![Standard Deviation Levels Indicator (STV Levels) for MT4 Download – Free – [TradingFinder]](https://cdn.tradingfinder.com/image/316450/11-74-en-stv-levels-mt4-01.webp)

![Standard Deviation Levels Indicator (STV Levels) for MT4 Download – Free – [TradingFinder] 0](https://cdn.tradingfinder.com/image/316450/11-74-en-stv-levels-mt4-01.webp)

![Standard Deviation Levels Indicator (STV Levels) for MT4 Download – Free – [TradingFinder] 1](https://cdn.tradingfinder.com/image/316445/11-74-en-stv-levels-mt4-02.webp)

![Standard Deviation Levels Indicator (STV Levels) for MT4 Download – Free – [TradingFinder] 2](https://cdn.tradingfinder.com/image/316447/11-74-en-stv-levels-mt4-03.webp)

![Standard Deviation Levels Indicator (STV Levels) for MT4 Download – Free – [TradingFinder] 3](https://cdn.tradingfinder.com/image/316446/11-74-en-stv-levels-mt4-04.webp)

The Standard Deviation Levels Indicator is one of the level and price action indicators in MetaTrader 4, which determines levels based on standard deviation.

This indicator helps traders identify key support and resistance zones by plotting potential levels in price action.

Standard Deviation Levels Indicator Table

Below are the general specifications of the indicator:

Indicator Categories: | Price Action MT4 Indicators Trading Assist MT4 Indicators Levels MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Entry and Exit MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Intraday MT4 Indicators Scalper MT4 Indicators |

Trading Instruments: | Share Stocks MT4 Indicators Indices Market MT4 Indicators Stock Market MT4 Indicators Forex MT4 Indicators |

Overview of the Indicator

The Standard Deviation Levels Indicator is a powerful and practical tool for traders looking to identify price reaction levels in the market. By drawing three lines above the central level and three lines below it, the indicator allows traders to use these levels as support or resistance. This structure simplifies market analysis and enhances trading strategies.

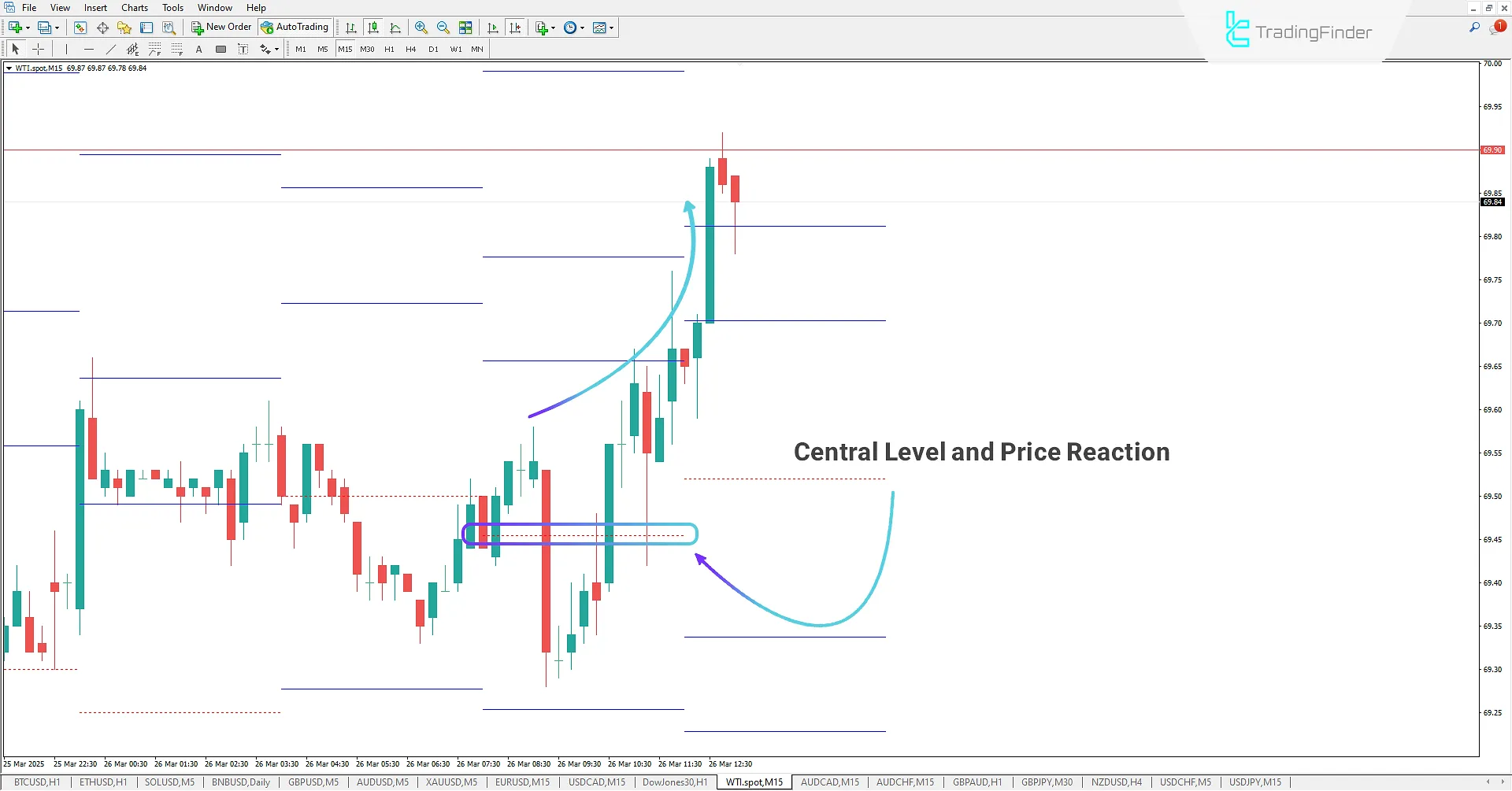

Standard Deviation Levels in an Uptrend

In the 15-minute chart of Texas Crude Oil, the price entered a strong uptrend after breaking the central level upward. Traders can utilize the Standard Deviation Levels Indicator to identify key levels and use them as support or resistance while also setting take profit and stop loss levels.

After breaking the central level, the price pulled back to retest it, where it acted as a strong support, ultimately pushing the price higher with more momentum.

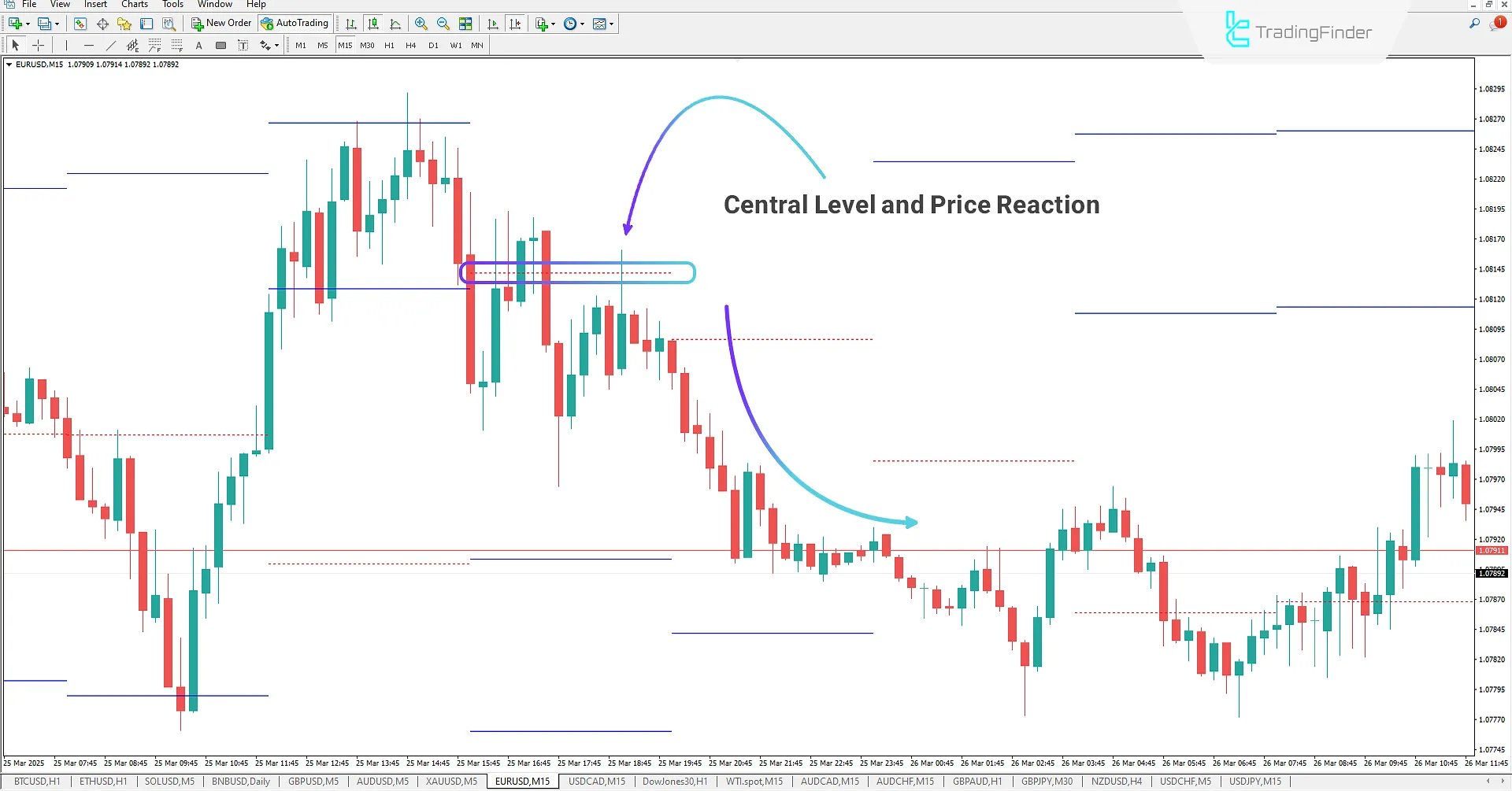

Standard Deviation Levels in a Downtrend

In the 15-minute chart of the EUR/USD pair, the price broke below the central level drawn by the Standard Deviation Levels Indicator. After this break, the price pulled back upwards, retested the central level, and then continued downward.

Traders can use this indicator to identify key levels and base their sell trades on these levels, helping them execute their Trading strategies effectively.

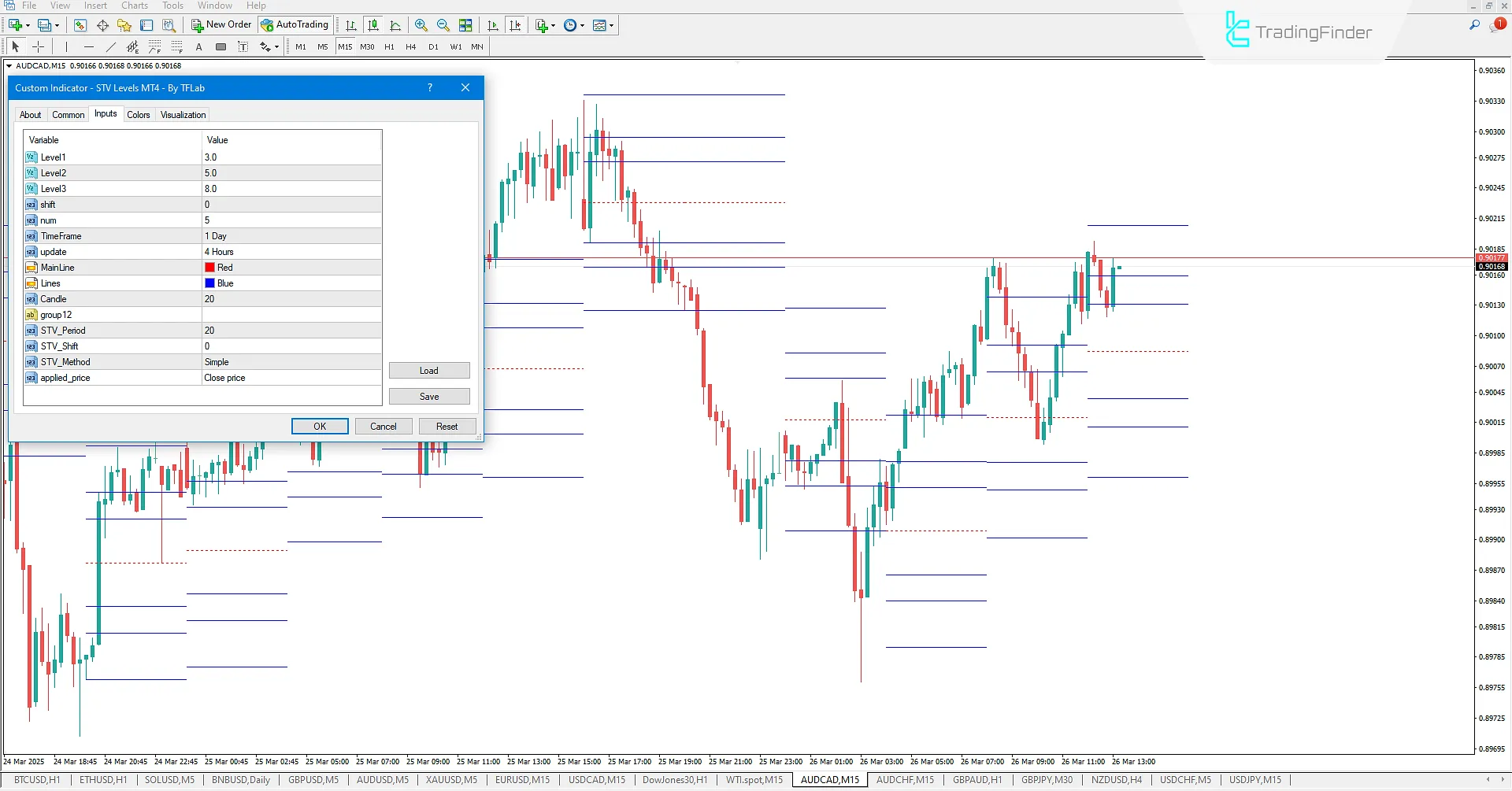

Standard Deviation Levels Indicator Settings

Below are the settings for the Standard Deviation Levels Indicator:

- Level 1: Settings for the first level (highest level);

- Level 2: Settings for the second level (middle level);

- Level 3: Settings for the third level (lowest level);

- Shift: Adjusts the calculation shift;

- Num: Sets the number of candles for calculations in the selected timeframe;

- Time Frame: Selects the calculation timeframe;

- Update: Sets the update interval for levels;

- Main Line: Sets the color of the central level;

- Lines: Adjusts the color of calculated levels;

- Candle: Defines the number of candles displayed for levels based on the timeframe;

- STV Period: Sets the standard deviation calculation period;

- STV Shift: Moves levels left or right based on candle count;

- STV Method: Configures the standard deviation calculation method;

- Applied Price: Defines the price type used for standard deviation calculations.

Conclusion

The Standard Deviation Levels Indicator is a MetaTrader 4 tool that allows traders to conduct deeper technical analyses by using plotted levels.

It helps traders identify key price reaction levels, enabling them to determine optimal entry and exit points.

Standard Deviation Levels STV MT4 PDF

Standard Deviation Levels STV MT4 PDF

Click to download Standard Deviation Levels STV MT4 PDFWhat is the Standard Deviation Levels Indicator?

This indicator is designed for MetaTrader 4 and uses standard deviation calculations to identify potential support and resistance levels on a chart. These levels help traders recognize price reaction zones more effectively.

How does this indicator work?

The Standard Deviation Levels Indicator plots three levels above the central price and three levels below it. These levels are considered potential price reversal points.