Pakistan’s expanding economy and rising investor participation have accelerated Forex adoption, within a global market exceeding 6 trillion dollars in daily volume. Oversight involves the State Bank of Pakistan and SECP, while retail traders legally access offshore brokers.

Selection focused on brokers accepting Pakistani residents, supporting PKR transactions, offering Islamic accounts, and providing practical trading platforms. Each broker was tested using live accounts, real spreads, instrument coverage, and payment methods.

| PrimeXBT | |||

| XM Group | |||

| HYCM | |||

| 4 |  | PU Prime | ||

| 5 |  | NordFX | ||

| 6 |  | FXCM | ||

| 7 |  | Alpari | ||

| 8 |  | VT Markets |

Pakistan Forex Brokers Ranked by Trustpilot Rating

Trustpilot feedback from Pakistani traders reveals meaningful quality gaps across major Forex platforms, using more than 7,800 combined reviews.

The highest score reaches 4.6 out of 5, while mid-tier providers cluster between 3.5 and 4.3. Lower-rated services highlight execution, support, and withdrawal consistency as key trust factors.

Broker | Trustpilot Score | Number of Reviews |

FXCM | 4.6/5 ⭐️ | 817 |

NordFX | 4.4/5 ⭐️ | 79 |

4.3/5 ⭐️ | 2,015 | |

PU Prime | 3.8/5 ⭐️ | 1,537 |

PrimeXBT | 3.8/5 ⭐️ | 362 |

3.5/5 ⭐️ | 2,831 | |

HYCM | 2.0/5 ⭐️ | 161 |

Alpari | No rating due to breach of guidelines | - |

Brokers with Lowest Spreads in Pakistan

Minimum spread comparison for Pakistani Forex traders shows intense pricing competition, with multiple global platforms offering raw spreads from 0.0 pips and others maintaining ultra-low levels below 0.2 pips.

Such pricing structures significantly influence trading costs, execution efficiency, and overall profitability for high-frequency and professional traders.

Broker | Minimum Spread |

0.0 pips | |

PU Prime | 0.0 pips |

0.0 pips | |

Vantage Markets | 0.0 pips |

FxPro | 0.0 pips |

AvaTrade | 0.0 pips |

PrimeXBT | 0.1 pips |

FXCM | 0.2 pips |

Non-Trading Fees in Pakistan Forex Brokers

Non-trading fees play a major role in long-term trading costs for Pakistani Forex traders. Several international platforms offer zero deposit and withdrawal charges, while others apply inactivity fees ranging from $10 to $50 monthly.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Global Prime | No | No | No |

Vantage Markets | No | No | No |

No | From 0.05% | No | |

No | No | $10/month | |

Alpari | No | Up to €30 | $10/month |

Admirals | No | 1 free/month (then up to 1%) | €10/month |

FXCM | No | No (except a $40 fee for bank transfers) | $50/month |

NordFX | Up to 4% | Up to 5% | $10/month |

Pakistan Forex Brokers’ Trading Instruments

Instrument availability is a key factor for Pakistani Forex traders seeking diversification. Leading global platforms now provide access to more than 13,000 tradable assets, while competitive alternatives exceed 10,000 instruments.

Even mid-tier brokers offer 500 to 1,400 markets, covering the Forex market, commodities, indices, stocks, and cryptocurrencies.

Broker | Number of Trading Instruments |

13,000+ | |

FP Markets | 10,000+ |

XM Group | 1,400+ |

800+ | |

Alpari | 750+ |

NordFX | 500+ |

Fusion Markets | 250+ |

IUX | 250+ |

Top 6 Forex Brokers in Pakistan

Pakistan’s Forex market in 2025 is served by internationally established brokers offering leverage up to 1:1000, minimum deposits as low as $15, and access to over 1,000 tradable instruments across Forex, CFD contracts, commodities, stocks, indices, and cryptocurrencies under multi-jurisdiction regulatory frameworks.

FXCM

FXCM, short for Forex Capital Markets, is a global Forex and CFD broker founded in 1999, operating with more than two decades of industry presence. The company provides access to Forex, indices, commodities, cryptocurrencies, and shares through major platforms including MetaTrader 4, TradingView, and TradeStation.

The broker is regulated by multiple international authorities, including the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission (under license 392/20), the Australian Securities and Investments Commission, the Financial Sector Conduct Authority of South Africa, and the Israel Securities Authority, providing multi-jurisdictional oversight for global traders.

FXCM registration provides access to three primary account structures: CFD, Active Trader, and Corporate accounts. Traders can start with a minimum deposit of $50, access floating spreads from 0.2 pips, and utilize maximum leverage of up to 1:1000, depending on the jurisdiction.

The broker supports algorithmic trading, copy trading, demo accounts, and Islamic accounts. Traders can also receive cashback of up to $2 on gold via the FXCM rebate program.

Client protection at FXCM includes segregated client funds, negative balance protection, investor compensation up to £85,000 for eligible UK clients, and regular audits. These mechanisms aim to provide operational transparency and financial security across FXCM’s regulated entities worldwide.

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

FXCM Pros and Cons

The following advantages and limitations summarize FXCM’s trading environment and operational structure.

Pros | Cons |

Over 20 years of industry experience | 2017 regulatory penalties and bankruptcy history |

Regulated by multiple Tier-1 authorities | An inactivity fee of $50 annually |

Supports MT4, TradingView, and TradeStation platforms | $40 fee on bank wire withdrawals |

Offers negative balance protection and fund segregation | Limited product depth compared with some competitors |

NordFX

NordFX is a global Forex and CFD broker founded in 2008, serving more than 1.7 million traders across 190 countries. The broker provides access to currency pairs, cryptocurrencies, metals, energies, indices, and stocks, supporting both retail and professional trading environments with competitive execution conditions.

Four primary account types: MT4 Pro, MT4 Zero, MT5 Pro, and MT5 Zero are available through the NordFX dashboard. Traders can start with deposits from $10, benefit from spreads starting at 0.0 pips, and access leverage up to 1:1000.

Both MetaTrader 4 and MetaTrader 5 platforms support advanced analytics and automated trading. NordFX deposit and withdrawal methods include Visa, Neteller, Skrill, Bitcoin, and many more.

The broker operates internationally through multiple entities based in Saint Lucia, Seychelles, and Mauritius. While NordFX does not hold Tier-1 regulatory licenses, it applies internal security protocols, including segregated client funds and negative balance protection.

NordFX registration also provides a wide investment ecosystem, including PAMM accounts, copy trading services, VPS hosting, and integration with the MQL5 community. Its infrastructure supports high-frequency strategies, algorithmic systems, and portfolio diversification.

Account Types | MT4 Zero, MT4 Pro, MT5 Zero, MT5 Pro |

Regulating Authorities | FSA, FSC |

Minimum Deposit | $10 |

Deposit Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies |

Withdrawal Methods | Bank wire, Credit/debit cards, E-wallets, Cryptocurrencies, Internal Transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

NordFX Pros and Cons

The following advantages and limitations summarize NordFX’s trading environment for prospective clients.

Pros | Cons |

Ultra-low spreads from 0.0 pips | No Tier-1 regulatory license |

High leverage up to 1:1000 | Limited research and education tools |

Low minimum deposit of 10 dollars | Restricted availability in several major regions |

Supports copy trading and PAMM investment | No proprietary trading platform |

VT Markets

VT Markets is a multi-asset brokerage firm headquartered in Australia, processing over 30 million trades monthly for more than 400,000 active traders. VT Markets registration delivers access to over 1,000 instruments across Forex, indices, commodities, shares, ETFs, bonds, and cryptocurrencies, supporting high-volume global trading.

The company operates under multiple regulatory jurisdictions, including the Australian Securities and Investments Commission, the Financial Sector Conduct Authority of South Africa, and the Financial Services Commission of Mauritius. This structure enables global market access, though the ASIC entity primarily serves wholesale clients.

VT Markets dashboard provides four core account types: Standard STP, RAW ECN, Cent STP, and Cent ECN. Clients benefit from spreads starting from zero, leverage up to 1:500, minimum deposits from $50, and trading via MetaTrader 4, MetaTrader 5, Webtrader+, and the VT Markets mobile application.

By completing the VT Markets verification procedure, traders get access to various trading tools, including Trading Central analytics, copy trading, PAMM accounts, VPS refunds, and loyalty programs.

Its ecosystem combines competitive pricing, strong liquidity, and multi-asset exposure suitable for both active and passive investment strategies.

Account Types | Standard STP, RAW ECN, Cent STP, Cent ECN, Demo |

Regulating Authorities | FSCA, ASIC, FSC Mauritius |

Minimum Deposit | $50 |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Wire Transfer, UnionPay, Fasapay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Webtrader+, VT Markets App |

VT Markets Pros and Cons

The following strengths and limitations outline VT Markets’ overall trading environment.

Pros | Cons |

Strong regulatory structure with multi-jurisdiction oversight | Limited availability in certain regions |

Zero spread ECN accounts and competitive commissions | No proprietary advanced trading platform like cTrader |

Over 1,000 tradable instruments across 7 markets | The offshore entity offers lower investor protection |

Extensive promotions, including bonuses and loyalty programs | No crypto spot trading, only CFD exposure |

PU Prime

PU Prime is a multi-asset Forex and CFD broker established in 2016, providing access to over 800 tradable instruments across six asset classes. The broker serves global traders with low entry requirements, offering minimum deposits from $20 and floating spreads starting from 0.0 pips.

PU Prime operates under multiple regulatory frameworks, including ASIC in Australia, FSCA in South Africa, FSC Mauritius, and FSA Seychelles. Client funds are maintained in segregated accounts, negative balance protection is applied, and strict data protection standards are implemented.

PU Prime dashboard delivers four main account types: Standard, Prime, ECN, and Cent. International wire transfers, credit cards, e-wallets, Alipay, Union Pay, and local bank transfers are among the PU Prime deposit and withdrawal methods.

Traders benefit from maximum leverage up to 1:1000, ECN and STP execution, commission structures from $1 per side per lot, and full support for MetaTrader 4, MetaTrader 5, WebTrader, and the proprietary PU Prime mobile app, by completing the PU Prime registration process.

The broker’s ecosystem integrates copy trading, social trading, demo accounts, Islamic accounts, multi-currency funding, and over 24/7 multilingual customer support. These features combine accessibility with advanced trading tools for both retail and professional participants.

Account Types | Standard, Prime, ECN, Cent |

Regulating Authorities | SVG FSC, Mwali FSC, FSCA, ASIC |

Minimum Deposit | $20 |

Deposit Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Withdrawal Methods | Credit Card, E-wallets, cryptocurrencies, wire transfer |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MT4, MT5, PU Prime app |

PU Prime Pros and Cons

The following strengths and limitations summarize PU Prime’s overall trading profile.

Pros | Cons |

Wide selection of 800+ tradable instruments | Mixed reputation across review platforms |

Low minimum deposit starting from 20 dollars | Restricted access in several major regions |

High leverage up to 1:1000 | Offshore regulatory structure for some entities |

Advanced platforms, including MT4, MT5, and mobile app | Inconsistent client experiences reported |

HYCM

HYCM, also known as Henyep Capital Markets, is a globally recognized Forex and CFD broker offering trading services across major financial markets.

The broker provides access to Forex, indices, commodities, stocks, cryptocurrencies, metals, and energy instruments, supporting traders with competitive pricing and professional-grade execution infrastructure.

The broker operates under a strong regulatory framework with oversight from the UK Financial Conduct Authority and the Dubai Financial Services Authority. Its multi-entity structure leads to a comprehensive HYCM verification procedure.

Client protection protocols include segregated client funds, negative balance protection, and investor compensation coverage (up to £85,000) for eligible UK clients.

HYCM dashboard delivers three primary account types Fixed, Classic, and RAW with a low minimum deposit of $20. Traders can access leverage up to 1:500, floating spreads from 0.1 pips on RAW accounts, and commissions ranging from zero to five dollars per round.

Traders get access to MetaTrader 4, MetaTrader 5, and the proprietary HYCM Trader mobile application by completing the HYCM registration process.

Additional features include demo accounts, Islamic accounts, Forex calculators, economic calendars, PAMM services, and 24/5 multilingual customer support, creating a comprehensive trading environment for global investors.

Account Types | Fixed, Classic, RAW |

Regulating Authorities | SVG FSC, FCA, DFSA |

Minimum Deposit | $20 |

Deposit Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, HYCM Trader |

HYCM Pros and Cons

The following strengths and limitations provide a balanced snapshot of HYCM’s overall trading profile.

Pros | Cons |

Strong regulation under FCA and DFSA | Limited educational resources |

Low minimum deposit starting from 20 dollars | An inactivity fee applied after prolonged dormancy |

Competitive RAW spreads from 0.1 pips | No built-in copy trading platform |

Wide range of 300+ tradable instruments | Restricted availability in several regions |

PrimeXBT

PrimeXBT is a global multi-asset trading platform established in 2018, serving more than 1 million clients worldwide. The broker offers access to Forex, 100+ CFDs, and full crypto spot and futures markets with a low minimum deposit of $15 and TradingView-powered charting tools.

The company operates under multiple regulatory registrations, including FSA Seychelles, FCIS Lithuania, FSCA South Africa, Banco Central de Reserva, and FSC Mauritius.

PrimeXBT also maintains a compensation fund of $20,000 per client, reinforcing its client protection framework across international operations.

PrimeXBT delivers a simplified account structure with a Standard live account and a 10,000 dollar demo account. Traders benefit from spreads from 0.1 pips, leverage up to 1:1000, zero commissions on most markets, and crypto futures fees as low as 0.01 percent maker and 0.02 percent taker.

Trading is conducted through the proprietary WebTrader, mobile applications for iOS and Android, and optional MT5 access via its Seychelles partner.

Additional features that are unlocked by completing the PrimeXBT registration include copy trading, seasonal promotions, crypto futures, affiliate programs, and 24/7 multilingual customer support.

Account Types | Standard, Demo |

Regulating Authorities | FSA, FCIS, FSCA, BCR, FSC |

Minimum Deposit | $15 |

Deposit Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer, Crypto |

Withdrawal Methods | Visa/Mastercard, E-Wallet, Bank cards, Crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | Proprietary Mobile App, WebTrader, MT5 |

PrimeXBT Pros and Cons

The following table highlights the main advantages and limitations of PrimeXBT’s trading ecosystem.

Pros | Cons |

Very low minimum deposit from $15 | No Tier-1 regulatory license |

High leverage up to 1:1000 | Limited traditional CFD instrument range |

Strong crypto futures offering with low fees | Limited fiat funding options in some regions |

Integrated copy trading for passive income | Complex regulatory structure across entities |

Is Forex Trading Legal in Pakistan?

Forex trading is fully legal in Pakistan and continues to expand alongside the country’s financial growth. Oversight is provided by the Securities and Exchange Commission of Pakistan (SECP), while monetary stability is managed by the State Bank of Pakistan (SBP). Pakistani residents may trade legally with both local and offshore brokers.

Although SECP does not license offshore brokers directly, it allows international firms to serve Pakistani clients. With daily global Forex turnover exceeding 6 trillion dollars, Pakistan represents a high-growth trading market where copy trading, managed accounts, and multi-asset platforms are increasingly popular.

- Forex trading is legal for Pakistani residents

- SECP regulates domestic financial activity

- SBP influences currency policy and inflation

- Offshore brokers may legally accept Pakistani clients

- Pakistan is classified among the “Next Eleven” emerging economies

- Rapid growth in retail trading participation

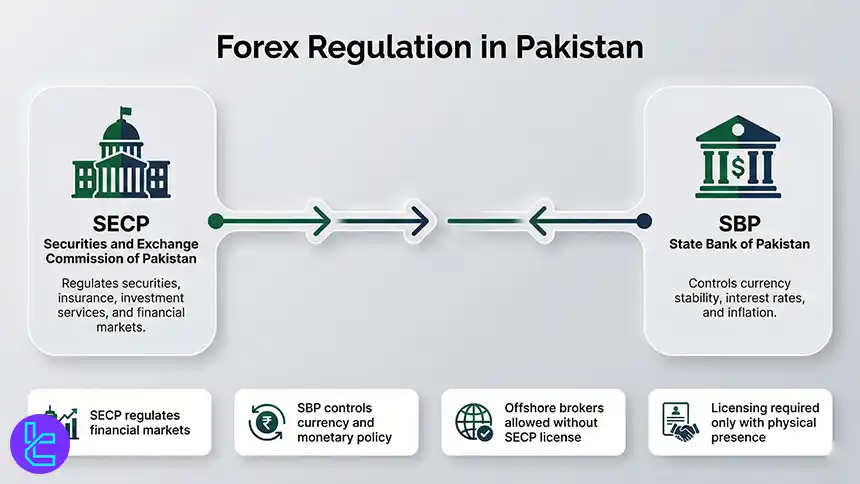

What Authorities Regulate Forex Trading in Pakistan?

Forex activity in Pakistan is primarily supervised by the Securities and Exchange Commission of Pakistan (SECP), headquartered in Islamabad. It oversees securities, insurance, investment services, and financial markets. Meanwhile, the State Bank of Pakistan (SBP) controls currency stability, interest rates, and inflation.

Although SBP does not license brokers directly, its monetary policy strongly influences the Forex market conditions. SECP allows offshore brokers to accept Pakistani clients without domestic licensing, unless the broker maintains a physical office within Pakistan’s borders.

- SECP regulates financial markets

- SBP controls currency and monetary policy

- Offshore brokers allowed without SECP license

- Licensing required only with physical presence

How to Verify a Broker's Authorization?

Pakistani traders should verify broker authorization by reviewing regulatory information on the broker’s website, usually located in the footer. This includes registration numbers and supervising authorities such as FCA, CySEC, ASIC, or FSC.

Traders may cross-check this data directly through each regulator’s official register. SECP itself does not maintain a public broker database, but direct contact with SECP can confirm domestic authorizations.

How Can I Start Forex Trading in Pakistan?

To begin trading Forex in Pakistan, traders must select a regulated broker, open an account, complete KYC verification, fund the account, and download platforms such as MetaTrader 4 or MetaTrader 5. Most brokers also provide demo accounts for strategy testing.

The most active trading hours for Pakistan occur between 1 PM and 5 PM PKT, during the London–New York trading session overlap, offering the highest liquidity and volatility conditions for efficient trade execution.

- Choose a regulated broker

- Complete registration and KYC

- Fund account using local payment methods

- Practice with a demo account

- Trade during peak liquidity sessions

Factors for Selecting the Best Forex Broker in Pakistan

Choosing the right broker in Pakistan depends on regulatory strength, fee transparency, platform technology, leverage limits, and available trading instruments. Brokers regulated by Tier-1 authorities provide the highest protection, including fund segregation and negative balance safeguards.

Traders should also assess spreads, commissions, swap rates, withdrawal costs, and conversion fees when using PKR. Account types such as ECN, STP, Islamic, Cent, and Demo play a major role in matching trading strategies and experience levels.

Negative Balance Protection in Pakistan Forex Brokers

Negative balance protection prevents a trading account from falling below zero, shielding Pakistani traders from owing funds during extreme volatility. This protection is mandatory under major regulators, including FCA, CySEC, ASIC, and IIROC.

Most reputable brokers offering services to Pakistani clients apply this protection automatically, ensuring traders cannot lose more than their deposited capital regardless of market conditions.

Client Protection Protocols in Pakistan Forex Brokers

While Pakistan itself applies a light regulatory framework, top international Forex brokers serving Pakistani clients are regulated by Tier-1 authorities such as the UK FCA, CySEC, ASIC, and IIROC, which mandate fund segregation, negative balance protection, and strict compliance controls.

Many brokers also participate in investor compensation schemes, offering additional protection in case of insolvency. These safeguards ensure Pakistani traders benefit from international best practices even when trading with offshore platforms.

- Fund segregation requirements

- Negative balance protection

- Compensation scheme participation

- Strict AML and KYC compliance

Is Forex Trading Halal or Haram?

Forex trading can be halal when conducted under Islamic finance principles, avoiding interest-based transactions and unethical practices. The primary concern is the elimination of riba, which is prohibited in Sharia law.

Many brokers provide swap-free Islamic accounts for Muslim traders in Pakistan, allowing positions to remain open overnight without interest charges, ensuring full compliance with Islamic financial rules.

Do Pakistan Forex Brokers Offer Islamic Accounts?

Most international brokers serving Pakistan provide Islamic trading accounts, also known as swap-free accounts. These accounts eliminate overnight interest and comply with Sharia law while preserving full trading functionality.

Islamic accounts are widely available across MT4 and MT5 platforms and support major, minor, and exotic currency pairs, commodities, indices, and cryptocurrencies.

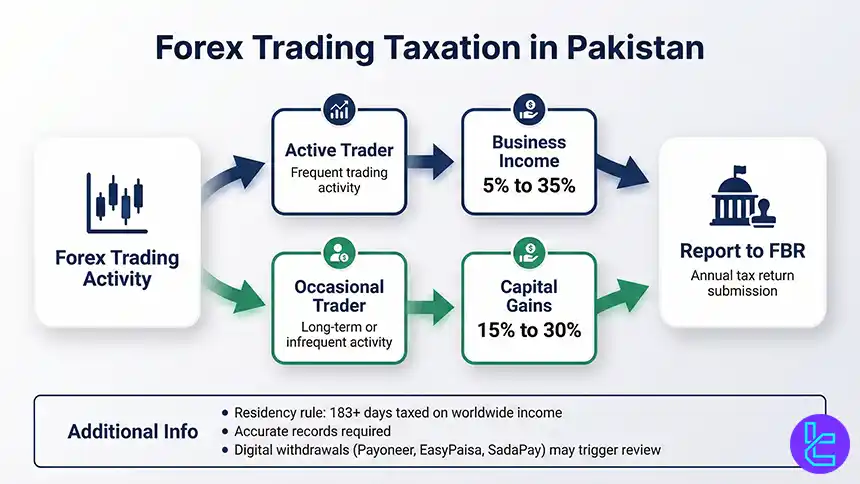

Forex Trading Taxation in Pakistan

Forex trading profits in Pakistan are fully taxable and must be reported annually to the Federal Board of Revenue (FBR).

Active traders are typically taxed as business income under progressive slabs from 5% to 35%, while occasional traders may fall under capital gains tax between 15% and 30%.

Tax liability depends on trading frequency, income level, and residency status. Pakistani residents spending 183+ days in the country are taxed on worldwide income, including Forex profits.

Withdrawals through services like Payoneer, EasyPaisa, and SadaPay can trigger compliance reviews, making accurate reporting essential.

Popular Forex and CFD Trading Platforms in Pakistan

Pakistani traders widely use MetaTrader 4, MetaTrader 5, TradingView, cTrader, and NinjaTrader. These platforms provide advanced charting, algorithmic trading, multi-timeframe analysis, and professional execution tools.

MT4 and MT5 dominate due to extensive indicator libraries and automated trading support. Trading cTrader excels in high-frequency execution, while TradingView integrates social trading and research across global markets.

Helpful Links for Forex Traders in Pakistan

Reliable regulatory and tax resources play a vital role in safe Forex trading. Pakistani traders should stay updated through official government and financial authority websites.

These resources provide licensing verification, monetary policy updates, taxation rules, and online tax payment services for Forex-related income.

- SECP Pakistan: Official regulator of Pakistan’s financial markets, securities, insurance, and corporate sector oversight

- State Bank of Pakistan: Central bank responsible for monetary policy, currency stability, banking supervision, and financial system regulation

- Federal Board of Revenue: National authority managing taxation, revenue collection, customs enforcement, and tax policy implementation

- Online Tax Portal: Government platform for electronic tax filing, payments, returns, and compliance management

Forex Trading in Pakistan vs Other Countries

Forex regulation differs widely across regions, shaping trading conditions, risk exposure, and investor protection.

Pakistan operates under the SECP with flexible leverage and variable taxation up to 35%, while the UAE, Saudi Arabia, and Lebanon apply distinct frameworks affecting leverage limits, tax treatment, and broker oversight.

Comparison Factor | Pakistan | |||

Primary Regulator | Securities and Exchange Commission of Pakistan (SECP) | Dubai Financial Services Authority (DFSA), Dubai International Financial Centre (DIFC) | Saudi Central Bank (SAMA), Capital Market Authority (CMA) | No local Forex regulator |

Regulatory Framework | National and international regulators | National framework | National regulatory framework under SAMA and CMA | International regulators |

Retail Leverage Cap Forex Majors | No fixed national cap | 1:50 | No fixed national cap | No fixed national cap |

Investor Protection Level | low | High | Medium | low |

Negative Balance Protection | Based on the broker’s license | Not mandatory; applied by many brokers | Mandatory | Based on the broker’s license |

Client Fund Segregation | Based on the broker’s license | Mandatory | Mandatory | Based on the broker’s license |

Broker Transparency Requirements | Market transparency under regulations | Transparent risk disclosures | market transparency under SAMA and CMA | market transparency under regulations |

Broker Availability | Local and international brokers | DFSA-regulated and international | Local and international brokers | Local and international brokers |

Access to International Brokers | Yes | Yes | Yes | Yes |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView | MT4, MT5, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Depends on broker policy and regulatory entity | Entity-dependent | Depends on broker policy and regulatory entity | Depends on broker policy and regulatory entity |

Tax Treatment of Forex Profits | Variable up to 35% | Tax-free | Capital gains tax of 10 percent via FIRS | Up to 25% for retail traders |

Conclusion and Final Words

With oversight from SECP and monetary governance by SBP, Pakistani traders legally access offshore brokers offering leverage up to 1:1000, minimum deposits from $15, and more than 13,000 tradable instruments.

Data from over 7,800 Trustpilot reviews shows clear performance gaps, while spread competition reaching 0.0 pips and non-trading fees ranging from $0 to $50 monthly directly impact long-term trading profitability for Pakistani market participants.

“The broker rankings and analysis presented above are produced using the TradingFinder Forex methodology, which evaluates brokers through real execution data, pricing transparency, platform performance, instrument coverage, payment infrastructure, and regulatory safeguards.”