Forex brokers registered by the Financial Services Authority in Saint Vincent and the Grenadines can provide Forex trading services globally but aren’t regulated by this authority.

SVG FSA only licensed Forex brokers and doesn’t require compensation schemes, negative balance protection or funds segregation. Here are the best brokers licensed by this authority.

| HFM | |||

| OX Securities | |||

| EBC Financial Group | |||

| 4 |  | Markets.com | ||

| 5 |  | Anzo Capital | ||

| 6 |  | Switch Markets | ||

| 7 |  | Esperio | ||

| 8 |  | HYCM | ||

| 9 |  | Go markets | ||

| 10 |  | NPBFX |

Trustpilot Ratings of SVG FSA-Regulated Forex Brokers

Traders can check the table below to see how reliable are the Forex brokers licensed and registered with the Saint Vincent and the Grenadines Financial Services Authority.

Broker | Trustpilot Rating | Number of Reviews |

Switch Markets | 4.7/5 ⭐ | 800+ |

4.6/5 ⭐ | 3000+ | |

OX Securities | 4.5/5 ⭐ | 700+ |

Go markets | 4.5/5 ⭐ | 600+ |

3.8/5 ⭐ | 100+ | |

3.7/5 ⭐ | 50+ | |

Markets.com | 3.7/5 ⭐ | 1000+ |

Anzo Capital | 2.7/5 ⭐ | 100+ |

HYCM | 1.5/5 ⭐ | 100+ |

Esperio | 2.0/5 ⭐ | 90+ |

Minimum Spreads of Forex Brokers Licensed by SVG FSA

Here are the minimum spreads traders must pay to trade Forex in the top SVG FSA regulated brokers. This is the main cost of trading with a Forex broker on Standard, Zero, or ECN accounts.

Brokers | Minimum Spreads |

HFM | 0.0 Pips |

0.0 Pips | |

Esperio | 0.0 Pips |

EBC Financial Group | 0.0 Pips |

ForexMart | 0.0 Pips |

AzaForex | 0.00001 Pips |

FXGlory | 0.1 Pips |

LHFX | 0.1 Pips |

PaxForex | 0.4 Pips |

AAFX | 0.6 Pips |

Non-Trading Fees in Forex Brokers Regulated by FSA in Saint Vincent and the Grenadines

Beside spreads and commissions, traders must consider deposit, withdrawal, and inactivity fees when choosing a Forex broker regulated by FSA in Saint Vincent and the Grenadines.

Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

$0 | $0 | $0 | |

NPBFX | $0 | $0 | $0 |

EBC Financial Group | $0 | $0 | $0 |

OX Securities | $0 | $0 | $0 |

Tiomarkets | $0 | $0 For withdrawals over $20 | $0 |

Grand Capital | $0 | 0 to 5% | $0 |

HYCM | $0 | $0 | $10 |

$0 | $0 | $10 | |

Axi | $0 | $0 For withdrawals over $50 | $10 |

$0 | $0 For withdrawals over $100 | $15 |

Number of Tradable Instruments in Forex Brokers Regulated by SVG FSA

The table below compares the number of tradable assets in the top SVG-FSA regulated Forex brokers. Having access to a wide range of tradable instruments is key when choosing a broker so traders can diversify their portfolio.

Broker | Number of Tradable Assets |

2000+ | |

1250+ | |

HFM | 500+ |

Tiomarkets | 300+ |

250+ | |

LHFX | 180+ |

NPBFX | 178+ |

ForexMart | 150+ |

AzaForex | 130+ |

PaxForex | 120+ |

Top 8 Forex Brokers Regulated by FSA in Saint Vincent and the Grenadines

The SVG FSA (St. Vincent and the Grenadines Financial Services Authority) is a prominent regulatory body that oversees financial activities within the region of St. Vincent and the Grenadines.

SVG FSA offers a regulatory framework for Forex brokers, financial institutions, and other businesses operating within the jurisdiction. Here are overview of the best available brokers registered in Saint Vincent and the Grendadines.

HFM

HFM (Hot Forex Markets) is a reputable Forex broker serving global traders since 2010. It offers commission-free trading on various account types, with spreads starting from 0.0 pips (excluding the Zero account).

Its multi-regulated status, with licenses from CySEC, FCA, and other authorities, ensures traders benefit from a secure environment. These entities require traders to complete the HFM verification to comply with AML and KYC laws.

This broker supports over 2.5 million live accounts, providing a wide array of tools including Autochartist, SMS market alerts, and more. The broker also accepts crypto payments and offers PAMM and HFM copy trading services for diverse investment strategies.

HFM offers a variety of accounts such as Cent, Zero, Pro, and Premium, with leverage options up to 1:2000 and minimum deposits starting at $0. Traders have access to Forex, metals, commodities, indices, stocks, and crypto markets.

The broker’s trading platforms include MT4, MT5, and a mobile app, all available to download in the HFM dashboard. This broker supports a wide range of payment options, including wire transfer, e-payments, credit/debit cards, cryptocurrencies (such as BTC, ETH, USDT, and more).

HF Markets also has a 4.6 Trustpilot rating based on over 3000 reviews with shows this broker’s commitment to providing top-tier services to traders worldwide.

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, FCA, DFSA, FSCA, SVG FSA |

Minimum Deposit | From $0.00 |

Deposit Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Withdrawal Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

HFM Group Pros and Cons

Check the benefits and drawbacks of choosing HFM as your Forex broker in the table below.

Pros | Cons |

Multi-regulated (CySEC, FCA, DFSA, etc.) | Lack of variety in trading platforms |

Wide range of trading instruments | - |

Spreads (from 0.0 pips) | - |

Crypto payment support | - |

Esperio

Esperio is a Forex broker that offers multiple account types such as Standard, Cent, Invest, MT5 ECN, and Demo.

The broker is regulated under the (FSA) of Saint Vincent and the Grenadines, although it operates with a relatively low tier of regulation.

They provide high leverage options of up to 1:1000, with no minimum deposit requirements. Esperio offers various funding and withdrawal methods, including credit cards, bank transfers, and cryptocurrencies like Bitcoin and USDT.

The trading platforms available include MetaTrader 4 and MetaTrader 5, and clients have access to over 3,000 tradable assets, including Forex, commodities, stocks, ETFs, and cryptocurrencies.

Traders have access to all these assets after completing the Esperio registration. Additionally, the broker offers Esperio copy trading services and a range of bonuses for clients, such as Extra Empower and Double Empower.

Despite the advantages like high leverage and various account types, Esperio lacks high-tier regulation and offers limited transparency about the company's history and leadership.

Reviews on platforms like Trustpilot and ScamAdviser are mixed, with an overall rating of 3.7/5 on Trustpilot and 46/100 on ScamAdviser.

The broker also offers a variety of educational tools, such as group and individual classes, as well as an economic calendar and terminology guides in the Esperio dashboard.

However, some non-trading fees, such as an inactivity fee, apply after three consecutive months of no trading activity.

Account Types | Standard, Cent, Invest, MT5 ECN, Demo |

Regulating Authorities | Financial Services Authority (FSA), Saint Vincent and the Grenadines |

Minimum Deposit | None |

Deposit Methods | VISA, MasterCard, Wire, SEPA, OWNR Wallet, Fasapay, MNTX, BTC, USDT |

Withdrawal Methods | VISA, MasterCard, Wire, SEPA, OWNR Wallet, Fasapay, MNTX, BTC, USDT |

Maximum Leverage | 1:1000 (for most accounts) |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Pros and Cons of Esperio

Traders must note the following benefits and drawbacks before opening an account with the Esperio broker.

Pros | Cons |

High leverage (up to 1:1000) | Low-tier regulation (SVG FSA) |

Multiple account types with no minimum deposit | Limited company transparency |

Access to MetaTrader 4 and MetaTrader 5 platforms | No negative balance protection |

Copy trading service available | Inactivity fee after 3 months of no trading |

HYCM

HYCM, a regulated multi-jurisdictional broker, is licensed by the FCA in the UK and the DFSA in the UAE, offering clients a variety of trading options across global markets.

It provides three main account types: Fixed, Classic, and RAW, with a minimum deposit of $20. Traders can manage their funds and create new trading account within the HYCM dashboard.

The broker supports a wide range of trading instruments, including Forex, commodities, stocks, and cryptocurrencies, and offers leverage up to 1:500, depending on the account type chosen during the HYCM registration.

HYCM's platform options include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary HYCM Trader app, making it accessible for both desktop and mobile traders.

The broker’s spreads start from 0.1 pips, with commissions ranging from $0 to $5 per round depending on the account type. They also offer a demo account, Islamic accounts, and PAMM accounts for traders who complete the HYCM verification process.

While HYCM provides competitive trading conditions, its limited educational resources and the imposition of a $10 inactivity fee are notable drawbacks.

Despite its solid regulation and diverse offerings, HYCM may not be suitable for traders seeking more advanced educational tools or those averse to inactivity charges.

Account Types | Fixed, Classic, RAW, Demo, Islamic |

Regulating Authorities | Financial Conduct Authority (FCA), Dubai Financial Services Authority (DFSA), Saint Vincent & the Grenadines |

Minimum Deposit | $20 |

Deposit Methods | Visa/MasterCard, PayPal, Bank Wire, Neteller, Skrill, Perfect Money, Fasapay, WebMoney, Crypto (BTC, USDT) |

Withdrawal Methods | Visa/MasterCard, PayPal, Bank Wire, Neteller, Skrill, WebMoney, Crypto (BTC, USDT) |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, HYCM Trader |

HYCM Pros and Cons

The following table outlines the benefits and drawbacks of trading with the HYCM broker.

Pros | Cons |

FCA and DFSA regulation (Tier-1 and Tier-2) | No longer accepts EU clients after renouncing Cyprus license |

Competitive leverage (up to 1:500) | Limited educational resources for beginners |

Wide range of tradable instruments (over 300) | Inactivity fee of $10 after 3 months of no trading |

Offers multiple account types with low minimum deposit ($20) | Low Trustpilot rating |

Go Markets

GO Markets, a well-regulated CFD broker, has been operational since 2006, providing clients access to a wide range of trading instruments.

With two main account types) Standard and GO Plus+) traders can enjoy leverage up to 1:500, with zero spreads available on the GO Plus+ account after completing Go Markets registration. Additionally, the broker offers a PAMM account and supports trading through platforms like MT4, MT5, and cTrader.

Regulated by CySEC and the FSC, GO Markets offers negative balance protection, segregated funds, and reliable customer service available 24/7.

It provides competitive trading conditions with no commissions on the Standard account and a $5 commission per round lot on the GO Plus+ account. Traders can lower costs by leveraging Go Markets rebate program.

GO Markets also allows trading in forex, shares, indices, commodities, and more, but the broker does not offer any bonuses due to regulatory restrictions.

While GO Markets offers an educational hub with webinars and trading strategies, it has received mixed reviews, with a 4.6/5 rating on Trustpilot.

However, some drawbacks include a higher minimum deposit compared to other brokers and limited asset options. GO Markets is best suited for those seeking a trusted, multi-regulated broker with advanced features for active traders.

Account Types | CySEC, FSC, ASIC |

Regulating Authorities | 100 EUR |

Minimum Deposit | Credit/Debit Cards, Bank Transfers, E-wallets |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-wallets |

Withdrawal Methods | 1:500 |

Maximum Leverage | MT4, MT5, cTrader |

Trading Platforms & Apps | CySEC, FSC, ASIC |

Go Markets Pros and Cons

The following table contains the pros and cons of Go Markets for Forex traders.

Pros | Cons |

Regulated by reputable authorities (CySEC, ASIC, FSC) | High minimum deposit requirement (€100) |

Multiple advanced trading platforms (MT4, MT5, cTrader) | Limited investment options |

Offers Islamic accounts and PAMM options | No bonuses or promotions |

Wide range of tradable instruments (Forex, Shares, Crypto) | No 24/7 support |

Switch Markets

Switch Markets is a rapidly growing broker offering both Forex and CFD trading. It provides competitive features such as low spreads, starting from 0.0 pips on the Pro account, and offers leverage up to 1:1000.

After finalizing the Switch Markets registration Traders can open accounts with a minimum deposit of €48, and can choose from Standard, Pro, and Islamic accounts.

The broker supports multiple payment methods, including Visa, MasterCard, PayPal, Neteller, and cryptocurrencies for Switch Markets deposits and withdrawals.

Operating globally, Switch Markets is regulated by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA);

Although its regulatory oversight is limited compared to other brokers but it still requires traders to complete the Switch Markets verification process.

The broker also provides a demo account, social trading, algo trading, and a PAMM account for those looking for additional investment options.

While Switch Markets offers a solid trading experience, it does have some limitations.

Its regulatory framework is weaker compared to tier-1 regulated brokers, and its higher-than-average spreads on the Standard account (starting from 1.4 pips) may be less favorable for cost-conscious traders.

Additionally, the broker does not accept clients from the USA, Cyprus, and other restricted countries.

Overall, Switch Markets provides a comprehensive trading platform suitable for both beginners and advanced traders, though its regulatory standing and higher spreads on certain accounts might be a concern for some traders.

Account Types | Standard, Pro, Islamic, Demo |

Regulating Authorities | Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) |

Minimum Deposit | €48 |

Deposit Methods | Visa, MasterCard, PayPal, Bank Wire, Neteller, Skrill, UnionPay, GlobePay, NganLuong, Fasapay, PayTrust, Crypto |

Withdrawal Methods | Visa, MasterCard, PayPal, Bank Wire, Neteller, Skrill, UnionPay, GlobePay, NganLuong, Fasapay, PayTrust, Crypto |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5, Web, Mobile) |

Switch Markets Pros and Cons

Traders must consider the following benefits and limitations before opening an account with the Switch Markets broker.

Pros | Cons |

High leverage up to 1:1000 | No tier-1 regulation |

Competitive spreads (from 0.0 pips on Pro account) | Higher-than-average spreads on Standard account (from 1.4 pips) |

Multiple account types including Islamic and Demo accounts | Limited availability in some countries (e.g., USA, Cyprus) |

Access to both MetaTrader 4 and MetaTrader 5 platforms | Relatively new broker with limited regulatory oversight |

Anzo Capital

Anzo Capital is a Forex and CFD broker, established in 2015, offering a variety of trading services, including commission-free trading on Forex and metals through its STP account.

The broker provides a EUR/USD spread target of 1.4 pips and a leverage of up to 1:1000 after completing the Anzo Capital registration.

This broker operates globally, with a presence in multiple regions, although it is regulated under the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) and has a Tier-3 regulatory standing.

The broker supports both MetaTrader 4 and MetaTrader 5 platforms, offering traders a range of tools and features such as economic calendars, mobile trading, and social trading. Traders can acess these platfroms and withdraw funds after Anzo Capital verification.

Anzo Capital offers two main account types: STP and ECN, with a $100 minimum deposit. It also offers PAMM accounts, copy trading functionality, and a variety of markets including forex, commodities, and CFDs on indices and stocks.

Despite offering competitive spreads and high leverage, Anzo Capital has some limitations, such as high minimum deposits, limited payment options, and no Islamic accounts available in the Anzo Capital dashboard.

Furthermore, its regulatory status may be a concern for traders seeking higher levels of regulatory protection. Overall, Anzo Capital is suitable for experienced traders, particularly those interested in high-leverage options and diverse trading instruments.

Account Types | STP, ECN, PAMM, Demo |

Regulating Authorities | Saint Vincent and the Grenadines Financial Services Authority (SVGFSA), Australian Securities and Investments Commission (ASIC) |

Minimum Deposit | $100 |

Deposit Methods | Wire Transfer, Skrill, Neteller |

Withdrawal Methods | Wire Transfer, Skrill, Neteller |

Maximum Leverage | 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

Pros and Cons of Anzo Capital

These are the advantages and disadvantages of choosing Anzo Capital as your broker.

Pros | Cons |

Multi-regulated broker (SVGFSA, ASIC) | High minimum deposit of $100 |

Access to MT4 and MT5 platforms | Limited deposit/withdrawal methods |

Leverage up to 1:1000 | Limited range of tradable assets |

Offers PAMM accounts and copy trading | Lack of transparency regarding the company’s founding and leadership |

OX Securities

OX Securities, founded in 2013, is a Forex and CFD broker regulated by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA).

The broker offers a diverse range of trading services, including over 10,000 instruments such as Forex, commodities, indices, stocks, and crypto, with leverage up to 1:500.

Traders can choose from Standard, Pro, and Swap-Free accounts, with a $0 minimum deposit required after finalizing their OXsecurities registration.

OX Securities supports popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for various trading strategies, and it also offers PAMM accounts and social trading features.

Traders have free access to these features by completing the OX Securities verification.

OX Securities stands out for its competitive pricing, with spreads starting from 0 pips on Pro accounts. While the broker provides customer support 24/5 via email, phone, and live chat, it is regulated by a Tier-2 authority, limiting its regulatory protection.

Furthermore, OX does not offer a full range of deposit and withdrawal options, and it lacks 24/7 support. The broker has received mixed reviews, with a TrustPilot score of 4.5/5 and a lower rating of 1.2/5 on REVIEWS.io.

Despite its drawbacks, such as high commissions on Pro accounts, OX Securities is an option for traders looking for low spreads and high leverage.

Account Types | Standard, Pro, Swap Free, Demo |

Regulating Authorities | Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfers, Crypto, E-Payment Systems, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Crypto, E-Payment Systems, Credit/Debit Cards |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | IRESS, MT4, MT5 |

OX Securities Pros and Cons

Traders must consider the following benefits and drawbacks of trading with OX Securities before opening an account.

Pros | Cons |

Leverage up to 1:500 | Regulated by a less stringent authority (SVGFSA) |

No minimum deposit requirement | Limited range of payment methods |

Competitive spreads (from 0 pips on Pro accounts) | Lack of 24/7 customer support |

Access to MT4, MT5, and IRESS platforms | No Islamic account option |

NPBFX

NPBFX (NEFTEPROMBANK FOREX) is a forex broker based in Moheli, offering three primary account types: Master, Expert, and VIP.

Traders can access 38 currency pairs and commodities like gold, silver, oil, and natural gas, with spreads starting from 0.4 pips and leverage up to 1:1000 after finishing the NPBFX registration.

This broker is regulated by the SVG FSA and is a member of the Financial Commission, providing a €20,000 compensation scheme for unresolved complaints.

NPBFX offers a range of deposit methods, including credit cards, e-wallets like Skrill and Neteller, and bank transfers. The minimum deposit requirement starts at just $10 for the Master account.

The broker supports the MetaTrader 4 platform and its proprietary NPBFX Trader for mobile trading. Account types differ in spreads and leverage, with the VIP account offering the tightest spreads and highest leverage.

Despite its competitive spreads and low minimum deposit, NPBFX is regulated by lower-tier authorities, posing a higher risk compared to brokers regulated by FCA, CySEC, or ASIC.

The platform also lacks transparency around its operations, and some users have reported slow withdrawal processing times. Additionally, NPBFX doesn't allow U.S. or Canadian clients to trade.

Account Types | SVG FSA, Financial Commission |

Regulating Authorities | $10 for Master account, $5,000 for Expert, $50,000 for VIP |

Minimum Deposit | Visa/MasterCard, Webmoney, Skrill, Neteller, Yandex Money, Qiwi Wallet, Bank Wire |

Deposit Methods | Visa/MasterCard, Webmoney, Skrill, Neteller, Fasapay, Yandex Money, Qiwi Wallet, Bank Wire |

Withdrawal Methods | 1:1000 |

Maximum Leverage | MetaTrader 4 (MT4), NPBFX Trader (Mobile) |

Trading Platforms & Apps | SVG FSA, Financial Commission |

NPBFX Brokers Pros and Cons

Traders must consider the following benefits and drawbacks before opening an account with NPBFX.

Pros | Cons |

Low minimum deposit for the Master account ($10) | High minimum deposit for Expert and VIP accounts |

Up to 1:1000 leverage | Limited choice of trading platforms |

Tight spreads starting from 0.4 pips | Lack of tier-1 regulation (SVG FSA) |

24/5 customer support | - |

How Did we Choose the Best SVGFSA-Regulated Brokers?

The TradingFinder experts have considered the following factors to choose the best brokers licensed and registered by the Financial Services Authority in the Saint Vincent and the Grenadines:

- Spreads

- Commissions

- Tradable instruments

- Deposit and withdrawal methods

- Support

- Leverage caps

- Trading platforms

What is SVGFSA?

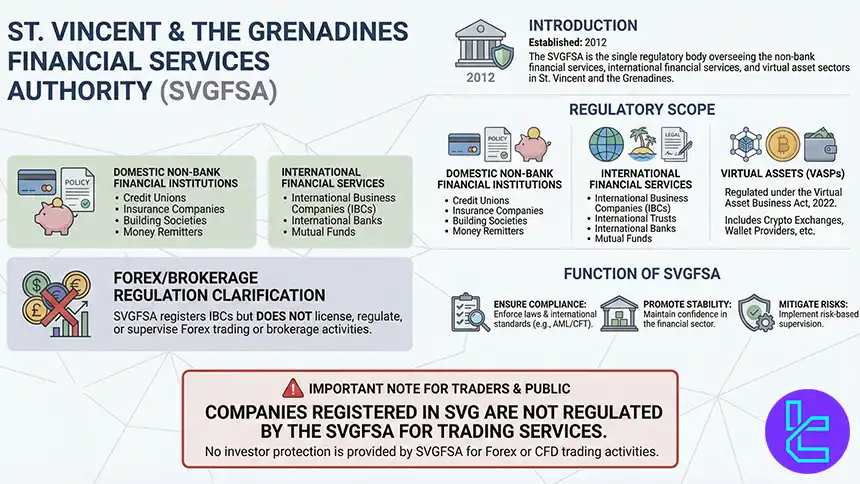

The St. Vincent and the Grenadines Financial Services Authority (SVGFSA), established in 2012, is an independent body overseeing non-bank financial services, international financial services, and virtual asset service providers.

It is responsible for regulating institutions like credit unions and insurance companies within the country.

- Regulatory Scope: The SVGFSA supervises both domestic non-bank financial institutions and international financial services;

- Virtual Assets: The Financial Services Authority (FSA) is responsible for regulating Virtual Asset Service Providers (VASPs) under the 2022 Virtual Asset Business Act;

- Forex/ Brokerage Regulation: Although the SVGFSA registers International Business Companies (IBCs), it does not regulate Forex trading or brokerage services;

- Function: The SVGFSA aims to ensure compliance, stability, and mitigate financial risks within its jurisdiction.

It is important to note that while companies can be registered in SVG, they may not necessarily be regulated by the SVGFSA for trading services, making it crucial for traders to understand the regulatory landscape in which their brokers operate.

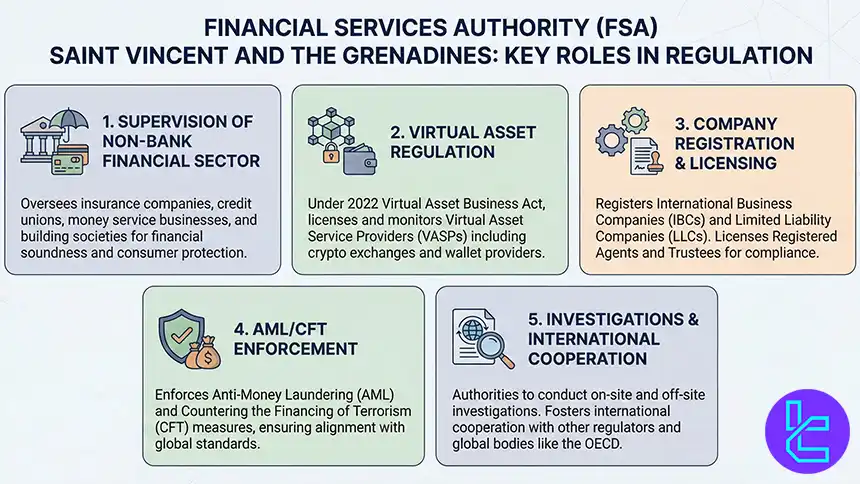

What Powers Does the FSA in Saint Vincent and the Grenadines Have?

The Financial Services Authority (FSA) plays a pivotal role in regulating and supervising the non-bank financial sector, which includes insurance companies, credit unions, money service businesses, and building societies.

Under the 2022 Virtual Asset Business Act, the FSA is also responsible for licensing and monitoring Virtual Asset Service Providers (VASPs), such as crypto exchanges and wallet providers.

In addition, the FSA registers International Business Companies (IBCs), Limited Liability Companies (LLCs), and licenses Registered Agents and Trustees to ensure compliance with local laws.

The FSA enforces strict Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) measures, ensuring that financial entities adhere to global regulatory standards.

With the authority to conduct both on-site and off-site investigations, the FSA ensures that regulated entities maintain stability, protect customer interests, and adhere to financial laws.

Moreover, the FSA fosters international cooperation, exchanging critical information with other regulators and aligning with global standards like those of the OECD to support the integrity of financial markets.

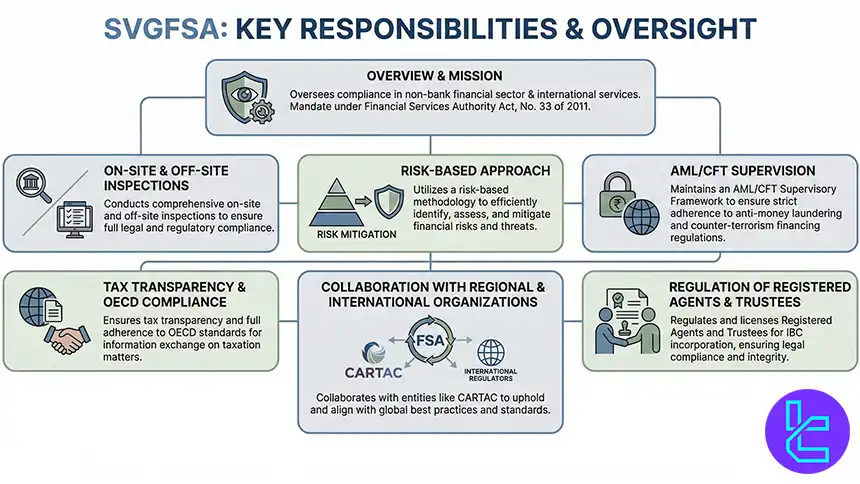

What Are SVGFSA Responsibilities?

The Financial Services Authority (FSA) is tasked with overseeing compliance within the non-bank financial sector and international financial services, in accordance with the Financial Services Authority Act, No. 33 of 2011.

The FSA ensures institutions meet these legal requirements through both off-site and on-site inspections. By employing a risk-based approach, the FSA aims to identify and mitigate financial risks and threats efficiently.

The authority has also established an AML/CFT Supervisory Framework that guides its methodology in supervising institutions under its jurisdiction.

In addition to AML/CFT supervision, the FSA ensures tax transparency by adhering to OECD standards for information exchange related to taxation.

It also collaborates with regional and international organizations, such as the Caribbean Regional Technical Assistance Centre (CARTAC), to maintain global best practices.

Furthermore, the FSA plays a key role in regulating and licensing Registered Agents and Trustees, who facilitate the incorporation of International Business Companies (IBCs).

While the Commerce and Intellectual Property Office (CIPO) handles general incorporation, the FSA specifically regulates international financial entities.

Do SVGFSA-Regulated Brokers offer Negative Balance Protection?

The offering of Negative Balance Protection (NBP) by SVG FSA-regulated brokers is not mandated by any regulatory requirement.

The St. Vincent and the Grenadines Financial Services Authority (SVG FSA) does not oversee forex trading activities, nor does it enforce policies regarding NBP, fund segregation, or compensation schemes.

Instead, the decision to offer NBP depends entirely on the individual broker's own risk management practices, often as a means of attracting clients.

However, since this protection is not regulated, traders must carefully review the terms and conditions of any SVG-regulated broker to confirm if NBP is provided and under what circumstances.

Unlike brokers regulated by bodies like the FCA (UK) or CySEC (EU), where NBP is often guaranteed, SVG brokers are not bound by such requirements, presenting a higher risk to traders.

The offshore jurisdiction of SVG means that, in case of a dispute, there may be limited recourse for traders if the broker fails to honor its NBP policy.

Are SVGFSA-Regulated Brokers Safe?

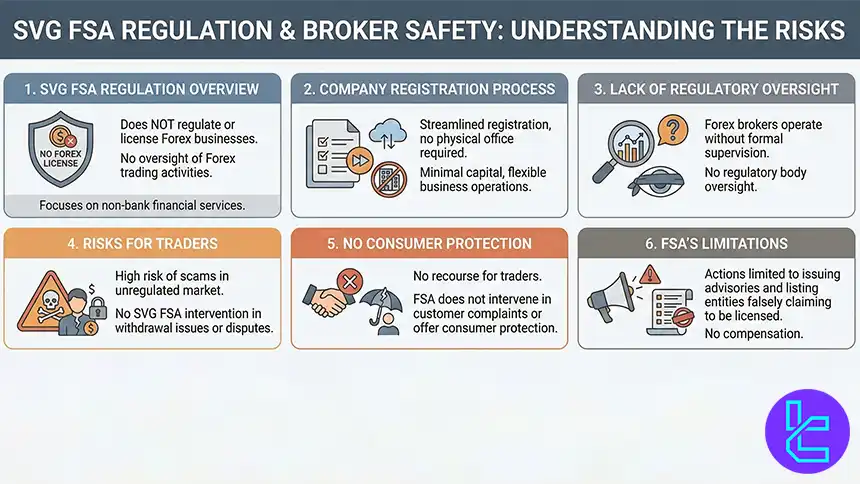

As highlighted in official statements, the SVG FSA does not regulate or license Forex businesses, nor does it oversee Forex trading activities.

Despite SVG offering a streamlined process for company registration, which doesn’t require a physical office in the country and allows for minimal capital and flexible business operations, it’s crucial to note the lack of regulatory oversight in the Forex industry.

Brokers registered under SVG can operate, accept payments, and provide trading environments but do so without any formal regulatory supervision.

This absence of regulation exposes traders to significant risks, particularly in the unregulated Forex market, where potential scammers may operate freely.

Additionally, the SVG FSA cannot assist in cases of withdrawal issues or financial disputes with brokers.

Traders who face such problems are left without recourse, as the SVG FSA does not intervene in customer complaints or offer consumer protection.

The FSA’s actions are limited to issuing advisories and listing entities that falsely claim to be licensed under SVG, but no further protections are provided.

Rules Set by SVGFSA for Forex Brokers

The Financial Services Authority (FSA) of St. Vincent and the Grenadines (SVG) introduced licensing requirements for registered forex companies as part of efforts to enhance transparency and combat fraudulent practices.

These measures were prompted by numerous complaints and allegations of fraud against Business Companies (BC) and Limited Liability Companies (LLC) involved in Forex trading.

The licensing rules mandate that any company seeking to engage in forex trading must provide proof of an approved license from the relevant jurisdictions where their operations are based when applying for incorporation with the SVG FSA.

Additionally, the SVG FSA has emphasized the importance of implementing effective Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) practices, as well as conducting thorough due diligence when onboarding key personnel.

These steps are aimed at ensuring higher standards of operation within the sector.

Tradable Instruments in the SVGFSA Regulated Brokers

Brokers licensed by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines typically offer a broad range of financial instruments, focusing on high-leverage Contracts for Difference (CFDs). Below are the key instruments available:

- Forex (Currency Pairs): Brokers provide a wide selection of major, minor, and exotic currency pairs;

- Cryptocurrencies: High liquidity is available for popular utility tokens, traded against USD;

- Metals (Spot Trading): Precious metals are available for hedging and speculation.

- Energies (Oil and Gas): Brokers offer CFD trading on energy commodities like oil, natural Gas, WTI, etc;

- Indices: CFDs on major global stock market indices are also commonly offered, providing exposure to global financial markets.

SVG FSA vs Other Regulatory Bodies

As discussed earlier the Saint Vincent and the Grenadines Financial Services Authority doesn’t regulate Forex brokers and it only issues licenses for BICs to provide financial services.

However, financial authorities in other parts of the world such as Europe, Singapore and Australia do regulate brokers and require them to provide compensation schemes, negative balance protection, and fund segregation to ensure funds safety.

The table below provides a comparison of the SVG FSA to other financial authorities.

Parameter | SVGFSA (Saint Vincent and the Grenadines) | CySEC (Cyprus) | MAS (Singapore) | ASIC (Australia) |

Minimum Capital Requirement | No | €750,000+ depending on firm type | $1 million SGD | Between AU$500,000 and AU$1,000,000 |

Client Fund Segregation | Not Required | Required | Required | Required |

Compensation Scheme | No | Investor Compensation Fund (~€20,000) | No | Investor Compensation Fund (AU$10,000) |

Leverage Limits | No limits | Set under MiFID (often 1:30 for retail in EU) | 1:30 | 1:30 |

Negative Balance Protection | Not Required | Often required | Required | Required |

Reporting & Audits | Not Required | Ongoing financial reporting | Ongoing financial reporting | Ongoing financial reporting |

Conclusion

Based on our complete review of the best Forex brokers regulated by Saint Vincent and the Grenadines Financial Services Authority, we can say that HFM, HYCM, Switch Markets, Go Markets, OX Securities, and NPBFX are the best available options.

However, traders mist note that this financial authority is a tier-3 regulator and doesn’t require a negative balance protection and funds segregation.

Therefor traders are advised to open an account with a Forex broker that is regulated by a top-tier authority such as the FCA, SEC, CySEC, or ASIC to ensure their funds are safe with the broker.

All brokers have been evaluated based on the factors listed in the TradingFinder Forex Methodology page.