TradingView

MetaTrader4

MetaTrader5

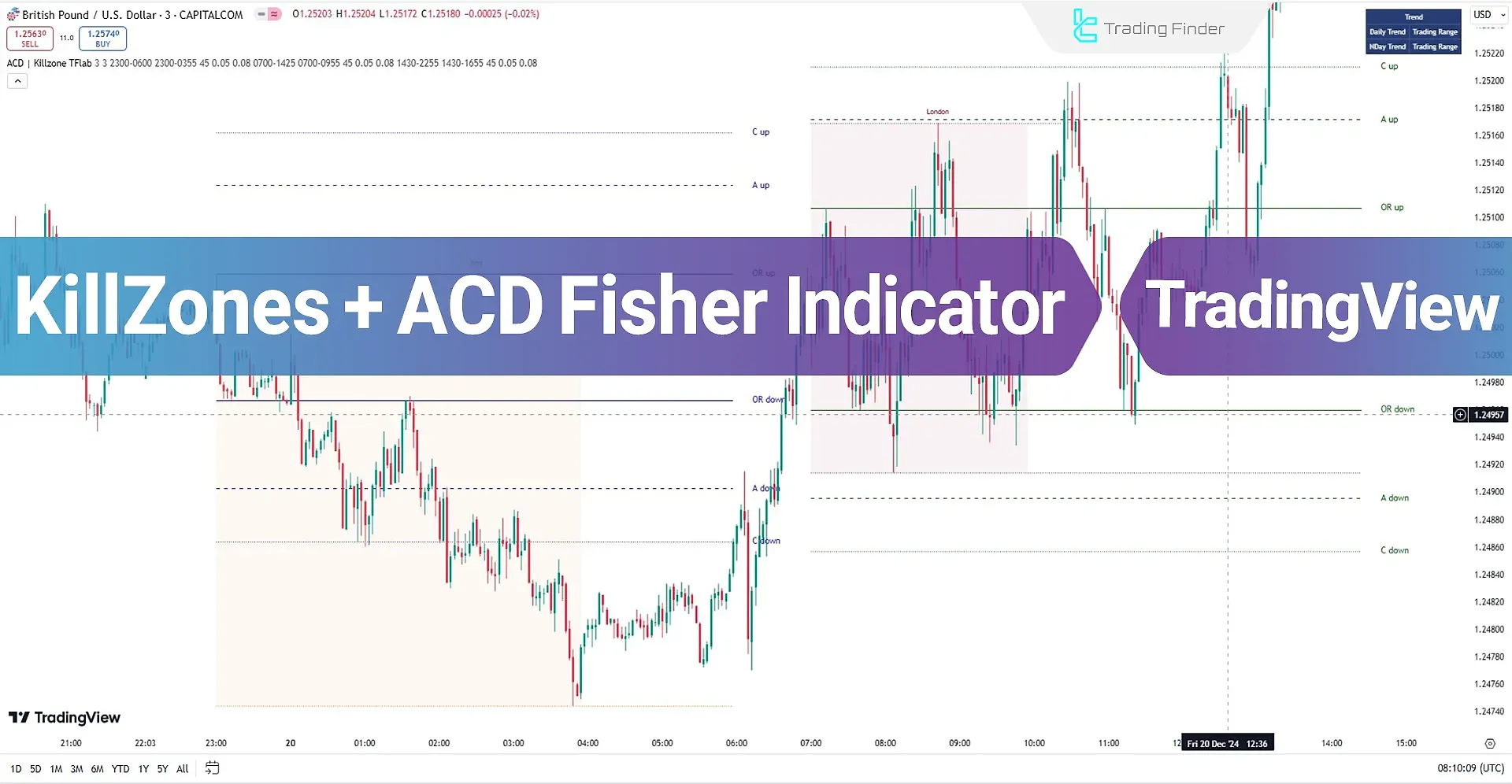

The KillZones+ ACD Fisher Indicator is an advanced hybrid tool developed by Mark Fisher for scalping strategies. It is one of the most widely used indicators on TradingView, specifically designed to display the trading sessions of New York, London, and Asia on charts.

In the ACD method, the A and C levels are calculated using the Opening Range and the Average True Range (ATR). These levels act as key tools for identifying entry and exit points in trades.

Indicator Table

The table below summarizes the specifications of the indicator.

Indicator Categories: | ICT Tradingview Indicators Risk Management Tradingview Indicators Levels Tradingview Indicators Kill Zones Indicators for TradingView |

Platforms: | Trading View Indicators |

Trading Skills: | Advanced |

Indicator Types: | Reversal Tradingview Indicators Breakout Tradingview Indicators |

Timeframe: | M1-M5 Time Tradingview Indicators |

Trading Style: | Day Trading Tradingview Indicators |

Trading Instruments: | TradingView Indicators in the Forex Market Cryptocurrency Tradingview Indicators |

Bullish Trend

In a bullish trend on the EUR/USD chart during the New York session, the price reaches the A up line, showing signs of buyer strength.

Traders enter abuy trade after observing a breakout in the C zone and the price consolidating above it. In this strategy, the stop-loss is logically and cautiously set below the A down line to manage risk in case of a trend reversal.

Bearish Trend

In a bearish trend, a price break below the A down line requires confirmation and price stabilization below this level.

After confirmation, traders entersell trades and manage risk by setting a stop-loss above the A up line.

KillZones + ACD Fisher Indicator Settings

The image below illustrates the settings for the KillZones + ACD Fisher hybrid indicator, which includes sections such as [Global Setting, Pivot Range, etc.]:

Global Setting

- Show More Info: Displays additional information

Pivot Range

- NDay Pivot Range Period: Defines the pivot range period for multiple days

- Show Daily Pivot Range: Displays the daily pivot range

- Show NDay Pivot Range: Displays the pivot range across different periods

ACD Level Multiplier

- ATR Period Levels: Specifies the number of periods for calculating ACD levels

Asia Session

- Asia Session: Time range for the Asian trading session;

- Asia Kill Zone: Specific time range within the Asian trading session.

Asia Market

- Show Asia ACD Setup: Displays the ACD setup for the Asian market

- Asia Opening Range Time: Sets the opening range time for the Asian market

- A Level Multiplier: Multiplier for the A level in the Asian market

- C Level Multiplier: Multiplier for the C level in the Asian market

London Session

- London Session: Time range for the London trading session

- London Kill Zone: Volatility period during the London session

London Market

- Show London ACD Setup: Displays the ACD setup for the London market

- London Opening Range Time: Opening range time for the London market (in minutes)

- A Level Multiplier: Multiplier for the A level in the London market

- C Level Multiplier: Multiplier for the C level in the London market

New York Session

- New York: Time range for the New York session (14:30 to 22:55)

- New York Kill Zone: Volatility period during the New York session (14:30 to 16:55)

New York Market

- Show New York ACD Setup: Displays the ACD setup for the New York market

- New York Opening Range Time: Opening range time for the New York market (in minutes)

- A Level Multiplier: Multiplier for the A level in the New York market (0.05)

- C Level Multiplier: Multiplier for the C level in the New York market (0.08)

Conclusion

The KillZones + ACD Fisher Indicator is an analytical tool developed by Mark Fisher. Risk management indicators, such as ACD Fisher, play a crucial role in identifying key entry and exit points in financial markets.

This indicator focuses on the Opening Range and uses A and C levels to distinguish real price breakouts from false ones. Additionally, the recommended reward-to-risk ratio for this strategy is 1:1, which should be verified through backtesting.

KillZones ACD Fisher TradingView PDF

KillZones ACD Fisher TradingView PDF

Click to download KillZones ACD Fisher TradingView PDFWhat trading style is this indicator suitable for?

The ACD Fisher Indicator is designed for scalping strategies (under 5 minutes).

What is the ACD Fisher + KillZones Indicator?

The ACD Fisher + KillZones Indicator is a tool for identifying trends and managing risk, developed by Mark Fisher, which analyzes market movements using A and C levels.