![FVG and Void indicator for ICT in MT5 Download - Free - [TradingFinder]](https://cdn.tradingfinder.com/image/107066/10-41-en-fvg-void-mt5.webp)

![FVG and Void indicator for ICT in MT5 Download - Free - [TradingFinder] 0](https://cdn.tradingfinder.com/image/107066/10-41-en-fvg-void-mt5.webp)

![FVG and Void indicator for ICT in MT5 Download - Free - [TradingFinder] 1](https://cdn.tradingfinder.com/image/44258/11-06-en-fvg-void-mt5-02.avif)

![FVG and Void indicator for ICT in MT5 Download - Free - [TradingFinder] 2](https://cdn.tradingfinder.com/image/44255/11-06-en-fvg-void-mt5-03.avif)

![FVG and Void indicator for ICT in MT5 Download - Free - [TradingFinder] 3](https://cdn.tradingfinder.com/image/44265/11-06-en-fvg-void-mt5-04.avif)

The Fair Value Gap and Void (FVG + Void) indicator is designed for ICT style and Smart Money (SMC) traders and uses advanced algorithms to automatically identify and display imbalance zones and FVGs on price charts.

This indicator is developed for the Meta Trader 5 (MT5) platform, displaying bullish FVGs in green and bearish FVGs in brown, helping traders quickly identify these key areas.

When the price returns to these zones, the indicator shows the consumed portion of the zone. Gray areas represent the consumed portion, and the exact amount is displayed as a percentage within the FVG zone, providing valuable information for better trade management and decision-making.

FVG + Void Indicator Table for MT5

Indicator Categories: | Smart Money MT5 Indicators Supply & Demand MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Leading MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Intraday MT5 Indicators Scalper MT5 Indicators Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Indices MT5 Indicators Forward MT5 Indicators |

Indicator at a Glance

The Fair Value Gap and Price Voids (FVG+Void) Indicator features a unique capability that highlights areas with Fair Value Gaps (FVG) on the chart by drawing a box around them.

Additionally, as these gaps are filled, the indicator displays the consumed portion to help traders better analyze the price gap status and make more accurate trading decisions.

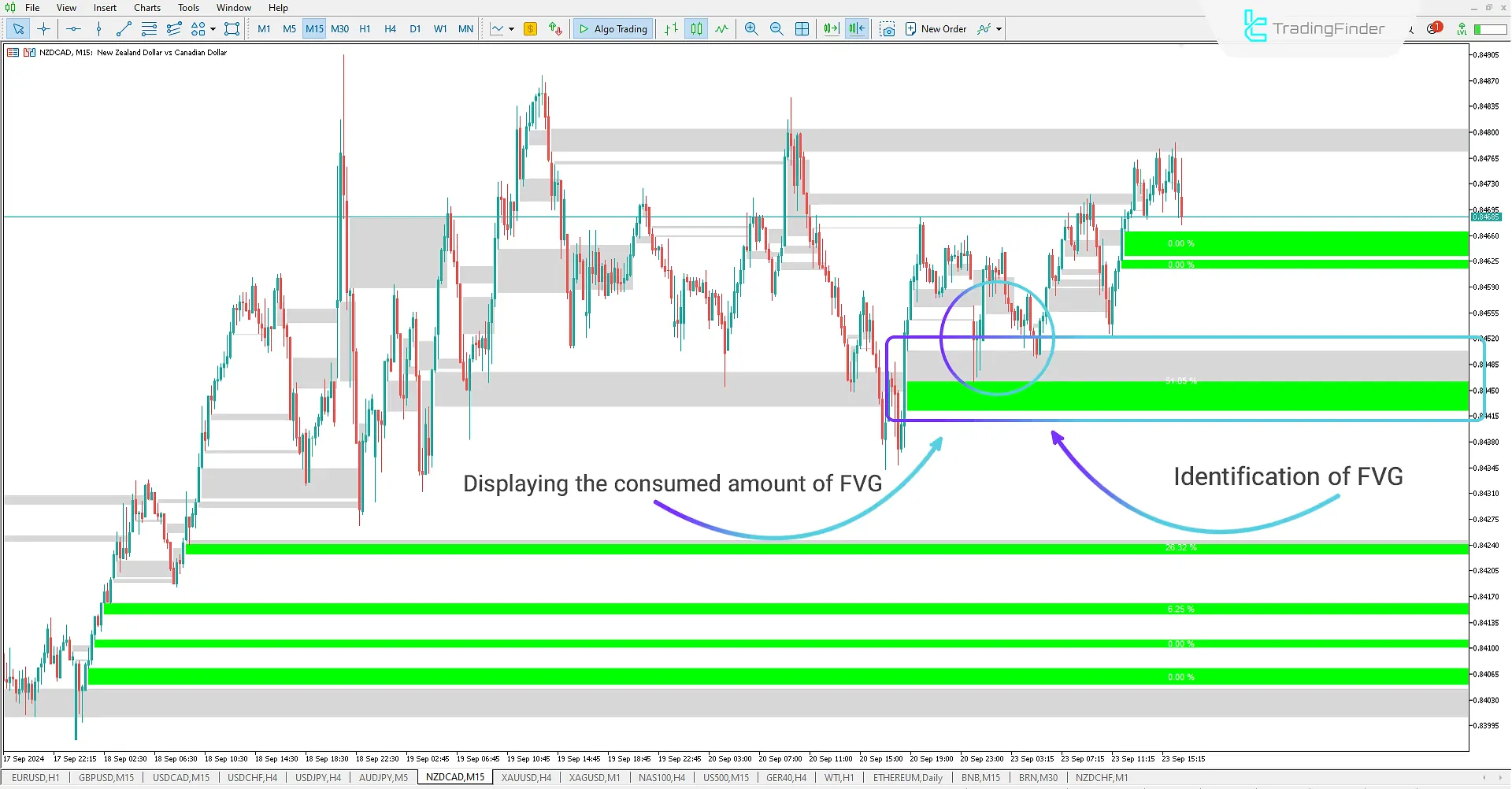

Bullish FVG Identification and Consumption in MT5

The FVG + Void indicator helps traders identify bullish FVG zones by displaying them in green on a bullish trend. In the chart example at the 0.84485 price level, the orders begin to be consumed as the price returns to the FVG zone.

The gray color on the chart indicates this consumption process, and the amount consumed is shown as a percentage inside the FVG zone. This allows traders to analyze the imbalance zone better and assess its potential.

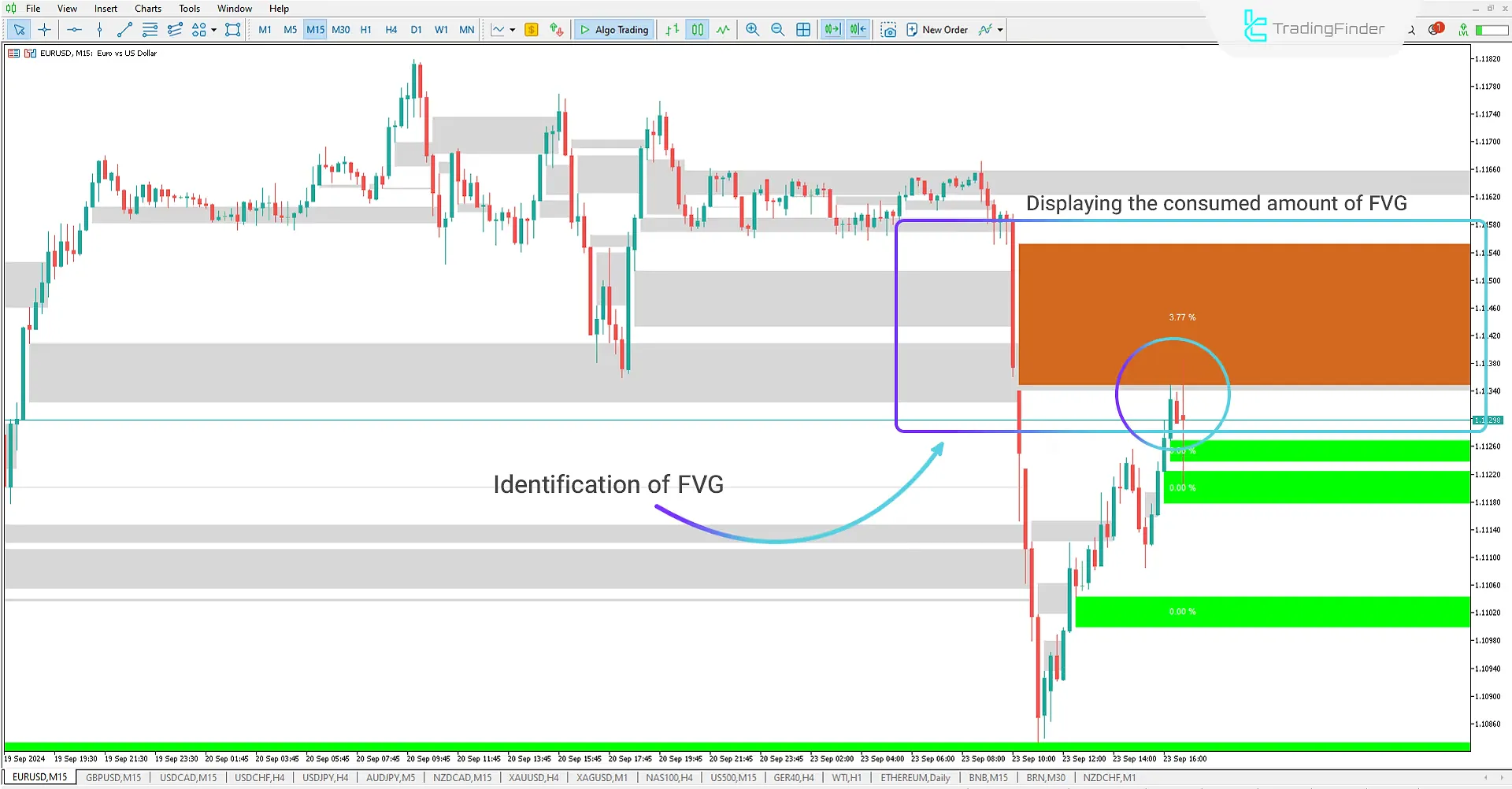

Bearish FVG Identification and Consumption in MT5

A sharp downward movement in the 15-minute EUR/USD chart creates price gap imbalances. The FVG + Void indicator identifies these zones and draws bearish FVG zones in brown.

As the price retraces upward toward these zones, the order consumption begins, and the indicator shows the consumed portion in gray while displaying the percentage consumed within the zone. This visual aid helps traders use these imbalanced areas in their trading decisions.

FVG + Void Indicator Settings for MT5

Display Setting: Customize the display settings

- Color theme of chart and object: Choose the chart theme.

Normal Setting:

- Candles to check at start time: Set the number of candles to check.

- FVG Types: Choose from 6 FVG drawing models: Normal, Very Aggressive, Aggressive, Defensive, Very Defensive, and The furthest or first FVG in the same trend.

FVG Setting:

- Show FVGs: Enable/turn off the display of FVG.

- Show invalidated FVGs: Display invalidated FVGs.

- Show percent of zone usage: Display the percentage of zone consumption.

- FVG Used Area color: Set the color for the consumed FVG area.

Invalid Setting:

- Invalid with a candle close: Invalidate the zone with a candle close.

- Invalid with OB size: Invalidate the zone based on order block size.

- Invalid with OB size value: Invalidate the zone based on the order block size value.

- Invalid with OBs' union: Invalidate the zone based on the union of OBs.

Conclusion

The Fair Value Gap and Void (FVG + Void) indicator is essential for ICT and Smart Money traders looking to identify FVG zones in financial markets. The indicator uses advanced algorithms to draw green rectangles for bullish FVGs and brown rectangles for bearish FVGs on the chart. When the price enters these zones, the order consumption process begins.

The indicator shows the consumed portion in gray and the remaining percentage within the zone, helping traders make better trading decisions based on the potential of these areas.

FVG Void indicator ICT MT5 PDF

FVG Void indicator ICT MT5 PDF

Click to download FVG Void indicator ICT MT5 PDFWhat does "order consumption" mean in this indicator?

When the price enters the FVG zones, the orders in that area start to be consumed. This indicator shows the consumed portion in gray and provides information about the remaining percentage in the zone.

Who is this indicator suitable for?

This tool is ideal for traders interested in advanced technical analysis, ICT, or Smart Money styles and looking to identify and take advantage of price imbalance zones in the market.