners.

Evaluation should include pricing across major instruments such as EUR/USD, XAU/USD, equity CFDs, and cryptocurrency pairs, while considering execution models like ECN, STP, and Market Maker environments.

Funding and Withdrawal Infrastructure

Efficient capital movement requires support for multiple deposit and withdrawal methods, including bank wire, credit and debit cards, and electronic wallets such as Skrill, Neteller, and PayPal.

Integration with global payment networks improves liquidity management, reduces transaction friction, and ensures rapid access to trading capital across Forex, indices, and commodity markets.

Customer Support Availability

Stable copy trading operations depend on responsive 24/5 customer support capable of handling issues related to MetaTrader 4 (MT4), MetaTrader 5 (MT5), account synchronization, and trade execution latency during active London and New York trading sessions.

Trader Resources and Platform Capabilities

Professional copy trading platforms provide advanced performance analytics, historical drawdown reports, risk management dashboards, and integrated execution across platforms such as MT4, MT5, cTrader, and proprietary WebTrader systems.

These tools strengthen strategic oversight for portfolios spanning Forex, CFDs, ETFs, and cryptocurrencies.

Regulatory Framework and Compliance

All copy trading activity should be conducted through brokers regulated by recognized financial authorities including FCA, ASIC, CySEC, FSCA, and CFTC.

Regulatory compliance enforces client fund segregation, negative balance protection, and legal accountability, forming the foundation of investor protection within global financial markets.

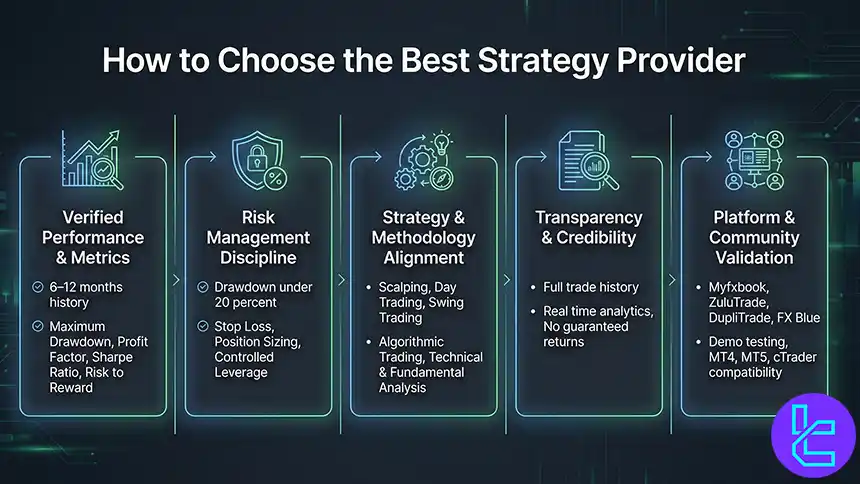

How to Choose the Best Strategy Provider

Selecting a high-quality strategy provider is a core decision in copy trading, directly influencing risk exposure, drawdown stability, and long-term portfolio performance across Forex, CFDs, indices, and cryptocurrency markets.

Effective evaluation requires combining quantitative performance metrics with platform-level and regulatory considerations.

A credible provider should demonstrate a verified performance history of at least 6 to 12 months, ideally across multiple market cycles and conditions including trending and ranging phases.

Key metrics such as maximum drawdown, profit factor, Sharpe ratio, and risk-to-reward ratio offer deeper insight than headline returns.

Sustainable strategies prioritize capital preservation, maintaining drawdown below 20%, applying consistent stop-loss placement, disciplined position sizing, and controlled leverage usage.

Understanding the provider’s trading methodology is equally essential. Strategies built on scalping, day trading, swing trading, algorithmic trading, technical analysis, or fundamental analysis should align with your investment horizon and risk tolerance.

High win rate alone is not sufficient without structural balance between expectancy and volatility. Transparency strengthens reliability.

Reputable providers publish complete trade histories, including both profitable and losing positions, accompanied by real-time analytics, commentary, and market rationale.

Avoid providers offering guaranteed returns or vague descriptions of their systems, as such claims violate established risk disclosure standards in regulated environments.

Additional validation should include independent user reviews, community feedback from platforms such as Myfxbook, ZuluTrade, DupliTrade, and FX Blue, and stress-testing performance through demo accounts or free trial periods.

Fee structures should be evaluated across subscription models, performance-based compensation, and profit-sharing agreements.

Finally, confirm platform compatibility with professional trading environments such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Comparison of the Copy Trading Platforms

In the table below, 4 well-known Forex trading platforms are compared to give you a better look on their copy and social trading offerings.

Comparison Parameter | cTrader | |||

Primary Use Case | Forex & CFD trading | Multi-asset trading | Charting & market analysis | ECN Forex & CFD trading |

Tradable Assets | Mainly Forex, CFDs | Forex, stocks, indices, commodities, crypto | Forex, stocks, crypto, futures | Forex, indices, commodities, crypto (CFDs) |

Order Types | Market, Buy/Sell Limit, Buy/Sell Stop, Trailing Stop | Market, Buy/Sell Limit, Buy/Sell Stop, Buy/Sell Stop Limit, Trailing Stop | Market & Limit (broker-dependent), alerts-based execution | Market, Limit, Stop, Stop Limit, Market Range, Trailing Stop |

Algorithmic and Copy Trading | Yes | Yes | Yes (via Duplikium, Affordable Indicators, or Tradesyncer) | Yes (cAlgo and cTrader Copy) |

Chart Types | Candlestick, Bar, Line | Candlestick, Bar, Line | Candlestick, Heikin Ashi, Renko, Kagi, Line Break, Point & Figure | Candlestick, Bar, Line, Heikin Ashi, Renko |

Strategy Backtesting | Single-threaded | Multi-threaded | Bar Replay (manual) | Tick-accurate backtesting |

Social / Community Features | No | No | Yes (ideas, streams, chat) | Limited |

Platform Access | Desktop, Web, Mobile | Desktop, Web, Mobile | Web, Desktop, Mobile | Desktop, Web, Mobile |

Typical User Profile | Algorithmic & retail Forex traders | Advanced multi-asset traders | Analysts & discretionary traders | ECN-focused & professional traders |

Price | Free platform (broker-provided) | Free platform (broker-provided) | Free plan + paid subscriptions | Free platform (broker-provided) |

Conclusion

Based on our evaluation, eToro, NAGA, Vantage Markets, IFC Markets, and FXCM offer the best copy trading software and social trading platfroms.

Now traders must consider signal provider commissions, minimum required deposits, and risk parameters to choose the best option based on their needs.

All brokers have been evaluated based on the Forex methodology created by TradingFinder experts considering various factors such as regulation, trading costs, copy trading and investment features, etc.