![ACD Indicator for MetaTrader 5 Download - Free - [TF Lab]](https://cdn.tradingfinder.com/image/104930/10-13-en-acd-mt5.webp)

![ACD Indicator for MetaTrader 5 Download - Free - [TF Lab] 0](https://cdn.tradingfinder.com/image/104930/10-13-en-acd-mt5.webp)

![ACD Indicator for MetaTrader 5 Download - Free - [TF Lab] 1](https://cdn.tradingfinder.com/image/2673/10-13-en-acd-indicator-mt5-02.avif)

![ACD Indicator for MetaTrader 5 Download - Free - [TF Lab] 2](https://cdn.tradingfinder.com/image/2674/10-13-en-acd-indicator-mt5-03.avif)

![ACD Indicator for MetaTrader 5 Download - Free - [TF Lab] 3](https://cdn.tradingfinder.com/image/2675/10-13-en-acd-indicator-mt5-04.avif)

The ACD indicator is a technical analysis tool in MetaTrader 5 developed by Mark Fisher and can also be used as a trading strategy. This tool is highly suitable for detecting daily price trends.

The way this indicator works is by defining theOpening Range in the 1-hour timeframe before the opening of major markets (Tokyo, London, New York) and then displaying the levels (A up - A down) and (C up - C down) on the chart.

Traders can make trading decisions based on price breaking through the(A up) and (A down) levels.

Indicator Table

Indicator Categories: | Price Action MT5 Indicators Supply & Demand MT5 Indicators Levels MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Range MT5 Indicators Breakout MT5 Indicators |

Timeframe: | M1-M5 Timeframe MT5 Indicators M15-M30 Timeframe MT5 Indicators |

Trading Style: | Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Stock MT5 Indicators Commodity MT5 Indicators |

In the image below, the price chart of the AUDUSD currency pair is shown in a 5-minute time frame. On August 6, during the London session, with the break of the (A down) level and 7 minutes of stabilization below it, a sell signal and the start of a bearish move are issued.

Also, during the New York session the same day, the price broke above the (A up) level and stabilized for 7 minutes, indicating the start of a bullish trend and entry into a buy trade.

Overview

The ACD indicator is calculated based on the range area before the opening of the main markets (Asia - Europe - America) and predicts the possible trend of each session with the breakout of the obtained levels (A up - A down).

These areas' importance lies in their hidden MetaTrader5 Supply and Demand indicator levels. This trading system is highly applicable in volatile symbols where liquidity and trading volume increase with the opening of different markets.

Bullish Signal Conditions of the Indicator (Bullish Setup)

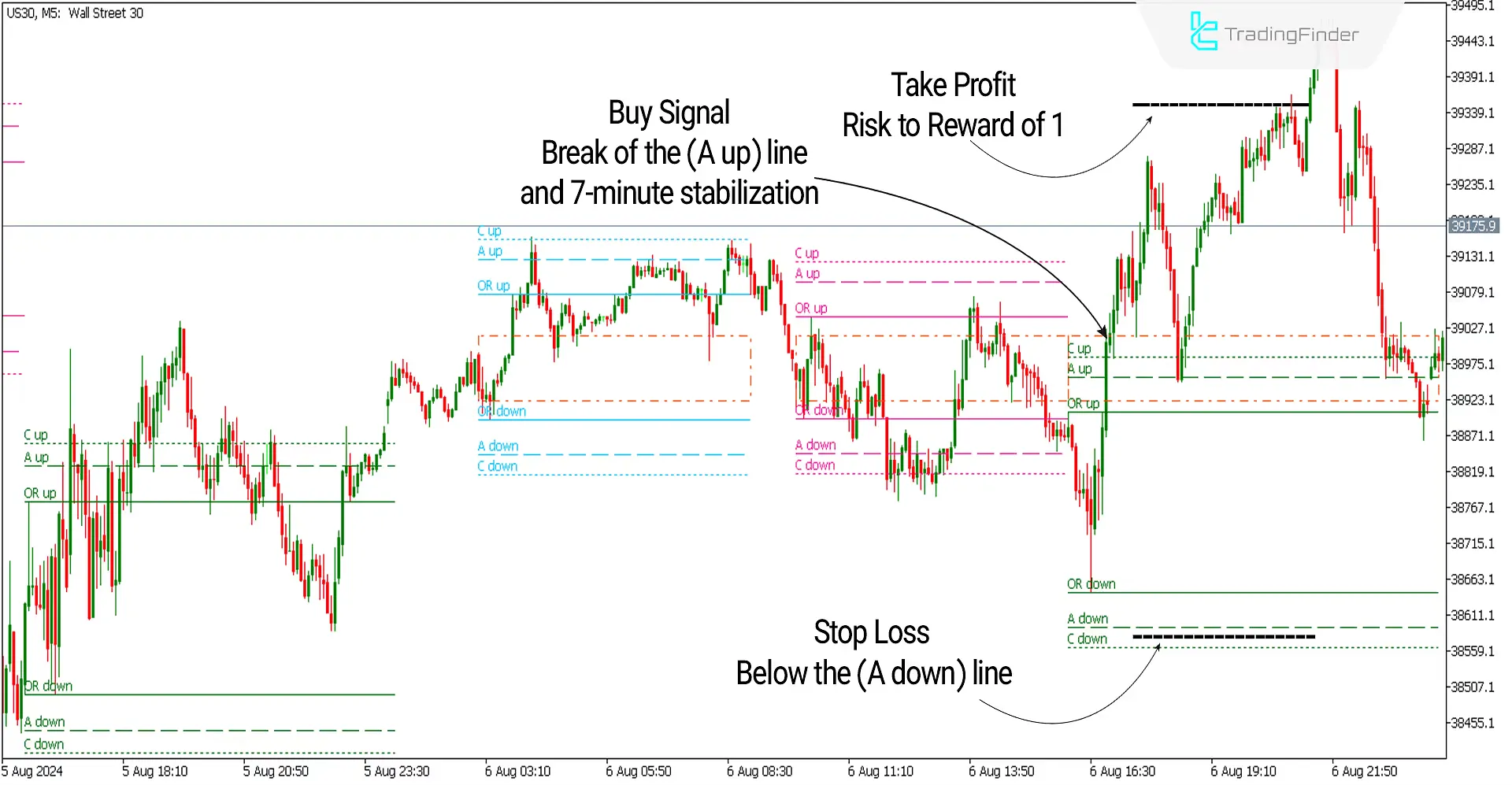

In the image below, the Dow Jones Index (US30) price chart is shown in a 5-minute time frame. The (A up) line has been broken strongly and stabilized on it for 7 minutes. This stabilization prevents traders from falling into the trap of Fake Breakouts. Then, one can enter a buy trade.

Take Profit and Stop Loss for Buy Trades of the ACD Indicator

After entering the trade, the stop loss can be set below the (A down) line, and the Reward-risk ratio for this strategy is 1, which can be used to set the take profit.

Bearish Signal Conditions of the Indicator (Bearish Setup)

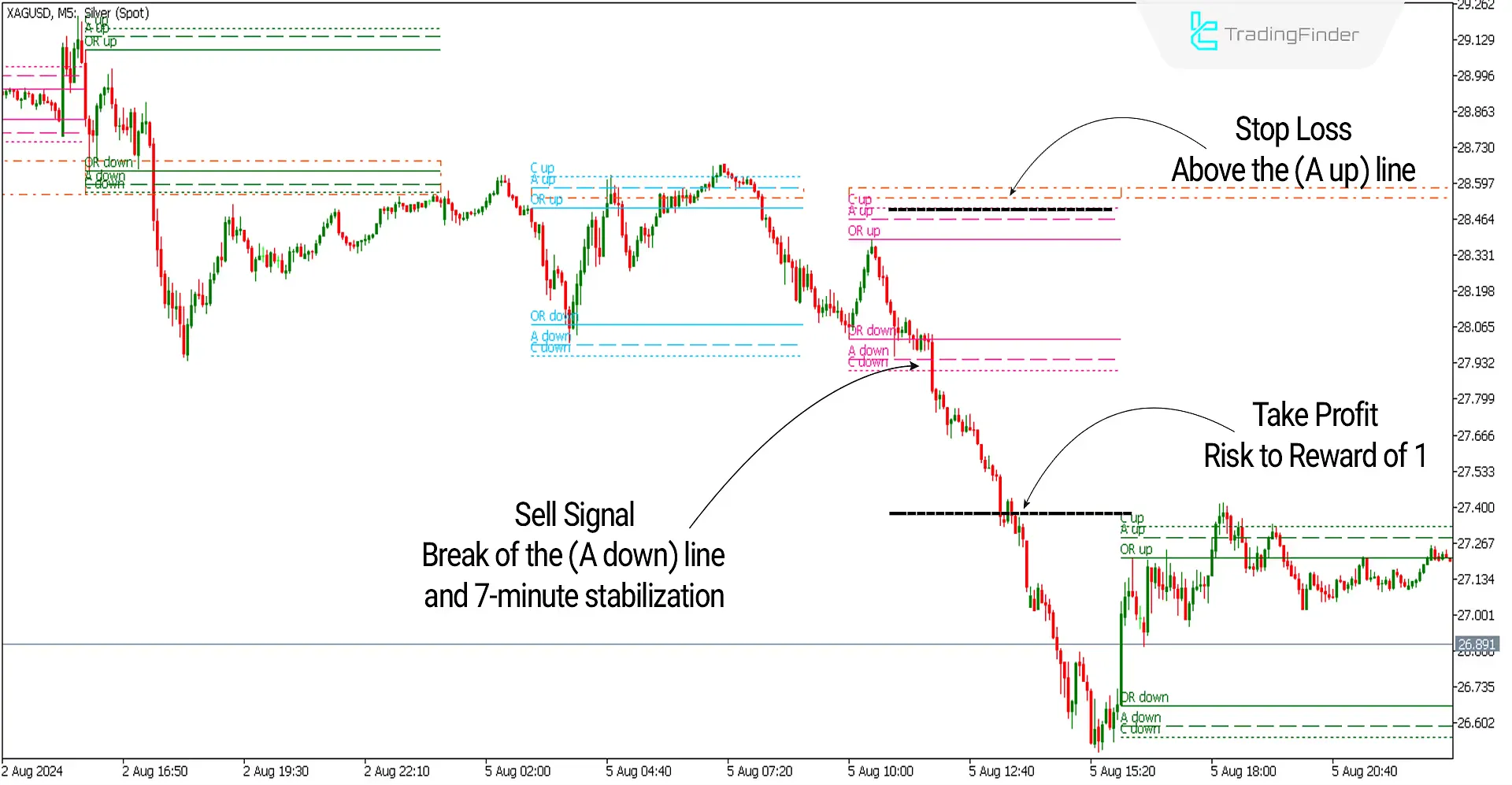

In the image below, the price chart of Global Silver (XAGUSD) is shown in a 5-minute time frame. The (A down) line has been broken strongly and stabilized below it for 7 minutes. This stabilization prevents traders from falling into the trap of Fake Breakouts. Then, one can enter a sell trade.

Take Profit and Stop Loss for Sell Trades of the ACD Indicator

After entering the trade, the stop loss can be set below the (A down) line, and the Reward-risk ratio for this strategy is 1, which can be used to set the take profit.

ACD Indicator Settings

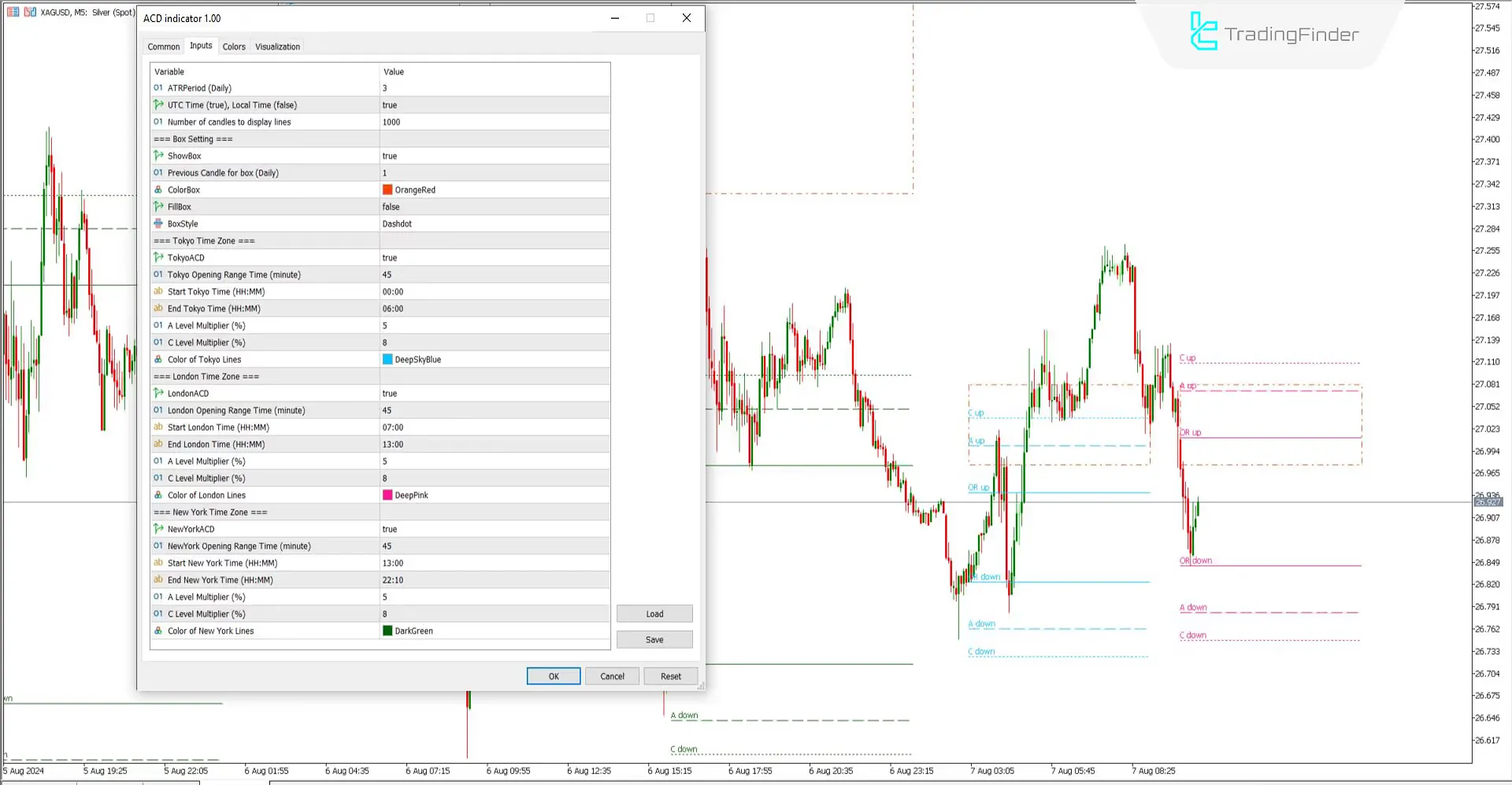

- ATR Period (Daily): Default value for calculations in the daily time frame is 3

- UTC Time (true) Local Time (false): Set TRUE to consider UTC time

- Number of candles to display lines: Considers 1000 candles back for calculations

- ShowBox: Set to True

- Previous Candle for box (Daily): Considers the previous daily candle for calculations

- ColorBox: OrangeRed color displayed on the chart

- FillBox: Set to false for a hollow box

- BoxStyle: Set to Dashdot

- TokyoACD: Set to True

- Tokyo Opening Range Time (minute): Consider High and Low in the first 45 minutes of the Tokyo session

- Start Tokyo Time (HH): Start of the Tokyo session is at 00:00

- End Tokyo Time (HH): End of the Tokyo session is at 06:00

- A Level Multiplier (%): The percentage distance of the A lines is 5

- C Level Multiplier (%): The percentage distance of the C lines is 8

- Color of Tokyo Lines: Tokyo session color is blue or as desired

- LondonACD: Set to True

- London Opening Range Time (minute): Consider High and Low in the first 45 minutes of the London session

- Start London Time (HH): Start of the London session is at 07:00

- End London Time (HH): End of the London session is at 13:00

- A Level Multiplier (%): The percentage distance of the A lines is 5

- C Level Multiplier (%): The percentage distance of the C lines is 8

- Color of London Lines: London session color is pink or as desired

- NewYorkACD: Set to True

- New York Opening Range Time (minute): Consider High and Low in the first 45 minutes of the New York session

- Start New York Time (HH): Start of the New York session is at 13:00

- End New York Time (HH): End of the New York session is at 22:10

- A Level Multiplier (%): The percentage distance of the A lines is 5

- C Level Multiplier (%): The percentage distance of the C lines is 8

- Color of New York Lines: New York session color is yellow or as desired

Conclusion

This ACD indicator and strategy suits scalpers and day traders looking for high-potential levels for their trades.

This indicator, like Metatrader5 support and resistance indicators, identifies possible daily support and resistance levels that have the potential to break with the opening of different markets, and it can be used to select suitable entry and exit points for trades.

ACD MT5 PDF

ACD MT5 PDF

Click to download ACD MT5 PDFIs the ACD Indicator applicable in all markets?

The ACD Indicator can be used in various markets, including forex, commodities, and stocks.

What are the benefits of using the ACD Indicator?

Practically speaking, the ACD Indicator serves as a specific trading strategy, equipping traders with reliable entry and exit points.