Scalping is a high-frequency trading strategy that allows traders to benefit from little fluctuations in the price of assets and currency pairs.

Many brokers offer spreads from 0.0 pips, high leverage up to 1:2000, and fast execution time (under 0.5 seconds), which allows traders to perform this trading strategy. Here are the best brokers for Scalpers:

| Exness | |||

| PRIME XBT | |||

| Libertex | |||

| 4 |  | TradersTrust | ||

| 5 |  | FreshForex | ||

| 6 |  | AMEGA | ||

| 7 |  | MTRADING | ||

| 8 |  | darwinex | ||

| 9 |  | Orbex | ||

| 10 |  | FXTM |

Trustpilot Ratings of Scalping Forex Brokers

The table below can help you measure the trustworthiness of the best Forex brokers perfect for Scalping

Broker | Trustpilot Rating | Number of Reviews |

4.8/5 ⭐ | 27500+ | |

Traders Trust | 4.5/5 ⭐ | 500+ |

Orbex | 4.3/5 ⭐ | 100+ |

Darwinex | 4.2/5 ⭐ | 200+ |

4.0/5 ⭐ | 100+ | |

FreshForex | 4.0/5 ⭐ | 100+ |

Libertex | 3.9/5 ⭐ | 9000+ |

PrimeXBT | 3.7/5 ⭐ | 400+ |

Amega | 3.1/5 ⭐ | 200+ |

1000+ |

Minimum Spreads of Scalping Forex Brokers

Traders must compare the minimum spreads in Forex brokers since it’s one of the important trading costs of using Scalping strategies.

Brokers | Minimum Spreads |

Exness | 0.0 Pips |

0.0 Pips | |

HFM | 0.0 Pips |

XM | 0.0 Pips |

Pepperstone | 0.0 Pips |

Eightcap | 0.0 Pips |

LiteFinance | 0.0 Pips |

0.1 Pips | |

AvaTrade | 0.6 Pips |

IG | 0.6 Pips |

Account Types and Leverage in Scalping Forex Brokers

The best Forex brokers for Scalping offer high leverage and allow traders to choose various account types with low spreads and trading commissions.

Broker | Account Types | Maximum Leverage |

Classic, Pro, VIP | 1:3000 | |

HFM | Cent, Zero, Pro, Premium | 1:2000 |

Classic, Market Pro, ECN | 1:2000 | |

XM Group | Ultra-low, Zero | 1:1000 |

Admirals | Zero, Invest, Trade | 1:1000 |

Tickmill | Classic, Raw | 1:1000 |

Live, Live MAX, Raw, Islamic, Standard | 1:1000 | |

Fusion Markets | Classic, Zero, Pro, Swap-Free | 1:500 |

XTB | Standard, Pro, Islamic | 1:500 |

Saxo | Classic, Platinum, VIP | 1:30 |

Number of Tradable Instruments in Scalping Forex Brokers

The table below shows the number of tradable instruments in the top Forex brokers for Scalpers.

Broker | Number of Tradable Assets |

CMC Markets | 12000+ |

Forex.com | 4500+ |

IC Markets | 2250+ |

Pepperstone | 1400+ |

FXTM | 1000+ |

Vantage | 1000+ |

800+ | |

400+ | |

Fusion Markets | 250+ |

MTrading | 130+ |

Top 8 Forex Brokers for Scalping

Best brokers for Scalping offer 0.0 pip spreads, low commissions, work under top-tier financial regulators such as FCA, SEC, CySEC, or ASIC and provide fast execution. Here are the top brokers you can choose from to Scalp in various financial markets.

Exness

Established in 2008 by Petr Valov and Igor Lychagov, Exness operates as a global Forex and CFD brokerage supported by a workforce of more than 2,100 professionals across nearly 100 jurisdictions.

The firm processes monthly trading volumes exceeding $4 trillion and delivers market access through entities such as Exness (UK) Ltd., Exness (Cy) Ltd., and Exness ZA (Pty) Ltd., under the oversight of regulators including the FCA, CySEC, FSCA, FSA, CMA, and FSC BVI.

Client protection mechanisms such as segregated accounts, Negative Balance Protection, and compensation frameworks like the FSCS in the UK or the ICF in Cyprus are implemented across regulated branches.

Depending on jurisdiction, leverage may reach up to 1:2000, while retail clients in tier-1 regulatory environments are typically subject to stricter limits.

Exness offers multiple account types, including Standard, Standard Cent, Pro, Raw Spread, and Zero, with trading costs structured through either floating spreads from 0.0 to 0.8 pips or commission-based models ranging from $0.2 to $3.5 per lot.

Traders can lower trading costs in this broker by using Exness rebate program provided by TradingFinder.

Execution is facilitated via both Market and Instant Execution methods, with minimum trade sizes starting at 0.01 lots.

Trading infrastructure supports platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness Terminal (Web), and the Exness Trade mobile application. All platforms can be easily download from the Exness dashboard.

Traders can access over 200 instruments across Forex, indices, cryptocurrencies, commodities, and equity CFDs.

Additional functionalities including algorithmic trading, Social Trading integrations, VPS hosting, and swap-free account options are available depending on account configuration.

Exness deposits and withdrawals accommodate e-wallets like Neteller, Skrill, and Sticpay, alongside bank cards and crypto assets such as USDT (ERC20/TRC20) and BTC, typically without broker-side deposit or withdrawal fees.

Account Types | Standard, Standard Cent, Pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | From $10 |

Deposit Methods | Bank Cards, Skrill, Neteller, SticPay, Perfect Money, Crypto (BTC, USDT), Bank Transfer |

Withdrawal Methods | Bank Cards, Skrill, Neteller, SticPay, Perfect Money, Crypto (BTC, USDT), Bank Transfer |

Maximum Leverage | Up to Unlimited (Conditions Apply) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness Terminal, Exness Trade App |

Exness Pros and Cons

Here are the benefits and drawbacks of trading with Exness broker.

Pros | Cons |

Multi-regulated under FCA, CySEC, FSCA, FSA, CBCS, FSC, and CMA | Services are restricted in some jurisdictions |

Raw Spread and Zero accounts with spreads from 0.0 pips | Educational resources are relatively limited for beginners |

Supports MT4, MT5, Exness Terminal, and mobile trading app | - |

Minimum deposit starting from $10 | - |

Libertex

Libertex is a Cyprus-based online brokerage operating under the CySEC regulatory framework through Indication Investments Ltd, in compliance with MiFID II standards.

Since its launch in 1997, the platform has expanded its services to more than 3 million clients across over 120 countries, offering trading access to multiple CFD markets including Forex, cryptocurrencies, commodities, stocks, and indices.

The broker provides several live account after finalizing Libertex registration structures such as Real, Invest, MT4, and MT5, in addition to a demo environment for strategy testing.

Retail clients are typically limited to leverage levels of up to 1:30 in line with EU regulatory requirements, while professional accounts may access leverage up to 1:600 depending on eligibility criteria.

Trading costs are structured through spreads starting from 0.1 pip and market-dependent commissions, with order execution supported via both Market and Instant models.

Libertex integrates MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary trading platform, enabling automated trading, economic calendar tracking, and risk management tools such as Quick-Take Profit.

Minimum deposits begin at 100 EUR, with Libertex deposit and withdrawal options available through bank transfers, credit or debit cards, and various e-payment systems. For enabling withdrawals, traders must complete the Libertex verification.

From a client protection standpoint, the broker maintains segregated accounts and negative balance protection across supported jurisdictions.

Additionally, eligible users are covered under the Investor Compensation Fund (ICF), which offers safeguards up to €20,000 in the event of firm insolvency.

Account Types | Demo, Real, Invest, MT4, MT5 |

Regulating Authorities | CySEC |

Minimum Deposit | €100 |

Deposit Methods | Credit/Debit Card, Bank Wire Transfer, E-payment Systems (Skrill, Neteller, PayPal) |

Withdrawal Methods | Credit/Debit Card, Bank Wire Transfer, E-payment Systems |

Maximum Leverage | Up to 1:30 (Retail) / Up to 1:600 (Professional) |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Proprietary Platform |

Pros and Cons of Libertex

Traders must consider the advantages and disadvantages of trading with Libertex before opening an account.

Pros | Cons |

Regulated under CySEC with ICF coverage up to €20,000 | Not available in several jurisdictions (e.g., US, UK) |

Supports MetaTrader 4, MetaTrader 5, and proprietary platform | Islamic (Swap-Free) accounts are not offered |

Negative Balance Protection and segregated client funds | Inactivity fee of €10/month after 180 days |

Commission-free crypto CFD trading on Invest account | Withdrawal fees apply on Bank Wire and Card methods |

Traders Trust

Traders Trust operates as a multi-entity Forex and CFD brokerage offering access to financial markets through Classic, Pro, and VIP trading accounts.

The broker provides trading infrastructure for over 200 instruments across asset classes such as Forex, indices, cryptocurrencies, stocks, metals, and oil, with order execution based on a market execution model.

Account access is available via MetaTrader 4 (MT4) and cTrader, supporting both manual and automated trading environments. From a regulatory standpoint, Traders Trust functions under three primary entities.

The CySEC-regulated branch adheres to MiFID II compliance requirements and participates in the Investor Compensation Fund (ICF), offering coverage up to €20,000 for eligible EU clients.

Client fund segregation and Negative Balance Protection are implemented across all operational entities.

Trading conditions vary across account types, with floating spreads starting from 1.5 pips on the Classic account and from 0.0 pips on Pro and VIP accounts, where commissions begin at $3 and $1.5 per lot respectively.

Maximum leverage can reach 1:3000 under offshore entities, while EU-based accounts are limited to 1:30 in accordance with regulatory standards.

The Traders Trust dashboard offers copy trading through Social Copy Trader and portfolio management via MAM accounts, allowing strategy providers to allocate trades across multiple sub-accounts.

Using these services require traders to complete the Traders Trust verification process. Additional features such as Islamic (swap-free) accounts and demo environments are also supported.

Traders Trust deposits and withdrawals are available through bank transfer, Visa/MasterCard, Skrill, Neteller, Bitcoin (BTC), and USDT, typically without brokerage-imposed transaction fees, though third-party banking costs may apply depending on the selected method.

Account Types | Classic, Pro, VIP |

Regulating Authorities | CySEC, FSA (Seychelles), BMA (Bermuda) |

Minimum Deposit | $50 |

Deposit Methods | Bank Transfer, Visa/MasterCard, Skrill, Neteller, BTC, USDT |

Withdrawal Methods | Bank Transfer, Visa/MasterCard, Skrill, Neteller, BTC, USDT |

Maximum Leverage | Up to 1:3000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), cTrader |

Traders Trust Pros and Cons

Understanding the benefits and drawbacks of Traders Trust allows you choose this broker by considering all factors.

Pros | Cons |

Maximum leverage up to 1:3000 | No MetaTrader 5 (MT5) support |

Floating spreads from 0.0 pips on Pro/VIP | $25 inactivity fee may apply |

Supports Social Copy Trading and MAM accounts | Limited educational resources |

Regulated by CySEC, FSA, and BMA | - |

Darwinex

Darwinex operates as both a brokerage provider and an asset management platform, offering access to more than 1,500 tradable instruments across Forex, Stocks, ETFs, Indices, Futures, and CFD markets.

Established in 2012, the company delivers regulated trading services under the supervision of the Financial Conduct Authority (FCA) in the United Kingdom, the Comisión Nacional del Mercado de Valores (CNMV) in Spain, and the FSA in Seychelles.

Through its proprietary DARWIN framework, Darwinex enables traders to convert algorithmic or discretionary trading strategies into investable assets known as DARWINs.

These instruments can be allocated third-party capital via the DarwinIA seed funding program, introducing an asset management layer alongside traditional trading activities.

Client funds are held in segregated accounts at European banking institutions and may qualify for investor protection schemes such as the FSCS in the UK (up to £85,000) or FOGAIN in Spain (up to €100,000), depending on the regulatory jurisdiction.

The platform ecosystem includes MetaTrader 4, MetaTrader 5, WebTrader, TradingView, NinjaTrader, Interactive Brokers’ Trader Workstation (TWS), MultiCharts, and FIX/API connectivity.

Integration with Interactive Brokers (IBKR) further expands access to global exchanges, including CME, CBOE, EUREX, and ICE-listed Futures contracts.

The broker supports Live, Professional, Darwin IBKR, and Classic IBKR account structures after Darwinex registration with a minimum deposit of $500 and leverage capped at 1:200.

Investment functionality is primarily delivered through diversified DARWIN portfolios, while commissions and spreads vary based on asset class and execution environment.

It’s important to note that traders must complete the Darwinex verification to access the investment features.

Account Types | Live, Professional, Darwin IBKR, Classic IBKR |

Regulating Authorities | FCA, CNMV, FSA |

Minimum Deposit | $500 |

Deposit Methods | Credit/Debit Cards, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer |

Maximum Leverage | 1:200 |

Trading Platforms & Apps | MT4, MT5, WebTrader, TradingView, NinjaTrader, TWS, MultiCharts, DARWIN API, FIX, ZORRO IB Bridge, IB Gateway |

Darwinex Pros and Cons

Traders must consider these benefits and limitations before opening an account with Darwinex.

Pros | Cons |

Regulated by FCA and CNMV | High minimum deposit requirement ($500) |

Access to 1500+ tradable instruments | No Islamic (swap-free) account option |

DARWIN investment and DarwinIA allocation program | Limited availability in some jurisdictions |

Integration with Interactive Brokers (IBKR) | - |

FreshForex

FreshForex is an offshore Forex and CFD brokerage established in 2004 and headquartered in Saint Vincent and the Grenadines, operating under Riston Capital Ltd.

The company provides access to 70+ currency pairs alongside a diversified set of CFD instruments across global markets, including cryptocurrencies, ETFs, stocks, and precious metals, serving clients in more than 150 jurisdictions.

The broker offers three live account types after completing FreshForex registration, including Classic, Market Pro, and ECN, each with distinct spread and commission structures.

Commission-free trading is available on Classic and Market Pro accounts for most instruments, while ECN accounts apply trading fees starting from 0.003% per contract. Trading conditions include market execution, a minimum order size of 0.01 lots, and leverage up to 1:2000.

FreshForex supports MetaTrader 4 and MetaTrader 5 platforms, enabling algorithmic trading, custom indicators, and multi-asset analysis across Forex, crypto, and equities markets.

Deposit and withdrawal options include Visa, Mastercard, USDT, Bitcoin, USDC, Perfect Money, WebMoney, and region-specific e-wallets, with a base funding requirement of $25.

All methods become available after finalizing the FreshForex verification process.

Despite offering swap-free (Islamic) accounts, demo access, and floating spreads from 0.0 pips on ECN accounts, FreshForex currently operates without authorization from Tier-1 financial regulators.

The absence of segregated funds, negative balance protection, or participation in an investor compensation scheme may affect capital safeguards, particularly in dispute resolution scenarios.

As a result, regulatory transparency and fund protection remain key considerations when evaluating this brokerage’s risk profile.

Account Types | Classic, Market Pro, ECN |

Regulating Authorities | None (Riston Capital Ltd – Saint Vincent and the Grenadines) |

Minimum Deposit | $25 |

Deposit Methods | Visa, MasterCard, Crypto (USDT, BTC, USDC), Perfect Money, Local E-wallets, Local Depositors |

Withdrawal Methods | Visa, MasterCard, Crypto (USDT, BTC, USDC), Perfect Money, WebMoney, Local E-wallets, Local Depositors |

Maximum Leverage | Up to 1:2000 |

Trading Platforms & Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

Pros and Cons of FreshForex

Traders must consider these benefits and drawbacks before opening an account with the FreshForex broker.

Pros | Cons |

Low minimum deposit starting from $25 | Not regulated by top-tier financial authorities |

Access to MetaTrader 4 and MetaTrader 5 platforms | No investor protection fund or compensation scheme |

Leverage up to 1:2000 for margin trading | Limited transparency due to offshore registration |

Availability of Islamic (Swap-Free) accounts | - |

Amega

AMEGA is a multi-asset brokerage established in 2018 by Vadim Zhuravlev through Amega Global Ltd and registered in Mauritius under the Financial Services Commission (FSC).

Operating under a tier-3 regulatory framework, the broker implements client fund segregation and Negative Balance Protection, although it does not participate in any Investor Compensation Scheme.

However, it does require traders to complete Amega verification to comply with AML and CFT laws.

The platform provides access to several markets including Forex, Stocks, Indices, Cryptocurrencies, Energies, Precious Metals, and Agricultural Commodities through MetaTrader 4, MetaTrader 5, and WebTrader environments.

Trading is executed using a market execution model, with leverage options extending up to 1:1000 depending on the selected instrument class.

Account structures such as Mini, Premium, and Scalper support a minimum trade size of 0.01 lots, while commission-free pricing is applied across all account types, with trading costs integrated into floating spreads starting from approximately 1.0 pip.

Swap-Free (Islamic) account configurations are also available for overnight position management without rollover interest.

Funding infrastructure in the Amega dashboard includes Visa, MasterCard, wire transfers, e-wallets such as Skrill, Neteller, and Perfect Money, as well as cryptocurrency-based transactions including Bitcoin and Ethereum.

Amega deposit and withdrawal fees are generally not charged by the broker, although inactivity beyond 180 days may result in a recurring monthly fee.

While the broker offers automated trading via Expert Advisors (EAs) and integrates analytical tools such as Trading Signals within the MT4 and MT5 platforms, it does not currently support cTrader or TradingView compatibility.

Clients from restricted jurisdictions including the United States, Iran, and North Korea are not eligible for account registration.

Account Types | Mini, Premium, Scalper |

Regulating Authorities | Financial Services Commission (FSC) Mauritius |

Minimum Deposit | $20 |

Deposit Methods | Bank Cards, Wire Transfer, E-wallets (Skrill, Neteller, Perfect Money), Cryptocurrencies |

Withdrawal Methods | Bank Cards, Wire Transfer, E-wallets (Skrill, Neteller, Perfect Money), Cryptocurrencies |

Maximum Leverage | 1:1000 |

Trading Platform& Apps | MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader |

Amega Markets Pros and Cons

The following table contains the pros and cons of trading with the Amega broker.

Pros | Cons |

Commission-free trading structure | Not regulated by tier-1 financial authorities |

Leverage up to 1:1000 | Limited account type variety |

Supports MT4 and MT5 platforms | No copy trading or PAMM services |

Segregated funds and negative balance protection | $5 inactivity fee after prolonged account dormancy |

MTrading

MTrading is a multi-asset Forex and CFD broker founded in 2012, delivering trading access to more than 260,000 clients through a network of international offices.

The platform enables market participation across 38 currency pairs, spot Metals and Energy CFDs, global Indices, Stock CFDs, and Cryptocurrencies, supporting diversified exposure within a single MT4-based environment.

From a regulatory standpoint, MTrading operates as a member of The Financial Commission (FinaCom), an independent external dispute resolution body. This affiliation provides client coverage through a compensation scheme of up to $20,000.

In addition, user funds are maintained in segregated accounts, and all live accounts benefit from Negative Balance Protection to mitigate downside risk during volatile market conditions.

The broker offers three primary account types (M.Cent, M.Premium, and M.Pro) after finalizing MTrading registration, each accessible via MetaTrader 4 (MT4) with support for automated trading through Expert Advisors (EAs).

Trading conditions include floating spreads starting from 0.0 pips, leverage up to 1:1000, and a minimum deposit requirement of $10. Commission-free execution is available on Cent and Premium accounts, while Pro accounts apply a fixed $4 per lot fee.

MTrading also integrates a native Copy Trading infrastructure, allowing users to mirror the strategies of signal providers based on metrics such as ROI and drawdown.

Supported payment channels include Bank Transfer, Neteller, Skrill, and USDT (Tether) for both deposits and withdrawals. Traders must complete MTrading verification to access withdrawals.

While the broker does not hold Tier-1 licenses such as FCA or CySEC, its operational framework incorporates compensation safeguards and standard market execution protocols.

Account Types | M.Cent, M.Premium, M.Pro |

Regulating Authorities | The Financial Commission (FinaCom) |

Minimum Deposit | $10 |

Deposit Methods | Bank Transfer, Neteller, Skrill, USDT |

Withdrawal Methods | Neteller, Skrill, USDT |

Maximum Leverage | Up to 1:1000 |

Trading Platforms & Apps | MetaTrader 4 (MT4) |

MTrading Pros and Cons

Check the table below to understand the benefits and drawbacks of trading with MTrading broker.

Pros | Cons |

Low minimum deposit requirement | No regulation from tier-1 authorities |

Leverage up to 1:1000 | MT5 platform not supported |

Copy trading functionality | $50 monthly inactivity fee |

Segregated client funds | Limited regulatory oversight |

PrimeXTB

PrimeXBT is a multi-asset trading platform that provides access to Forex, 100+ CFD instruments, and both Spot and Futures Cryptocurrency markets through a web-based interface and mobile applications.

Established in 2018, the broker operates under several regulatory frameworks, including oversight from FSA, FSCA, the Financial Services Commission of Mauritius (FSC), and Lithuania’s FCIS registry, enabling service coverage across multiple jurisdictions.

The platform supports Standard and Demo account types with a minimum deposit requirement of $15. Users can trade via a proprietary WebTrader environment, mobile app, or MetaTrader 5 (MT5) through a partner entity.

PrimeXBT offers market execution with spreads starting from 0.1 pips and leverage of up to 1:1000, depending on the asset class and client profile.

Cryptocurrency Futures trading integrates TradingView charting tools, with maker and taker fees of 0.01% and from 0.02%, respectively.

Available funding methods after completing the PrimeXBT registration include Visa and Mastercard, international bank wire transfers, selected e-wallets such as Perfect Money and Volet, and digital assets including BTC, ETH, LTC, and USDT.

While account setup and maintenance fees are not applied, certain withdrawal requests may incur blockchain or voucher-based transaction costs.

PrimeXBT also incorporates Copy Trading functionality, allowing strategy replication across asset classes such as Forex, Commodities, Indices, and Crypto.

Additional features include support for stop-loss and take-profit orders, seasonal promotional programs, PAMM access, and 24/7 customer service via live chat and email.

Overall, PrimeXBT utilizes a commission-light pricing model and consolidated platform architecture, where trading costs are reflected through spreads or asset-specific fee structures rather than uniform commission schedules.

Account Types | FSA, FSCA, FCIS, FSC, BCR |

Regulating Authorities | $15 |

Minimum Deposit | Visa/Mastercard, Bank Wire Transfer, E-Wallets, Crypto (BTC, ETH, LTC, USDT) |

Deposit Methods | Visa/Mastercard, Bank Cards, E-Wallets, Crypto |

Withdrawal Methods | Up to 1:1000 |

Maximum Leverage | Proprietary WebTrader, Mobile App, MetaTrader 5 (MT5) |

Trading Platforms & Apps | FSA, FSCA, FCIS, FSC, BCR |

PrimeXTB Pros and Cons

The following table contains the advantages and disadvantages of trading with the PrimeXBT broker.

Pros | Cons |

Low minimum deposit requirement ($15) | No Tier-1 regulatory oversight |

Access to Forex, CFDs, and Crypto Futures markets | MT5 available only via partner entity |

Leverage up to 1:1000 for margin trading | Limited transparency in fee structure |

Integrated Copy Trading functionality | Fewer account type options compared to multi-tier brokers |

What is Scalping?

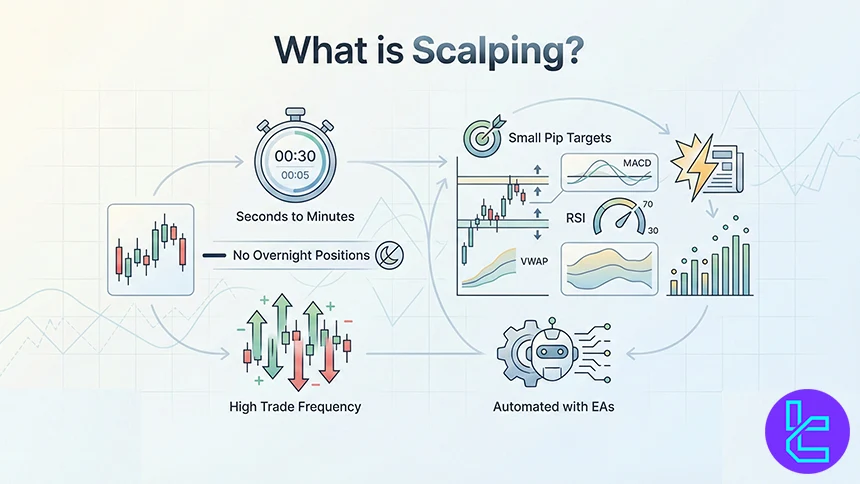

Scalping strategy is a short-term trading methodology focused on extracting incremental gains from minor price fluctuations across highly liquid markets such as Forex.

The approach is built around executing a large number of trades within compressed timeframes, typically between a few seconds and several minutes, with each position targeting limited pip movement before being closed.

Positions are rarely held beyond the intraday session, as overnight exposure contradicts the strategy’s risk framework.

This technique is grounded in the statistical observation that small market movements occur more frequently than extended directional trends.

As a result, traders aim to accumulate returns through repeated execution rather than relying on a single large price move.

Maintaining predefined entry and exit thresholds is essential, requiring strict trade management and continuous market observation throughout the trading session.

To streamline execution, some participants integrate Expert Advisors (EAs) to automate order placement and monitoring.

Analytical models commonly used in scalping environments include price action analysis based on candlestick formations, support and resistance zones, and chart patterns supplemented by Multi-Timeframe Analysis.

Momentum-based setups may incorporate technical indicators such as Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), Stochastic Oscillator, or Parabolic SAR to identify short-term trend acceleration or reversal points.

In range-bound environments, tools like Bollinger Bands or Volume Weighted Average Price (VWAP) assist in detecting oscillations between defined price levels.

News-driven execution models focus on volatility spikes following macroeconomic releases, where tick volume and Volume Price Analysis (VPA) can signal abrupt shifts in buying or selling pressure.

Pros and Cons of Scalping

The table below showcases the most important benefits and drawbacks of using scalping in financial markets.

Pros | Cons |

Eliminates overnight market exposure by closing trades within the same trading session, reducing gap risk associated with after-hours price movements. | Intensive trade frequency increases psychological pressure and may lead to cognitive fatigue over extended trading periods. |

Provides frequent entry and exit setups in highly liquid markets such as Forex due to continuous micro price fluctuations. | Accumulation of minor execution errors can materially affect overall performance in high-frequency trading environments. |

Aligns with traders who operate efficiently in fast-paced, short-term decision-making conditions using intraday strategies. | Requires low-latency infrastructure, stable internet connectivity, and rapid order execution systems for optimal implementation. |

Enables systematic intraday participation without prolonged capital exposure to macroeconomic or geopolitical events. | Transaction-related costs, including spreads and commissions, may significantly impact net returns when executing numerous trades. |

Eliminates overnight market exposure by closing trades within the same trading session, reducing gap risk associated with after-hours price movements. | Intensive trade frequency increases psychological pressure and may lead to cognitive fatigue over extended trading periods. |

Only professional traders who have mastered capital management strategies must use scalping to trade Forex.

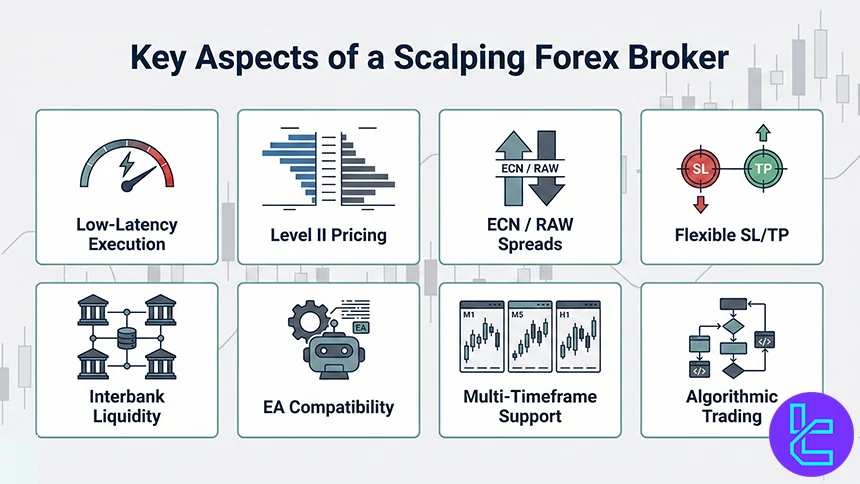

What Are Important Aspects in a Scalping Forex Broker?

For scalping-focused strategies in the Forex market, broker infrastructure plays a critical role in execution quality and cost efficiency.

One of the primary considerations is access to low-latency order execution, as delays can increase slippage and distort entry or exit pricing in fast-moving intraday conditions.

Brokers that provide Level 2 pricing or direct connectivity to interbank liquidity pools are generally more suitable for short-term trading environments.

Equally important are competitive spreads and commission structures. Since scalping typically targets marginal price movements, often below one pip, trading costs such as spreads and per-lot commissions can directly influence trade viability.

Cost-efficient pricing models, especially those aligned with ECN or RAW execution, tend to be more compatible with high-frequency strategies.

Order management flexibility is another key requirement. Scalpers frequently rely on stop-loss and take-profit orders to manage risk exposure across multiple intraday positions.

A broker that allows unrestricted placement of SL/TP levels, without minimum distance constraints or holding-time limitations, supports more precise trade management.

Additionally, platform compatibility with technical indicators and automated systems such as Expert Advisors (EAs) can enhance execution consistency.

Integration with platforms that support multi-timeframe analysis and algorithmic trading tools enables traders to streamline short-duration setups.

Do All Forex Brokers Allow Scalping?

Not all Forex brokers permit scalping as part of their trading conditions. This restriction is often linked to the broker’s execution model, particularly in Market Maker environments where the firm acts as the counterparty to client positions.

In such setups, high-frequency trading strategies like scalping may increase internal risk exposure, especially when traders attempt to capitalize on short-lived price inefficiencies.

Scalping typically involves submitting a large number of orders within very short timeframes, which can place additional strain on trading infrastructure, including pricing engines and order-matching systems.

In some cases, excessive order flow may affect execution speed or lead to technical bottlenecks during peak volatility.

Instead of implementing a direct ban, certain brokers introduce limitations such as minimum trade duration requirements or caps on the number of transactions per session.

These conditions can indirectly impact the feasibility of scalping strategies. As a result, reviewing execution policies, latency thresholds, and order management rules is essential before applying short-term trading techniques on any given Forex platform.

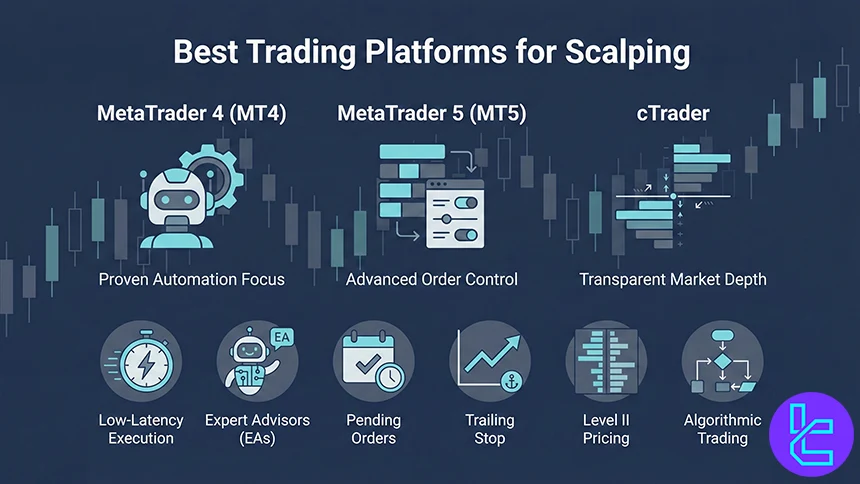

Best Trading Platforms for Scalping

Efficient Forex scalping depends heavily on trading platforms capable of processing high-frequency orders with minimal latency while supporting advanced technical analysis and automation.

Among the commonly used environments, MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader each provide infrastructure aligned with short-term trading strategies.

- MetaTrader 4: MT4 remains widely adopted due to its stable architecture and compatibility with Expert Advisors (EAs), enabling algorithmic execution based on predefined scalping logic;

- MetaTrader 5: MT5 expands on this framework by offering additional order types, including pending and trailing stop orders, alongside access to a broader range of asset classes such as commodities and equities;

- cTrader: The cTrader platform on the other hand, incorporates Level II pricing, allowing traders to assess market depth and liquidity more effectively.

Each platform addresses key operational requirements of scalping, including execution speed, order control, and automation capabilities.

Selecting between MT4, MT5, or cTrader typically depends on the trader’s preference for asset coverage, interface design, and algorithmic customization options.

Who Should Use Scalping to Trade Forex?

Due to the rapid execution cycle and limited margin for analytical delay, this approach is more commonly associated with experienced market participants rather than occasional or entry-level traders.

From a behavioral standpoint, effective scalpers tend to rely on predefined execution frameworks that prioritize immediate risk control.

The ability to close positions after marginal price movements (often measured in only a few pips) requires strict adherence to trade plans without deviation caused by emotional responses such as fear or overconfidence.

Operationally, this strategy demands rapid judgment in live market environments where trade opportunities may last only seconds.

As a result, participants must be capable of initiating or exiting positions without extended confirmation, particularly when working within lower timeframes where volatility can shift direction quickly.

Sustained attention is another critical factor, as scalping often involves monitoring price action across multiple charts throughout an active trading session.

This level of concentration becomes especially relevant in high-liquidity periods when order flow and bid-ask dynamics change continuously.

Despite the fast execution nature of Forex scalping, patience remains a core requirement. Traders must selectively engage with setups that meet predefined probability criteria rather than reacting to every short-term fluctuation.

Maintaining composure under these conditions is essential, particularly when consecutive outcomes may occur within a compressed timeframe, increasing both cognitive load and emotional pressure.

What is the Best Forex Trading Account for Scalping?

Selecting an appropriate Forex trading account for scalping depends largely on execution infrastructure, pricing model, and order-handling environment rather than promotional account labels.

In practice, Raw Spread, ECN, or Pro accounts are more compatible with scalping strategies.

They typically provide access to tighter bid-ask spreads sourced from Liquidity Providers via Straight Through Processing (STP) or Electronic Communication Network (ECN) routing.

These account types are commonly deployed on platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, where low-latency execution, Level II market depth, and support for algorithmic trading is available.

Scalping-oriented accounts generally feature floating spreads starting from 0.0 pips on major currency pairs like EUR/USD, alongside commission-based pricing structures that allow traders to isolate transaction costs more transparently.

Compatibility with One-Click Trading, VPS hosting, and FIX API connectivity may also be significant for strategies relying on high-frequency order placement across M1 or M5 timeframes.

In addition, accounts that allow unrestricted Stop-Loss and Take-Profit placement, hedging functionality, and support for custom indicators such as MACD, RSI, VWAP, and Bollinger Bands are often better suited for short-duration trade management.

From a structural perspective, the presence of Market Execution, absence of requotes, and minimal slippage (particularly during periods of elevated liquidity in sessions like London or New York) can materially influence scalping performance.

As such, the best Forex account for scalping is typically defined by execution speed, spread consistency, and integration with real-time analytical tools rather than by leverage alone.

The table below helps you understand the differences of these account types for Scalping.

Parameter | Raw Spread | ECN | STP |

Order Routing | Direct to interbank liquidity; orders matched on network | Direct to interbank liquidity; orders matched on network | Routed to liquidity providers (banks, brokers) |

Spread Type | Raw Spreads | Variable spreads | Variable spreads (aggregated) |

Commission | Yes (per trade) | Yes (per trade) | Sometimes none; markup in spreads |

Conflict of Interest | Minimal | Minimal | Minimal |

Transparency | High (real market pricing) | High (real market pricing) | Moderate |

Execution Speed | Fast (direct matching) | Fast (direct matching) | Fast |

Market Access | Full interbank access | Full interbank access | Access via LPs |

Conclusion

Based on the TradingFinder expert review of the top brokers for Scalping, PrimeXBT, Exness, Amega, MTrading, Drawinex, and FreshForex are the best available options to choose.

Now traders must open a demo account and trade in their preferred broker to examine the execution times, minimum spreads (from 0.0 pips), maximum leverage (up to 1:2000), and more to choose the best one.

All brokers have been assessed based on various factors mentioned in the TradingFinder Forex methodology.