The Forex market of the Spanish-speaking countries continues to expand within a regulated financial framework governed by CNMV, CBR, CNBV, and BCRA.

The table below shows the best available Forex and CFD brokers that traders residing in Peru, Spain, Ecuador, Argentina, and many more can use.

| MultiBank Group | |||

| Fusion Markets | |||

| Global Prime | |||

| 4 |  | FXCM | ||

| 5 |  | LiteForex | ||

| 6 |  | eToro | ||

| 7 |  | Darwinex | ||

| 8 |  | FxGrow | ||

| 9 |  | Moneta Markets | ||

| 10 |  | Libertex |

Trustpilot Ratings of Forex Brokers in the Spanish-speaking area

Knowing the trust score of each broker and other traders’ opinions about them is an essential part of evaluating the best forex broker in the Spanish-speaking area.

Broker | Trustpilot Rating | Number of Reviews |

4.8/5⭐️ | +5500 | |

Global Prime | 4.7/5⭐️ | +300 |

FXCM | 4.6/5⭐️ | +800 |

4.6/5⭐️ | +1500 | |

Moneta Markets | 4.4/5⭐️ | +400 |

eToro | 4.2/5⭐️ | +29000 |

Darwinex | 4.2/5⭐️ | +100 |

3.9/5⭐️ | +3500 | |

LiteForex | 3.7/5⭐️ | +300 |

FxGrow | 3.4/5⭐️ | +4 |

Minimum Spreads of Forex Brokers in the Spanish-speaking area

The main trading cost that traders pay in the Spanish-speaking area is spreads. Here is the minimum spread amount in the best Forex broker in the Spanish-speaking area.

Brokers | Minimum Spreads |

Saxo Bank | From 0.0 Pips |

From 0.0 Pips | |

Fusion Markets | From 0.0 Pips |

From 0.0 Pips | |

XM Group | From 0.0 Pips |

IC Markets | From 0.0 Pips |

XTB | From 0.1 Pips |

Interactive Brokers | From 0.1 Pips |

AvaTrade | From 0.6 Pips |

IG Markets | From 0.6 Pips |

Non-Trading Fees in Forex Brokers of the Spanish-Speaking Area

Non-trading fees, including deposit, withdrawal, and inactivity fees add up to the overall costs of trading with a well-known broker in the Spanish-speaking area. The table below contains information about the non-trading fees of the best Forex brokers in the Spanish-speaking area.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

Degiro | $0 | $0 | No |

$0 | $0 | No | |

IC Trading | $0 | $0 | No |

Ingot | $0 | $0 | No |

Darwinex | Varies | $0 | No |

Lightyear | Varies | $0 | No |

FP Markets | $0 | Varies | No |

AvaTrade | $0 | $0 | $10 |

XM Group | $0 | Varies | $10 |

$0 | Varies | $50 |

Number of Tradable Instruments in Forex Brokers of the Spanish-Speaking Area

Here are the number of tradable assets in the best Forex brokers of the Spanish-speaking area.

Broker | Number of Tradable Assets |

MultiBank Group | +20000 |

CMC Markets | +12000 |

XTB | +10000 |

+7000 | |

Forex.com | +5500 |

Plus500 | +2800 |

Eightcap | +800 |

+600 | |

Swissquote | +400 |

+150 |

Top 8 Forex Brokers in the Spanish-speaking area

Spanish-speaking areas’ Forex market is served by internationally established brokers offering leverage up to 1:30, minimum deposits starting from $10, and access to over 2,000 tradable instruments.

These assets span across Forex, CFD contracts, commodities, stocks, indices, and cryptocurrencies under multi-jurisdiction regulatory frameworks.

FxGrow

FxGrow operates as a multi-regulated Forex and CFD brokerage established in 2008, offering access to global markets including Forex, indices, commodities, metals, energies, futures CFDs, and cryptocurrencies.

The broker holds primary authorization from CySEC (License 214/13) and maintains regulatory recognition across multiple European authorities such as CNMV, BaFin, ACPR, MNB, and FINANSTILSYNET, providing a structured compliance environment for international traders.

All these regulatory bodies require traders to complete the FxGrow verification process to comply with AML and KYC laws.

Trading is conducted through the MetaTrader 5 platform, with execution based on market pricing and ECN-styled account structures including ECN, ECN Plus, and ECN Elite.

Entry requirements remain accessible, with minimum deposits from $100 and base currencies in USD, EUR, and PLN.

Spreads vary by account type, reaching as low as 0.00001 pips on ECN-VIP configurations, while commission is applied at $8 per FX round-turn.

New users begin through the FxGrow registration process, followed by mandatory KYC procedure requiring proof of identity and residence.

Once onboarded, account management and funding activities are handled through the FxGrow dashboard, where traders monitor execution, margin levels, swaps, and portfolio exposure.

FxGrow also integrates copy trading, supports Islamic accounts, and provides multi-channel customer support, positioning itself as a structured brokerage solution for diversified retail participation.

Account Types | ECN, ECN Plus, ECN Elite, Demo |

Regulating Authorities | CySEC, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Deposit | $100 |

Deposit Methods | Bank Wire, Skrill, Neteller |

Withdrawal Methods | Bank Wire, Skrill, Neteller |

Maximum Leverage | 1:300 |

Trading Platforms & Apps | MetaTrader 5 (Desktop, Web, Mobile) |

FxGrow Pros and Cons

Here are the advantages and disadvantages of trading with the FxGrow broker.

Pros | Cons |

Regulated by CySEC and supervised by multiple EU authorities (CNMV, BaFin, ACPR, MNB, FI, HCMC) | No proprietary trading platform, only MetaTrader 5 |

Wide range of markets: Forex, indices, commodities, metals, energies, futures CFDs, crypto | Limited base currencies (only USD, EUR, PLN) |

ECN-based account structure with competitive execution | No RAW or zero-spread account options |

Spreads starting from 0.00001 pips on ECN Elite | Mixed user reviews on Trustpilot with limited sample size |

LiteForex

LiteForex operates as a CySEC-regulated Forex and CFD brokerage established in 2008 and headquartered in Limassol, Cyprus.

The company holds license number 093/08 and participates in the Investor Compensation Fund, while its global entity, LiteFinance broker extends services internationally under FSC supervision in Mauritius.

Trading access covers Forex, indices, commodities, and selected stock CFDs, with execution conducted on MetaTrader 4, MetaTrader 5, and the LiteForex proprietary mobile application.

Account structures include Classic, ECN, and Demo, supported by base currencies USD, EUR, GBP, and PLN. Entry requirements remain accessible, with a minimum deposit of $50 and minimum trade size of 0.01 lots. The ECN account features variable spreads from zero with commission from $5 per lot, while the Classic account applies floating spreads from two points with no commission.

Maximum leverage for EU clients is capped at 1:30 under CySEC regulatory conditions.

LiteForex integrates copy trading as an investment option and provides a multi-channel support framework operating 24/5.

Account Types | Classic, ECN, Demo |

Regulating Authorities | CySEC (Europe), FSC (Mauritius via LiteFinance) |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, Skrill, Neteller |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, Skrill, Neteller |

Maximum Leverage | 1:30 (EU Clients) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, LiteForex Mobile App |

Pros and Cons of LiteForex

The following table contains the benefits and drawbacks of choosing LiteForex as your broker.

Pros | Cons |

Low minimum deposit of $50 | Monthly inactivity fee of €3 |

Multiple platforms: MT4, MT5, proprietary mobile app | No PAMM account service |

ECN account with variable spreads from zero | Mixed user reviews (2.9/5 on ForexPeaceArmy) |

Copy trading available | Maximum leverage capped at 1:30 for EU clients |

Darwinex

Darwinex operates as a hybrid brokerage and asset-management platform established in 2012, providing regulated market access across Forex, CFDs, futures, stocks, indices, ETFs, options, and cryptocurrencies.

The company functions under multi-jurisdiction supervision from the FCA, Spain’s CNMV, and FSA, offering investor protection schemes of up to £85,000 in the UK and €100,000 in Spain depending on the regulatory entity.

A defining feature of Darwinex is its proprietary DARWIN framework, which converts trading strategies into investable assets, enabling traders to attract third-party capital and earn performance-based fees.

Investment services are further expanded through DarwinIA and Darwin Zero programs, while platform integration with Interactive Brokers (IBKR) grants access to global exchanges, including CME, CBOE, EUREX, and ICE.

Account structures include Live, Professional, Darwin IBKR, and Classic IBKR, supported by platforms such as MetaTrader 4, MetaTrader 5, TradingView, NinjaTrader, TWS, MultiCharts, and DARWIN API.

All traders must do to access these extensive account types is complete the Darwinex registration. Entry requirements start from a $500 minimum deposit, with leverage reaching up to 1:200 under specific account conditions.

Although Darwinex does not provide Islamic or PAMM accounts and applies geographic restrictions, its regulatory depth, advanced investment architecture, and diversified asset offering position it as a distinct participant within the institutional-grade trading ecosystem.

This brokerage requires all traders to complete the Darwinex verification process to comply with AML laws. Top of FormBottom of Form

Account Types | Live, Professional, Darwin IBKR, Classic IBKR |

Regulating Authorities | FCA (UK), CNMV (Spanish-speaking area), FSA (Seychelles) |

Minimum Deposit | $500 |

Deposit Methods | Credit/Debit Cards, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer |

Maximum Leverage | 1:200 |

Trading Platforms & Apps | MT4, MT5, WebTrader, TradingView, NinjaTrader, TWS, MultiCharts, DARWIN API, ZORRO IB Bridge, IB Gateway |

Darwinex Pros and Cons

Traders must consider the following pros and cons before joining the Darwinex broker.

Pros | Cons |

Strong multi-regulation (FCA, CNMV, FSA) with investor compensation schemes | High minimum deposit requirement ($500) |

Unique DARWIN investment system converting strategies into investable assets | No Islamic (swap-free) accounts |

Integration with Interactive Brokers (IBKR) for global market access | No PAMM account offering |

Wide range of professional platforms and APIs | - |

Moneta Markets

Moneta Markets is a multi-asset Forex and CFD broker established in 2020 and headquartered in Johannesburg, operating under FSCA regulation in South Africa and registration with the Saint Lucia financial registry.

The broker provides access to more than 1,000 tradable instruments across Forex, stocks, indices, commodities, bonds, ETFs, and cryptocurrencies, supported by STP and ECN execution models.

Account offerings include Direct, Prime, and Ultra, with entry requirements starting from a $50 minimum deposit and leverage available up to 1:1000.

Client onboarding begins with the Moneta Markets registration process, which grants access to multiple trading environments including MetaTrader 4, MetaTrader 5, Pro Trader, and App Trader.

Following onboarding, users complete Moneta Markets verification by submitting identity and address documentation through the Moneta Markets dashboard, where funding, withdrawals, account configuration, and risk management tools are centrally managed.

Moneta Markets integrates copy trading and PAMM account investment services while supporting Islamic accounts and demo trading.

Account Types | Direct, Prime, Ultra |

Regulating Authorities | FSCA (South Africa), FSRA |

Minimum Deposit | $50 |

Deposit Methods | Bank Wire Transfer, Visa/MasterCard, FasaPay, SticPay, JCB, Cryptocurrency (USDT, BTC, ETH, USDC) |

Withdrawal Methods | Bank Wire Transfer, Visa/MasterCard, FasaPay, SticPay, JCB, Cryptocurrency |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Pro Trader, App Trader |

Moneta Markets Pros and Cons

Before creating an account with the Moneta Markets broker, consider the following advantages and disadvantages.

Pros | Cons |

Wide selection of over 1,000 tradable instruments | Not regulated by top-tier authorities such as FCA, ASIC, or CySEC |

Low minimum deposit requirement ($50) | Relatively young brand with limited long-term track record |

Multiple trading platforms: MT4, MT5, Pro Trader, App Trader | - |

Competitive spreads from 0.0 pips on ECN accounts | - |

Global Prime

Global Prime is a multi-asset Forex and CFD brokerage founded in 2010 in Australia, operating under regulatory oversight from the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

The broker provides market access to more than 150 tradable instruments across Forex, Indices, Commodities, Crypto CFDs, Bonds, and US Share CFDs.

Trading infrastructure is built primarily around the MetaTrader 4 (MT4) platform, supporting Expert Advisors, VPS hosting, algorithmic trading, and market execution with raw spreads from 0.0 pips on Raw accounts and standard pricing from 0.9 pips on Standard accounts.

Client onboarding begins with the Global Prime registration workflow, followed by structured Global Prime verification through digital KYC procedures covering identity validation, residency confirmation, and regulatory compliance.

Account configuration, leverage selection up to 1:500, margin controls, funding operations, and withdrawal management are centralized within the client portal.

From a custody and risk framework perspective, Global Prime maintains segregated client funds with HSBC and National Australia Bank, applies margin call and stop-out policies, and enforces negative balance protection under ASIC conditions.

The brokerage ecosystem further integrates Autochartist trading signals, ZuluTrade social trading connectivity, GP Hub payment processing, and multi-currency account support across USD, AUD, EUR, GBP, CAD, SGD, and JPY.

Traders who want to use this broker can benefit from the TradingFinder IB Global Prime rebate program and earn spread and commission cashbacks up to 44.44%.

Account Types | Standard, Raw |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu) |

Minimum Deposit | No minimum deposit |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, Apple Pay, Interac, BPay, POLi, Jeton, and regional gateways |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire, Jeton, Interac, local bank transfers |

Maximum Leverage | 1:500 (1:30 for ASIC retail clients without Pro status) |

Trading Platforms & Apps | MetaTrader 4 (MT4), WebTrader, MT4 Mobile (iOS & Android) |

Pros and Cons of Global Prime

Traders must consider the pros and cons of trading with Global Prime before creating a new Forex trading account with this broker.

Pros | Cons |

Strong regulation under ASIC with additional VFSC oversight | Only MetaTrader 4 is currently available as the main trading platform |

Raw spreads from 0.0 pips with a transparent commission model | No Islamic (swap-free) account option |

No minimum deposit requirement | Limited number of tradable instruments compared with large multi-asset brokers |

Segregated client funds held with HSBC and National Australia Bank | - |

Fusion Markets

Fusion Markets is a multi-jurisdiction Forex and CFD brokerage founded by Phil Horner, operating under regulatory supervision from the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

The broker delivers access to more than 250 tradable instruments across Forex, Indices, Share CFDs, Commodities, Metals, Energy, and Cryptocurrencies, supported by market execution on MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Account structures include Zero, Classic, and Swap-Free, with spreads starting from 0.0 pips and commission from $4.5 per lot, while the minimum deposit remains $0 and leverage reaches up to 1:500 under applicable regulatory conditions.

Client onboarding begins with the registration process, after which users proceed through Fusion Markets verification via a structured KYC framework that validates identity and residency documentation.

Account management, funding operations, platform configuration, VPS access, copy trading integration, and risk controls are centralized inside the Fusion Markets dashboard, where traders manage leverage, margin levels, and execution preferences.

From a custody and compliance standpoint, Fusion Markets maintains segregated client funds with HSBC and National Australia Bank, supports MAM and PAMM investment models, integrates DupliTrade copy trading systems, and enforces margin call and stop-out mechanisms.

This institutional-grade trading architecture positions Fusion Markets within the professional retail brokerage segment defined by regulatory oversight, execution transparency, and multi-asset market infrastructure.

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC (Australia), VFSC (Vanuatu) |

Minimum Deposit | $0 |

Deposit Methods | Bank Wire, Visa, MasterCard, PayPal, PayID, Crypto, Skrill, Neteller, Perfect Money, BinancePay, Interac, FasaPay, UPI, Pix |

Withdrawal Methods | Bank Wire, PayPal, Crypto, Skrill, Neteller, Interac, Jetonbank, DragonPay |

Maximum Leverage | 1:500 (1:30 for ASIC retail clients) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Fusion Markets Pros and Cons

Check the table below to see what are the pros and cons of trading with the Fusion Markets broker.

Pros | Cons |

Ultra-low trading costs with spreads from 0.0 pips | No investor compensation fund |

No minimum deposit requirement | Limited educational resources |

Wide platform support: MT4, MT5, cTrader, TradingView | Relatively new broker (launched in 2019) |

Regulated by ASIC and VFSC | - |

MultiBank Group

Founded in 2005, MultiBank Group operates as a global multi-asset brokerage headquartered in Dubai, delivering trading services across Forex, Share CFDs, Indices, Commodities, Metals, Futures, and Cryptocurrencies.

The firm functions under a broad regulatory framework that includes ASIC, CySEC, MAS, SCA, BaFin, CIMA, FMA, and AUSTRAC providing segregated client funds, negative balance protection, and insurance coverage of up to $1,000,000 per account in select jurisdictions.

Client onboarding begins with MultiBank registration, after which all account management, funding operations, and platform controls are handled inside the MultiBank dashboard.

Trading infrastructure supports MetaTrader 4, MetaTrader 5, and the proprietary MultiBank-Plus platform, enabling access to over 20,000 tradable instruments.

Expert Advisors, FIX API connectivity, VPS hosting, and copy trading via PAMM and MAM structures are all available after completing the MultiBank verification.

Account models include Standard, Pro, and ECN, with spreads from 0.0 pips, zero commission, leverage up to 1:500, and minimum deposits from $50.

While educational research remains limited and geographic restrictions apply in regions such as the USA and UK, MultiBank’s regulatory depth, asset diversity, and execution framework place it firmly within the institutional retail brokerage segment.

Account Types | Standard, Pro, ECN |

Regulating Authorities | ASIC, CySEC, MAS, SCA, BaFin, CIMA, FMA, AUSTRAC |

Minimum Deposit | $50 |

Deposit Methods | Bank Wire, Visa, MasterCard, Skrill, Neteller, Perfect Money, UnionPay, USDT, Bitcoin |

Withdrawal Methods | Bank Wire, Visa, MasterCard, Skrill, Neteller, Perfect Money, UnionPay, USDT, Bitcoin |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, MultiBank-Plus Platform |

MultiBank Group Pros and Cons

The following table helps traders decide whether MultiBank Group pros outweigh its cons.

Pros | Cons |

Strong global regulation across ASIC, CySEC, MAS, SCA, BaFin, CIMA, FMA, and AUSTRAC | Limited educational and research resources |

Insurance coverage up to $1,000,000 per account (select entities) | No fixed spread account option |

Very broad asset offering with 20,000+ instruments | - |

Supports MT4, MT5, and proprietary MultiBank-Plus platform | - |

FXCM

Founded in 1999, FXCM (Forex Capital Markets) operates as a globally recognized multi-asset Forex and CFD broker regulated by FCA, ASIC, CySEC, FSCA, and ISA.

The brokerage provides market access across Forex, Indices, Commodities, Cryptocurrencies, and Share CFDs, supporting execution on MetaTrader 4, TradingView, and TradeStation.

Account structures include CFD, Active Trader, and Corporate accounts, with spreads from 0.2 pips, no commission on CFDs, minimum deposit of $50, and leverage up to 1:1000 under applicable regulatory entities.

Client onboarding begins with FXCM registration, followed by full KYC compliance, where identity and residency documentation are submitted digitally before trading access is granted.

Account configuration, funding, withdrawal processing, margin controls, and risk management tools are administered through the MyFXCM client portal.

FXCM further integrates algorithmic trading, Capitalize AI, ZuluTrade copy trading, VPS hosting, and volume-based incentives such as the FXCM rebate program for high-activity traders.

From a safety perspective, FXCM enforces segregated client funds, negative balance protection, and investor compensation coverage up to £85,000 under FSCS eligibility.

Account Types | CFD, Active Trader, Corporate |

Regulating Authorities | FCA, ASIC, CySEC, FSCA, ISA |

Minimum Deposit | $50 |

Deposit Methods | Bank Wire, Visa, MasterCard, Skrill, Neteller, Google Pay |

Withdrawal Methods | Bank Wire, Visa, MasterCard, Skrill, Neteller |

Maximum Leverage | Up to 1:1000 (varies by regulatory entity) |

Trading Platforms & Apps | MetaTrader 4, TradingView, TradeStation |

Pros and Cons of FXCM

Here are the benefits and drawbacks of trading with FXCM.

Pros | Cons |

Regulated by multiple top-tier authorities (FCA, ASIC, CySEC, FSCA, ISA) | History of regulatory penalties and past bankruptcy (2017) |

Over 20 years of industry presence | $50 annual inactivity fee |

Strong platform ecosystem: MT4, TradingView, TradeStation | $40 bank wire withdrawal fee |

No commission on CFDs with spreads from 0.2 pips | Restricted in several major jurisdictions including the USA |

Is Forex Trading Legal in Spanish-speaking Areas?

Forex trading in the Spanish-speaking area is fully permitted. Forex brokers in Spain operate under the supervision of the Comisión Nacional del Mercado de Valores (CNMV), the country’s primary financial regulator.

Spanish regulatory standards align with the European Union’s MiFID II framework, which establishes requirements for broker authorization, transparent pricing, client fund segregation, leverage limitations, and comprehensive investor protection mechanisms.

Spanish and EU regulations strictly prohibit the marketing and distribution of binary options, and since 2023, the CNMV has imposed additional restrictions on CFD advertising, including bans on celebrity endorsements and event sponsorships.

Various other Financial Authorities regulate the Forex brokers in countries like Mexico, Argentina, Uruguay, and El Salvador.

Which Financial Authority Regulates Forex Brokers in the Spanish-speaking area?

The Spanish-speaking areas’ Forex market operates within Multiple Financial jurisdictions.

Primary oversight is exercised by the Comisión Nacional del Mercado de Valores (CNMV), a tier-1 financial authority based on TF scores.

CNMV is the national authority responsible for supervising securities markets, investment firms, and foreign exchange activity under the legal framework of Securities Market Law 24/1988.

The CNMV functions as an independent public institution under the supervision of the Ministry of Economy and Finance, with governance conducted by a formal board structure that includes executive and advisory committees.

The CNMV is chaired by Carlos San Basilio, with Paloma Marín Bona serving as Vice Chair. The regulator plays an active enforcement role, issuing public warnings against unauthorized platforms and processing investor complaints.

In 2024, the CNMV recorded 1,034 consumer claims, released 1,247 investor alerts, and imposed approximately €12.3 million in financial penalties on non-compliant firms.

At the European level, the Spanish financial system operates within the regulatory scope of the European Securities and Markets Authority (ESMA), established in 2011.

In other Spanish-speaking countries, these are the main financial regulators.

- Comisión Nacional Bancaria y de Valores en México

- Central Bank of Argentina

- Financial Supervisory Authority of Bolivia

- Financial Market Commission of Chile

- Central Bank of Uruguay

- Central Reserve Bank of El Salvador

How to Verify Forex Brokers' Regulation in the Spanish-speaking Countries

Verifying a broker’s regulatory status in the Spanish-speaking area is a critical step in protecting capital and ensuring legal compliance within the Spanish Forex market.

The primary authority responsible for oversight is the Comisión Nacional del Mercado de Valores (CNMV), which maintains a public registry of authorized investment firms and financial institutions.

To confirm a broker’s authorization, Spanish traders should access the official CNMV website and check the CNMV Company Register, where regulated entities are listed with detailed records.

Searches can be conducted using the broker’s legal name or any part of its registered business identity, allowing traders to quickly identify whether a firm operates under CNMV supervision.

If the broker originates from another European Union member state, verification should continue through the European Securities and Markets Authority (ESMA) database, which catalogs MiFID II–II-compliant investment firms.

This database displays licensing jurisdiction, passporting status, and regulatory history. The CNMV further supports investor protection by issuing ongoing public warnings and maintaining blacklists of unauthorized entities.

Finding broker regulations in other authorities follows the same principles and steps.

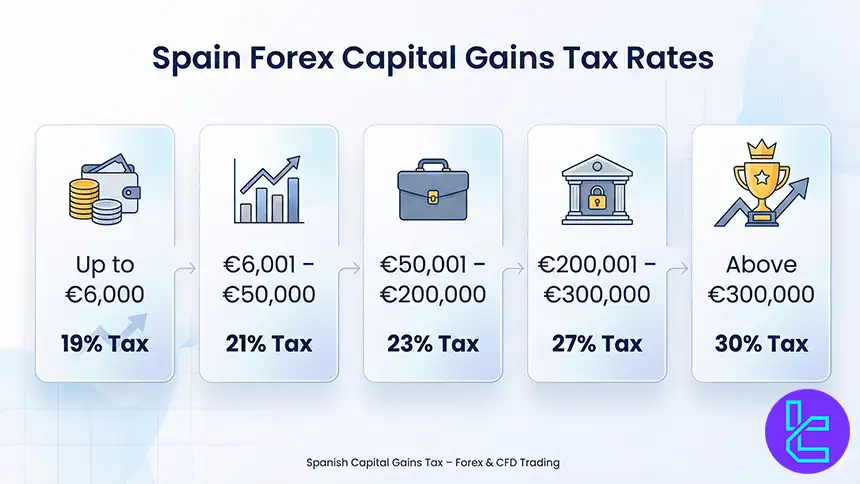

Do I Pay Taxes on My Forex Gains in a Spanish-speaking Country?

Profits from Forex and CFD trading in Spain are classified as Savings Income (capital gains) and taxed under the national IRPF (Personal Income Tax) framework.

There is no general tax-free threshold, and all profits must be reported annually.

Spanish legislation applies a progressive capital gains tax system, while also allowing traders to carry forward net losses to offset future taxable gains.

All capital gains and losses are declared via Modelo 100, and foreign assets exceeding €50,000 must be disclosed using Modelo 720 by March 31 of each financial year.

Annual Capital Gains | Applicable Tax Rate |

Up to €6,000 | 19% |

€6,001 – €50,000 | 21% |

€50,001 – €200,000 | 23% |

€200,001 – €300,000 | 27% |

Above €300,000 | 30% |

The Spanish tax year follows the calendar year, with the main Modelo 100 filing period taking place in the spring and early summer of the following year.

Here are the tax rules in other Spanish-speaking countries.

- Argentina: Argentina applies a special foreign-currency levy known as Impuesto PAIS on selected cross-border transactions such as imports, foreign services, and online purchases. Although the rate was partially reduced in late 2024 and potential elimination has been discussed, the Forex trading profits of residents remain subject to standard income tax obligations.

- Colombia: In Colombia, Forex profits are classified as personal income and taxed under progressive income tax rates ranging from 0% to 39%. In addition, bank movements related to trading activity are affected by the GMF financial transactions tax (0.4%), while non-residents are taxed only on Colombian-source income.

- Chile: Chile applies a 10% withholding tax on recurring foreign exchange gains, which may be credited against the annual global complementary tax. Non-resident capital gains are generally taxed at 35%, reinforcing Chile’s dual tax structure for domestic and foreign participants.

- Peru: In Peru, capital gains from qualifying securities, including certain foreign exchange instruments, are subject to a final flat tax of 6.25% for residents, while non-domiciled entities face withholding tax on Peruvian-source income. Financial movements are further impacted by the ITF financial transactions tax (0.005%) on bank debits and credits.

Do Forex Brokers in Spanish-speaking Areas Provide Negative Balance Protection?

Under CNMV regulations, Spanish Forex and CFD brokers are required to provide mandatory negative balance protection for retail clients. This safeguard ensures that account losses cannot exceed the trader’s deposited funds, eliminating any obligation to repay the broker.

The protection applies primarily to leveraged products, including CFDs, while professional accounts may fall outside this coverage.

To enforce this framework, CNMV-licensed brokers implement margin call procedures when account equity falls below 50%, followed by automatic position liquidation if losses continue.

These mechanisms, combined with maintenance margin rules, systematically limit downside exposure and prevent deficit balances, reinforcing investor protection within the Spanish-speaking area’s regulated trading environment. Offering newgative balace protection is also a key requirement in other jurisdictions.

What is the Maximum Trading Leverage in the Spanish-speaking Area?

The effective leverage accessible to a Forex trader is determined by broker regulation and regulatory jurisdiction, rather than linguistic or regional preferences. Regulatory frameworks impose different leverage thresholds based on the trader’s legal classification and the supervisory authority governing the brokerage.

Under EU and ESMA regulations, retail traders in Spain are subject to a strict leverage ceiling of 1:30 on major currency pairs. Traders who qualify for professional account status in Spain may obtain substantially higher leverage, typically reaching 1:500, subject to broker eligibility criteria and account classification.

Additionally, traders operating through international offshore brokers, regulated outside restrictive regimes such as the EU or the United States, may access significantly expanded leverage levels, commonly ranging from 1:500 to 1:1000, and in some cases extending to 1:2000 or 1:3000, depending on the broker’s regulatory framework and internal risk policies.

What are the Best Forex Trading Platforms in the Spanish-speaking area?

Spanish-speaking traders operate within a technologically diverse trading environment that supports multi-asset execution across Forex, CFDs, indices, commodities, equities, and cryptocurrencies.

MetaTrader 4 (MT4)

Introduced in 2005, MetaTrader 4 remains a core trading environment for Forex and CFD execution. It supports algorithmic trading through Expert Advisors (EAs), custom indicators, multi-timeframe analysis, and automated strategy testing.

MT4 is accessible on Windows, macOS, Android, and iOS, making it a standard interface for both discretionary and systematic traders.

MetaTrader 5 (MT5)

Released in 2010, MetaTrader 5 expands upon MT4 by enabling native access to a broader range of asset classes beyond Forex, including equities and futures.

It features an advanced economic calendar, enhanced strategy tester, depth of market (DOM), and improved order management architecture.

TradingView

Founded in 2011, TradingView functions as both a professional charting engine and a financial social network. It offers cloud-based access to advanced technical indicators, custom scripting via Pine Script, multi-asset screening, and collaborative analysis across global markets.

cTrader

Launched in 2010, cTrader provides a highly customizable trading interface with institutional-grade execution, Level II pricing, detachable charts, and algorithmic development via cAlgo. It is widely adopted for ECN-style trading environments.

NinjaTrader

NinjaTrader specializes in futures, Forex, and options trading, offering advanced order flow tools, market depth visualization, strategy automation, and high-performance analytics.

Its modular architecture and professional execution engine make it a preferred platform for advanced and quantitative traders.

Forex Trading in Spanish-speaking Areas Compared to Other Countries

The table below provides a comparison of the trading conditions and regulatory perspective of Forex trading in the Spanish-speaking area and 3 other countries.

Comparison Factor | Spanish-speaking area | |||

Primary Regulator | CNMV, CBR, BCU, BCRA | Autorité des marchés financiers (AMF) | Federal Financial Supervisory Authority (BaFin) | Financial Conduct Authority (FCA) |

Regulatory Framework | Varies Based on the Country | EU-wide MiFID II and ESMA compliance | EU-wide MiFID II and ESMA compliance | National FCA framework post-Brexit |

Retail Leverage Cap Forex Majors | 1:500 | 1:30 | 1:30 | 1:30 |

Investor Protection Level | High | Very high | Very high | Very high |

Negative Balance Protection | Mandatory | Mandatory | Mandatory | Mandatory |

Client Fund Segregation | Mandatory | Mandatory | Mandatory | Mandatory |

Broker Transparency Requirements | Varies Based on the Country | Strict EU disclosure rules | Strict EU disclosure rules | Very strict conduct and disclosure standards |

Broker Availability | Regional and international brokers | Broad EU access via passporting | Broad EU access via passporting | FCA licensed local and international brokers |

Access to International Brokers | Yes | High via EU passporting | High via EU passporting | High global broker access |

Typical Trading Platforms | MT4, MT5, cTrader, TradingView, NinjaTrader | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView | MT4, MT5, cTrader, TradingView |

Maximum Loss Protection | Cannot lose more than the deposit | Cannot lose more than deposit | Cannot lose more than deposit | Cannot lose more than deposit |

Tax Treatment of Forex Profits | Varies based on the country | Flat tax plus progressive option | Capital gains tax with limited offsets | Capital gains tax or income tax depending on activity |

Conclusion

Based on TradingFinder's review of the best Forex brokers in the Spanish-speaking area, we can conclude that FXCM, LiteForex, Moneta Markets, Global Prime, and Darwinex are the best available options.

Now traders must compare spreads, commissions, account types, deposit and withdrawal methods, leverage, and other important factors to choose the best option.

“Each broker has been thoroughly examined based on the Forex methodology of TradingFinder experts. Various factors, including regulation, trading fees, leverage, security, customer support, etc. have been considered when conducting the research to create this article.”