![Cumulative Delta Indicator for MT5 - Download - [TradingFinder]](https://cdn.tradingfinder.com/image/294344/2-26-en-cumulative-delta-mt5-1.webp)

![Cumulative Delta Indicator for MT5 - Download - [TradingFinder] 0](https://cdn.tradingfinder.com/image/294344/2-26-en-cumulative-delta-mt5-1.webp)

![Cumulative Delta Indicator for MT5 - Download - [TradingFinder] 1](https://cdn.tradingfinder.com/image/294337/2-26-en-cumulative-delta-mt5-2.webp)

![Cumulative Delta Indicator for MT5 - Download - [TradingFinder] 2](https://cdn.tradingfinder.com/image/294349/2-26-en-cumulative-delta-mt5-3.webp)

![Cumulative Delta Indicator for MT5 - Download - [TradingFinder] 3](https://cdn.tradingfinder.com/image/294338/2-26-en-cumulative-delta-mt5-4.webp)

On July 22, 2025, in version 2, alert/notification and signal functionality was added to this indicator

The Cumulative Delta Indicator is one of the MetaTrader 5 volume analysis tools used to measure buy and sell pressure in the market. It compares market order volumes and displays cumulative changes to detect divergence signals.

This MetaTrader5 indicator helps traders identify strong trends, better understand liquidity flow, and confirm price movements.

Cumulative Delta Indicator Specifications Table

Table below outlines the key features of the Cumulative Delta Indicator.

Indicator Categories: | Volume MT5 Indicators Oscillators MT5 Indicators Trading Assist MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Intermediate |

Indicator Types: | Range MT5 Indicators Breakout MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators |

Indicator Overview

Cumulative Delta Indicator is a valuable tool in volume analysis, functioning in two main ways:

· Confirming Major Market Trends: If price and cumulative delta move in the same direction, it indicates that the current trend is strong and sustained.

· Identifying Trading Divergences: A price decline combined with an increasing cumulative delta signals weak selling pressure, while a price increase with a decreasing cumulative delta indicates weak buying pressure.

Uptrend Conditions

The following 5-minute gold (XAU/USD) price chart shows a scenario where the price declines while the cumulative delta increases.

This indicates bullish divergence, meaning selling pressure is weakening, and buyer strength is increasing.

Downtrend Conditions

The price chart below displays the EUR/AUD currency pair in a 5-minute timeframe.

In this indicator, simultaneous price and cumulative delta decline strengthen bearish momentum and weaken buyer interest. This situation may provide an optimal entry point for sell trades.

Indicator Settings

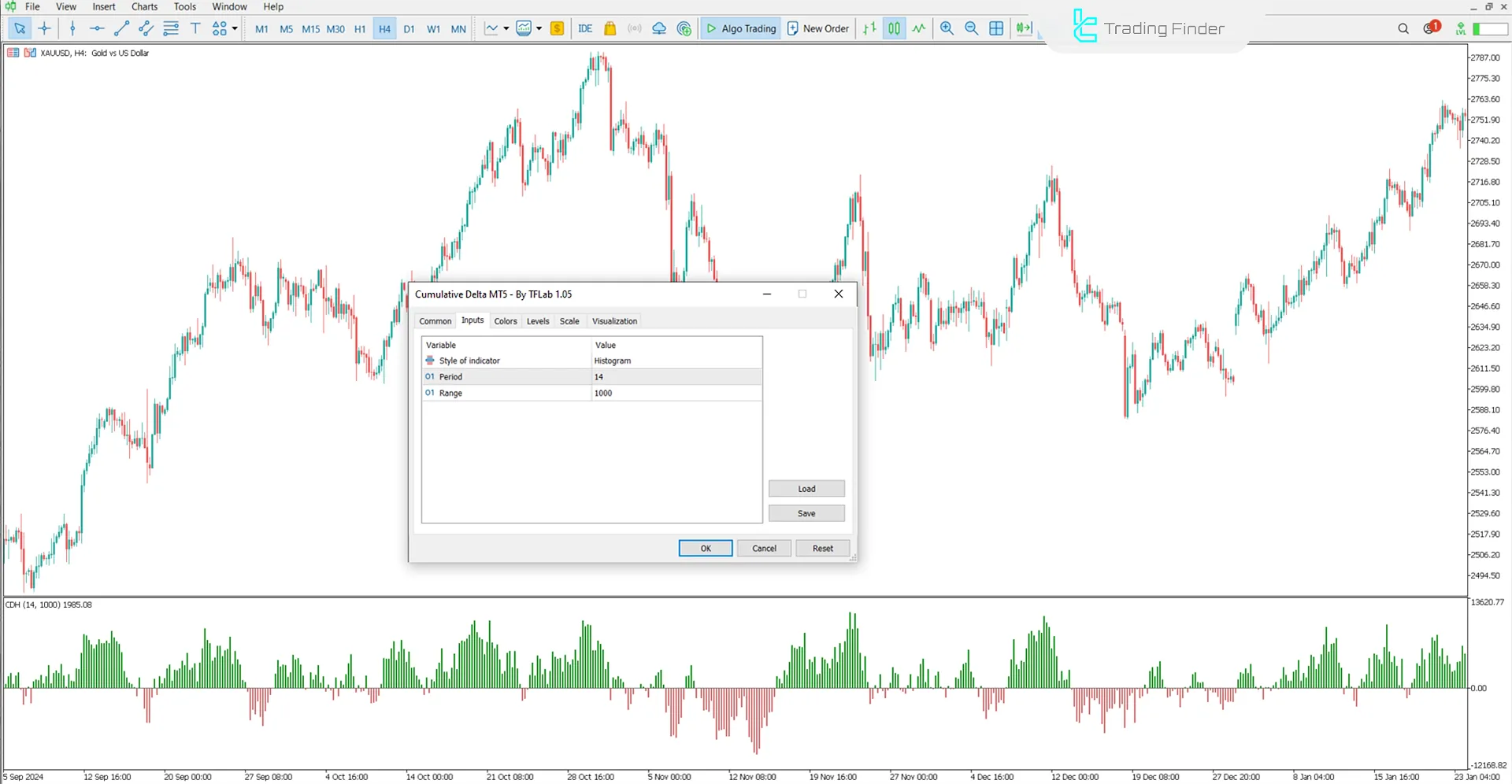

Image below displays the customizable parameters of the Cumulative Delta Indicator:

- Style: Indicator display style

- CDI Period: Cumulative Delta calculation period

- CDI Range: Cumulative Delta calculation range

Conclusion

The Cumulative Delta trading tool is a powerful tool for order flow analysis, allowing traders to evaluate buy and sell pressure in the market.

As an MT5 Volume indicator, it plays a crucial role in trend confirmation, breakout identification, and divergence detection.

Cumulative Delta MT5 PDF

Cumulative Delta MT5 PDF

Click to download Cumulative Delta MT5 PDFWhich markets can the Cumulative Delta Oscillator be used in?

This trading tool is applicable across all financial markets, including Forex, cryptocurrencies, commodities, and more.

Does this indicator only generate signals in short timeframes?

No, the Cumulative Delta Indicator supports multi-timeframe analysis and can be used across all.