![Dynamic Zone RSI Indicator MetaTrader 5 - Free Download [TradingFinder]](https://cdn.tradingfinder.com/image/613067/2-163-en-dynamic-zone-rsi-mt5-1.webp)

![Dynamic Zone RSI Indicator MetaTrader 5 - Free Download [TradingFinder] 0](https://cdn.tradingfinder.com/image/613067/2-163-en-dynamic-zone-rsi-mt5-1.webp)

![Dynamic Zone RSI Indicator MetaTrader 5 - Free Download [TradingFinder] 1](https://cdn.tradingfinder.com/image/613063/2-163-en-dynamic-zone-rsi-mt5-2.webp)

![Dynamic Zone RSI Indicator MetaTrader 5 - Free Download [TradingFinder] 2](https://cdn.tradingfinder.com/image/613056/2-163-en-dynamic-zone-rsi-mt5-3.webp)

![Dynamic Zone RSI Indicator MetaTrader 5 - Free Download [TradingFinder] 3](https://cdn.tradingfinder.com/image/613052/2-163-en-dynamic-zone-rsi-mt5-4.webp)

The Dynamic Zone RSI Indicator, designed based on the Relative Strength Index (RSI) and dynamic bands, is responsible for identifying overbought and oversold areas.

This tool removes the fixed RSI boundaries, analyzes market conditions in real time, and displays entry and exit points in the form of dynamic ranges.

Dynamic Zone RSI Indicator Table

The general specifications of the Dynamic Zone RSI Indicator are presented in the table below:

Indicator Categories: | Oscillators MT5 Indicators Trading Assist MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Overbought & Oversold MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators Commodity MT5 Indicators Indices MT5 Indicators Share Stock MT5 Indicators |

Dynamic Zone RSI Indicator at a Glance

The operation of the Dynamic Zone RSI Indicator is based on the reaction of the RSI line to the dynamic bands, which act as support and resistance levels:

- Crossing of the RSI line above the upper band indicates an overbought condition and increases the probability of a downward reversal or correction;

- A drop of the RSI line below the lower band indicates an oversold condition and the probability of an upward move.

Indicator in Uptrend

In a bullish scenario, when the RSI line moves upward from the oversold area and crosses the lower band, a buy entry signal is generated.

Stabilization of the RSI above the mid-level of the dynamic range confirms the strength of the uptrend.

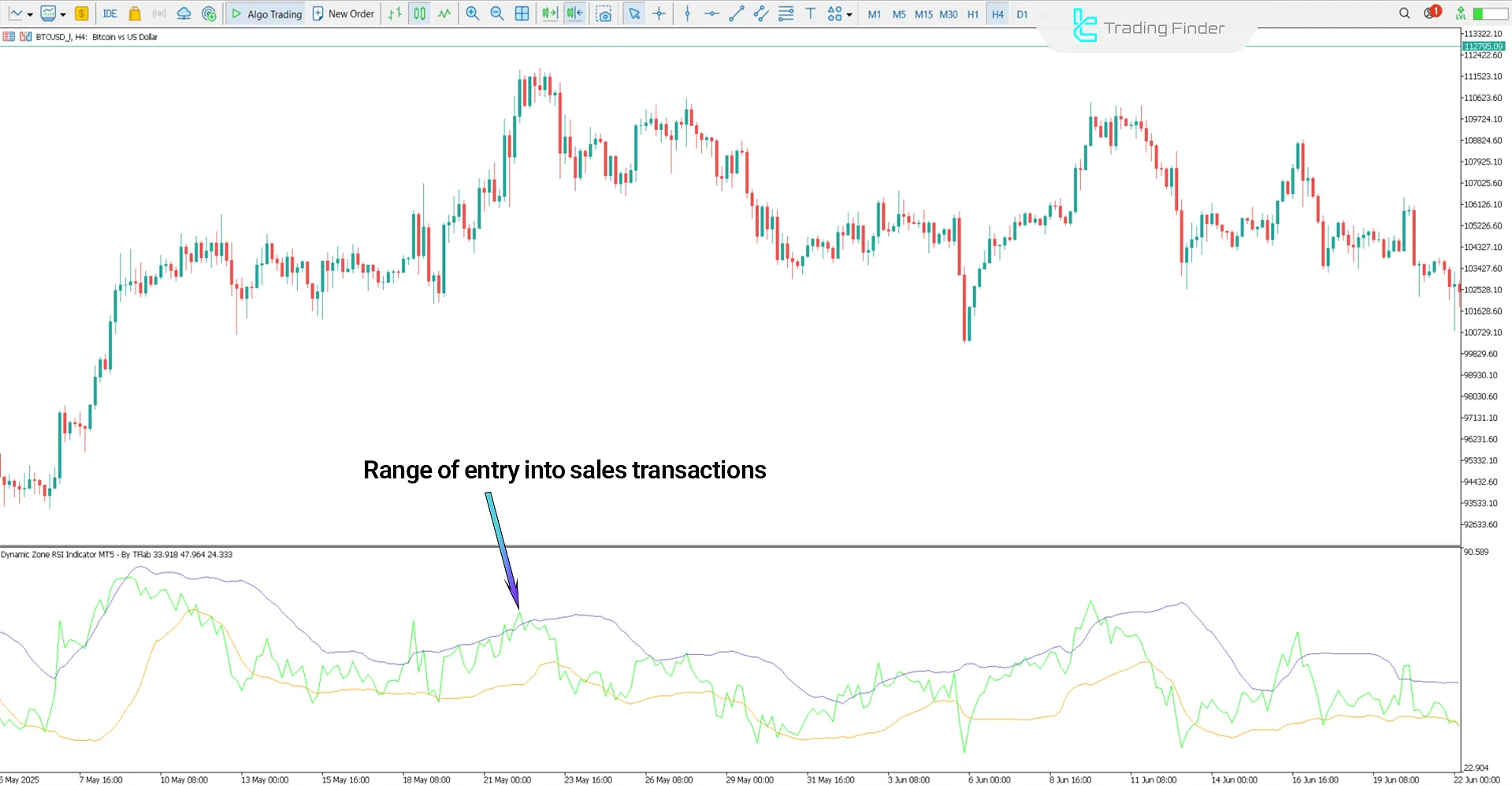

Indicator in Downtrend

In a bearish scenario, when the RSI line moves downward from the overbought area and cuts the upper band, a sell signal is generated.

Stabilization of the RSI below the mid-level of the dynamic range indicates sellers’ pressure and the continuation of the bearish trend.

In addition, a negative divergence between price and RSI reinforces the probability of a market reversal.

Dynamic Zone RSI Indicator Settings

The image below shows the settings panel of the Dynamic Zone RSI Indicator in the MetaTrader 5 platform:

- RSI Period: Display period of the Relative Strength Index

- Bollinger Bands Period: Timeframe of Bollinger Bands

Conclusion

The Dynamic Zone RSI Indicator, by combining the traditional RSI structure with dynamic bands, is considered an advanced tool in technical analysis for identifying key market areas.

This indicator, with adaptability to fluctuations, reduces false signals and displays entry and exit points with greater accuracy.

Dynamic Zone RSI Indicator MetaTrader 5 PDF

Dynamic Zone RSI Indicator MetaTrader 5 PDF

Click to download Dynamic Zone RSI Indicator MetaTrader 5 PDFWhy are dynamic bands important in the Dynamic Zone RSI Indicator?

In this trading tool, dynamic bands are sensitive to market fluctuations and by automatically adjusting the ranges, they increase the accuracy of signal generation.

What is the role of divergence in the Dynamic Zone RSI Indicator?

In this oscillator, positive divergence strengthens the probability of a bullish reversal, while negative divergence increases the probability of a bearish reversal.